Robust high yield

Henderson High Income’s (HHI‘s) dividend income proved relatively resilient in the face of COVID-19. Its manager says that it will likely dip into its revenue reserves to maintain its dividend this year and perhaps next, but having avoided the worst of the crisis, HHI manager David Smith sees little danger of these being exhausted.

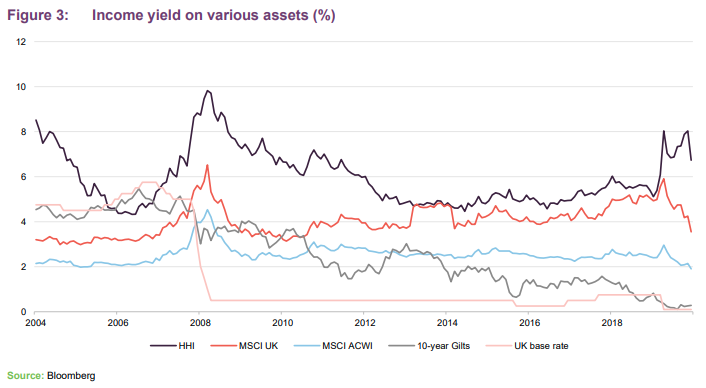

HHI is trading on a yield close to 7%. The manager believes that this could prove an attractive entry point. On previous occasions where the trust has traded at similar yield levels, it has delivered high returns subsequently. In that regard, it helps that the UK market is entering what could be a global synchronised economic recovery on a much lower valuation than other developed market peers. The manager suggests that more clarity on Brexit could be the final hurdle to clear for a turning point in the UK market’s fortunes.

High income from diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities, which helps dampen the overall volatility of the trust.

Fund profile

Henderson High Income Trust (HHI) aims to invest in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high-income stream, while also maintaining the prospect of capital growth.

The majority of HHI’s assets are invested in the ordinary shares of listed companies with the balance in listed fixed interest stocks (i.e. the trust will not hold unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked by investors and which offer the potential for capital appreciation over the medium term. A maximum of 20% of gross assets may be invested outside of the UK.

Gearing is used to enhance income returns, and also to help achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities.

Henderson Investment Funds Limited is the company’s AIFM and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purposes of this note, we have replaced the All-Share with the MSCI UK Index.

Manager’s view

HHI’s revenue account was relatively robust

Link UK Dividend Monitor estimates that dividend income for the UK market in aggregate will be down 40% in 2020 due to the significant number of dividend cuts or suspensions. By comparison, HHI’s income has proved relatively resilient. The manager believes that it is likely to do much better than the market average – he is estimating a fall in revenue of only about 15 to 20%.

Despite the better relative income performance, HHI has had to use some revenue reserves this year to maintain its dividend, and David thinks it may have to do the same next year, but it has reserves sufficient to cover 65%–70% of a year’s dividend going forward, which should be more than sufficient.

David believes that the worst is probably over for UK dividends and notes that companies are already starting to restore distributions. Within HHI’s portfolio, stocks such as housebuilder Persimmon, business services company Bunzl, and soft drinks company Britvic are back paying dividends at previous levels. Some others, such as the industrials Bodycote, Vesuvius and Smiths, have trimmed pay-outs but are contributing to HHI’s revenue account, once again. David thinks that dividend pay-out ratios are now at much more sustainable levels (between 40% and 50%) than they were at the start of the year.

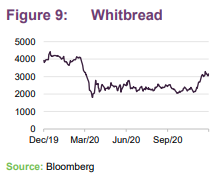

One of the sectors most impacted by the pandemic has been travel and leisure. David thinks that many of these companies may not pay dividends again until the second half of 2021, or maybe 2022. He includes Whitbread, Compass and National Express in this group.

Manager optimistic on banks

David is reasonably optimistic about the prospect for banks. He thinks that, subject to regulatory approval, they could be back paying dividends early next year, but perhaps at lower levels than previously.

