Proving its mettle

With a solid first set of results published, revenue and dividends running ahead of IPO forecasts, a diverse and differentiated portfolio of attractive renewable energy assets, and a growing NAV supported by investments that are helping to build NAV and profits, Downing Renewables and Infrastructure (DORE) is attracting the support of new investors.

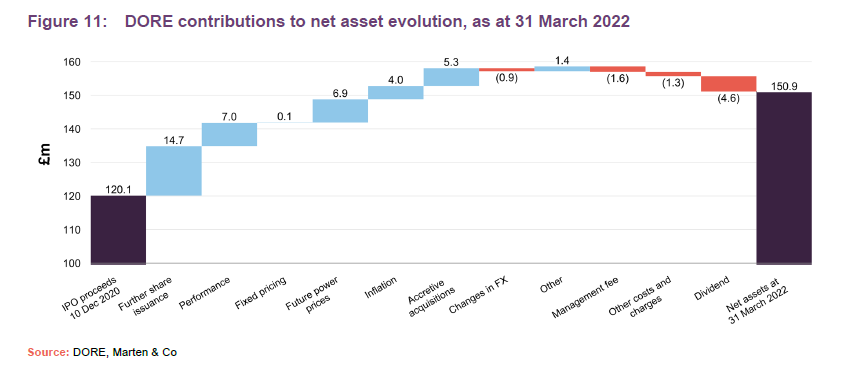

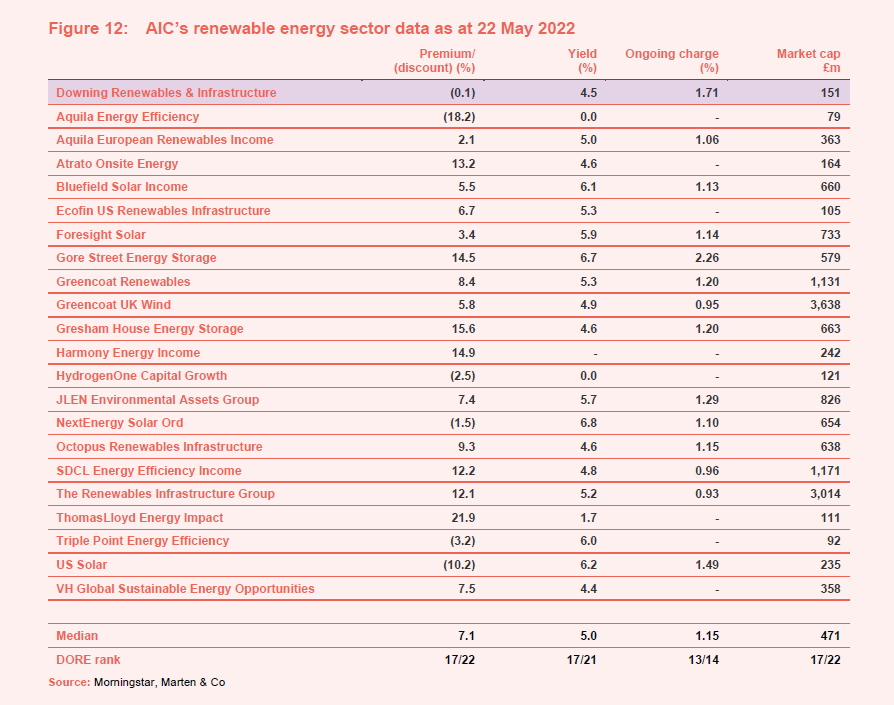

On 11 May 2022, the trust announced an NAV as at end March 2022 of 110.1p – up from 103.5p per share as at 31 December 2021; we discuss what drove this uplift on page 15 of this note. The share price is yet to fully reflect the good news, however; currently DORE’s shares are trading at asset value, compared to a median premium of over 7% for its peer group (see page 16).

Following its latest acquisition, DORE has drawn down 69% of its £25m revolving credit facility (RCF). The manager has a strong pipeline of investment opportunities (see page 11), and to access that and repay the drawings on the RCF, the directors are considering a fundraise.

Russia’s war on Ukraine and the associated spike in energy prices have underscored the need for Europe to rid itself of its fossil fuel dependence and accelerate the switch to renewables. The compelling associated cost-saving (renewable-powered energy tends to be cheaper than gas-powered energy) is an added bonus. DORE deserves to be playing an active part in this.

Diversified renewable energy and infrastructure

Downing Renewables and Infrastructure Trust aims to provide investors with an attractive and sustainable level of income returns, with an element of capital growth, by investing in a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland and Northern Europe.

Fund profile

DORE aims to provide investors with an attractive and sustainable level of income returns, with an element of capital growth, by investing in a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland and Northern Europe.

The company aims to accelerate the transition to net zero carbon emissions through its investments. DORE believes that its actions should directly contribute toward reducing the impact of climate change.

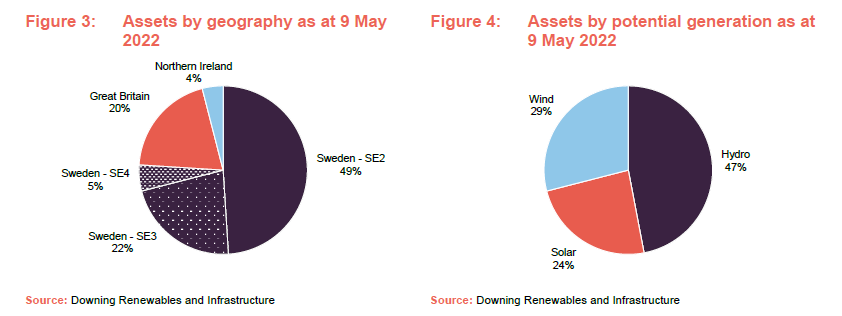

The strategy focuses on diversification by geography, technology, revenue and project stage. The investment manager believes that by investing in a range of renewable energy sources, DORE can reduce the seasonal volatility of revenues (wind strength tends to pick up in winter when there is less sunshine, and the reverse is true in summer) and reduce dependency on any single technology to provide more consistent income. There may also be some investments in other infrastructure assets, whose principal revenues are not derived from energy generation, thus reducing DORE’s exposure to merchant power prices. In addition, diversifying the portfolio geographically should help reduce the portfolio’s regulatory and political risk.

The portfolio will also blend operational projects with construction-ready projects and those under construction. The manager says that investment in construction-phase projects offers the potential for higher returns. The amount invested in construction-ready assets or assets under construction will be limited to 35% of gross asset value, as construction projects tend to have more risk associated with them. The company will not acquire assets that are not construction-ready.

