Shepherding its portfolio through the storm

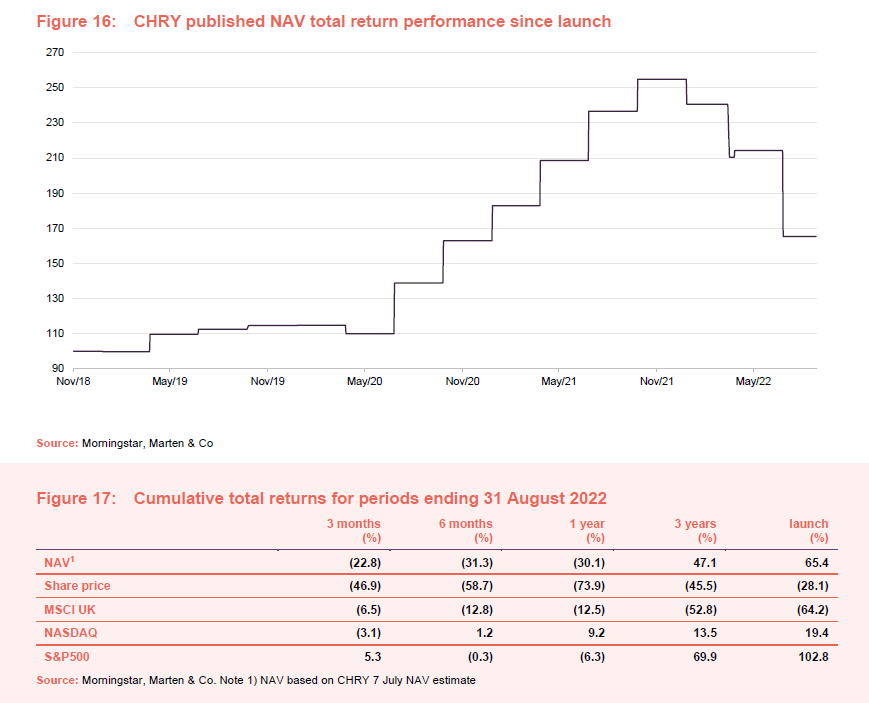

In its first three years, Chrysalis Investments (CHRY) generated significant net asset value (NAV) and share price returns for investors by building an exciting portfolio of fast-growing, disruptive and potentially market-leading companies. An abrupt change in sentiment towards these types of businesses has since impacted on CHRY’s NAV, with falls in the values of listed investments and a notable write down in the valuation of Klarna. However, this is set against good news coming from portfolio companies such as Starling Bank and wefox.

In a market where financing for growth companies has become harder to obtain, CHRY is fortunate to have cash on hand from its first full exit to support portfolio companies, if needed. However, increasingly, these businesses are becoming profitable and cash-generative.

The extreme discount that CHRY’s shares trade at relative to NAV represents a significant cushion against any further bad news. In time, sentiment will switch back, and if the portfolio lives up to the potential that the advisers believe it has, CHRY’s current share price has a long way to climb.

Supporting growing businesses

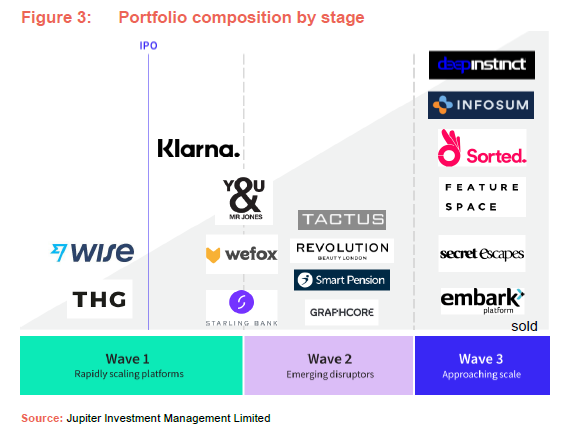

CHRY aims to provide access to returns available from investing in later-stage private companies with long-term growth potential, an investment class that has traditionally been difficult to access for individual investors. CHRY also benefits from the flexibility to continue to support these businesses after they IPO.

Fund profile

CHRY’s investment objective is to generate long-term capital growth through investing in a portfolio consisting primarily of equity or equity-related investments in unquoted and listed companies. Having the ability to back growing companies regardless of whether they are listed or not is core to CHRY’s investment rationale.

At launch, the company’s name was Merian Chrysalis (ticker MERI). That changed in December 2020 following Jupiter’s acquisition of Merian Global Investors Limited.

The management team of Nick Williamson and Richard Watts (the advisers) moved across from Merian and remain focused on the fund. They are supported by research analyst Mike Stewart (who is described as integral to the fund’s due diligence process as well as sourcing deals), legal counsel James Simpson, ESG director Andrew Mortimer, and finance director Bekki Whiting. In addition, they can tap into the expertise of Jupiter’s seven-strong UK small- and mid-cap team (see page 30 for more detail).

With effect from 1 July 2022, CHRY is a self-managed AIF, to which Jupiter Investment Management Limited provides portfolio management.

For comparative purposes, we have used the MSCI UK, NASDAQ 100 and S&P 500 indices in this note – as CHRY does in its annual report.

Indiscriminate sell-off exposes value

As we set out in this note, in recent months sentiment towards CHRY and the companies it backs has shifted dramatically. The trigger for this was a shift in interest rate expectations. However, CHRY’s advisers feel that investors are not differentiating between companies with ill-defined business models and no clear path to profitability, and the disruptive, fast-growing companies in its portfolio.

They believe that the result is that many of CHRY’s holdings could be trading on single-digit EV/EBITDA multiples within a few years, while still offering revenue and profit growth rates far in excess of market averages.

As we examine from page 14 onwards, much of the portfolio continues to demonstrate supernormal growth. On average, portfolio companies delivered revenue growth of about 80% over the 12 months ending March 2022, about 4x that of the average of stocks listed on NASDAQ. The advisers suggest that, as portfolio companies demonstrate that this can be sustained, this should drive NAV growth.

In January 2022, CHRY achieved its first full realisation of an investment through the takeover of Embark, receiving proceeds of £57.2m, 2.1x the value of its investment. Embark (embarkgroup.co.uk) describes itself as the UK’s fastest-growing digital retirement platform. It offers a range of pension, wrap platform, multi-asset funds, research, and consultancy services (note: a wrap platform is an investment platform allows its users to access a broad range of tradeable securities and investment wrappers – such as a general investment account, ISA or SIPP). The deal to sell Embark to a subsidiary of Lloyds Banking Group was announced in July 2021, and valued the business at £390m.

The advisers say that portfolio companies are still investing in the current environment, and we may see some opportunistic mergers and acquisitions (M&A) activity, turbocharging future growth. Fortunately, thanks to achieving its first full exit, CHRY has cash on hand and also has the option to sell down some of the listed equities that it holds. Therefore, CHRY believes that it is adequately funded to be able to support its companies in any reasonable scenario.

The importance of having cash on hand

At 7 July 2022, the advisers said that approximately 45% of the portfolio by value was already profitable, and a further 6% of the portfolio had sufficient cash to enable it to achieve profitability.

For the remainder, having encouraged them to manage their operating expense budgets against their growth aspirations, they have, on average, sufficient cash on hand to fund themselves for 15 months.

Then, on 22 August 2022, the advisers said that each of Starling, Klarna and Featurespace was now either profitable or considered to be funded through to profitability.

The advisers recognise that investors have become more selective in committing capital; are putting pressure on deal pricing, particularly for assets with weaker economics; and are looking to increase the use of investor protections via capital structuring.

Therefore, when portfolio companies do need additional funding, it is crucial that CHRY can play its part. The companies that get through this period may emerge stronger as weaker players fall by the wayside.

The advisers said that, at end June 2022, CHRY had sufficient cash on hand to fund its share of the capital needed to finance its unprofitable investments for a further year. In addition, if needed, CHRY can monetise its listed investments.

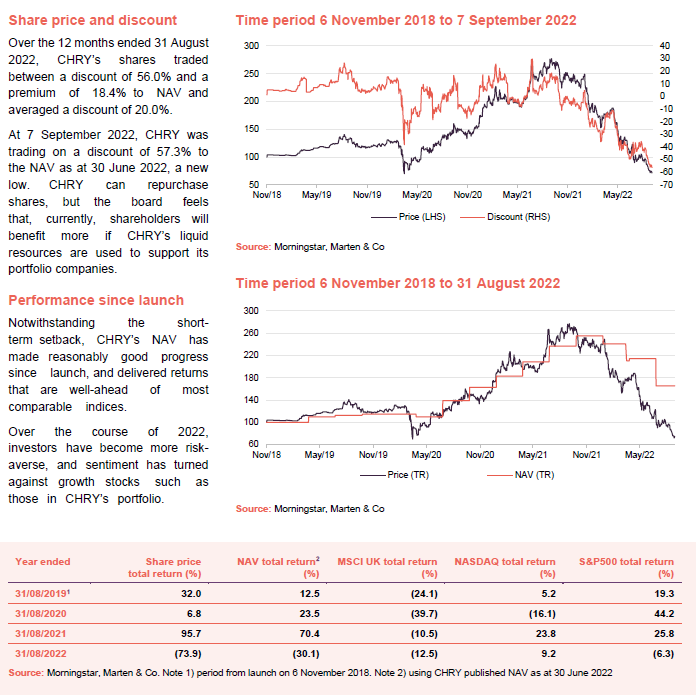

The board and the advisers feel strongly that, even at the current level of discount, CHRY’s investors will be best served by seeking to use the company’s liquid resources to preserve the value of the portfolio through the current period, rather than using them to fund a share buyback.

