Reliable source of income

Reliable source of income

It is hard to gauge the true extent of the damage that the pandemic is inflicting on the global economy, but already many companies have been forced to reduce or suspend dividends. For investors reliant on income, the renewable infrastructure sector offers some sense of security. JLEN Environmental Assets Group’s (JLEN’s) diverse portfolio and predictable long-term revenue stream provide some additional reassurance.

For the moment, attention has shifted away from the longer-term climate-related threats that face us, but this issue has not gone away. JLEN is playing its part in helping to reduce carbon emissions and tackle waste. In December 2019, JLEN further diversified its portfolio, with an investment in a food waste collection and processing business. It continues to build the agricultural anaerobic digestion side of its business, most recently with an investment in Scotland. JLEN still has considerable resources available to it to continue to grow and further diversify its portfolio.

Progressive dividend from investment in environmental infrastructure assets

Progressive dividend from investment in environmental infrastructure assets

JLEN aims to provide its shareholders with a sustainable dividend, paid quarterly, that increases progressively in line with inflation. It also aims to preserve the capital value of its portfolio on an inflation-adjusted basis over the long term. It invests in environmental infrastructure assets with predictable, wholly or partially index-linked cash flows, supported by long-term contracts or stable regulatory frameworks.

COVID-19

COVID-19

JLEN is fortunate in that the main drivers of its business are only marginally affected by the COVID-19 outbreak. Of the 32 assets in the portfolio, only the recently acquired food waste business (described in more detail below) – has been materially impacted by the pandemic. It has seen a reduction in food waste from restaurants and businesses whilst household food waste has remained stable.

JLEN’s service providers have business continuity plans and the adviser, Foresight LLP (Foresight) has reviewed these and has confirmed that they are operating effectively. Many of the people working for these service providers are providing an essential service (literally, keeping the lights on) and these companies have done what they can to protect the health of their workers.

The lockdown has reduced the demand for power, and this puts some downward pressure on daily power prices, which were already low following a mild winter. JLEN’s asset mix means that it is less affected by this than most other listed renewable energy funds. Roughly a third of its revenues come from the sale of wholesale power, and roughly half of that is currently subject to contracts where the price is fixed or where a minimum price has been agreed.

JLEN has no immediate need to refinance any debt. Its revolving credit facility is not due to be renewed until June 2022 and the debt that exists within the projects in its portfolio is all long-term and fully amortising.

Significant ‘war chest’

Significant ‘war chest’

On 27 February 2020, JLEN was able to raise £57.2m through the issue of 49.7m shares at 115p. The fundraise was significantly oversubscribed. The growth in the size of the fund unlocked further borrowing capacity under the revolving credit facility. All in all, the advisers estimated that they had a ‘war chest’ of about £150m available with which to make acquisitions.

On 2 April, JLEN announced that £11m of this had been used to fund an investment into a Scottish anaerobic digestion plant, Peacehill Farm. The plant is slightly different to others in the portfolio in that it is situated on a poultry farm and fuelled, in part, by the manure generated by the farm. The investment is also unusual in that it comprises a debt facility and the subscription for a minority (unquantified) equity stake in the vehicle that holds the anaerobic digestion plant. No information is available on the terms of the debt facility, but we believe the prospective returns on the combined investment holdings are within the normal parameters for other anaerobic digestion investments within JLEN’s portfolio.

Further diversification within the waste and wastewater portfolio

Further diversification within the waste and wastewater portfolio

The breadth of the portfolio has expanded again with JLEN’s first venture into food waste collection and processing business. In December 2019, JLEN acquired a 70% stake in Bio Collectors Holdings, the holding company for a food waste anaerobic digestion plant in Mitcham in south west London. The plant is bigger than JLEN’s agricultural anaerobic digestion plants, with a thermal capacity of about 10MWth (Vulcan Renewables had a thermal capacity of 5MWth before the upgrade that completed at the end of 2019, which has roughly doubled its capacity, while the others have a 5MWth capacity). The plant came with a relatively long operating history, having been commissioned at the end of 2013.

