Healthy yield attracts investors

Healthy yield attracts investors

The managers of International Biotechnology Trust (IBT) have focused its portfolio in oncology, diseases of the central nervous system and rare diseases – areas where pricing pressure is less of an issue. This should cushion the trust as we approach election year and (as is usually the case in the US political cycle) threats to intervene in drug pricing create volatility in the biotech sector.

In an environment where concern has been building that we are approaching the end of this economic cycle, it might be worth remembering that this is not a cyclical sector. Demographics and innovation combine to sustain demand and broaden the addressable market.

Aided perhaps by its sector-leading dividend yield, the trust remains popular with investors and has been issuing shares to meet demand.

Access to the fast-growing biotech sector

Access to the fast-growing biotech sector

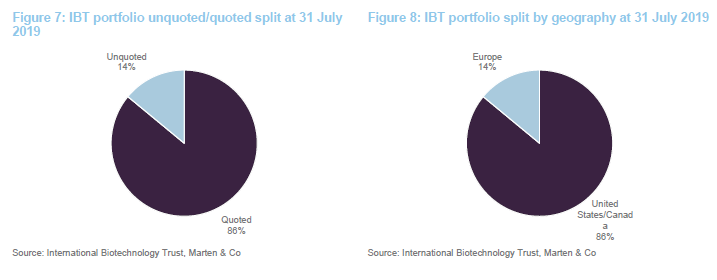

IBT is the longest-established of the London-listed funds specialising in the biotech/healthcare sector. It aims to achieve long-term capital growth by investing in biotechnology and other life sciences companies, and offers investors the highest yield in the sector. The portfolio is invested primarily in quoted companies, but IBT also has exposure to unquoted companies through a well-diversified investment fund.

Fund profile

Fund profile

IBT aims to achieve long-term capital growth by investing in biotechnology and other life sciences companies. Notably, it also provides a dividend equivalent to 4% of NAV, making it the highest-yielding fund in its peer group. This is despite it investing exclusively in a sector where companies do not usually provide income.

A small portion of IBT’s portfolio is invested in unquoted stocks.

For the quoted portion of the portfolio, the manager seeks to provide returns to shareholders ahead of the NASDAQ Biotech Index (NBI). The NBI is a market-cap weighted index where the four largest positions are capped at 8%.

The manager

The manager

IBT is managed by SV Health Managers LLP, which is part of the wider SV group, advising and managing seven healthcare/life sciences venture capital funds with over $2bn in capital under management. It is also the manager of the £250m Dementia Discovery Fund and has offices in Boston and London.

The lead manager is Carl Harald Janson, who joined SV Health in September 2013. He is assisted by Ailsa Craig (investment manager) and Marek Poszepczynski (portfolio manager). Kate Bingham (one of SV Health’s managing partners) manages the trust’s unquoted portfolio. She sits with Carl Harald and Ailsa on the investment committee which decides which investments to make on behalf of IBT. More information on the management team is provided on page 16.

Resilient in a downturn

Resilient in a downturn

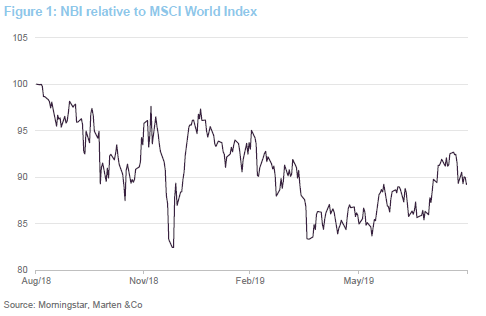

The biotech sector has had a fairly turbulent 2019 and, over the 12 months to the end of August 2019, did not kept pace with broader market.

To some extent, the uncertainty created by geopolitical events, such as the US/China trade war and Brexit, has caused investors to sit on their hands. More specific to the sector, however, has been a resurgence of political posturing in the US on drug pricing. This will be a familiar story to investors who have been following the sector for some time. In the run up to the US elections, the healthcare sector tends to become a political football.

It is important to remember that the companies in IBT’s portfolio tend to sell their products globally. Weak sterling has been beneficial to performance, because the trust is priced in sterling and the UK is a relatively small part of the global healthcare market. Events in the US have more of an impact.

