Executing on revised objective

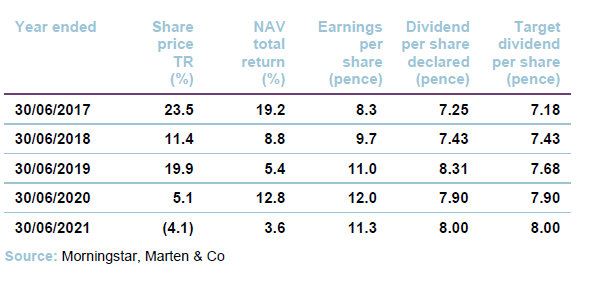

Since we last published on Bluefield Solar Income Fund (BSIF), the company has raised £105.1m in an oversubscribed share issue, and completed on the purchases of its first wind and battery storage investments. The company’s financial results, covering the year ended 30 June 2021, were encouraging. BSIF hit its 8p per share dividend target comfortably, maintaining its record of sector-leading distributions that are well-covered by underlying earnings post debt amortisation.

A high proportion of subsidy income means that BSIF’s revenues already have a high degree of predictability and inflation-linkage. In addition, soaring power and carbon prices create the potential to lock in higher revenue from sales of power over the next few years.

Evolving beyond large-scale solar assets

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions. Historically, this has been achieved by investing in a portfolio of large-scale UK-based solar-energy infrastructure assets. BSIF can now augment its solar portfolio with investments in other renewable technologies and energy storage assets.

Progress on a number of fronts

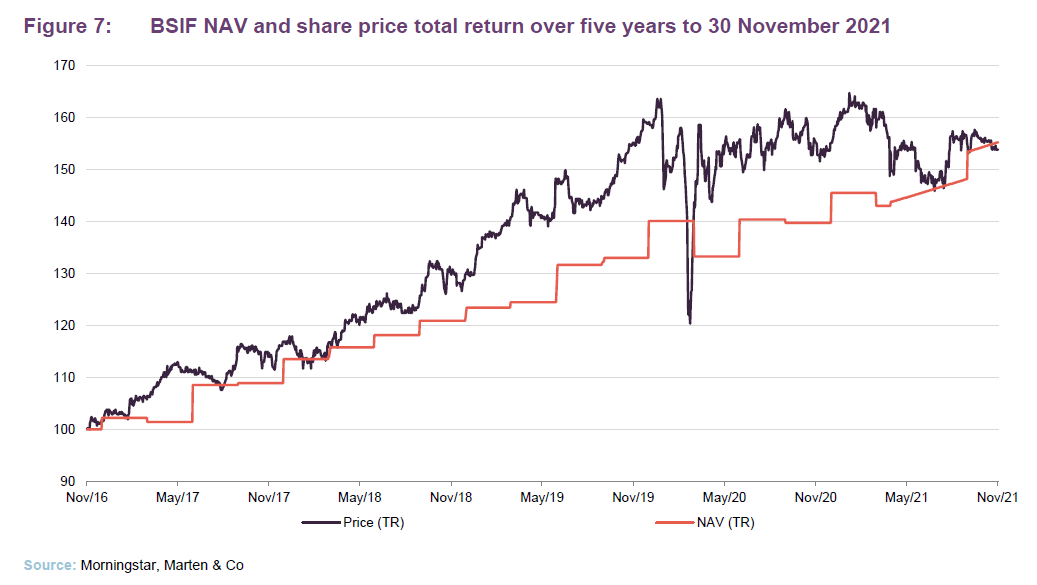

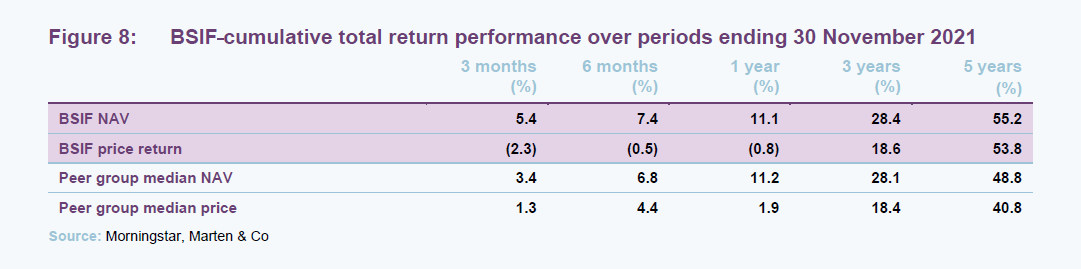

BSIF is one of the oldest of the UK-listed renewable energy funds and has built up a good long-term track record, with returns of about 9% per annum since IPO. Defensive, sterling revenues from a portfolio of UK solar projects with high levels of regulated income, and the highest dividend per share in its sector have attracted a loyal shareholder base. As we described in our April 2021 note, plans to expand and diversify the portfolio were welcomed enthusiastically.

