Bluefield Solar Income Fund

Investment companies | Annual overview | 12 January 2023

Politicians cloud otherwise bright future?

There are a lot of moving parts that go into making Bluefield Solar Income Fund (BSIF) run smoothly. However, when brought together as one, the aim is that BSIF should be a fund that offers investors attractive, relatively predictable and largely inflation-linked levels of income, plus the prospect of capital growth.

In recent months, the actions of successive UK governments and sharp increases in bond yields appear to have unnerved investors in the sector. BSIF and its peers have experienced some discount volatility.

However, BSIF’s latest solar plants have secured long-term, predictable, and inflation-linked income through CfD arrangements and there is also greater clarity on windfall taxes and the impact of higher discount rates. These might be factors behind BSIF trading closer to NAV again. The chairman says BSIF’s latest acquisition (see page 13) helps underpin the board’s confidence in delivering its FY2022/23 dividend target of 8.4p per share.

Evolving beyond large-scale solar assets

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions. Historically, this has been achieved by investing in a portfolio of large-scale UK-based solar-energy infrastructure assets. BSIF can now augment its solar portfolio with investments in other renewable technologies and energy storage assets.

Fund profile

BSIF is a Guernsey-domiciled sterling fund, with a premium main market listing on the London Stock Exchange (LSE). At launch on 12 July 2013, it focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. BSIF owns and operates one of the UK’s largest, diversified portfolios of solar assets with a combined installed power capacity of 813MWp.

In July 2020, shareholders approved proposals to expand the remit and BSIF began making investments in onshore wind and energy storage projects soon after.

BSIF is designed for investors looking for a high level of income with regular distributions.

Further information regarding BSIF can be found at: www.bluefieldsif.com.

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in SPVs which, in turn, are held through BSIF’s wholly-owned and UK-domiciled portfolio holding company, Bluefield Renewables 1 Ltd (BR1).

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch. Its business comprises the investment adviser, an asset manager (Bluefield Services Ltd), a maintenance manager (Bluefield Operations Ltd), and a solar project developer (Bluefield Development).

Market backdrop

2022 has been a tumultuous, but generally a positive year for the renewable energy sector.

With soaring energy prices, inflation, higher interest rates, and considerable confusion over UK government energy policy, 2022 has been a tumultuous, but generally positive year for the renewable energy sector.

Energy market reform

The UK government’s Review of Electricity Market Arrangements (REMA) launched on 18 July 2022 and its consultation stage ran until 10 October 2022. It is a far-ranging review intended to deliver an appropriate framework for all non-retail electricity markets to deliver security of supply, cost effectiveness, and decarbonisation. Within this, there is a clear desire to move away from a system whereby the national power price is set by the marginal producers – which in the UK tends to be gas-powered plants – to one which sees consumer prices for power produced by renewable generators better reflect the cost of producing that power.

BSIF’s board believes that the industry needs a solution that does not constrain the sector’s ability support the investment needed to continue the process of decarbonising the economy.

That could also include a shift towards regional/local power prices and a more decentralised power grid, with increased energy storage. Energy-intensive industry could be encouraged to relocate closer to sources of renewable power, for example.

BSIF’s board would like to see a solution that is fair to both generators and consumers, and which does not constrain the sector’s ability to raise the new capital required to support the investment needed to continue the process of decarbonising the economy.

Support for new renewable energy

Since 2014, the UK government has sought to support the development of new renewable energy projects through a mechanism of contracts for difference (CfDs). Generators bid in a reverse auction for a guaranteed price for the power that they produce.

Earlier this year, in auction round four (AR4), contracts were agreed to support the development of 900MW of onshore wind, 2.2GW of solar and 7GW of offshore wind, plus lesser amounts of other types of generation. These contracts cleared at:

- £42.47MWh for the onshore wind;

- £45.99MWh for the solar; and

- £37.35MWh for the offshore wind.

These are 2012 prices, equivalent to £55.64MWh, £60.25MWh and £48.93MWh in September 2022 prices, respectively. Successful bidders receive the guaranteed price, adjusted for inflation based on CPI, for 15 years from the date that production commences. Income from power sales below these prices is topped up to the guaranteed level by the government-owned Low Carbon Contracts Company (LCCC), and income from power sales above this level is handed over to the LCCC. Assuming everything is built, at current prices, the LCCC’s income would be considerable.

BSIF secured CfDs for 100% of the generating capacity of Yelvertoft (49.9MW), Romsey (6.5MW) and Oulton (6.0MW); its latest new-build UK solar projects. The CfD contracts have a 15-year duration, are index linked to inflation (CPI) annually, and are scheduled to commence from 31 March 2025.

Inflation

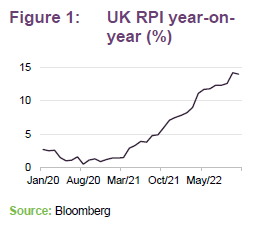

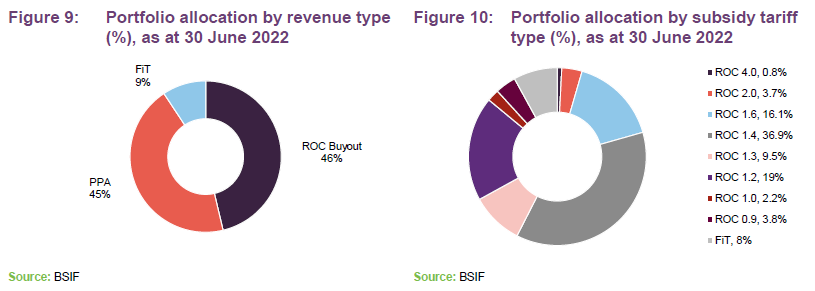

Rising inflation, linked in part to rising power prices, has been a factor weighing on markets as banks raise interest rates in response. BSIF’s revenues include a significant element of subsidy income, from ROCs and FiTs, which is linked to inflation as measured by the UK RPI.

At 30 June 2022, BSIF was assuming that RPI would be 10.9% in 2022 (up from a forecast of 6.4% as at the end of December 2021), 3.4% in 2023, 3.0% per annum from 2024 until 2029, and 2.25% thereafter.

Inflation assumptions feed through into BSIF’s revenues and its NAV calculations, but it also has a direct effect on operations and maintenance (O&M) expenditure, the price of equipment and other costs related to new installations, and to some extent the cost of BSIF’s debt (see page 21). BSIF’s O&M functions are now largely the responsibility of its in-house Bluefield Operations team. Managing this in-house should give BSIF greater control over its costs and the quality of the service.

