For me, one of the nice features of the investment companies’ sector is that the closed end structure of the funds contained therein can house some really interesting, and sometimes unique, investment propositions that are otherwise hard for the average investor to get exposure to. I often cite Herald Investment Trust, which is managed by veteran fund manager Katie Potts and her team at HIML Investment Management, as an example of this. It sits in the Global Smaller Companies sector but is distinctly different from its peers as it focuses on small cap TMT.

Of course, the broader investment companies sector has a couple of really good large cap tech funds (Polar Capital Technology managed by Ben Rogoff, for example), which reside in a different sector altogether, but none of Herald’s peers (either in the tech sector or in the global smaller companies sector) offer anything quite like it; investing in what is a relatively illiquid asset class, where it is an important source of capital, compounding decent returns for its shareholders for a very long time – you can read our latest note here.

There are some other funds with not dissimilar characteristics, that are offering something different, and where investors might want to take a closer look.

An emerging infrastructure fund???

I think that one such fund is Utilico Emerging Markets (UEM). Like Herald, it has a well-regarded fund manager and supporting team that is offering something distinctly different to its peers. UEM sits in the global emerging market sector, but is differentiated by a focus on infrastructure, utilities and related sectors. There are some other very well-regarded funds looking at these sorts of assets in more developed markets, once again these funds sit in different sectors altogether (think of the likes of Ecofin Global Utilities and Infrastructure, JLEN Environmental Assets or GCP Infrastructure or some of the pure-play funds such as Bluefield Solar, Downing Renewables or NextEnergy Solar).

Herein lies part of the problem. If a commentator is looking at global emerging markets trusts, UEM feels like a bit of a square peg in a round hole, so it gets pushed into the ‘too hard bucket’ or the ‘not quite right for this discussion bucket’ and gets put to one side for another day. The same can be said when analysts are looking at funds focused on utilities, infrastructure or renewables. There are plenty of funds focused on better-understood and easier to navigate jurisdictions and, once again, there seems little need to include UEM. However, where things are under-researched, this can create an opportunity and we, at QuotedData, try to shine a light to shine a light into the less visible corners of the market in the hope that it will benefit all.

UEM – backed by a team with a wealth of experience

This week, I got to speak to the team managing UEM, which is led by Charles Jillings, a manager who brings a wealth of experience to the role. Charles, who qualified as a South African chartered accountant in 1980, has been at the helm of UEM since its launch in 2005, but his experience of emerging markets and utilities/infrastructure investments predates this and, comfortingly, given the challenges of managing these sort of long-lived assets in emerging markets, Charles has been through a number of economic cycles and has an investment process that is honed to pick out those assets that offer superior growth prospects over the long-term but with the resilience to navigate more difficult periods.

Focused on operating cash generative assets with established regulatory frameworks

Reflecting this, 95% of UEM’s portfolio is invested in operating assets, and most are situated in jurisdictions with established regulatory frameworks. The portfolio, which is value-focused, is inherently cash-generative, allowing UEM to offer a decent yield (approaching 4%), which is paid quarterly and remained fully covered by earnings even during the depths of the pandemic. Over three-quarters of UEM’s holdings pay a dividend and about two-thirds of portfolio companies are growing their dividends.

The quality of the management team is key and regular company visits are a critical part of the process. Charles and his deputy portfolio managers each spend around 40 days travelling a year, visiting nearly all of the countries they are invested in and typically meeting between five and eight companies a day, which adds up to a lot of market intelligence. Charles comments that this is invaluable – it is perfectly possible to have great assets in a strongly growing market but lose out to poor execution.

It should also be remembered that UEM is investing in the kinds of assets that are essential to the modern functioning of society. The world still needs electricity, water and waste systems, transport systems, telecommunications networks and the like, even when economies are slowing down, so they are inherently defensive, offering predictable and sustainable cash flows.

Many of these types of assets are long-lived with a high fixed cost base, but the marginal cost of adding additional users tends to be, meaning that they have a high degree of operational leverage when it comes to adding customers – meaning they’re well positioned to benefit from expanding populations.

Strength of process reflected in minimal allocation to Russia

When Russia invaded Ukraine, UEM had just one investment with exposure to the country – Globaltrans, the London-listed railfreight company, which accounted for 0.8% of the portfolio as at the end of January 2022. The manager moved quickly, selling two-thirds of the position in the first two days of the invasion, realising £1.5m of proceeds from an investment that had been carried at £4.3m – a respectable result under the circumstances. So far, Globaltrans has not been subject to sanctions, but its shares were suspended in the aftermath of Russia placing restrictions on foreign investors repatriating profits and the holding was written down to zero. Fortunately, UEM had been structurally underweight Russia for many years due to its weak governance and endemic corruption.

Interestingly, while the Ukraine war has been a definite headwind, UEM’s manager think that it will likely create opportunities. First of all, some manufacturing activities that were previously undertaken in Ukraine will likely be driven westwards into other Eastern European nations. This is occurring at a time when Europe as a whole is increasingly recognising that it needs to invest in Eastern Europe if it wants to avoid these middle nations slipping towards Russia’s sphere of influence. The likes of Poland and Hungary are obvious beneficiaries.