In our July 2021 note we outlined BSIF’s planned acquisition of a portfolio of 109 small-scale wind turbines (the Arena Capital portfolio). That deal was contingent on BSIF raising fresh equity. Since then, BSIF has raised £105.1m from investors through an oversubscribed issue of shares (see page 11).

With the acquisition complete, attention has turned to achieving technical improvements within that portfolio. The adviser believes that higher returns can be achieved through active management. Its 80-strong team can boast high levels of operational and technical expertise. This is a key differentiator for BSIF relative to some other funds reliant on outsourcing these functions. John Rennock’s chairman’s statement says that Bluefield Operations, the principal O&M contractor, is a key element behind the ‘highly pleasing’ technical performance of the portfolio over the year to 30 June 2021. It now provides O&M services on over three-quarters of the portfolio.

The Arena Capital deal followed on from the £195.6m acquisition of 134MWp of ROC-supported ground mounted PV plants (in two transactions – one in August 2020 and the other in January 2021). In the second half of 2020, BSIF also secured planning consent on 50MWp subsidy free plant (Yelvertoft in Northamptonshire).

Most recently, BSIF paid £5m to buy a ready-to-build 45MWp solar asset and co-located 25MWp battery project. The project (based in Lincolnshire) comes with a grid connection, land and planning permissions and construction will start next year.

At the end of June 2021, the investment adviser had a 593MWp pipeline of subsidy-free solar and 179MWp of battery projects. 81MWp of the solar pipeline and 19MWp of battery pipeline was in planning. Securing planning and appropriate grid connections forms a key part of the development process and is a constraint to the pace of development across the industry. The adviser estimates that, subject to finance being in place, the pipeline could be built out over about three years. BSIF may seek to sell on some of the development projects once completed, crystallising profits and freeing up cash for reinvestment into new opportunities.

At present, the two projects highest up the development timetable are the new Lincolnshire project referred to above and Yelvertoft. The adviser is mindful that development costs for renewable energy projects are rising. In particular, solar PV module costs are rising for the first time in many years. This is part of a general pattern of higher inflation, which was thought to be transitory but seems to be becoming more entrenched. However, the established portfolio is well-suited to an inflationary environment.

Subsidy income is RPI-linked and it is reasonable to assume that there will be some linkage between power prices and inflation. Part of the underlying debt facility is index-linked – £61.1m of £250.6m at 30 June 2021. At that date, the directors’ valuation was assuming inflation of 3.0% per annum between 2020 and 2025 and 2.75% per annum from 2025 onwards. It estimates that a 0.25% increase in inflation over the life of BSIF’s portfolio would add 3.49p to the NAV per share.

The new UK renewable energy subsidies, offered in the form of CFDs accessed through annual auctions, could provide opportunities for BSIF. It will not participate in this year’s round of auctions (where £10m is available to support new solar and onshore wind projects), however.

This is evolution not revolution. As the portfolio expands over coming years, UK-based solar projects will continue to dominate (at least 75% of the portfolio will be in UK solar).