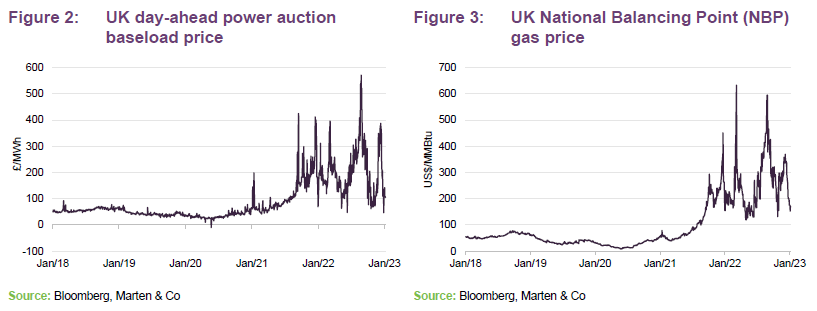

Power prices

As 2021 progressed, gas prices began to move higher. However, the outbreak of the war in Ukraine and the associated sanctions imposed on Russia was accompanied by a sharp spike in energy commodity prices. In the UK, the market price for power is heavily influenced by gas prices, as gas plants are the marginal generators. Prices in the UK emissions trading scheme have been rising too, from £45/tCO2e in June 2021 to £81/tCO2e by end June 2022 and are currently around £68/tCO2e. UK power prices soared past previous highs. However, in recent weeks, with EU gas storage facilities full and mild temperatures, gas and power prices have fallen sharply.

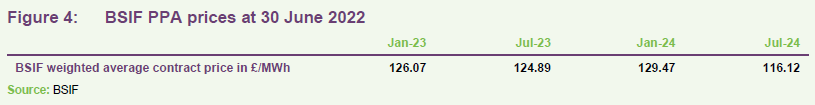

BSIF seeks to fix its power prices through power purchase agreements (PPAs) that typically run for periods of one to three years, but with a bias to 18 months and longer. At the end of June 2022, the weighted average PPA term on the portfolio was 25.2 months. That strategy worked well in the pandemic, when prices fell sharply, but worked against the fund as prices soared. The table in Figure 4 shows the position at 30 June 2022.

This is increasing the predictability of BSIF’s income. Taken in combination with its subsidy revenue, and based on the portfolio as at 30 June 2022, at end December 2022 BSIF could look to 53% of its revenue coming from subsidies and a further 43% from PPAs, with a balance of variable income of just 4%. By June 2023, the split would be 44%, 33% and 13%, respectively.

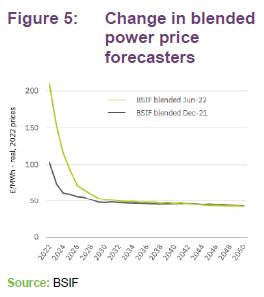

For the purposes of calculating its NAV, BSIF uses a blended forecast of power prices provided by three independent forecasters. The change incorporates the effects of the rise in prices for gas and coal since the invasion of Ukraine. Forecast deployment of renewable energy installations and the increase in annual electricity demand for the UK (driven in part by the shift towards the electrification of transport and heating) from 305TWh in 2022 to 497TWh by 2050.

Figure 5, which is taken from BSIF’s annual report, shows the change in BSIF’s blended power price forecasts from the position as at the end of December 2021 to the position at the company’s financial year end on 30 June 2022.

Electricity generator levy

Despite ruling out a windfall tax on the renewable energy sector on more than one occasion, the UK government eventually U-turned, with the stated aim of recouping some of the considerable outlay on its price cap for consumers of energy.

Renewable energy generators received no support when prices fell sharply as a result of reduced demand during the COVID period. In addition, while the windfall tax on oil & gas producers allows an offset for investment in new projects, this is not part of the UK government’s plans for the renewable energy sector.

The UK government’s Energy Prices Act 2022, which became law on 25 October 2022, intended to introduce a price cap on power produced by renewable energy generators. Whereas the EU Commission imposed a windfall tax on power sold at prices over €180MWh, the UK mooted a price cap for low carbon electricity generators of about £50-60/MWh. This appeared to have an adverse impact on ratings within the renewable energy sector, including BSIF’s.

However, in his autumn statement, Chancellor Jeremy Hunt scrapped the price cap in favour of a windfall tax – labelled an electricity generator levy.

The levy applies from 1 January 2023 and runs until 31 March 2028. Non-fossil fuel generators generating electricity from nuclear, renewable, biomass, and energy from waste sources, such as BSIF, are required to pay a tax of 45% of their excess revenue from sales of power generated in the UK above a level of £75/MWh from 2023 to April 2024, and thereafter adjusted each year in line with the change in inflation (as measured by CPI) on a calendar year basis.

The definition of revenue includes the impact of any hedging or forward sales of power, and excludes income from FiTs, the sale of ROCs, and capacity market payments. It will not apply to electricity generated and used under a private wire arrangement or “behind the meter” generation that is not exported. The levy does not apply to revenues derived from battery storage, and sites that incorporate both renewable energy generation and battery storage will have to separate power generated from power re-exported to the grid for the purposes of calculating the levy.

The tax does not apply to generators whose in-scope generation output of electricity is less than 50GWh per year (reduced from 100GWh at the time of the autumn statement) and also does not apply to the first £10m of excess revenue. The levy is administered via the corporation tax system and paid by the responsible company in a group of companies.

BSIF generated over 624GWh in the 12 months to 30 June 2022 and its portfolio has and looks likely to continue to expand from that level. BSIF will definitely exceed the 50GWh threshold, therefore. However, revenues from sales of power through the CfD mechanism under contracts with the LCCC are excluded from the levy.

In its annual report, BSIF said that, at the end of June 2022, it had contracted to sell power at an average price of £126.1/Mwh for January 2023 and £124.9/MWh in July 23. Therefore, it seems likely that BSIF will also exceed the £10m excess profits threshold.

Discount rates

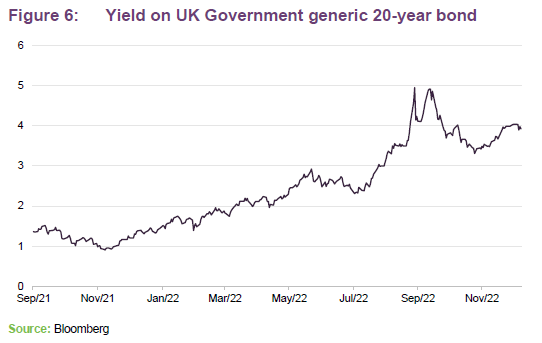

Another potential headwind that renewable energy generation funds face is the prospect of higher discount rates to reflect rising interest rates.

