The future is brighter and greener

GCP Infrastructure (GCP) has seen a marked improvement in its net asset value (NAV) performance in recent months. The surge in UK power and carbon prices (see page 8) is working to the benefit of the entities behind many of GCP’s renewable energy infrastructure loans.

The push to reduce carbon dioxide and other greenhouse gas emissions from the UK economy is likely to provide substantial new opportunities for the company. A £260m pipeline of potential investments identified by the investment adviser is likely to swell over time.

Public-sector-backed, long-term cashflows from loans used to fund UK Infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.

GCP primarily targets investments in infrastructure projects with long-term, public-sector-backed, availability-based revenues. Where possible, investments are structured to benefit from partial inflation-protection.

Fund profile

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The fund’s income is derived from loaning money at fixed interest rates to entities which derive their revenue, or a substantial portion of it, from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

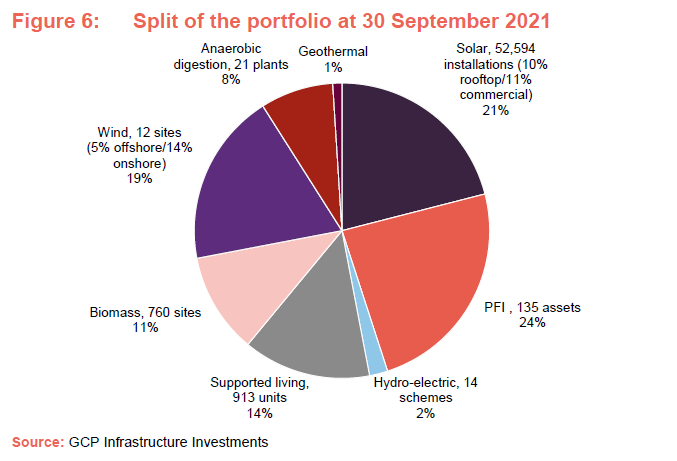

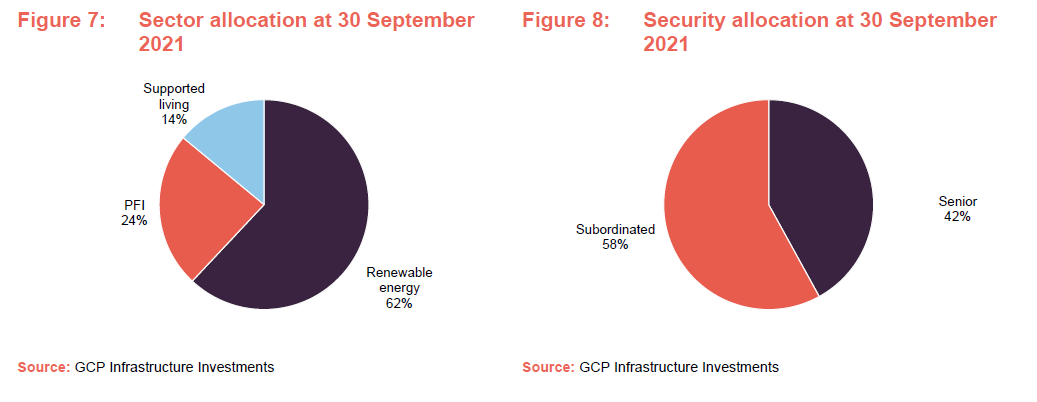

In practice, GCP has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), private finance initiative (PFI) and public-private partnership (PPP) type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported social housing (where local authorities are renting specially-adapted residential accommodation for tenants with special needs).

The investment adviser

Gravis Capital Management Limited (Gravis) is the fund’s AIFM and investment adviser. It is also investment manager of GCP Asset Backed Income, and advises VT Gravis Clean Energy Income Fund, VT Gravis UK Listed Property Fund and VT Gravis UK Infrastructure Income Fund. At 30 September 2021, it had assets under management of approximately £3bn.

Philip (Phil) Kent is the lead fund adviser, and is supported by an extensive team which includes Rollo Wright (Gravis’s chief executive officer (CEO), who was co-lead manager until May 2018). Stephen Ellis, who co-founded Gravis, provides strategic advice.

Phil joined Gravis from Foresight Group, where he had responsibility for waste and renewable projects, including large waste wood combustion projects and a pipeline of anaerobic digestion projects across the UK (anaerobic digestion is a process where bacteria break down organic matter – for example animal manure, wastewater biosolids, and food wastes – in the absence of oxygen, to produce biogas, which can be used like natural gas, and digestate, which has solid and liquid portions that can be used in a range of applications, such as fertilisers). His 11-year experience of the energy sector includes periods at Gazprom Marketing and Trading (latterly in its Clean Energy team) and PA Consulting’s Energy practice.

More information on the team is provided on page 10.

At 9 December 2021, the directors of the investment adviser – together with their family members – held 805,330 shares in GCP.

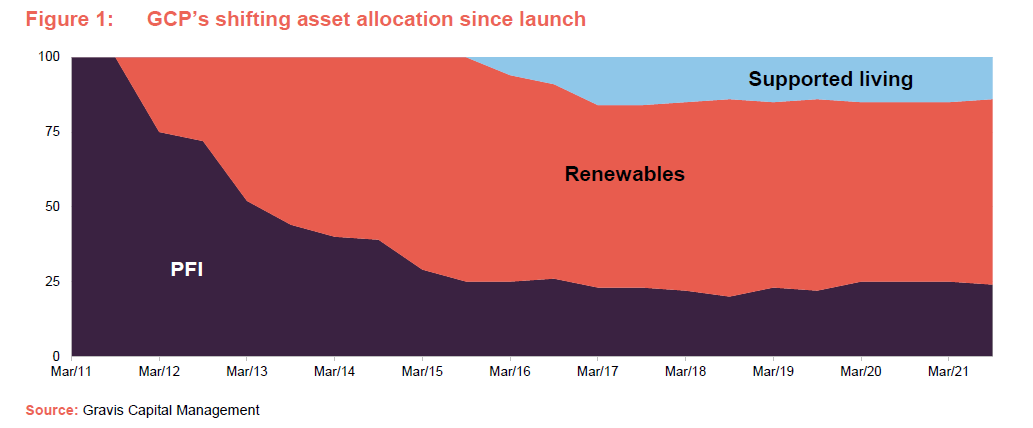

The future is green

In past notes, we have drawn attention to the shift in GCP’s broad asset allocation since launch. A portfolio that was once dominated by PFI/PP-type assets now has a distinct bias towards assets that promote decarbonisation (reducing CO2 emissions).

As GCP’s chairman highlighted in the recently-published annual report, GCP’s ability to expand its PFI/PPP portfolio is constrained by the low cost of government borrowing and a perception that public-private procurement models do not provide value-for-money.

While the investment adviser is more comfortable with the risks associated with financing specialist supported housing assets, the opportunity is no longer attractive. Other players have entered the sector and driven down the potential returns from this sector.

By contrast, the renewables sector and, more widely, decarbonisation and the transition to a more sustainable economy present a number of attractive opportunities for GCP. The direction of travel may be towards even greater renewables exposure within GCP’s portfolio. However, the adviser is not interested in pursuing unsubsidised renewable energy generation assets where the income is heavily exposed to merchant power prices (competitive prices from wholesale power markets). To be suitable for inclusion within the portfolio, an asset’s revenue profile should have a significant element of fixed/predictable income, such as government subsidy.

As the London-listed renewable energy infrastructure sector has expanded in recent years, it has also become more diverse. Funds are already investing in the likes of electric vehicle charging, combined heat and power (CHP) plants, and district heating projects, where heat is produced centrally and then distributed to local customers. These are also opportunities for GCP.

In his statement, the chairman drew attention to opportunities arising from allocation round four (AR4, the fourth auction of contracts for difference (CfD) to support the development of new renewable energy generation infrastructure), the Green Gas Support Scheme, which was introduced in 2021, electric vehicles, green hydrogen and the decarbonisation of heavy transport and industry, heating and energy efficiency projects, supporting the establishment of new forests, and changes to food production methods. We have discussed many of these areas in earlier notes, but over the next couple of pages we look at some of the developments in these areas.

AR4 – renewed subsidy for onshore wind and solar

The fourth allocation round for CfDs is underway and the results are expected to be announced in the summer of 2022. The auction is intended to support the deployment of 12GW of low-cost renewable generation as well as developments in energy storage. The money available to support the scheme has been divided into three pools (to avoid cheaper generation options crowding out areas that the government would like to see progress in). Established technologies like solar and onshore wind are in one pool. Less established technologies such as anaerobic digestion, biomass with CHP and wave energy are in another. The final pool covers offshore wind.

The green gas support scheme

Funded by a new green gas levy paid by all licensed suppliers of natural gas, the green gas support scheme launched on 30 November 2021. It will remain open for applications until November 2025. The government has said that it will explore the replacement of the scheme with a long-term biomethane support scheme. The green gas support scheme replaces the non-domestic renewable heat incentive, which closed to new applicants on 31 March 2021.

The scheme is designed to support the production of biomethane from anaerobic digestion and is not available for the production of green hydrogen, for example. At least 50% of all the gas produced must come from waste, including by-products from food production, waste wood, and sewage, for example.

Registered participants receive quarterly payments over a period of 15 years. The amount received depends on the quantum of biomethane produced. Tariffs will be set each year, with the rate being published in the autumn.

Woodland carbon guarantee

Designed to accelerate the planting of new forests, the next woodland carbon guarantee auction will be held in May 2022.

Sustainable farming initiative

This initiative is focused on improving soil health, including ensuring that soils are not left uncovered over winter. The scheme will be launched in the middle of 2022, and for 2022 farmers will be paid between £20/ha and £58/ha to protect soils. This only applies to England – the devolved administrations will make their own arrangements.