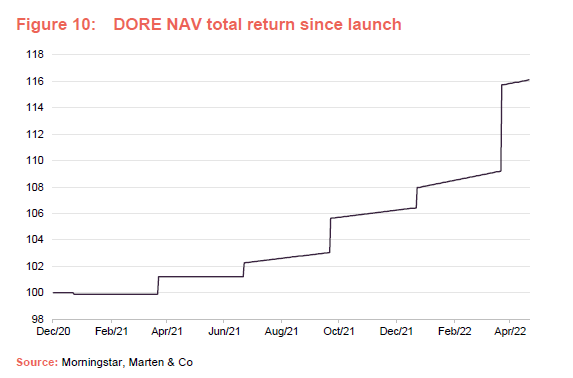

DORE is targeting a NAV total return of 6.5% to 7.5% per annum over the medium to long term. From launch to end April 2022, DORE has generated annualised returns of 9.9% in share price terms and 11.4% in NAV terms, well ahead of target.

DORE’s AIFM is Gallium Fund Solutions Limited. It has delegated portfolio management services to the investment manager Downing LLP (Downing or the manager). Downing had assets under management of over £1.6bn at end December 2021, and a team of more than 40 investment and asset management specialists (up from 30 last time we published) focused exclusively on energy and infrastructure transactions.

DORE raised £122.5m at its initial public offering (IPO) and topped that up in October 2021 with a £14.9m issue of shares at 102.5p.

A detailed look at DORE’s investment process is given in the appendix at the back of this note.

Backdrop

The COP26 climate summit in Glasgow last November proved disappointing for some observers. Nevertheless, significant commitments to renewable energy investment were made, and DORE’s home markets in the UK and Northern Europe are amongst the forefront of this.

The UK Government’s Energy Security Strategy, published on 6 April 2022, foresees the possibility of 95% of Great Britain’s electricity coming from low carbon sources by 2030. In a surprise move, notwithstanding our dire record of delivering nuclear power projects on time and budget, much of this is planned to come from new nuclear plant. Ambitions also include 50GW of offshore wind by 2030, a fivefold expansion of UK solar by 2035, and more onshore wind for supportive communities who want guaranteed lower energy bills.

That last comment, allegedly much watered down on fears of NIMBYism, was seen as a disappointment.

Tom Williams, partner and head of energy and infrastructure at Downing said: “What we do over the next decade will be critical to mitigating or averting a climate crisis but, unfortunately, it seems that a short-term focus on the cost of living and energy security is driving much of the Government’s Energy Strategy. Increased emphasis on nuclear energy as part of the solution is a medium to long term effect; it takes years to plan, commission, build and deliver new nuclear capacity. In the short term, fossil fuel intensive generation will be sweated harder for longer, emitting more greenhouse gases in the process.

The fastest and cleanest way to reduce our energy bills is a greater use of renewable energy. The Government must do more to encourage the rapid scale up of renewable energy infrastructure through easing of planning regulations for wind and solar, especially on-shore wind. Pairing this with improved storage and transmission is the only way to deliver against our competing demands of energy security and an impending climate crisis, while to mitigate the short-term impact of fossil fuel use, we need to see equal commitment to carbon capture and sequestering technologies. [Note Sequestering technologies refers to means by which carbon that has been captured can then be isolated and stored for the long-term.]

Like any area of policy, it can’t be considered in isolation but our greatest fear is that the Climate Crisis will be the price we pay for Energy Security.”

Fortunately, DORE is not dependent on the UK or UK onshore wind in particular. The news reinforces the attraction of an investment objective that is diversified by geography and technology.

For example, Sweden, an important market for DORE, is targeting 100% renewable energy production by 2040, and is planning to phase out its nuclear plants.

In some European countries, the imposition of sanctions on Russia has caused some short-term backsliding in the phase out of the use of fossil fuels. However, the associated much-higher-than-average power prices reinforce the argument for investing in renewable sources of energy and may accelerate the process over the medium term.

Power prices

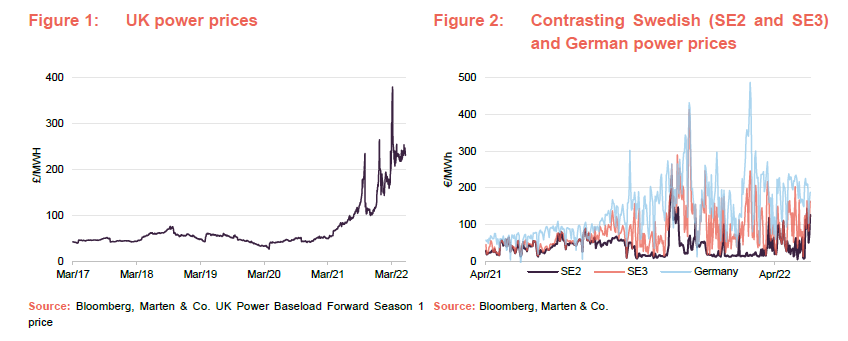

In a market such as the UK, where the proportion of baseload generation has been falling, the marginal price for power is set by the cost of electricity provided by peaking plant (generating plant that kicks in when supply dips from other sources). In the UK, this tends to be gas-fired stations. Rising natural gas prices have contributed to higher power prices, and this situation has been exacerbated by Russian sanctions.

By contrast, Sweden which derives most of its energy from hydropower and nuclear, has tended to have much more stable and lower power prices.

However, the Swedish power market is integrated with the rest of Europe. In our last note, we highlighted the disparity between Swedish and German power prices and noted that the manager believes that interconnectors will encourage Nordic power prices to rise towards northern European averages. That scenario has played out in recent months, albeit the effect is much more marked in the SE3 region (which includes Stockholm) than the less well-connected SE2 region to the north. As an aside, an upgrade to Sweden’s internal transmission network could make DORE’s SE2-located hydropower plants more profitable. In addition, power demand is rising within Sweden as businesses opt to locate data centres and factories in places where they can tap into renewable energy.

Inflation

Supply chain bottlenecks, rapidly recovering economies as we emerged from COVID lockdowns and higher energy prices have contributed to rising inflation in many markets. The war in Ukraine has made the problem worse, driving up prices for many commodities. This has a modest impact on renewable energy investors – prices for solar modules have risen for the first time in many years, for example. However, for those operating in the UK, where subsidies are linked to RPI, inflation promises to drive NAVs higher.