At 30 September 2022, the weighted average discount rate used to value BSIF’s portfolio was 7.25%.

At 30 September 2022, the weighted average discount rate used to value BSIF’s portfolio was 7.25%, up from 6.75% at 30 June 2022 and 6.0% at 30 June 2021.

A range of factors influenced this upward shift in discount rates including the recent increase in yields on long-term government debt. The board also took into account transaction values for large-scale solar portfolios, which at end of June 2022 had edged up to around £1.25m–£1.45m/MWp (last year: £1.20m–£1.40m/MWp). Based on the discount rates adopted by the directors, the average value of BSIF’s solar assets at 30 June 2022 was £1.38m/MWp, up from £1.24m/MWp a year earlier.

The relationship between discount rates and government bond yields is not linear, and the risk premium attached to investment in renewable assets has varied considerably over BSIF’s life.

Investment process

Bluefield Partners has a formalised and repeatable investment process based on its extensive experience.

BSIF’s investment adviser, Bluefield Partners, believes that it has developed a formalised and repeatable investment process, based on its extensive experience, which it rigorously applies to all potential investments. As a significant investor in the space, the manager benefits from natural deal flow from its network of advisers and partners. BSIF continues to benefit from an ongoing pipeline of potential opportunities as described later in this note.

Before any costs are incurred in preparing for a transaction, a ‘concept review’ of the project is undertaken by the adviser’s managing partners. If, following this review, the partners consider that the project should be progressed, a letter of interest or memorandum of understanding is then issued to the vendor and the adviser will secure exclusivity on the asset. By securing exclusivity, the adviser avoids incurring transactions costs on projects in which it could be subsequently outbid.

Once Bluefield’s managing partners have approved a concept review, the investment adviser issues a concept paper to BSIF’s board. This concept review fixes a project evaluation budget as well as confirming the project proposal is in line with the BSIF’s investment policy and strategy, and aligned to ESG principles. Once approved, the project moves on to the due diligence stage.

Independent legal, technical, insurance and accounting advisers form part of the due diligence process.

As part of its due diligence, the adviser engages legal, technical and, where required, insurance and accounting advisers to undertake independent due diligence in respect of the project. This includes site visits and a detailed survey of the site to highlight any potential issues. Where specialist expertise is required due to project specifications, the adviser has experience in identifying relevant experts and, in addition to this, it applies its own direct commercial experience. Assuming that a project passes through the due diligence stage, a detailed investment paper is prepared and submitted to the Bluefield Partners LLP investment committee for approval.

The investment committee reviews the paper and makes an investment recommendation for the board. The investment committee operates based on unanimous consent and the adviser says that it has a record of making detailed evaluations of project risks. The investment paper discloses all interests which the adviser and any of its affiliates may have in the proposed transaction.

BR1 is BSIF’s wholly-owned and UK-domiciled portfolio holding company.

Following approval by the investment committee, recommendations are issued by the adviser for review by the boards of the company and BR1. Both the company and the BR1 board undertake detailed review meetings with the adviser to assess the project before determining any approval. Both board approvals are required for a transaction to be approved.

If the boards of the company and BR1 approve a transaction, the adviser is authorised to execute the transaction in accordance with the recommendation and any condition stipulated in the boards’ approval. The board is kept aware of the adviser’s pipeline of potential new investments.

Before executing the transaction, the adviser completes a closing memorandum confirming that the final transaction is in accordance with the terms presented in the investment paper to the investment committee, detailing any material variations and outlining how any conditions to the approval of the investment committee and/or board approval have been addressed. This closing memorandum is countersigned by an appointed member of the investment committee prior to completing the transaction.

Key features of the investment process

Having worked with a range of legal, technical, insurance and accounting advisers to execute transactions in the UK market, the adviser believes that it has developed an understanding of key areas of competence for the specialist advisers in the space. It uses this to identify specific individuals who are expert in advising on specific detailed technical aspects of a project both during and following a transaction.

The adviser has developed standardised contract terms with specific protections for the recovery of revenue losses for underperformance and the correction of defects.

Contract terms are specifically negotiated and tailored for each project, but based on its transaction and project operational experience, the adviser has also developed standardised terms. These have specific protections from the construction contracts regarding recovery of revenue losses for underperformance and obligations for the correction of defects. Underlining their value, these contractual protections have, at times, been exercised by the adviser to the ultimate benefit of BSIF’s shareholders.

Investment restrictions

- No less than 75% of the gross assets will be invested in UK solar assets. BSIF can also invest up to 25% of its gross assets into complementary renewable technologies, principally wind and storage.

- BSIF does not intend to be a long-term holder of non-UK assets. However, it can invest up to 10% of its gross assets into assets outside the UK to enable it to acquire portfolios with a mix of UK and non-UK assets.

- Up to 5% of gross assets may be invested into pre-construction UK solar development opportunities.

- The aggregate exposure to other renewable energy assets, energy storage technologies, UK solar development opportunities and non-UK assets will be limited to 30% of gross assets.

- Individual assets or portfolios of assets are held within SPVs into which the company invests through equity and/or debt instruments. The company typically seeks legal and operational control through direct or indirect stakes of normally 100% in such SPVs, but may participate in joint ventures or minority interests to gain exposure to assets which the company would not be able to acquire on a wholly-owned basis.

- BSIF may make use of non-recourse finance at the SPV level to provide leverage for specific renewable energy infrastructure assets or new portfolios provided that at the time of entering into (or acquiring) any new financing, total non-recourse financing within the portfolio will not exceed 50% of GAV.

- BSIF may, at holding company level, make use of both short-term debt finance and long-term structural debt, but such holding company level debt (when taken together with the SPV finance noted above) will not exceed 50% of gross assets.

- At the time of acquisition, no single investment in a solar energy infrastructure asset (excluding any third-party funding or debt financing in such asset) will represent more than 25% of BSIF’s net asset value.

Sustainability

Decarbonising energy generation looks to be central to tackling climate change, but the board feels that it is important that the renewable energy industry also pays mind to the social impacts of the shift to renewable energy, and says that BSIF is playing an important role in this. Meriel Lenfestey (see page 23) chairs BSIF’s ESG committee which has oversight and overall responsibility for the company’s ESG risks and opportunities. An external sustainability consultancy was engaged to gather stakeholders’ views and feed these back into BSIF’s sustainability policies.

ESG metrics – year to 30 June 2022

624GWh of renewable energy was generated, enough to power 215,000 houses, avoiding the emission of the equivalent over 120,000 tonnes of CO2.

In addition, over £154,000 was paid to community benefit schemes.