The level of payments depends on the actions of farmers to promote soil health. Those who cover at least 70% of land during winter and add organic matter to at least one third of the land each year get the lowest level of payment. £40/ha is available for those who also apply a multispecies cover to at least 20% of the land and the highest level of payment is reserved for those who, in addition, have herbal leys (temporary grasslands made up of legume, herb and grass species) on at least 20% of the land.

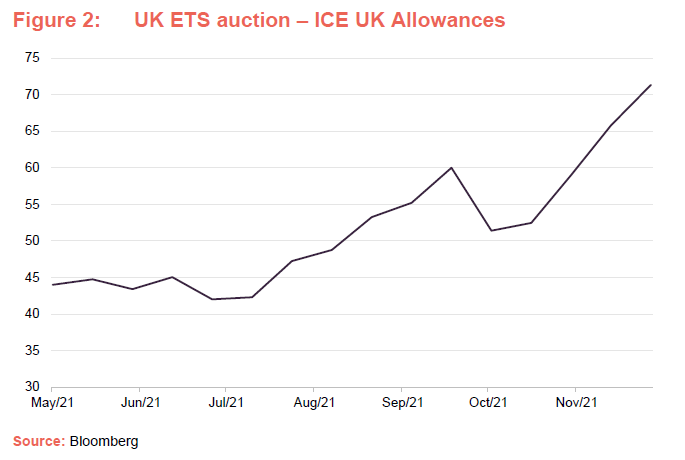

UK emissions trading scheme

The UK emissions trading scheme (ETS) was introduced in the wake of Brexit on 1 January 2021. The scheme is designed to ensure that large emitters of greenhouse gases pay for the volume of emissions that they produce. A cap has been set on the total amount of certain greenhouse gases that can be emitted by large (20MW+) power generators using fossil fuels and the aviation sector. This cap decreases over time. Participants receive free allowances and/or buy emission allowances at auction or on the secondary market which they can trade with other participants as needed. A minimum price (the auction reserve price) has been set by the government. At the end of year, the emitter surrenders allowances equivalent to the amount of emissions produced.

The price of allowances has been rising strongly. This has contributed to the increase in wholesale power prices, to the benefit of many of the assets in GCP’s portfolio.

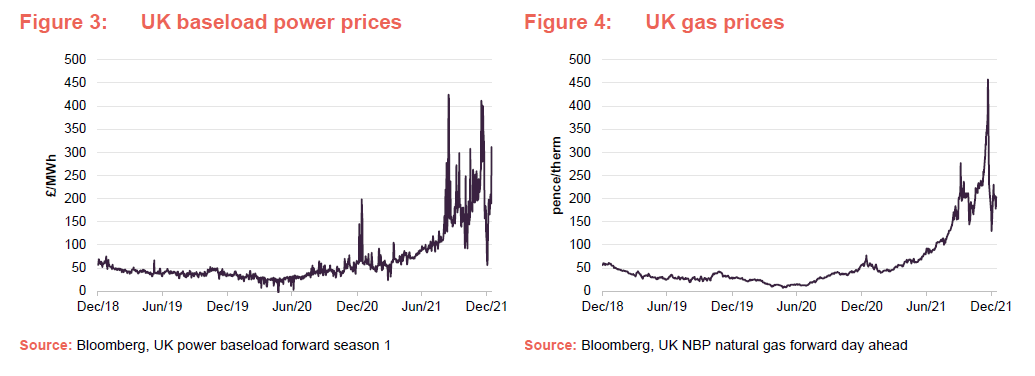

Dramatic jump in power prices

A year ago, we were writing about hopes for a recovery in UK power prices. Measures to control the spread of COVID-19 had reduced power demand by about 15% and forecasters were factoring in lower-than-expected demand for power for three to five years. However, the end of lockdowns, facilitated by vaccination programmes, had triggered increased demand for power.

In the UK, the marginal price for power tends to be heavily influenced by the natural gas price as shortfalls in supply are met by gas-fuelled peaking plant. Increased demand from a rebounding economy was accentuated by relatively low wind resource across Northern Europe. Heightened global demand for gas, particularly in the Middle East and Asia, is expected to be maintained as it is preferred over coal for new power plants in many markets (thanks to gas’ lower CO2 emissions).

On the supply side, Norwegian exports were constricted by maintenance works and supplies from Russia fell, perhaps as part of a deliberate policy by the Russian government to emphasise the need for security of supply so that the Nord Stream 2 gas pipeline (running down the Baltic Sea between Russia and Germany) would be connected as planned. Both Norway and Russia stepped up gas deliveries around the end of September and this helped to ease prices for a while. However, in November 2021, the new German government suspended approval for the pipeline and later deferred a decision until summer 2022. In the UK, the issue was compounded by a shortfall in strategic reserves following Centrica’s decision to close the Rough gas storage site.

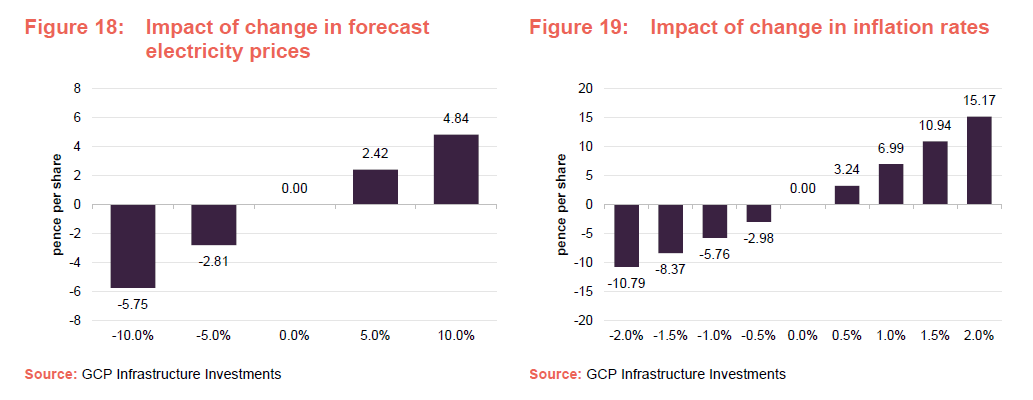

The net effect has been soaring UK gas and power prices, as is evident in Figures 3 and 4. Higher power prices are a positive for GCP to the extent the price for sales of power has not been fixed under power purchase agreements (PPAs) or through hedging activity. Figure 18 on page 18 shows the sensitivity of GCP’s NAV to a change in power prices.

Investment process

Restrictions

GCP invests at least 75% of total assets, directly or indirectly, in investments with exposure to infrastructure projects with the following characteristics (core projects):

- pre-determined, long-term, public-sector-backed revenues;

- no construction or property risks; and

- benefit from contracts where revenues are availability-based.

In respect of core projects, the company focuses predominantly on taking debt exposure (on a senior or subordinated basis) and may also obtain limited exposure to shareholder interests (equity).

The company may also invest up to 25% of total assets (at the time the relevant investment is made) in non-core projects. These might include:

- taking exposure to projects that have not yet completed construction;

- projects in the regulated utilities sector; and

- projects with revenues that are entirely demand-based or private-sector-backed (to the extent that the investment adviser considers that there is a reasonable level of certainty in relation to the likely level of demand and/or the stability of the resulting revenue).

There is no – and it is not anticipated that there will be any – outright property exposure (except potentially as additional security).

No more than 10% in value of its total assets (at the time the relevant investment is made) will consist of securities or loans relating to any one individual infrastructure asset (having regard to risks relating to any cross default or cross collateralisation provisions).

The portfolio should be diversified by asset type and revenue source.

Structural gearing of (borrowing against) investments is permitted up to a maximum of 20% of NAV at the time that the debt is drawn down.

The investment adviser

Phil leads the team that works on GCP, but the investment adviser has a significant resource working on the fund.

Ben Perkins, Beth Watkins, Max Gilbert and Ben Rider are analysts dedicated to GCP. GCP and a sister fund GCP Asset Backed Income (GABI) share an origination team of five, including Phil and David Conlon (the lead adviser to GABI). Members of staff monitor loans, keeping in regular contact with borrowers and monitoring covenants and an administration team helps process payments. Matteo Quatraro is commercial director at Gravis, looking after GCP’s renewable energy investments.

GCP lends money to a relatively narrow group of sectors. The investment adviser may consider other infrastructure sectors or renewable technologies, but considerable due diligence is required before investing in new areas. As stated above, to be eligible as a core investment, a loan must have some backing from public-sector cashflows. This rules out unsubsidised solar and wind farms (which derive their revenue largely from PPAs), for example.

GCP is operating in relatively small markets. Some new business comes from direct approaches. Much of it is the result of introductions from lawyers and advisers whom the investment adviser has worked with before. Not much proactive marketing is necessary and the investment adviser steers clear of competitive auctions.

Ideally, returns on loans will have some inflation-linkage, but this is not always available. Even where it does exist in the portfolio, the relationship between returns and inflation may not be linear. Some loans have clauses that trigger higher rates if inflation spikes above a certain threshold, for example.

Exposures informed by rigorous risk analysis

A thorough understanding of risk is essential. This varies by asset type and by where GCP sits in the capital structure. The approach is a cautious one – senior debt (higher ranking when it comes to getting paid interest or a repayment of capital) is favoured over subordinated debt when first making a foray into a sector, for example.

