QuotedData attends Tritax EuroBox’s annual results – QuotedData attended Tritax EuroBox’s (EBOX/BOXE) inaugural annual results presentation earlier today. Here are a selection of highlights followed by some takeaways from manager Nick Preston’s presentation.

Since launching in mid-2018, with a £300m initial public offering (IPO), EBOX has built a ten-asset warehouse and logistics portfolio that was most recently valued at €691.7m (30 September 2019). The trust expects to add two more assets to the stable over the coming months, fully deploying the capital raised in the process. The IPO was augmented by combined debt financing facilities of upto €425m at the end of September.

Financial highlights – dividends 85.6% covered

- Independent valuation of the asset acquired in the period of €691.7m;

- EPRA (a standardised measure of NAV for property assets) NAV: €484.2m;

- Total return for the period: 3.4%;

- Dividends paid or declared for the period 85.3% covered by adjusted earnings per share;

- The portfolio had a contracted annualised passing rent of €34.8m as at 30 September 2019.

Operations highlights – tenants include Amazon and Mango

- Acquired 10 prime ‘big-box’ logistics assets totalling 785,276 sqm of logistics space in five continental European countries;

- Portfolio weighted average unexpired lease term of 11 years;

- 81% of tenants are multi-billion Euro businesses;

- 93% of leases are subject to an element of indexation.

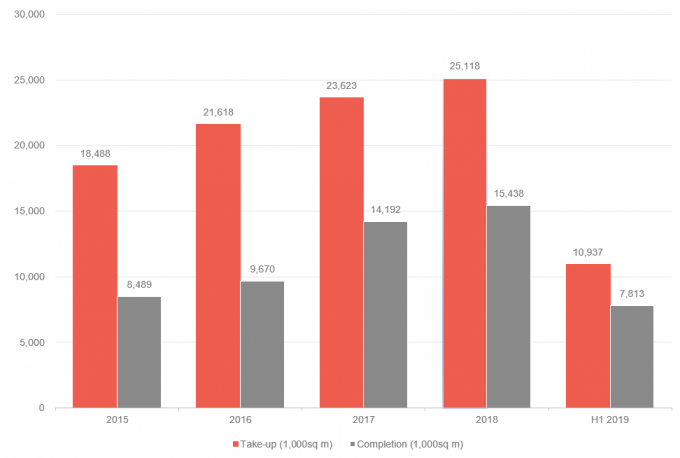

Nick was upbeat in his outlook for ‘big-box’ logistics. Discussing the data in Figure 1 below, Nick said that demand for ~ 1k square meter warehouses is oustripping supply. The square footage of typical assets means that there is limited availability of land zoned for industrial use which is near enough to urban centres. The assets that do exist have scarcity value and Nick says these demand/supply imbalances are driving prime rental growth in key city markets like Milan, Frankfurt and Barcelona. The gap between ‘take-up’ and ‘completed’ is filled by second-hand space. Demand is expected to remain robust, supported by e-commerce as a pillar. Interestingly, though EBOX’s total NAV returns have not been near the top of the AIC property – Europe sector this year, the shares are not discounted (the discount was 1.9% most recently) to anywhere near the same extent as a number of other funds. This ties back to Nick’s outlook for the sector.

Compared to the UK, where about 17% of retail sales by value are online-based, penetration in Germany, France, and especially Spain remains significantly lower. Nimble retailers like Mango and the Zara-owner Inditex, as examples, rely heavily on ‘big-box’ warehouses, to drive their online businesses. EBOX’s properties have to be appropriately kitted-out with state-of-the-are electricity and data connectivity. As part of the asset management provisions in the properties they own, EBOX works to provide tenants with the best-platform to improve throughput (the rate at which a good is produced).

Figure 1: Constrained supply of large-scale European logistics assets

Some figures we found interesting:

- 84% of assets built in 2016 or thereafter;

- About half of the assets are in the biggest-box category of >100k square meters;

- Over the year to 30 September, 81% of tenant income came from multi-billion euro businesses like Amazon. Of course, given the size of trust’s assets, they are only suitable for high-scale companies.

Going forward, Nick touched on some drivers of rental income growth, including

- Indexation: Embedded rent increases through indexation will contribute to rental growth. Nick noted that even in Germany, where rents typically have ‘indexation holidays,’ EBOX’s tenant agreements will allow it to benefit from above-average indexation-linked rental increases.

- Asset management – expansion land: EBOX has agreed an expansion with Mango to grow the Barcelona warehouse by 88k square meters after the retailer brought forward expansion plans by five years. The trust has four more properties with expansion land available, including in Rome and Wunstorf (Germany).

Figure 2: Interior of an EBOX warehouse

In his outlook, Nick said good progress has been made since the trust’s IPO 18 months ago. Going forward the demand/supply imbalances as well as the structural shifts in the foundations of how retailing is carried out in many sectors bode well. It is also not just retailers who want big-box space, as improvements in throughput and general efficiency are desired across many areas of manufacturing-focused sectors. Nick also expects there to be ongoing room to add value through asset management across the portfolio.

EBOX/BOXE: QuotedData attends Tritax EuroBox’s annual results