Clear path to growth

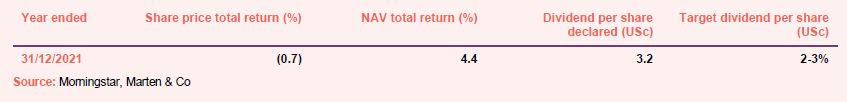

Having just had its first birthday in December, Ecofin US Renewables Infrastructure (RNEW) has had plenty of reasons to celebrate. It successfully deployed all its IPO proceeds ahead of target and managed to increase its dividend each quarter, bringing its aggregate total dividends for 2021 to 3.2 cents per ordinary share, a 3.2% dividend yield – again ahead of its 2-3% target for its first financial year (the target is an annual dividend yield of 5.25% to 5.75% for 2022 onwards).

The political and regulatory environment in the US continues to be supportive of substantial and reasonably rapid growth in RNEW’s target markets and as such, performance has been good for the relatively new and small fund. RNEW’s wholly-owned US subsidiary, RNEW Capital, secured a $65m revolving credit facility (RCF) last year with KeyBank (one of the premier lenders to the US renewable energy industry) on attractive terms, which the manager says will help pave the way to growing the company. It is also considering an equity fundraise in the near-term, which we welcome.

Long-term, progressive income from diversified portfolio of US renewables

RNEW aims to provide its shareholders with an attractive level of current distributions by investing in a diversified portfolio of mixed renewable energy and sustainable infrastructure assets predominantly located in the United States with prospects for modest capital appreciation over the long term.

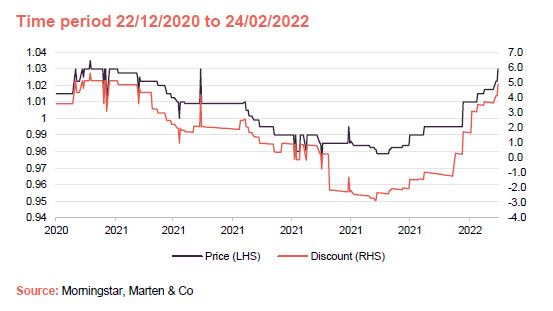

Share price and discount since launch

Performance since launch

Market outlook – united desire for clean energy

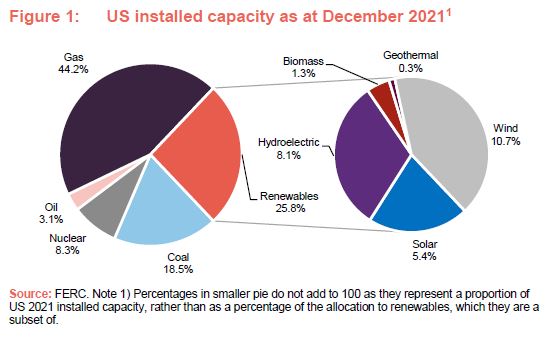

Investment in renewable energy generation is expected to account for more than 67% of US power capital expenditures over the next decade – representing a potential $350bn growth opportunity for renewable energy to further decarbonise the power sector.

As shown in Figure 1, renewable energy accounted for almost 26% of US energy installed capacity in 2021, made up of hydroelectric, wind, solar, geothermal and biomass power. This compares with 44% for gas, 19% for coal and 8% for nuclear energy.

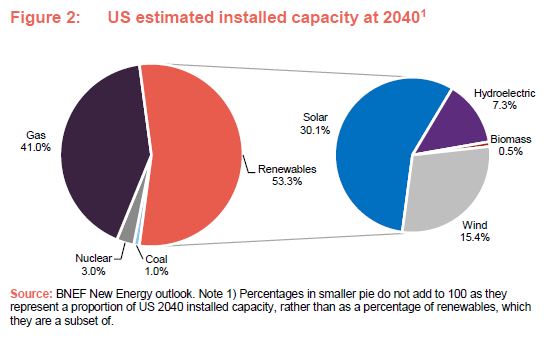

Meanwhile, Figure 2 shows what the breakdown in 2040 could look like, with the use of oil almost completely eradicated, while coal usage could fall to just 1%.

Renewable energy resources could well account for 53% of total US installed capacity, with solar power accounting for more than half of that.

There is strong support from the current Biden administration to achieve its 2035 carbon-free US power goal while dramatic cost reductions and rising natural gas prices have transformed renewable energy into an economically compelling source of power.