Regulatory action has helped to recapitalise the banking sector over the past decade. This time around there is no banking crisis. Banks’ balance sheets were robust going into this and the ban on dividends has accentuated this.

Banks’ share prices were hit hard in the general market panic. David thinks that they are now undervalued and markets have priced in a worst-case scenario. He has been adding to exposure to the sector – starting a position in NatWest, for example. HHI already had a holding in Lloyds. These banks are valued on 0.5x/0.6x book, but David thinks they could soon be earning high single digit/low double digit returns on equity as a recovery emerges.

The risk of large impairments within the UK banks’ loan book should have been mitigated by the actions taken by the government. Big corporates have largely been bailed out (with some obvious exceptions in the retail and leisure sector), and low interest rates and furlough schemes have helped mortgage holders.

The cycle has turned

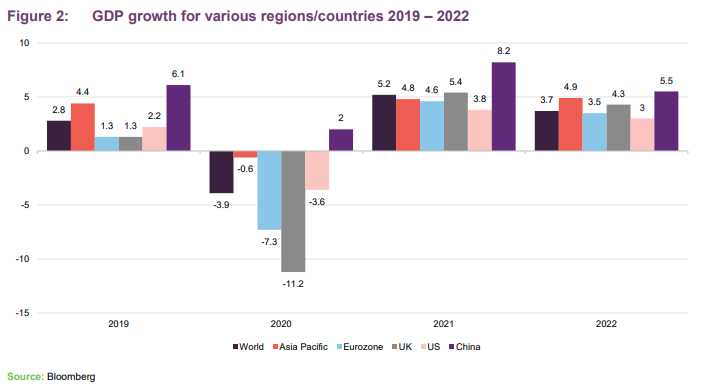

Policymakers staved off the direst economic predictions with lower rates, more QE and fiscal stimulus. David points out that, effectively, the economy has moved from being late cycle to early cycle in just six months. With effective vaccines just around the corner, we could now see a synchronised global economic recovery, which would be a positive environment for equity markets.

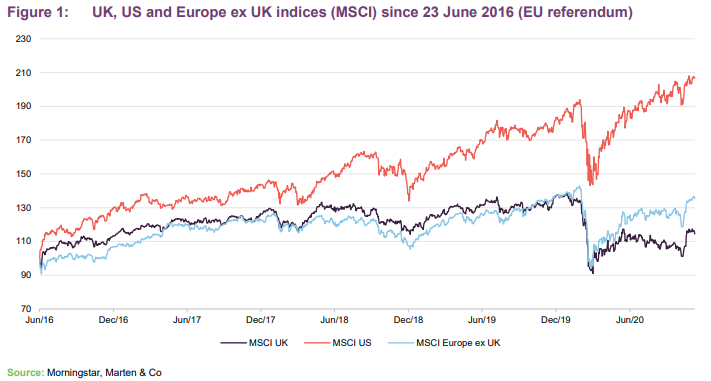

As is illustrated in Figure 1, for some time now, the UK market’s returns have been poor and, while markets such as the US are now trading close to all-time highs, the UK is trading on just 11x cyclically adjusted earnings versus 17x for the EU and 30x for the US. The manager feels that a UK economic recovery is not priced in.

In addition, UK companies are cheaper – on average – than their European peers across a range of sectors, not just those that we know have been out of favour such as banks and energy companies.

Brexit is thought to have been a major contributory factor to UK underperformance, but we should be closer to knowing whether the UK will secure a trade deal. David thinks there is a high chance of a last-minute deal – perhaps not a good deal, but a deal nonetheless. He feels that having some certainty will be positive for the UK market.

The uncertainty created by Brexit is one factor that has been weighing on sentiment towards the UK. This year, this has been compounded by our relatively poor handling of COVID-19. This is evident in GDP growth forecasts.

High yield presaging good capital returns?

