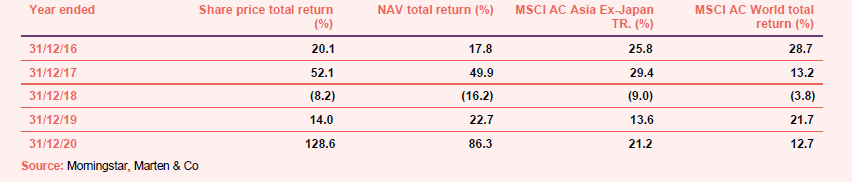

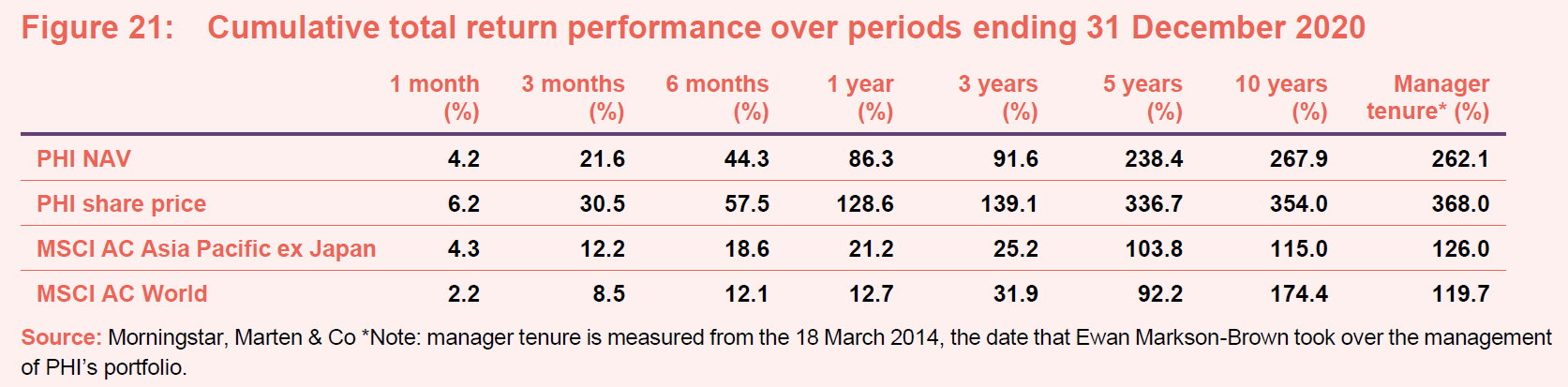

Pacific Horizon (PHI) generated a very impressive uplift in its NAV over the course of 2020. This reflects its focus on growth, and technology and biotechnology stocks in particular. These performed well as we attempted to adjust to life under the pandemic, thereby accelerating a number of structural trends. PHI provided an NAV total return of 86.1%, which eclipsed the return on the MSCI AC Asia Pacific ex Japan index of 21.2%, the broader MSCI AC World of 12.7% and the average of its Asia Pacific sector peer group (see page 23) of 25.3%. PHI is the top-performing trust in this sector by a significant margin.

Despite this stellar growth, PHI’s manager is not resting on his laurels. Emerging Asia still remains a high-growth and under-researched region, and he continues to focus on those themes he expects to do well over the next five years. For example, companies exposed to the growth in electric vehicles (EV) continue to be a significant theme. The manager has been increasing exposure to the commodities needed to deliver a greener future, but which the world is structurally short of, following long-term underinvestment.

Focused on Asia ex Japan growth stocks

PHI invests in the Asia-Pacific region (excluding Japan) and in the Indian subcontinent in order to achieve capital growth. The company is prepared to move freely between the markets of the region as opportunities for growth vary. The portfolio will normally consist entirely of quoted securities, although it may hold up to 10% of total assets in unlisted investment opportunities.

Fund profile

Pacific Horizon (PHI) is an Asia ex Japan fund that specialises in investing in growth companies. Baillie Gifford & Co (Baillie Gifford) has been appointed to manage PHI’s portfolio on behalf of Baillie Gifford & Co Limited, the trust’s alternative investment fund manager. Baillie Gifford has managed PHI since 1992. Baillie Gifford is a long-term growth investor and it believes there is a significant opportunity to outperform markets over the long term using this approach.

Ewan Markson-Brown (Ewan, or the manager) has day-to-day responsibility for the management of PHI. He took over the management of the portfolio from Mike Gush on 18 March 2014. Ewan joined Baillie Gifford in 2013 from PIMCO, where he had been a senior vice-president in its emerging markets team. Prior to that, he managed Asian funds at Newton Investment Management.

Additional information is available at the manager’s website: www.bailliegifford.com

About the manager

Baillie Gifford has 122 investors/analysts based in its Edinburgh office, with a further three in the US and five in China. It is structured as a partnership and encourages a collegiate approach to managing money, although it allows its portfolio managers the freedom to have the final say about their portfolios. It managed or advised on about $370bn at the end of September 2020, of which £36.2bn was invested in Asia Pacific equities. PHI and the Baillie Gifford Pacific Fund (its open-ended equivalent) have combined total assets of roughly £750m.

Ewan says that his natural inclination is to take a macro view and that thematic considerations are always in the back of his mind. However, he thinks that you only really get to see the big picture by looking bottom-up. Consequently, this is very much a stock-picking fund and the portfolio bears very little resemblance to the fund’s MSCI All Country Asia ex Japan Index comparative Index (the active share of PHI’s portfolio at the end of November 2020 was 88%). Ewan spends most of his time in meeting companies and undertaking stock-specific research.

Ewan is assisted with the management of the fund by Roderick Snell, who has a degree in Medical Biology. Roderick has been at Baillie Gifford since 2006 and has managed the Baillie Gifford Pacific Fund since 2010. He has been deputy portfolio manager of PHI since September 2013 and is a co-manager on the Baillie Gifford China Growth Trust.

Market roundup – Asia, a relative bright spot

2020 was, without question, a challenging year for financial markets as the impact of the COVID-19 virus was felt around the globe. However, although the virus originated in China and quickly spread to the rest of the Asia Pacific region and beyond, many parts of the region have fared relatively well. The region has, with its experience of similar pandemics, been successful at implementing controls to restrict the spread of the virus (in comparison, more developed markets have generally struggled to get to grips with the virus). Furthermore, as we have discussed in our previous notes, the Asia Pacific ex-Japan region offers long-term structural growth opportunities although, as with all emerging markets it tends to exhibit greater volatility along the way.