Less-exposed to fluctuating power prices

COVID-19-related falls in power prices were an overhang on the wider renewable energy sector during the pandemic, particularly in 2020. However, 2021 saw rising power prices due to rising natural gas prices and recovering power demand. Because most of its assets have long-term power purchase agreements (PPAs) in place, RNEW is largely insulated from volatile near-term wholesale power prices but has appropriate inflation protection over the medium-to-long-term as initial revenue contracts expire and are re-contracted.

As we highlighted in our last note, we think the fundamental difference between the US renewable energy industry and that of the UK (which is the one that many readers may perhaps be most familiar with) is the revenue structure.

In a PPA, a solar purchaser or ‘offtaker’ buys power from a project developer at a negotiated rate for a specified term without taking ownership of the system. The project developer procures, builds, operates, and maintains the system. The RNEW team says demand from offtakers has reached all-time highs and that a big trend at the moment is increasing renewable usage targets from different states.

Many targets are being met and some states are celebrating good milestones, and so these are continuing to be extended. For example, New York has undertaken ambitious reforms toward a clean energy future. The state has committed to modernising its grid and dramatically increasing renewables in its energy mix. EnergyVision 2030 data show that New York can achieve its goals by accelerating adoption of clean energy technologies.

Meanwhile, companies of all sizes and industries have their own targets and commitments towards net zero which is also driving demand and an increase in power purchase agreements from corporations.

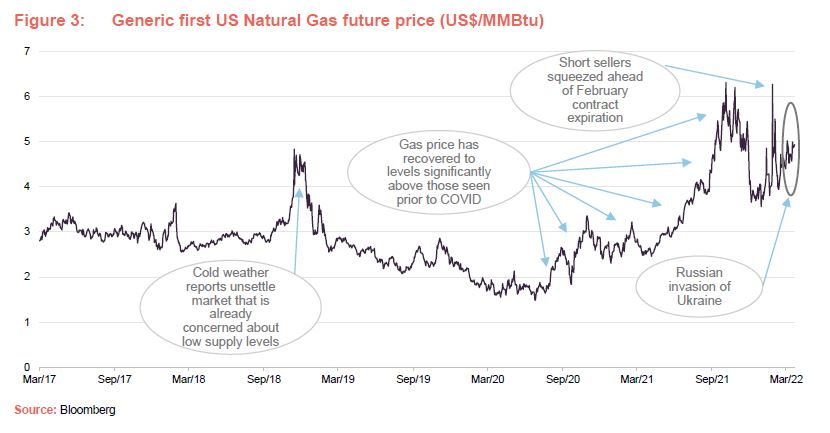

Another, more recent, catalyst (as shown in Figure 3), which has been market-driven, is rising natural gas prices. This has caused consumers to think more carefully about whether or not to opt for a gas plan with potentially increasing prices, or wind or solar with zero fuel costs. Offtakers are considering these factors and looking ahead at how to hedge their energy costs for the next 10-20 years.

Manager’s view

RNEW is managed by the team at Ecofin, consisting of Jerry Polacek, Matthew Ordway and Prashanth Prakash, who worked together at Energy & Infrastructure Capital LLC (EIC) for a number of years, before reuniting at Ecofin in 2016. For this research note we spoke to Jerry and Matthew, who are based in the US.

Biden administration supportive

The RNEW team says there is strong support from the Biden administration for the US to achieve its 2035 carbon-free power goal while dramatic cost reductions have transformed renewable energy into an economically compelling source of power. In addition, in the aftermath of Russia’s invasion of Ukraine, the US government has banned imports of Russian coal, gas and oil. This is pushing up the cost of various forms of thermal generation at the margin, effectively improving renewables’ competitive position in the process. These restrictions do not look set to end anytime soon and so this competitive advantage may continue for an extended period.

In December 2020, the US Congress passed a broad spending bill which included a two-year extension of the investment tax credit (ITC) for solar power (retaining throughout 2022 the 2020 rate of 26%, which had been due to step down to 22% in 2021) and a one-year extension of the production tax credit (PTC) for onshore wind power.

RNEW says that the Biden administration has ushered in a new era of enhanced federal government support for renewable energy, which includes executive actions aimed at tackling climate change. For instance, setting a goal of achieving a carbon pollution-free power sector by 2035 and having the US re-join the Paris Climate Agreement, which was achieved on 19 February 2021 (the day before Biden’s inauguration).

However, Ecofin notes that the industry already seemed to be making reasonable progress under Trump, despite his views on climate change and preference for fossil fuels. The main reason for this comes down to economics. Falling costs and efficiency gains make renewable energy projects cheaper than fossil fuel equivalents, even without subsidy. Couple that with tax credits designed to stimulate investment in the sector, and renewable energy makes a compelling proposition.