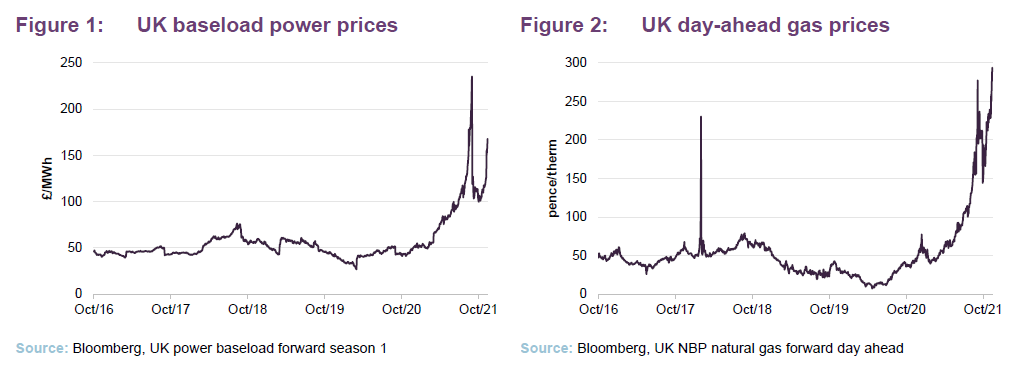

Soaring power prices

Over the course of 2021, there has been a decisive increase in UK power prices. The marginal price for power tends to be heavily influenced by the gas price as shortfalls in supply are met by gas-fuelled peaking plant.

The gas price has been rising as demand rebounds from last year’s COVID-19 impacted levels. A cold winter in Europe had depleted storage levels and then over the first half of 2021, relatively low wind resource in Northern Europe increased demand for gas. Global demand has been rising too as it is preferred over coal for new power plants in many markets (thanks to gas’ lower CO2 emissions). Supply from Norway was constricted by maintenance works and supplies from Russia have declined somewhat. Commentators have questioned whether that was part of a deliberate policy by Russia to emphasise the need for security of supply so that the Nord Stream 2 pipeline would be connected as planned. Both Norway and Russia stepped up gas deliveries around the end of September and this helped to ease prices for a while. However, in recent days the new German government has said that the pipeline does not comply with EU law and tensions have been growing over the massing of Russian troops on the Ukrainian border.

At the same time, as the use of gas and coal-fired plant has picked up, carbon prices have been rising too.

The intermittency of supply from renewable generation may eventually be offset by additional energy storage. However, demand for power is also set to increase as it supplants the use of fossil fuels in heating, transport and heavy industry. BSIF quotes an anticipated 51.9% increase in electricity demand between 2021 and 2050 (to 474TWh).

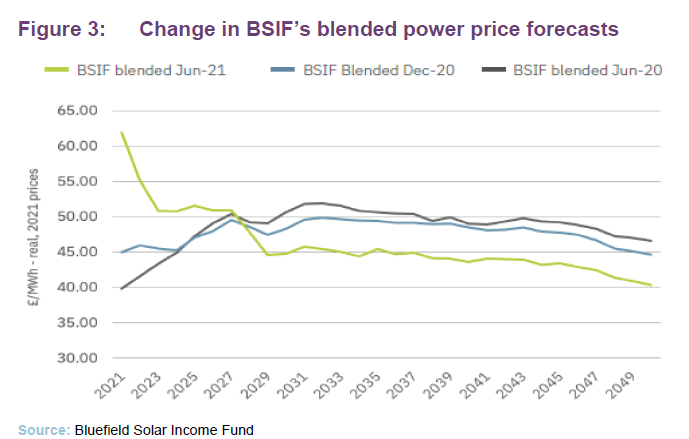

Figure 3, which was taken from BSIF’s annual report, shows how BSIF’s long term power price forecasts have changed over the past few years. The chart shows an expectation of power prices of about £62/MWh in June 2021, falling rapidly towards £50/MWh and falling away again towards around £45/MWh at the end of the decade.

Contrast that with Figure 1, where over four months later prices are over £150/MWh and consensus is building that elevated gas prices and hence power prices may persist for some time yet. It could be that, at the next calculation point, long-term power price forecasts recover a little, to the benefit of BSIF’s NAV, as was the case at 30 September 2021.