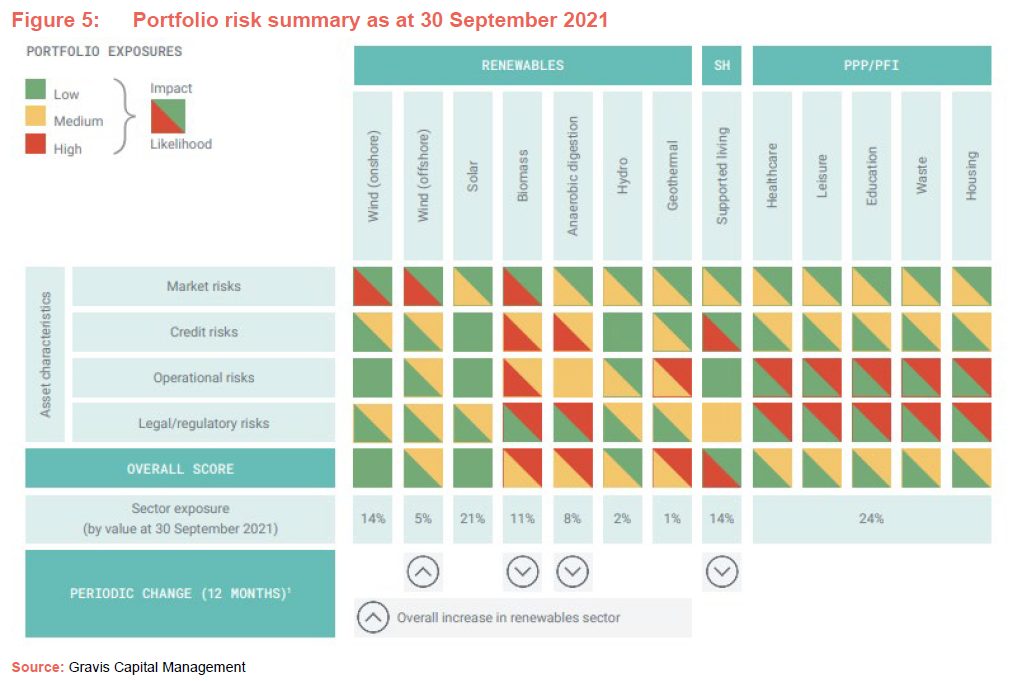

Gravis has compiled a matrix of their perception of risks across the various asset classes that GCP invests in.

Notable changes to the risk summary reflect a better outlook for anaerobic digestion, following the introduction of the green gas support scheme, more volatile energy prices, a problem with cable protection systems at some offshore windfarms, and governance improvements at a number of social housing registered providers.

The portfolio’s exposure to PFI is mainly through subordinated loans or loans secured against equity positions within the capital structure. Wind farms are an area with which the investment adviser feels comfortable enough to gain all the exposure through subordinated debt. By contrast, the initial investments in social housing have been made via senior debt. Corporate and social responsibility analysis may disqualify some potential investments. The investment adviser takes into account the alignment of incentive structures with GCP’s interests, for example.

External advisers help with an assessment of legal, tax and insurance factors and the investment adviser may also use some external technical expertise when evaluating projects.

Proprietary cash flow models are built for each potential investment, and these incorporate an element of sensitivity analysis.

Independent board sign-off for every investment decision

Once the investment case has been established, potential investments are first submitted to an internal credit committee consisting of Nick Parker, Stephen Ellis and Rollo Wright (all founders of Gravis Capital Management and members of its board of directors).

However, the final decision on each investment is the responsibility of the GCP board’s investment committee, made up of non-executive directors, independent of Gravis (see page 30). They will have been made aware of potential investments well before the formal business of the investment committee. The investment adviser says that the questions that they raise and the opinions that they put forward are invaluable to the investment process.

Every investment is through a loan to an intermediate company

GCP’s loans carry fixed interest rate coupons, albeit with some inflation protection. The company is permitted to use interest rate hedging. Where GCP holds subordinated debt, the investment adviser ensures that the senior debt ranking above it has been, where appropriate, hedged against movement in interest rates, through the use of interest rate swaps.

Sustainability

GCP’s investment focus on public infrastructure, social housing and renewable energy infrastructure means that almost everything it backs is in some way contributing towards a better society and a sustainable future.

GCP’s board believes that the best-practice application of environmental, social and governance (ESG) principles is paramount in the company’s operations. It is working to implement the recommendations of the TCFD when applicable and appropriate. Mindful of existing requirements on gender diversity and Sir John Parker’s report on the ethnic diversity of boards, the GCP board anticipates participating in a ‘board apprentice’ scheme in the near future (NB: a new director is currently being recruited – see page 30).

Gravis is a signatory to the UN Principles for Responsible Investment and, as such, incorporates a consideration of ESG issues into its decision-making. It has also adopted the principles of the UK Stewardship Code 2020.

Potential investments should promote sustainability or benefit society, including, but not limited to, the areas of climate change mitigation and adaptation, energy transition, critical infrastructure, affordable living, social housing, education and healthcare. It excludes investments which focus on animal testing; armaments; alcohol production; pornography; tobacco; coal production and power; and nuclear fuel production.

Gravis believes that integrating ESG considerations into investment management processes and ownership practices can help to create more successful and sustainable businesses over the long term, which in turn should generate enhanced value for its clients and society at large.

Prior to a new investment being approved, Gravis’s investment teams will assess how the investment fares against key relevant ESG criteria, laid down in an ESG checklist tailored for GCP. Gravis’s checklists typically cover the counterparty’s commitment and capability to effectively identify, monitor and manage potential ESG-related risks and opportunities (counterparties can include management teams, borrowers, asset developers and operators and the equity owners of the projects in which its funds invest). Furthermore, to the extent that it is applicable, Gravis will assess the availability of relevant policies and procedures; alignment with industry or investment specific standards and ratings; and compliance to relevant ESG-related regulation and legislation.

The investment adviser recognises the importance of addressing biodiversity loss and this is a risk that it intends to track and seek to mitigate where possible, including requiring or financing habitat creation.

A positive outcome from Gravis’s ESG due diligence assessment may increase the adviser’s enthusiasm for an investment. Conversely, where it identifies issues, this may weigh against a potential investment, and although it would not necessarily prevent an investment, it may cause Gravis to seek a greater risk premium or hold a smaller position.

Following an investment, relevant ESG indicators will be monitored on an annual basis. Gravis may engage with counterparties on ESG issues. It also reports on its progress on responsible investment on an annual basis. An external consultant will perform a periodic review of Gravis’s responsible investment processes and ensure the policy remains relevant and appropriate.

In October 2020, the London Stock Exchange awarded GCP its Green Economy Mark. The company’s renewable energy investments have supported renewable energy facilities, displacing the production of the equivalent of around 1m tonnes of CO2 each year.

The investment adviser and the company are working towards running their operations on a carbon-neutral basis by 2023. The investment adviser has also been working with registered providers within GCP’s social housing portfolio that have been graded as non-compliant in respect of governance by the Regulator for Social Housing. The adviser says that good progress has been made in this respect over 2021.

Asset allocation

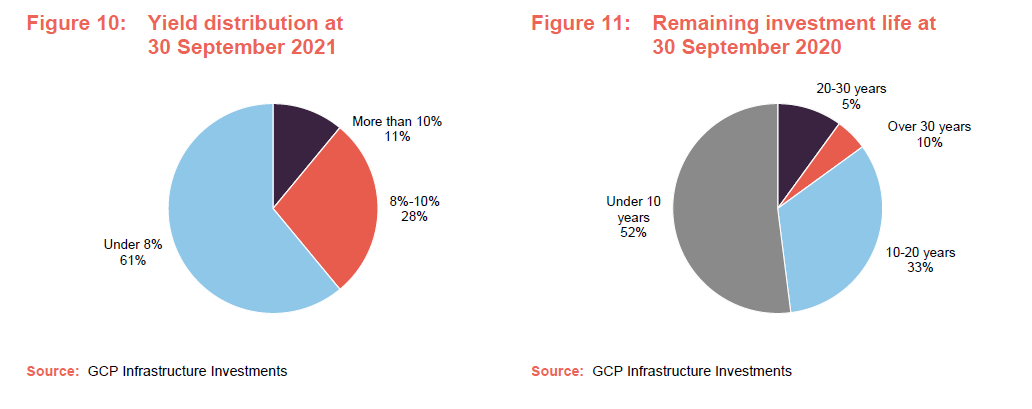

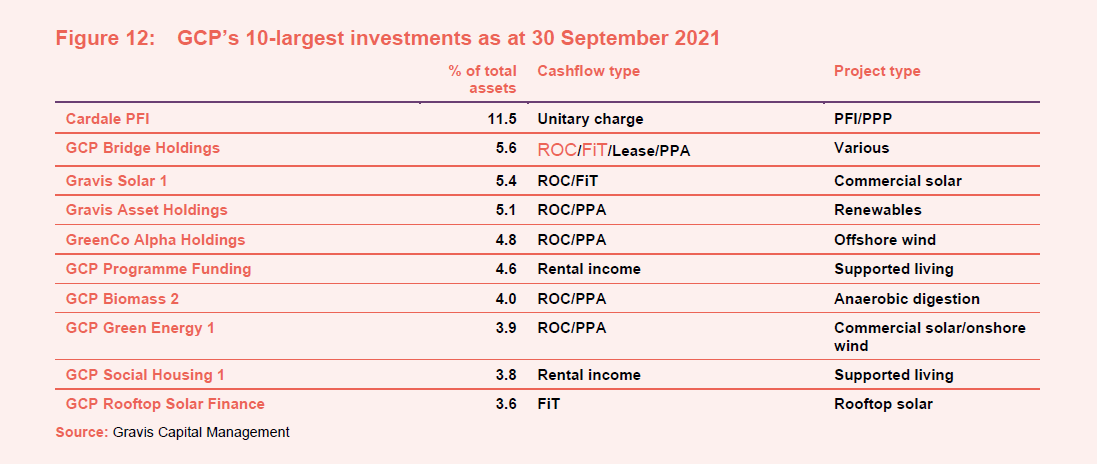

At the end of September 2021, there were 49 investments in GCP’s portfolio, producing an annualised yield of 8.0% and with an average life of 12 years. Two new anaerobic digestion projects have entered the portfolio; otherwise these figures are not much changed from when we last published, using data at the end of March 2021.