On an ungeared basis, HHI’s equity portfolio yields about 4.5% and the portfolio’s dividends are covered about 1.7x by earnings, on average. Forecast average dividend growth for stocks in the portfolio is estimated to be about 8%. HHI’s structural gearing and bond portfolio enhances that income, helping to explain the higher than average headline dividend yield. At 2 December 2020, HHI was yielding 6.6%.

David points out that there are few times in HHI’s recent history when it has yielded close to or higher than 7%. He says that, in all of them, this has been followed by periods of strong returns.

Investment process

David is responsible for stock selection in the equity portfolio, asset allocating between bonds and equities and setting the day-to-day level of gearing. The split between bonds and equities in the portfolio varies, but is typically 20:80. The bond portfolio will usually be funded in whole or in part by gearing, which is limited to a maximum of 40% of gross assets. The margin achieved on the bond portfolio (HHI’s cost of borrowing is about 2.5% and the yield on the bond portfolio is about 4.0%) supplements the income account and allows HHI to hold lower-yielding, and higher-dividend growth equities, without compromising the trust’s dividend paying ability.

The bond portfolio is managed by John Pattullo and Jenna Barnard, part of a five-strong Strategic Fixed Income team. They are supported by Janus Henderson’s wider fixed-income team. John and Jenna’s approach to managing bond portfolios, and their views on the fixed interest market, have been explored in depth in our notes on Henderson Diversified Income Trust, one of the other funds that they manage. These are available on our website (click here to read our most recent note).

Within the global equity income team, each manager has a good deal of autonomy and is accountable for the performance of their funds. The managers on the team are generalists, and get to know investee companies directly rather than relying on analysts’ views. That said, there is considerable proprietary research available to David – regular meetings and a centralised system enable the sharing of research across the whole group, including the analysts based in the US.

Fundamentals, financials and valuation

For inclusion within HHI’s portfolio, each stock has to pass muster on each of three criteria – fundamentals, financials and valuation. If a stock fails on one criterion, it will be excluded from the portfolio.

- Fundamentals: the process places strong emphasis on companies that display market leadership, good visibility of earnings, strong franchises, proven management and robust defensible business models with high barriers to entry that cannot be disintermediated.

- Financials: companies with the fundamental characteristics outlined above should also demonstrate sustainable returns. David is also looking for cash-generative companies with robust balance sheets, which have invested in their businesses, have a sustainable dividend policy – the payment of dividends should not compromise investment in the business, and where management are aligned with shareholders.

- Valuation: companies should be paying dividends and offer the prospect of dividend growth. They should be valued at a discount to David’s estimation of their fair value (offering upside in absolute terms) and attractively valued relative to their peers. The valuation should also be underpinned in some way (for example, by realisable assets) so that the downside is limited. David aims to own companies for the long-term. He looks two-to-three years out when valuing businesses.

David believes that there is a sweet spot for equity income investors of companies offering yields between about 2% and 6%. He thinks that, within this range, companies tend to offer a good combination of yield and dividend growth. Above this level, it is more common to see dividend cuts/omissions and stocks that fall into value traps. Those very high-yielding companies that HHI does hold, such as the life assurer, Phoenix Group have strong cash generative business models.

To achieve a balanced portfolio, David focuses on three types of stock: stable growth companies that can provide good dividend growth through a cycle; high yielders that provide a good base level of stable, predictable income; and quality cyclicals that provide strong dividend growth during economic upswings but, given their quality nature, can still pay and maybe grow their dividend in more challenging times. Utilising gearing and owning bonds to boost income means HHI can own lower yielding companies that offer more dividend growth, typically stable growth companies and quality cyclicals. He likens his portfolio construction to putting together a well-balanced football team.

Responsible investment

Environmental, social and corporate governance (ESG) factors are taken into consideration when evaluating a company’s business model and prospects and in the ongoing monitoring of the portfolio. Janus Henderson uses a variety of sources to help identify and monitor material ESG risks, including fund manager research and input from the independent Janus Henderson Governance and Responsible Investment Team and third-party data providers, such as Sustainalytics, RepRisk, Climetrics and ISS.