The plant sits on an industrial estate in Mitcham. It has a fleet of about 20 vehicles, some of which are powered by its own biogas, that it uses to collect about 100,000 tonnes of food waste each year. The collections come from households, restaurants, schools, hospitals and other businesses within the M25. The processed waste produces biomethane, which can be injected to the national gas grid, and digestate, which forms a natural fertiliser. In addition, the plant has 1.7MWe of capacity through two combined heat and power (CHP) engines and is accredited under the Renewable Heat Incentive (RHI) and Feed-in-Tariff (FiT) schemes.

Recent legislation means that from 2023, all waste will have to be sorted by households prior to collection and local authorities will have to deal with this appropriately. This will increase the availability of feedstock for biodigesters such as this one.

Foresight says that opportunities exist to make some similar investments, although expansion on this site is likely to be limited.

Commitment to development fund

Commitment to development fund

JLEN is permitted to have some exposure to construction-stage assets but has approached this cautiously. Foresight has greater experience of greenfield investments and more resource dedicated to this area than JLEN’s previous investment adviser had. At the end of January, JLEN’s board approved a €25m commitment to Foresight Energy Infrastructure Partners SCSp (“FEIP”), a Luxembourg limited partnership investment vehicle.

The majority of the partnership’s investments will be in construction-stage European renewable energy generation infrastructure such as wind farms and solar parks, and associated energy storage, transmission and distribution assets. FEIP has identified an initial portfolio that includes European construction-stage wind and solar assets and operational battery storage assets.

The attraction for JLEN is the higher returns that construction stage assets can offer and the ability to further diversify its revenue. Investing through a fund allows JLEN to spread its construction risk over a wider range of assets than making direct investments would. Although, if it chooses, JLEN will be able to make direct co-investments in projects alongside FEIP.

Any management fees payable by FEIP in connection with JLEN’s commitment will be rebated to JLEN. However, a carried interest is due to Foresight, subject to a hurdle rate.

Reintroduction of subsidies

Reintroduction of subsidies

Ahead of the budget, as part of its commitment to meeting net zero emissions by 2050, the government mooted the idea of a reintroduction of subsidy for onshore wind generation. On 2 March, the Department for Business, Energy and Industrial Strategy announced that it would consult on whether 2021’s auction of contracts for difference (CFDs) should be open to onshore wind and solar projects. The hope is also that floating offshore wind projects will also be developed, allowing the exploitation of wind resource in deeper water than has been the case for conventional offshore wind.

Further conversions of power stations from burning coal to biomass will be excluded from the auction.

The consultation is open until 22 May 2020. There is a strong message in the statement that accompanied the launch of the scheme that local communities will still have control over whether planning approval is given to new onshore projects.

The proposal acknowledges the growth of unsubsidised solar and onshore wind generation in the UK but seeks to encourage greater investment in that area than would be supported by prospective long-term power prices alone. This commitment has implications for long term power prices. Foresight cautions that many of the best sites for onshore wind have already been developed.

Including onshore wind and solar in a single CFD auction would likely crowd out other desirable generation sources such as offshore wind. The government’s approach is to split the available subsidy into two ‘pots’. Onshore wind and solar projects will compete against energy from waste with CHP, hydropower, landfill gas and sewage gas projects. The other pot will be for offshore wind (including floating offshore wind), dedicated biomass with CHP, geothermal, remote island wind, tidal stream and wave technologies. However, one of the questions posed by the consultation is whether the offshore wind projects should be in a pot of their own (this is because the government sees considerable potential to achieve its renewable generation targets from this technology).

Sustainability

Sustainability

COVID-19 is dominating the headlines but, hopefully, this will be a relatively short-lived problem. Climate change and issues of sustainability are pressing long-term problems, however. The UK Government’s commitment to net zero emissions by 2050 will require considerable investment in renewable energy and energy storage, as it seeks to cut CO2 output associated with power generation.