Rising interest rates might be expected to have an impact on discount rates (used in discounted cash flow calculations to work out the NAV). However, these are also informed by the prices that projects change hands at in the secondary market, and there has been no sign of any weakness on pricing.

Asset allocation

Since launch, DORE has invested more than £160m in a portfolio that is expected to generate 372GWh of renewable energy each year.

Figures 3 and 4 show the distribution of DORE’s portfolio at 9 May 2022, following its most recent acquisition.

Hydropower – Downing Hydro AB (DHAB)

Since we last published, DORE has bought three operational portfolios of hydropower plants located in central Sweden for a total consideration of approximately €45m, adding 60% to forecast annual energy production from this area:

- a 12 GWh portfolio of hydropower plants was acquired from ÄSI Kraft AB for about €6m;

- a 36 GWh portfolio of four run-of-the-river plants was bought for about €19m from AB Edsbyn Elverk; and

- an 18 GWh portfolio of two run-of-the-river hydropower plants in the SE4 pricing region was acquired from Batten AB and Daturum AB for €20m.

These deals were funded largely through debt drawn down on the DHAB Swedish hydropower portfolio debt facility agreed in November 2021 (see page 20). The Edsbyn plants were refurbished between 2010 and 2013. The SE4 plants were comprehensively renovated between May 2014 and September 2019.

DORE’s hydropower assets are all located in Sweden. With the exception of the run-of-the-river plants, they have the advantage of storage capacity (totalling about 120m cubic metres) to help regulate flows. These reservoirs act like a battery allowing the plants to capture periods of higher power prices (such as times when wind resource is not available), but crucially they can discharge power for a much longer period than a conventional lithium-ion battery could.

The hydropower plants have an extensive operating history. The manager feels that one of the strengths of hydropower assets is their longevity, which extends well beyond the design-lives of wind and solar assets.

DORE has a framework agreement with Axpo, a Swiss energy company, which allows DHAB to lock in prices for the power it produces. DHAB has hedged positions in line with the requirements of its SEB debt facility.

Solar

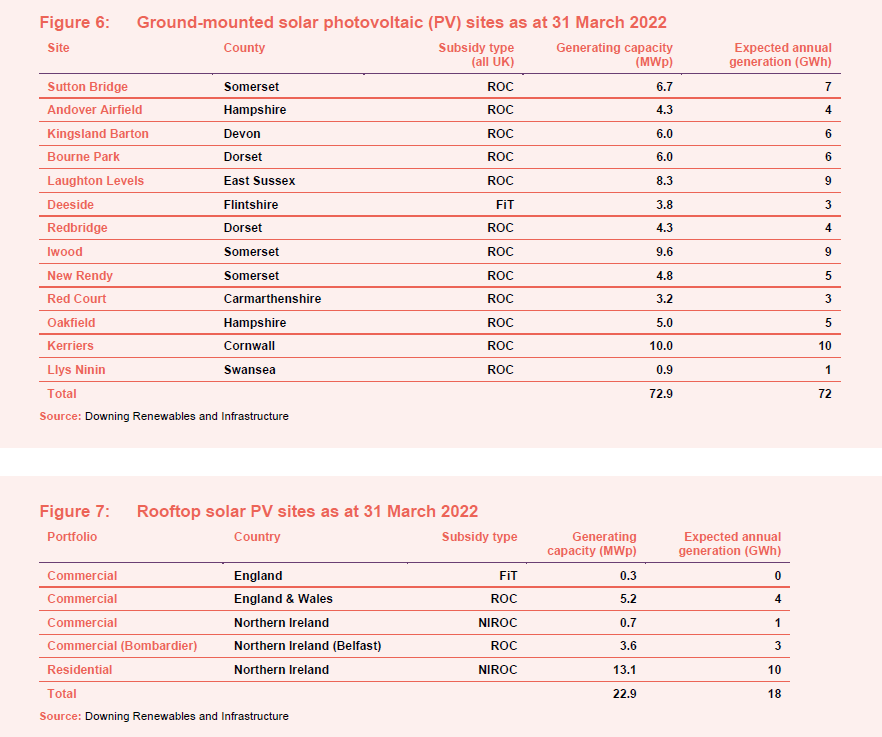

DORE’s solar portfolio was acquired in March 2021. It comprises 13 ground-mounted solar photovoltaic (solar PV) assets have a generating capacity of 73MWp, as well as four commercial portfolios and one residential rooftop portfolio, which have a generating capacity of about 23MWp. All of these solar assets are located in the UK and benefit from a combination of feed-in-tariff (FiT), ROC and the Northern Irish equivalent NIROC subsidies.

The power produced by the ground-mounted solar portfolio is sold through a long-term offtake agreement with Statkraft (a power company owned by the Norwegian state), with the effect that 86% of the solar portfolio (by capacity) benefits from a power purchase agreement (PPA) floor, which sets a lower limit for prices.

Wind

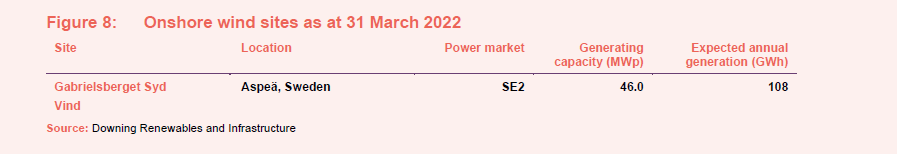

On 2 February 2022, DORE said it had completed the acquisition of an operational 46 MWp onshore wind project located in northeast Sweden for a total consideration of approximately €23.8m. The deal was funded on a no debt (ungeared) basis using the group’s cash resources.

The wind farm is powered by 20 Enercon E-82 2.30 MW turbines and is located on a plateau in north-eastern Sweden at approx. 220 metres above sea level in the SE2 pricing region. The project has been operational since 2011. Operation and maintenance services are provided by Enercon GmbH. The asset is expected to generate about 108 GWh of electricity per annum. The power generated is sold through a short-term offtake agreement with Centrica.

DORE decided not to proceed with the proposed investment in a planned 100MW nearshore, shallow water wind farm in Lake Vänern in southern Sweden that we described in our last note. The manager says that some of the aspects of the project did not meet the criteria set by DORE for the investment to proceed.

Pipeline

The manager has identified a pipeline of potential investments valued in excess of £4bn in hydropower, solar, wind, batteries and utilities in Sweden, Poland, Finland, Iceland, Norway, Denmark and the UK (£2.6bn in UK and Ireland and £1.6bn in Northern Europe).

