Laser focus on the basics

Share price discounts to net asset values (NAVs) amongst commercial real estate companies has widened dramatically since the end of September after the disastrous ‘mini’-budget spooked gilt markets and sent bond yields above property yields (implying that property yields will rise, and values fall). Things have since calmed down to some degree and even though the repricing of real estate has further to play out, the near 50% discount to NAV that abrdn Property Income Trust’s (API – formerly Standard Life Investments Property Income Trust) shares trade on seems excessive.

Higher debt refinancing costs secured at the height of the volatility (when raised interest rate expectations were elevated) were disappointing but have since been reworked on better terms. The manager has a strong track record of long-term performance and has a laser focus on doing the basics well – that being growing rental income. API’s portfolio has 23.0% of reversion (rental growth) potential, equivalent to £6.2m of additional annual rent, whilst recent letting deals and space under offer would boost earnings and bring its vacancy rate below 5%.

UK commercial property exposure

API aims to generate an attractive level of income, along with the prospect of both income and capital growth, by investing in a diversified portfolio of UK commercial property assets, in the industrial, office, retail and alternative sectors. API uses gearing with the aim of enhancing returns, with the current loan-to-value (LTV) ratio at 21.7%.

Fund profile

API launched on 19 December 2003. It was previously called Standard Life Investments Property Income Trust and is domiciled in Guernsey. It has a premium main market listing on the London Stock Exchange and, to maintain a tax-efficient structure, migrated its tax residence to the UK on 1 January 2015, when it also became a UK Real Estate Investment Trust (REIT).

API aims to provide investors with an attractive level of income, together with the prospect of income and capital growth. It aims to achieve this by investing in a diversified portfolio of UK commercial property. These are principally direct holdings within the industrial, office, retail and ‘other’ sectors, where ‘other’ includes leisure, data centres, student housing, hotels (and apart-hotels) and healthcare.

The board’s and manager’s preference is towards properties that are in good, but not necessarily prime, locations, where it is perceived that there will be good continuing tenant demand. The manager also looks for properties where it can add value using asset management initiatives. There is a focus on tenant quality, and as part of API’s strategy, tenants are treated as key stakeholders and the manager works closely to understand their needs. The aim is to achieve greater tenant satisfaction and retention, and hence lower voids, higher rental values and stronger returns.

API has full use of the wider abrdn team, which has 270 people globally working on property. This provides access to specialist transactions, environmental, social and governance (ESG), debt and research teams, as well as providing a risk management framework.

The manager

API’s portfolio has been managed by Jason Baggaley since September 2006. Jason has 30 years of property management experience. He has previously worked for Legal & General as a portfolio manager and joined Standard Life Investments in 1996. He gained his degree in real estate from the University of Portsmouth in 1990 and is a member of the Royal Institution of Chartered Surveyors (RICS).

Benchmark index

API uses the quarterly version of the IPD Balanced Monthly Funds Index to assess the performance of its property portfolio. The trust also uses the FTSE All-Share REIT Index and, to a lesser extent, the FTSE All-Share Index as means of comparison in its own literature. For the purpose of this report, we have used the Morningstar UK REIT Index, the MSCI UK Index and the AIC’s Property – UK Commercial peer group as comparators.

Market outlook

The commercial real estate market has seen a huge shift in fortunes and sentiment in the past few months, with property yields rising and capital values falling due to interest rate rises. The Bank of England raised the interest rate by 0.5% to 3.5% in early December as it continues its efforts to bring inflation under control. Inflation is persisting at 40-year highs of 10.7% (in November) and concerns are growing that inflation may become embedded (higher inflation rate expectations being built into wages and prices – exacerbating the problem).

What proved to be a disastrous, but thankfully short-lived, economic experiment by then-Prime Minister Liz Truss and her chancellor Kwasi Kwarteng also had a catastrophic impact on the real estate market. The market reaction to the uncosted tax cuts announced in the ‘mini’-budget at the end of September saw bond yields spike and the cost of borrowing rocket. Although bond markets have calmed since a new Prime Minister and chancellor took office, the higher interest rate environment has had a distinct impact on the real estate sector.

The five-year SONIA swap rate (the typical floating rate on which banks add their margin for lending to real estate) increased from 0.97% in October 2021 to 5.08% in October 2022 before dropping back to 3.7% in December. This has pushed the total cost of borrowing close to or higher than the prime real estate yield for some segments of the property market, where yields had compressed to sub-3% in some prime markets. Real estate yields are inherently linked with the risk-free rate (government bonds) and the sector has enjoyed the fruits of low interest rates and bond yields for many years. However, investors now have a risk-free alternative to real estate and therefore property yields will have to rise to compensate and entice investors back.

Companies with floating rates of interest on their debt and/or with looming debt maturities saw a huge uptick in interest rate payments, hedging costs or refinancing costs – or all three. API was caught out here, refinancing its debt (which matures in April 2023) in October at a far higher cost than what they are currently paying. As interest rate expectations retreated as markets calmed, API’s manager took the decision to break the expensive interest rate swap and replace it with an interest rate cap at far superior terms (see page 20 for a detailed look at API’s debt refinancing).

Without the availability of low-cost finance, which had pushed yields to new record low levels in certain real estate sectors, many investors that acquire property with debt have been forced to withdraw from the market and the pressures that had underpinned pricing have been taken away. Lower-yielding commercial real estate sectors, such as industrial and logistics, find themselves amongst the most susceptible of the real estate sectors to softening (rising) investment yields and falling capital values.