The advisers also note that over 60% of the investments in the portfolio are structured in such a way that CHRY is protected on the downside, with preferential rights in the event of any liquidity event (such as a dividend, distribution of capital, outright sale, or liquidation), for example.

Sentiment turns against growth

In its brief history, CHRY has faced COVID-19 related disruption, a sharp reversal of sentiment towards growth stocks, and now a probable recession.

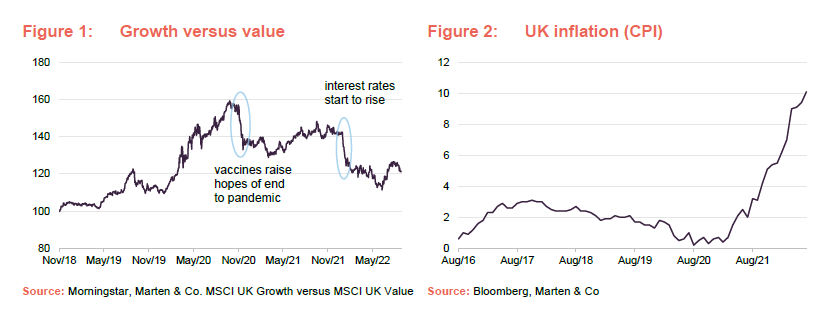

Inflation has been rising sharply – a product of various factors including significant economic stimulus from government policy, the economic recovery from COVID, associated supply/demand imbalances and supply chain problems, and the war in Ukraine (which has hit oil & gas, wheat and some metals prices).

Central banks have been raising interest rates to combat inflation. This leads to increases in discount rates, which depresses valuations based on discounted cash flows. This hits long-term growth stories much harder than cash-generative value plays as the former have more of their value discounted from the future. The effect is clear in Figure 1, which shows how UK growth stocks have been performing relative to UK value stocks.

However, in the US, two 75 basis point (bp – equivalent to 0.75%) interest rate hikes in quick succession appeared to give some comfort to markets that inflation will be reined in. The yield on US 10-year treasuries (government bonds) peaked in June, and, for a while, growth stocks made a tentative recovery. However, it was perhaps too early to call a decisive turn in markets. More recently, as the chairman of the US central bank (the Federal Reserve or Fed) Jerome Powell cautioned that interest rates would need to restrain growth to choke off inflation, the yield on 10-year treasuries has been climbing again and markets have sold off, with growth stocks the most affected.

For CHRY, the environment is not altogether negative. Higher interest rates are normally good news for financial stocks, particularly banks. This has already had a positive impact on the valuation of Starling Bank, for example.

Long-term partner for growing businesses

CHRY is designed to be a valuable source of capital and expertise to growing businesses. New investments are made in later-stage unlisted companies, but the structure of the fund means that follow-on capital can continue to be provided even after these businesses IPO (should they choose to do so).

As an evergreen fund (with no fixed endpoint), CHRY is not constrained by the typical life-cycle of a private equity investor (which tend to invest through limited partnership funds with 10-year lives). Companies backed by CHRY at the pre-IPO stage can also look to the substantial £6bn of capital (as at 31 March 2022) dedicated to small- and mid-caps managed by Jupiter once they list.

An investor in CHRY gets liquid access to exciting, fast-growing, disruptive but unlisted companies which would otherwise be hard for them to access.

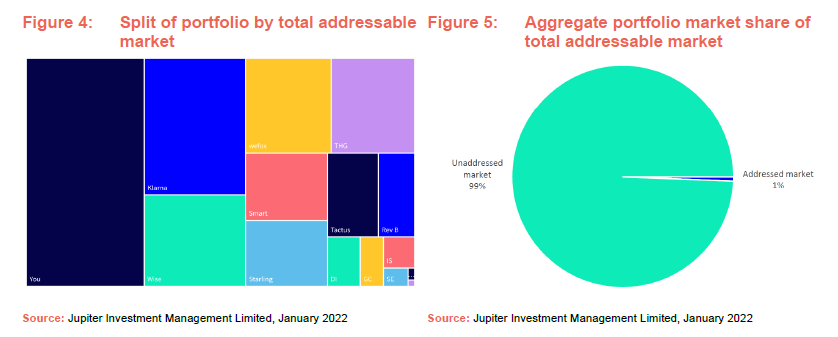

The advisers reckon that, in aggregate, the companies within the portfolio have a total addressable market in excess of $1trn and, as yet, are only addressing about 1% of that.

Nick and Richard have long experience of investing in predominantly UK small- and mid-caps. As leading players in this area with a focus on growing companies, they have long been key figures in the UK IPO market. They have backed many success stories, including Trainline, Blue Prism and Fevertree.

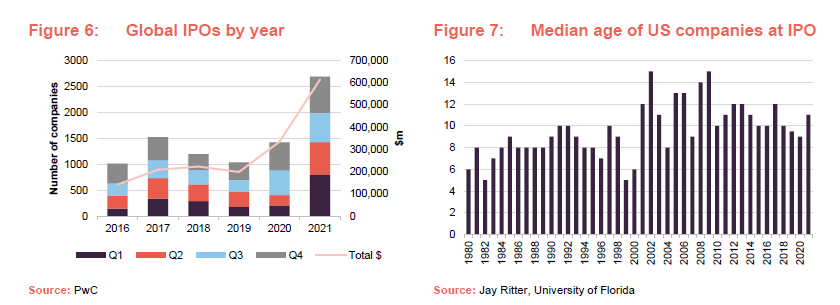

2021 was a bumper year for IPOs, with 2,693 new listings raising $614bn of fresh money according to PwC. London saw 121 new listings raising a total £16.8bn, including Wise from CHRY’s portfolio; the largest ever direct listing on the London Stock Exchange. However, the pace of IPO activity has slowed dramatically in 2022 (down 46% in number of deals and 58% by value over the first half (H1) of 2022, according to EY), and 2021 bucked a longer-term trend of declining new issue activity.

Companies do not necessarily need to IPO to secure finance (especially capital-lite businesses focused on areas such as cloud computing and ecommerce), and some are staying private for longer. CHRY’s prospectus quoted Pitchbook data that showed the average age of UK private companies at exit had roughly doubled between 2011 and 2017. Figure 7 shows equivalent data for the US market. Increasingly, when companies do IPO, it is to allow early backers to exit rather than to secure growth capital.

Trainline offers a good example of this. In 2015, having marketed itself ahead of a planned IPO, Trainline instead secured the backing of KKR. It then listed in 2019 for more than three times the original mooted valuation. Smaller investors had no obvious way of gaining exposure to this particular high growth story. Had CHRY been around in 2015, this might have been different.

Given their position in the market, the advisers found that they were often being approached by unlisted businesses asking for advice about funding and a prospective IPO. This experience led to the launch of CHRY.

The benefits of scale

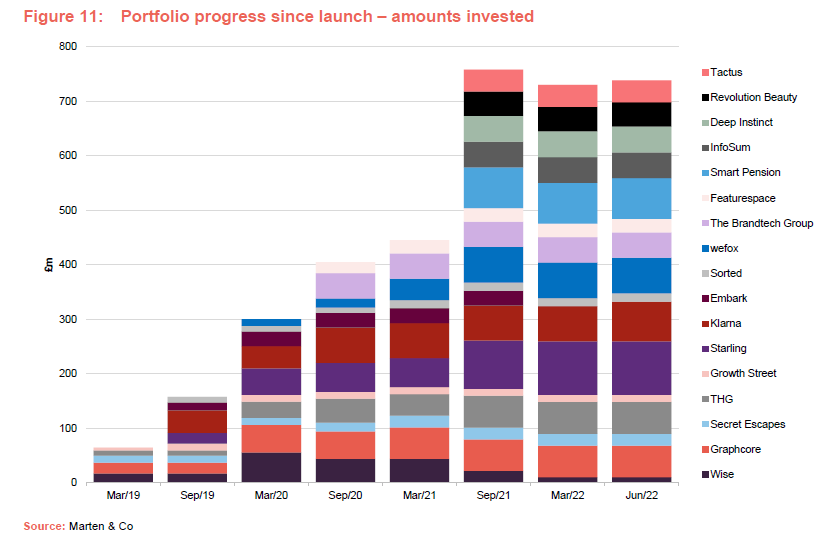

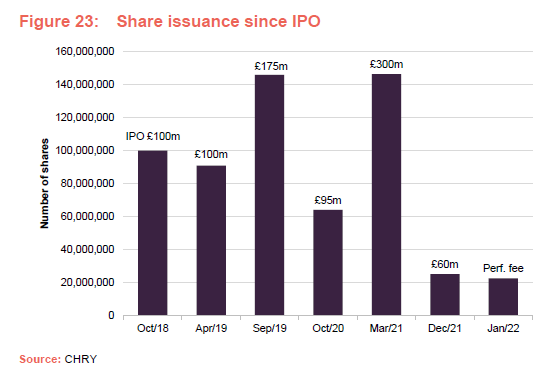

CHRY listed in November 2018 with £100m of gross IPO proceeds. The money was deployed relatively quickly – 85% invested by February 2019 (proceeds of CHRY fundraises have always been deployed within the allotted timescale). This gave investors confidence in the investment approach, and the company was able to expand quickly (see page 29 for details) such that it became a FTSE 250 constituent on 23 March 2021, and currently has a market cap of £415m.