The sector’s fundamentals are strong

The sector’s fundamentals are strong

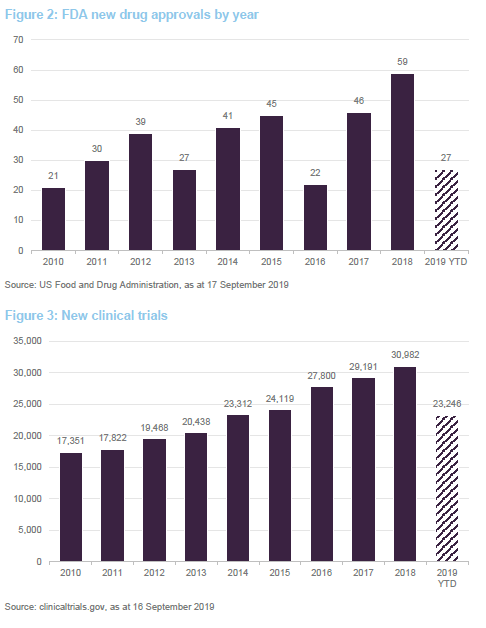

IBT’s manager believes that the sector’s fundamentals remain strong. There were record drug approvals in the US last year and it is expected that this pace will continue, albeit that we are behind the curve in 2019 year to date. Innovation is running high, as is evident in the ever-increasing number of clinical trials (Figure 3) and the manager believes that the sector’s long-term future is secure.

Demand growth seems inexorable

Demand growth seems inexorable

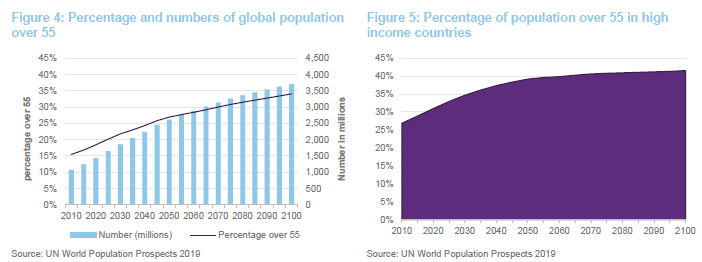

It is fair to say that there is inexorable upward pressure on healthcare spending. This is driven largely by demographic pressures as an aging population has greater healthcare needs. IBT’s manager cites, as evidence of this, analysis by the Kaiser Family Foundation, which shows that over 55s make up 29% of the US population but account for 55% of healthcare spend. That is a pattern that is replicated globally.

It is clear too that the global population is ageing. In high income countries the proportion of over 55s is higher than average. In addition, a growing middle class in emerging economies is adding to demand for therapies.

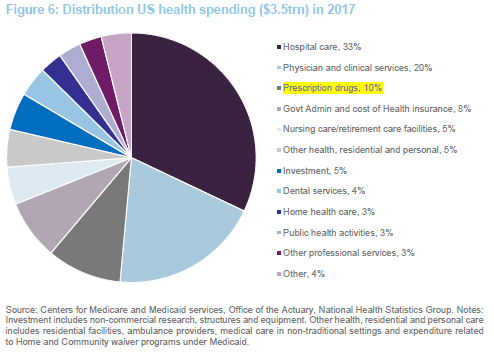

However, spending on drugs, which garners most of the adverse headlines, is just 10% of total Federal healthcare spending in the US. What’s more, many drugs help keep patients out of hospital and therefore help reduce overall health care spending.

Focus on companies with pricing power

Focus on companies with pricing power

Conscious of the debate on healthcare spending, IBT’s manager is focusing on firms that it believes have pricing power. Many of these operate within areas of unmet clinical need or have therapies that offer clear advantages over alternatives. The bulk of the portfolio is concentrated in the areas of oncology, diseases of the central nervous system and orphan drugs (drugs that address rare conditions and which may benefit from R&D subsidies). The growth of generics and biosimilars has helped to rein in pricing in more mature therapeutic areas. IBT is not exposed to the more controversial areas of the market – such as insulin or opioids.

The manager highlights that combination of secular demand for the biotech sector’s products, the growing pipeline of new therapies and IBT’s bias towards companies with strong pricing power should make this trust resilient in the event of any economic slowdown, even outright recession.