EU SFDR

Under the EU SFDR classification, BSIF has adopted an Article 8 classification (funds that promote social and/or environmental characteristics, and may invest in sustainable investments, but do not have sustainable investing as a core objective). It might have opted for an Article 9 classification (funds that have a sustainable investment objective), but the board felt that there is currently insufficient detail on the level of regulatory scrutiny Article 9 funds will be subject to compared to

Article 8.

BSIF felt it needed to demonstrate that it was mitigating any potential harmful effects from its activities. This includes adhering to a landscape and ecological management plan for each site, and exploring ways to maximise the recycling of materials at the end of asset lives.

Promoting biodiversity is seen as an important ancillary goal. BSIF also highlights the benefits to farmers of deriving an income from solar projects on lower quality land, thereby supporting their other activities. In addition, typically, the land around solar plants is used for grazing.

The solar industry has come in for some criticism on the use of low-paid/unpaid workers in its supply chain. BSIF plans to adopt a Supplier Code of Conduct and require its adoption by its Tier 1 suppliers by the end of June 2023. Representatives of the investment adviser are part of the Solar Energy UK Supply Chain Taskforce, which is seeking to improve transparency and sustainability within the PV supply chain.

UN Sustainable Development Goals

BSIF’s activities are aligned with eight of the UN Sustainable Development Goals.

Incorporation within the investment process

Potential investments are screened on their ESG characteristics and are evaluated against a comprehensive due diligence questionnaire. Checks are made in areas such as anti-money laundering, anti-bribery and anti-corruption, and sanctions breaches. Third-party service providers are vetted and monitored, checking health and safety compliance and labour practices at O&M contractors, for example.

An ESG report forms part of the papers submitted to the investment committee.

Aspects of sustainability are monitored and reported on over the life of the asset, and, as discussed above, at the end of the asset life, best-practice recycling standards will be followed.

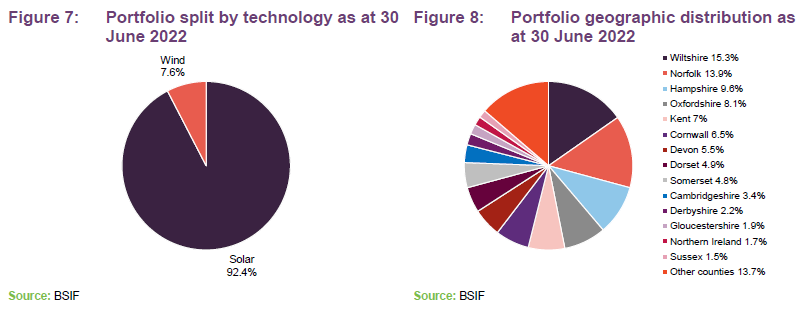

Asset allocation

As at 30 June 2022, BSIF’s portfolio had the capacity to generate 766.2MWp, recent acquisitions have since taken that up to 813MWp. The portfolio, all of which is in the UK, is split between solar and onshore wind, with a strong bias to solar. In addition, BSIF has a number of new projects, including 170MWp of battery storage projects and three new solar plants. These are discussed in more detail below.

BSIF’s solar farms are spread across England and Wales, with a bias towards southern England (31% in South East England and 42% in South West England), reflecting the higher irradiation levels available.

Over half of BSIF’s revenue is derived from subsidies – ROCs and FiTs – but its practice of fixing prices for sales of power through PPAs further increases the predictability of BSIF’s revenue.

Recent operational investments

Over the 12 months ended 30 June 2022, BSIF spent £208.5m and took on third-party debt of £115m to add 95MW of solar and 58.3MW of onshore wind projects to its portfolio. In December 2022, BSIF announced the acquisition of a further 46.4MWp solar portfolio to take the total installed capacity of its portfolio to 813MWp.

Small-scale wind

The first of these acquisitions was the £63m portfolio of 109 small-scale wind turbines that we discussed in our last note, with the potential for a £35m additional investment to repower 17 turbines in Northern Ireland with new EWT 250KW turbines. BSIF says that these assets can be repowered while maintaining their RO accreditation status.

As at 30 June 2022, four of these turbines had been repowered and were operational, and a further seven had received full planning approval for a new 25-year term. Before the end of the year, an additional turbine will be decommissioned and repowered, and a further three are scheduled for early 2023. The remaining six turbines have seen planning applications submitted to the relevant local planning authorities.

Mixed wind and solar – January 2022

Then, in January 2022, BSIF invested £22.5m into the equity portion of a £62.5m portfolio comprised of six ground mounted solar PV plants totalling 30.1MW and two onshore wind farms with a total capacity of 17.4MW, all of which is operational. Of the solar projects, five are accredited under the FiT regime and the other is accredited under the ROC regime with a tariff of 1.4 ROCs. Both of the wind farms are accredited under the ROC regime, being 1 ROC and 0.9 ROCs respectively. Over the period from 2021 to 2034, the proportion of regulated revenues from this portfolio is projected to be approximately 65%.

Mixed wind and solar – May 2022

In May 2022, BSIF spent £112.4m on the equity portion of a £187m portfolio of 64.9MW solar and 28.3MW onshore wind, again all of which is operational. Of the solar projects, five are accredited under the FiT regime and 10 of the projects are accredited under the ROC regime with tariffs of 1.2-1.6 ROCs. All of the wind farms are accredited under the ROC regime, with tariffs of 0.9-1.0 ROCs. In the period 2021-2035, the proportion of fixed and regulated revenues from this portfolio is projected to be approximately 57%.

Fengate portfolio – December 2022

Finally, on 23 December 2022, BSIF announced the purchase of a 46.4MWp solar portfolio from Fengate Asset Management for £28.7m. The purchase was funded from BSIF’s RCF. The enterprise value of the portfolio was £56.0m; the portfolio contains £27.3m of long-term amortising debt provided by Macquarie.

The portfolio’s two ground mounted plants – a 39.3MWp plant in Scunthorpe, Lincolnshire (Raventhorpe) and a 7.1MWp plant in Barrow-in-Furness, Cumbria (Roanhead) – come with 1.4ROCs.

Development projects

Mauxhall Farm – August 2021

In August 2021, BSIF spent £5m buying development rights and associated land to build a 45MW solar asset and co-located 25MW battery storage asset in Mauxhall Farm, Lincolnshire. Commercial operations are scheduled to start in 2023/24.

Battery storage – January 2022

In January 2022, BSIF also made a £1.5m acquisition of the development rights, grid connection costs and the leasehold of land for a ready-to-build 20 MW battery storage project.

Battery storage – May 2022

The in May 2022, it acquired two standalone 40MW battery storage projects for about £4.5m. The acquisition represented the development rights, grid connection costs and the leasehold of land for the two projects, which are based in Derbyshire and Worcestershire. Both projects are fully consented and benefit from near-term grid connections, and the construction of the projects was expected to commence in 2022.