Scale is important to the fund. There are clear network effects that lead to better deal flow and open up more opportunities. It also enables CHRY to carry out more follow-on investments and drive growth. A larger fund can also operate with a lower ongoing charges ratio. As we show on page 26, CHRY’s ongoing charges ratio is the lowest of its peers.

The board and the adviser believe that, as the fund expands and is able to write larger cheques, it should be able to cement its access to the best deal flow.

Picking winners

A typical CHRY company will be highly innovative, a disruptor with the potential to transform a sector, growing rapidly, and addressing large target markets. Often, these are entrepreneur-led businesses. Funding solutions must work for CHRY and the entrepreneurs. The team feels that is important to build good relationships with these individuals. They are a valuable source of new investment opportunities for the fund. There are certain sectors outside of CHRY’s remit – healthcare, mining, oil and gas, for example.

CHRY is not an early-stage investor. Typically, it will get involved around the Series C financing round or later, once a company has proven its go-to-market strategy and is generating revenues and profitable unit economics.

The process often starts by identifying areas with structural tailwinds – ecommerce, and digital banking, for example. Businesses should have best-in-class technologies that can be used to disrupt incumbents.

Wise (see page 23), which was one of CHRY’s early success stories, is a good example of such a business. It has become successful by offering the lowest costs for foreign exchange transactions and passing cost-savings through to the customer.

The team want to back the leading players – no.1 or no.2 – in any vertical. Often these companies end up taking about 80% of the available market share. The companies may not occupy those positions when CHRY invests, but they must have a clear trajectory to achieve this.

The trust was UK-focused at launch, and the UK still makes up the majority of the portfolio. However, it now encompasses businesses such as Klarna (Sweden), wefox (Germany) and The Brandtech Group (USA).

Themes that the advisers like and are represented within the portfolio include software-as-a-service (SaaS), artificial intelligence (AI), digital entertainment and fintech. Areas that they are exploring include 5G, the metaverse and automation. The advisers won’t pursue investments in sectors that they are less familiar with, such as medical technology.

Sometimes, the team identify an area that they would like to invest in well ahead of the right opportunity becoming available. A good example of this is cybersecurity – a sector that they would have liked to back when CHRY was launched in 2018, and in which they have met many of the leading players, but did not make an investment in until the purchase of a stake in Deep Instinct in 2021.

Flat structure streamlines decision-making

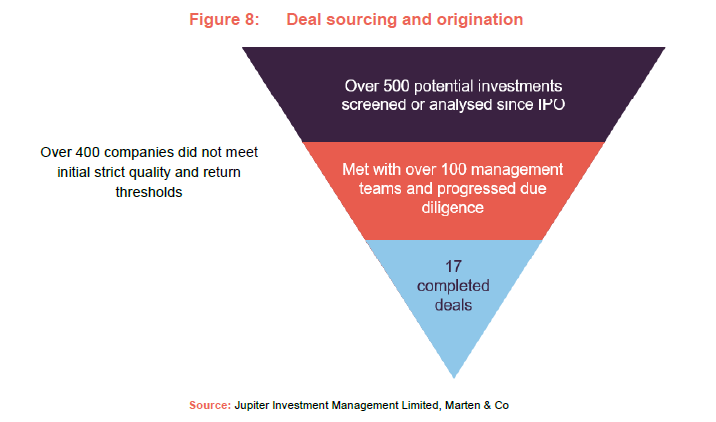

Of the 17 investments made to date, six came via the advisers’ network of contacts, six came through direct contact with the advisers and five came through external firms. Typically, the first two routes are less competitive, enabling the team to negotiate more favourable terms.

The team have long had good relationships with UK corporate advisers. The international deals that they have done to date have led them to develop their adviser network across Europe and the US too.

The advisers churn through ideas constantly. They see a lot of potential opportunities and screen them based on their past experience. The team focus on key value drivers and leverage the expertise of third parties where appropriate, in areas such as regulation and compliance, for example.

In the advisers’ experience, the standard private equity approach to assessing deal flow is to build complex financial models on the target and its peers from the outset, and write extensive briefing notes. However, the team feel that this limits their ability to analyse the maximum number of deals. Often, they get a feel for whether a potential investment will work early in the process. They produce simple financial models on potential targets, conduct due diligence on the sustainability of the target company’s business model, and identify milestones by which valuation success could be judged. Ideas are discussed at weekly meetings.

Deals can be completed in as little as six to eight weeks, given the focus on the key value drivers throughout the due diligence process. There is no investment committee. The team feel that it is important that they are close to their investments and that they take full ownership of investment decisions.

However, the work that they do is subject to the wider oversight of the board with respect to factors such as risk parameters, portfolio construction and ongoing valuation appraisals relative to the initial acquisition cases.

The advisers say that the streamlined decision-making process adopted by the team worked to CHRY’s advantage during the lockdown phase of the pandemic. They cite Featurespace (which uses real-time machine learning software to provide solutions to fight enterprise fraud and financial crime – see page 19), and Brandtech (a digital advertising business, then-called You & Mr Jones – see page 18) as examples of businesses that they were able to back at attractive valuations during this period.

The advisers put a lot of work into understanding the unit and customer acquisition economics of a business. This is particularly important when investing in loss making companies as it demonstrates a roadmap to profitability at scale – growth must be value-accretive.

Survivorship bias concentrates the portfolio

Once an investment has been made, members of the team will often become board observers or directors, keeping them close to decision-making within investee companies.

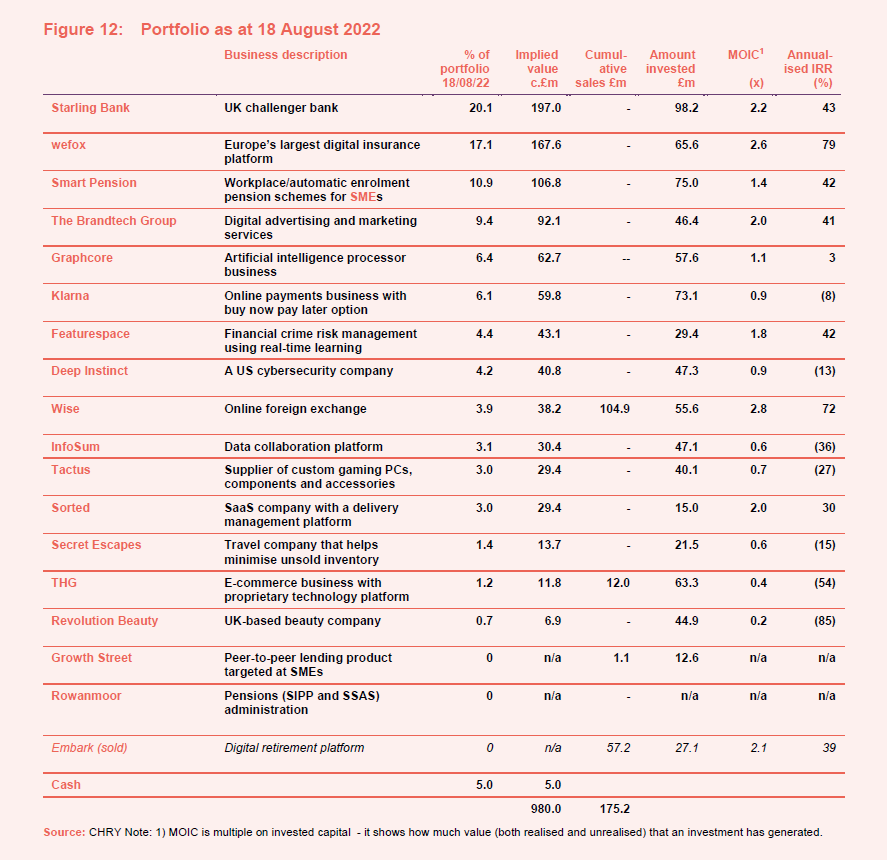

As we show on page 14, the portfolio has become concentrated on the five- or six-largest positions. Unit sizes reflect both the strength of the advisers’ conviction and the success of investments.

The maximum position size is 20% of gross assets at the point that an investment is made. The advisers have managed positions before – selling some Wise in July 2020, for example. The exposure to Klarna was increased close to the 20% limit in 2020 because they felt that the entry multiple was very attractive. It is worth bearing in mind that positions can become skewed just because of ‘lumpy’ revaluations – the advisers cannot control the timing of funding rounds that can lead to a material uplift in the valuation of an asset. The advisers say that it is unlikely that a position would account for more than 30% of the portfolio.

Some portfolio companies may never IPO. They thought at one stage that Wise might have been one of these; it did not need to IPO to fund itself, given its level of profitability. However, the listed market still offers a deep pool of liquidity when it is needed. There may be an emotional reason why businesses want to IPO; as a milestone in the development of the business, for example. Employees may to wish to crystalise share options. It is also easier to fund M&A.

ESG

The board and Jupiter have implemented an ESG policy with the aim of aligning the company with best practice in this area.

The board believes that the type of tech-enabled, disruptive businesses in which Chrysalis invests are well-positioned to navigate the transition to a low carbon economy. They are also likely to be significant job creators, with positive spill-over effects elsewhere in the economy. Often, CHRY’s investee businesses are delivering social benefits too.