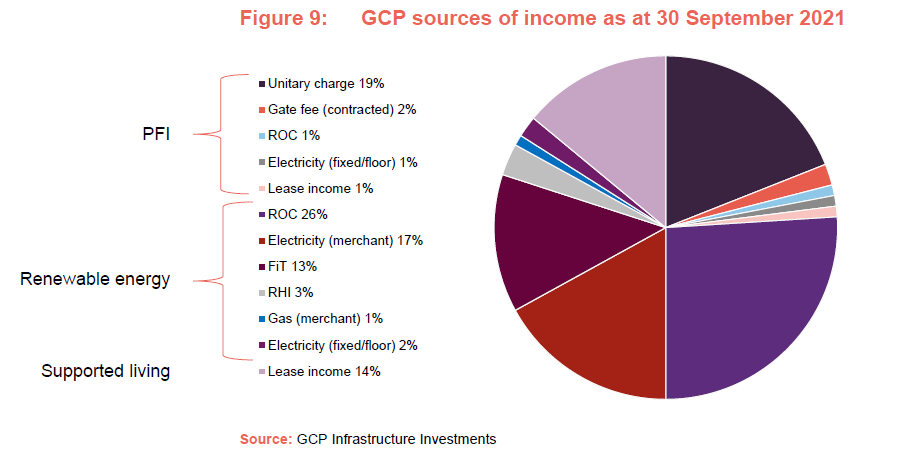

Figure 9 breaks down Figure 7 further, providing more information on GCP’s sources of income.

The vast majority of GCP’s sources of revenue are predictable and stable. Exposure to merchant electricity and gas accounted for just 18% of GCP’s revenue at end September 2021.

Top 10 investments

There has been no substantial shift in the 10-largest investments since we last published.

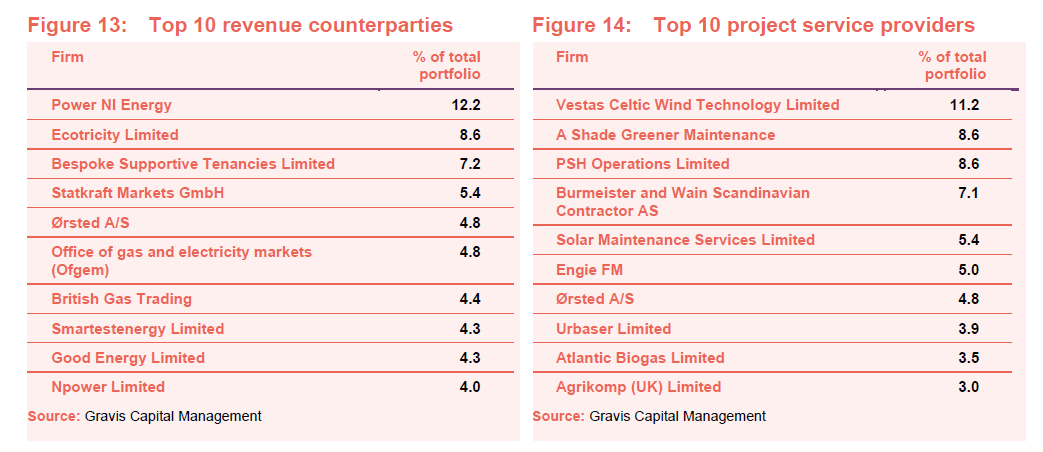

There have been no changes of note to Figures 13 and 14 since the end of March 2021 save that Npower has replaced Gloucester County Council in Figure 13. The switch to PSH Operations from Solarplicity that we discussed in our last note will save money and that has contributed to the recent NAV uplift.

Good Energy’s recent results reflect lower profits, but both it and Smartestenergy have survived the recent bloodbath amongst the smaller energy suppliers. SmartestEnergy has been named a supplier of last resort by the regulator Ofgem and SmartestEnergy Business Limited is to take on customers of MA Energy, which supplies 300 non-domestic customers.

Recent investment activity

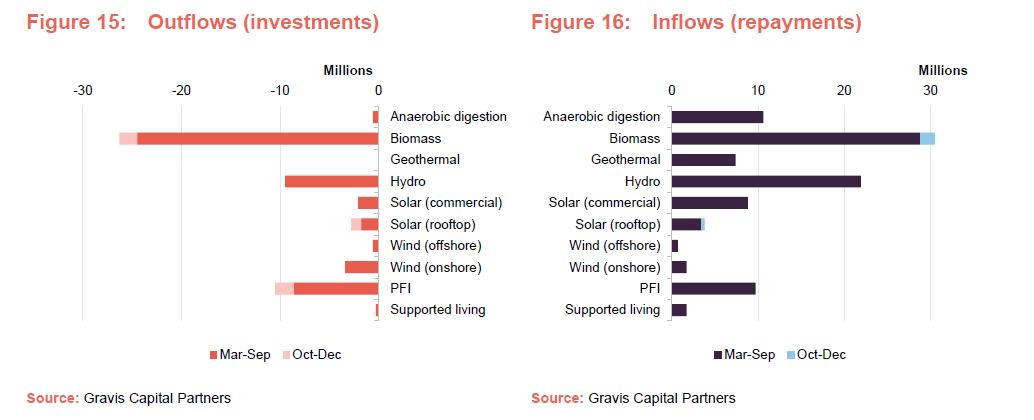

Figures 15 and 16 show the recent investment activity within GCP’s portfolio. The relatively recent geothermal and hydro investments (discussed in the last note) are evident, as well as the new loans against two anaerobic digestion plants.

Pipeline of potential new investments

At 30 September 2021, GCP’s adviser had an active pipeline of around £260m of investment opportunities under consideration. These included follow-on investments in existing assets, operational projects in the anaerobic digestion, CHP and biomass sectors, renewable generation from both ground-mounted and rooftop solar, wind, and hydro, electric vehicle charging and finance for electric taxis, battery storage and gas peaking assets, and a forestry project capable of benefitting from the woodland carbon guarantee scheme.

Disposal of interest in offshore wind farm

GCP recently entered into a conditional agreement to sell its interest in an offshore wind farm. It said that the expected disposal proceeds would reflect a 12% premium to their most recent valuation.

Valuation

Each quarter, the investment adviser and a third-party valuation agent (Mazars LLP) reassess the fair value of GCP’s financial assets. Values are based on discounted cash flows, where asset-specific market discount rates are applied to the contractual cash flows of each asset.

The valuation agent decides what the discount rates should be, taking into account:

- UK interest rates;

- changes in spreads for similar credits;

- observable yields on other comparable instruments;

- investor sentiment, activity and pricing in the primary and secondary markets for infrastructure investments; and

- changes to the economic, legal, taxation or regulatory environment.

The expected operational performance of the asset is factored into the valuation. Other factors, such as power prices and inflation rates, are factored in where appropriate. The valuations are reviewed by the investment adviser and the board. The directors review and approve the quarterly NAV before publication.

Conservative assumptions

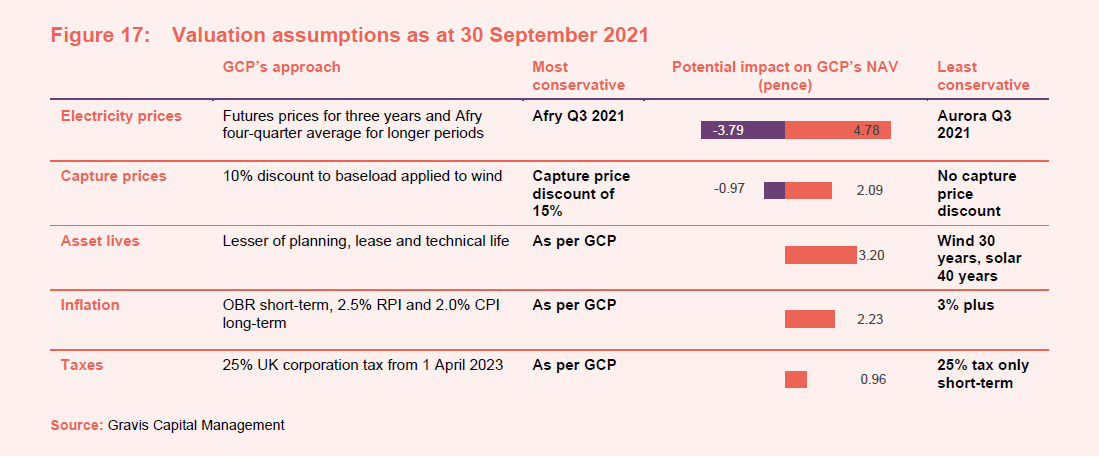

Our last note – Penalised for being conservative? – published in July 2021 looked at a number of areas where GCP was adopting more conservative valuation assumptions than many other funds in its peer group. GCP’s recent sale of an offshore wind investment at a 12% premium to its last valuation supports that assertion.

Sensitivities

The investment adviser provides sensitivity analysis to a range of factors. Figures 18 and 19 show the impact of changes in power prices and the inflation rate.

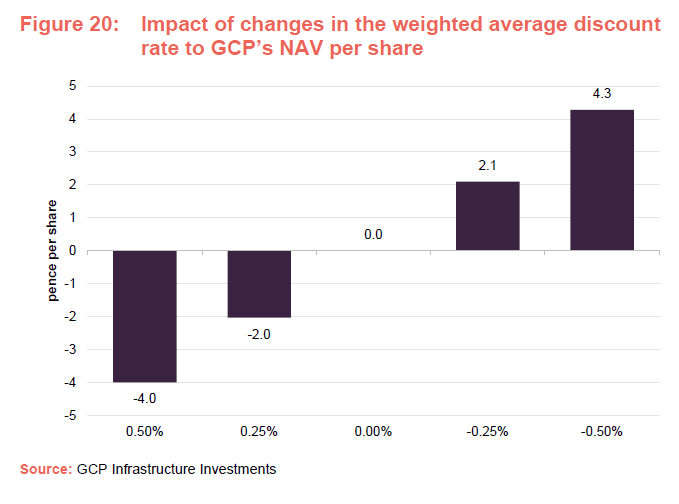

Figure 20 shows the sensitivity of GCP’s NAV per share to changes in the weighted average discount rate. In practice, at 30 September 2021, the discount rates used in the valuation of financial assets ranged from 4.58% to 10.38%.