On top of this, the surge in interest rates is putting pressure on loan covenants, which could precipitate forced sales. As values fall, loan to value (LTV) covenants could also start to feel the heat. There is also a growing risk that for some real estate companies with high debt levels, refinancing loans at the end of their term could become impossible, forcing a fire sale of assets and driving a further decline in values in the market. This is more likely to be the case in retail and some office sectors, where values have fallen over the past five years (the typical loan term) and lending conditions have tightened, meaning that a lower LTV ratio is now on offer relative to five years ago. This is less of an issue in the industrial and logistics sector, where values have risen sharply in the same period.

Valuation declines have further to go

By how much values fall in the real estate sector, it is too early to say and depends on a number of factors including the level of interest rates rises required to bring inflation under control and how long this takes – something inherently linked with the war in Ukraine and energy prices – and at what level gilt yields stabilise once inflation is brought under control. Goldman Sachs has predicted commercial property values in the UK to fall by between 15% and 20%, while Oxford Economics and Bayes Business School forecast values to fall by up to 35% – mainly in the retail sector.

Understandably, there has been a hiatus in commercial real estate investment over the past few months as investors assess the market. UK real estate transaction volumes in the third quarter of 2022 was £10bn, according to Real Capital Analytics, down around 50% compared to the same period in 2021 and down 30% on the third quarter 10-year average. The manager expects that transaction volumes will see further falls in the fourth quarter and in early 2023 as investor concerns persist.

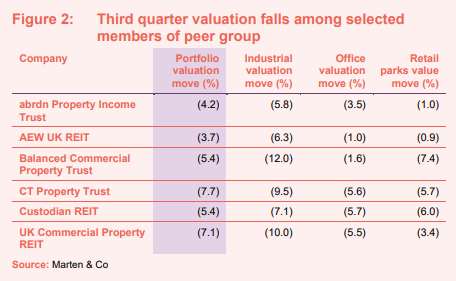

The first signs of tangible valuation declines are starting to come through. UK real estate fell by 2.6% on average in September and 5.1% in the quarter to the end of September, according to the MSCI/IPD UK Monthly Property Index, which tracks the value of more than £37bn of UK real estate. Figure 1 shows the extent of movement in property yields across different sectors over the past few months and year to November 2022.

Prime real estate assets and the industrial sector as a whole have been the hardest-hit due to the fact that they are the lowest-yielding property assets and the most liquid investments. Other sectors and secondary assets are sure to follow suit in the coming months and the manager expects valuation declines to be greater and more prolonged on secondary assets which do not meet occupier and investor demand.

API reported that in the quarter to the end of September the value of its portfolio fell by 4.2% on a like-for-like basis to £518.5m, led by a 5.8% fall in its industrial portfolio. Offices also fell 3.5% and retail by 0.9%. This compares favourably with valuation declines reported by its peers in the Property – UK Commercial sector, as shown in Figure 2, which perhaps demonstrates the superior quality of the individual assets in API’s portfolio, especially in the industrial and retail parks sectors.

Focus on income

The real estate sector can do little to influence inflation and interest rates, but has a big say in rental growth within their portfolio, which could help mitigate the impact of softening (rising) property yields on capital values. Driving rents higher through asset management initiatives such as refurbishments, as well as capturing market rental growth, should be the number one focus for real estate companies. API’s manager has always been focused on growing the income from its portfolio and has doubled down on its approach.

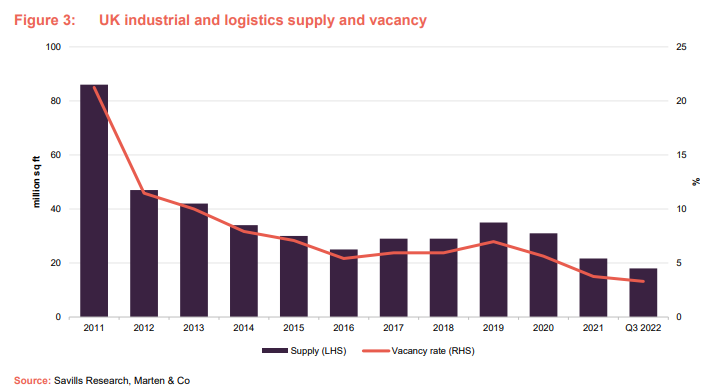

It says that income resilience will be increasingly important, especially during a recession, with affordable, ‘future-fit’ assets expected to be most robust. This means being invested in the right sectors that have strong supply-demand characteristics and having a tenant base with strong balance sheets. Despite facing large capital value falls, the industrial and logistics sector, which makes up 55.9% of API’s portfolio, continues to display strong occupier fundamentals. Demand has remained robust, with take up over the first half of the year above the 10-year average, while supply remains near historic lows of 3.3%, according to Savills, with limited new development (exacerbated by increased cost of development). This makes it well-placed for further rental growth.