As one example, the advisers welcome THG’s vision for a sustainable future, ‘THG x Planet Earth’ and its THG (eco) initiative to help others deliver positive sustainability benefits. The company offsets all of its operational carbon emissions and has been a Certified Carbon Neutral company since 2019. However, it aims to go further than this with measures such as a target to turn 100% of its waste into resources for its value chain by 2030, a reduction in the use of plastics for packaging, and efforts to reduce carbon emissions associated with customer deliveries. THG is a member of Sedex, an ethical trade membership organisation and through Sedex THG engages with suppliers to review and audit their environmental and ethical performance.

ESG analysis is integrated within the investment process. Jupiter encourages all portfolio companies to set out a net zero target consistent with less than 1.5 degrees Celsius in line with the Paris Agreement across their own operations and value chain. Jupiter has also committed to achieving net zero emissions by 2050 across its full range of investments and operations, including the holdings within CHRY’s portfolio.

The board believes that, to grow successfully, companies and their founders must not only execute strategically; they must also lay the foundations for future growth by creating appropriate corporate governance structures. Though they are in growth mode, they must also consider long-term themes relating to the sustainability of their business model.

This includes a broad range of considerations, but fundamentally the purpose of the business must remain focused on creating value for all of these stakeholders and reduce negative impacts if it is to succeed over the long term. Jupiter continues to emphasise these points and encourage founders and management teams that are considering listing to prepare themselves for the additional scrutiny which comes with going public.

Jupiter has also aligned its strategy, purpose and principles with the UN Global Compact (UNGC) such that all investment decision-making and engagement is guided by the principles of the UNGC. This means investee companies are expected to abide by the Compact’s Ten Principles, committing to meeting fundamental responsibilities in the areas of human rights, labour, environment, and anti-corruption. These commitments apply to the investment management of CHRY.

Asset allocation

It is important that CHRY can continue to support investee companies and having a war chest – or a pool of strategic capital as the advisers refer to it – is therefore useful.

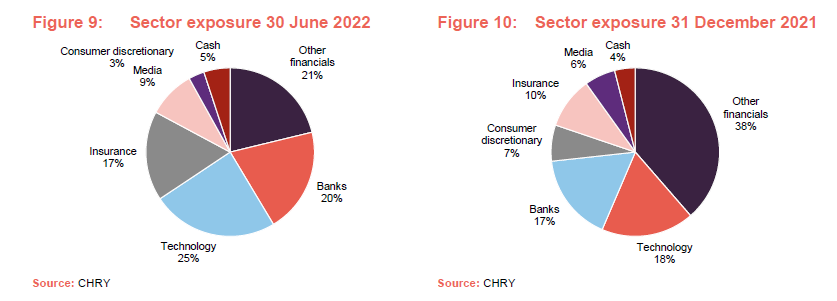

Industry exposure is driven by the advisers’ stock selection decisions. CHRY has a significant exposure to the financials sector (banks, insurance, and other financials), which accounted for 58% of the portfolio at end June 2022.

Figures 9 and 10 show how the split of the portfolio by industry sector changed over the first half of 2022. The figures reflect the sale of Embark, an increased investment in Starling and a reduction in exposure to Wise, as well as valuation moves. Figure 11 does not reflect the £5m invested in Featurespace’s recent Series G fundraise (see page 19).

Starling Bank

Starling Bank (starlingbank.com) was established in 2014 and secured a UK banking licence in 2016. It has opened almost three million customer accounts since launch, around 475,000 of which are for UK small-medium enterprises (SMEs). The advisers note that at around 7.5%, Starling’s share of the UK SME market is already around half that of Barclays. Starling’s retail market share is about 3%.

Starling’s last funding round was an internal fundraise of £131.5m, completed in April 2022, and valuing the bank at more than £2.5bn pre-money. CHRY invested £10m and existing Starling investors Harold McPike, Fidelity, RPMI Railpen, Qatar Investment Authority and Goldman Sachs all participated in the round. This followed on from a £322m Series D round in April 2021.

Starling has been profitable in every month since October 2020, and it recently reported its first full-year profit. Over the financial year ended 31 March 2022, Starling made a pre-tax profit of £32.1m on revenue of £188m. In addition, for the quarter ended 30 June 2022, Starling reports an annualised revenue run rate of £331m, driven by year-on-year lending growth of 72% to £4bn. Its return on total equity (ROTE) is about 17.5%, best-in-class for the UK and well ahead of traditional high street banks, which Starling says have ROTEs of about 11%.

At the end of June 2022, Starling’s deposit base was £9.6bn, 43% higher than a year earlier, and the loan book was £4.0bn, 73% higher, helped by the acquisition of a couple of mortgage books (mortgage lending now accounts for around half of the loan book). Starling bought specialist buy-to-let mortgage lender Fleet Mortgages for £50m in July 2021, a £1bn book of mortgages from Kensington in November 2021, and agreed to buy a £500m book of mortgages from Masthaven in June 2022. Starling recently missed out on acquiring the rest of the Kensington business, which went to Barclays in a £2.3bn deal.

Given the size of the deposit base, the loan book could be much larger. The advisers think that this bodes well for the bank’s future profit growth.

International expansion is on the cards, with work underway to establish a presence in Ireland, for example. Another potential source of profit growth is to monetise the software that underpins the business. It is marketing this as SaaS to banks around the world.

The advisers say that Starling is a profitable bank, focused on growing areas and in good shape if it were to consider an IPO. Its cost of funds is low and that boosts its margins. These are further augmented by the efficiency of its platform. The advisers suggest that, like Wise, Starling sets out to share the benefits of its efficient business model with its customers. That helps it grow at a faster rate. In addition, Starling’s strong deposit growth and substantial excess capital mean that higher deposit rates at the Bank of England are driving higher profits. Starling should be a net beneficiary of the current economic environment.

Klarna

Klarna (klarna.com) is a Swedish fintech (online payments/shopping) business which offers customers a buy now, pay in instalments option. It is regulated as a bank in Sweden and can boast a Tier 1 ratio of 31.3%. Launched in 2005, the business now has over 150m active users globally and processes more than 2m transactions per day on behalf of over 400,000 retail partners in 45 countries. The growth in online retail associated with the pandemic benefitted the business. However, the company also has a substantial in-store presence. A strategic partnership with payment processing business Stripe is accelerating take-up of the service within small- and medium-sized businesses.

The advisers believe that consumers value the convenience of the app (everything in one place), and especially the speed with which they are refunded if they make a return. Customers get a small line of credit (about $100 worth) when signing up. The amounts lent are relatively small, and debt must be repaid within a relatively short time frame. This contributes towards low credit losses (0.6% of gross merchandise volume for the first quarter of 2022). However, the quantum of losses has increased as the overall book has grown.

The advisers note that, since CHRY’s initial investment in August 2019:

- revenues have grown from $753m in 2019 to $1.6bn in 2021 (+112%);

- gross merchandise volume processed has increased by $45bn (to $80bn);

- the number of global active users has increased from 60m to 150m (+150%);

- the number of users in the US has increased to 27m (+700%);

- the number of merchants using Klarna has increased from 130k to 400k (+167%);

- 10 new markets have been entered and Klarna is now present in 45 countries globally;

- the company has acquired Pricerunner, Hero, Inspirock, APPRL and Stocard; and

- a global partnership with Stripe was announced in October 2021 giving access to millions more small-to-medium-sized businesses.

In the first quarter of 2022, the company delivered year-on-year growth of 19% in gross merchandise volume (despite a 3% drop in global e-commerce) and 20% in net operating income ($20bn and $381m, respectively). However, the company made a loss of SEK2.57bn. Klarna also announced that it was cutting 10% of its workforce in the face of a more uncertain economic climate.

The advisers think that if Klarna can maintain its annualised revenue growth at around 25% and achieve planned overhead reductions, and if loan impairments fall back to historic levels, Klarna could breakeven in 2023.

About 40% of Klarna’s business is pay now, rather than buy now pay later. In other words, customers are not just using the app for the delayed payment function. The advisers say that the take rate (Klarna’s transaction processing fee as a percentage of the transaction value) is competitive. They also note that Klarna’s deposit base (mainly fixed-term savings accounts in Germany and Sweden) is interest rate insensitive.

Klarna raised $1.1bn in March 2021, $640m in June 2021 and a further $800m in July 2022 to fund its growth. New market launches in 2021 included France, New Zealand, Ireland, Poland, and Portugal.

The latest funding round valued Klarna at $6.65bn (post-money), a material discount to the $46bn value implied by its previous funding round. CHRY committed to invest its pro-rata entitlement of $8.7m. The managers note that the funding round was carried out at a 30% lower EV/sales multiple than Affirm (Klarna’s closest listed peer) was trading on at the time.

wefox

Founded in 2015, wefox (wefox.com) is a digital insurance business based in five territories in Europe (Germany, Austria, Switzerland, Italy and Poland), but with ambitious expansion plans.

The advisers say that most European insurance markets outside the UK are not driven by price comparison sites. That means that insurance is an intermediated market. The wefox digital platform is designed to make that intermediation process simpler and more efficient. Customers manage their policies through the wefox app but are still advised by a broker.

In addition, the data that it gathers as part of this process allows wefox to cherry-pick business for its own book. Its in-house insurance business has customer acquisition costs that are close to zero and should be best in class in terms of quality. That should, in turn, generate much higher than industry-average margins.