ESG factors are an important consideration when it comes to determining whether a company’s business model is sustainable. The manager believes that those companies with good processes for managing ESG risk factors generally outperform.

No company will be specifically excluded from investment on ESG grounds. However, the manager will actively engage with companies and their management teams and, if the manager believes that material ESG policies and processes are not sufficient or improving, or that change is not being embraced, the position in the company will be sold or no investment will be made.

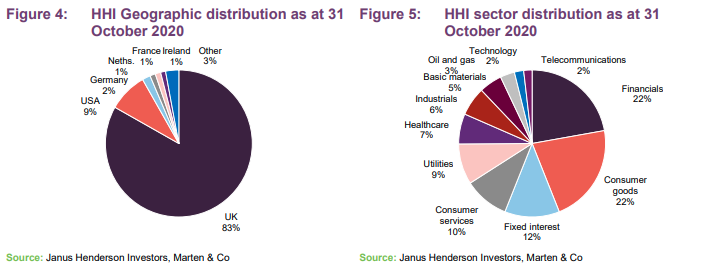

Asset allocation

HHI’s geographic asset allocation is fairly stable although, with the purchase of RWE (see below), the allocation to Germany has increased.

The exposure to financials has increased as David has begun to add to HHI’s holdings in the banking sector. The other notable change is an increase in the exposure to the utilities sector and a decrease in exposure to oil and gas. The former represents a conscious decision to increase exposure to companies focusing on renewable energy. The latter is a consequence of market moves.

Top 10 holdings

Turnover within the portfolio is low, reflecting the manager’s long-term approach. Two stocks have moved up into the top 10 list since we last published (using data at the end of April 2020). 3i and Vodafone have replaced Royal Dutch Shell and BP. The oil companies fell out of the top 10 on price weakness. David respects their ambition to transition their businesses, but acknowledges that this may take time.

Portfolio changes

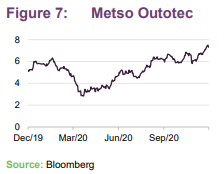

In anticipation of a more buoyant global economy, David has sought to increase HHI’s exposure to global cyclical stocks that generate a yield. With that in mind, he has been building positions in the mining giants Rio Tinto and Anglo American. He has also added a position in a Finnish company – Metso Outotec.

Metso Outotec

Metso Outotec (mogroup.com) describes itself as a frontrunner in sustainable technologies, end-to-end solutions and services for aggregates production, mining, metals refining, and recycling. Products include crushers, grinders and conveyors, and equipment used to refine ores into metals.

Metso and Outotec merged this year and David sees upside in its earnings as synergies are extracted. The combined company is targeting EBITDA margins of 15%+ and a dividend pay-out ratio of at least 50%.

Post-COVID recovery plays

With a vaccination programme on the way, David has added to positions in stocks that should benefit. These include housebuilder Bellway, food service group Compass, and transportation company National Express.

Bellway reinstated its dividend in October, having reopened its construction sites in May. It may have benefitted from the stamp duty holiday but it is notable that orders for new homes are running ahead of levels in 2019.

Many of these companies placed stock to shore up balance sheets in the face of the pandemic. For example, Compass Group raised £2bn via a rights issue in May. Its food service business has been hit hard by lockdown measures. It used the money to reduce debt and David believes that this now gives them the strength to take market share from weaker competitors as the economy recovers.

More renewables exposure

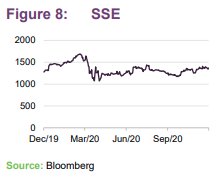

HHI’s utilities exposure has been increased with a greater focus on companies generating renewable energy. David believes that some stocks within the utilities sector are now in a position to offer decent capital growth as well as income. HHI owns positions in SSE in the UK, EDP in Portugal and RWE in Germany. All of these companies have strong pipelines of renewable projects.