BSIF’s revenue should benefit as PPAs roll off

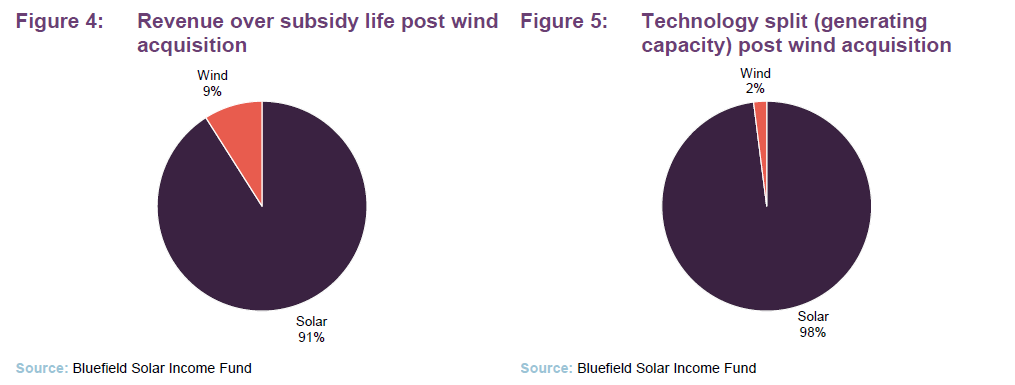

A high proportion of BSIF’s revenues are provided by subsidy income (68% post the wind farm acquisition). Merchant power is sold through PPAs which typically have a duration of 12–36 months. Contracts struck in 2018 locked in what were then relatively high prices (in the 60s). In recent years, as these have rolled off, this has impacted on earnings.

However, today, BSIF’s PPAs are at prices well below prevailing spot rates (£49.88/MWh at 30 June 2021). New fixes are coming at materially higher prices (at 30 June 2021, the average contracted price for PPAs starting after that date was £61.70/MWh) and contracts covering 300MWp of generation are due for renewal over 2022. The implication is that BSIF’s like-for-like revenue will continue to climb over coming months. The adviser will also attempt to increase the average length of BSIF’s PPAs.

Portfolio

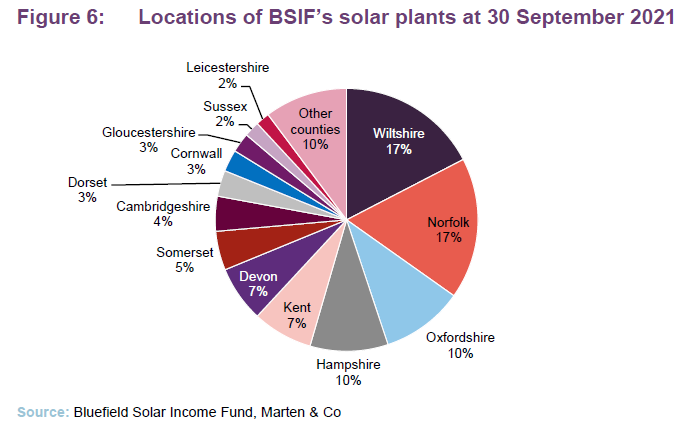

At 30 June 2021, BSIF had an operational portfolio of 106 solar PV plants with a total capacity of 613MWp. After the financial year end, the company acquired a portfolio of 109 small-scale wind turbines and a ready-to-build 45MWp solar asset and co-located 25MWp battery project.

The wind acquisition came with an opportunity to repower 17 Northern Irish turbines with newer, larger and more efficient kit at a cost of about £35m. More than 90% of the revenue from the wind portfolio is derived from subsidies. These start to roll off between 2034 and 2037.

ESG

Following COP26 in Glasgow, there appears to be a global consensus that real action is needed to tackle climate change and that a shift away from fossil fuels is an essential part of that. BSIF was the first London-listed investment company to achieve Guernsey Green Fund status, holds an LSE Green Economy Mark and is a constituent of the TISE Sustainable market segment.

BSIF’s annual report has an extensive section dedicated to aspects of ESG. Over the year ended 30 June 2021, BSIF’s portfolio generated sufficient energy to power 187,000 homes and delivered savings of the equivalent of 127,000 tonnes of carbon dioxide. The company paid £151,000 to support community benefit schemes.

A landscape and ecological management plan is drawn up for each site. The plan seeks to support (and potentially increase) the biodiversity present, including wildflower seeding, bat and bird box installation, hibernation spaces and access for small mammals. Land management activities seek to minimise the impact on local flora and fauna.

Performance

Since we last published, BSIF has published its annual results covering the 12 months ended 30 June 2021 and an NAV as at 30 September 2021.

Solar irradiation was 0.8% below budget for the financial year and this fed through into generation of 545GWh, 1.1% below budget. Unplanned outages took about 9.6GWh off total generation, some of these were the subject of insurance claims in respect of equipment failures. However, higher than forecast prices helped revenues exceed expectations by 2.8%.

The net effect was that BSIF generated underlying earnings of 11.34p per share, which after debt amortisation of 2.17p and 8.0p of dividends (up from 7.9p for FY20) left 1.17p per share to be added to reserves.