Like Starling, the advisers foresee wefox monetising its software in time. wefox revenues were $320m in 2021 and have been forecast to exceed $600m in 2022 (having roughly doubled each year since 2015).

wefox raised $650m of Series C financing in June 2021, valuing the business at $3bn. Then, in July 2022, it raised $400m from its Series D funding round, valuing the business at $4.5bn.

The advisers say that they are very happy with wefox’s rate of growth so far and see plenty of potential for the business. CHRY did not participate in the Series D round.

Smart Pension

Leveraging the experience gained from CHRY’s investment in Embark, in 2021 CHRY made an initial £75m investment in Smart Pension (smartpension.co.uk) in its £165m June 2021 series D funding round, and topped that up with a further £15m in December 2021.

Smart Pension is a leading workplace pensions provider in the UK (one of four major players). The business was established in 2015 and, at the end of 2021, it had £2.2bn of assets under management and 900,000 underlying customers. The advisers characterise workplace pensions as a sticky, high-margin business.

Companies with standalone pension schemes have the option to roll these into the Smart Pension master trust. Smart Pension estimates that the master trust business in the UK can grow by 20.8% per annum through to 2029, outstripping a forecast 8.3% annual growth in the workplace defined contribution pension market over that period.

There is an opportunity to expand the business as other countries adopt a similar model. The advisers highlight the potential of the Middle and Far East, but Smart Pension’s ambitions are truly global.

Again, the proprietary software developed by Smart Pension has a value in its own right.

The advisers say that Smart Pension grew its revenue by 300% in 2021, as it continued its rollout of technology partnerships with financial institutions in the US, Ireland and Dubai, and secured a cornerstone technology transformation contract in Hong Kong.

The advisers look at the valuations ascribed to major savings firms such as AJ Bell and Hargreaves and see the potential for Smart Pension’s valuation multiple to grow over time.

Smart Pension used its latest funding to finance the purchase of Stadion Money Management. Stadion was an independent managed account provider, with $2.3bn in assets under management and over 4,000 plans (as of end November 2021). With this deal, Smart Pension has grown its assets under management (AUM) 20-fold over three years. The advisers note that Stadion helps to bulk up Smart Pension’s US presence and Smart Pension has backing and interest from a number of US banks. Smart Pension is targeting $10bn of AUM by the end of 2022.

The Brandtech Group (formerly You & Mr Jones)

The Brandtech Group (thebrandtechgroup.com) is a marketing technology company that aims to use technology to help brands execute marketing better, faster and cheaper. It was founded by ex-Havas personnel in June 2015. The company achieved more than 50% organic revenue growth in 2021, exceeding $500m, and now has over 5,000 employees.

The advisers say that Brandtech is operating in a vast market. Half of advertising is now digital. It is hard to manage advertising spend across a range of platforms and geographies, but Brandtech seeks to provide solutions that address this.

It has grown both organically and by acquisition, buying businesses such as Gravity Road (creating content for digital and virtual reality environments), DP6 (a Brazilian-based business) and Oliver. Oliver is an innovative in-house marketing division, which embeds Brandtech personnel within clients’ marketing departments, speeding up decision-making, and saving clients like Unilever considerable sums.

Brandtech’s most recent acquisition was of Acorn-i, an e-commerce platform that helps brands and sellers grow and scale their business across direct-to-consumer channels and digital marketplaces.

Brandtech Ventures has also backed some early-stage businesses including Niantic (augmented reality – AR – gaming) and Zappar (AR content).

CEO David Jones has stated that the company has a range of options open to it, including an IPO, a new funding round, or a significant acquisition.

We note that S4 Capital, a London-listed competitor to Brandtech, published a profits warning in July which triggered a substantial fall in its share price. However, many of its problems look to be company-specific, and this does not necessarily imply a valuation reduction for Brandtech at the next NAV calculation.

Graphcore

Graphcore’s (graphcore.ai) intelligence processing units (IPUs) are designed to support artificial intelligence and machine learning. They have been designed as an alternative to the graphics processing unit-based approach offered by the likes of NVIDIA (which, even after recent share price weakness, can boast a market cap in excess of $340bn).

Graphcore’s origins go back to 2012, but it was founded as a company in 2016 with $32m of Series A finance. CHRY first invested in the Series D financing round in December 2018 (alongside companies such as BMW and Microsoft). That round valued the company at $1.7bn.

The first IPU products were sold in November 2019, but Graphcore continued to develop and refine its platform. A second generation of IPUs went on sale in July 2020, and in March 2022, it announced a new wafer-on-wafer chip – ‘Bow’ and new models of its multi-processor computers – ‘IPU-POD’, which are said to be 5x faster than equivalent machines made by competitor NVIDIA.

The Bow chip was developed in conjunction with Taiwan Semiconductor Manufacturing, and exploiting the ability to stack wafers has great potential. Graphcore’s chief technology officer, Simon Knowles, says the Bow chip is the highest-performing AI processor in the world today. The advisers say that it is expected to deliver up to 40% higher performance and 16% better power efficiency compared with its predecessors.

CEO Nigel Toon says the next step is to use Graphcore technology to build the ‘Good computer’, a machine capable of exceeding the computational capability and information capacity of the human brain. He thinks these will sell for $120m and will be bought in preference to supercomputers costing far more.

The last funding round in December 2020 valued the business at $2.77bn.

Featurespace

Featurespace (featurespace.com) uses real-time machine learning software to provide solutions to fight enterprise fraud and financial crime. CHRY led a £30m funding round for the business in May 2020. The business is based in Cambridge, UK and also has offices in London and Atlanta, Georgia.

Featurespace’s ARIC Risk Hub is used by customers such as HSBC, NatWest and GoCompare. The advisers cite a number of awards that the software has won over recent years, and note that Featurespace won over 70 new customers, both directly and indirectly, over the course of last year, including eftpos (Australia’s debit card system), which handled over two billion card transactions in 2020.

The advisers say that the global market for fraud detection and prevention is expected to grow at a compound annual growth rate (CAGR) of over 20% from 2022 to 2029.

In its second quarter (Q2) NAV announcement published on 22 August, CHRY said that it invested an additional £5m in Featurespace as part of a successful Series G funding round. The funding round was completed at a premium to the valuation of the asset as at 30 June 2022.

Tactus

Tactus (tactusgroup.com) is a multi-channel e-commerce technology business operating in areas such as computing, gaming and education. It has been growing rapidly by acquisition and now operates under six main brands:

- Chillblast (chillblast.com) a custom PC builder, acquired in November 2021;

- Nazare (cclonline.com/page/nazare-gaming-pcs);

- Horizon (cclonline.com/page/horizon-gaming-pcs) which make high-spec gaming PCs. CCL was acquired in April 2021;

- Geo (geo-computers.com) which sells a range of laptops and recently partnered with German e-commerce platform Notesbooksbilliger to sell devices to the DACH – Germany, Austria, Switzerland – market;

- Iota (iotatablets.com) which sells Windows 10 PC, laptops, and tablets through Amazon; and

- Coda (codacomputers.com) which sells a range of laptops.

In March 2022, Tactus bought Tamworth-based online gaming and technology retailer Box. Box brings £100m of sales, a 120,000 sq ft logistics centre, and two-thirds more staff (Tactus’ headcount rose 10-fold over the course of 2021). CHRY invested £40m in August 2021 and Tactus later secured £13m of funding from Santander. The advisers say that as a result of organic growth and this significant acquisition activity, Tactus has experienced very strong revenue growth over the course of the past year.

InfoSum

Data management business InfoSum (infosum.com), formerly Cognitive Logic, provides data management services to a wide range of well-known businesses. As Google (Android) plans to follow Apple in constraining access to user data across apps, advertisers are looking for alternative ways to know that they are targeting ads to interested consumers. InfoSum can create data clean rooms, which allow companies to match and analyse data, across unlimited datasets, in real-time, without sharing or moving data. This eliminates the risk of exposure, leakage, or misuse. Businesses select their own data collaboration partners.

For example, Boots has opted to collaborate with a range of brands, and ITV is using InfoSum to optimise its PlanetV TV advertising services.

InfoSum continues to expand internationally and, in the first half of the year, the company announced that it has entered Germany, Italy, Australia and New Zealand.

CHRY led a $65m funding round in August 2021.

Deep Instinct

Conventional cybersecurity businesses react to threats as they are identified. However, Deep Instinct (deepinstinct.com) uses deep learning to predict and protect against threats before they emerge. Deep Instinct’s approach also reduces the incidence of false positives.

CHRY’s advisers are encouraged by Deep Instinct’s success in the 2022 MITRE Engenuity ATT&CK® Evaluations for Enterprise, which simulates attacks on systems and measures the success of cybersecurity products. Deep Instinct achieved a prevention score of 100%. Similarly, cybersecurity firm Unit 221B announced that it had validated Deep Instinct’s threat prevention capabilities in June 2022.

As it seeks to attract new customers, the advisers point to Deep Instinct’s partnership with cybersecurity and systems management company Tanium, announced in late 2021. The advisers think that this could be highly significant, given Tanium’s relationships with a large number of leading US businesses.

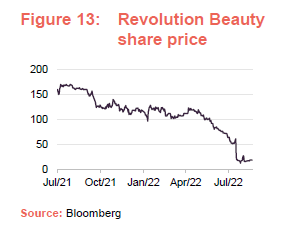

Revolution Beauty

Revolution Beauty (revolutionbeautyplc.com) describes itself as a multi-brand, multi-category, multi-channel mass beauty innovator with proven global scale. The business was established in 2014 and grew rapidly. In July 2021 it listed on AIM. CHRY committed to invest £45m at the time of the IPO with other Jupiter funds putting in a similar amount between them.