JLEN’s investments sit at the heart of the solution to these problems. This has been recognised by the London Stock Exchange, which included JLEN within its Green Economy Mark scheme (recognising companies that derive more than half their revenues from products and services that contribute to the green economy).

Foresight is a signatory of the United Nations’ Principles for Responsible Investment (UNPRI) and Environmental, Social and Governance (ESG) analysis is built into JLEN’s investment process, as we described in our last report (see page 9 of that note). It is also incorporated into the ongoing monitoring programme for JLEN’s portfolio.

JLEN publishes ESG reports on a regular basis and we expect to see an updated version with the publication of the next annual report in June this year.

Over the six months to the end of September 2019, JLEN’s portfolio generated 375,000MWh of clean energy, recycled 63,853 tonnes of waste, diverted 233,082 tonnes of waste from landfill and treated 21.4bn litres of water. A by-product of JLEN’s anaerobic digestion plants is organic fertiliser – JLEN’s plants produced 160,000 tonnes of it over the year ended 31 March 2019.

In May 2019, Aardvark Certification published a report commissioned by JLEN on JLEN’s CO2 emissions. For the year ended 31 March 2019, JLEN’s wind portfolio produced 421,769MWh, saving the emission of the equivalent of 119,390 tonnes of CO2. For the solar and anaerobic digestion portfolios, the estimated savings were 21,632 and 29,734 tonnes, respectively. The waste processing activities saved a further 197,650 tonnes. Aardvark reckoned that the March 2019 generation portfolio would save 4m tonnes over its lifetime and the waste operations a further 4.9m tonnes.

The Aardvark report also drew attention to the work that JLEN does with the local communities that it interacts with – the Social part of ESG. JLEN’s projects contributed £350,000 to local community projects in its last financial year and have made a commitment to maintain this funding in real terms over the life of the projects.

Valuation – many moving parts

Valuation – many moving parts

JLEN publishes net asset values (NAVs) on a quarterly basis based on valuations prepared by the investment adviser. These are approved by the board prior to publication. There is no publicly quoted price for the projects that JLEN invests in, and so the individual projects are valued on the basis of discounting the forecast cash flows over the life of each project at a rate that reflects market benchmarks and Foresight’s experience of bidding for assets.

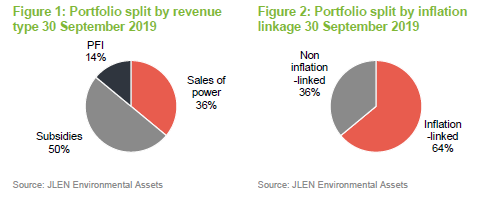

JLEN’s cash flows are fairly predictable in that a large proportion of them come from subsidies or contractual payments under private finance initiative (PFI)-type contracts. At the end of September 2019, such income accounted for almost two thirds of its annual revenue. This income is also inflation-linked and estimates of future inflation are one input into the valuation model.

Subsidy income

Subsidy income

The useful life of JLEN’s assets is longer than the period for which they will attract subsidy and so, in the absence of the purchase of new assets, over time the proportion of income that comes from subsidy will fall. This is not much of an issue for more than a decade, however.

The ROCs that make up a significant proportion of JLEN’s subsidy income (see page 10 of our annual overview note for more information) last for 20 years from the date of the commissioning of the project.

The oldest asset in JLEN’s portfolio is the Moel Moelgan wind farm in Llanrwst, Wales and its subsidy will start to fall away in 2027 (part of the wind farm was commissioned in January 2003 and a much larger extension was commissioned in October 2008).

The weighted average length of remaining subsidies across JLEN’s wind portfolio is around 13.8 years. For those solar projects that attract subsidies under the ROC scheme, it is about 14 years. JLEN has some solar projects that are subject to the feed-in tariff (FIT) regime and the subsidies on these projects range between 20 and 25 years from the date of commissioning. The rooftop solar portfolio has a range of commissioning dates but the other three still have about 16.8 years of subsidy still to come on average.