BSIF’s NAV fell from 117.0p at 30 June 2020 to 115.8p at 30 June 2021. The report identified a number of factors that drove this change:

- Asset life extensions – as at 30 June 2021, 490MWp (about 80% of the portfolio by capacity) was being valued on the basis of an additional 5–15years of operational life, resulting in a weighted average life of the portfolio of30.2 years (vs. 27.4 years in June 2020), reflecting both new acquisitions and asset life extensions. These asset life extensions added about 2.7% to the NAV. If extensions were secured on the remainder of the portfolio, this would add about 2.9p per share to the NAV.

- Discount rates – the equity discount rate of 6.0% was unchanged from 30June 2020. The investment adviser and board note that there is continued demand for subsidised solar assets. The range of values that they observe remains between £1.20m/MWp and £1.40m/MWp. BSIF’s operational portfolio is valued at an enterprise value of £770.1m, equivalent to £1.26m/MWp, at the lower end of that range.

- Corporation taxes – following the Spring Budget in 2021, the corporation tax rate assumed within the valuation has been increased from 19% to 25% from April 2023 for the remaining life of each asset (NB some other funds have assumed that the increase is temporary). This took about 2.0% off the NAV.

- The directors’ valuation included the latest power curves from three leading forecasters (see Figure 3). Over the financial year, the NAV fell by about 2.5% on the basis of reductions to forecast long-term power prices.

At 30 September 2021, the NAV was revised upwards to 117.18p. This equated to a movement of +1.35p and an NAV total return for the quarter of 1.2%.

The NAV as at 30 September 2021 reflected the adoption of the most recent power curves published by the BSIF’s three independent power forecasters. This resulted in a positive impact on NAV for the quarter of approximately 1p per share. The remaining uplift of 0.35p was principally the result of recent PPA fixes and working capital movements over the quarter to 30 September 2021.

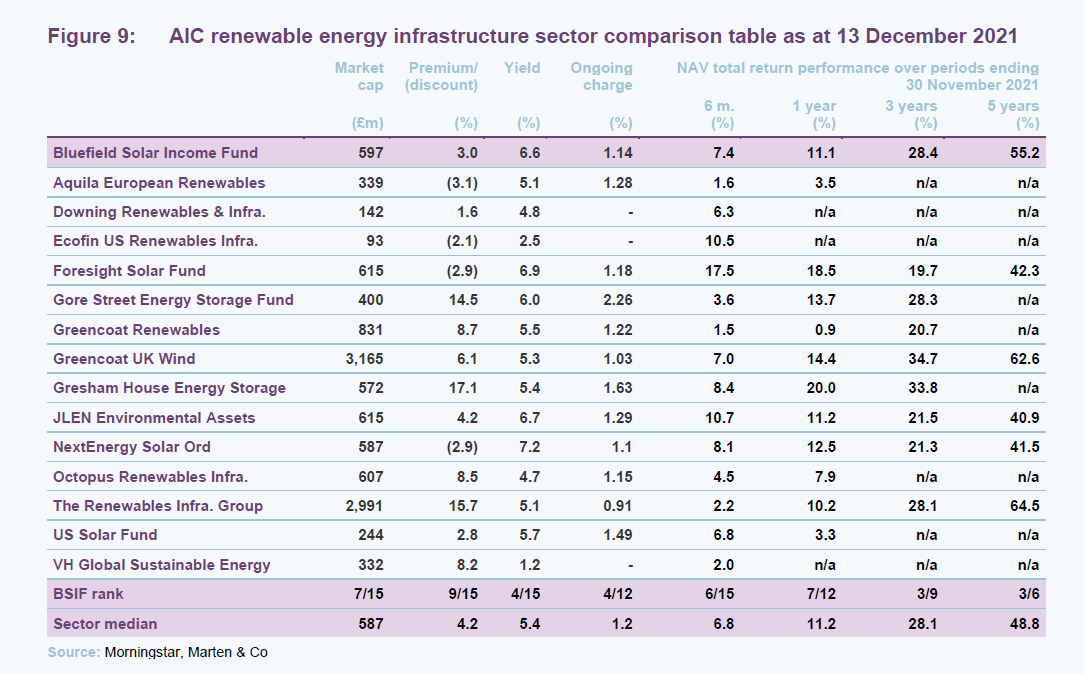

Peer group comparison

With the recent additions of Atrato Onsite Energy, Harmony Energy Income Trust, HydrogenOne Capital Growth, and ThomasLloyd Energy Impact Trust there are now 22 companies in the AIC’s renewable energy sector. As we did in our last note, for the purposes of constructing a peer group, we have excluded the three funds focused on energy efficiency, although we may review this stance when we next publish on BSIF given that these funds seem to have a bias toward energy generation rather than energy efficiency. We are also excluding the newly-launched funds for the moment.