Performance

NAV progression

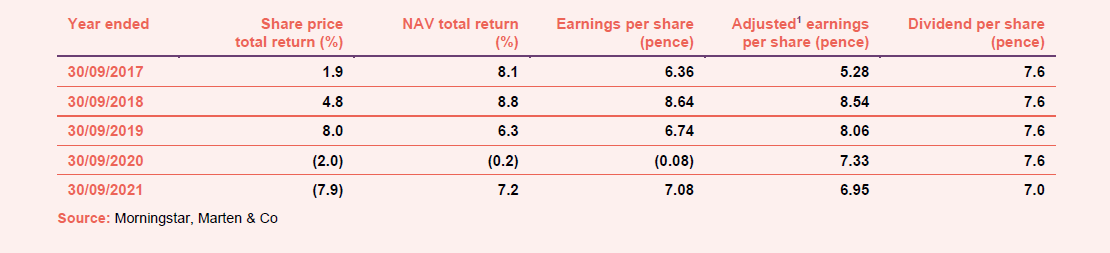

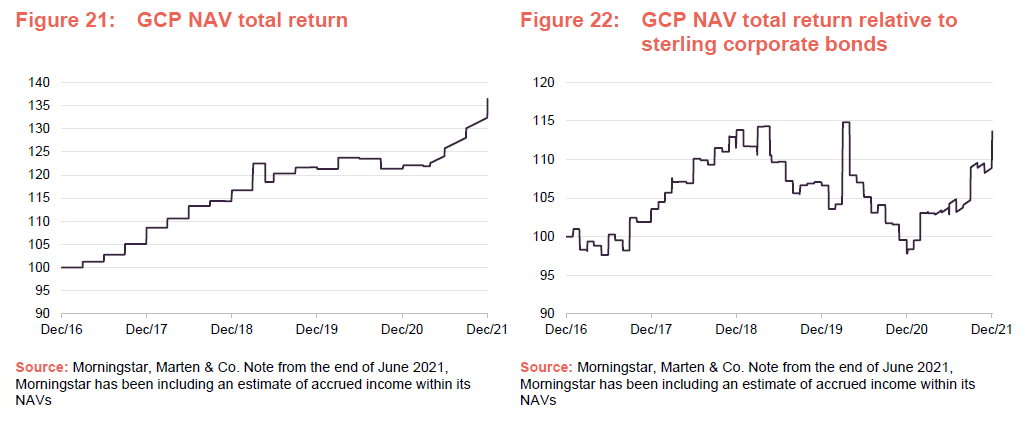

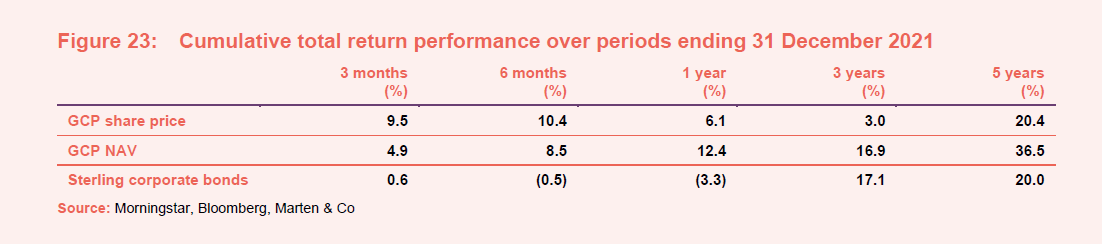

GCP does not have a formal benchmark, but the board chooses to compare its returns to those of a sterling corporate bond index, and we have done so here.

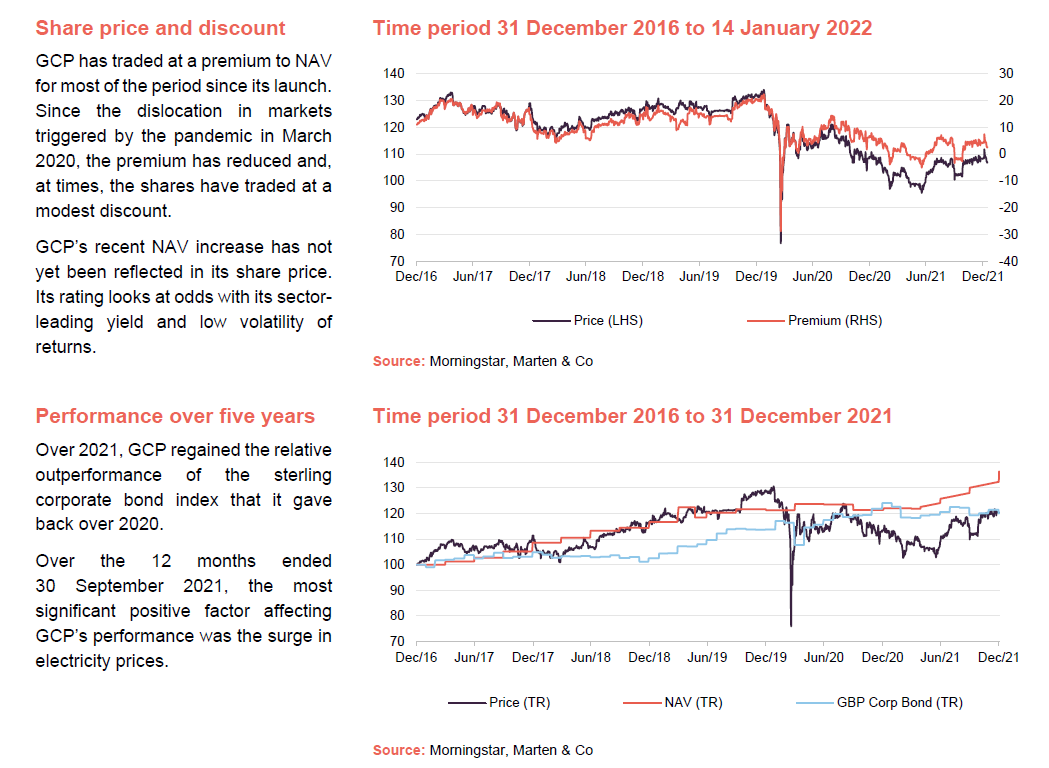

Over 2021, GCP regained the relative outperformance of the sterling corporate bond index that it gave back over 2020.

Over the three months ended 31 December 2021, the NAV rose by 3.26p. Positive factors influencing the NAV move were the rise in market electricity prices (+2.2p), higher inflation (+1.1p) and the sale of the offshore wind investment discussed above (+0.7p).

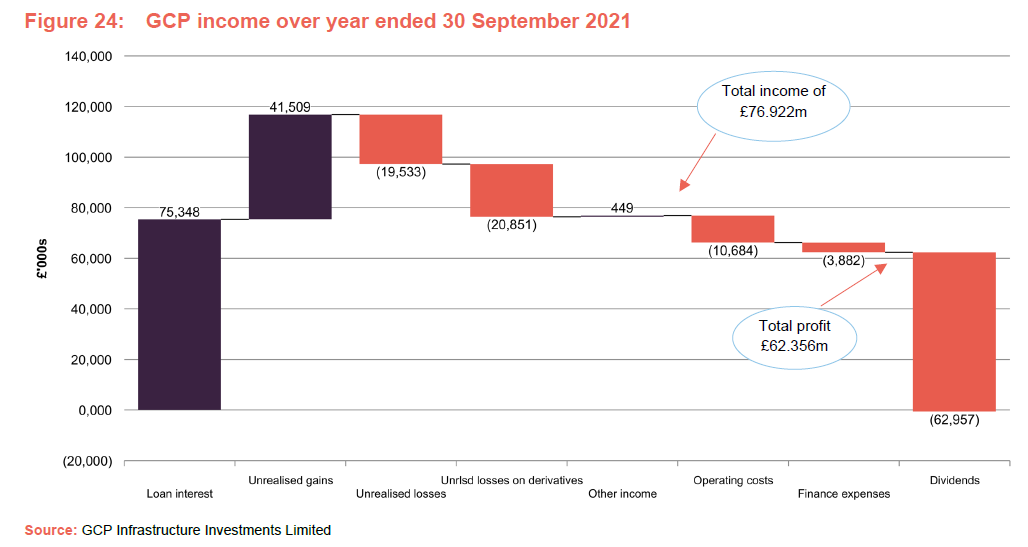

Results for the year ended 30 September 2021

GCP announced a profit of £62.4m for the year ended 30 September 2021, the main driver of which was much higher electricity prices. Operating costs of £10.6m were lower as the 2020 financial year figure was inflated by one-off costs. Finance expenses fell as GCP drew down less on its revolving credit facility.