Investment process

Investment process

Although the trust has an investment universe of some 700 listed companies in the US and EU, in practice it is invested mostly in the c200 constituents of the NBI.

Within the quoted portion of IBT’s portfolio, the manager operates as a bottom up stock picker, with a bias towards subsectors where it believes companies tend to enjoy pricing power or at least are not subject to pricing pressure. The strategy is designed to identify potentially successful drugs, via attractively priced equities, while, if possible, avoiding exposure to binary events (see below).

Like other biotech specialist investors, SV Health Managers attends healthcare investment banking conferences and meets potential investee companies’ managements on non-deal roadshows. The manager has access to sell-side research, data aggregators (Bloomberg etc) and can obtain expertise from key opinion leaders (doctors considered to have in-depth experience in specific fields). It can also draw upon its own in-house expertise. SV Health also organises a large number of one-to-one meetings with management teams via video conference calls.

These interactions allow the managers to examine the investment proposition and compare each company against others in the same space. SV Health’s significant investment of time and effort in building and maintaining its database represents a significant competitive asset.

As part of this, a comprehensive news-flow analysis, led by Ailsa Craig, helps the team to assess the likely timing of key data events. To add substance to their analysis, Marek Poszepczynski, whose background is in biotech business development (specifically M&A and licensing), runs various valuation analyses on companies whose market values seem out of kilter with their underlying assets. This helps to drive portfolio decisions and tends to identify likely M&A candidates.

Finally, the management team is headed up by Carl Harald Janson, a trained medical doctor with a PhD in immuno-oncology. His CV includes a host of biotechnology companies, as well as a six year stint as the head of Carnegie’s biotechnology fund, where he was rated as the world’s top-performing biotech manager.

Portfolio companies should meet a series of quantitative criteria, including:

- addressing areas of unmet medical need;

- having strong intellectual property and/or commercial exclusivity;

- competitive advantage (with market pricing power); and

- adequate financing to deliver scientific and commercial goals.

The team’s investment process also includes a qualitative judgement based on the expertise of the managers, including assessing quality of management and the perceived views of the sell-side/buy-side (i.e. analysts and investors).

In the same way as identifying companies that are attractively priced, the team has to monitor stocks within the portfolio to establish where profits can or should be taken, or where, perhaps after a setback, the investment proposition has changed. Investors in the sector have a habit of shifting from over-pessimism to over-optimism and when a stock hits the team’s valuation targets it will usually be sold. This sell discipline is extremely important for maintaining outperformance.

IBT mostly buys stocks in the secondary market but also invests in IPOs. It does not, as a policy, make use of financial derivatives to hedge individual stock or currency risk, adopt a market-neutral position or otherwise seek to boost investment returns.

Managing binary events

Managing binary events

As a deliberate risk-mitigation strategy, the managers try to minimise the trust’s exposure to binary events, typically the results of clinical trials, which can trigger large positive or negative changes in the share price (rises of up to 100% or falls of 80% are not uncommon).

This recognises the difficulty for even for the most experienced medics, scientists or investment managers to predict the outcome of these events and the approach has considerable merit.

IBT’s manager says that the market is often optimistic in the run up to a significant clinical milestone. Its strategy allows IBT to benefit from the anticipatory price rise but, by selling ahead of the actual announcement, the managers say that:

- IBT can buy the de-risked asset back after a positive announcement (usually at a better risk-adjusted valuation), or

- IBT avoids the sharp losses that tend to occur where an announcement is negative.

IBT’s manager says that this is an attractive and surprisingly low risk strategy. They find that share price momentum often can continue for several weeks following the initial surge on a positive announcement and say that this can sometimes exceed 100%, over the longer term, aided by index tracking and other effects. This is in contrast to the permanent loss of capital that typically accompanies the catastrophic falls that occur on day one of a negative announcement.

It should be noted however that, in practice, binary events are difficult to eliminate entirely. The timing of announcements cannot always be accurately predicted, especially in the case of an unsuccessful trial being halted early for example, and sharp moves can also occur from other situations such as results from competitor trials. Furthermore, in the case of a significant event affecting a very large index constituent, the trust may opt to hold a stock through a key trial readout.