The anaerobic digestion portfolio attracts subsidies under the non-domestic renewable heat incentive (RHI) which runs from 20 years from the date of commissioning. The average length of remaining RHI subsidies on the seven plants in the portfolio at the end of September 2019 is about 15.5 years. The Mitcham plant was commissioned in 2013 but has been expanded since. The profile of the cash flows from the latest acquisition (Peacehill – see page 2) has not yet been published. JLEN also receives FIT income with respect to the electricity generated by the CHP engines at these plants.

Power prices

Power prices

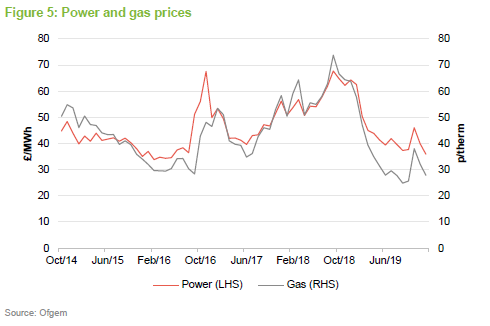

Power price assumptions are a significant component of the valuation model. For the first two years from the valuation date, Foresight uses market rates to forecast prices, where fixed price arrangements are not in place. For periods beyond two years, it uses long-term forecasts supplied by external consultants as adjusted for project-specific arrangements.

The power price model used by JLEN anticipates a recovery from current depressed levels and then gently declining prices from about 2029 onwards. Forecast prices were revised downwards by about 4.5% in September 2019 as is shown in Figure 3, and a further 7.5% at the end of December 2019.

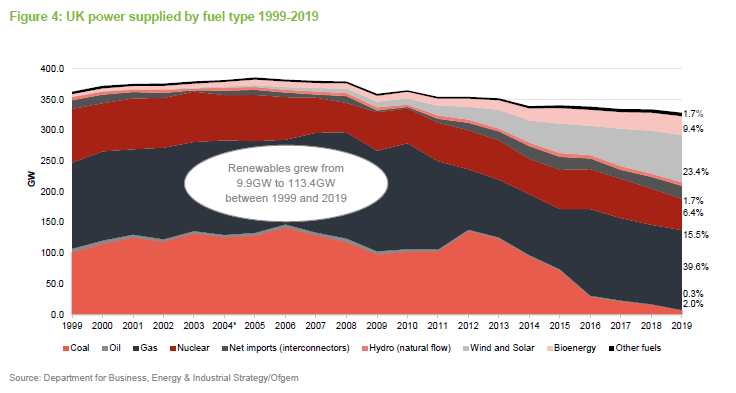

The UK power market is evolving. Less power is being produced as demand-side factors such as increased energy efficiency reduce aggregate demand.

Today, the UK’s electricity price is heavily influenced by natural gas prices, reflecting the importance of gas-fired plants within its generation mix.

Compared to coal and nuclear plants, gas plants can be fired up relatively quickly but unfortunately not fast enough to respond to sudden drops in wind or solar output. Intraday power prices adjust to encourage or discourage generation and electricity storage projects can help smooth short-term fluctuations. We discussed this in some detail on pages 5 to 7 of our last note.

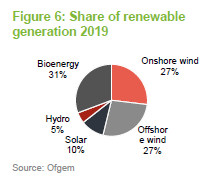

Renewables have become an increasingly important component of the generation mix in the UK. For 2019 as a whole, they supplied 34.5% of the power consumed in the UK.

The numbers in Figure 4 do not break down the contribution from wind and solar but separate figures released by Ofgem show that solar generation accounted for 10% of all renewable energy generation. Wind plays a more significant role and, within that, offshore wind is of increasing importance.

Towards the end of January 2020, a broker’s note warned of much more savage falls in power prices to come. This was based on forecasts by a research firm, Bloomberg New Energy Finance (BNEF), that made some fairly bold assumptions about the growth of renewable energy. Amongst other things, BNEF speculated that, following $10trn of investment, wind and solar will make up 50% of global energy supply by 2050. In the UK, it expects renewables to account for 87% of generation. The report said that the cost of solar and wind installations would continue to fall considerably (although it is hard to see how this would happen in practice).