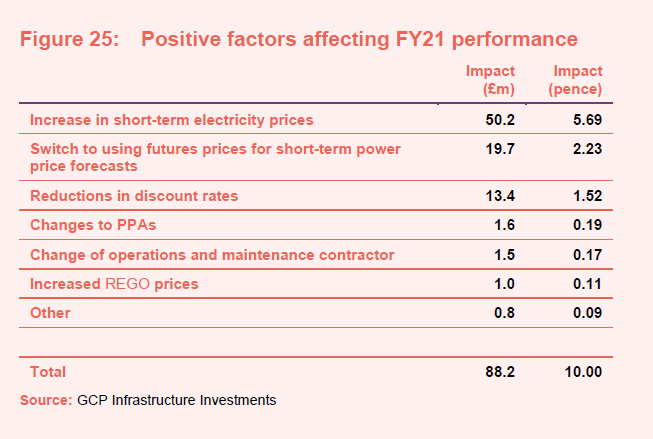

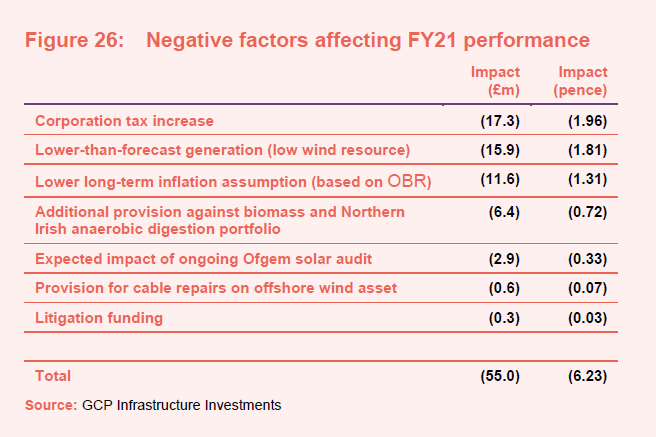

Factors affecting performance over the year to the end of September 2021

As Figure 25 shows, over the 12 months ended 30 September 2021, the most significant positive factor affecting GCP’s performance was the surge in electricity prices. The effect on the fund would have been even greater were it not for the decision to introduce the hedge against volatile electricity prices.

In May 2021, after a period of volatile power prices, the investment adviser recommended hedging about 75% of the company’s exposure to the UK electricity market (excluding Northern Ireland) for the winter of 2021/22. The board approved the proposal, and on 15 June 2021, the company entered into a commodity swap agreement with Axpo Solutions AG which had the effect of fixing a price for winter 2021/22 at £89.60/MWh.

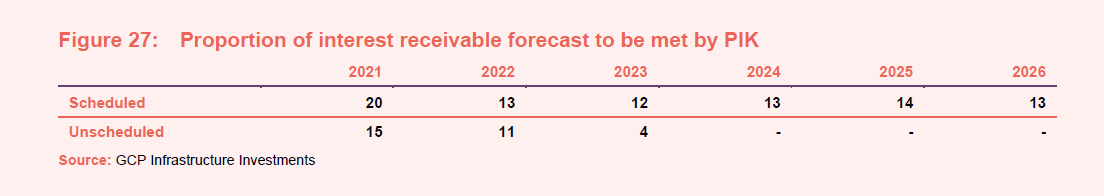

Payments in kind

Some borrowing entities in GCP’s portfolio do not produce regular cashflows to support regular interest payments. Consequently, a proportion of GCP’s interest payments are scheduled to be capitalised – treated as payments in kind (PIK). In addition, from time to time GCP may be exposed to some borrowers who find themselves unable to meet scheduled interest payments for a limited period, but are nevertheless expected to service their loans over the life of the underlying asset. Figure 27 shows the breakdown between scheduled and unscheduled PIKs at 30 September 2021.

The unscheduled PIKs relate principally to:

- two waste wood biomass investments which were affected when the UK construction industry was in lockdown. GCP anticipated that this situation would be resolved by the end of 2021 for one of these plants (which it was) and the other in 2022;

- the ongoing audit of a portfolio of solar assets by Ofgem, which we have discussed in earlier notes; and

- three Scottish gas-to-grid anaerobic digestion plants which have been experiencing performance issues. These are expected to be resolved during the early part of 2022.

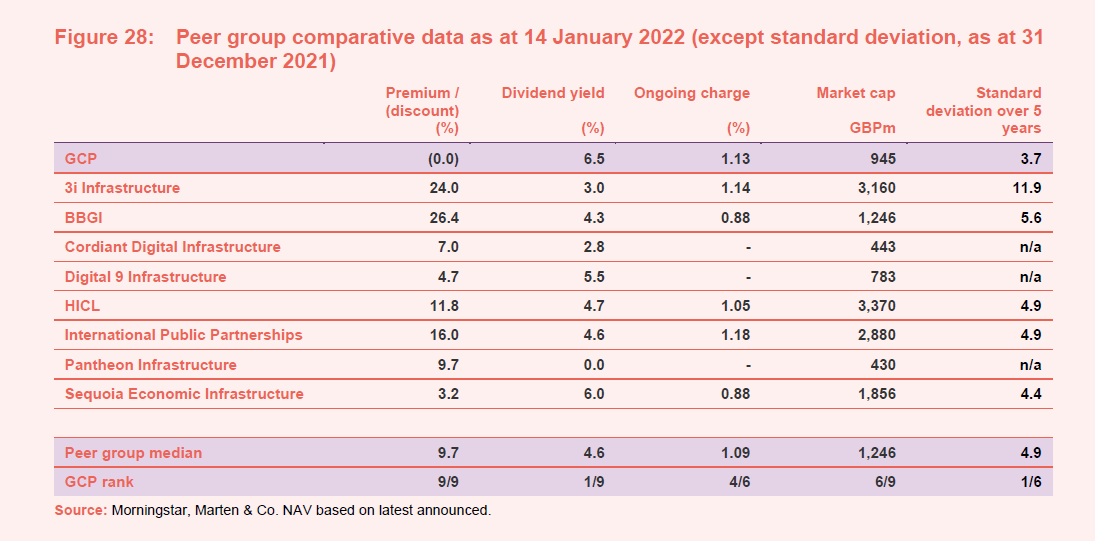

Peer group

GCP is a constituent of the Association of Investment Companies’ infrastructure sector alongside four funds (3i Infrastructure, BBGI, HICL and International Public Partnerships) which invest primarily in public/private partnership project equity, two digital infrastructure funds (Cordiant Digital Infrastructure and Digital 9 Infrastructure), and two funds (the recently-launched fund Pantheon Infrastructure and Sequoia Economic Infrastructure) which have adopted a broad definition of infrastructure including digital infrastructure and renewables. Like GCP, the Sequoia fund invests primarily in debt. We have excluded Infrastructure India (which has a very different risk/reward profile to the rest of the peer group) for the purposes of this note. GCP is the only fund in this peer group focused exclusively on the UK.

GCP’s recent NAV increase has not yet been reflected in its share price. Its rating looks at odds with its sector-leading yield and low volatility of returns (measured by the standard deviation of returns). GCP’s charges and market cap are close to the middle of this peer group.

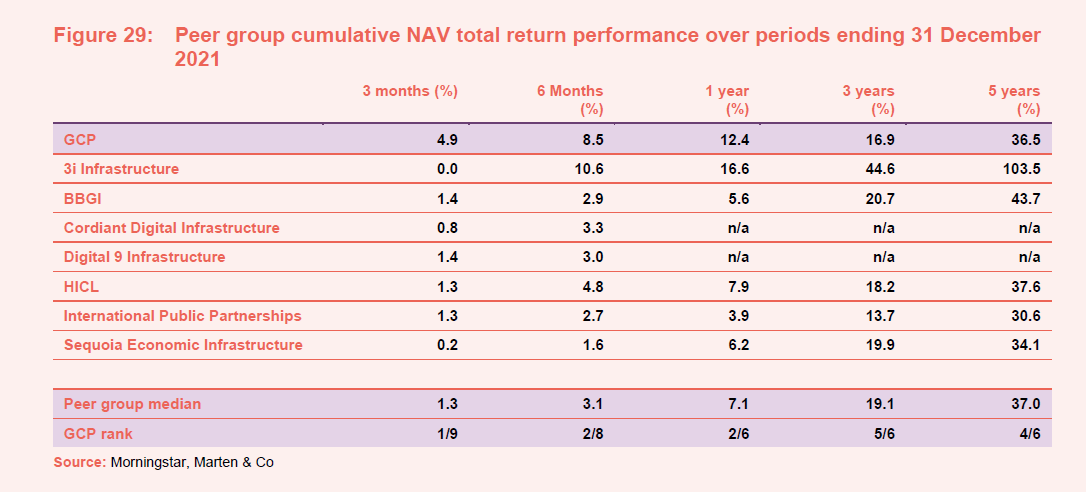

Figure 29 compares the performance of the funds in this peer group. It excludes the recently-launched Pantheon Infrastructure.

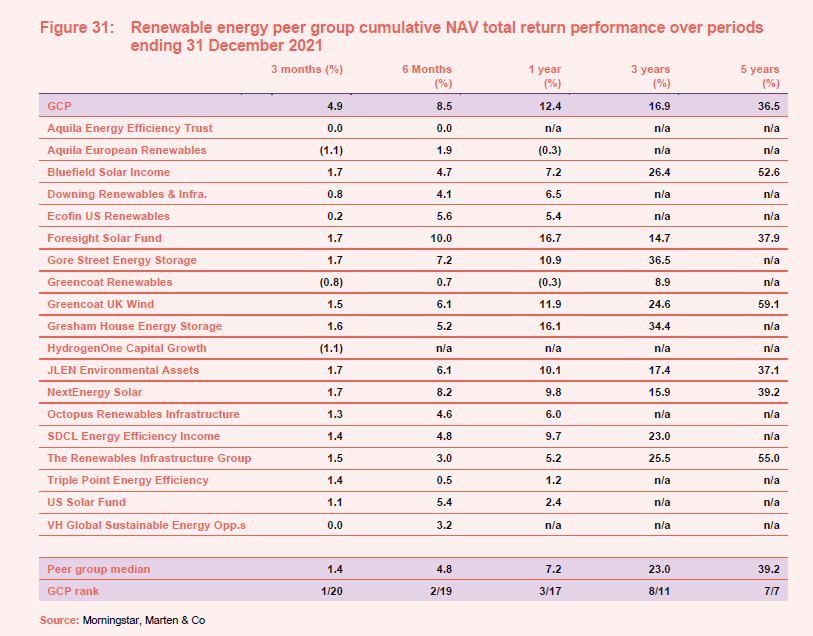

GCP’s NAV returns have been towards the top of the peer group recently. 3i Infrastructure takes on more risk than competing funds. With that exception, the long-term returns of the peer group are quite similar. GCP’s returns reflect its conservative approach towards calculating its NAV and its asset mix.