Looking ahead, the team says that President Biden’s $1.2trn Infrastructure Plan, which was signed into law in November 2021, along with a forthcoming Congressional budget reconciliation bill – the Build Back Better Act, which has so far struggled to get final approval, but is expected to include billions of dollars of incentives for the solar and wind industries including a 10-year extension of the ITC and a national clean energy standard – provide further support for growth of the renewables sector in the US, which has continued to be very active notwithstanding the impact of COVID-19.

Jerry says that the industry is likely to see policy benefits taking shape in 2022 alongside a more stable policy environment, which would be helpful for margins. Wind and solar power is used in most industries now, given that it is increasingly economically viable, irrespective of these incentives. The team feels good about the current policy environment.

High demand for projects

Matthew explains PPA prices are primarily determined through a competitive bidding process. Typically, when evaluating bids, the power purchaser is seeking to achieve a price that is a discount to that which is available in the wholesale power market or a discount to available commercial utility rates, for the long term. Bids tend to be priced according to the cost of establishing a project (construction and equipment). This is a key difference between the structure of the US market and that of the UK, for example. Matthew says that PPAs are highly desired by investors such as RNEW for their predictability of revenues.

He also notes that development pipelines are at all-time highs. The reality is that some developers may have assets that will not be in operation for two, or three – maybe even four – years. A major limiting factor is the time required to get a grid connection in place, which varies according to the jurisdiction. He says if you are looking to develop the next solar project in New Jersey, for example, you could be waiting five years, as there are lots of developers in the queue in front of you. This does not impact RNEW, as the company looks at construction-ready and operating stage projects to invest in.

Protected from increasing costs and power outages

Whilst the industry is seeing increasing costs as a result of higher demand for renewable energy and, in some instances, a shortage of materials – Jerry says that RNEW has, to date, managed to avoid being exposed to this as it negotiated fixed prices for its projects that are under construction.

RNEW has taken no development risk to date. It plans to minimise construction risk by clustering projects together or working with large vendors with strong balance sheets, which have already procured large inventories (of solar modules, for example) that they are deploying on RNEW’s sites. Jerry points out that the industry has similarities to a commodity type market in that there are lots of vendors and an array of sites available – as well as competition to work on those sites. He adds that if there are already resources on the ground, then the cost for RNEW is reduced.

For example, in Texas, which is the largest state for wind generation and where RNEW’s Whirlwind project is based, there is a huge fleet of operators to work with and so the team can find what they want at attractive prices. Similarly, RNEW’s solar assets are geographically diversified with clusters in the Northeast and California.

While RNEW contracts to supply power under a PPA, power production outages are not seen as much of a problem for it. The team says almost all contracts have a floor provision which aims for 75-80% of expected production, but this is much lower than what is usually produced. For a solar project, for example, Jerry says you can have 99% confidence to get 90% of expected production, and that contracts are structured well to mitigate that type of risk.

The overall availability of RNEW’s portfolio assets sit around 95% and outages are budgeted for. These can be caused by something as simple as inverters switching off and having to be reset, to more dramatic events, such as extreme weather conditions – for example, hurricanes force temporary shutdowns of wind farms to avoid damage to the equipment.

RNEW’s Beacon Solar 2 and 5 projects, based in California, did experience increased panel soiling due to wildfires last year. Although the projects are situated some 100 miles away from the fires, output from these solar farms was down temporarily, but did not materially impact RNEW’s overall production. Wildfires are, sadly, a traditional seasonal event in this part of the US and Jerry admits that they have increased in severity. Meanwhile, certain parts of the US are known to suffer from severe storms and even hurricanes. To mitigate the impact of events such as these, the portfolio is insured across all areas from business interruption insurance to casualty insurance.

The team ensures that the right materials are used to cope with these events such as increased galvanised steel for its wind projects. It also assesses these kinds of risks ahead of investment through its due diligence process which includes an integrated analysis of environmental, social and governance (ESG) risks. Site assessments are carried out with environmental consultants and independent engineers in consultation with outside legal counsel.

Asset allocation

RNEW has a portfolio of renewable assets with contracted revenues from investment-grade counterparties with a weighted average remaining revenue contract term of approximately 17 years.

In October, the trust’s wholly owned US subsidiary, RNEW Capital, entered into a $65m secured revolving credit facility (RCF) with KeyBank, one of the premier lenders to the U.S. renewable energy industry. The RCF comprises a $50m two-year facility priced at LIBOR plus 1.75% and a $15m three-year facility priced at LIBOR plus 2.00%. It also includes an accordion option which provides access to an additional $20m of capital which can be accessed subject to certain conditions.