One-in-one-out portfolio ensures high conviction maintained

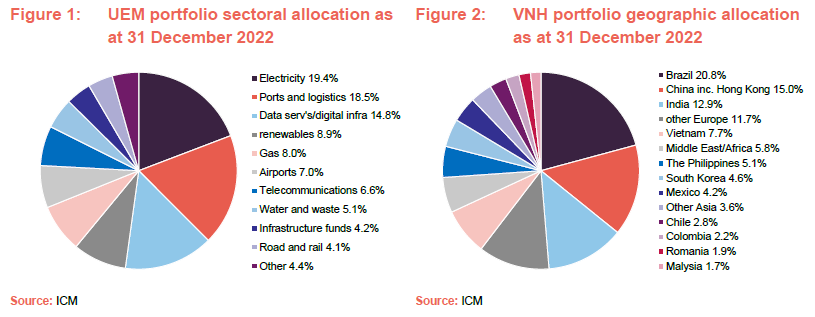

UEM operates with a relatively high conviction (the top ten 10 holdings tend to account for around a one-third of the portfolio, while the top 30 accounts for around two-thirds) with around 90% invested in listed securities. To make sure the portfolio maintains its focus, it effectively operates with a one-in-one-out approach, which forces the manager to really think about the investment cases for its holdings. The managers look to diversify risk – both sectorally and geographically and UEM has a good mix of assets as illustrated below.

For performance evaluation purposes, UEM benchmarks itself against the MSCI Emerging Markets Index but the portfolio is built bottom up using an approach that is benchmark agnostic and results in a portfolio that is radically different from the composition of the index (its active share is close to 100%). The process includes the construction of detailed financial models with valuation targets that sifts an investible universe of more than 1,000 companies down to around 50. The portfolio includes some small- and mid-cap companies that are frequently overlooked by other investors.

Sitting in a sweet spot

The pandemic laid bare the frailties of infrastructure in both the developing and developing world. A colossal amount of investment is required to bring aged infrastructure up to date and expand capacity to address the issues of population growth (a more acute issue in the developing world), plus considerable investment is required if we are continue on the path of digitalisation and, more importantly, decarbonise the global economy. These needs have completely changed the face of investment in infrastructure and utilities, which had long been seen as a dull defensive area. Now, such investments are exposed to long-term structural tailwinds.

UEM’s assets benefit from a trend towards urbanisation, which requires governments to upgrade basic infrastructure, and the growth of the middle class. With the notable exception of China (with its ageing population), emerging economies are growing faster than developed ones and, within these, the middle class is growing at a faster rate than overall GDP growth.

Inflation and interest rates

While inflation has been relatively benign in many emerging markets, particularly in Asia, high inflation in developed markets has led to interest rate rises as central banks have sought to take aggregate demand out of the system. Over the last 18 months, these have been a headwind to emerging markets, despite their generally benign inflation at home. A resultant strong US dollar has led to capital flows out of emerging markets. However, there are signs that inflation in the US is rolling over and the pace of rate rises there is slowing, which could be a boon to emerging market equities.

To the extent that inflation persists, it helps that UEM’s investments tend to have inflation linkage built into their contracts and even non-regulated companies should still be able to pass through inflation, albeit with a lag. Regardless, emerging markets tend to be quite well adapted to dealing with inflation. UEM’s managers also highlight that the management teams they invest with are good at controlling costs, which keeps earnings and bolsters their operational leverage.

Why now?

UEM’s managers think that investors should be looking at emerging markets now. Trends such as the emerging market middle class and increased urbanisation are driving infrastructure investment in regions that, combined is generating around 60% of global economic growth. The primary economies for this, in the managers’ view, are Brazil, China and India, which are the three highest geographical allocations.

China’s zero-COVID policy effectively locked the brakes onto that country’s growth, impacting countries in the surrounding region, but there has been a significant volte-face and UEM’s managers think demand will rebound and demand will be strong. At the same time, tension between the US and China, is helping emerging countries in Asia and elsewhere as global companies adopt China plus One (or two) strategies. They see Vietnam and Mexico as obvious beneficiaries.

Investors tend to think of less developed markets as being inherently risky, and there are some good reasons for this (for example, their legal and financial systems maybe more open to political interference) but the reality is a bit more nuanced. Developing markets are often less-interconnected and so less correlated to developed markets, offering diversification benefits. In addition, they are a diverse bunch in themselves, with an array of opportunities across varying economic, political and market cycles, making such an allocation a good diversifier to many portfolios.

These markets tend to be less well researched, creating greater opportunities for mispricing that the patient investor who is prepared to dig a little further can take advantage of. Furthermore, reflecting the sheer level of uncertainty in global markets, the managers say that valuation levels are exciting – emerging market valuations have rarely looked so attractive in both absolute and relative terms.

UEM’s managers comment that we are reaching a point where its space has been out of favour for quite a long time but, despite the noise, their investee companies have continued to quietly grow their earnings and develop their businesses. The team thinks that such disparities cannot last forever, particularly with interest rate expectations moderating. Perhaps it’s time to take another look?