Historically, Foresight Solar and NextEnergy Solar have been BSIF’s closest comparators. Due to BSIF continuing to focus the majority of its investments in solar, they will continue to be a good benchmark reference for the company.

One thing that struck us looking at the data in Figure 9 is that, relative to the peer group, BSIF’s premium was out of step given its high yield, low charges and strong long-term returns. We explore this further on page 11.

Dividend

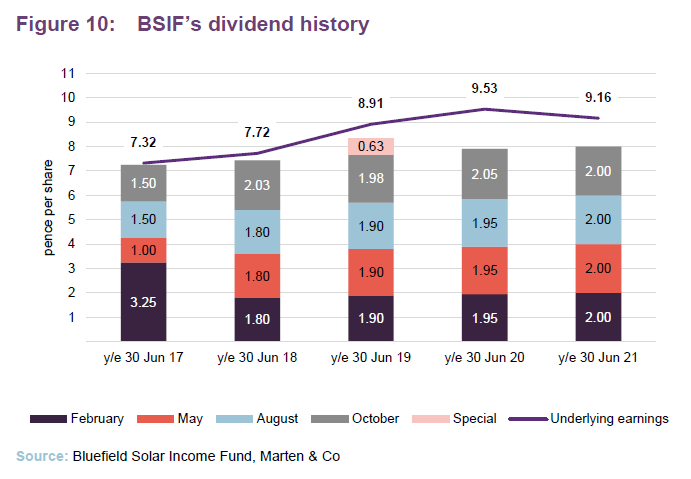

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February, with the second, third and fourth interims paid in May, August and October/November respectively (dividends are usually declared the month before payment).

BSIF delivered on its 8.0p per share dividend target for the financial year ended 30 June 2021. As Figure 10 shows, BSIF’s dividends have consistently been covered by underlying earnings post debt amortisation. At the end of June 2021, BSIF had carry forward earnings available to fund future dividends of about 2.67p per share.

Within its peer group, BSIF has consistently delivered the highest dividend on a pence per share basis (or euro equivalent). Investors at IPO are now receiving an 8% yield on their investment. The next best funds launched a few months after BSIF – Greencoat UK Wind’s yield on its IPO price is 7.2% as is NextEnergy Solar’s.

Going forward, BSIF’s dividend is no longer linked to inflation (RPI). It has instead adopted a progressive dividend policy.