SSE (sse.com) is already one of the UK’s largest generators of renewable energy, with substantial wind and hydroelectric assets. It has been developing and monetising new renewables projects. SSE has a half-share in the development of 4.7GW of offshore wind projects (Seagreen Wind Farm and Dogger Bank Wind Farm). It is also developing a 443MW onshore wind farm (Viking). Further out, it has an additional 5.5GW of offshore wind projects where it has secured seabed rights, and is seeking development consent and other prospects beyond that.

EDP (edp.com) is Portugal’s dominant power company and a global leader in renewables generation with 20GW of installed generation capacity across wind, solar and hydroelectric. It has secured a further 6.5GW of development projects across Europe, and North and South America. Two thirds of this is in onshore wind and the balance split between offshore wind and solar.

This summer, RWE (group.rwe/en) cemented its position as Europe’s third-largest renewable energy generator with the conclusion of an asset-swap with E.ON. It has a sizeable existing portfolio, including 8.7GW of wind and solar projects. It is expanding this with the development of offshore wind in UK and German waters, onshore wind in the US and solar projects in the US and Australia – all projects that should complete by the end of 2022.

Low-cost leaders

David has also been adding to positions in stocks which he believes can benefit as they exploit their market positions to take share from higher-cost competitors.

These include:

- Whitbread, where David thinks that its Premier Inn business is in much better shape than Travelodge (which has been in dispute with its landlords);

- 3i, which has a big position in Action (a fast-growing, non-food discounter). That company has been growing all the way through the crisis; and

- Tesco, which David feels has been overlooked by many investors and has the firepower to compete against the discount food chains. It increased its online shopping capacity by 1.5x in six weeks in response to COVID-19, bringing forward five years’ planned growth in this area. The company is paying down debt and reducing its pension deficit. With improving free cash flow, David thinks we could see Tesco buying back its shares in future.

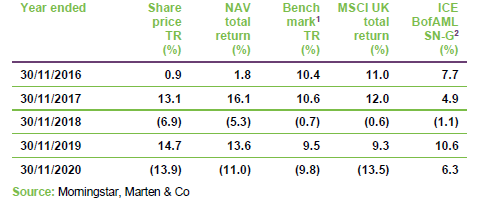

Performance

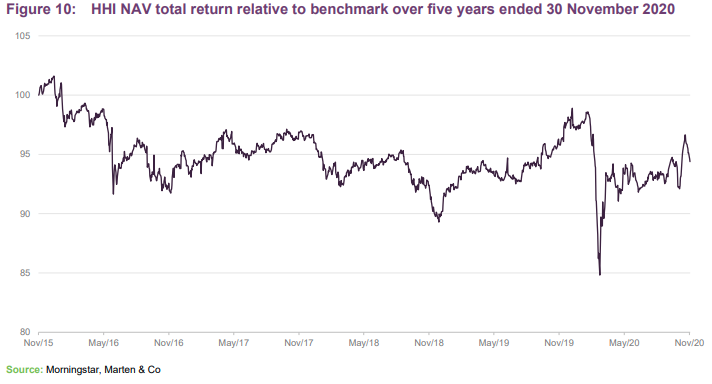

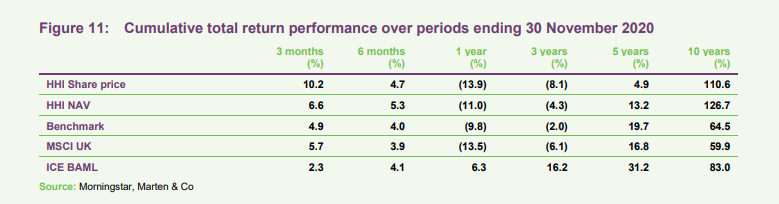

At the start of the five-year period shown in Figure 10, HHI’s relative performance may have been held back by the market’s focus on growth stocks and a relative overweight exposure to domestically-focused stocks ahead of the EU referendum in 2016.