Downing has secured exclusivity or is in bilateral negotiations with relation to investments amounting to an excess of £200m. These include;

- three separate bolt-on hydropower acquisitions for the DHAB portfolio – seven sites producing about 14GWh per annum in the SE2 and SE3 pricing regions, an operational run-of-the-river 0.6GWh plant in SE2, and a pipeline of construction-ready plants in Norway which could, over the next three years add 50GWh;

- eight ground-mounted sites and 1,600 commercial and residential rooftop solar sites in the UK, all operational and subsidised (FiTs and ROCs) and capable of producing about 32GWh;

- a stake in a UK offshore windfarm which has been operational for three years and has a capacity in excess of 500MW. It is subsidised under the ROC regime; and

- a 400km electricity distribution network in the Nordic region which operates under a regulated asset base model.

ESG

As might be expected, DORE has very strong ESG credentials. DORE is an Article 9 fund under EU taxonomy and the EU Sustainable Finance Disclosure Regulations, which are explained below. As an article 9 fund, DORE has a core sustainable objective of accelerating the transition to net zero carbon emissions through its investments.

EU taxonomy for sustainable activities

The EU taxonomy for sustainable activities is a classification system, establishing a list of environmentally sustainable economic activities. It is still a work in progress but could play an important role in helping the EU scale up sustainable investment, particularly in the renewables space, and implementing the European green deal. It should also help the EU to meet its climate and energy targets for 2030.

Controversially, the EU included gas and nuclear as environmentally sustainable (the argument being that these are necessary as part of the transition away from dirtier forms of fossil generation), but it is possible that they will be removed from the definition as EU member states and the EU parliament review the proposal. DORE’s invested portfolio is 100% aligned to the EU taxonomy.

If it is designed properly, the EU taxonomy will provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. This should create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed.

ESG performance over 2021

DORE reports to shareholders on matters of sustainability on a regular basis, and the annual report dedicates many pages to this topic. We provide a snapshot below.

Over the accounting period ended 31 December 2021 and for the period of ownership of the assets by DORE, the portfolio generated 195GWh of clean energy, avoiding the emission of 90,523 tCO2e of greenhouse gases, and producing enough energy to power 41,973 homes.

DORE goes beyond this in its efforts to contribute to the natural environment in respect of the land that its projects sit on. DORE installed four beehives (in conjunction with the British Beekeepers Association), 12 bird boxes and 10 bat boxes over the reporting period. Ground-mounted solar sites are grazed by sheep.

In respect of its social obligations, DORE contributed £19,646 of annual community funding. It can also report zero accidents and injuries amongst its workforce. Downing is a signatory to the Stewardship Code, and to HM Treasury’s Investing in Women Code; the manager is also committed to improving female entrepreneurs’ access to tools, resources and finance.

Both DORE and Downing LLP partner Earth Energy Education, which educates children as to the benefits of renewable energy, including organising visits to renewable energy production sites across the UK.

Downing LLP is a signatory to the UN Principles of Investment and DORE’s portfolio is aligned to many of the UN’s Sustainable Development Goals, including (7) Affordable and clean energy, (9) Industry, innovation and infrastructure, (13) Climate action, and (15) Life on land.

DORE was awarded The Green Economy Mark by the London Stock Exchange.

Pages 17 to 25 of the annual report cover DORE’s disclosures in accordance with TCFD. Within them, the board presents a series of scenarios for the impact of climate change on the portfolio. The analysis suggests to us that such impacts are not likely to be material.

NAV assumptions

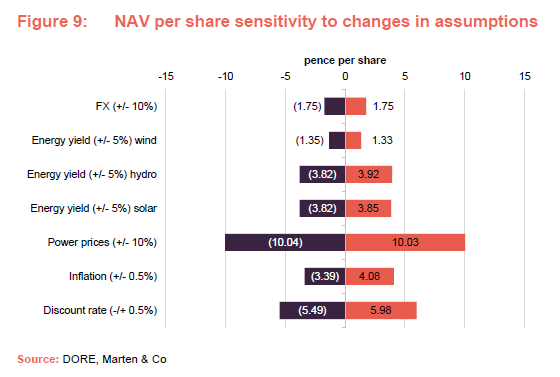

Forecast power prices are based on fixed prices under contractual arrangements where these are in place, short-term power price hedges, and a blend of forecasts from two leading independent consultants. The increase in short-term power prices over 2021 is reflected in Figure 11.

At the end of December 2021, UK inflation was assumed to be 2.75% rising to 3% over the medium-term and falling to 2.25% from 2030 onwards. Swedish inflation was assumed to be 1.8%.

When calculating the NAV as at 31 March 2022, in light of the continuing rises in actual and forecast inflation across Europe and the UK, 2022 inflation forecasts were increased to 7.8% in the UK, and 4% in Sweden, with previous inflation assumptions left unchanged for subsequent years.

For the wind and solar projects, asset lives are assumed to be the earlier of planning consent or lease expiry. The hydropower assets are assumed to have unlimited lives. The ground-mounted solar assets had a weighted average life of 25 years at end December 2021. Work is underway to extend this to about 27.8 years (which would add £1.1m to DORE’s NAV).

Forward foreign exchange rates are based on a 10-year forward exchange rate curve provided by DORE’s foreign exchange advisers.

Discount rates are assigned to individual assets. At end December 2021, these ranged between 5.5% and 7.5%, with a weighted average of 7.3%.

About 89% of revenue forecast for 2022 is not exposed to floating power prices.