The company has a strong digital presence, with sales made direct to consumer as well as through eight digital retail partners, but its products are also sold through retailers such as Superdrug and Boots in the UK, and Ulta and Target in the US. The company has a strong social media presence and uses influencers to lead its marketing efforts. The feedback from digital trials of new products informs the approach to physical retail. Short supply chains contribute to an ability to design, develop and launch new products within 16 weeks.

A trading update covering the 12 months ended February 2022, showed revenue and EBITDA growth of 42% and 73% respectively. The advisers say that this was marginally below expectations, but was nonetheless a good performance.

However, on 2 August 2022, Revolution Beauty said that it had seen short-term challenges as a result of post-COVID retailer updates during the first quarter of its 2023 financial year (Q1 FY23) – notably in the USA, cost inflation, supply chain issues and the war in Ukraine. It expects the first half of the year to deliver low single-digit revenue growth versus H1 FY22, resulting in a small adjusted EBITDA loss for the six month period ending 31 August 2022. For the full year to 28 February 2023, it now expects between £215m and £225m net sales and adjusted EBITDA of between £18m and £20m.

Sorted

Sorted (sorted.com) is a SaaS business that supports retailers’ deliveries and collections. It says that retailers who use its software see higher rates of conversion, are better able to manage external logistics suppliers and the delivery experience, have fewer customer queries, and are able to offer an improved returns service – thereby enhancing the customer experience. Its clients include ASOS, Asda and Lush.

Sorted beefed up its senior management team in 2021, and in December it raised $40m from a Series C funding round. This enabled it to finance the acquisition of Clicksit (an automated returns specialist). CHRY and Arete Capital Partners led the funding round.

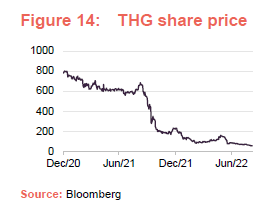

THG

THG (thg.com), formerly The Hut Group, was founded in 2004 as an online music and DVD retailer. It developed proprietary technology (Ingenuity), which supports ecommerce; linking brands – some of which it owns – with consumers. CHRY invested soon after CHRY’s launch. THG IPO’d in September 2020, valuing the business at £5.4bn and making THG one of CHRY’s largest investments.

At IPO, in addition to its Ingenuity business, THG owned a range of nutritional supplement brands centred on ‘Myprotein’, a number of beauty brands, a route to market for around 850 third-party beauty brands, a consumer and luxury products business, a country club and two hotels. The business was loss-making, but had delivered good revenue growth.

Controversially, THG’s CEO Matthew Moulding continued to act as both chairman and CEO post-IPO and is the owner of a founder share that gives him a veto on any bid or change of control for three years following the IPO. In addition, he owns property rented to the company and could benefit from an incentive scheme that could see his stake in the business rise from 4.5% to around 25%.

THG’s shares fell sharply over September and October 2021, prompting Mr Moulding to say that the London IPO was a mistake. CHRY’s advisers added to the stake in October and November 2021, but the share price continued to fall.

In March 2022, a new chairman – Lord Charles Allen – was appointed, and in June, in a vote of confidence, he invested £1m into THG’s shares.

The 2021 full-year numbers showed group revenue growing by 35.1% year-on-year. EBITDA rose by 7.0% to £161.3m, but the group made a loss of £127m (FY20 loss of £538m). Revenue growth for the first quarter of 2022 was expected to be between 22% and 25%. The advisers say that revenues were in line with expectations, but margins were under pressure due to an increase in whey prices in the nutrition division, compounding industry wide inflation in other areas, such as freight costs. THG said that it expects this to persist into the first half of 2022, leading to EBITDA downgrades of about 10% for the current financial year.

Ingenuity Commerce revenue was £45.4m for 2021, shy of an expected £50m, but still 135% higher than the previous year. THG is targeting £110m for 2022.

The advisers believe that the two main businesses are valuable. They feel that there are opportunities to grow the beauty business through M&A. The governance aspects that have been highlighted in the press since the share price fall should, the advisers think, have been reflected into the IPO price.

THG recently confirmed that it has received numerous takeover approaches, which have been dismissed as undervaluing the company.

On 19 May, the board of THG issued a statement in response to press speculation in which it confirmed it had rejected, as insufficient, an indicative, non-binding proposal for a bid at 170p per share from Belerion Capital Group together with King Street Capital Management. On the same day, Candy Ventures Sarl – the investment vehicle of Nick Candy – said that it was in the early stages of considering a possible offer for THG.

However, on 16 June, as THG announced that it had not considered it appropriate to provide due diligence access to any of these parties, both Belerion/King Street and Candy Ventures confirmed that they did not intend to make an offer for THG.

The advisers say that peers of THG peers have been acquired on 5x sales.

On 26 July 2022, THG said that it had completed a reorganisation of its business that separates out its key trading divisions. It also said that an option and collaboration agreement with part of SoftBank had been terminated, along with a call option granted by THG.

Wise

Wise (wise.com), formerly TransferWise, formed part of CHRY’s initial portfolio. Wise is a leading online foreign exchange business which IPO’d in London in July 2021. The business is performing well and is profitable – diluted earnings per share rose from 3.04p to 3.18p for the year ended 31 March 2022.

The cost to customers of transacting through Wise has fallen from an average of 69bps in 2020 to 61bp for Q2 2022. This reflects Wise’s policy of sharing scale benefits with customers. Increasingly, payments are made instantly, including more than half of payments made in Q2 2022, and more than 90% are made in less than 24 hours. Personal customers can now link their Wise Account to over 6,000 finance apps.

In its trading update for Q2 2022, Wise said that it had processed payments totalling £24bn on behalf of 5m customers, a 49% year-on-year increase. Revenue rose by 51% to £185.9m (the total for the financial year ended 31 March 2022 was £560m). Financial guidance for FY23 is for revenue growth of between 30-35% and greater than 20% CAGR over the medium term. The adjusted EBITDA margin is expected to be at or above 20% over the medium term.

Notwithstanding these positive trends within the business, the share price has fallen significantly since IPO.

Secret Escapes

Secret Escapes is an online travel agent. Pandemic-related disruption hit the business and in May 2020 it shored up its balance sheet with a £55m Series E fundraise from existing investors. In 2020, the business lost £48.2m on underlying revenue of about £57.7m (down from £118.3m for 2019). 2021 figures have not yet been published. The company’s rumoured IPO plans had to be put on hold. Secret Escapes made some opportunistic acquisitions, such as Dutch travel business TravelBird, but sold its Spanish business for an undisclosed sum in March 2022.

The advisers say that Secret Escapes has got a very strong customer proposition and has more recently proven its ability to generate robust profit margins from a much lower revenue base. This has given them increased confidence in the outlook of the business. As demand-side shocks ease, they believe the business has a strong chance of realising its potential.

Rowanmoor

In January 2022, CHRY sold its stake in Embark, receiving net cash proceeds of £57.2m for its stake; 2.1x the value of its investment. However, Embark’s Rowanmoor SIPP and SSAS administration business was excluded from the sale and remains within the CHRY portfolio. The business is held at negligible value, however, as it is facing numerous compensation claims in relation to due diligence failings, and recently lost a case brought by the Financial Ombudsman Service.

On 31 August 2022, Rowanmoor Personal Pensions Limited was placed in administration by its directors.

Performance

Notwithstanding the short-term setback, CHRY’s NAV has made reasonably good progress since launch, and delivered returns that are well-ahead of most comparable indices.

Positions are revalued quarterly. Ahead of CHRY’s migration to self-managed status, the board established an independent valuation committee (see page 32). Under the new structure, the company assumed direct responsibility for the valuation process. The committee decides what the appropriate valuation should be and submits that to the board for approval. The board may opt to commission a report from another external valuer.

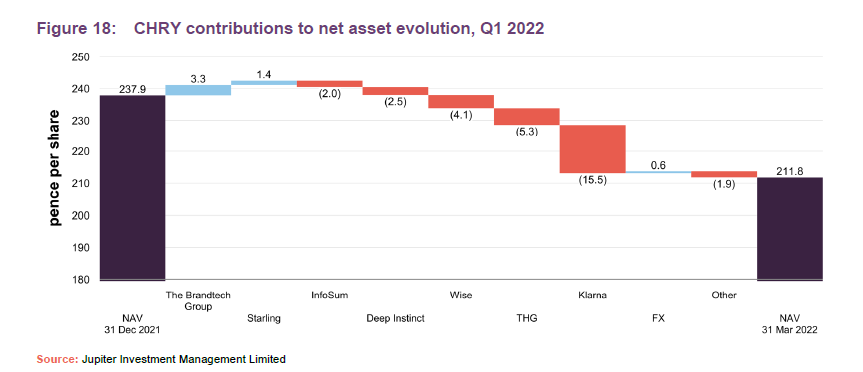

Q1 2022 NAV

On 23 May 2022, CHRY published an end March NAV of 211.76p, 11% less than the NAV at end December 2021. The statement said that the main influences on the NAV over the first quarter of 2022 were:

- The Brandtech Group, written up on the back of revenue and profit growth;

- Starling Bank, written up on the back of a recent funding round that valued the business at £2.5bn;

- Klarna, written down on the back of weak share prices for listed comparators. The end March valuation for the whole business is about $30bn;

- Deep Instinct and InfoSum, written down on the back of weak share prices for listed comparators; and

- sharp falls in the share prices of THG and Wise. £12.2m worth of Wise was sold at an average price of 500p during March.