Rental growth in the office sector, which makes up 22.4% of API’s portfolio, is prone to stalling during a recession. Occupational demand has historically been closely correlated with gross domestic product (GDP) growth and, given the poor economic outlook, office take-up levels are expected to fall. The manager says that this will be more evident in the secondary end of the market, with demand for ‘best-in-class’ assets proving more resilient. Tight supply of best-in-class accommodation should insulate Grade A rental values, but a decline in secondary office rents is expected. The sector is still in a state of flux following the pandemic and growth in hybrid working. The manager believes that some downsizing may take place and buildings with large floorplates are most at risk. Demand for offices with smaller floorplates and fitted solutions should hold up, the manager adds. This is evidenced in API’s office portfolio, which currently has more space under offer than it has at any point over the past four years (more information on the portfolio is on page 10).

The prospect for rental growth in the retail sector (which makes up 11.9% of API’s portfolio) is limited. The cost-of-living crisis and subsequent squeeze on household disposable incomes will be most acutely felt in the retail sector, and particularly within discretionary-led retail. Occupational demand from discretionary retailers is likely to fall, while those retailers deemed to be essential (such as budget supermarkets) will perform better in this environment. DIY and housing-related retailers are also likely to face tougher trading conditions in the period ahead as the UK housing market comes under pressure.

‘Future-fit’ assets means a focus on the ESG credentials, and especially sustainability. The manager says that the issue has become ever more important to both occupiers and investors and, as a result, integrating ESG strategies into its portfolio and investment decision-making is paramount to ensuring assets are ready for a recovery in real estate performance. While there may be a cost in the short term, long-term, sustainable and growing income will come from better-quality assets.

Letting up vacant space and capturing some of the rental reversion (rental growth potential) within the portfolio, in order to help offset the effects of softening property yields is a priority for API’s manager. A detailed look at the portfolio’s rental growth potential can be found on page 14.

Investment process

The portfolio is invested in direct UK commercial property holdings within the retail, office, industrial and ‘other’ sectors. Investment in property development and in co-investment vehicles where there is more than one investor is permitted up to a maximum of 10% of the property portfolio.

Risk limits and controls

API must abide by the following restrictions to the portfolio:

- No property will be greater by value than 15% of total assets;

- No tenant (with the exception of the government) shall be responsible for more than 20% rent roll; and

- Gearing (borrowing), calculated as borrowings as a percentage of the group’s gross assets, may not exceed 65%. The board’s current intention is that the company’s LTV will not exceed 35%. The LTV at 30 September 2022 was 21.7%, which is at the lower end of the manager’s intended range of 20–30%, a comfortable place to be in the current climate.

Research-based approach to investment

A research-based approach is taken to buying and selling property, looking at where markets are likely to change in the short term, with changes in infrastructure seen as a key driver of market developments. Following the COVID-19 pandemic, the manager has changed its approach to investments, with an absolute focus on the long-term durability of income. This means owning property that fits with macroeconomic trends that have developed or that it believes will develop because of the pandemic (such as offices with amenity space and retail that supports an omnichannel strategy) and that it believes will appeal to occupiers in the future. The sustainability credentials of an investment are a major facet of long-term durability of income, as well as a priority for the fund (more information on API’s ESG credentials is detailed on page 15). API cannot complete investment deals without the prior consent of abrdn’s ESG team.

API’s ESG charter includes:

- all members of the team being able to demonstrate that ESG is considered in every decision;

- a team member being given overarching responsibility to drive solar photovoltaics (PV) installation and electric vehicle (EV) charging point roll out;

- new lettings to have enhanced lease provision for collection of utility consumption data;

- net zero assessment being made from fund level to asset action plans;

- all assets to be assessed under the abrdn Impact Dial proprietary tool (an internally developed tool to measure all aspects of an asset’s performance in terms of ESG, as well as to identify the asset’s potential performance);

- all office maintenance plans to incorporate additional capex required to meet future energy standards through to 2030; and

- a future carbon offset plan in place to give fixed-cost solutions.

When it comes to sourcing deals, API’s size and reputation see it receive numerous leads from the market; these are then passed through a centralised acquisitions team. API minimises the use of agents when dealing with its tenants, preferring a principal-to-principal approach in order to reduce fees, improve outcomes and increase its understanding of tenant needs. This is possible because of API’s existing relationships and the abrdn network.

The manager considers no property to be ‘sacrosanct’ and makes the point that API’s asset base has been turned over three times since he took over in 2006. Realising profit at key times has been just as important as making new investments.

Asset allocation

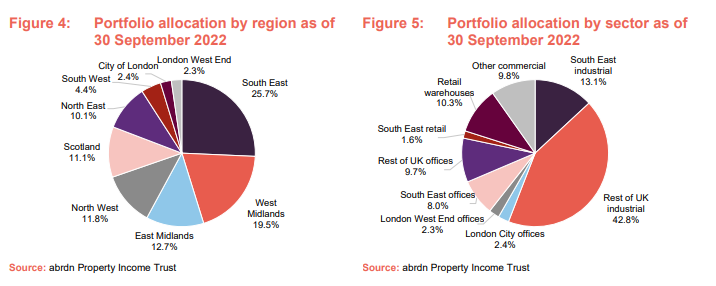

API’s portfolio was valued at £518.5m on 30 September 2022 (June 2022: £543.6m) and consists of 48 assets, primarily allocated across three sectors: industrials 55.9%, offices 22.4% and retail 11.9%. The ‘other commercial’ sectors make up 9.8% of the portfolio and consists of a data centre and a leisure complex in north London with redevelopment potential. The three largest properties are covered in more detail below.