The target for commercial operation of these three battery projects is 2023/2024.

Yelvertoft

Yelvertoft, the 49.9MW solar plant that we discussed on page 4, has signed an EPC contract with Bouygues. Construction is due to start in this current quarter and the plan is for it to be operational in the third quarter of 2023.

Romsey and Oulton

Construction on Romsey 6.5MW and Oulton 6.0MW will follow on from that of Yelvertoft.

Performance

Results for the year ended 30 June 2022

Over the 12 months ended 30 June 2022, solar irradiation for BSIF’s portfolio was 2.6% higher than forecast. In total, generation was 624.7GWh and the average price achieved for that was £132.71/MWh, 3.3% more than forecast. The relatively small uplift in achieved prices versus forecasts reflects BSIF’s policy of selling power through PPAs, making its revenue reasonably predictable.

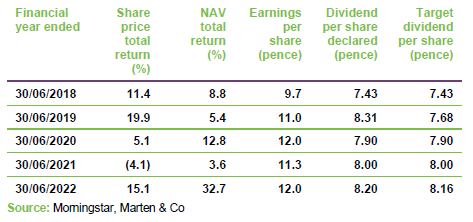

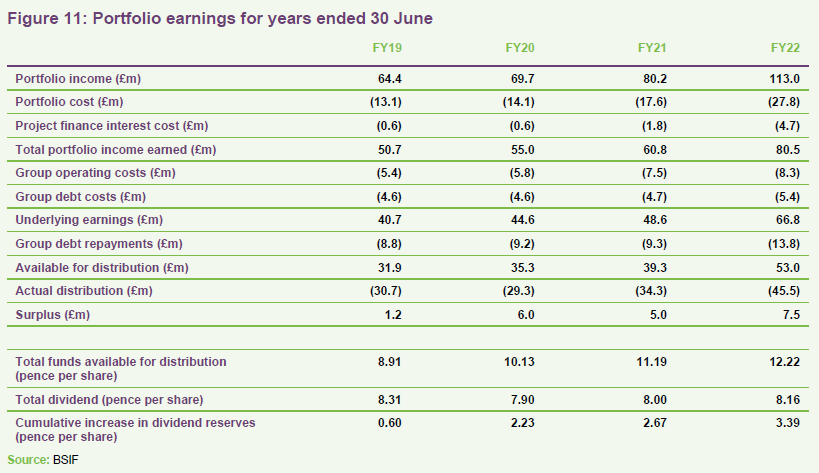

BSIF’s dividend has been covered by earnings in every year since its launch in 2013.

For every year since BSIF’s launch in 2013, BSIF’s dividend has been fully covered by earnings. The 8.16p total dividend declared and paid for FY22 was once again covered by total funds available for distribution of 12.22p. At the end of June 2022, BSIF’s retained earnings amounted to £194.6m or 31.8 pence per share.

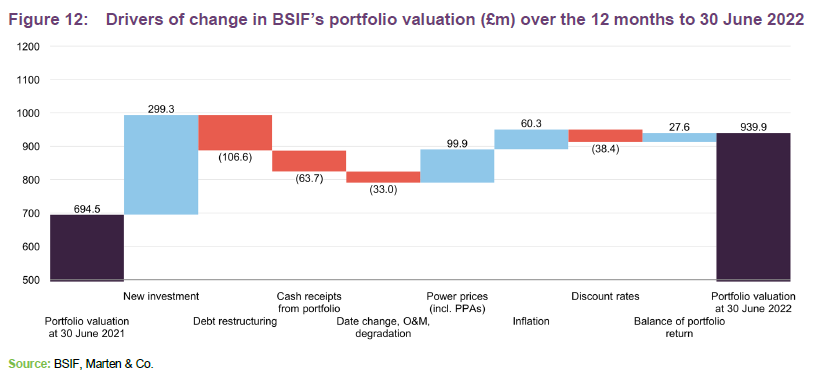

Many of these drivers of change were discussed earlier – the capturing of higher power prices through PPAs, higher inflation assumptions and a modest increase in the discount rate.

The valuation assumes a terminal value of zero for all projects within the portfolio of about 25 years after operations commence, or up to 40 years for those with asset life extensions. The directors believe there are further opportunities to secure asset live extensions within the portfolio. They also think that there is scope to cut O&M overheads as recently-acquired projects are folded into the in-house O&M structure.

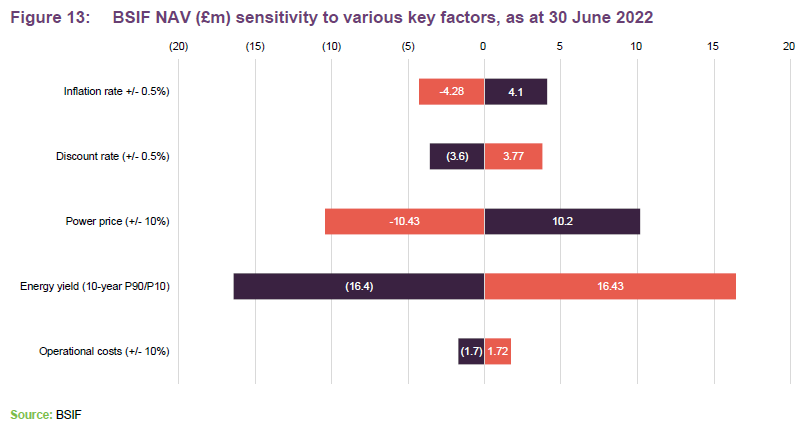

Sensitivity analysis

Figure 13 shows the impact on BSIF’s NAV per share based on various scenarios. Mixing wind and solar within the portfolio could help reduce the sensitivity to solar/wind resource, in part as the two tend to move in opposite directions.

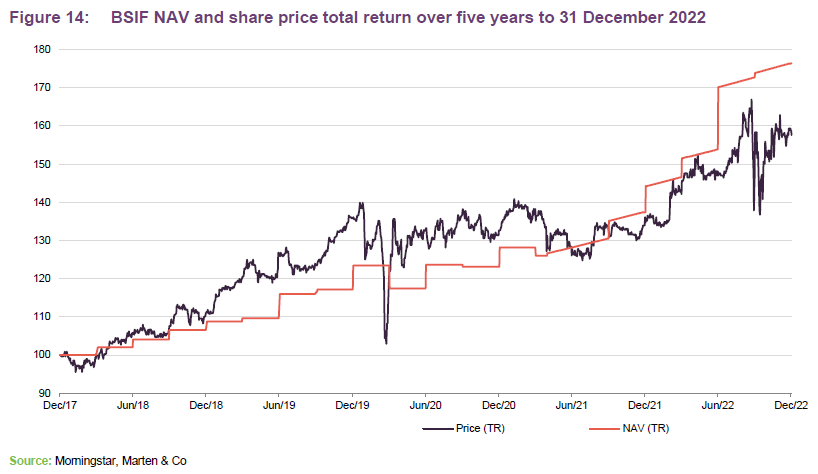

Longer-term returns

From its IPO in July 2013 to its financial year end on 30 June 2022, BSIF delivered a return to shareholders of 92.5% (74.8% on an NAV basis).