GCP versus renewable energy infrastructure funds

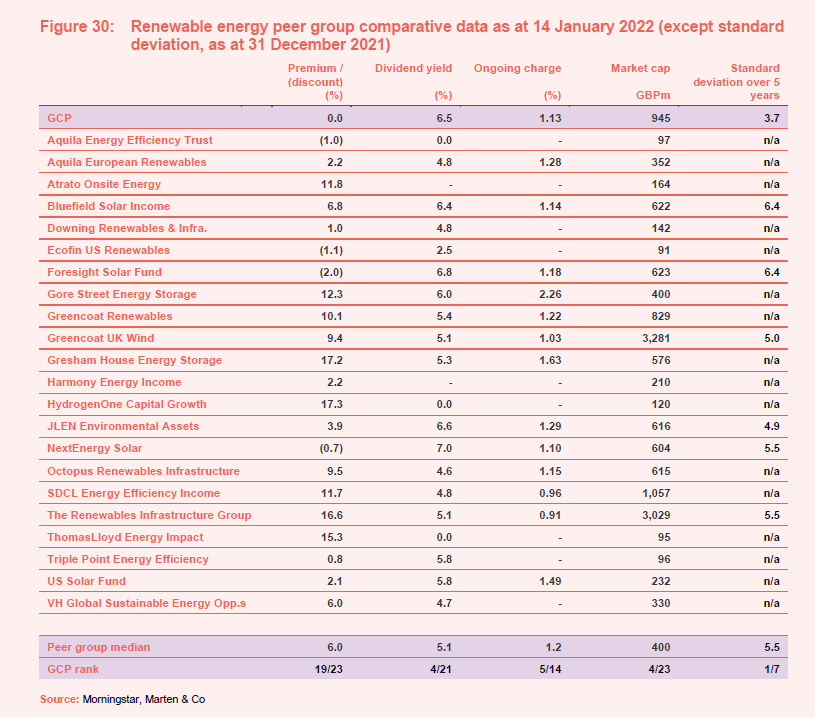

We feel that, given the increasing importance of renewable energy within GCP’s portfolio, it is helpful to compare GCP to the constituents of the renewable energy sector. The sector has been expanding rapidly and consequently many of these funds have not yet built up much of a track record.

The 22 constituents of the AIC’s renewable energy infrastructure sector include three funds (Gresham House Energy Storage, Gore Street Energy Storage and Harmony Energy Income) focused on investments in batteries.

Many (notably Aquila European Renewables, Ecofin US Renewables, Greencoat Renewables, Octopus Renewables Infrastructure, ThomasLloyd Energy Impact, US Solar and VH Global Sustainable Energy Opportunities) are substantially invested outside the UK.

HydrogenOne Capital Growth is unique in its focus on capital growth rather than income, as well as the emergent green hydrogen sector.

In comparison with this peer group, GCP’s rating is once again out of step. However, it ranks towards the best of the peer group by yield, charges and size, and once again offers the lowest volatility of NAV returns.

GCP’s focus on debt instruments rather than equity investments may account for its lower volatility of returns. This and the asset mix within its portfolio are most likely the chief influences on its performance relative to the renewable energy infrastructure peer group.

Quarterly dividend

Dividends are declared and paid quarterly. Shareholders are able to elect to take their dividend as scrip (in shares rather than cash).

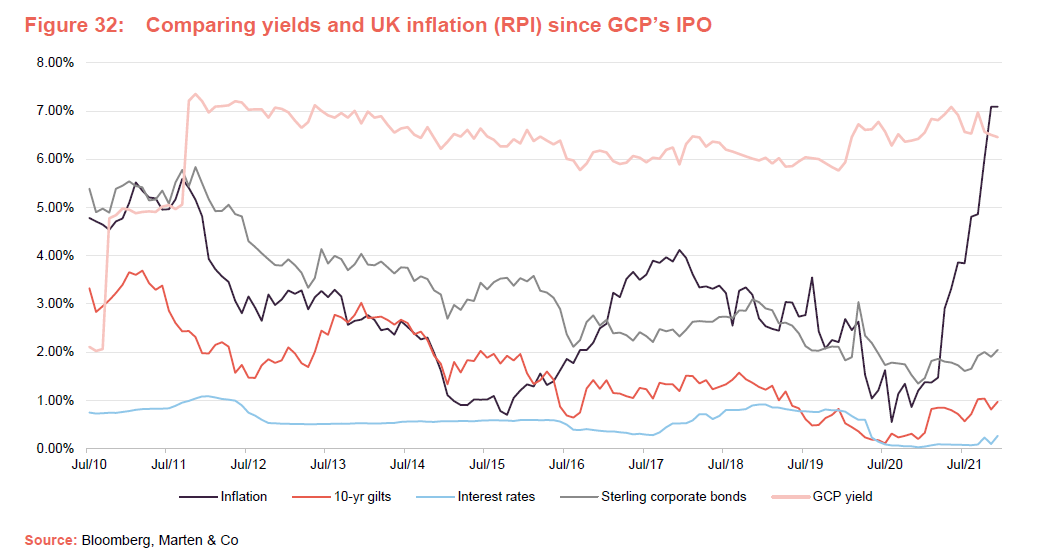

For the financial year ending 30 September 2021, GCP’s target dividend was reduced to 7.0p from 7.6p, reflecting the decline in acceptable rates of risk-adjusted returns available in an environment of ultra-low interest rates. The board and the adviser believe that at the new lower level of dividend, the current pipeline of investment opportunities is likely to enable GCP to reinvest capital and to support modest potential growth in the dividend. The board has set a dividend target of 7.0p per share for the current financial year.

Figure 32 illustrates the shifting economic and market backdrop that necessitated the modest reduction in the dividend.

GCP’s managers have sought out new opportunities that would offer similar risk-adjusted returns to those available when the trust was launched. The dividend reduction was considered preferable to taking on additional risk.

Dividend cover

Loans made by the company are valued on a discounted cash flow basis. When a loan is first made, it is typically valued using the interest rate charged to the borrower. However, loans are often revalued by the valuation agent to reflect changes in the market rate of interest or for project specific reasons, for example.

As market rates of interest have fallen since GCP was launched, higher values have been attributed to many of the loans that it has made, uplifting the NAV. That has the effect of pulling forward the recognition of income from these loans and, on an IFRS accounting basis, reduces GCP’s earnings per share and dividend cover in subsequent years. For this reason, the board and the investment adviser have calculated a range of alternative performance measures.

Figure 33 shows GCP’s dividend cover ratios on two bases – normal (IFRS) earnings cover, and an adjusted figure which strips out the impact of unrealised fair value adjustments on the company’s earnings, and better contrasts GCP’s revenue and dividend payout.

The board and advisers use two other alternative performance measures, including two other measures of dividend cover. The first is based on loan interest accrued for the financial year (less total expenses and finance costs) and the second is a cash earnings cover calculated as the ratio of total cash received per share to the dividend per share. For the year ended 30 September 2021, the dividend cover based on loan interest accrued was 1.11x (FY20: 1.01x) and cash earnings cover was 1.37x (FY20: 1.37x). This measure does not assume any reinvestment of loans that have been repaid in the period.

We discussed the factors affecting the recent results on pages 20 and 21.

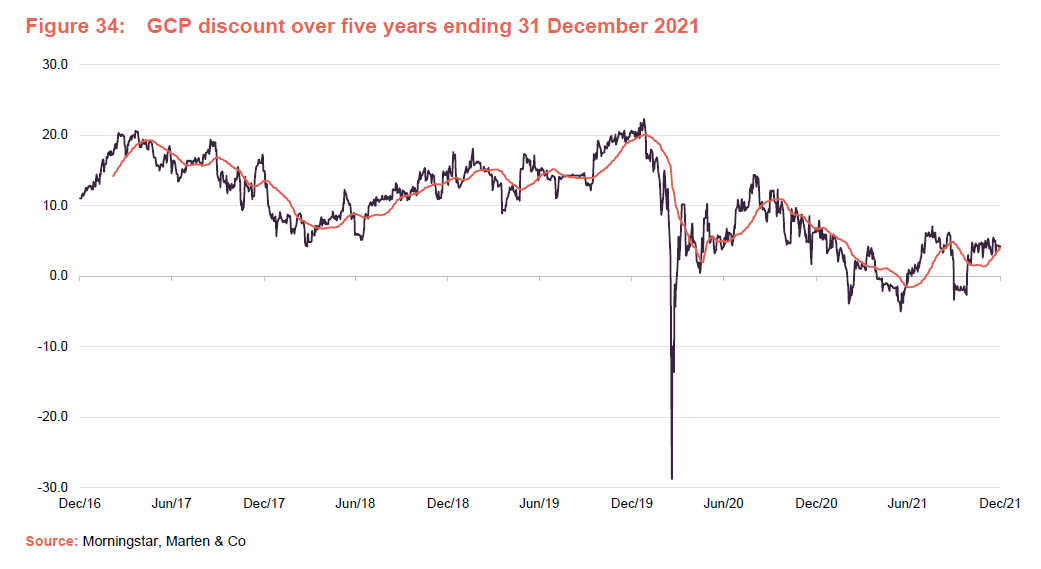

Premium rating

GCP has traded at a premium to NAV for most of the period since its launch. Since the dislocation in markets triggered by the pandemic in March 2020, the premium has reduced and, at times, the shares have traded at a modest discount.

Over the year ended 31 December 2021, GCP’s shares traded within a range of a 5.0% discount to NAV to a 7.9% premium. Over that period the premium averaged 2.2%. At 14 January 2022, based on its year-end NAV, the shares were trading just below asset value.

In February 2021, shareholders approved the issuance of up to 10% of GCP’s then-issued share capital without pre-emption. They also approved the repurchase of up to 14.99% of the then-issued share capital. Repurchased shares could be held in treasury and reissued at the board’s discretion. The board does not issue shares in an attempt to moderate the premium. However, it would consider buying back shares if the shares were trading at a discount to NAV.