The portfolio has a net initial yield at 30 September 2022 of 4.8% and an equivalent yield of 5.7%. The portfolio had a WAULT of 5.7 years and an occupancy rate of 90.7%.

Top 10 holdings

The biggest change to API’s top 10 assets was the sale, in October, of the group’s lowest-yielding asset, an industrial unit in Marsh Way, Rainham, for £21.65m, representing a net initial yield of 2.84%. The sale price was a slight discount to June 2022 valuation but was a significant sale for API, especially given the low yield achieved on the sale in the current investment market and the valuation decline that is likely to come through. The manager says that the proceeds of the sale will be used to reduce debt.

Other recent sales include a single let office in Kidlington (on the outskirts of Oxford) for £8.033m, 14.8% above the June 2022 valuation, and the sale of the Kirkgate office in Epsom for £7.725m, reflecting a 7.25% net initial yield and a 11.7% discount to the June 2022 valuation. API has also exchanged on the sale of a small multi-let office in Bristol for £4.3m, reflecting a net initial yield of 6.95%, which the manager says is attractive in the current market especially given that the lease has a break clause in less than two years, at which point substantial capex could be required. The office sales are in line with the company’s strategy to reduce exposure to the office sector, as well as being at the end of their asset management plans (having refurbished and re-let).

B&Q retail warehouse, Halesowen

API’s largest asset is a B&Q retail warehouse located in Halesowen, West Midlands, which it purchased for £19.5m in September 2020. The purchase price reflected a net initial yield of 7.5%.

The property is let to B&Q for a further nine years and is a top-quartile trader for B&Q. It is let on a reasonably low rent in the mid-teens per square foot, equating to £1.56m per annum, making B&Q the fund’s largest tenant.

Although the DIY sector is likely to suffer during a recession, the manager says it is not worried about B&Q, which has survived many recessions in the past. It has very little competition in the retail DIY sector, with Homebase reducing its presence and smaller operators (such as ScrewFix and Wickes) more focused on the trade sector and operate from smaller units on industrial estates.

Why does the manager like it? The manager says the asset fits its strategy exceptionally well, providing secure long-term income on an asset that not only works for the existing tenant, but also has future potential for urban logistics.

54 Hagley Road

API acquired 54 Hagley Road, Birmingham, in late 2018 for £23.75m, the fund’s largest acquisition to date. The multi-let office complex comprises 141,436 sq ft and is located in an area where rents are generally cheaper than in other parts of Birmingham, at around £20 per sq ft compared with prime rents in excess of £40 per sq ft. The building is equipped with shared amenities that include conferencing facilities, a yoga studio and parking docks for cyclists.

Five floors in the building, including the reception area, underwent a £2m refurbishment following the administration of a tenant. The ground floor refurbishment includes new conference facilities (which double up as a fitness studio), bike storage, lockers and changing facilities. API has completed several lettings in the refurbished space – including some of its flexible fitted office suites – and agreed terms on further lettings. It is currently under offer to let four floors in the building covering almost 21,500 sq ft of space (more details on API’s vacant space and lettings is on page 14).

A new tram stop right outside the building opened in December 2021, increasing connectivity. Meanwhile, 54 Hagley Road is located just outside of Birmingham’s new Clean Air Zone congestion charge, which launched in June 2021.

Why does the manager like it? The manager believes the building to be well-situated and to offer good prospects for rental growth. The location on the edge of the congestion charge zone, a new tram stop outside, ample car parking, and shared services have resulted in strong demand for space at the building.

Symphony

The Symphony acquisition in October 2014, for £14.6m, included three storage units in Rotherham, covering 360,000 sq ft. The units were acquired with a 20-year letting agreement in place with Symphony Group, a kitchenware and bathroom furniture manufacturer. The passing rent is £1.225m per annum, making Symphony the third-largest tenant behind B&Q and the public sector.

Symphony Group is the UK’s largest privately-owned manufacturer in the kitchenware and bathroom sector, turning over more than £220m per annum, with a headcount of over 1,500 staff. It supplies private developers, social housing providers, retailers and hotel operators across the UK and internationally. The 20-year lease includes a tenant break clause after 15 years, as well as a provision for fixed uplifts every five years.

Why does the manager like it? The three units are located in an established manufacturing region and were acquired with a long-term lease in place with a leading firm in its sector. The lease contract also includes an inflation adjustment.

Rental reversion

Given that further commercial property valuation declines are expected this year and next year, income growth will play an important role in minimising these falls. API’s portfolio has almost £6.2m, or 23.0% rental reversion (growth potential) in it, comprised of:

- the realisation of the estimated rental value (ERV) of the current leases would result in a £2.44m uplift in rents, or a 9.1% reversion (with around 30% of its income is subject to inflation linked and fixed rate uplifts and 70% open market reviews);

- the letting of the group’s development project (where leases have exchanged subject to completion of works) would add a further £1.25m to annual rent, or 4.7% rent reversion; and

- the leasing of vacant space would add a further £2.45m of rent, or 9.2% reversion.