Since then, HHI has largely kept pace with markets. In 2020, the sharp underperformance that the trust saw in the general market panic in March (as gearing amplified the fall in markets) has largely been recouped over the summer.

Based on some figures provided to us by the manager, we can say that, over 2020, HHI’s relative performance has been boosted by having underweight positions in HSBC and Shell, as well as strong relative returns from the likes of Roche, Rio Tinto and Phoenix.

Detractors from the trust’s relative returns this year are dominated by companies that were hit hard by COVID-19. These include National Express and Go-Ahead (as travel restrictions held back their business), Informa (whose exhibition and events business was impacted by lockdown measures) and Hammerson (as its shopping centres closed).

Peer group

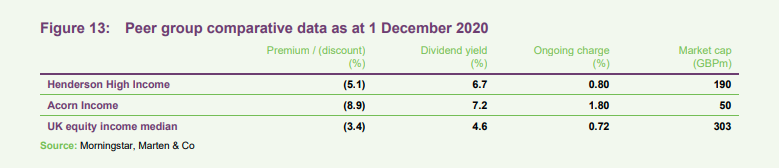

HHI sits within the AIC’s UK equity income and bond sector. There is just one other constituent, Acorn Income, and that is a split capital trust with a small-cap focus. Acorn’s capital structure amplifies NAV moves, both positive and negative. In this section, we have also compared HHI to the UK equity income sector, which, following the merger of Perpetual Income and Growth with Murray Income, and The Investment Company’s adoption of a flexible investment mandate, now has 23 constituents.

Within that group are a few investment companies with unusual structures or asset exposures including British & American (highly-geared and significant biotech exposure), Value & Income (large property weighting) and Law Debenture (subsidiary engaged in commercial activity). The closest comparator to HHI is probably Shires Income, which is a smaller trust and whose fixed interest investments are largely represented by preference shares.

Acorn Income’s gearing boosts its performance when markets are rising but increases the volatility of its returns.

HHI’s ongoing charges ratio is competitive for its size and would likely be lower if the trust was as large as the median fund in the UK equity income sector.

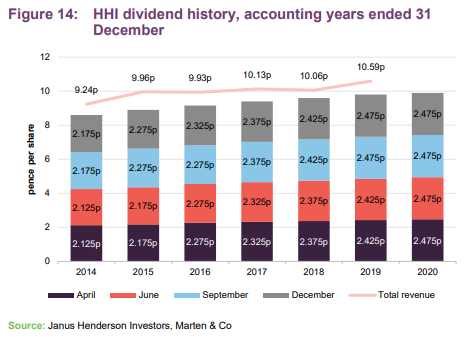

Dividend

On 7 May 2020, in the face of widespread dividend cuts across the UK market, HHI’s board said that it intended to use revenue reserves where necessary to maintain the quarterly dividend at the existing level of 2.475p for the remainder of the financial year.

At the half-year stage, HHI’s revenue per share was 4.63p, down from 5.57p for the equivalent period a year earlier. Against that, HHI declared two quarterly dividends of 2.475p, implying a small transfer from reserves.

At the end of June 2020, HHI had revenue reserves of £10,263,000, equivalent to 8.0 pence per share.