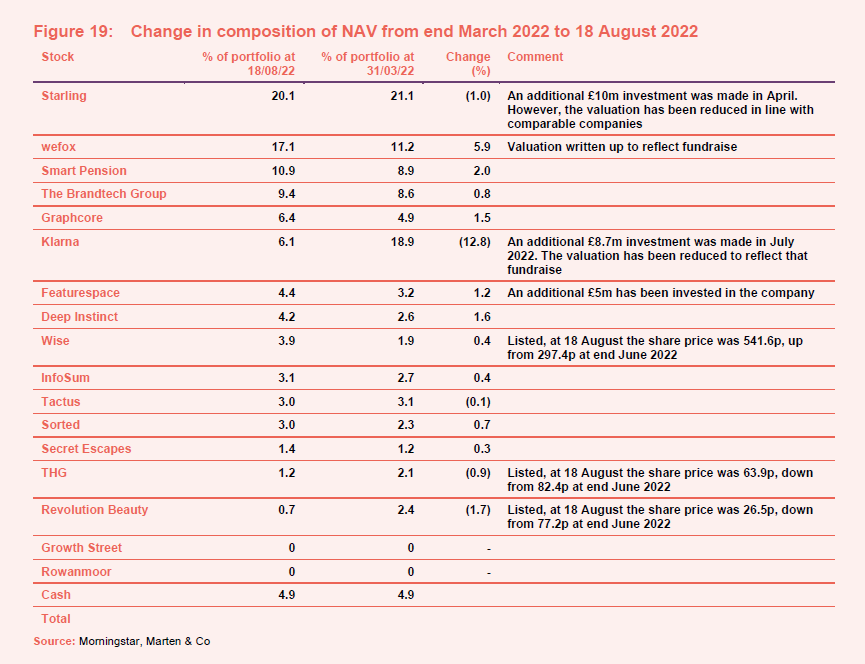

Q2 2022 NAV statement and 18 August update

On 22 August 2022, CHRY published its NAV as at 30 June 2022 of 163.48p, but also included information as to the composition of the portfolio at 18 August 2022.

For the most part, the move in valuations of unlisted investments since 31 March 2022 reflects changes in the valuations of comparable listed companies over the period ended 30 June 2022.

There were some additional investments in Starling, Klarna and Featurespace during the period.

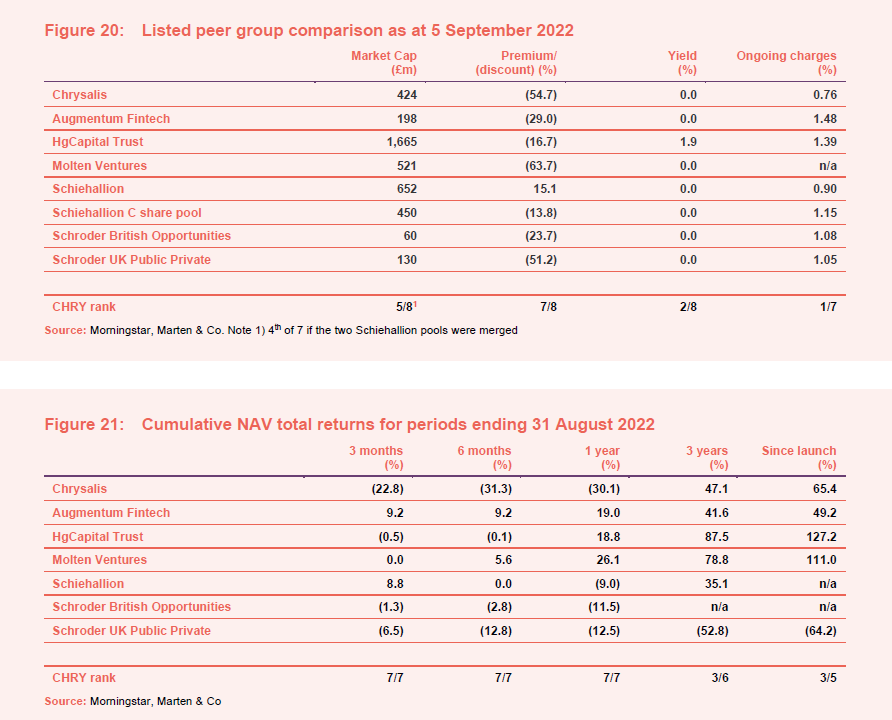

Peer group

For the purposes of this note, we have compared CHRY with the other trusts in the AIC’s Growth capital sector. We have excluded Jade Road Investments on size grounds, and Petershill and Seraphim Space which have quite different remits (taking stakes in alternative asset managers, and space technology).

We have also included comparisons with HgCapital Trust, Augmentum Fintech and Molten Ventures.

Within our selected peer group, CHRY is differentiated by its focus on late-stage investments (Molten Ventures has some exposure to venture-stage investments, for example), its diversification by industry (notably CHRY’s bias to financials rather than technology which dominates Hg Capital’s portfolio), and its EU and US exposure (contrasting with Augmentum Fintech’s European focus, for example).

While CHRY’s short-term returns have been towards the lower end of this peer group, its long-term returns look much better and, since it was launched, it ranks third in this peer group.

Dividend

The nature of CHRY’s portfolio is such that it is unlikely to generate a revenue profit. At 30 September 2021, the balance on CHRY’s revenue account was negative £13.4m. No dividend has been declared since CHRY was launched.

Premium/(discount)

Over the 12 months ended 31 August 2022, CHRY’s share’s traded between a discount of 56.0% and a premium of 18.4% and averaged a discount of 20.0%. At 7 September 2022, CHRY was trading on a discount of 57.3% to the NAV as at 30 June 2022, a new low.

As we show in the next section, CHRY has issued shares on a fairly regular basis since launch and, over time, this has helped moderate the premium at which its shares traded relative to NAV. CHRY’s board has permission from shareholders (granted at the AGM held in February 2022) to issue up to 114,496,632 shares. To avoid diluting the NAV, such shares would only be issued at a price higher than NAV plus the associated costs of issuance.

In March 2020, when markets were panicked by the COVID-19 outbreak, the shares moved to trade at a discount. As the year progressed and it became clear that, if anything, COVID-19 was accelerating the business plans of some portfolio investments, the share price recovered. However, over the course of 2022, investors have become more risk-averse, and sentiment has turned against growth stocks. This is related to an anticipated rise in interest rates in response to heightened inflation. In common with other similar funds, CHRY’s discount has widened.

Shareholders have granted CHRY’s board powers to repurchase shares (up to 14.99% of shares in issue at the time of the publication of the notice of the AGM held in February 2022). These would only be bought back at a discount to NAV. Once repurchased, they may be cancelled or held in treasury. Shares held in treasury would only be reissued at a price equal to or higher than NAV.

As noted on page 5, currently, the board feels that shareholders will benefit more if CHRY’s liquid resources are used to support its portfolio companies rather than to buy back shares.

Share issuance

Fees and costs

The adviser is entitled to a monthly management fee equal to 1/12 of 0.5% of the NAV (less any amount invested in a fund or special purpose vehicle (SPV) paying fees to Jupiter), calculated and paid monthly in arrears.

The investment management agreement may be terminated by either party on six months’ notice, and may be immediately terminated by either party in certain circumstances such as a material breach which is not remedied.

There is also a performance fee, calculated as 20% of gains (including unrealised gains) in excess of an 8% per annum hurdle rate and subject to a high watermark.

Unlike most private equity structures, CHRY’s performance fee is based on unrealised and realised gains. However, the fee can only be paid from realised gains, plus unrealised gains on investments that have IPO’d during the relevant calculation period, plus any change in the value of listed securities over the calculation period, plus dividends and other income received from companies in the portfolio during the calculation period. Any amount accrued but unpaid at the year is carried forward to subsequent periods.

For the financial year ended 30 September 2021, where the NAV rose by 57%, a performance fee of £112.1m was payable (FY20 £32.7m) and £60.5m of that was settled in shares issued at 267p (a 6% premium to the year end NAV).

The fee has no clawback arrangement, but the adviser argues that by electing to be paid in shares for a substantial part of the fee, it has participated in the subsequent share price fall and that is akin to a clawback.

In last year’s annual report, the board said that it would be reviewing the management fee arrangements with Jupiter. It commissioned a perception study from Rothschilds of CHRY’s top 20 investors. The chairman has subsequently engaged with a number of those shareholders.

The study confirmed that these shareholders shared the board’s view of the shortcomings of the existing performance fee structure and wished to see amendments made. The board has provided Jupiter with a framework for how a new arrangement could work, which would align the payment of any performance fee due to Jupiter with shareholders more appropriately over the medium term. The board is working with Jupiter over the current calendar quarter to finalise this and aims to provide shareholders with more details prior to the company’s year end, with the intention that the new arrangement would operate from the beginning of the next financial year.

The ongoing charges ratio for the year ended 30 September 2021 was 0.77% excluding performance fees (as is normal practice) and 10.70% including performance fees.

Capital structure

CHRY has 595,150,414 ordinary shares in issue and no other classes of share capital.