Performance

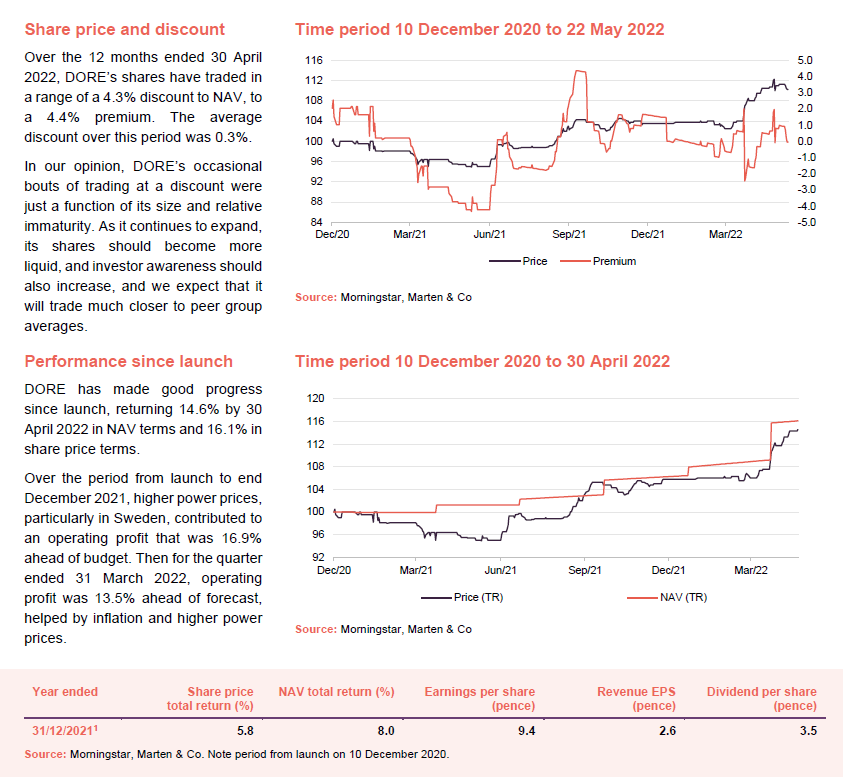

DORE has made good progress since launch, returning 14.6% by 30 April 2022 in NAV terms and 16.1% in share price terms.

Period from launch (8 October 2020) to 31 March 2022

In its accounts covering the period from launch to end December 2021, DORE said that its operating assets produced about 195GWh of energy over the reporting period. Generation was 4.7% ahead of expectations, driven largely by the hydropower portfolio generating 9.1% more power than budgeted.

Although irradiation for the solar portfolio was 1.9% above expectations, transmission network outages at two sites brought output back down to budgeted levels. DORE says that the operations and maintenance team took advantage of the outages to work on preventative maintenance on those sites.

Higher power prices, particularly in Sweden, contributed to an operating profit that was 16.9% ahead of budget.

A programme of asset optimisation has commenced. This includes a digitalisation project for the hydropower portfolio which is exploring ways of using technology to reduce downtime and improve operational efficiency, and the use of satellite irradiation data for monitoring the efficiency of DORE’s rooftop solar portfolios.

Over the quarter ended 31 March 2022, operating profit was 13.5% ahead of forecast, helped by inflation and higher power prices.

The hydro portfolio generation was below budget due to dry weather and a delayed spring flood, but returned a strong financial result, as cost savings were achieved as a result of transitioning assets acquired from Fortum on time and under budget. Solar generation was 13.9% above budget and wind generation was line with forecasts.

Peer group

DORE is a constituent of the AIC’s renewable energy sector. There are now 22 members of this peer group, and the sector is increasingly diverse. Three funds focus exclusively on battery storage assets. These fall within DORE’s remit, but as yet do not feature within its portfolio. Three funds are focused on energy efficiency projects. Two funds invest exclusively in US projects, which tend to have long-term PPAs. One invests in hydrogen-related assets, and has more of a capital growth focus. Of the remainder, none has DORE’s current strong focus on the Nordic region or hydropower. There are some others that invest across different technologies – Aquila European Renewables, Bluefield Solar Income, JLEN Environmental Assets, Octopus Renewables Infrastructure, The Renewables Infrastructure Group and VH Global Sustainable Energy Opportunities. This last group are probably the closest comparators.

DORE’s size has an impact on its ongoing charges ratio – this should fall as the trust expands. DORE’s dividend is ahead of where it was forecast to be at IPO and the yield is now closer to the median. The board’s policy is to pay a progressive divided from next year. The premium is still on the low side within the peer group.

Dividend

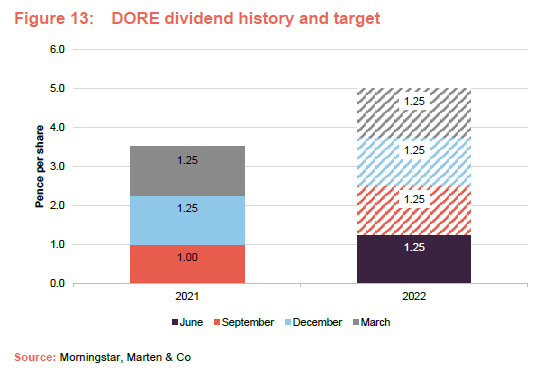

DORE intends to pay dividends on a quarterly basis, with dividends typically declared in respect of the quarterly periods ending March, June, September and December and paid in June, September, December and March respectively. DORE has declared and paid dividends totalling 3.5p in respect of the accounting year ended 31 December 2021. These dividends were covered by cash generated from the portfolio 1.21x (after adjusting to account for dividends paid on newly issued shares – without this adjustment, the figure would have been 1.14x). This 3.5p dividend is ahead of the target of 3.0p set out in DORE’s original prospectus.

The target dividend for 2022 is 5.0p and, in line with this objective, DORE recently declared an interim dividend of 1.25p for the quarter ended 31 March 2022 which is payable in June.

Thereafter, the company intends to adopt a progressive dividend policy.

Following Court approval, DORE cancelled its share premium account and created a special distributable reserve account which can be used to fund the dividend. At end December 2021, the balance on the special distributable reserve account stood at £118.4m.

Premium/(discount)

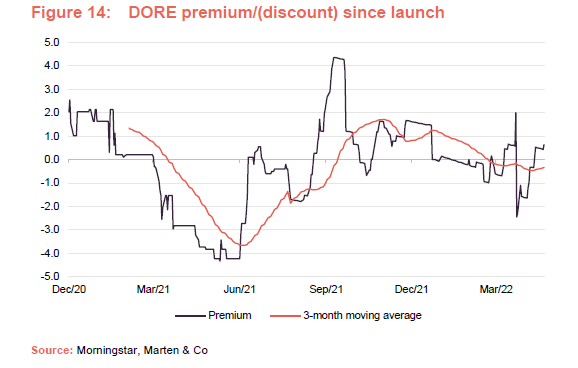

Over the 12 months ended 30 April 2022, DORE has traded in a range of a 4.3% discount to a 4.4% premium. The average discount over this period was 0.3%. At 22 May 2022, DORE was trading on a discount of 0.1%.

In our opinion, DORE’s occasional bouts of trading at a discount were just a function of its size and relative immaturity. As it continues to expand, its shares should become more liquid, and investor awareness should also increase, and we expect that it will trade much closer to peer group averages.

DORE’s shares appeared to trade on a meaningful premium over April and the start of May, but the sizeable upward revision in its end March NAV, announced on 11 May 2022, is yet to be fully reflected in its share price, and the premium ought to rise towards the sector median of 7.1% in our view.