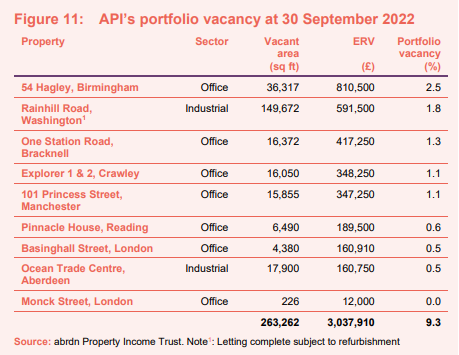

The group is making solid progress on letting up its vacant space. Recent lettings within API’s industrial portfolio have brought the wider portfolio vacancy rate down to 9.3% at the end of September 2022 (from 10.2% in June 2022). The company completed the letting of a logistics unit, which it had recently refurbished to an EPC A-rating standard with operational net-zero carbon emissions, at a rental level that was 63% ahead of the previous rent. The manager has also let another logistics unit, subject to API completing a refurbishment of the building to carbon net-zero and EPC A-rating, at a rent 59% above the previous rental level. The refurbishment is expected to complete, and the lease begin, in June 2023. The letting represents 1.8% of portfolio income, which brings the vacancy rate down to 7.5%.

The majority of the vacant space within its portfolio comes within the office sector, as shown in Figure 11. Vacant space within its largest office asset, 54 Hagley Road, accounts for 2.5% of the overall portfolio vacancy, but as mentioned earlier, the manager is under offer to let a large proportion of this (accounting for 1.3% of overall portfolio vacancy). The company completed a letting on 5,650 sq ft of space at its Princess Street office in Manchester in October and is under offer to let 13,000 sq ft at its office in Crawley. If the under offer office lettings complete, around £707,000 will be added to the group’s annual rent and the portfolio vacancy rate would fall to below 5%.

Future investments

The group has financial resources of £59m, giving the manager the opportunity to source investment deals at attractive prices. The manager says it will look to take advantage of pricing pressure in the market to buy assets with strong long-term real estate fundamentals. The manager says that it would also look to tweak its portfolio sector weightings with the addition of assets in the ‘alternative’ or ‘other’ sector – primarily living assets such as student accommodation, apart-hotels in key cities, and budget hotels.

ESG initiatives

As mentioned earlier, ESG and sustainability are at the heart of all of the manager’s investment decisions. API made a significant purchase in September 2021 in its aim to be carbon net zero, acquiring 1,471 hectares of upland rough grazing and open moorland in the Cairngorm National Park, in Scotland, for £7.5m that is expected to offset a large proportion of carbon emissions from the portfolio.

Around 1.5m trees will be planted and the site is expected to offset around 195,630 tonnes of carbon up until 2060, representing 73% of the company’s residual embedded and operational carbon. It is anticipated that the costs of planting the 1.5m trees will be met through grant funding.

QuotedData believes that API will benefit from early mover advantage, with the cost of carbon offsetting expected to rise dramatically in the future. Through this investment, API is taking the issue of carbon offsetting into its own hands, and avoiding any potential future increases in carbon credits by paying a fixed price today.

The manager says that the fund’s net carbon zero strategy is primarily based on reducing operational carbon at the individual property level, with offsets for residual carbon that cannot be eliminated.

Upgrades have been made on the energy efficiency of API’s portfolio through refurbishments. At 30 September 2022, 77% of API’s portfolio was rated EPC C and above – a marked improvement on the 56% at the end of 2021. New legislation is expected to come into force requiring that commercial properties have EPC ratings of at least C by 2027 and B by 2030. The manager says that it has a clear route to getting the portfolio to a minimum C-rating and is assessing the route to a B-rating.

API has undertaken a major photovoltaic (PV) installation across its industrial portfolio, the largest undertaken by abrdn in the UK. It currently has seven operational PV schemes providing almost three million kWh of power. Contractors have been appointed on two further installations this year, with terms being documented on three other schemes, and tenders out for another three. In total, 15 other sites are at various stages of feasibility assessment.

Performance

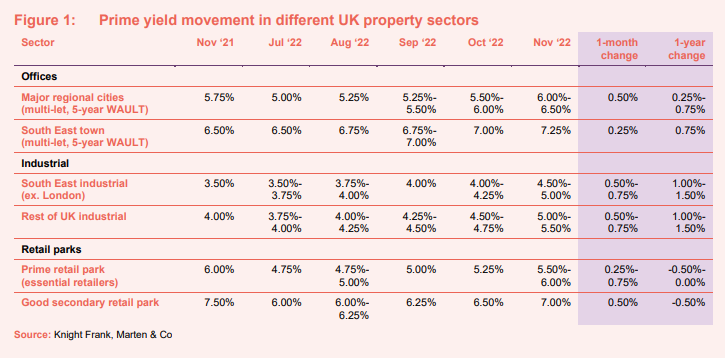

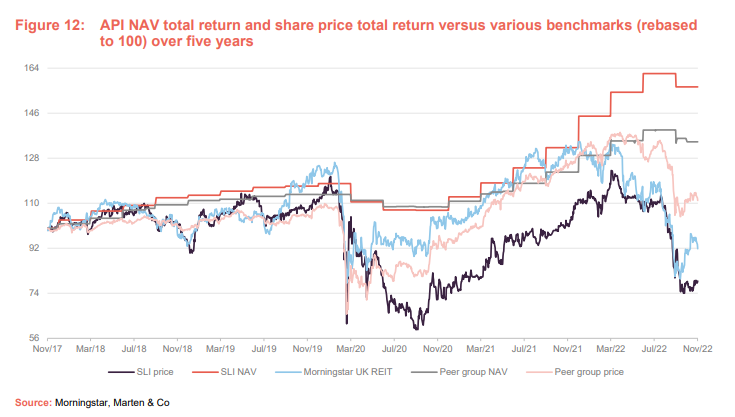

API’s NAV total return fell for the first time since the start of the pandemic in the quarter to 30 September 2022, due to valuation declines in the commercial real estate sector (for reasons mentioned earlier). Prior to this, API’s NAV total return had recovered strongly from its pandemic lows and as Figure 12 shows, API’s NAV total return has markedly outperformed that of its Property – UK Commercial peer group (which is made up of 14 REITs – primarily with diversified portfolios) over the five-year period. Despite API’s superior NAV performance, its share price has lagged that of its peer group and the Morningstar UK REIT index.

