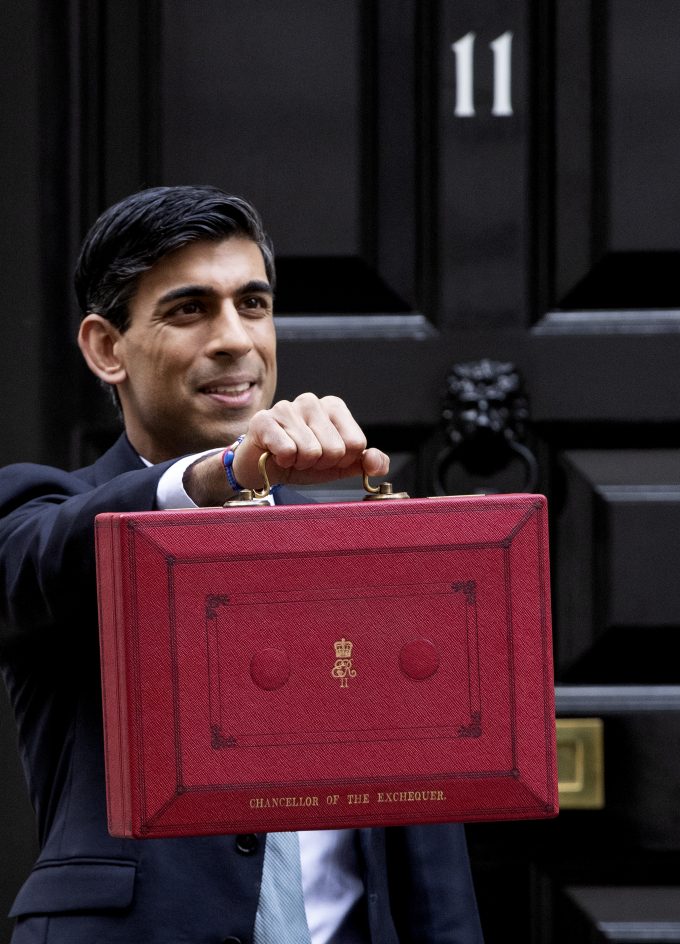

A story in today’s Financial Times seems to have triggered a slide in the share prices of a number of renewable energy companies. Rishi Sunak is said to be exploring the possibility of a windfall tax on all energy generating companies, including those in the renewable energy sector, as well as oil and gas companies.

Having categorically ruled out a windfall tax only a couple of months ago, and rejected a Labour motion to implement a windfall tax on oil and gas companies only a week ago, the U-turn may be a cynical ploy to distract from other news. However, the inclusion of renewable energy funds within the scope could be a way of whipping up opposition to the idea to have it ruled out.

The argument is that a windfall tax would deter much needed investment in renewable energy infrastructure.

All this is still speculation. Some funds have been hit harder than others. As I write this, Greencoat UK Wind’s shares are off 5.5%, The Renewables Infrastructure Group’s shares are off 2.1%, JLEN Environmental is off 2.7%, and Foresight Solar shares are off 1.6%. By contrast, Greencoat Renewables, which invests in Europe outside the UK, is unchanged.

Renewable energy funds hit by windfall tax rumour

Windfall Tax?

In case politicians haven’t noticed power prices have doubled in wind industry deluded Britain. They are expected to treble in October.

In the UK, higher energy prices are poised to push an estimated 2 million additional households into fuel poverty, taking the total to 6 million, the highest level of fuel poverty in more than 25 years.

Far from becoming cheaper, meticulously audited accounts from the wind industry prove that wind power is actually becoming even more expensive. Ongoing maintenance, repair and replacement costs are rising exponentially.

In 2019, subsidies for wind power in Scotland cost consumers £954 million. Fortunately for the Scots, this subsidy is absorbed by the National Grid and charged out to all UK customers. If Scottish householders had to pay for it themselves, it would cost every household £367 a year.

And that does NOT include all the other additional costs for integrating wind power, such as constructing transmission lines. Nor does it include the extortionate cost of essential back-up whenever the wind stops. We are effectively paying for two systems running in parallel.

As at January 3, 2022, according to data compiled by the Renewable Energy Foundation, we have been forced to pay £1,076,455,630 to the Wind Industry for providing absolutely nothing and the majority is paid out in Scotland by all UK consumers.

According to the annual Medium Term OBR Forecasts, subsidies for renewable energy have cost the public £78 Billion in the last ten years. This equates to about £3000 per household!