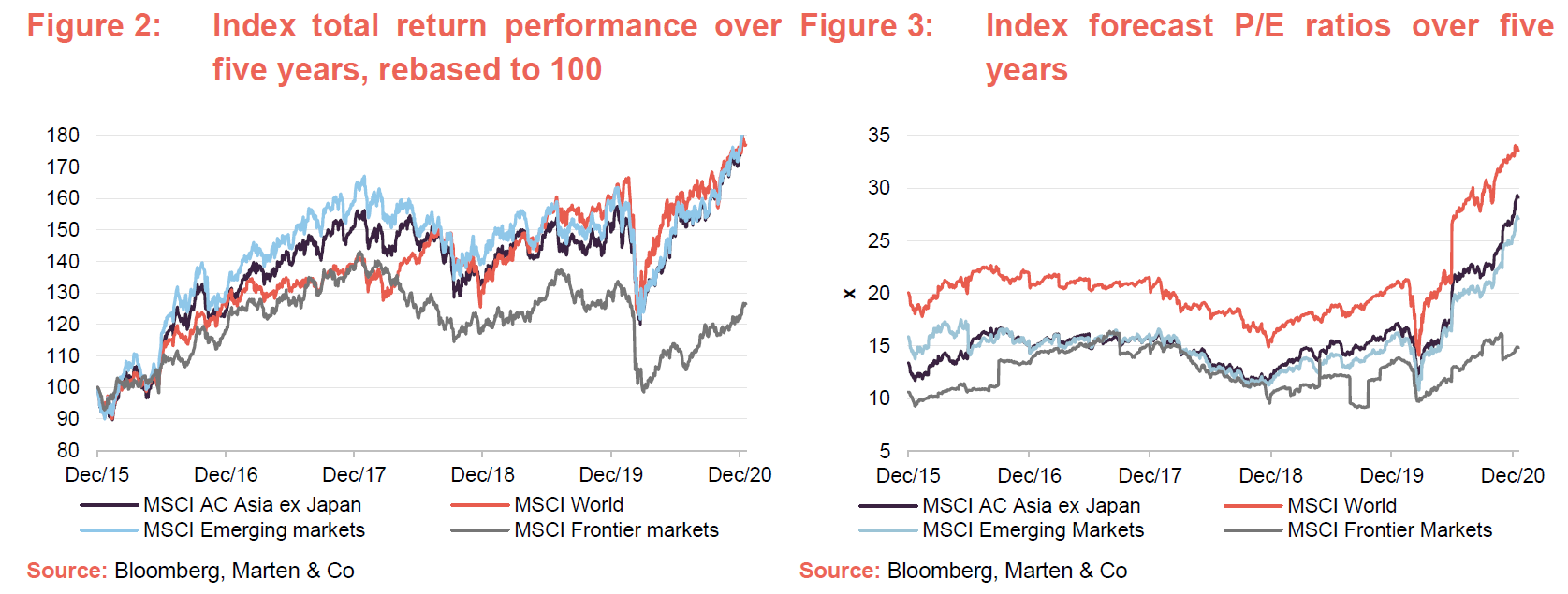

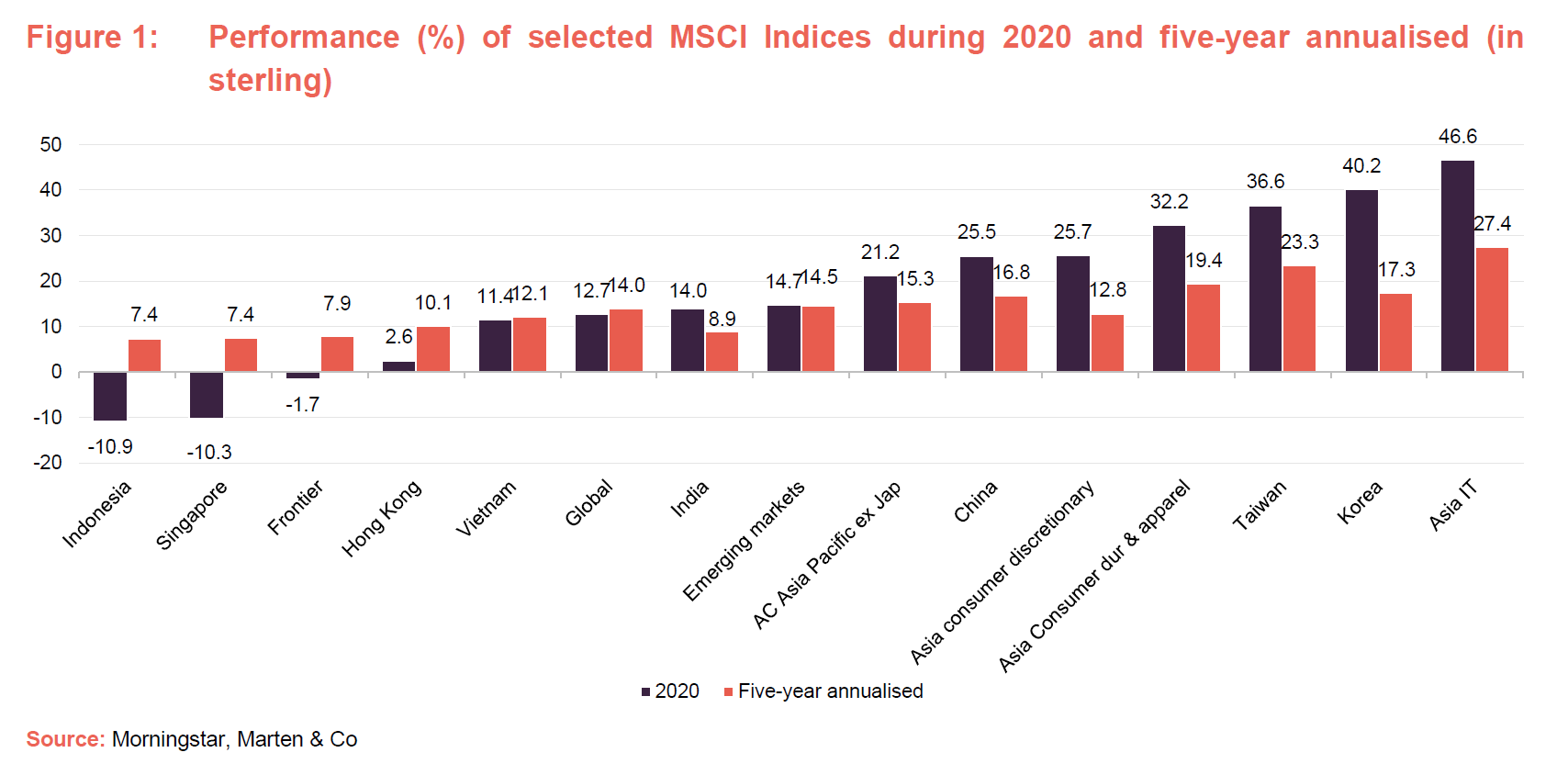

As is illustrated in Figures 1 and 2, Asia Pacific ex Japan has, during 2020 and over the last five years, outperformed broader global markets, emerging markets and frontier markets. However, Figure 1 also illustrates the considerable variation that can be seen within the region. Asian consumer stocks (both discretionary and durable) as well as Asian information technology has performed very strongly during 2020 (these all being strong areas of focus for PHI), with consumer durables and IT providing very strong five-year annualised returns.