The board has said that it intends to seek to limit, as far as practicable, the extent to which the market price of the ordinary shares diverges from the NAV. At the AGM on 6 April 2022, shareholders granted the board permission to issue up to 13,700,800 ordinary shares (10% of DORE’s issued share capital) and buy back up to 20,537,572 ordinary shares (14.99% of DORE’s issued share capital). No ordinary shares will be issued (or reissued from treasury) at a price less than NAV plus the cost of issuance.

The directors will consider repurchasing ordinary shares in the market if they believe it to be in shareholders’ interests and as a means of correcting any imbalance between the supply of and demand for the ordinary shares.

Ordinary shares repurchased may be held in treasury or cancelled.

Fees and costs

The investment manager is entitled to a management fee of 0.95% per annum of NAV up to £500m and 0.85% per annum on amounts in excess of £500m. The fee is payable quarterly in arrears. There is no performance fee.

The asset manager, a wholly owned subsidiary of the investment manager, charges separate asset level fees. £370,635 had been invoiced under this agreement in the initial accounting period and a further £222,801 was accrued, but unpaid at the period end.

The investment management agreement is for an initial term of five years from the date of admission and thereafter is subject to termination on not less than 12 months’ written notice by any party.

For the initial accounting period, the other major items of expenditure included £110,000 for the AIFM, £185,000 for the auditor BDO LLP (of which £96,000 related to the audit of the annual accounts), £62,000 to Link Company Matters Limited as company secretary, and £87,000 in legal fees.

DORE’s ongoing charges ratio for its first accounting period was 1.60%. As noted in the peer group section, this should fall as the trust grows.

Capital structure and life

DORE has 137,008,487 ordinary shares in issue and no other classes of share capital.

DORE has an unlimited life. However, the company’s articles require the directors to propose a continuation resolution (as an ordinary resolution) at a general meeting to be held in December 2025, and then again at the annual general meeting to be held in 2031, and at each fifth annual general meeting thereafter.

If a majority of shareholders vote against continuation, the directors will put forward proposals for the reconstruction or reorganisation of the company.

The company’s financial year end is 31 December and its AGMs are likely to be held in April.

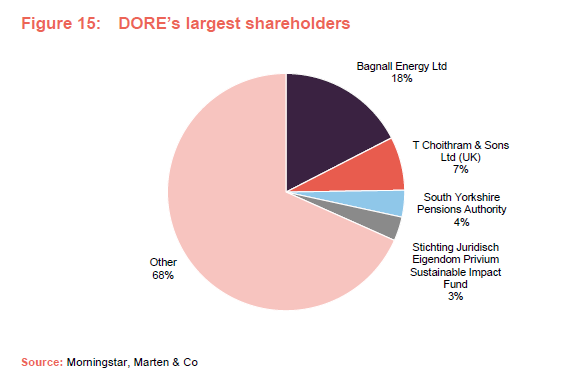

Major shareholders

Gearing and hedging

The company seeks to adopt a prudent approach to leverage such that each asset is financed appropriately for its underlying cash flows. Total long-term structural debt will not exceed 50% of gross asset value (at the time of drawing down or acquiring the debt). Short-term debt may also be used to facilitate the acquisition of investments. Short-term debt will not exceed 10% of gross asset value (again, at the time of drawing down or acquiring the debt).

The solar portfolio has £68.2m of long-term debt from Aviva and £10.4m from BlackRock.

DORE, through its subsidiary DORE Hold Co Limited, has access to a four-year £25m multicurrency (sterling and euros) revolving credit facility provided by Santander UK at a rate of 225b over SONIA. This is now 69% drawn.

DORE also has a €43.5m seven-year facility with Skandinaviska Enskilda Banken (SEB) secured against its Swedish hydropower assets (held through DHAB – see page 8). €27.4m of this is drawn with long dated interest rate swaps until 2033.

DORE’s total leverage (on a loan to value basis) is currently about 39% of gross asset value.

DORE’s hedging policy is described on page 29. As at end December 2021, 77% of the expected euro receipts from the underlying special purpose vehicles that hold the assets, up to March 2026, were hedged back into sterling.

Investment adviser

Downing LLP (Downing) was founded in 1986 and has over 30 years of experience of investing in the renewables sector. Downing has over 180 staff, including over 40 investment and asset management specialists focused exclusively on energy and infrastructure. Downing has over £1.6bn of assets under management.

Downing has a 21-strong in-house asset management team with expertise across power markets, engineering, data analytics, finance, and commercial management.

Investment team

The investment team is responsible for originating, negotiating and executing renewable energy and infrastructure investments. It is responsible for all aspects of the capital and acquisition structure, including raising debt finance.

The key individuals responsible for executing the DORE’s investment strategy are:

Tom Williams – partner, head of energy and infrastructure

Tom heads up the team, which he joined in July 2018. He has 23 years of experience as principal and adviser across the private equity and private debt infrastructure sectors. Tom has carried out successful transactions totalling in excess of £13bn in the energy, utilities, transportation, accommodation and defence sectors.

He started his career working as a project finance lawyer in 1999 before moving into private equity with Macquarie Group in London and the Middle East. Tom holds a Postgraduate Diploma in Legal Practice from the Royal College of Law and a BA in law from Cambridge University.

Henrik Dählstrom – investment director

Henrik joined as investment director in June 2020 to expand the team’s European presence and lead transactions in the Nordic regions. Henrik spent 17 years with Macquarie Infrastructure and Real Assets (MIRA). When leaving MIRA, Henrik was a director responsible for covering the Nordic region. This role included the origination and execution of transactions in the renewable energy and infrastructure sectors as well as holding asset management and board responsibilities.

Henrik has worked across renewable energy and infrastructure sectors as a principal for investments in the UK and in Europe. He holds a Bachelor’s degree in Business and Finance from Bond University and a Master’s degree in finance from Gothenburg School of Economics.

Tom Moore – head of fund reporting and co-head of asset management

Tom joined Downing in May 2019 and now heads a team of 21 managing over 470MWp of energy generating assets across five separate technologies. The team has expertise split across financial, technical and commercial sectors. Prior to joining the investment manager, Tom was a director at Foresight Group, where he had oversight of a significant portfolio of renewable energy investments. Tom is a Chartered Accountant and has a BSc in Economics from the University of York.

Danielle Strothers – co-head of asset management

Danielle joined the team in September 2019. She works alongside Tom, focusing on asset performance, business operations and compliance. Danielle is also responsible for the co-ordination of the valuation process across the energy portfolio.

Prior to joining the investment manager, Danielle was a senior portfolio manager at Foresight Group, where she was responsible for the operations of their renewable energy portfolio. She is a chartered accountant and holds a BSc in Accounting & Finance from the University of Birmingham.