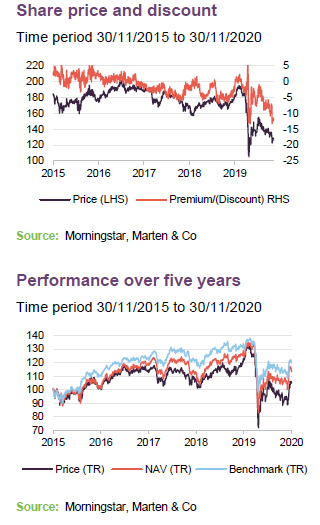

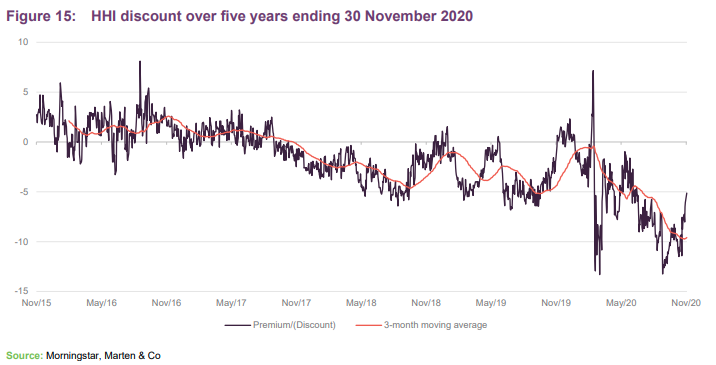

Premium/discount

Over the 12 months ended 30 November 2020, HHI ranged between trading at a discount of 13.3% and a premium of 7.2%. The average discount over this period was 5.3%. At 2 December 2020, HHI was trading at a discount of 5.0%.

The board considers the issuance and buy-back of the company’s shares where prudent, subject always to the overall impact on the portfolio, the pricing of other comparable investment companies and overall market conditions. The board believes that flexibility is important in this regard and that it is not in shareholders’ interests to set specific levels of premium and discount for its issuance and buy-back policies.

Fees and costs

HHI’s base management fee is charged at 0.5% on the first £250m of adjusted gross assets (gross assets less current liabilities and less any investment in Janus Henderson or the funds it manages and advises) and 0.45% on assets above this figure. The fee is payable quarterly in arrears.

There is also a performance fee, calculated annually, of 15% of returns above the benchmark return plus 1%. The performance fee is capped at 0.4% of average adjusted gross assets in the year under consideration, with the excess carried forward for up to three years to offset against subsequent underperformance. There is also a high watermark.

Janus Henderson and its subsidiaries provide accounting, company secretarial and general administrative services to HHI, and delegates some functions to BNP Paribas Securities Services.

The company’s ongoing charges ratio for the year ended 31 December 2019 was 0.80%, unchanged from the prior year.

Capital structure and life

At 2 December 2020, HHI had 128,596,278 ordinary shares in issue and no other classes of share capital.

The company’s accounting year end is 31 December and AGMs are usually held in May, in London. However, this year the AGM was delayed until June because of the restrictions imposed by measures to tackle COVID-19.

HHI does not have a fixed life but shareholders are asked on a five-yearly basis whether they want to approve the continuation of the trust. The last continuation vote was held at the AGM in June 2020. Shareholders voted overwhelmingly (99.8% of those voting) to support continuation. The next such vote is scheduled for 2025.

Gearing

HHI is permitted to borrow up to 40% of gross assets, but in practice, gearing will usually be lower than this, and the majority of it tends to be used to finance fixed interest investments rather than just gearing the equity portfolio. The trust should exhibit lower volatility of returns than a pure equity trust with similar levels of gearing. HHI has a £45m floating rate revolving credit facility provided by Scotiabank and a £20m unsecured note which pays a sterling coupon of 3.67% per annum (split into two equal payments in January and July). The note will expire on 8 July 2034.

At 30 November 2020, HHI’s net gearing was 24.9%.