Investment restrictions

Investment restrictions

IBT’s managers operate within the following investment restrictions:

- the company will not invest more than 15% in aggregate, of the value of its gross assets in any one individual company at the time of acquisition;

- the great majority of the company’s assets will be invested in the quoted biotechnology sector with a global mandate across the entire spectrum of quoted companies;

- gearing is restricted to 30% of NAV; and

- the company will not invest more than 15% in aggregate, of the value of its gross assets in other closed-ended investment companies quoted on the London Stock Exchange or any other stock exchanges.

Unquoted investments

Unquoted investments

While historically it made direct investments in unquoted companies, IBT made a $30m commitment to SV Fund VI in September 2016. As the drawdown of the commitment to SV Fund VI has evolved, the portfolio of direct investments has continued to run-off, returning value to shareholders as it does so. As a result, the unquoted portfolio is now mostly through the diversified fund, resulting in a more consistent exposure to unquoted companies.

Tactical use of gearing

Tactical use of gearing

As discussed on page 16, IBT is permitted to borrow. However, rather than having a strategy of being permanently geared, IBT’s manger uses gearing tactically, when valuations fall and/or volatility spikes, to take advantage of specific opportunities. The manager says that gearing is unlikely to ever exceed 15%.

Asset allocation

Asset allocation

As at the end of July 2019, IBT had 79 companies in its portfolio, made up of 69 quoted holdings, one venture fund investment (which has 22 holdings) and nine direct unquoted holdings.

Perhaps the most significant shift in the distribution of the portfolio since we last wrote on IBT has been a significant increase in the trust’s exposure to companies addressing rare diseases. This is explained by the manager’s stock selection decisions rather than any deliberate attempt to target a particular therapeutic area.

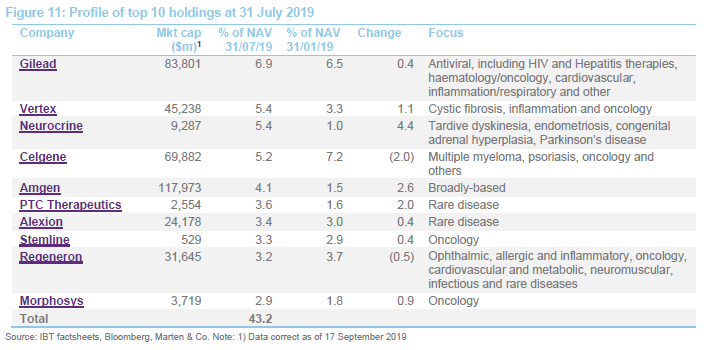

IBT’s managers have been increasing positions in larger biotechs on valuation grounds. These include Celgene, Gilead, Amgen and Biogen.

10 largest quoted holdings

10 largest quoted holdings

At the end of July, since we last wrote on the company, Incyte, Acadia, Illumina and Exelixis had dropped out of the top 10 holdings to be replaced by Neurocrine, Amgen, PTC and Morphosys.

Incyte did well on the back of the success of its Jakafi (ruxolitinib) drug and also rose on takeover rumours. The managers decided to take profits on the position.

Regeneron and Illumina have underperformed this year but remain within the portfolio. Regeneron’s shares fell on the prospect of increased competition for its Dupixent treatment for atopic dermatitis and Eylea.

Neurocrine was weak in April as prescriptions for Ingrezza disappointed briefly but bounced back in May. The managers topped up the position believing that demand for Ingrezza would be robust. They say that this is one of their favourite stocks.

PTC Therapeutics is developing, in partnership with Roche, a treatment (risdiplam) for spinal muscular atrophy. This has clear advantages over Biogen’s Spinraza, which has to be injected into the spine while risdiplam can be taken orally.

The managers also highlight Stemline, which is developing therapies to tackle rare cancers. They believe there is low risk of adverse trial results. In addition, while the pricing for these treatments looks high, it reflects the rarity of these diseases (the R&D costs need to be recovered from a small base of patients) and the lack of alternative treatments. Stemline’s lead product is ELZONRIS, which is used to treat adult and paediatric patients, two years or older, with blastic plasmacytoid dendritic cell neoplasm and is being evaluated in clinical trials in additional indications including chronic myelomonocytic leukaemia, myelofibrosis and acute myeloid leukaemia.