Board

The board is comprised of three non-executive directors, each of whom is independent of the manager and does not sit together on other boards.

Hugh Little (non-executive chair)

Hugh qualified as a chartered accountant in 1982. In 1987, he joined Aberdeen Asset Management (AAM) and, from 1990 to 2006, oversaw the growth of the private equity business before moving into the corporate team as head of acquisitions. Hugh retired from AAM in 2015, and since then he has become chair of both Drum Income Plus REIT Plc and CLAN Cancer Support, a director of Dark Matter Distillers Limited, and a governor of both Robert Gordon University and Robert Gordon’s College. Hugh won the ‘Non-Executive Director of the Year’ award at the Institute of Directors, Scotland awards ceremony held in May 2019.

Joanna de Montgros (non-executive director)

Joanna is a specialist in the technical and commercial elements of energy projects, with 20 years’ experience in renewable energy and flexibility investments, building on her academic engineering background. In 2015, she co-founded international consultancy company Everoze. Everoze provides a broad range of engineering and strategic consulting services, plus incubation and development of other start-ups in this space. Prior to co-founding Everoze, Joanna led the global Project Engineering group within DNV Renewables and was a member of the DNV Renewable Advisory Board.

Joanna’s early career included management consultancy (PWC) and project finance (Fortis Bank).

Ashley Paxton (non-executive director)

Ashley has 25 years’ experience in the funds and financial services industry in London and Guernsey. Throughout that period, he has served a large number of London listed fund boards on IPOs and other capital market transactions, audit and other corporate governance matters. Ashley was a partner with KPMG in the Channel Islands since 2002, and transitioned from audit to become its C.I. head of advisory in 2008, a position he held through to his retirement from the firm in 2019.

Ashley is a Fellow of the Institute of Chartered Accountants in England and Wales and a resident of Guernsey. Amongst other appointments he serves on the board of JZ Capital Partners Limited, TwentyFour Select Monthly Income Limited and is chairman of the Youth Commission for Guernsey & Alderney, a locally-based charity delivering high-quality targeted services to children and young people to support the development of their social, physical and emotional wellbeing.

Previous publications

Readers may wish to refer to our initiation note, published on 20 November 2020 at the time of DORE’s IPO

Downing Renewables and Infrastructure Trust – Targeting attractive and sustainable income returns

or our update note published on 4 August 2021.

Downing Renewables and Infrastructure Trust – Ahead of expectations

Appendix – the investment process

The investment manager sources investment opportunities from its established global network of players in the renewable energy market. In addition, prospective investments may also be sourced from other funds managed by the Downing group.

DORE predominantly invests, via its wholly-owned subsidiary, DORE HoldCo Limited, in special purpose vehicles (SPVs) which individually own the underlying assets. Each SPV enters into an asset management agreement with Downing’s asset management business (the asset manager), a wholly-owned subsidiary of Downing LLP.

Deal screening

Each prospective investment is first assessed against DORE’s investment objectives and policy, and also DORE’s ESG policy. If a prospective investment passes these assessments, both a high-level financial and economic analysis, and a review of the investment, are undertaken by the investment manager.

Sighting paper

Downing’s energy and infrastructure investment team performs an initial review of an investment opportunity and prepares a short summary (a sighting paper) which is shared with both the senior management of the investment manager and members of the investment committee.

The sighting paper includes an overview of the opportunity, its key characteristics, the investment rationale, a summary of the expected returns, the key risks and the next steps in progressing the transaction. Consideration is given to matters such as the investment’s suitability (from a portfolio, investment objectives and ESG perspective), high-level returns, capital structure, likely transaction structure and process.

Following discussion and approval of the sighting paper, the investment team will submit a non-binding offer in relation to the opportunity. A de minimis initial budget for due diligence may also be approved at this stage.

First-stage investment committee approval

Should a transaction proceed to a stage where significant third-party due diligence costs are required to be incurred, the investment team prepares a deal memorandum with the aim of obtaining first-stage approval from the investment committee.

The memorandum assesses the opportunity in greater depth than the sighting paper. It sets out the project’s technology and stage of development, its suitability, the key risks, expected returns, the jurisdiction and the regulatory and policy background. Detail is also included on the transaction process and timetable and, if it was not previously approved at the sighting paper stage, approval will be sought for a due diligence budget.

The memorandum also outlines the key value drivers underpinning the projected returns, principal contractual arrangements, counterparties and stakeholders (including their experience and track record in the sector), an overview of prior performance (where the asset is already operating), initial identified risks and proposed due diligence process, advisors and their proposed scopes of work. Any debt or hedging requirements will also be considered at this stage.

The potential impact on DORE’s portfolio of the proposed investment is also considered as part of the memorandum. Specifically, the portfolio’s composition, concentration, revenue mix and wholesale electricity price exposure are assessed before and after inclusion of the proposed asset.

Due diligence and negotiation

If the investment committee approves the deal memorandum, the investment team is authorised to carry out detailed due diligence on the project, within the approved budget. It is also authorised to negotiate the commercial terms of the transaction and prepare the associated documentation. This approval is reported to the board by the investment manager. The investment team and technical, commercial and energy market specialists from the energy and infrastructure asset management team, work together to conduct the detailed due diligence. As noted below, they will employ external advisers where necessary.

Where any potential transactions involve unusual tax implications; low tax jurisdictions; unusual structuring; or have significant complexity, potential financial exposure or risk, new technologies or geographical jurisdictions or there is deviation from approved policies, the investment team consults the board before the investment manager starts detailed due diligence. Similarly, the manager will not begin the negotiation of the commercial terms until this consultation has been completed.

External advisers (for example, technical, legal, insurance, financial and tax advisers) may also be appointed. Where these are required, the manager will usually undertake a tender process amongst its panel of preferred advisers (for which it has also secured preferential rates). The tender process ensures that DORE can get the best price and quality for the work that it needs.

Technical due diligence typically includes a physical site visit and a review of the designs, the construction and maintenance contracts, the planning permissions, accreditations, the grid connection agreements, health and safety assessments and energy yield assessments. In addition to this, where an asset is operational, an analysis of prior performance data and operations and maintenance reports is undertaken.

Legal due diligence typically involves external legal advisers reviewing and advising on the contractual structure, the property documents (such as leases, easements, wayleaves and origins of title to land), the planning permissions, the grid connection agreements, construction and maintenance contracts and offtake arrangements.