The note knocked the prices of renewable energy funds temporarily (JLEN held up relatively well thanks to its lower reliance on power prices). However, as Foresight pointed out, the investment needed to fund the growth in renewable generation will not be forthcoming if the returns on investment are not acceptable. One answer is to supplement the power price return with subsidy and in this respect, the UK government’s moves to reintroduce subsidies on new solar and onshore wind projects are a step in the right direction.

Life extensions

Life extensions

Extending the useful life on an asset will also add to its value. JLEN had been assuming a 25-year life for its wind and solar assets but has been working to extend these where it can. This is not a straightforward process. In addition to ensuring that the life of the physical infrastructure can be extended, planning permissions need to be extended and so do leases on the underlying land.

The advisers caution however, that life extensions cannot be taken for granted as landowners have recognised the future value that owners of renewable energy assets are seeking to capture and often wish to negotiate a share of this. Where a project comes to the end of its life and the land is handed back to the landowner, there is a cost associated with removing equipment and returning it to its pre-existing state. Landowners who want the supporting infrastructure may be prepared to pay for this.

Other inputs

Other inputs

In addition to inflation rates, subsidy income, power prices and the useful economic lives of assets, JLEN’s valuation model also includes assumptions about the amount of power produced (based, in part, on long-term averages for wind speed and solar irradiation), throughput volumes for JLEN’s PFI concessions (both have favourable payment mechanisms but forecasts of waste and wastewater volumes are based on the client’s own projections where available and independent studies where appropriate), feedstock prices for the anaerobic digestion plants, corporation taxes (a planned cut to 17% from 19% was later ruled out), deposit interest rates and exchange rates.

Discount rates

Discount rates

Once the cash flow forecast has been compiled, discount rates are applied to these cash flows to calculate a net present value. Each asset has its own discount rate (these ranged between 6.5% and 9.2% at the end of September 2019), which reflect amongst other things the amount of debt within the special purpose vehicle that holds the asset. Discount rates also reflect the demand for each type of asset in the secondary market and the prices at which similar assets have been changing hands.

At 30 September 2019, the discount rate on JLEN’s wind assets was reduced. Prices of wind assets have been bid up in the secondary market. The advisers note that the relatively low levels of gearing attached to JLEN’s wind portfolio would make it attractive to potential purchasers.

At the same time, the board observed that there was also interest from the market in anaerobic digestion plants with established track records, due to the high proportion of inflation-linked subsidy revenues. Some market participants had experienced poor returns from investing in construction-stage anaerobic digestion assets but JLEN’s anaerobic digestion portfolio does not face this risk. Reflecting these considerations, the board wrote up the values of some of JLEN’s anaerobic digestion plants at the end of December 2019.

Sensitivities

Sensitivities

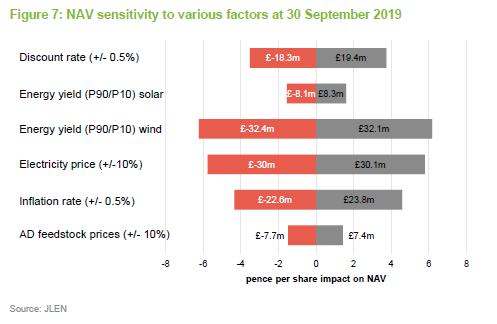

Figure 7 shows how the NAV might move given various scenarios. ‘P90’ and ‘P10’ against the electricity yields show the impact if electricity yields were 10% off their worst and highest assumptions respectively. The bars show the impact both in monetary terms and the potential impact on the NAV and this reflects the asset mix within JLEN’s portfolio.

