Menhaden Resource Efficiency reports an NAV return for 2021 of 17.3% and a share price return of 13.0%. The discount widened to 28%, but the board is resisting share buybacks and instead hopes to narrow this by marketing the trust. There is a 0.2p dividend, enough to satisfy the minimum requirement to maintain investment trust status.

The leading contributors to performance in the year were the holdings in the digitisation space, notably Alphabet and Microsoft because of the holding sizes, but all of the holdings within that theme benefited from the accelerated digital transformation being driven along by the evolution of working practices and consumer behaviour during the pandemic.

Change to investment policy

When the company was launched in 2015 the investment policy, as set out in the IPO prospectus, reflected the intention that the portfolio would be comprised of three main allocations: listed equity; yield assets; and special situations (the last being private equity investments). However, in the current economic environment it has proven to be very difficult to find investments suitable for the portfolio with attributes that would cause them to be identified as yield assets. Additionally, those that were identified have tended to also fall into the special situations (private equity) category. The board has concluded that the yield assets description is superfluous and, therefore, have made a minor change to the investment policy to remove the reference to a yield assets allocation. The investment policy now says: “The company invests, either directly or through external funds, in a portfolio that is comprised predominantly of a combination of listed equities and private equity investments”. There is no change to the way investments are selected for the portfolio.

The manager notes that “Given the successful exits of private investments over the last few years, our portfolio is overweight public equities. Alphabet and Microsoft both performed exceptionally well, accounting for the majority of our investment performance. Waste Management and our semiconductor capital equipment companies were also notable contributors. Charter Communications ended the year approximately flat, whilst Safran was the single largest detractor. Key investment decisions included exits from both Airbus and Union Pacific, the material increase of our position in Microsoft and the initiation of a new position in French infrastructure group, VINCI.

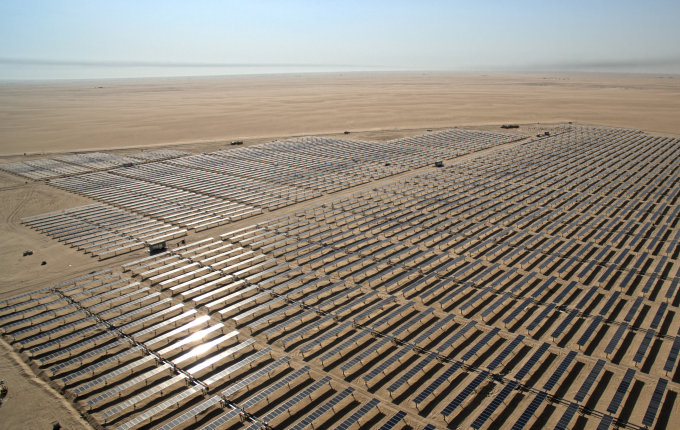

Our private investment activity was limited, with X-ELIO and TCI Real Estate Partners III each making a return of capital payment and the completion of the sale of Calisen.

However, we were pleased to announce the completion of a new private investment in infrastructure operator and developer, John Laing, in December 2021. This is our third co-investment with KKR.”

MHN : Menhaden discount widens further