BB Biotech (SWX:BION) has continued to show a resilient performance this year, a period that has proved to be extremely challenging for biotech investing – indeed the sector is now considered to be experiencing its most severe bear market for more than two decades.

BB Biotech’s shares closed on Friday at CHF 56.00, down 23% in the year-to-date, while the NAV – which reflects its investment performance – largely mirrored this, with a 22% decline. The NAV itself, is CHF43.00/share, highlights the fact the shares stand at a 30% premium – a figure that has remained broadly the same over the past year. Although this is unusual in the investment company space (and particularly so in biotech), this has been a consistent feature of BB Biotech and we see it as indicative of the confidence investors place in the company’s manager, Bellevue Asset Management.

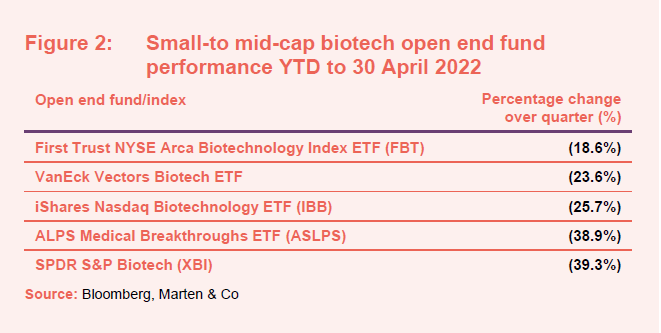

Although BB Biotech’s share price and NAV clearly have seen substantial declines this year, both are better than those of the broad market for small-to-mid cap sized US biotech stocks – in which BB Biotech almost entirely invests. This has fallen by 39% year-to-date, as measured by the XBI (the SPDR S&P Biotech ETF), while the IBB (the iShares Biotechnology ETF), the other closely watched benchmark for stock prices that is biased towards larger capitalised companies, fared somewhat better (or less badly) at 26% down in the year-to-date.

To put the current bear market into perspective, the XBI has fallen by 58% from its peak that was reached some 15 months ago, while the IBB is 36% off its own peak, which was achieved eight months ago – the larger caps saw their sell off start later. It has been calculated that the aggregate enterprise value – that is market capitalisation, net of their cash (or debt) – for the 890 US-quoted biotechs have now fallen by 70% from the February 2021 peak. This aggregate EV of the sector, at $176bn, is now less than that of the one major US pharmaceutical group, Bristol Myers Squibb (at $185bn). At its peak, the biotech sector’s EV was $598bn.

There are 208 biotech companies trading at capitalisations below their last reported cash and are said to have a negative EV. Some 86 of these are within the 370 constituents of the Nasdaq biotech index and as a proportion of the total, this is two-to-three times more than at any of the previous bear markets in biotech over the last two decades (2002-3, 2008-9, 2016 and in 2019). Five such negative EV stocks are in BB Biotech’s portfolio: Black Diamond Therapeutics, Homology Medicines, Molecular Templates, Wave Life Sciences and Generation Bio.

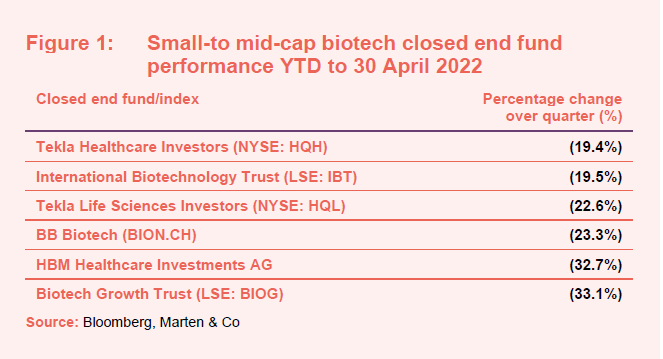

BB Biotech’s share price performance so far this year places it in the middle of the six closed end funds that invest in small-to mid-cap biotech stocks (see table below, with comparison of some ETFs that invest in the same space).

Close inspection of the BB Biotech’s first quarter report shows that there was decision taken to sell 5% of the trust’s holdings across the board – with a handful of exceptions – and to exit entirely from the position in Biogen, the US biotech that had developed the controversial Alzheimer’s treatment Adulelm. This, we presume was to reduce gearing in the balance sheet, as the market conditions worsened. With the benefit of hindsight, this will have mitigated what might otherwise have been a worse performance for the portfolio.

Three holdings were, however, increased – Radius Health, Molecular Templates and Nectar. In the last case, simply based on timing, it seems likely that this purchase was made before the read out of the Phase 3 trial of bempegaldesleukin in melanoma, which occurred in mid-March. The failure of this study, and the subsequent cancellation of the development partnership with Bristol-Myers Squibb, has contributed to a 68% fall in Nektar’s share price in the YTD period, one of the three worst in the portfolio.

Currently, just five stocks in the 31-strong portfolio are sitting on gains in the YTD period (Ionis, Exelixis, Vertex, Esperion and Incyte). Several portfolio companies have encountered setbacks, including Nektar, Black Diamond and Scholar Rock and are down by approximately 60-70%.

[QuotedData comment: Most observers predict a recovery for biotech stocks driven by big pharma M&A activity, seeking to take advantage of the current low valuations. The stock price movements also highlight the volatility inherent in biotech and are a reminder that investors should only ever consider it as part of a portfolio and with a long-term view. BB Biotech’s long-term investment horizon has delivered excellent returns on 10-year basis and we consider the stock offers investors an attractive vehicle to gain exposure to a focussed group of biotech drug developers.]