Asset allocation

Asset allocation

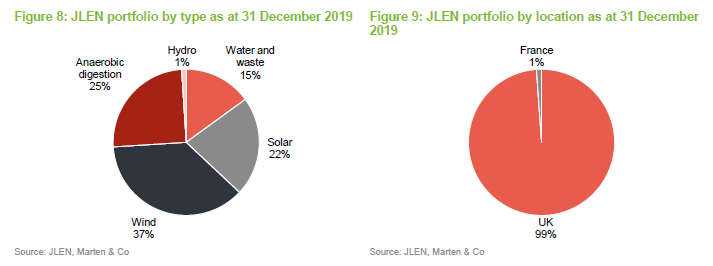

Recent announcements from JLEN have trailed the prospect of further expansion into Europe. Foresight has the expertise and experience to support this and there is a deep renewables market with many other countries having attractive subsidy regimes.

The advisers say that they are not looking at subsidy-free projects such as Scandinavian wind or Spanish solar. Bioenergy projects in Europe look more likely than wind or solar.

Down the line, there are other investment areas that they are evaluating. These are as diverse as electric vehicle charging stations, carbon capture and storage and the provision of flood defences (on a public-private partnership model).

Additional investments in battery storage are also a possibility. For now, the battery project that JLEN acquired with last year’s hydropower investment is being used for firm frequency response (a balancing service provided to the National Grid whereby a provider uses approved assets to either quickly reduce energy consumption or increase generation to help balance the grid and avoid power outages). They are yet to test the potential to generate revenue from trading power prices intraday.

Performance

Performance

Operational performance

Operational performance

For the final quarter of 2019, energy generation from the portfolio was 1.8% behind budget, mainly because wind speeds were lower than average in October and November. By contrast, JLEN’s portfolio is said to have made a positive start to the calendar year, with generation approximately 15% over budget including very strong performance from the wind assets due to good wind resource. The problems that JLEN (and others) were experiencing with operations and maintenance contractor Senvion are behind them.

The solar portfolio experienced two unplanned outages in the final quarter of 2019, the effects of one of which (a lightning strike) can be recovered from insurance. The other (Shoals Hook) involved routine maintenance by a supplier (the timing of which is outside JLEN’s control but, following discussions, will be timed to avoid peak generation periods in future).

Whilst power prices have been weak, JLEN currently has fixed price or floor arrangements covering 49% of electricity generation for the summer 2020 season and 48% for winter 2020/21.

At 31 December 2019, energy generation from the anaerobic digestion plants was running at 3% above budget.

The recent floods had an interesting impact on the hydropower schemes. The equipment was not damaged, but for a short time, higher water levels meant that the water simply flowed over the top of the turbines rather than being forced through them, and generation slowed as a consequence. This quickly returned to normal, however.

Financial performance

Financial performance

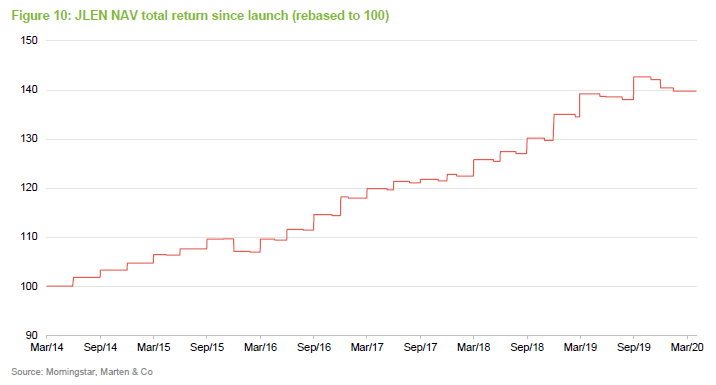

The NAV has been held back by the reductions in forecast power prices but, offsetting that, it has benefitted from the lower weighted average discount rate applied to parts of the wind and anaerobic digestion portfolio and some life extensions. Some anaerobic digestion plants were written up in value by £7.4m at the end of December.

Asset management initiatives such as the Vulcan Renewables extension and higher priced power purchase agreements within the wind portfolio added £4.1m to the NAV.