Since our last note in May 2021, RNEW has made a number of new acquisitions, which has resulted in full deployment of its IPO proceeds within 10 months rather than its initial target of 12 months. Some of the acquisitions were also funded by part of the RCF.

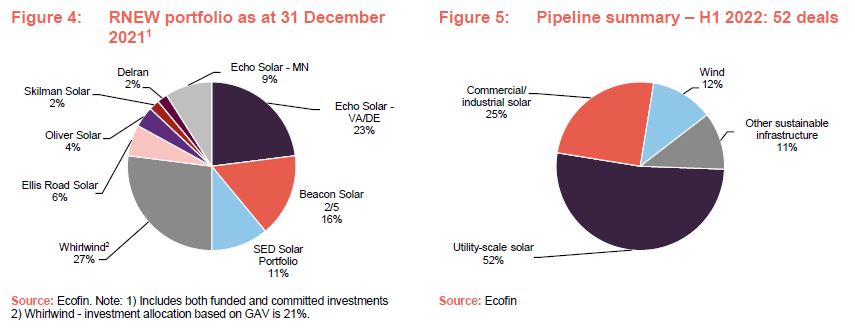

Extensive pipeline

Meanwhile, the team is evaluating deals totalling in excess of $2.6bn of potential equity investment (see Figure 5), from which it will select the most appropriate assets for the portfolio over the next six to 12 months. They say there is already a strong pipeline of either committed (purchase agreements have already been signed) or exclusive deals in excess of $100m. The team say there is a clear path to doubling the size of RNEW over 2022 and that a capital raising could also be on the cards in the near-term, having put the idea forward to institutional investors during their roadshow in September 2021.

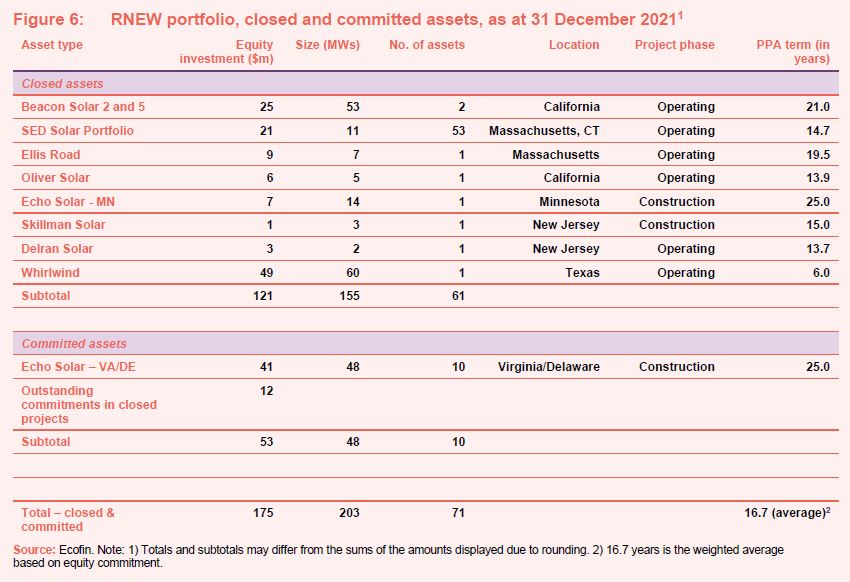

Diversified portfolio – RNEW has closed on eight investments

Since launch, the team has closed seven solar investments and one wind investment with investment-grade quality purchasers and an average PPA term of around 17 years, totalling 61 assets across six states (see Figure 6, below). By the end of 2021, 80% of RNEW’s portfolio was operational. It is worth noting that throughout the pandemic, there were no payment defaults or delinquencies, which the team says demonstrates the resiliency of the holdings.

Portfolio activity

Echo Solar

In July 2021, RNEW signed an agreement to buy 11 ground mount solar photovoltaic projects in Minnesota, Virginia, and Delaware, with aggregate asset value, collectively known as the Echo Solar Portfolio, all at construction stage, with an aggregate asset value of approximately $84m. The combined capacity of these projects is estimated at 62MW, which will help offset over 83,000 tonnes of CO2 equivalent each year. (Note: Echo Solar was previously reported as a 69MW investment comprising 12 ground-mounted solar projects, but one project has been released from commitment due to development delays – without any investment made and without any impact on the remainder of the Echo Solar Portfolio – and will be reconsidered for future investment upon achieving its milestones.)

As at 31 December 2021, the company had closed on the 13.7 MW solar project in Minnesota and RNEW expects to close on five additional solar assets in Virginia and Delaware during the second quarter of 2022 totalling circa 23 MW. The remaining five assets are expected to close in the second half of 2022 upon full completion of various development milestones.