Late cycle to early cycle in six months

We have previously commented how a strong US dollar tends to lead to outflows from emerging Asia. One effect of the pandemic is that it appears to have turned the tide on the global economic cycle, moving us from late cycle to early cycle in around six months. Hawkish monetary policy (designed to put a brake on economic activity) and the prospect of interest rate rises in more developed markets look a long way off, which should act as a tailwind for emerging Asia for some time.

Furthermore, it seems reasonable that the chaotic policy moves of the Trump presidency are now largely behind us and there is the potential for a less-combative approach from the US administration in engaging with China and the wider region. As we note in the asset allocation section, PHI has considerably more small holdings in its portfolio compared to when we last published. Ewan says that he’s happy to have these at the start of a bull market.

Manager’s view

The manager’s long-term arguments for investing in growth companies in emerging Asia remain broadly unchanged, and we would suggest that readers interested in further details should see our previous notes for more discussion. It should be noted that, whilst the manager takes a macroeconomic view and long-term structural themes are a key consideration, the portfolio is very much managed bottom up – looking first at the attractions of individual stocks. A key summary is as follows:

- China and the broader Asia Pacific ex Japan region offer very strong growth prospects. PHI’s mandate provides it with access to more than 3bn consumers across Asia and pre-pandemic data from the International Monetary Fund (IMF) forecast that the per capita spending power of Chinese consumers would nearly double in US dollar terms over the five-year period to 2024.

- While the underlying tensions that led to the protests in Hong Kong have been overshadowed by the impact of COVID-19, these have not been resolved, as is illustrated by the recent mass arrests of democracy activists. Ewan will invest in broader regional names that are listed on the H-share market (Hong Kong’s stock exchange), but has very little appetite for domestic Hong Kong stocks. Retail spending and tourism are both suffering, while a lot of luxury brands have been reconsidering their strategy (Hong Kong has been a hugely profitable gateway into the mainland, helped by tax-free price differentials).

- The manager continues to like Vietnam. It has been very effective in managing COVID, and its 95m-population economy is expected to return to brisk growth. It has a young population, with around 1m people entering the workforce each year; education levels are relatively high as is female participation in the workforce; and Vietnam is urbanising faster than every other country in Asia, except China. While the trade war risk has lessened, manufacturers are still looking to diversify this risk and Vietnam is well placed to benefit.

- The pace of the digitalisation of the economy, technological change and the rise of the Asian middle class are key themes within PHI’s portfolio. These are discussed in greater detail in the next section.

Thematic focus – digitalisation and technology transforming industry

The manager believes that the market’s focus on geopolitics and capital flows can result in it missing the bigger picture of a global rise in the digitalisation of the economy, technological change and the rise of the Asian middle class. To the extent that he can, Ewan ignores the noise, focusing on thematic opportunities. He looks for companies that have the potential to increase revenue and earnings at around 15% per annum over a five-year period or longer, and for opportunities where this potential has not been fully recognised by the market.

PHI’s starting premise is how they think the world and individual countries may change over the next three, five and 10 years plus, in every area of life – economically, socially and politically – and the impact that technology might have on these trends. When they look at a company and think about what the market size of its industry might be, they ask themselves what the current rate of growth is, how this industry could change, and whether there are additional opportunities for growth in adjacent markets that the company could enter.

The manager’s feeling is that the rapid development of technology is creating a fundamental change in market behaviour, with digitalisation driving profound changes in economic and political systems, businesses, consumer habits and behaviours. The number of sectors and industries that are becoming digitalised and connected is increasing rapidly. There is growing awareness of these changes across the globe.

Asymmetric return profile necessary to find ‘winners’

Ewan says that he is comfortable with the underlying portfolio’s asymmetric return profile (where a small number of stocks will either make a multiple of money invested and a small number will collapse in value). Following this strategy, with a large tail of smaller companies, leads to a high likelihood of severe negative returns at the individual stock level. However, PHI’s long-term performance record suggests that these losses are more than offset by gains elsewhere. Although there is volatility and uncertainty at the individual holding level, this indicates that the right kind of risk is being taken at the fund level to generate superior returns. Whilst every effort is made to pick the ‘winners,’ Ewan says that it is very difficult, if not impossible, to have certainty on any investment. Early recognition of picks that will not perform is important, though; arguably the biggest risk to this strategy is potentially missing out on a ‘winner’ by selling too early or not taking the right level of risk.

Electric Vehicles and commodities

Electric vehicles (EV) continue to be a significant theme with PHI’s portfolio. Tata Motors was a new investment for PHI in 2020 (see page 14) although the manager is not necessarily focusing on the EV manufacturers themselves. There is a considerable allocation to companies exposed to the components and materials that Ewan expects will be in demand. Ewan thinks, after a decade of ’informational wins‘, where companies have added value through the development of software, intellectual property and the like, with investors focusing on asset light businesses, that the balance could switch back again. Ewan believes that we now need to make progress with physical components.

For example, to move to a net zero-carbon economy we need to build considerable infrastructure to support this (for example EV and batteries large enough to be used in national electricity grids), which will require vastly more commodities than are currently available (mining requires considerable capital expenditure just to maintain existing production levels and cash-strapped mining companies have been curtailing this investment). Reflecting this, mining now accounts for around 10% of PHI’s portfolio. PHI now has investments in: MMG (Chinese copper miner), Zijin Mining Group Co Ltd H Shares (gold and copper miner), Merdeka Copper Gold (Indonesian miner); and Nickel Mines (Indonesia base metal miner – see page 18). Ewan is focused on companies with low-cost operational assets. He thinks that, at present, the market is giving little consideration to the fact that the value of these companies’ reserves could grow as the value of the end-product increases. Ewan thinks that the NAVs of these mining companies could triple, and he observes that some already have within the last couple of months. He thinks that the market is slowly waking up to the shortage of commodities that will be required to bring about a greener future. Consequently, he expects PHI’s commodities overweight to continue to grow from here.

Investment philosophy and process

The underlying approach

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least three years, and that this creates an opportunity to generate alpha. For this reason, it aims to encourage a culture of long-term thinking within the firm. Baillie Gifford believes there is persistence of good company management, business models and stock prices. This translates into a culture of ‘sticking with the winners’.

The manager uses Baillie Gifford’s own research. The team undertakes much of this, but will often commission research from local research teams, academics and industry experts. Baillie Gifford also subjects some companies to forensic analysis, using the services of investigative journalists and forensic accountants. When it is talking to companies, the conversations with their management teams focus on the long-term prospects of the business.

Ewan is able to draw on the resources of the whole investment team, when analysing companies, and can sit in on meetings with companies outside his geographic remit. This is especially beneficial when he is trying to identify how his companies compare with competitors domiciled in other markets.

Each member of the team is assigned a geographical focus for research, and these responsibilities are rotated every 18 months. Investment ideas are presented to the group, but the lead portfolio manager makes the final decision. Ewan spends four to five weeks visiting Asia each year.

