Fourth quarter rent collection figures have been coming in thick and fast over the past week or so and overall they show a general improvement on collection rates during the COVID-19 pandemic.

There are a few nuggets to come from the announcements so far.

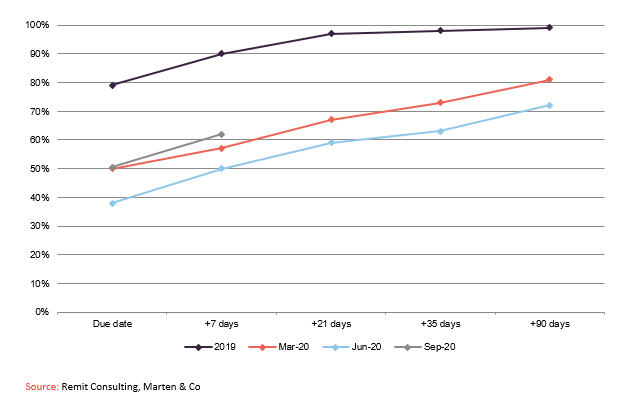

The first thing to say is that collection rates have improved on the previous two quarters across the wider property sector, which is promising. Analysis by Remit Consulting shows that fourth quarter collections (which are billed at the end of September) are ahead of June and March rent collection days (Q3 and Q2), albeit still well below normal levels.

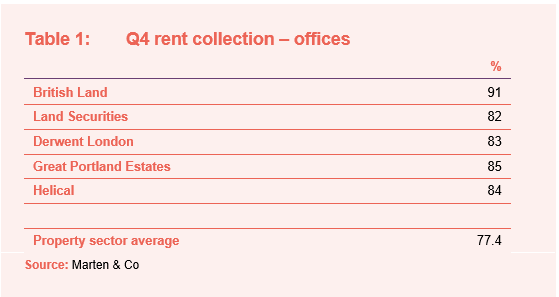

You would expect listed property companies to have better rent collection figures than the wider market due to the quality of their portfolios. A breakdown of the rent collection announcements made so far supports this belief.

In the office sector, the rent collection rates for Q4, so far, are all ahead of the sector average.

An interesting stat in Great Portland Estate’s announcement was that occupancy across its central London offices was around 27%. It just shows the strength of tenant’s businesses and the importance the office is to their business that rent collection has been in the high 80%.

This reinforces our belief that prime offices will prevail, despite less office space demand due to increased working from home provisions.

We have much more concern for the secondary office market – the older, poorly located offices.

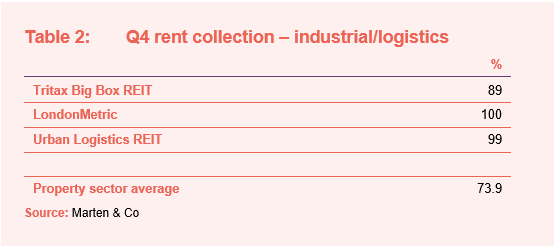

The industrial and logistics sector has been going great guns as can be seen in the collection rates, with Tritax Big Box’s figure increasing to 99% by the end of November when monthly payments are factored in.

Demand for logistics space has been insatiable as more and more people spend online and this year’s take-up (32.6m sq ft) is already more than the highest annual take-up level on record, after just nine months.

The supply isn’t there and developers can’t get these things up quick enough, so strong rental growth is sure to follow.

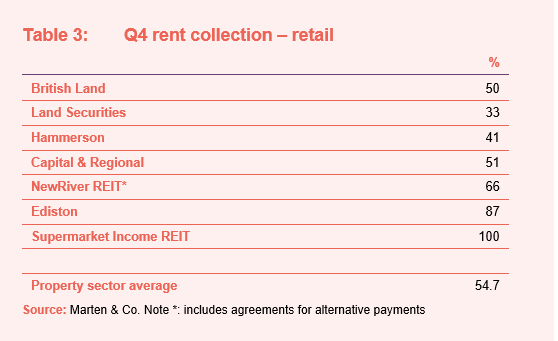

No prizes for guessing that it is retail, leisure and hospitality that has brought the rent collection numbers down.

However, the retail sector is the one that holds the most opportunity, in our view. The problems the sector is facing are well known and its demise has gone hand-in-hand with the ascent of logistics.

The retail sector is very fragmented with lots of different sub-sectors. Supermarkets, for example, are doing really well, which is reflected in Supermarket Income REIT’s performance.

One company worth highlighting is Ediston, which has received 87% of rents due for the fourth quarter that it expects to rise to 93%.

Its portfolio is predominantly retail parks, which has completely different characteristics to shopping centres and high street retail but seems to have been tarred with the same brush.

We have written about it before here, but a killer stat in British Land’s announcement shows the strength of the sub-sector.

Almost half of its retail portfolio is retail parks, and in September it saw footfall at 89% and like-for-like sales at 93% of levels recorded in September 2019.

Although rent collection rates are still far below normal levels, they do reveal valuable information about the performance of the different property sub-sectors.