The manager is working with construction and tax equity financing parties to structure these transactions optimally for the benefit of investors. It is expected that the company will invest approximately $25m during the construction phase with potential to increase its equity investment up to approximately $56m during the operating phase through a reduction of gearing.

Completion of this transaction will further diversify the investment portfolio across the states of Minnesota, Virginia, and Delaware through 25-year fixed price power purchase agreements with investment grade utility purchasers.

Skilman Solar and Delran Solar

RNEW closed the acquisition of Skillman Solar on 30 September 2021. Skillman has substantially completed construction and is working towards commissioning. At the same time, RNEW also bought a 2.0MW commercial solar facility, Delran Solar, for approximately $3m. The project has been operating since mid-2020 and immediately added distributable to RNEW’s distributable cash flows. Both projects have 15-year fixed price feed-in-tariffs for the projects’ renewable energy credits and a fixed price power purchase agreement with two large corporate customers. These extend for up to a 30-year term for Skillman Solar and 25 years for Delran Solar.

Whirlwind

In October 2021, RNEW made a contractual commitment to acquire Whirlwind, a 60MW operating wind asset, for $49m. Whirlwind is a proven operating wind asset, located in Texas, that was placed in service in December 2007. The site has 26 Siemens 2.3MW wind turbine generators with operations and maintenance performed by Siemens Gamesa under a long-term service and maintenance agreement. Whirlwind benefits from a fixed-price power purchase agreement with an investment grade electric utility that has over six years remaining on the initial contract term, providing predictable cash flows.

RNEW says that Texas is experiencing sustained growth in electricity demand, due to population growth and corporations migrating to this business-friendly state. With electricity prices linked to natural gas prices, which have been rising, these factors provide a good backdrop for re-contracting in the future and potential for inflation protection.

The purchase price was funded by a combination of the remaining net proceeds from the IPO and from the newly established revolving credit facility. The acquisition of Whirlwind completed in October 2021 and marked the full deployment of RNEW’s IPO proceeds. The acquisition added diversification to RNEW’s solar portfolio in terms of technology, its proven wind resource, and its location in the central US.

Performance

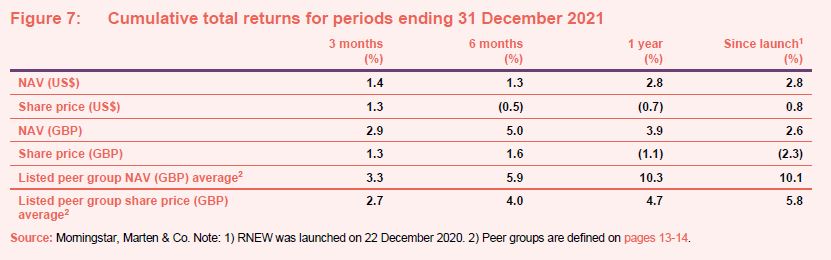

RNEW has had a good start to its life, achieving or exceeding most of its targets from its dividend to the target date for the deployment of its IPO proceeds. In terms of performance, it has returned 2.8% in NAV terms since launch, and is up 0.8% in share price terms. A modest discount opened towards the third quarter in 2021.

Operating performance

Over 2021, the portfolio generated 169.2 GWh of clean energy, offsetting about 89,000 tonnes of CO2 and equivalents. The team said this equates to powering around 16,000 homes. This means its annual production budget was exceeded by 2%. More detailed figures are expected to be released in RNEW’s annual report which is due in the coming weeks.

Looking over the 12 months ended 31 December 2021, the portfolio generated 169.2GWh of clean energy, 1.9% ahead of budget. Output from the solar portfolio was 4.9% below budget, primarily due to lower solar insolation during the period. However, wind production from the Whirlwind project exceeded its budget by 25.7% due to lower than forecasted curtailment. This led to the overall portfolio outperformance.

Despite the disruption effects of COVID-19, the Ellis Solar (7.1 MW) and Oliver Solar (4.8 MW) assets achieved mechanical completion as planned with only relatively minor impacts. Both projects experienced delays in connecting to the power grid, with utilities citing COVID-19-related impacts on their workforce availability and scheduling programmes. Ellis Solar, however, was eventually placed in service on 31 May 2021 with no negative impact on its value.

Oliver Solar experienced delays (its power purchaser requested a delay to commencement of operations so that an enhancement could be made to the combiner box connecting the system to the grid within its commercial facility) before achieving utility approval to interconnect. This occurred on 4 July 2021 and subsequently allowed the commissioning of Oliver Solar to be completed and for it to commence commercial operations. Similarly, the delay on Oliver Solar had no negative impact on the project valuation.