Peer group analysis

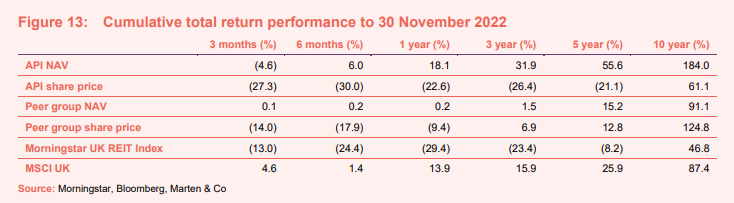

API’s NAV total return has, for all periods from six months to 10 years, beaten that of the Property – UK Commercial peer group average, as illustrated in Figure 13. For a strategy such as API’s, where assets tend to be held for the long term, we consider that the longer-term periods are the most relevant when assessing the effectiveness of the strategy. In this regard, API has clearly outperformed the peer group averages. Over a 10-year period it has more than doubled the performance of the peer group in NAV terms. However, in share price terms over the same period it has considerably underperformed the peer group. We have used the Morningstar UK REIT Index and the MSCI UK Index as further comparators to API’s short- and long-term performance.

NAV and portfolio valuations

API publishes NAVs on a quarterly basis, based on portfolio valuations, which are approved by the board prior to publication.

Independent international real estate consulting firm Knight Frank performs the valuation, in accordance with the then-current Royal Institute of Chartered Surveyors (RICS) guidance. The fair value of properties is determined using the income capitalisation method, which begins by capitalising a property’s net income over its lease period; the valuer then assumes the property will be re-let at a pre-determined estimated open market rental value; and allowances for voids are made where applicable. The yield used by the valuer to capitalise a property’s income stream reflects views on factors that include (not an exhaustive list): a property’s location, its perceived quality, the credit quality of its tenants and its lease term profile.

API’s manager meets with the valuers on a quarterly basis to ensure the valuers are aware of all relevant information for the valuation and any change in the investment over the quarter. The manager then reviews and discusses the draft valuations with the valuers to ensure that correct factual assumptions are made. The valuers report a final valuation that is then reported to the board.

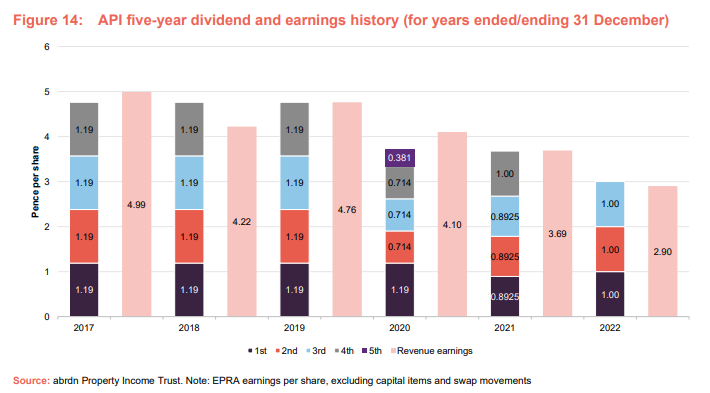

Dividend

API increased its quarterly dividend to 1.0p per share at the end of 2021 to match earnings, having cut the dividend at the start of the pandemic to review the impact of COVID-19 on its rent collection levels. In total, the group distributed 3.6775p in 2021, which was covered by earnings of 3.69p per share. So far in 2022, the company has paid 3.0p in dividends, not quite covered by earnings of 2.9p per share for the first nine months of the year. The company forecasts that dividend cover for the year will be around the mid-70%, due to the cost of refinancing its debt.

The board has provided guidance that the dividend at its current level of 4.0p per share on an annualised basis will at least be maintained for the next two years.

API’s EPRA earnings per share were less than its total dividend payment only once in the last five financial years (in 2018). In this instance, API was able to draw on its retained earnings to fund any deficit. As at 30 June 2022, API had retained earnings of £8.4m (equivalent to 2.15p per share).