The open-ended investment company (OEIC) and PHI are run in parallel, with some exceptions. Whilst Ewan is lead portfolio manager on this fund, he is co-manager of the OEIC with Roderick Snell. This does introduce one small element of differentiation between the two portfolios. More significant differences arise because of the need to keep the OEIC’s portfolio relatively liquid. There is an internal limit of holding no more than 12 days’ volume in any stock across the whole firm, but within this constraint, PHI has greater freedom to hold more illiquid investments than the OEIC. The OEIC has ended up with more of a large-cap bias as a result, while PHI has more exposure to small-cap names. There is considerable commonality of the stocks held, although the individual weightings may differ. PHI, unlike the OEIC, also has the option of using gearing and invests in unlisted companies.

There is a small- to mid-cap bias to PHI’s portfolio. This reflects Ewan’s belief that smaller companies grow faster than larger ones, although they exhibit higher volatility. He also subscribes to the view that smaller companies tend to be less well-researched, which means that they are more likely to be mispriced.

Building the portfolio

With over 6,000 stocks in PHI’s universe and a target portfolio size of between 40 and 120 stocks, Ewan focuses on those that he believes are beneficiaries of positive themes such as demographic shifts or technological change.

Ewan is looking for companies that are capable of growing earnings and cash flow faster than market averages. He wants companies to exhibit some or all of the following qualities: good management teams; barriers to entry; positive cash flow; self-funded growth; and a high return on invested capital (around double the market rate). Companies with ‘blue-sky’ technology are only interesting to him if he sees a path to sustainable positive cash flow.

The managers do not set target prices for stocks, but Ewan is mindful of valuations. He aims to at least capture a company’s earnings growth on the assumption that the price/earnings (P/E) multiple in five years or so, when he is looking to sell, will be at least as high as it is when he makes the investment. There is an obvious problem if you buy on a high P/E multiple; the business case works out but the P/E multiple declines. As an example of this, Ewan would not buy most consumer staples stocks today because he believes that, in the search for companies with stable revenues, investors have bid up valuation multiples to unsustainable levels.

The research process is flexible and can be carried out quickly if necessary – if there is the opportunity to invest in an initial public offering (IPO), for example. Ewan will typically have met the management before investing, and the investment case will always be discussed internally. In addition, he or a member of the team may have produced a brief report, an internal model, a cash-flow projection and/or an extensive internal research note on the company. He will at times canvass analysts and external research providers for their opinion as well.

Baillie Gifford is an active investor and does not hold stocks just because they are large constituents of any benchmark. Consequently, there are few limits on country, sector or stock weightings imposed on managers. The initial size of a position will reflect the strength of the manager’s belief in the potential risks and rewards of the investment. One of the guiding principles of investing at Baillie Gifford is to ‘run the winners’ (reflecting the belief in the persistency of good business models). However, PHI has a ‘soft’ upper limit of 10% exposure to any one stock. Ewan looks at the shape of the overall portfolio to ensure that he does not have too many companies exposed to similar thematic dynamics.

The mandate allows the manager to use derivatives to control risk and to alter the portfolio’s exposure to markets. In practice, Ewan is not undertaking such activity. The managers have no plans to use hedging to alter the portfolio’s currency exposure.

Sell discipline

Loss of faith in a company’s management is an instant trigger for a sale. Ewan will also sell if he feels the business model is not working, or if the market has caught up with his expectations.

Asset allocation

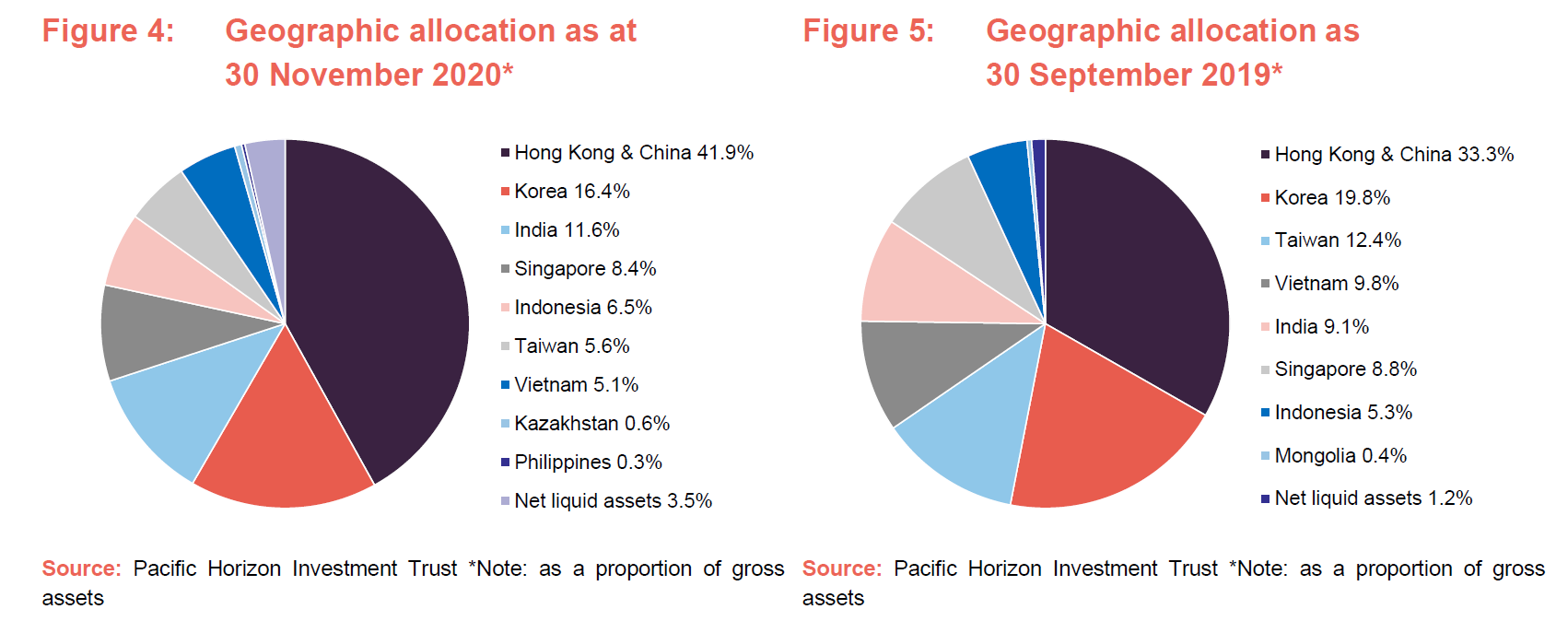

As at 30 November 2020, PHI held 106 holdings in the portfolio, which is a significant increase over the 82 stocks it held at 30 September 2019 (the most recently available data when we last published). PHI believes that it can achieve an appropriate level of diversification for its strategy by holding 40–120 companies.

This increase reflects the fact that, in the aftermath of the market collapse, the manager has seen a lot of value within the market and increased PHI’s turnover, reducing stocks that had done well as well as increasing gearing (borrowing), to take advantage of companies exposed to long-term structural growth trends that the manager considered to be heavily mispriced in the market panic. As a consequence of this, PHI has seen a significant increase in the number of small positions that it holds, which Ewan says he is happy to have at the start of a bull market.

