In QuotedData’s morning briefing 16 November 2021:

- International Public Partnerships (INPP) says that the consortium that it is a member of (alongside Amber Infrastructure Group and Transmission Investment) now owns the 400MW Rampion offshore wind farm transmission link. The offshore wind farm is located approximately 13km off the Sussex coast and consists of 116 x 3.45MW wind turbine generators. These are connected to an offshore substation platform located within the boundaries of the Rampion wind farm. INPP is taking no exposure to electricity production or price risk but is paid a pre-agreed, availability-based revenue stream over 20 years which is fully linked to UK inflation (‘RPI’). For its £35m investment, INPP gets 100% of the equity and subordinated debt in TC Rampion OFTO Ltd. Project level senior debt will be provided by a group of banks to match the maturity of the OFTO revenue period such that there is no refinancing risk. The customer is a subsidiary of National Grid.

- Pantheon Infrastructure starts trading today. 400m ordinary shares (PINT) and 80m subscription shares (PSNT) have been admitted to the standard segment of the Official List of the Financial Conduct Authority and to trading on the Main Market of the London Stock Exchange.

- Dunedin Enterprise (DNE) says 73.85% of its shares were tendered under its latest tender offer. 4,963,370 shares will be repurchased under the tender (27.42% of the company).

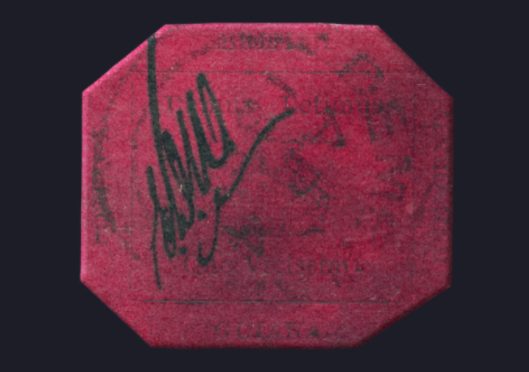

- Castlenau Group (CGL) now owns 80% of Showpiece Technologies, a vehicle which acts as a fractional ownership platform. It is currently selling stakes in ‘the world’s most valuable stamp’ – the British Guiana 1c Magenta (pictured) – ownership of which has been split into 80,000 ‘pieces’ and is being sold off at £100 per piece. The value of Showpiece is negligible currently – Castlenau paid £8,000 for its stake and Stanley Gibbons paid £2,000 for the remaining 20%.

- On 9 December, Scottish Investment Trust (SCIN) will ask shareholders for their permission to make JPMorgan its manager and adopt the same investment strategy as JPMorgan Global Growth and Income (JGGI). Once this is done, the next stage will be another vote, probably in March next year, to approve the merger of the two funds.

- Supermarket Income REIT (SUPR) has acquired a Sainsbury’s supermarket in Swansea, South Wales, and a Tesco supermarket in Maidstone, Kent, from Argo Real Estate Limited for a total purchase price of £73.0m, reflecting a combined net initial yield of 4.6%. The Sainsbury’s store comprises 65,000 sq ft of net sales area, an 18-pump petrol filling station and over 500 car parking spaces. The store has a purpose-built online fulfilment centre, supporting Sainsbury’s online grocery network across the region. It is being acquired with an unexpired lease term of 27 years, with five-yearly, upwards only, open market rent reviews. The Tesco site in Maidstone, Kent, comprises 39,000 sq ft of net sales area, a 12-pump petrol filling station, 369 car parking spaces and a small parade of adjoining units. It is being acquired with an unexpired lease term of 13 years, with five-yearly, upwards only, open market rent reviews.

- Land Securities (LAND) has reported an increase in the value of its portfolio for the first time since COVID struck, with an £81m surplus in the six months to September 2021. Its portfolio is now worth £11bn. This contributed to a 2.7% rise in EPRA net tangible assets (NTA) to 1,012p per share. EPRA earnings per share was up 56.8% to 24.3p, while it paid a dividend of 15.5p in the period.

- McKay Securities (MCKS) also posted an uplift in valuations for the six months to September 2021, with a 2.7% rise in its portfolio value to £454.95m. This contributed to a 4.3% rise in EPRA NTA to 322p.

- Literacy Capital (BOOK) has made an investment into Cross Rental Services (CRS), a market leading provider of Refrigeration & Catering and Climate Control rental equipment. Headquartered in Andover, with operations across the UK and Ireland, CRS serves blue-chip customers across a diverse range of end markets, including retail, manufacturing, and facilities management. CRS was sold to Elysian Capital in August 2021, and has made significant progress since then, including the acquisition of All Seasons Hire from HSS Plc, completed in September 2021. The acquisition creates one of the market leading Climate Control rental providers in the UK alongside the already strong position held in the UK Refrigeration & Catering rental space.

We also have results from Troy Income & Growth and a takeover offer for Yew Grove REIT