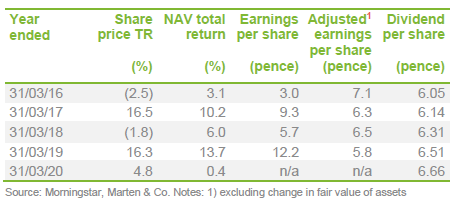

JLEN reaffirmed its 6.66p dividend target for the current financial year when it published its COVID-19 update on 26 March 2020.

Premium/(discount)

Premium/(discount)

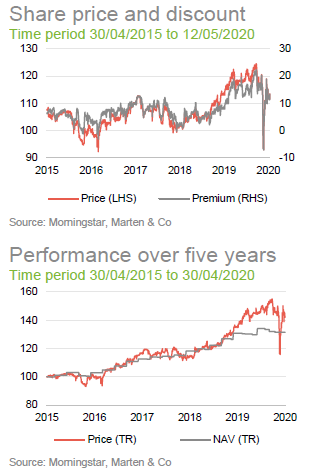

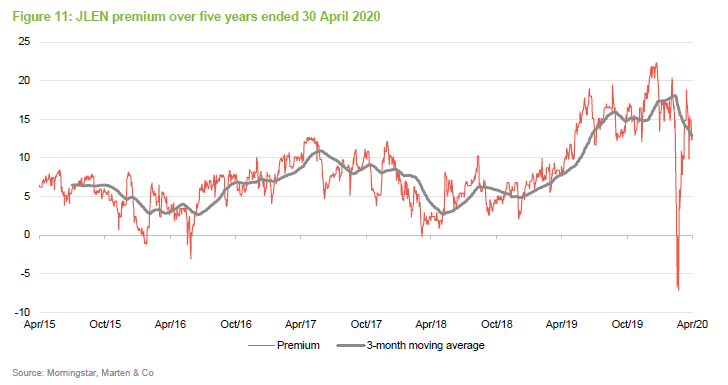

Over the year to the end of April 2020, JLEN traded between a discount of 7.1% and a premium of 22.3%, with an average premium of 14.7%. On 12 May 2020 JLEN was trading on a premium of 13.3%.

JLEN’s share price fell sharply in the initial panic around COVID-19 but recovered swiftly once investors realised that it was unlikely to be much affected by the virus. Its attractive dividend yield, which is uncorrelated with equity markets, appears to be attracting investors in this environment. On page 2 we discussed JLEN’s most recent share issue. It will most likely seek to expand further when markets permit.

Previous publications

Previous publications

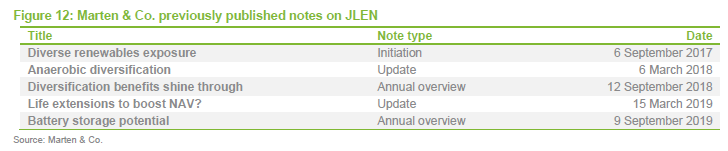

Readers interested in further information about JLEN may wish to read our earlier notes. Details are provided in Figure 12 below. You can read the notes by clicking on them in Figure 12 or by visiting QuotedData.com.

Fund profile

Fund profile

JLEN Environmental Assets Group (JLEN) invests in infrastructure projects that use natural or waste resources or support more environmentally-friendly approaches to economic activity. This could involve the generation of renewable energy (including solar, wind, hydropower and biomass technologies), the supply and treatment of water, the treatment and processing of waste, and projects that promote energy efficiency. It aims to build a portfolio that is diversified both geographically and by type of environmental asset. This emphasis on diversification helps differentiate JLEN from its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, inflation-linked dividends and preserving its capital, JLEN does not invest in new or experimental technology. A substantial proportion of its revenues is derived from long-term government subsidies.

Investment adviser

Investment adviser

JLEN is advised by Foresight Group LLP (Foresight, or the adviser). Foresight is one of the best-resourced investors in renewable infrastructure assets, with AUM of £4.6bn, over £4bn of which is in energy infrastructure. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. The lead advisers to JLEN are Chris Tanner and Chris Holmes.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JLEN Environmental Assets Group.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.