We talk about changes within the top 10 holdings below. We also discuss some of the more interesting new additions to the portfolio below (Zomato, MediaTek, Tata Motors, Ningbo Peacebird and Meituan Dianping).

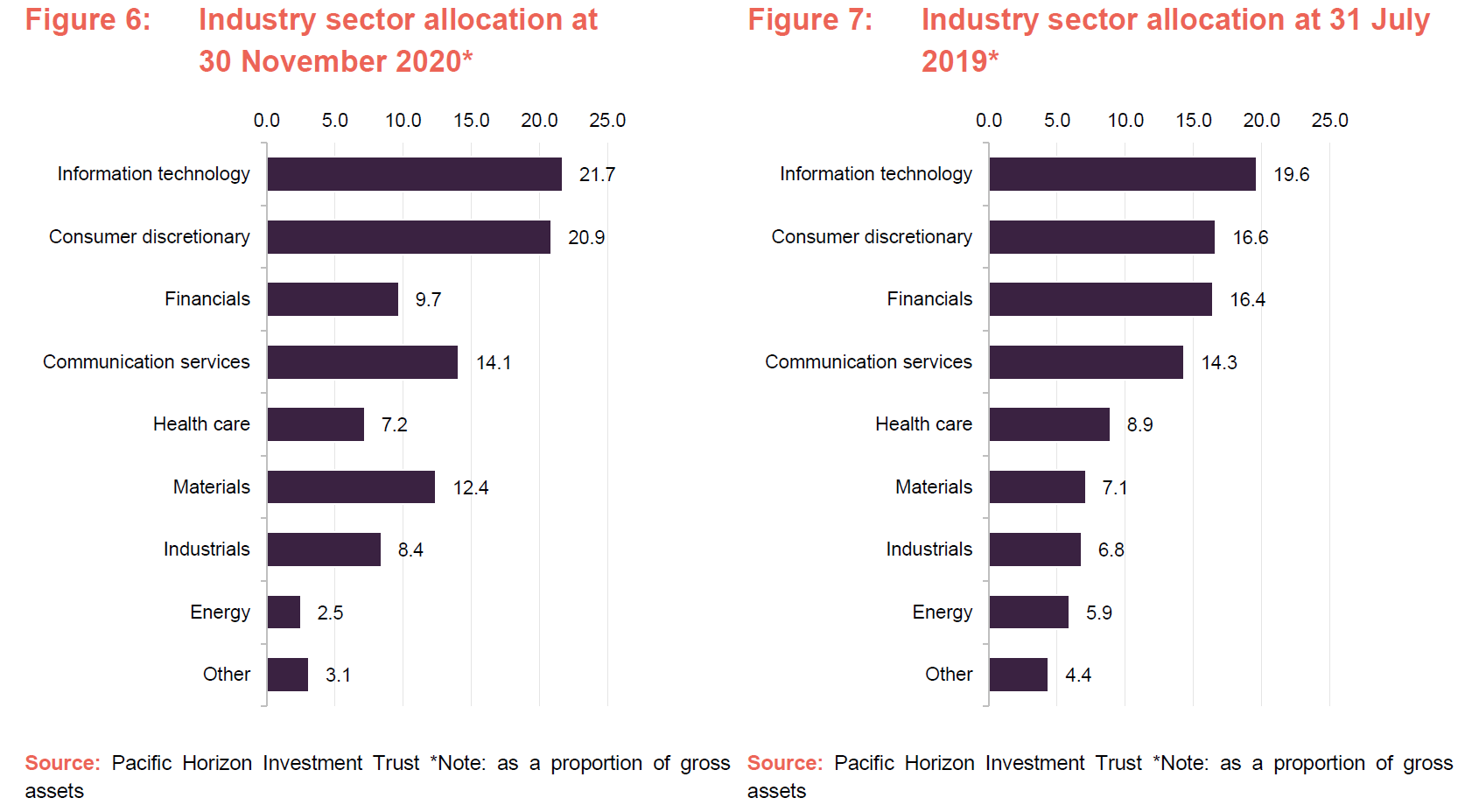

More recently, the changes in PHI’s asset allocation have been driven by relative performance differentials; however, some themes can be drawn out. Comparing Figures 4 & 5 shows a number of changes in the geographic allocations. The increase in the allocation to Hong Kong and China reflects the strong performance of PHI’s holdings in this region (the manager is very positive on the outlook for China but has little interest in domestic Hong Kong stocks). Elsewhere, the manager has been actively reducing the large overweight exposure to South Korea but has been increasing exposure to India and Indonesia. PHI’s portfolio’s exposure to Korea and Taiwan is dominated by biotech and technology hardware companies, respectively.

The manager is still very constructive on Vietnam (which is not a constituent country within the Index), is very bullish on its long-term prospects and has not been reducing the size of PHI’s Vietnamese positions. However, it has shifted down the list due to the strength of performance of other markets. Exposure to Taiwan, already a big underweight, has drifted down as the manager has been reducing PHI’s exposure to technology stocks (see below), which includes TSMC (Taiwan Semiconductor Manufacturing Company).

TSMC dominates the Taiwanese market and is a big component of the MSCI AC Asia Ex-Japan Index. Ewan says that, beyond TSMC, he struggles to find opportunities in Taiwan as he sees better investments elsewhere. He observes that mainland China is highly focused on trying to out-compete Taiwan and, being a more developed market within Asia, he struggles to find anything else particularly exciting. Consequently, the Taiwan underweight is expected to continue.

Broadening the portfolio

In terms of sectoral developments, the manager has been reducing PHI’s exposure to Chinese technology stocks – a reduced dependency on both Alibaba and Tencent is a topic we have discussed in our previous notes. The manager has also been reducing PHI’s exposure to biotechnology. This has largely been a consequence of taking profits following strong performances, with the manager refocusing the portfolio on what he considers to be stronger opportunities. As discussed in the manager’s view section, the manager sees an opportunity in the commodities that will be needed to bring about a greener future. Consequently, the manager expects PHI’s commodities overweight to continue to grow from here.

Zomato Media – PHI’s largest unlisted holding

Zomato Media (www.zomato.com) has been a new addition to PHI’s portfolio since we last wrote. It is an unlisted holding (PHI’s largest) with PHI investing US$5m in a fundraising round just before the pandemic broke (Baillie Gifford invested alongside Tiger Global Management, Temasek Holdings and Ant in that round). Ewan was then able to add to the holding in November 2020 at the same price. Zomato could be described as a pre-IPO investment; the company announced in September that it expects to list in the first half of 2021.

Zomato is an Indian last-mile food delivery company. It operates an online restaurant search, ordering and discovery platform (both through a website and an app) that provides menus, contact details, pictures, directions, ratings, and customer reviews for a range of restaurants. It is among the two largest players in India’s food delivery business (the other is Swiggy, which is being backed by names such as Tencent Holdings, Naspers and DST Global).

Both Zomato and Swiggy faced challenging business conditions during the pandemic, as lockdowns shuttered restaurants for walk-in customers, but food delivery is beginning to recover as Indians continue to order food via apps (aided by strong growth in smart phone penetration).