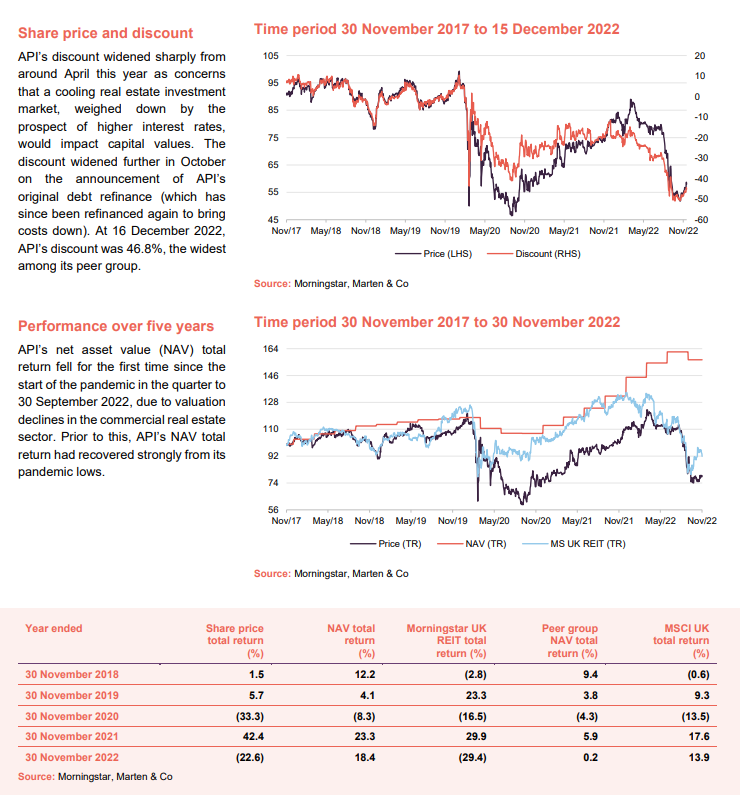

Premium/(discount)

As illustrated in Figure 15, API’s discount widened sharply from around April this year as concerns that a cooling real estate investment market, weighed down by the prospect of higher interest rates and a recession, would impact capital values. The discount widened further in October on the announcement of API’s original debt refinance, which would have seen its interest cost rise dramatically (however, it has since refinanced the debt again to bring costs down – more information on page 20). At 16 December 2022, API’s discount was 46.8%, the widest among its peer group. This seems unjustified given the reversionary potential of the portfolio and the manager’s long-term track record on performance.

API is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital (renewal of these authorities is sought annually at the company’s annual general meeting (AGM)). Purchase of shares will only be made at prices below the prevailing NAV to enhance shareholder value.

Between May 2022 and September 2022, API repurchased 15.7m shares for just under £12.4m at an average price of 78.9p in a share buyback programme. This follows a similar buyback programme between November 2020 and April 2021 in which 9.9m shares were repurchased. In total, 25.6m shares are now held in treasury.

Fees and costs

API recently announced a reduction in its management fees by 10bps. From 1 January 2023 the management fee will be charged according to the following structure: 0.6% of total asset up to £500m and 0.5% of total assets above £500m. The reduction in the management fee will increase dividend cover by 3.4% based on its last published gross asset value. API does not pay a performance fee. The investment management agreement can be terminated at one year’s notice by either side.

Administration, secretarial and registrar services

Administrative, company secretarial and registrar services are provided by Northern Trust International Fund Administration Services (Guernsey) Limited. For these services, Northern Trust is entitled to a fee of £65,000 per annum, payable quarterly in arrears. Northern Trust is also entitled to reimbursement of reasonable out-of-pocket expenses. Total fees and expenses charged for the year ended 31 December 2021 amounted to £81,250 (2020: £81,250).

Portfolio valuation services

Portfolio valuation services are provided by Knight Frank LLP, which values API’s property portfolio on a quarterly basis. For these services, Knight Frank is entitled to an annual fee that is equal to 0.017% of the aggregate value of property portfolio paid quarterly.

The total valuation fees charged for the year ended 31 December 2021 were £77,457 (2020: £84,638). Knight Frank charges a minimum fee of £2,500 per property for new properties that are added to API’s portfolio.

Allocation of fees and costs

In API’s accounts, investment management fees, administrative expenses, finance costs and all other revenue expenses are charged to the revenue account. The costs of property purchases and disposal are allocated to the capital reserve, as are capital expenditure on properties and the capital expenditure that results in a movement in the capital value of a property (for example, refurbishing an asset).

Capital structure and life

API has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 15 December 2022, there were 381,218,977 ordinary shares in issue and 25,646,442 shares in treasury. API does not have a fixed winding-up date and there is no specific measure, such as a regular continuation vote, to wind up the company.

Borrowings

API is permitted to borrow and its articles of association mandate that its gearing – defined as total borrowing divided by gross assets – cannot exceed 65%. The board’s current intention is that API’s loan-to-value ratio (LTV – total borrowings less cash divided by portfolio value) shall not exceed 35%. At 30 September 2022, API’s LTV ratio was 21.7%. The manager says an LTV in the range of 20% to 30% is desirable in the current market.

In October, API secured extensions to its two debt facilities (a £110m term loan and a £55m revolving credit facility (RCF) both with RBS) that were due to expire in April 2023 at a significant increase in interest rate costs. The term loan was reduced to £85m, with the RCF increasing to £80m and a new three-year tenor was agreed on both. The new facilities have a competitive margin of 150 basis points (bps – equivalent of 1.5%) over SONIA, but the company entered into a forward interest rate swap on the full amount of the term loan at a cost of 5.47% (giving an all-in rate on the £85m loan of 6.97%).