Dividend

In October 2021, RNEW declared a dividend of 0.8 cents per share and published a new NAV of $1.0067 as at 30 September 2021, up 2.2% over the quarter.

The main factors behind this were a decrease in the discount rates applied to the Beacon Solar 2 and 5 utility scale operating assets to bring them in line with market rates, and a reduction to solar panel degradation rates to conform to estimates consistently used by the company’s independent engineer.

In December 2021, RNEW went on to declare an interim dividend of 1.4 cents per share, which represents an annualised dividend yield of 5.6% and is consistent with RNEW’s 2022 annual dividend target range for 2022 of 5.25 to 5.75%. This brought aggregate total dividends since IPO to 3.2 cents per share – that is a 3.2% dividend yield for 2021, and well ahead of its target annual dividend yield of 2-3% for the first year of operations.

The interim dividend of 1.4 cents per share is payable on 11 March 2022 to shareholders on the register at 25 February 2022. The ex-dividend date was 24 February 2022.

Peer group

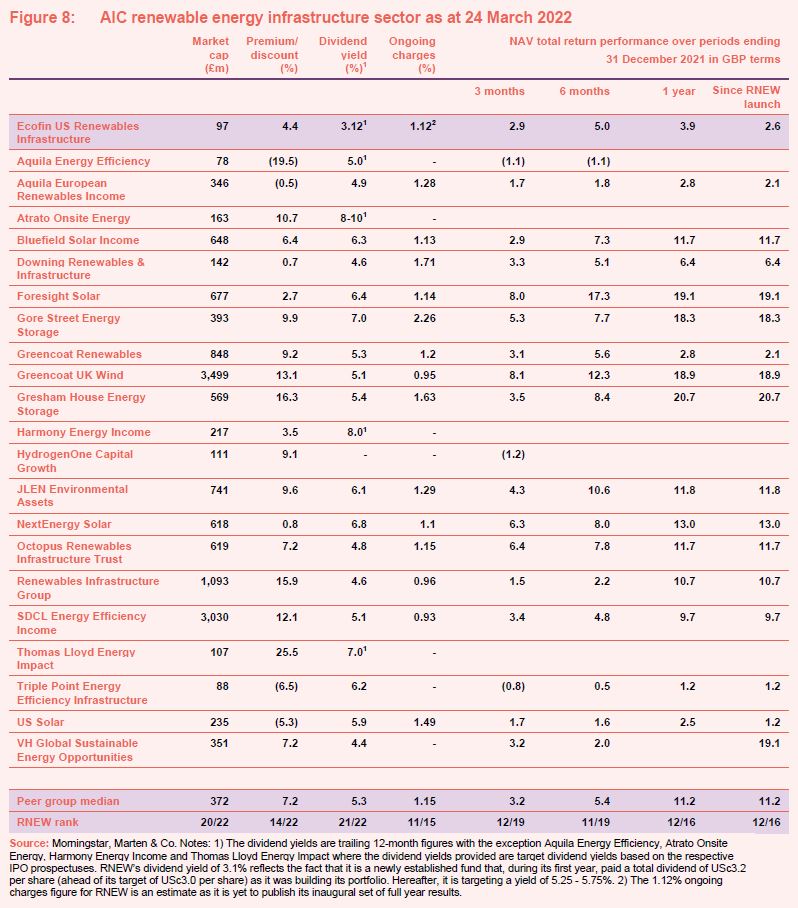

RNEW is a member of the AIC’s renewable energy infrastructure sector, which now has 22 constituents, compared to 17 at the time of our last note. The peer group is reasonably diverse, however, and RNEW is differentiated from its peers, primarily by its focus on the US.

As RNEW launched at the end of 2020, it only has just over one year’s worth of performance to compare. We have therefore also included performance numbers from its launch date (12 December 2020) up to the end of December 2021 for its peers in Figure 8. All other information is updated to 24 March.

Six trusts have launched in the sector since then, and so there are no figures for certain time periods for these funds.

Of the peer group, US Solar Fund, SDCL Energy Efficiency Income Trust offer exposure to US solar projects while VH Global Sustainable Energy Opportunities, which launched 12 months ago, is permitted to do so.

RNEW is likely to be the only fund offering pure play exposure to the wider renewable energy generation industry in the US. It is the smallest of these funds, and, as we said in our last note, we would like to see it raise more money in order to grow (although we acknowledge that Ecofin will want to build out the portfolio in a controlled manner). Many of the other funds also started off small but were successful and able to expand over time.