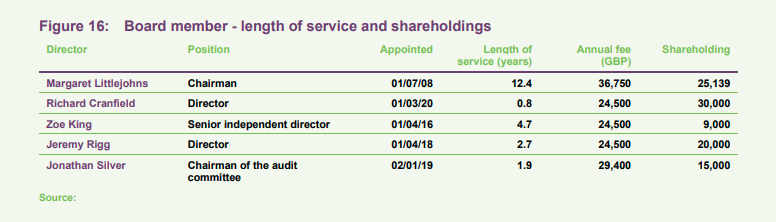

Board

HHI’s board consists of five directors, all of whom are independent of the manager, non-executive and who do not sit together on other boards. HHI is implementing a board succession plan over a five-year time frame (between 2016 and 2021). Four new directors have been recruited to date. The newest recruit to the board was Richard Cranfield. He replaced Anthony Newhouse, who stepped down from the board following the 2020 AGM. The chairman, Margaret Littlejohns, intends to retire from the board following the 2021 AGM. She will be succeeded by Jeremy Rigg.

19.7% of shares voted at this year’s AGM were voted against Margaret Littlejohn’s reappointment, presumably on the grounds that she has been a director for more than 10 years. The board has stated that, following the chairman’s retirement in 2021, no director is expected to serve for more than nine years unless particular circumstances warrant it, for example to facilitate effective succession planning, maintain continuity in post (particularly in regard to the chairman) or promote diversity.

Margaret Littlejohns

Margaret has been the chairman of the board since 3 May 2016. She spent the early part of her career with Citigroup, gaining 18 years’ experience in both the commercial and investment banking divisions, latterly specialising in derivatives and market risk management. Between 2004 and 2006, she co-founded two start-up ventures providing self-storage facilities to domestic and business customers in the Midlands, acting as finance director and company secretary until the businesses were sold to a regional operator in 2016.

Margaret was a non-executive director of JPMorgan Mid Cap Investment Trust Plc from 2009 to 2019, and latterly chairman of its audit and risk committee. In 2017, she became a non-executive director of Foresight VCT Plc and in 2018 she was appointed to the board of UK Commercial Property REIT Limited, where she serves as chairman of the risk committee. She is also a trustee of The Lymphoma Research Trust and a member of the development committee of Southern Housing Group.

Richard Cranfield

Richard is a partner at Allen & Overy LLP, having joined them from university in 1978. Richard is global chairman of the Corporate Practice and co-head of its Financial Institutions Group. He was appointed global head of Corporate in 2000, and in 2010 took a step back from management to focus on client relationships.

In June 2019, he was appointed to the board of IntegraFin Holdings Plc, becoming chair in October 2019. IntegraFin Holdings Plc is a FTSE 250 company, the ultimate owner of the investment platform provider Transact.

Zoe King

Zoe is a director of Smith & Williamson Investment Management Limited, specialising in the management of private client portfolios. She also acts as an independent director to the Dunhill Medical Trust investment committee and is a member of the Trinity College Oxford investment committee, the Carvetian Capital Fund investment committee and the Stramongate S.A. shareholder advisory committee. She was formerly a vice president at Merrill Lynch Mercury Asset Management and a fund manager at Foreign & Colonial Investment Management. She graduated from Oxford University in 1994.

Jeremy Rigg

Jeremy is currently an independent investment consultant. He has over 20 years’ experience within the investment management industry, having held roles at Schroder Investment Management (UK) Limited and as a senior investment manager at Investec Asset Management limited. In 2004, he was a founding partner of Origin Asset Management, a boutique equity investment manager, which grew successfully and was acquired by Principal Global Investors in 2011. Jeremy graduated from St Andrews University in 1989.

Jonathan Silver

Jonathan has held various senior financial positions, including 21 years as chief financial officer on the main board of Laird Plc from 1994 to 2015. He is a non-executive director and chairman of the audit committee of Spirent Communications Plc, a position he has held since 2015. He is also chairman of the audit committee at Invesco Income Growth Trust Plc, having been appointed in 2007. Since 2017, he has been a non-executive director of East and North Hertfordshire NHS Trust. Jonathan is a member of the Institute of Chartered Accountants of Scotland.

Previous publications

Readers may wish to read our earlier notes on HHI. Please click the links.

The trust that delivers, initiation note, published November 2019

Able to commit to the dividend, update note, published May 2020

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson High Income Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.