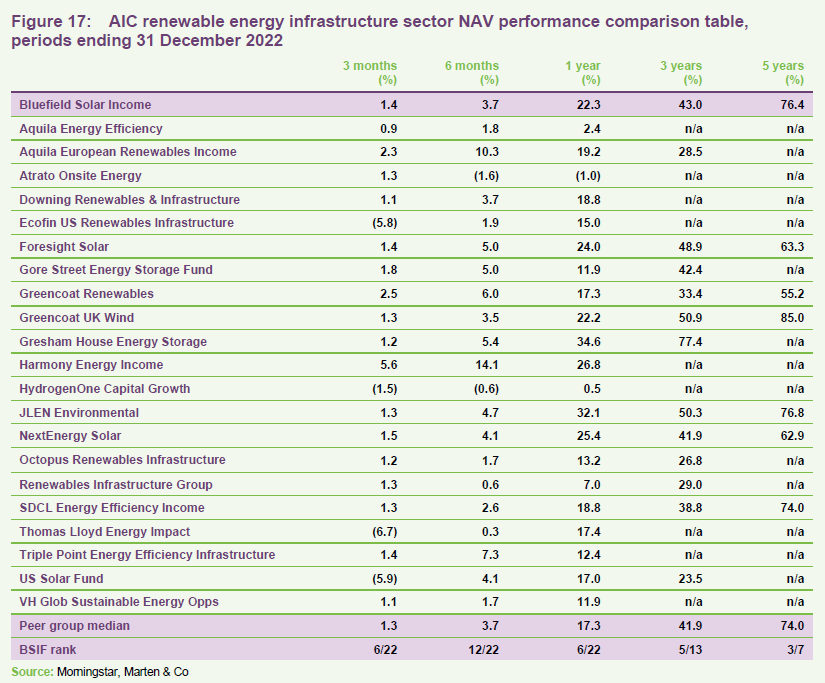

Peer group comparison

You can access up-to-date information on BSIF and its peers on the QuotedData website.

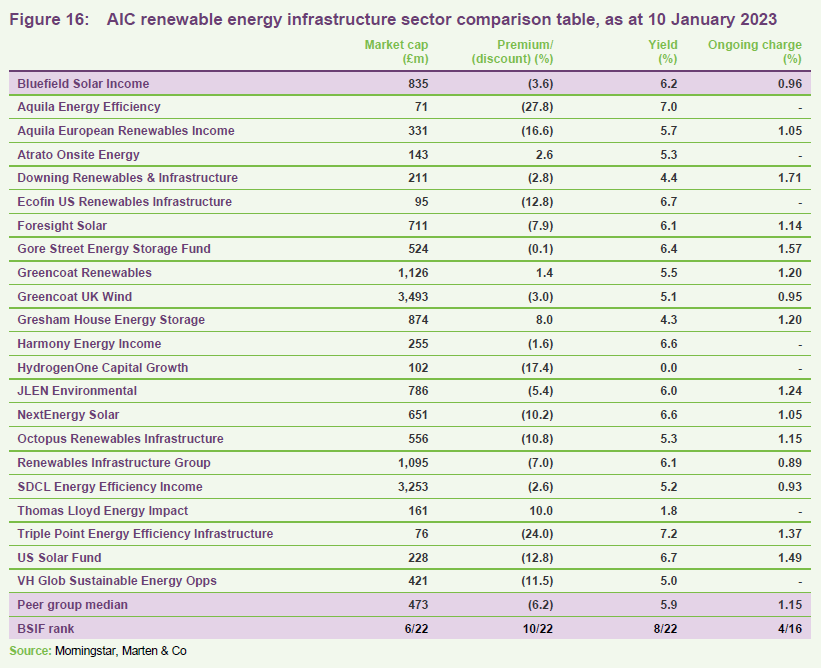

There are now 22 companies that make up the members of the AIC’s renewable energy sector. Most of these funds are focused on solar or wind or some combination of the two. Three of these funds are focused solely on energy storage.

There is an increasing variation of geographic exposure within the peer group, with a number of funds that are heavily exposed to the North American market (which has a different risk/reward structure) and one focused on Asia.

These figures suggest that BSIF is a large, liquid fund, offering an attractive yield and with one of the most competitive ongoing charges ratios within the peer group. The recent discount widening within the sector seems to have hit indiscriminately and may reflect selling pressure on individual funds rather than fundamentals.

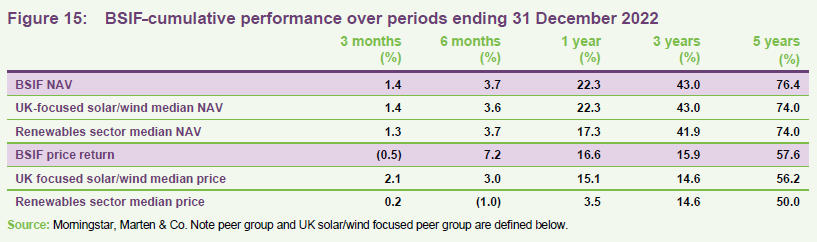

BSIF’s three- and five-year figures are amongst the best in the sector. In recent periods, the returns of funds with overseas assets have been flattered by the weakness of sterling. The other strong performers have been the battery storage-focused funds – an area that is intended to form an increasingly important part of BSIF’s portfolio.

Dividend

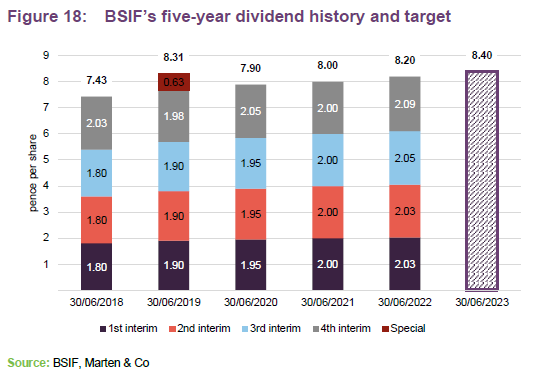

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February with the second, third and fourth interims paid in May, August and November respectively (dividends are usually declared the month before payment).