Over the course of its financial year ending 30 September 2021, GCP issued 2,544,179 shares to satisfy demand for scrip dividends and a further 624,031 shares were issued in December for the same reason. No shares were repurchased.

Fees and costs

The investment adviser receives an investment advisory fee of 0.9% a year of the NAV net of cash. This fee is calculated and payable quarterly in arrears. There is no performance fee. The investment adviser is also entitled to an arrangement fee of up to 1% (at its discretion) of the cost of each asset acquired by GCP. Gravis will generally seek to charge the arrangement fee to borrowers rather than to the company where possible. To the extent that any arrangement fee negotiated by the investment adviser with a borrower exceeds 1%, the benefit of any such excess shall be paid to the company. The investment adviser also receives a fee of £70,000 (subject to RPI adjustments) a year for acting as AIFM.

The investment advisory agreement may be terminated by either party on 24 months’ written notice.

Apex Financial Services (Alternative Funds) Limited is GCP’s administrator and company secretary. Depositary services are provided by Apex Financial Services (Corporate) Limited. The fee for the provision of these services during the year was £962,000 (FY20 £1.015m).

Valuation agent fees (for the independent third-party valuation agent, Mazars) totalled £281,000 for the year ended 30 September 2021 (FY20 £220,000).

The ongoing charges ratio for the year ended 30 September 2021 was 1.1%, unchanged from the prior year.

Capital structure and life

GCP has 882,834,259 ordinary shares outstanding and no other classes of share capital. The company’s financial year end is 30 September and AGMs are held in February.

GCP is an evergreen fund with no fixed life and no regular continuation vote.

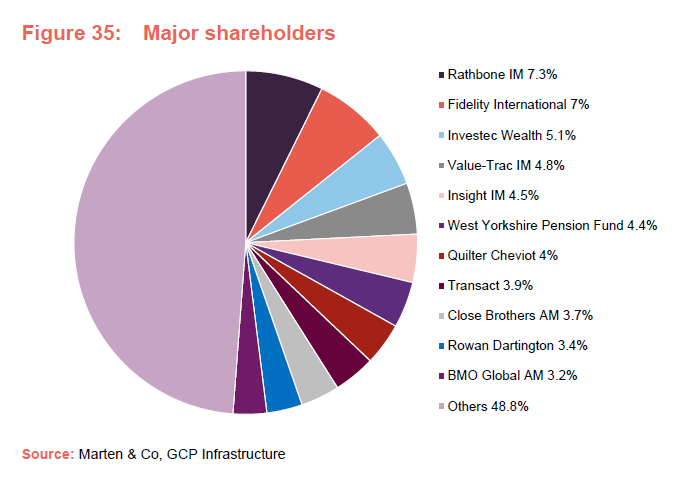

Major shareholders

Gearing and derivatives

Structural gearing of investments is permitted up to a maximum of 20% of NAV immediately following drawdown of the relevant debt. At 30 September 2021, GCP’s net gearing was 18%.

GCP has revolving credit facilities totalling £165m available to it. £165m is provided by RBSI, Allied Irish Bank, Lloyds and Clydesdale Bank, and is repayable in March 2024. Interest is charged at a margin of 200bps over SONIA. The full £165m was drawn at 30 September 2021. A commitment fee of 0.7% is payable on undrawn amounts of the facilities.

As discussed on page 21, GCP entered into a commodity swap agreement with Axpo Solutions AG on 15 June 2021. The company has been granted a £50m credit line by Axpo Solutions AG to mitigate the need for regular cash flows associated with the hedge. The swap matures on 31 March 2022 and is for a notional 148,512MWh of power. The fixed price for that power as a result of the swap is £89.6/MWh. At 14 January 2022, the Electricity N2EX UK Power Index Day Ahead price was £373.2/MWh.

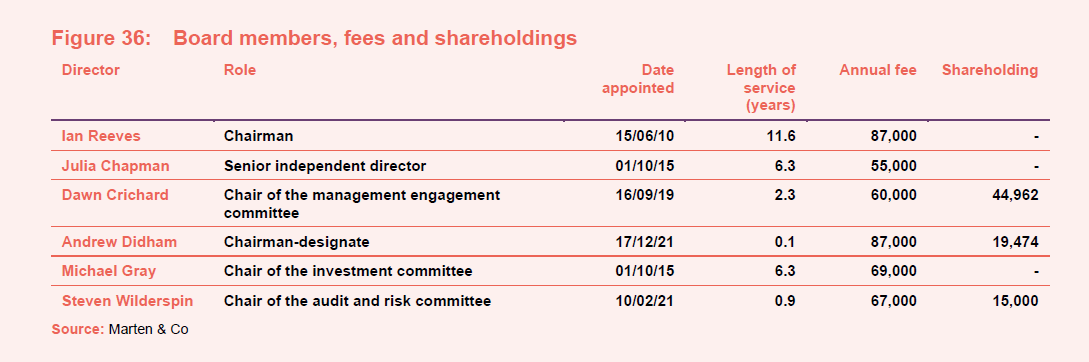

Board

Currently, the board has six directors, all of whom are non-executive and independent of the investment adviser.

Over the past year, David Pirouet and Paul de Gruchy have both retired from the board and two new directors – Steven Wilderspin and Andrew Didham – have replaced them.

Ian Reeves intends to step down as chairman in June 2022 and, subject to shareholder approval, will hand over to Andrew Didham. While Ian will remain on the board as a non-executive director, another non-executive director is being sought and it is intended that Ian will retire from the board before the end of 2022 once this new director has been recruited. As flagged in advance, Steven Wilderspin has assumed the chairmanship of the audit and risk committee.

Dawn Crichard’s role as chair of the management engagement committee encompasses responsibility for ESG matters – an area that she assumed responsibility for at board level in 2021.

Ian Reeves CBE (Chairman)

Ian Reeves CBE, a Jersey resident, is the CEO and co-founder of Synaps International Limited, the senior independent director of Triple Point Social Housing REIT Plc, a non-executive director of Geiger Counter Limited, and a director of several other private companies. He is also visiting professor of Infrastructure Investment and Construction at The Alliance Manchester Business School. Ian was founder and chairman of High Point Rendel Group Plc, president and CEO of Cleveland Bridge, chairman of McGee Group, and chairman of the London regional council of the Confederation of British Industry. He was made a CBE in 2003 for his services to business and charity.

Julia Chapman (senior independent director)

Julia Chapman, a Jersey resident, is a solicitor qualified in England & Wales and Jersey with over 30 years’ experience in the investment fund and capital markets sector. Having trained with Simmons & Simmons in London, she moved to Jersey to work for Mourant du Feu & Jeune (now known as Mourant) and became a partner in 1999.

Julia was appointed senior counsel to State Street following its acquisition of Mourant’s fund administration business in April 2010. She headed up a team supporting State Street’s European alternative investment services division. In July 2012, Julia left State Street to focus on the independent provision of directorship and governance services to a small number of alternative investment fund vehicles. Julia serves on the boards of three other Main Market listed companies: Henderson Far East Income Limited, BH Macro Limited and Sanne Group Plc.

Dawn Crichard (chair of the management engagement committee)

Dawn Crichard, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England and Wales with over 20 years’ experience in senior chief financial officer and financial director positions. Having qualified with Deloitte, she moved into the commercial sector and was chief financial officer of a large private construction group for 12 years. Dawn then worked with both private and listed clients in the hedge fund division of State Street. Following this, she was appointed as chief financial officer for Bathroom Brands Plc. In her current role as head of finance at a family office she has been involved in establishing and overseeing high-value private expert funds. Her broad accounting and commercial experience includes establishing new group head offices, mergers, acquisitions, refinancing and restructuring.

Andrew Didham

Andrew Didham, a UK resident, is a Fellow of the Institute of Chartered Accountants in England & Wales. He is a senior executive director with extensive board level experience within the Rothschild banking group. Andrew was group finance director for 16 years and a member of the group management of the worldwide Rothschild business, comprising investment banking, wealth management, asset management and merchant banking activities. He has broad non-executive director experience, being on the boards of IG Group Holdings Plc, Shawbrook Group Plc, Charles Stanley Group Plc, and formerly Jardine Lloyd Thomson Group Plc. Within Rothschild, he remains an executive vice chairman (a position he has held since 2012) and a non-executive member of NM Rothschild and Sons Limited. Formerly, he was a partner in the London office of KPMG with responsibility for the audit of a number of global financial institutions and assignments for various government and regulatory authorities.

Michael Gray (chair of the investment committee)

Michael Gray, a Jersey resident, is a qualified corporate banker and corporate treasurer. Michael was most recently the regional managing director, Corporate Banking for RBS International, based in Jersey, but with responsibility for The Royal Bank of Scotland’s Corporate Banking Business in the Crown Dependencies and British Overseas Territories.

In a career spanning 31 years with The Royal Bank of Scotland Group Plc, Michael has undertaken a variety of roles, including that of an auditor, and has extensive general management and lending experience across a number of industries. He is also a non-executive director of Jersey Finance Limited, the promotional body for the finance sector in Jersey, and a Main Market listed company JTC Plc, as well as other listed and private companies.

Steven Wilderspin (chair of the audit and risk committee)

Steven Wilderspin, a Jersey resident, is a Fellow of the Institute of Chartered Accountants of England & Wales. Since 2007, he has acted as an independent director on a number of public and private investment funds and commercial companies. In 2017, he retired as the chair of the audit and risk committee of 3i Infrastructure Plc after 10 years of service.

Steven is currently the chair of the risk committee of Blackstone Loan Financing Limited and chair of the audit and risk committee of HarbourVest Global Private Equity Limited, both listed on the LSE. Prior to 2007, he was a director at Maples Finance Jersey, with responsibility for their fund administration and fiduciary business. He began his career at PwC in London in 1990.

Previous publications

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on GCP Infrastructure Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.