Real Estate Investors seeing HS2 related demand – Real Estate Investors has published results for the year ended 31 December 2017. Highlights are:

- EPRA NAV per share of 68.9p (2016: 66.2p), up 4.1%

- EPRA EPS 3.3p (2016: 2.8p), up 17.9%

- Pre-tax profits at GBP11.3 million, up 37.8%

- Record underlying profit before tax of GBP6.2 million, up 19.2%

- Gross property assets increased to GBP213.1 million (2016: GBP201.9 million) up 5.5%

- Revenue GBP14.9 million (2016: GBP13.5 million), up 10.4%

- Contracted rental income of GBP16.2 million (2016: GBP14.9 million), up 8.7%

- Real Estate Investors acquired GBP18.4 million (net of acquisition costs) of new property and capitalised on a strong investor market with sales of GBP13.5 million

- WAULT 4.53 years to break and 6.52 years to lease expiry (2016: 4.71 years to break and 6.76 years to lease expiry)

- Overall occupancy increased to 94% (2016: 93%), up 1.1%

- Total dividend per share for 2017 of 3.125p, up 19.0%, final dividend 0.875p per share

Since the year end, they have agreed terms for a new 5-year facility of GBP10 million with RBS at 1.95% above Libor. They say that they will consider utilising further debt to grow the business but will retain our overall aim of sub 40% net loan to value. During the year, they fixed a GBP41 million facility with RBS at 2.75% until February 2021. They have GBP20 million plus of cash and available facilities to pursue future acquisition opportunities of criteria compliant investment properties.

Paul Bassi, CEO of Real Estate Investors Plc, commented: “During another year of macro-economic uncertainty, REI has once again prospered, with growth in our property assets to GBP213.1 million, up 5.5%, and our pre-tax profits rising to GBP11.3 million, up 37.8%. Our dividend payment has increased for five consecutive years, rising a further 19.0% in 2017, displaying a consistent and proven track record.

The continued uncertainty provides an ideal environment in which to secure further criteria compliant assets and make strategic sales by taking advantage of a strong investor market and our privileged network and market reputation. We are fortunate to be operating in a vibrant and expanding regional economy that is set to re-establish itself as a major national and international economic powerhouse.

We remain confident that we will extract further value from the existing portfolio and see our rental income and portfolio grow further.”

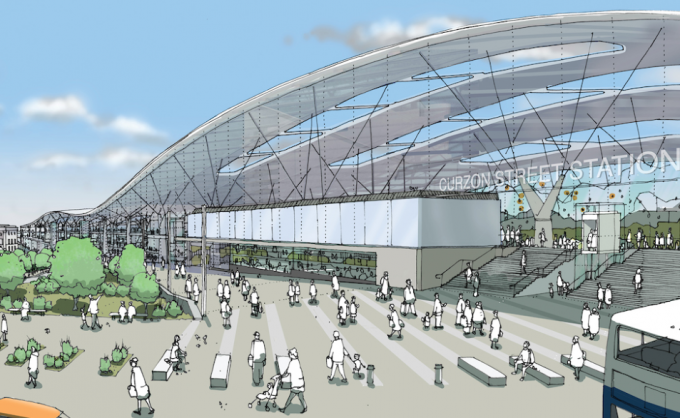

Talking about their core market, they said: “Birmingham is undoubtedly entering a new era. Take-up figures released from the Birmingham Office Market Forum suggests take-up increased from 692,729 sq ft in 2016 to 1,005,072 sq ft in 2017 in 130 letting transactions. As a consequence, we have seen record-levels of construction with developer confidence high in the wake of HMRC, HS2, HSBC, the forthcoming 2022 Commonwealth Games and the Coventry City of Culture for 2021. Deloitte Real Estate report that 1.4 million sq ft of offices are under construction, compared to the 10-year average of 567,000 sq ft (Source Deloitte Real Estate Crane Survey January 2018).

Birmingham city centre’s office market enjoyed a record breaking 2017, with deals surpassing 1 million sq ft for the first time. The market is expected to exceed the five-year average by more than a fifth, with pre-letting activity also likely to increase in 2018. This activity is driven by both an ever-decreasing supply and sustained requirements from HS2-linked occupiers which could see prime Grade A rents reach GBP34 per sq ft within the next 12 months and potentially GBP35 per sq ft in 2019, according to Savills. The average 10-year annual take up in the city centre is now 750,000 sq ft, compared to last year’s 716,000 sq ft and REI is well positioned to take advantage of this increased activity.

We have achieved a current occupancy of 94% across the portfolio, and we expect to see continued rental growth and low vacancy rates supporting the Company’s investment objectives and maintain our strategy of delivering further growth of our fully covered dividend payments.

We continue to enjoy punctual rental payments across the portfolio, which we believe reflects a robust property portfolio and a stable local economy.”

RLE : Real Estate Investors seeing HS2 related demand