BSIF’s five-year dividend history is shown in Figure 18, along with the target for a total distribution of 8.40p for the year to 30 June 2023, which the board says is expected to be covered by earnings and be post-debt amortisation.

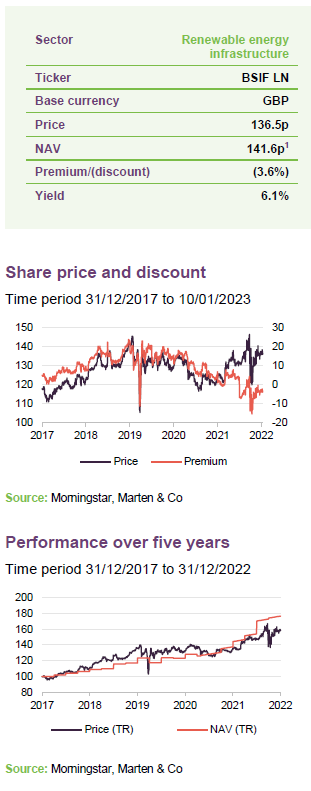

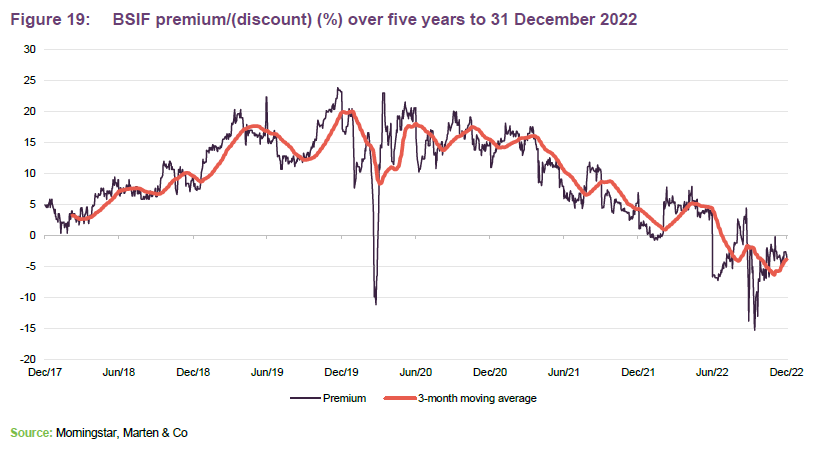

Premium/(discount)

Over the 12 months ended 31 December 2022, BSIF’s shares traded at an average discount of 0.5% to net assets, peaking at a 7.9% premium and as low as a 15.3% discount. At 10 January 2023, BSIF was trading on a discount of 3.6%.

On 1 June 2022, BSIF issued 115,384,615 new ordinary shares at 130p each, raising gross proceeds of £150m for the company. This followed an issue of 89,06,980 new ordinary shares at 118p each (raising gross proceeds of £105.1m) in July 2021.

As BSIF’s share price fell following the ‘mini’ budget, a number of its directors and PDMRs bought shares in the company, demonstrating their belief in the company’s attractions.

The board recognises that wider market conditions and other considerations will affect BSIF’s premium/discount in the short term and the board may seek to limit the level and volatility of any discount to NAV. This might include the use of share buybacks. At the last AGM, shareholders granted authority for the repurchase of up to 14.99% of the ordinary shares in issue. Such repurchases would only be made through the market for cash at a discount to NAV. Ordinary shares repurchased by the company may be cancelled or held as treasury shares.

Fees and costs

The investment adviser is entitled to an annual fee calculated as 0.8% of NAV up to £750m, 0.75% on the next £250m and £0.65% of any balance. The investment adviser was reappointed for a three-year term from 1 July 2020. From 1 July 2023 onwards its contract can be terminated on 12 months’ notice.

BSIF’s auditors are KMPG Channel Islands Limited. At the AGM held on 29 November 2022, over 20% of shares voted were cast against the reappointment of the auditors and authorising the directors to set their remuneration. BSIF will be undertaking an audit tender process during 2023 as the current auditors will have been in place for 10 years.

BSIF’s ongoing charges ratio as at 30 June 2022, was 1.02%.

Capital structure

BSIF has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 10 January 2023, there were 611,452,217 shares in issue with none held in treasury.

Shareholders vote every five years on whether BSIF should continue. The next vote will be in 2023.

BSIF has been established with an unlimited life, but its articles of association require that it offer its shareholders a vote on whether the company should continue every five years. The first discontinuation vote took place at the company’s AGM on 30 November 2018 and was overwhelmingly rejected (by 99.5% of shares voted). The next vote is scheduled for the company’s AGM this year.

Gearing

BSIF is permitted borrowings of up to 50% of its gross assets. BSIF’s outstanding debt totalled £537m at 23 December 2022, equivalent to leverage of 40% of GAV. This is comprised of:

- an RCF (provided equally by RBSI and Santander UK) which pays interest at 1.9% over SONIA. The facility matures in May 2024, but BSIF has an option to extend this to May 2025. £120m of this had been drawn down at 23 December 2022;

- a £93.9m (30 June 2022) fixed, £64.1m index-linked amortising loan provided by Aviva. This has an 18-year life and matures in September 2034. The loan is secured against a 401.2MW solar portfolio;

- a £110m 3-year team loan from NatWest which matures in September 2023 and is secured against a 141.7MW solar portfolio. 75% of the interest cost is fixed at 0.31% until 2038. The increase in rates since the hedge was put in place means that this hedge is quite valuable to BSIF;

- a £38.3m (30 June 2022) 15-year amortising loan from Gravis which matures in June 2035 and is secured against a 47.5MW solar and wind portfolio;

- three 15-year amortising loans maturing between December 2033 and June 2034, and secured against a 93.2MW solar and wind portfolio. The loans total £75.5m (30 June 2022), split £57.0m from BayernLB, £10.6m from KfW, and £8.1m from Clydesdale; and

- a £8.7m (30 June 2022) project-finance loan from BayernLB that matures in September 2029 and is secured against a 5MW solar asset.

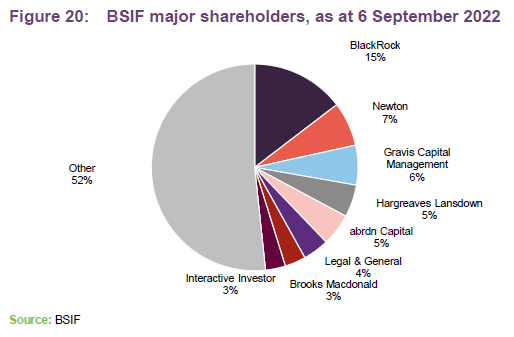

Major shareholders

Financial calendar

BSIF’s year-end is 30 June. The annual results are usually released towards the end of September (interims in February) and its AGMs are usually held in November of each year. BSIF pays quarterly dividends in February, May, August, and November of each year.