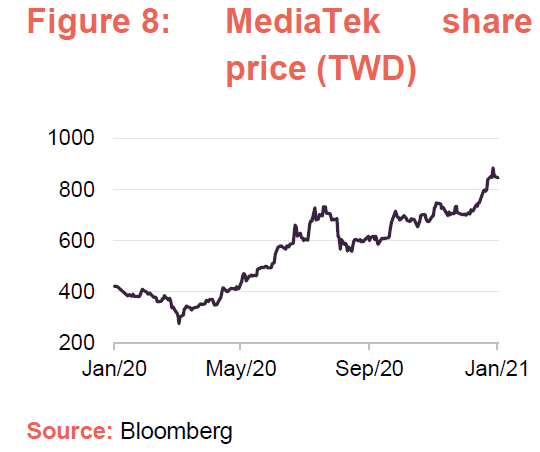

MediaTek is a new holding

MediaTek (www.mediatek.com) is a leading integrated circuit (IC) design company. It is a fabless producer (it does not have its own manufacturing facilities, instead choosing to outsource production) that makes chips for wireless communications, high-definition television, handheld mobile devices, navigation systems, consumer multimedia products and digital subscriber line services as well as optical disc drives. It produces 5G smartphone chips and Ewan says that it leads the low-mid-end chip range in China and Emerging markets more generally. Furthermore, with various restrictions impinging on Huawei, Ewan sees MediaTek as the obvious non-US/non-Chinese supplier of chips.

In addition to the opportunities that the roll out of 5G offers, MediaTek has a substantial non-5G related business that the manager believes will continue to gain market share. Ewan says that the firm’s operating margins have been weak, but he envisages a new upturn in profitability. Ewan bought MediaTek around the TWD 250 mark (close to the low – see Figure 8) and PHI has benefitted as the stock has recovered strongly since. Despite this strong performance, Ewan says that MediaTek is a long-term structural growth story and PHI could make three to four times its money.

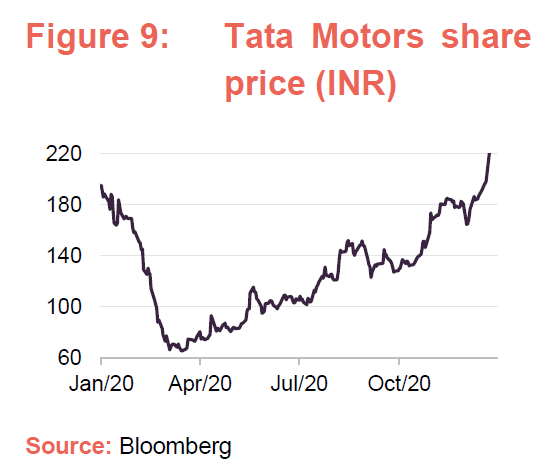

Tata Motors – waiting to reap the benefits of seven years of EV investment

PHI has made an investment in Tata Motors (www.tatamotors.com), which plays into the manager’s theme of investing in companies exposed to the structural move away from fossil fuel powered vehicles to electric vehicles. Tata Motors is the largest automobile manufacturing company in India. It offers an extensive range of passenger and commercial vehicles including passenger cars, trucks, vans, coaches, buses, sports cars, construction equipment and military vehicles.

Tata Motors is part of the Tata Group, an Indian conglomerate that is one of the biggest and oldest industrial groups in India. Headquartered in Mumbai, Maharashtra, Tata Group has gained international recognition after purchasing several global companies. This includes the purchase of Jaguar Land Rover (JLR) in January 2008, in the aftermath of the global financial crisis.

Ewan says that the company has spent seven years investing in the development of electric vehicles and is well placed to capture the rapid growth this market is expected to see in the years to come as the world decarbonises. Tata benefits from a large domestic market and Ewan believes that India is on an uptrend, bolstered by significant improvements across the board in areas such as agricultural and industrial policy (it should be noted that the world’s fifth-largest economy has rebounded very strongly as COVID-related restrictions have eased).

The Modi government has been working to reduce India’s dependency on imports, particularly where the country has a large market (the government’s “Made in India” programme has been a big success) and this provides a structural tailwind to Tata Motors. However, Ewan believes that if Tata Motors can make this technology work with its high-end Jaguars and Land Rovers, it can do very well.

Ewan says that, if you assume that Tesla will end up with around a 20% global market share in EVs, there is room for existing original equipment manufacturers (OEMs) to survive and prosper. However, he thinks that not all OEMs will survive, but those that can make the grade will have higher margins. Baillie Gifford’s intelligence suggest that Tata Motors has got its strategy right and that it should survive, although Ewan recognises that the investment in Tata Motors is not without its risks (he says that the existing OEMs are at an inflexion point – they need to either evolve and grow, or they will be forced out of the market). However, Ewan believes that if Tata Motors and its JLR subsidiary can get their product line-ups correct, the margins will expand significantly, and he believes the investment could make PHI five times its money.

Ningbo Peacebird – Chinese fast fashion for generation Xi

Ningbo Peacebird (www.peacebird.com) is a Chinese clothing company that designs, manufactures and sells garments for men, women and children. Ewan describes it as a Chinese fast fashion company (like a Chinese Zalando), which plays both into the theme of rising real wages and an emerging middle class. Ewan says that Generation Xi view China differently to previous generations and are more focused consumers with a much greater interest in Chinese fashion. He believes that this is a multi-decade trend that Ningbo, with its multi-brand fashion offering, is well positioned to capture.

As illustrated in Figure 10, Ningbo’s share price has doubled over 12 months, despite the recent share price retrenchment. Ewan considers there to be much more to go for, and established a smaller 1% position, which he expects to grow as he gains confidence in the stock. The company is listed in China’s A-share market (this is the domestic market rather than Hong Kong’s H-share market) but, reflecting restrictions on foreign investors, PHI gains its exposure via a warrant derivative.

Meituan Dianping – China’s dominant food delivery platform; its ‘go to’ app is driving massive growth

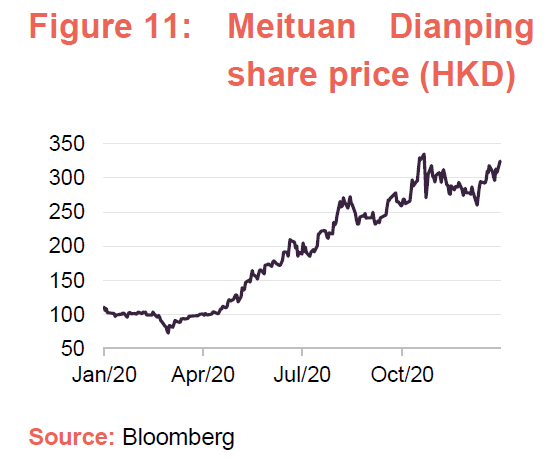

Meituan Dianping (www.meituan.com) has evolved to become China’s dominant player in food delivery. Its platform also offers services in a variety of other areas, from in-store restaurant services to travel; its apps connect consumers with local businesses for food takeout, hotel bookings, and cinema tickets, among other things. The company began life in 2003 as a restaurant review and coupon business but, after a series of mergers and restructurings (one of which saw Tencent take a 20% stake in 2014) – it has emerged as China’s pre-eminent food delivery platform. It is a new entrant to PHI’s portfolio that was added in March 2020 and, as is illustrated in Figure 11, the company has performed very strongly since purchase.