Performance

Performance

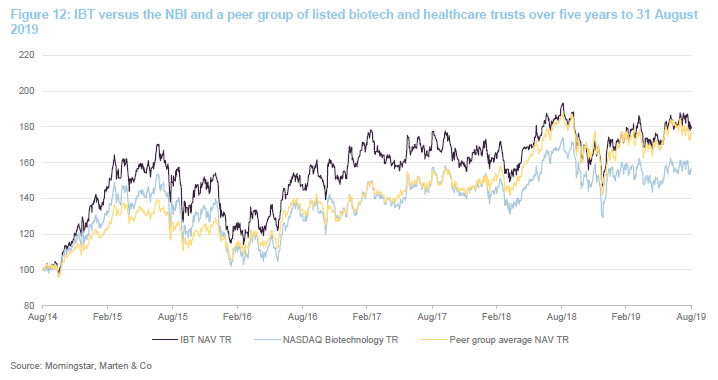

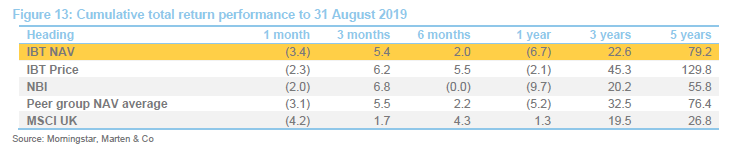

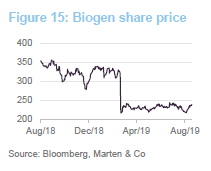

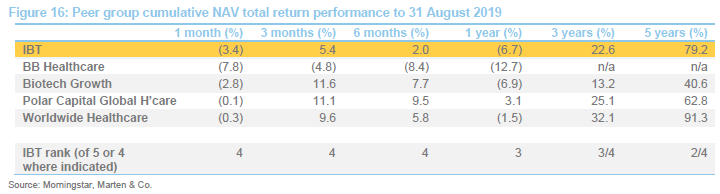

IBT’s exposure to smaller companies has been beneficial, thanks to the manager’s stock picking skills. The takeover of Celegne was beneficial to performance as was Pfizer’s bid for Array Biopharma. One other influential factor, at least in terms of the trust’s performance relative to its peers and the NBI, was IBT’s low weighting in Biogen in March 2019.

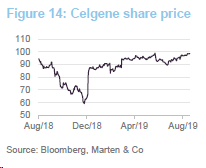

Celgene

Celgene

Celgene was bid for (by Bristol-Myers Squibb) during the period. That transaction is subject to approval by competition authorities. The transaction is expected to complete towards the end of 2019/beginning of 2020, and Bristol Myers has already met one condition set by the competition authorities by selling OTEZLA, which is used to treat psoriasis and psoriatic arthritis, to Amgen for $13.1bn. Celgene has been boosted by the approval of Inrebic (a JAK inhibitor used to treat myelofibrosis – a bone marrow disorder).

Biogen

Biogen

Biogen is a large, profitable biotech company with existing products in multiple sclerosis (MS) and spinal muscular atrophy. Having an underweight exposure to Biogen compared to the NBI (1% versus 8%) proved beneficial in March when that company reported the termination of phase III trials of its Alzheimer’s drug, aducanumab. As we have mentioned before, IBT’s managers try to mitigate binary risk around trial outcomes affecting large biotech stocks by holding a market weight position, in advance of the expected read-out. The trial read out for aducanumab was not expected until next year, however the managers’ in-depth study of the aducanumab trial and consultation with experts had led them to a low conviction of its likely success. In June, Biogen completed the acquisition of Nightstar Therapeutics, a clinical-stage gene therapy company focused on treatments for inherited retinal disorders. The company has late-stage trials running in a range of areas including MS, Progressive Supranuclear Palsy (PSP), Epilepsy, Lupus, Parkinson’s, Alzheimer’s, Choroideremia and stroke.