CHRY has no borrowing facilities currently. During its financial year ended 30 September 2021, the company entered into a revolving loan facility with Barclays Bank Plc and drew down £15m at an interest rate of LIBOR +2.5%. The loan was repaid in full on 15 October 2021.

CHRY’s accounting years run to 30 September and typically its AGMs are held in February.

CHRY has an unlimited life, but the directors will propose a continuation vote at the AGM that follows the fifth anniversary of the fund’s IPO (i.e. most likely in February 2024).

Management team

Nick Williamson

Nick is a fund manager in the UK small- and mid-cap team at Jupiter Asset Management, focused exclusively on Chrysalis Investments as co-lead adviser. Previously he worked at Merian Global Investors (now part of Jupiter) as a UK smaller companies portfolio manager. Additionally, he has over a decade of experience as a sell-side analyst, having taken on a broad range of responsibilities, most recently at Citigroup. Nick began his investment career in 1995. He has a BA in Economics from Durham University and is a CFA charterholder.

Richard Watts

Richard is co-lead adviser to Chrysalis Investments and head of strategy within the Jupiter UK small- and mid-cap team. Prior to Chrysalis, Richard worked at Merian Global Investors (now part of Jupiter) as a UK mid-cap portfolio manager, and as an equity analyst at Orbis Investment Advisory. He has previously also held the role of senior associate in the investment management division of PricewaterhouseCoopers. Before beginning his investment career in 1998, Richard attained a degree in Mathematical Sciences from the University of Oxford. He is also IIMR-qualified and is a CFA charterholder.

In addition, Jupiter has a 10-strong team dedicated to UK small- and mid-cap, which includes Mike Stewart, an equities analyst who has worked closely with Nick and Richard on Chrysalis since it was launched.

Mike Stewart

Mike is an equities analyst in Jupiter’s UK small- and mid-cap team. Before joining Jupiter, he worked at Merian Global Investors as a research analyst in the UK equities team. Prior to this, Mike worked at private equity firm 8c Capital as an associate. Earlier roles included fund manager at Belerion Capital, and an equity analyst at Panmure Gordon and at Shore Capital. Mike began his investment career in 2013. He has a BA degree in Business Finance.

James Simpson

James is legal counsel, fund management in Jupiter’s UK small- and mid-cap team. Before joining Jupiter, he worked at Merian Global Investors as the dedicated legal counsel for Merian’s UK small- and mid-cap equities desk, advising on equity investments in unlisted companies. Prior to this, James was an associate solicitor in the private equity and M&A team at Travers Smith. He began his asset management career in 2017. James has a degree in Economics and undertook his postgraduate legal studies at the College of Law in London.

Andrew Mortimer

Andrew is an ESG investment director at Jupiter, working with the UK small- and mid-cap team and Chrysalis. He joined Jupiter in 2015 as an investment writer before transferring to the Governance and Sustainability team in 2016. Before joining Jupiter, Andrew worked as a financial journalist at Euromoney. He has a degree in Philosophy & Theology from Christ Church, Oxford, and is a CFA charterholder.

Bekki Whiting

Rebecca (Bekki) Whiting is director of finance for Chrysalis. She joined Jupiter in November 2021 from Big Society Capital where she was a senior director and head of finance. Earlier roles include financial controller of the Pension protection Fund, over six years as finance director/group financial controller at Apax Partners, and six years at Invensys where she rose to become director, financial planning and analysis. Bekki is an FCA and has a BSc (Hons) DPS in Accounting and Financial management from Loughborough University.

Independent valuation committee

Lord Rockley (Committee Chairman)

Anthony Rockley was an audit partner at KPMG until 2015 with a sector focus on private equity and venture capital. Over a 34-year career with KPMG, Anthony has been responsible for auditing private equity and venture capital companies and structures. Amongst other sector specific work, Anthony was a member of International Private Equity and Venture Capital Guidelines Board for nine years.

Diane Seymour Williams

Diane has a career spanning over 30 years in asset and wealth management. She was a listed portfolio manager with Deutsche Morgan Grenfell, ultimately running DMG’s asset management business in Asia. After returning to the UK, Diane subsequently held a number of board positions in the financial services sector. Currently she sits, inter alia, on the boards of abrdn Private Equity Opportunities Trust Plc, Mercia Asset Management Plc and SEI’s European business. Diane brings extensive fund management and portfolio oversight experience. In addition to her public company roles, Diane sits on the investment committees of Newnham College, Cambridge and the Canal & River Trust.

Jonathan Biggs

Jonathan worked at Accel, a leading global venture and growth capital investor, for 20 years up until 2021. One of the first hires in Europe, he was the COO of Accel’s European business. During his time at Accel, he raised over $2.5bn in five early-stage venture funds focused on Europe. Jonathan subsequently joined SVB Capital as a managing partner, where he is a senior leader in its funds management business.

Tim Cruttenden

Tim is an existing board member (see below).

Board

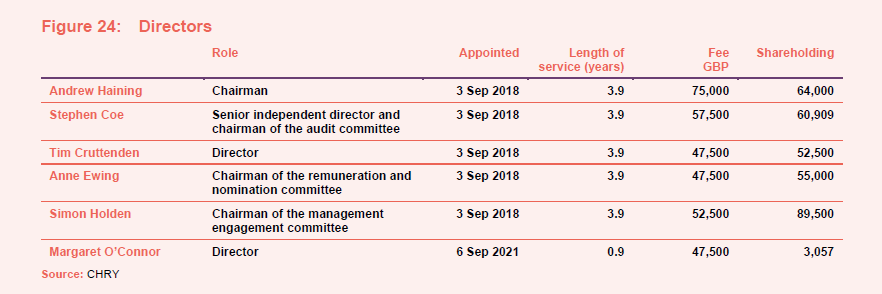

CHRY’s board is comprised of six non-executive directors, all of whom are independent of the adviser and do not sit together on other boards.

Andrew Haining (chairman)

Andrew has had a 30-year career in banking and private equity with Bank of America, CDC (now Bridgepoint) and Botts & Company. During his career, he has been responsible for over 20 private equity investments with transactional values in excess of $1bn. Andrew holds several Guernsey and UK board positions.

Stephen Coe (senior independent director and chairman of the audit committee)

Stephen serves as chairman of the audit committee. He is currently a non-executive director of River and Mercantile UK Micro Cap Investment Company Limited. Stephen has been involved with offshore investment funds and managers since 1990, with significant exposure to property, debt, emerging markets and private equity investments. Stephen qualified as a Chartered Accountant with Price Waterhouse Bristol in 1990 and remained in audit practice, specialising in financial services, until 1997. From 1997 to 2003 Stephen was a director of the Bachmann Group of fiduciary companies and managing director of Bachmann Fund Administration Limited, a specialist third-party fund administration company. From 2003 to 2006, Stephen was a director with Investec in Guernsey and managing director of Investec Trust (Guernsey) Limited and Investec Administration Services Limited. Stephen became self-employed in August 2006, providing services to financial services clients.

Tim Cruttenden

Tim is chief executive officer of VenCap International Plc, a UK-based asset management firm focused on investing in venture capital funds.

He joined VenCap in 1994 and is responsible for leading the strategy and development of the firm. Prior to joining VenCap, Tim was an economist and statistician at the Association of British Insurers in London. He received his BSc (with honours) in Combined Science (Economics and Statistics) from Coventry University and is an Associate of the CFA Society of the UK. Tim is a non-executive director of Polar Capital Technology Trust Plc.

Anne Ewing

Anne has over 35 years of financial services experience in banking, asset and fund management, corporate treasury, life insurance and the fiduciary sector. She has an MSc in Corporate Governance and has held senior roles in Citibank, Rothschilds, Old Mutual International and KPMG and latterly has been instrumental in the start-ups of a Guernsey fund manager and two fiduciary licensees.

Anne has several non-executive directorships and chairman roles in investment companies and a banking and trust company group in the Channel Islands and in London.

Simon Holden

Simon, a Guernsey resident, brings board experience from both private equity and portfolio company operations roles at Candover Investments and subsequently Terra Firma Capital Partners. Since 2015, he has been an independent director to listed alternative investment companies, private equity funds and trading company boards, including pro-bono roles to the States of Guernsey overseeing infrastructure critical to the Island including the airport, harbours and two maritime fuel supply vessels.

Simon is a Chartered Director (CDir) accredited by the UK Institute of Directors, graduated from the University of Cambridge with an MEng and MA in Manufacturing Engineering and is an active member of UK and Guernsey fund management interest groups.

Margaret O’Connor

Margaret brings global experience of guiding boards through investments in disruptive technologies, including artificial intelligence, big data, augmented reality, and blockchain to this role. She has had a 30-year career building value in global technology companies across the US, Asia, Africa, and Europe. Margaret has been instrumental in starting up two Mauritius-domiciled, pan-African technology investment funds. During 2020, she moved to London and was appointed to chair the Launch Africa Venture Fund 1 and Pay Today and to serve on the Investment Committee of Five35 Ventures.

Prior to this, Margaret was a Silicon Valley VC-funded marketing technology entrepreneur and a founding member of the MasterCard Asia Pacific management team in Singapore and the MasterCard Global New Technology Communications group in New York. She is a member of the Institute of Directors and a nominee for the Private Equity Women Investor Network (PEWIN.org). Margaret earned her BA from Rutgers University and an Eagleton Institute of Politics fellowship. She studied International Relations at Princeton University before moving to Seoul, Korea in 1987.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Chrysalis Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication.

Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.