The potential offer for Drum Income Plus REIT (DRIP) by Custodian REIT (CREI), which we think makes perfect sense for both sides (see our news story for more detail) got us looking into the wider UK commercial property peer group to see how are they faring now as the country transitions out of lockdown.

The companies in this sector, which all own diverse property portfolios, are rebuilding having been hammered during the pandemic, with lockdowns impacting rent collection and several forced to cut dividends.

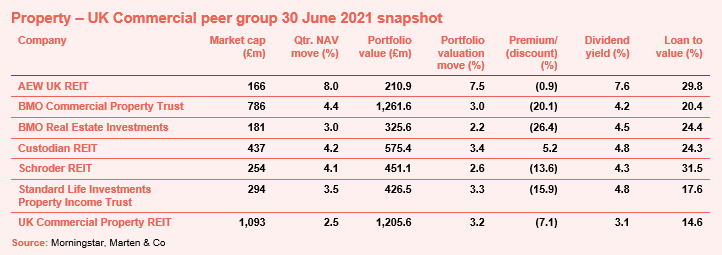

Each have reported their quarterly NAV updates for the end of June, showing a rise across the board of between 2.5% and 8%. This table gives an overview of the listed UK commercial property sector.

They have all seen their discounts narrow in recent months as restrictions have eased and dividends increased. It is worth delving into one or two of these companies to see the growth potential.

Firstly, AEW UK REIT (AEWU), which is trading at a slim discount of 0.9%, has performed consistently well during the pandemic and is starting to be rewarded in its share price performance. It posted a record quarter for NAV total return in the three months to the end of June 2021 of 10.0%, driven by a whopping 7.5% increase in the value of its portfolio (helped by its 57% weighting to the industrial sector and some asset management incentives coming through) and its sector beating 2p quarterly dividend (which it has maintained throughout the pandemic).

The dividend was covered by earnings this quarter (it hasn’t in previous quarters) due to the recovery of rent owed to it by well-funded national businesses that refused to pay their rents throughout the pandemic despite being able to. AEWU’s successful legal battle with the tenants should be applauded and has set a precedent for the rest of the property sector. It should also be pointed out, however, that AEWU does not treat all its tenants like this and has offered concessions to smaller businesses that have legitimate issues with paying rent.

The sector high dividend should be covered by earnings by the second quarter of 2022, when asset management initiatives – namely the sale of a vacant property in Glasgow and remedial works at a property in Blackpool – complete.

The other company worth exploring further is Standard Life Investments Property Income Trust (SLI). Its studious manager, Jason Baggaley, had been re-shaping the portfolio to match trends in the sector way before the pandemic. For example, SLI was selling office assets that it did not think met future amenity requirements long ago and refurbishing others to bring them up to standard.

Now Jason is focused on assets that will meet future sustainability credentials. Accordingly, the fund has sold some assets that are not up to the required mark and/or would take too much capex to bring up to the standard, and Jason is in the process of recycling the proceeds into assets with high ESG credentials. This may mean the trust is foregoing yield in the short-term but the long-term durability of income should be far superior.

Another SLI investment strategy to get excited about is the funding of speculative urban logistics development. We expect announcements on deals in the coming months, but that specific sub-sector has one of the highest rental growth prospects in property due to an insatiable demand from online retailers and a chronic lack of supply.

Getting involved in the development phase will bring higher returns (SLI estimates around 5.5% yield on cost) versus the investment market (sub-4% yield) and gives durability of income, with online retailing only predicted to get stronger.

QD view – who’s looking good for property bounceback?