Financial and tax due diligence typically includes a review of the project budgets, the project financial models, historical financial statements and tax returns. Where a site is operational, the energy yield assessment will take into account prior operational performance and the financial and tax due diligence will include a review of prior financial performance.

The investment manager will also conduct appropriate due diligence on the corporate entities (typically SPVs) that hold the assets and their counterparties to ensure that they are competent, stable and appropriate. In addition, where the investment is in an asset held in shared ownership or co-investment arrangements, the investment manager will negotiate shareholder arrangements and constitutional documents to ensure the interests of the company are appropriately protected.

The investment and asset management teams direct, review and assess the due diligence findings. They aim to arrive at an informed view on the risks involved and the possible mitigations required.

The external professional advisers also work with the investment manager’s teams to establish the optimum financial and tax structures for the prospective investment.

At the same time as carrying out the due diligence, the investment team enters into negotiations for the commercial terms with the vendor crystallising whether the deal represents an investable proposition. The team also engages with ESG related risks and opportunities via additional due diligence as needed and via engagement with the seller and related counterparties.

If key aspects of the prospective deal change during this stage, such as key changes in returns, or material risks are encountered during due diligence, then the investment team may revert back to the investment committee to ensure that it is satisfied that the transaction parameters remain with the existing approvals.

Final investment committee approval

Once due diligence and negotiations have substantially completed, a comprehensive investment paper is prepared for the investment committee and, if approved, shared with the board and the AIFM.

This paper includes a summary of the due diligence findings, detailed forecasts of operational and financial performance, returns and sensitivity analysis and a comparison of the transaction against prior transactions by the company and comparable transactions in the wider market.

The paper also includes details of the ESG evaluation, measures to ensure effective stewardship of these principles on an ongoing basis, reporting protocols and how periodic reviews will be conducted.

The board has the opportunity to provide comments back to the investment committee. The committee considers and takes account of the board’s observations and, if necessary, will re-evaluate the proposal.

With the exceptions that are set out below, any decision to proceed with a transaction is the sole responsibility of the investment manager. The acquisition of assets from, disposal of assets to, or co-investment by DORE with other Downing-managed funds is subject to approval from the board (all of whom are independent of the investment manager) prior to the acquisition, disposal or co-investment proceeding.

Pre-completion

The investment team facilitates completion of the transaction through provision of the following services:

- negotiating the final forms of all transaction documents;

- ensuring appropriate insurance is put in place; and

- establishing the relevant company structure and necessary bank accounts.

The investment committee reviews a final note outlining any material changes since the final deal memorandum was signed off. Following that note’s approval, the investment team informs the board of any such changes and the board is again given the opportunity to comment.

Post completion

During the transaction process the asset management team starts on-boarding the asset to its systems (assets should be fully incorporated within 60 days of completion). After the completion and execution of the transaction, the investment team finalises the handover by completing a checklist documenting matters, including:

- registration of documentation with the relevant authorities and filing of company secretarial documents;

- filing of insurance policies, legal bible, completion statements, loan notes, share certificates etc.;

- clearance of any conditions subsequent;

- confirmation of cash receipts/payments by solicitors;

- balance sheet opening position;

- scheduling of SPV board meetings, accounting timelines etc.;

- scheduling of debt service payments and reporting requirements;

- setup and reporting on key performance indicators:

- operational;

- financial;

- commercial; and

- ESG.

Asset management

The investment manager considers asset management as a fundamental pillar to ensuring proper performance and governance and thereby protecting, and creating, value for the company. The investment manager has direct control of key decision making, risk management and performance optimisation.

The asset management team has dedicated engineering, commercial, data, financial and operations functions with each function being responsible for providing the relevant scope of services to the assets. The management team sits above the specialist functions and provides oversight as to asset and service performance.

The asset management team is responsible for directing the activity of third-party contractors, managing key commercial contracts (construction, maintenance and leases), bookkeeping and accounting, portfolio performance and reporting thereon to the board. In doing so, the key areas of focus are:

- portfolio performance against key metrics;

- asset level performance including operational and financial performance;

- contractor performance including compliance with contractual obligations and identifying opportunities for optimisation;

- supporting the investment manager in the valuation process;

- ESG compliance, governance, health, safety and environmental and regulatory compliance; and

- stakeholder and counterparty management, including offtakers, communities, finance providers and investment partners.

The asset management team oversees the sale of the power, leveraging the asset manager’s scale to try to achieve attractive risk-adjusted prices. The team seeks to structure deals that drive competitive tension while allowing flexibility to facilitate further price hedging during the contract term.

Health and safety

DORE believes that the health and safety of contractors and the public is a fundamental part of management processes.

For example, following the acquisition of the hydropower assets, a dam safety framework was established to ensure effective management of the risks surrounding hydropower activities and classified dams in Sweden. The framework is based on industry best-practice. It focuses on regular inspections, the expertise of operators, and the frequency and content of reporting.

In January 2022, Ulf Wennilsjo joined the Downing team. He has over 25 years of experience in the operation and management of large hydropower portfolios in Sweden, and a wealth of knowledge in the management of dam safety practices and procedures.

A rolling programme of Health and Safety audits is in place across the portfolio. Risks and procedures are audited both at the site level and also the operator level. Downing has a process of continuous assessment and feedback of site and operator practices, ensuring that effective management systems are in place and adhered to.

IT systems are used to thoroughly track all incidents. They enable performance measurement and trend analysis, but also ensure the effective communication, escalation and management of incidents.

Investment restrictions

DORE observes the following restrictions when making investments:

- No more than 60% of gross asset value (GAV) in the UK.

- No more than 60% of GAV in Northern Europe (including Ireland).

- No more than 25% of GAV in assets in which the company does not hold a controlling interest.

- No investment in companies that generate electricity through the combustion of fossil fuels or derive a significant proportion of their revenue from the use or sale of fossil fuels unless the purpose of the investment is to transition them away from these activities.

- No investment in other UK-listed investment companies.

- No more than 50% of GAV in any one technology.

- No more than 25% of GAV in other infrastructure.

- No more than 30% of GAV in any single asset, and investment in another single asset may not exceed 25% of GAV.

- No more than 40% of GAV exposed to any single off-taker.

Hedging

DORE may hedge foreign currency exposure on equity distributions, on construction budgets, and on NAV. It may also engage in inflation and interest rate hedging through swaps, derivatives or other market instruments. DORE may also enter power purchase agreements and engage in power and commodity price hedging through the use of derivatives or other market instruments. However, DORE will not undertake any of these activities on a speculative basis.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Downing Renewables and Infrastructure Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.