Meituan Dianping, which is listed in Hong Kong, is owned within other accounts at Baillie Gifford. The company came to market in 2018 and Ewan looked at it at that time and initially decided against investing (at the time, the market was more fragmented and considerable consolidation was taking place. Ewan felt there were a number of risks to the story that weren’t adequately factored into the price). However, two years on, Ewan decided to take another look.

The team ascertained that Meituan was becoming a successful platform in its own right, with over 90% of Meituan’s food delivery orders generated on its own platform. This development is key. The manager concluded that Meituan was becoming a ‘super app’ and, when an app becomes the ‘go to’ place, it generates its own traffic, which means that it is able to leverage its position and make considerably more money. Ewan says that this progress is reflected in Meituan’s recent results – while the company is still loss-making, it has been able to scale back its subsidies and move into profit while still taking market share. Ewan says that the market in which Meituan operates has massive potential and, as the dominant player in the sector, it is positioned to grow exponentially.

Top 10 holdings

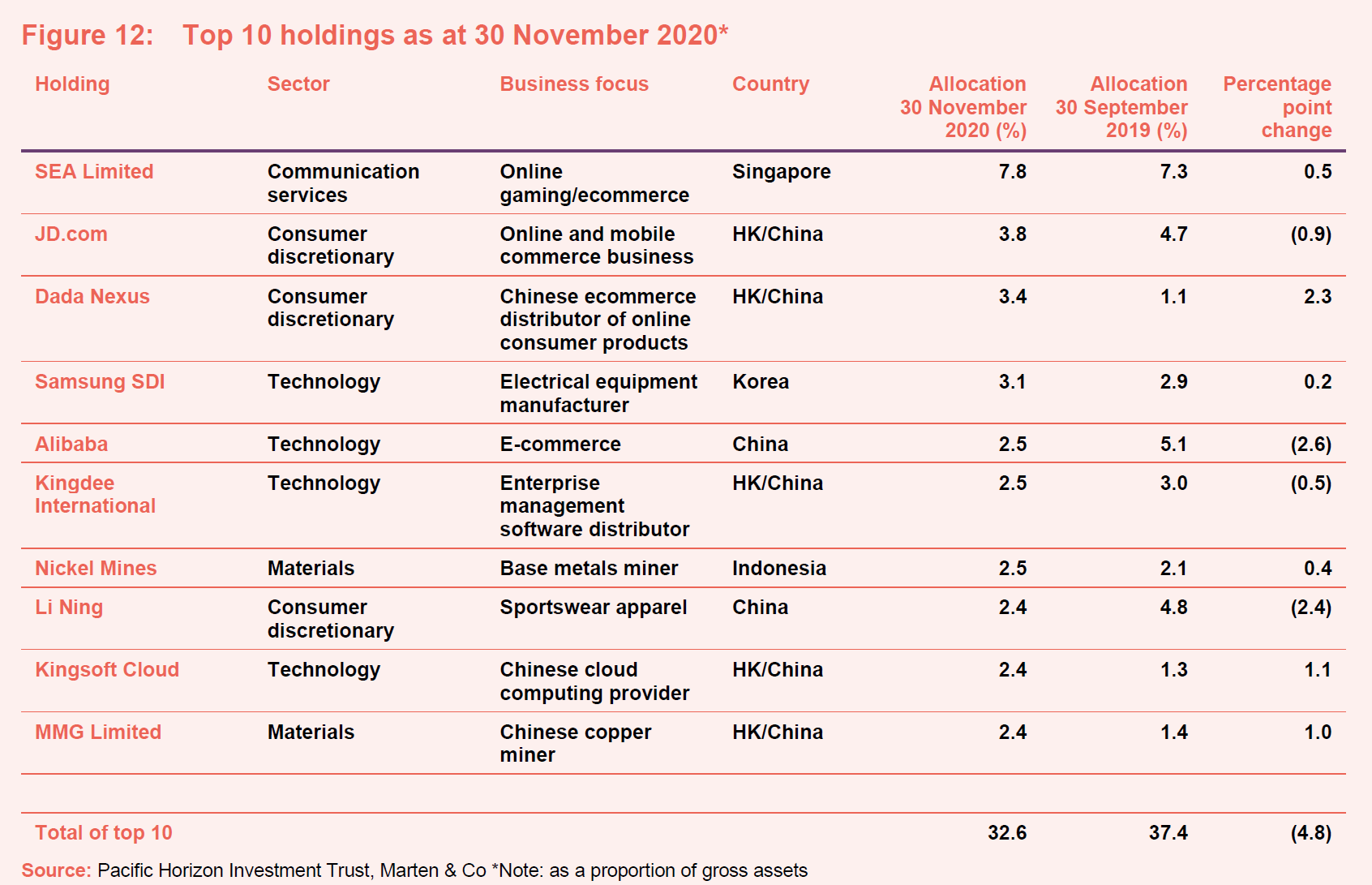

Figure 12 shows PHI’s top 10 holdings as at 30 November 2020 and how these have changed since 30 September 2019 (the most recently available data when we last published). Holdings that have moved in to the top 10 are JD.com (spoken about previously), Dada Nexus, Kingdee International Software, Nickel Mines, Kingsoft Cloud and MMG Limited. Names that have moved out of the top 10 are Accton Technology, Tencent, Vietnam Enterprise, Ping An Insurance, Ping An Bank ‘A’ and CNOOC. We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see page 33 of this note). We have also provided an update on SEA Limited, PHI’s largest holding.

JD.com (3.8%) – growth across the board; benefitting from growth in active customers, margins and revenues

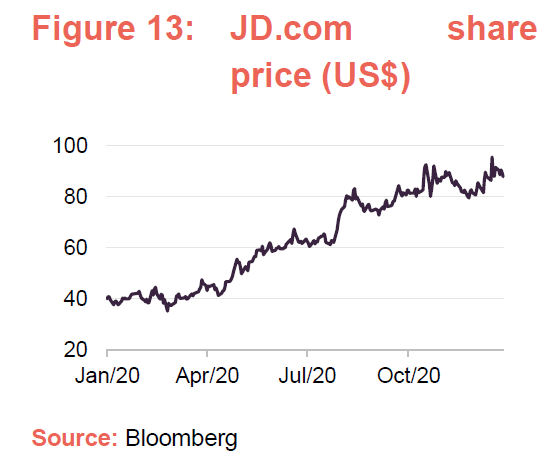

JD.com (corporate.jd.com – also known as Jingdong) is a Chinese e-commerce company headquartered in Beijing. It is the largest Chinese retailer, via its dominant share in the online ecommerce 3C (computers, communications and consumer electronics) market, and it is the second player in overall Chinese ecommerce (along with Alibaba, it is one of the two massive business-to-consumer (B2C) online retailers in China).