Peer group

Peer group

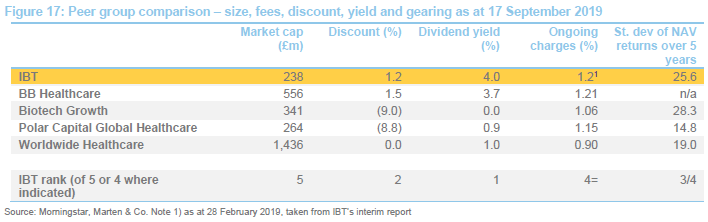

IBT sits within the AIC’s biotechnology and healthcare sector, which, including IBT, has six constituents. Within this group, three of the funds are focused primarily on the wider healthcare sector: BB Healthcare, Polar Capital Global Healthcare and Worldwide Healthcare, and three are focused primarily on the higher-beta biotech area: IBT, The Biotech Growth Trust and Syncona. Of these, Biotech Growth is IBT’s closest comparator.Syncona has been excluded from our peer group as it is currently in a transition phase. Syncona was formed by the merger of the Battle Against Cancer Investment Trust and certain funds managed by the Wellcome Trust and Cancer Research UK. It currently holds a fund of funds portfolio, a substantial amount of cash and a portfolio of direct investments in early-stage biotech companies.

IBT is growing by issuing shares, thanks to its premium rating, but as yet remains the smallest of the funds in the peer group. On average, the sector trades on tight discounts/premiums, the exceptions being Biotech Growth and Polar Capital Global Healthcare (both have underperformed IBT by a significant margin over the long term). IBT’s ongoing charges ratio has fallen sharply as the company has sought to control its costs.

Dividend

Dividend

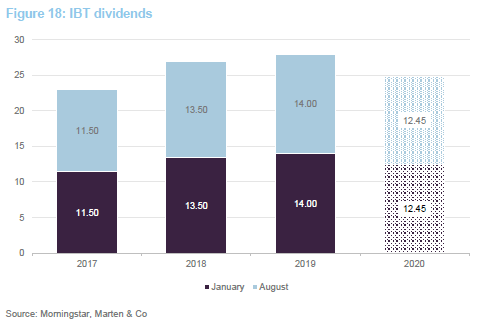

IBT pays a dividend equivalent to 4% of its preceding year-end NAV in two equal instalments in January and August each year. The dividend is largely paid from capital reserves. The payments made in 2019, totalling 28p, were based on an NAV of 31 August 2018 of 699p. IBT’s NAV at the end of August 2019 was 622.6p, implying dividends totalling 24.9p in 2020.