RNEW has provided dividends totalling USc3.2 per share during the last twelve months, which is a yield of 3.1% on its share price. This lower yield versus its peers reflects the fact that this is a period in which RNEW has been deploying its IPO proceeds and its distributions were actually ahead of its target at IPO. RNEW is now fully invested and the dividend target of 5.25 – 5.75% going forward is in line with its more seasoned peers.

In terms of the annual running costs for the fund, it is expected that the ongoing charges ratio for the year ending 31 March 2022, will be in the region of 1.12%. Despite its smaller than average size, its ongoing charges are very competitive versus its peers, assuming that it is able to achieve ongoing charges in the region of this estimate (an ongoing charges ratio of 1.12% would be the 11th lowest within the peer group). Assuming that RNEW is successful in its ambitions to grow, this should – all things being equal – put downward pressure on its ongoing charges ratio.

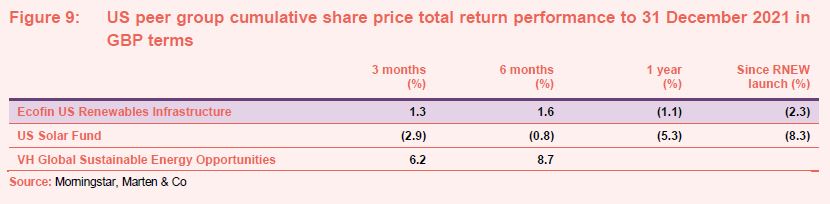

In terms of performance versus its peers, RNEW just about misses a position in the top 10 since its launch but sits within the top quartile of trusts over six months while placing third of all 22 trusts over January 2022, behind only US Solar and VH Global Sustainable Energy Opportunities. As these are RNEW’s most comparable peers, we have included them only when looking at share price in Figure 9.

In share price terms, RNEW beats US Solar Fund over three months, six months, one year and since launch.

Premium/(discount)

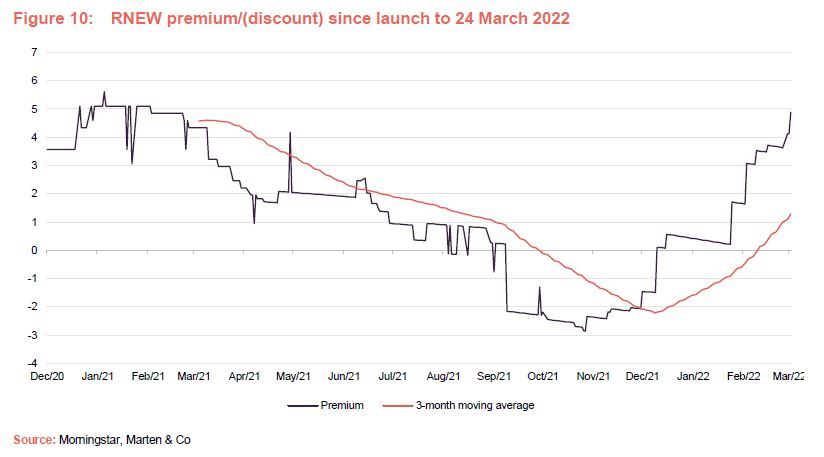

Following its launch in December 2020, RNEW traded at a marked premium although, from the end of Q1 2021, this started to narrow so that, by the end of September 2021, RNEW had moved to trade at a modest discount (as is illustrated on the front page, RNEW’s share price did not keep pace with its NAV). More recently, RNEW’s share price has since caught up and it is once again trading at a modest premium (4.4% as at 24 March 2022). The median premium for the trust since launch is 1.7% (the average is 1.4%).

On 19 October 2021, RNEW announced that its unaudited net asset value as at 30 September 2021 on a cum-income basis was $125.9m or $1.0067 per ordinary share. The primary drivers of the 2.2 cent quarterly increase were a decrease in the discount rates applied to the Beacon Solar 2 and 5 utility scale operating assets to bring them in line with market rates, and a reduction to solar panel degradation rates to conform to estimates consistently used by the company’s independent engineer.

RNEW’s share price was slow to adjust to the NAV increase following the announcement. We think that a backdrop of rising inflation and interest rates may have created some uncertainty, particularly regarding the strength of the inflation linkages in RNEW’s revenues and how this might ultimately affect its income. Concerns over the potential for interest rate rises have affected renewable stocks more generally, while uncertainty created by the stalling of the ‘Build-back-Better’ bill in the US was likely another contributory factor. Our feeling is that, as the market has become more comfortable about the resilience of RNEW’s income in an inflationary environment, the discount has narrowed and RNEW has moved back to trading at a premium. Whilst it is not yet certain whether the Build-back-Better bill will pass in its entirety, it appears that there may be support for parts of it, which could be passed by congress on a piecemeal basis. This includes Biden’s climate change policies. If progress is made in this area, this could stimulate demand for RNEW’s strategy, with the potential to expand the premium from here. This would assist RNEW in achieving its plans for expansion.