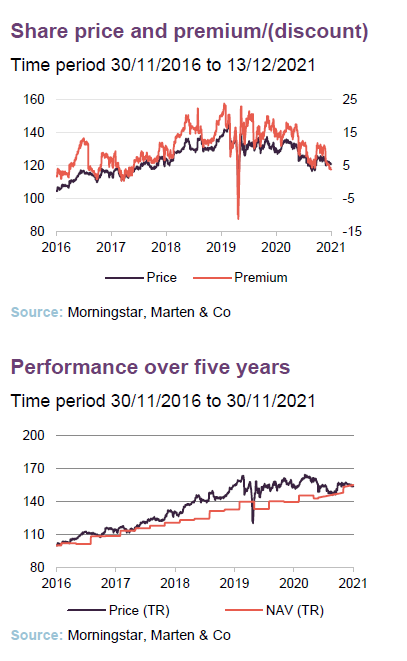

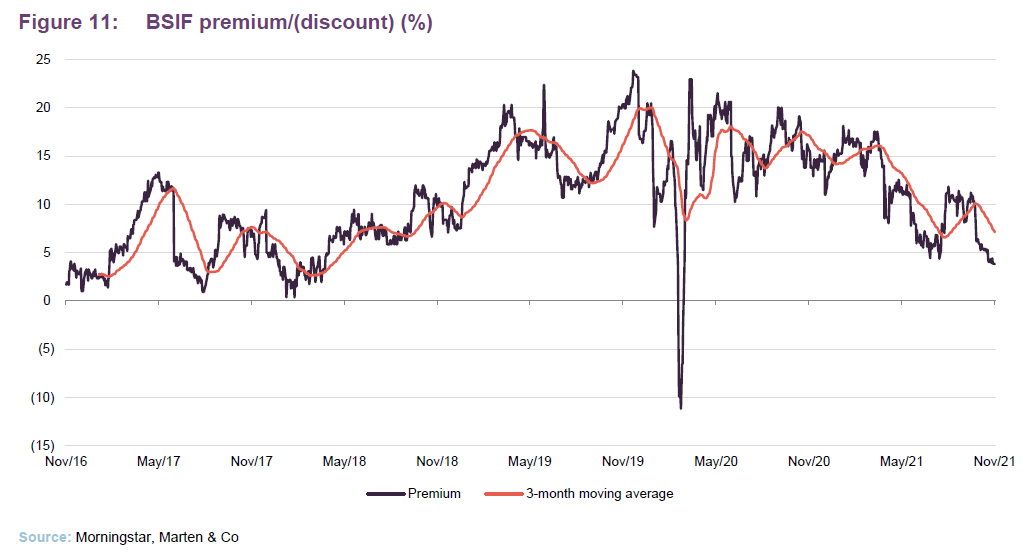

Premium/(discount)

The COVID-related panic in markets during March 2020 triggered a short-lived discount for BSIF. The shares quickly regained their poise. However, the premium eased over the course of 2021. In part, that may reflect BSIF’s announcement that it intended to seek to expand the company. Negative pressure on NAVs in the renewable energy sector at the start of the year may also have played a part. Over the 12 months ended 30 November 2021, BSIF’s premium ranged between 3.8% and 18.1% and averaged 10.9%. At 13 December, the premium was 3.0%.

BSIF’s investment adviser feels that investors should focus more on the yield that BSIF generates and that the shares could reasonably trade on a yield closer to that of the sector median – around 5.3%–5.5%. At the lower end, that would imply a share price of 150.9p.

On 15 July 2021, shareholders gave BSIF’s directors permission to issue up 500m new ordinary shares at any time up to 28 June 2022. Shortly thereafter, BSIF announced that its first share issue under the new permissions was oversubscribed. The directors opted to expand the issue, saying BSIF was issuing 89,067,980 new ordinary shares at 118p to raise gross proceeds of £105.1m.

Balance sheet

At the project level, BSIF has a £110m three-year term loan provided by NatWest secured against a portfolio of projects totalling 141.7MWp and a project finance loan of £9.8m provided by BayernLB secured against a 5MWp plant.

At the group balance sheet level, on 30 June 2021, BSIF had £160.5m of long-term loans provided by Aviva. Of this £61.1m related to an index-linked facility at a cost of RPI +70bps. The balance is at a fixed rate of 287.5bps. These facilities mature in 2034. In addition, BSIF has a £100m RCF provided by NatWest. The cost of this is 200bps over LIBOR.

Prior to the recent fundraise of £103m (net of costs) BSIF had drawn £90m of its £100m RCF. The fundraise proceeds were used to pay down the RCF entirely, leaving £13m available in addition to the then undrawn £100m RCF. With the deals that BSIF has announced since then, the company has now redrawn about £60m of its RCF. As a result, total outstanding debt is approximately £340m and an LTV of 37% as at 30 September 2021.

Over the coming year, as BSIF seeks to deploy more money into its pipeline, we would anticipate further equity fundraises.

Fund profile

Stable regulated sterling income

BSIF is a Guernsey-domiciled sterling fund, with a premium main-market listing on the London Stock Exchange (LSE). Since its launch on 12 July 2013, it has focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. BSIF owns and operates one of the UK’s largest, diversified portfolios of solar assets, with a combined installed power capacity of over 600MWp.

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in SPVs which, in turn, are held through Bluefield SIF Investments Limited.

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch.

Bluefield Partners says that its team has been involved in over £2.5bn of solar photovoltaic funds and/or transactions in both the UK and Europe since 2008. This includes over £1.1bn in the UK since December 2011.

The team was recently strengthened with the appointment of Michael Covington as an investment director at Bluefield Partners LLP. Michael was the renewables investment director at Alpha Real Capital and, before that, was a managing partner at the Barcelona based sustainable investment specialist, SI Capital Private Equity.

Previous publications

The legal bit

This marketing communication has been prepared for Bluefield Solar Income Fund Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.