Premium/discount

Premium/discount

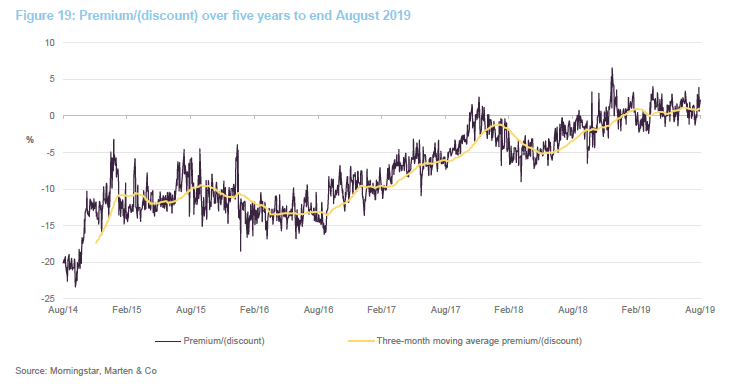

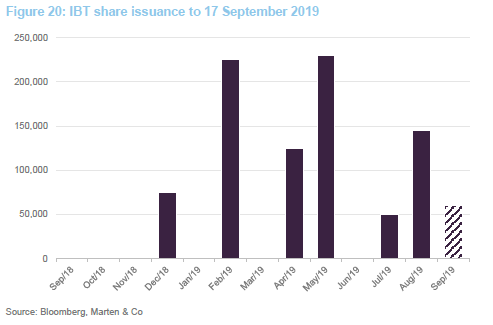

During the 12 months to 17 September 2019, IBT has traded between a discount of 6.5% and a premium of 6.6%, with an average premium of 0.3%. As illustrated in Figure 19, the broad trend during the last five years has been one of a gradual tightening of IBT’s discount, and the trust has recently been trading at a modest premium, which has allowed it to reissue stock from treasury. This has dual benefits for existing shareholders in that it should, all things being equal, lower the ongoing charges ratio as IBT’s fixed costs are spread over a larger asset base and a larger shareholder base should also support greater liquidity in IBT’s shares. At each AGM, the board asks shareholders to grant it powers to issue new shares and to issue these without first offering them to existing shareholders. The powers cover up to 10% of IBT’s then issued share capital and the shares cannot be issued at a price that is less than the last published NAV. These powers expire at the next AGM (or after 15 months, whichever is earlier). The board also has power to buy back up to 14.99% of IBT’s issued share capital which, once again, expires at the next AGM. Shares bought back can be held in treasury. The board has said that no treasury shares will be reissued at a price less than the prevailing NAV. As Figure 20 shows, IBT has been issuing shares over the course of the past year. The shares were reissued from treasury. The share issuance has helped moderate IBT’s premium. The managers believe that the company’s rating and stock issuance reflect increasing interest in the company from retail investors.

Fees and costs

Fees and costs

The manager is entitled to a management fee payable monthly at the rate of 0.9% per annum of the NAV. In addition, the manager is entitled to an annual performance fee.

The portfolio consists of two pools: quoted and unquoted. The performance fee on the quoted pool is 10% of relative outperformance above the NBI in sterling plus a 0.5% hurdle.

The performance fee on the unquoted pool is 20% of net realised gains, taking into account any unrealised losses but not unrealised gains. There is no double charging ofinvestment management fees in relation to IBT’s commitment to SV Fund VI. The performance fee is calculated as 20% of realised gains once all committed capital has been repaid.

The payment of the performance fee is subject to the following limits:

- the maximum performance fee in any one year is 2% of average net assets;

- any underperformance of the quoted portfolio against the benchmark is carried forward for the current financial period plus two succeeding periods; and

- performance fees in excess of the performance fee cap are carried forward for the current financial period plus two succeeding periods and are offset against any subsequent underperformance before being paid out.

Under normal circumstances, IBT’s contract with the manager is terminable by either side on 12 months’ written notice.

Fund accounting administration, depositary and custody services are provided by HSBC Bank Plc. Company secretarial services are provided by BNP Paribas Securities Services S.C.A. who delegate this activity to their wholly owned subsidiary, BNP Paribas Secretarial Services Limited. The auditor is PricewaterhouseCoopers LLC (PWC), which has been in place since 2007. A minority (10.6%) of shareholders voting at the December 2018 AGM voted against PWC’s reappointment, presumably on the grounds that the auditors had been in place since 2007, but the board considers that the auditors remain independent.

IBT’s ongoing charges ratio for the year ended 31 August 2018 was 1.36%. However, by the interim stage (28 February 2019) this had fallen to 1.2%, reflecting the company’s efforts to control its costs.

Capital structure and life

Capital structure and life

IBT had 38,457,663 ordinary shares in issue at the date of the publication of this report and 2,885,000 ordinary shares in treasury. There are no other classes of share capital. IBT’s financial year end is 31 August and its AGMs are usually held in December.

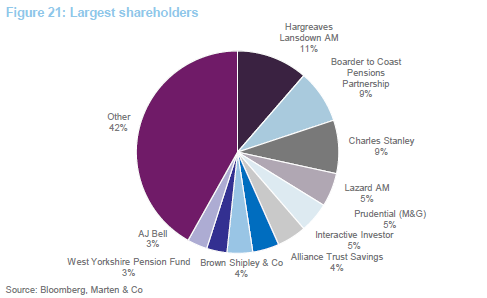

The most significant change to IBT’s register in recent times has been the reduction of the stake held by Lazard (from around 30% to about 5% today).

Gearing

Gearing

There is a £35m overdraft facility in place with HSBC Bank Plc with a cost of borrowing set at the Bank of England base rate +1.5%. Gearing is limited to 30% of NAV but, in practice, IBT operates with much lower gearing levels than this (typically between +10% to -10%). At 31 August 2019, IBT had a net cash position of 1%.

Life

Life

Shareholders are asked to vote on the continuation of the company at two-yearly intervals. The last such vote was held at the AGM in December 2017 and continuation was approved by 99.99% of shareholders voting. The next vote is scheduled for the December 2019 AGM.

The management team

The management team

The team at SV Health Managers LLP has over 60 years’ experience between them.