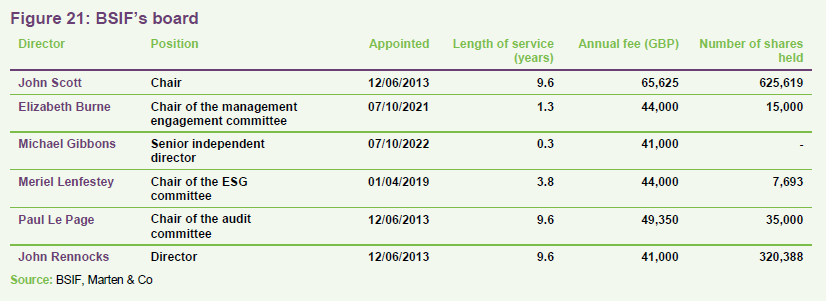

Board

BSIF’s board comprises six directors all of whom are non-executive and considered to be independent of the investment manager.

BSIF’s board is cognisant of the AIC guidance around board member tenure and has taken positive action to address this. A number of changes have been made to BSIF’s board since we last published. Laurence McNairn retired from the board on 17 February 2022 and Elizabeth Burne was appointed as a director on 7 October 2021. Most recently, Michael Gibbons was appointed a director on 7 October 2022 and has since been made the senior independent director. John Rennocks stepped down as chair of the company on 1 December 2022 and will remain an independent non-executive director until he retires from the board during Q1 2023. John Scott took on the role of chair.

John Scott and John Rennocks are directors of BR1. They receive an annual fee of £6,565 for providing their services to this company.

John Scott (chair)

John is a former investment banker who spent 20 years with Lazard and is currently a director of several investment trusts. He has been chair of Impax Environmental Markets Plc since May 2014 and chair of Alpha Insurance Analysts since April 2013. In 2019, John was appointed chair of JP Morgan Global Core Real Assets. In June 2017, he retired as chair of Scottish Mortgage Investment Trust Plc.

John has an MA in Economics from Cambridge University and an MBA from INSEAD. He is also a Fellow of the Chartered Insurance Institute.

Elizabeth Burne

Prior to becoming a non-executive director, Elizabeth was an audit director at PwC, working in alternative asset management and insurance, assisting clients with strategic, financial, risk and corporate governance matters. She holds a portfolio of non-executive directorships including HarbourVest Global Private Equity Limited (a constituent of the FTSE 250 Index), as well as a number of private companies in the venture capital, real estate and insurance sectors.

Elizabeth is a Fellow of the Association of Chartered Certified Accountants with a First Class Honours degree in Applied Accounting and over 20 years’ experience within the financial services sector across the Channel Islands and Australia.

Michael Gibbsons CBE FEI

Michael has held a very wide range of senior appointments in the private and public sectors. The main part of his career has been in the energy industry, taking senior positions in ICI, Powergen and Elexon, who run central systems in the GB wholesale electricity market, and where he was chair from 2013-2022. Michael has also worked on carbon capture and storage at board level for several developers and became chair of the Carbon Capture and Storage Association in 2014-2017. He was also chair of the British Committee of the World Energy Council from 2009 to 2014.

Michael has also served British governments from 2002 as a member of the Better Regulation Task Force and then the Better Regulation Commission and was appointed the founding chair of the independent Regulatory Policy Committee from 2009-2017. He has extensive experience on other boards including at ICI and Powergen subsidiaries, an acute NHS Trust, and was chair of the Hertfordshire Family Mediation Service 2005-2009. Michael conducted the “Gibbons review” for the Government of dispute resolution in the workplace, and has extensively advised the European Commission and the OECD on regulatory and energy issues.

Michael holds an MA from Downing College, Cambridge, is a Fellow of the Energy Institute, and was awarded an OBE in 2008 and CBE in 2015 for services to regulatory reform.

Meriel Lenfestey (chair of the ESG committee)

Meriel founded Flow Interactive in 1997, a London-based Customer Experience Consultancy assisting clients across many sectors in embracing digital transformation. Since exiting the business in 2016 she has held a portfolio of non-executive director and advisory roles across energy, telecoms, transport, infrastructure, technology,e-gaming and local charities. She is a non-executive director at International Public Partnerships (FTSE 250), Boku (FTSE AIM), and Ikigai Ventures (FTSE All share).

Meriel also holds non-executive director roles at several private companies including Gemserv, Jersey Telecom and Aurigny as well as Art for Guernsey, a local charity.

She has an MA in Computer Related Design from the Royal College of Art, a Financial Times Non-Executive Director Diploma and is a Fellow of the RSA.

Paul Le Page (chair of the audit committee)

Paul Le Page is a former executive director and senior portfolio manager of FRM Investment Management Limited, a subsidiary of Man Group, and holds non-executive directorships of a number of investment funds. He is audit committee chair of RTW Venture Fund Limited and was previously audit committee chair of UK Mortgages Limited, Thames River Multi Hedge PCC Limited and Cazenove Absolute Equity Limited.

Paul has 18 years’ audit committee experience within the closed end investment fund sector and has a broad-based knowledge of the global investment industry, fund governance, reporting and product structures.

He graduated from University College London in Electrical and Electronic Engineering and qualified as a Chartered Electrical Engineer while leading the development of robotic immunoassay equipment. Paul obtained an MBA from Heriot-Watt University in 1999 which he used to switch from industrial R&D to investment research.

John Rennocks (director)

John has broad experience in emerging energy sources, support services and manufacturing. He is also chair of Utilico Emerging Markets, an investor in infrastructure and related assets in emerging markets.

John previously served as a non-executive director of Greenko Group Plc, a developer and operator of hydro and wind power plants in India, non-executive deputy chair of Inmarsat Plc, a non-executive director of Foreign & Colonial Investment Trust Plc, chair of Diploma Plc, as well as several other public and private companies, and as executive director-finance for Smith & Nephew Plc, Powergen Plc and British Steel Plc/Corus Group Plc.

John is a Fellow of the Institute of Chartered Accountants of England and Wales.

Previous publications

We refer readers interested in further information about BSIF to our earlier notes, which can be accessed by clicking on the links in the table or by visiting our website.

Figure 22: QuotedData’s previously published notes on BSIF

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Bluefield Solar Income Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.