Premium and discount management

With a view to moderating the level of the premium and expanding the company, the directors have authority to issue, in aggregate, up to 500m ordinary shares and/or C shares on a non-pre-emptive basis.

Issuance will only be undertaken at a price which is a premium to net asset value that at least covers any associated issue costs. Where it might take some time to get the net proceeds invested, the intention is to issue C shares rather than new ordinary shares. This helps protect existing shareholders from the effects of cash drag.

In the event that the shares trade at a discount, the directors have discretion to authorise share repurchases with a view to managing any imbalance between the supply of and demand for shares. The board has powers to buy back up to 14.99% of RNEW’s initial share capital following admission, which it will ask shareholders to renew at each AGM. However, it should be noted that the board’s focus is on growing the trust and given its size, we think that repurchases could actually be counter-productive, as they would likely reduce the liquidity of RNEW’s shares and would put upward pressure on its ongoing charges ratio. RNEW’s manager says that the trust is supported by a group of large institutional investors which are keen to see, and have the capacity to support, further growth.

The prospectus says that share buybacks are likely to be considered where the rolling 12-month average discount is 5% or more (commencing on the 18-month anniversary of admission, provided that the available cash is not required for working capital purposes or the payment of dividends).

Any shares bought back may be held in treasury and later re-sold at a premium.

Fund profile

RNEW is an investment company that has been established to invest in a diversified portfolio of renewable assets. Predominantly, these will be in the United States, but it may also invest up to 15% of gross assets in other OECD countries. The company is being managed to qualify as an investment trust. Since 20 December 2020, RNEW has had a premium listing on the main market of the London Stock Exchange.

Ecofin Advisors LLC – the manager

RNEW’s investment manager and AIFM is Ecofin Advisors LLC (Ecofin), which is headquartered in Leawood, Kansas. That and Ecofin Advisors Limited, manager of Ecofin Global Utilities and Infrastructure Trust, are indirect wholly-owned subsidiaries of TortoiseEcofin Investments LLC, an $8.5bn asset under management (AUM) business with offices across the US and in London. The two subsidiaries had $1.7bn of AUM between them as at 31 December 2021.

The senior members of the team managing RNEW have a combined 50 years of private investment experience and have worked together for seven years.

Sustainability process

Ecofin’s mission is to generate strong risk-adjusted returns while optimising investors’ impact on society. They describe themselves as socially-minded, ESG-attentive investors. The management team has a wealth of experience and expertise in investing in sustainable infrastructure, energy transition, clean water & environment, and social impact sectors.

The company’s strategies seek to achieve positive impacts that align with UN Sustainable Development Goals (SDGs) by addressing pressing global issues surrounding climate action, clean energy, water, education, healthcare and sustainable communities. Its ambition is to contribute towards the reduction of carbon and other greenhouse gas emissions, and reducing pollution, while not compromising investors’ desire for stable cash yields and attractive total returns.

Ecofin conducts its business in alignment with the UN-supported Principles for Responsible Investment (PRI) and is a PRI signatory. The investment manager is committed to integrating ESG criteria into its investment process to enhance overall governance. All of RNEW’s investments are analysed through Ecofin’s proprietary ESG due diligence risk assessment framework for suitability, prior to commitment.

ESG criteria and impact of the company’s investment activities will be measured, analysed and reported to investors on an ongoing basis, culminating with an annual ESG impact report.

Each asset’s contribution to decarbonisation is assessed and the manager actively manages RNEW’s assets to realise those objectives. In the due diligence phase of the investment process, Ecofin engages with third-party environmental consultants to produce reports that assess the environmental impacts of each asset. It also engages legal counsel and independent engineering firms to confirm project compliance with all permitting and regulatory requirements.

Ecofin also analyses the impact of investments on the local community, including the extent to which they contribute a positive economic impact through tax-related payments and recurring lease revenue to landowners. It also engages with the community and hires experienced operations and maintenance providers, project asset management, and construction firms, which will be held responsible for reporting on health and safety incidents related to the assets.

RNEW has been awarded the London Stock Exchange’s Green Economy Mark, which recognises companies that derive 50% or more of their total annual revenues from products and services that contribute to the global green economy.

Previous publications

Readers interested in further information about RNEW, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note, ‘Sunny outlook’, published on 18 May 2021.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Ecofin US Renewables Infrastructure Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note

until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.