Carl Harald joined SV Health in 2013 as the lead investment manager for IBT. He qualified as a medical doctor in 1988, completed his PhD in immune oncology in 1990 at the Karolinska Institutet in Sweden, and qualified as Certified European Financial Analyst from the Stockholm School of Economics in 1999. During his more than six years as principal fund manager of Carnegie Biotechnology Fund, Dr Janson was the top performing biotech fund manager worldwide. During this time, the Carnegie Biotechnology Fund achieved a total return of 54% (US dollars) while the NBI returned minus 26% (US dollars), a relative outperformance of approximately 80% (US dollars).

Ailsa Craig joined SV Health in 2006. She has a BSc (Hons) in Biology from the University of Manchester. Ailsa was awarded the IMC in 2002 and the Securities Institute Diploma in 2007.

Marek Poszepczynski joined SV Health in 2014. He has an MSc in Biochemistry and an MSc in Business Management from the Royal Institute of Technology, Stockholm.

Kate Bingham joined SV Health in 1991 and is one of its managing partners. She has a first class degree in Biochemistry from Oxford University, and graduated from Harvard Business School with an MBA.

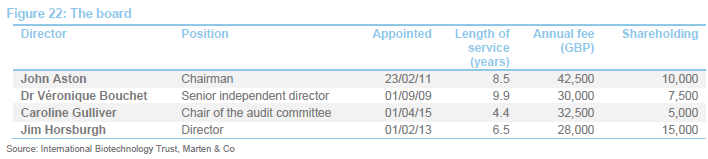

The board

The board

IBT has four directors all of whom are independent of the manager and who do not sit together on other boards. They stand for re-election every three years. A minority (10.5%) of shareholders voting at the December 2018 AGM voted against Caroline Gulliver’s re-election, presumably on the grounds that she has been on the board for more than nine years.

IBT’s articles of association limit the aggregate fees payable to directors to £250,000 per annum. The fees for the financial year ended 31 August 2019 were unchanged on the previous year.

John Aston OBE has been IBT’s chairman since 12 December 2017. He was CFO of Astex Therapeutics Ltd between January 2007 and May 2010 and held the same position at Cambridge Antibody Technology for 10 years to 2006. Prior to this he was a director in investment banking with Schroders in London and previously worked for British Technology Group and Price Waterhouse. He is a chartered accountant and has a degree in Mathematics from Cambridge University. He is also a director of a number of private biotech companies.

Dr Véronique Bouchet is IBT’s longest-serving director. She is the chief medical officer of RowAnalytics Ltd, an AI enabled precision medicine company. She has previously held a variety of senior international roles in the healthcare industry across several therapeutic areas and functions. She is a non-executive director of Stevenage Bioscience Catalyst, a member of the Council and Finance and Investment Committee of Queen Mary, University of London and a member of the scientific committee of Breast Cancer Now. She has an MB BS from St Bartholomew’s Hospital Medical School and holds a BSc in Psychology from University College London. She has an MBA from INSEAD and has been awarded the Institute of Directors’ Diploma in Company Direction (Distinction).

Caroline Gulliver has been chair of the audit committee since 13 July 2016. She spent a 25-year career with Ernst & Young LLP, from where she retired in 2012 to pursue other interests including non-executive directorship positions. She is a chartered accountant with a background in the provision of audit and advisory services to the asset management industry, with a particular focus on investment trusts. She is also a non-executive director of JPMorgan Global Emerging Markets Income Trust Plc, Civitas Social Housing Plc and Aberdeen Standard European Logistics Income Plc.

Jim Horsburgh commenced his career in 1977, joining Hill Samuel Investment Management as a graduate trainee. He moved to the ICI Pension Fund in 1979 and Abbey Life Assurance Company in 1982, where he managed the company’s flagship life and pension equity funds. In 1984 he joined Schroder Investment Management as a UK pension fund manager becoming an account director, a director and in 1998 UK managing director. He left Schroders in 2001 and, following a career break, was chief executive of Witan Investment Trust Plc from February 2004 to October 2008.

Previous publications

Previous publications

We published an initiation note on IBT – Outperformance and income – on 19 July 2018 and an update note, Beating the odds, on 8 March 2019. You can access the notes by clicking on the links above or by visiting our website, www.martenandco.com.

The legal bit

The legal bit

This marketing communication has been prepared for International Biotechnology Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.