Given the change in the interest rate environment since October, the manager took the decision to break the swap at a cost of £3.56m and replace it with an interest rate cap at a rate of 3.96% (with the 150bps margin being retained). This means that the maximum all-in cost of the term loan is capped at 5.46%. At the current SONIA rate of 2.92%, the company will pay interest of 4.42% on the term loan. The interest rate cap also enables the company to benefit from lower interest costs as SONIA falls. The cost of the interest rate cap is £2.51m which will be amortised over the three-year tenor of the loan.

The cost of breaking the swap is a one-off charge that will impact dividend cover in the fourth quarter of 2022. This charge is consistent with the fair value mark-to-market loss that the company would have suffered if the swap had been left in place, and therefore there is no material effect on the company’s NAV from breaking the swap.

The manager acknowledges that, with the benefit of hindsight, it could have waited longer and achieved the more favourable terms it has now got but should be commended for taking swift and decisive action to rectify the mistake.

The RCF is undrawn and will have a floating rate based on the prevailing SONIA rate.

Loan covenants on the new debt have been maintained, with an LTV covenant of 55% and an interest coverage ratio (ICR) of 175%. For the quarter ended 30 September 2022 these were comfortably met. API’s interest cover was 825% and its LTV of 25.4% (loan value less cash held in RBS accounts only divided by pledged portfolio) is well below the covenant limit.

Financial calendar

The trust’s year-end is 31 December. The annual results are usually released in April (interims in September) and its AGMs are usually held in June of each year. API pays quarterly dividends in May, August, November and March.

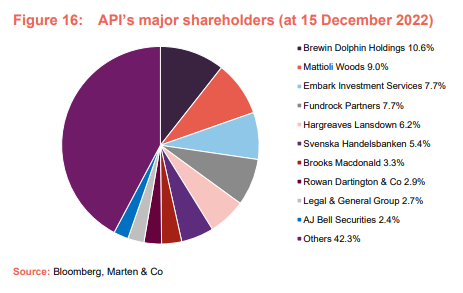

Major shareholders

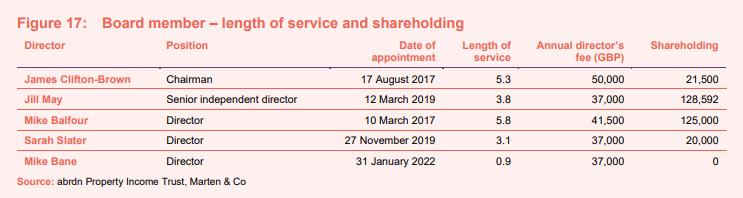

Board

API’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. All of the directors stand for re-election on an annual basis. Huw Evans resigned from the board in June 2022 and was replaced by Mike Bane.

James Clifton-Brown (chairman)

James heads the board as non-executive chairman. He has extensive experience in the real estate sector, and joined CBRE Global Investors in 1984 as a fund manager on the Courtaulds Pension Scheme Account (now Akzo Nobel Pension Scheme) becoming the firm’s UK chief investment officer in 1996, where he had responsibility for the firm’s UK house strategy and risk management as well as client and investor relationship management. Since 2004, he has been a director on a number of boards relating to CBRE Global Investors Limited. James is a voting member on the USA and European Investment Committees of CBRE Global Investors.

Jill May (senior independent director)

Jill assumed her role as senior independent director following the resignation of Huw Evans in June 2022, having joined the board in March 2019. She has spent most of her career in investment banking, where she held roles with SG Warburg & Co for 13 years (in mergers and acquisitions) and UBS for 12 years. Jill is currently an external member of the Prudential regulation committee of the Bank of England. She is also a non-executive director of Sirius Real Estate, JPMorgan Claverhouse Investment Trust, Ruffer Investment Company, and the Institute of Chartered Accountants in England & Wales (ICAEW).

Mike Balfour (director)

A chartered accountant by training, Mike has more than 30 years of experience in investment management. He has held a number of executive leadership roles, including seven years as the chief executive of Thomas Miller Investment, before which he was the chief executive at Glasgow Investment Managers. He has also held the role of chief investment officer at Edinburgh Fund Managers. Mike was appointed to API’s board in March 2017. He also holds non-executive directorships with Perpetual Income and Growth Investment Trust, Fidelity China Special Situations and chairs the Investment Committee of TPT Retirement Solutions.

Sarah Slater (director)

Sarah joined the board on 27 November 2019. She is the chief executive of The Eyre Estate, a private family trust, a trustee of Dulwich Estate, and was a board member of GRIP REIT Plc, one of the UK’s largest residential REITs. During her career, Sarah has held senior positions at The Canada Pension Plan Investment Board (CPPIB), ING Real Estate Investment Management (now CBRE GI) and Henderson Global Investors (now Nuveen) with responsibility for the delivery of major real estate programmes.

Mike Bane (director)

Mike joined the board on 31 January 2022, replacing Huw Evans. Mike retired as an assurance partner at Ernst & Young (EY) in 2018 and has over 35 years’ experience in the asset management and real estate industries. He was a member of EY’s EMEIA Wealth and Asset Management Board. Mike is currently chairman of HICL Infrastructure Plc. In addition, he is a non-executive director of The Health Improvement Commission for Guernsey & Alderney LBG. He is a resident of Guernsey and a member of the Institute of Chartered Accountants of England & Wales.

Previous publications

QuotedData has published six previous notes on API. You can read these by clicking the links in the table below.

Figure 18: QuotedData’s previously published notes on API

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn Property Income Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.