JD.com has been held in PHI’s portfolio since May 2014 and has been a strong performer during this time. In our October 2017 note, we explained how its rival, Alibaba (also owned by PHI), had made significant investments in technology and big data to drive its customer and merchant experiencers and improve its marketing (which was driving profit growth higher than revenue growth), while JD.com owns its back-end logistics operations (Alibaba is largely outsourced) and was working to move to 100% automation within its factories.

Ewan says that, while PHI continues to be underweight Alibaba, it is overweight JD.com and the newly-acquired Dada Nexus (see below). All three companies have been given a boost by the pandemic as consumers have switched more and more of their purchases online (this has been reflected in JD.com share price performance – see Figure 13). However, JD.com’s one-stop-shop approach (an e-commerce platform offering a wide range of products, which is supported by its own logistics network) has proven particularly resilient during the current climate. Ewan believes that the intellectual property that JD.com has been acquiring by developing its back-end automation will be very valuable.

For the first half of 2020, JD.com’s net revenue was 28% higher, year-on-year, driven by a strong performance across its products revenue (an increase of 27%) and services revenue (an increase of 34%). However, by spreading its fixed costs over a larger revenue base, JD.com’s operating income more than doubled, hitting US$1bn (in addition to revenue growth, it benefitted from higher margins). The company saw a 30% increase in its number of annual active customers to 417m (for the 12 months ended 30 June 2020).

Ewan says that it is JD.com’s strong logistics network and its focus on customer service that has been driving increased revenue market share. He also thinks that new investments in small-medium enterprise (SME) finance and online food delivery could create exciting new market opportunities.

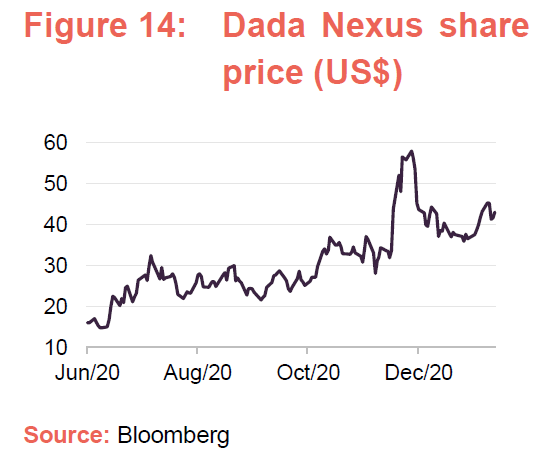

Dada Nexus (3.4%) – local on-demand Chinese online retail platforms for delivering groceries and consumer goods

Dada Nexus (imdada.cn) is a Chinese ecommerce distributor of online consumer products that came to market with its IPO in June last year. The company’s IPO on NASDAQ raised US$336m through the sale of 21m American depositary shares, at US$16 per share, in a transaction that valued the company at approximately US$3.5bn. The company, which was founded in 2014, operates JD Daojia and Dada Now, local on-demand online retail platforms for delivering groceries, consumer goods and meals in China. Ewan thinks that the company has massive growth potential, which has been given a boost by the pandemic.

Dada Nexus has recently announced that it is strengthening its strategic partnership with Unilever. Together, they are developing a data-driven on-demand retail model in the fast-moving consumer-goods (FMCG) sector. The plan is that both will leverage their relationships with key retailers to develop differentiated regional operations and expand into lower-tier cities. The partnership plans to use Dada’s proprietary technology to enhance Unilever’s product management system.

As illustrated in Figure 14, the company’s share price performed strongly following its IPO until the 1 December when the company announced a modestly dilutive share issue that was not well received by the market. The company said it was planning to issue 9m ADS (American depositary shares – equivalent to 36m common shares) at US$50 per share (the share price was c. US$53 per share at the time of the announcement).

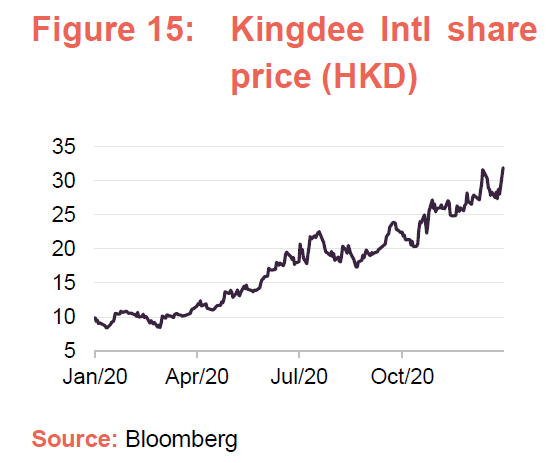

Kingdee International Software (2.5%) –strong growth in cloud services business

Founded in 1993, and listed on the Hong Kong Stock Exchange, Kingdee International Software Group (www.kingdee.com.hk/en) provides management software and cloud services to enterprises (it has over 6.8m enterprise clients and 80m users). This includes cloud-based enterprise resource planning (ERP) software (including supply chain management and accounting). Ewan says the company is somewhat comparable to Adobe in the US and the industry has an attractive margin profile (at around 20%).

Ewan first purchased a position for PHI in April 2015, and it has been a strong contributor to performance since (it was PHI’s best-performing stock in the year ended 31 July 2018, for example). Kingdee performed strongly during 2019 and has performed strongly during 2020 as businesses have sought to adjust their operations post-COVID-19. This has been reflected in its strong share price performance during 2020 (see Figure 15). Like Kingsoft Cloud (discussed overleaf), Kingdee is benefitting from a tailwind as the Chinese government is focused on advancing technology and reducing dependence on US providers.

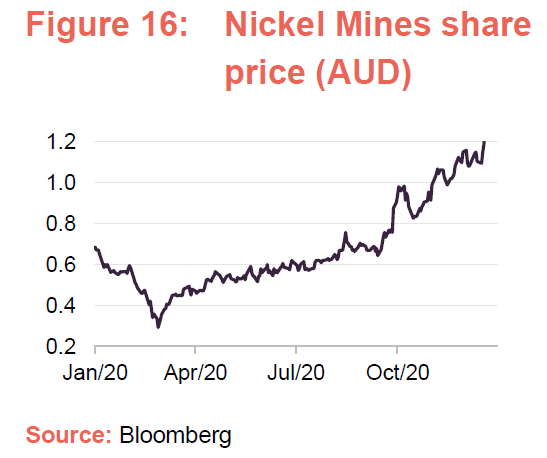

Nickel Mines (2.5%) – well positioned to add assets cheaply

Nickel Mines Limited (www.nickelmines.com.au) is an Australian listed base metals mining company, with operations in Indonesia, that has been held in PHI’s portfolio since November 2018. The company holds 80% economic interests in the Hengjaya Nickel and Ranger Nickel projects. Both of these projects, which are located within the Indonesia Morowali Industrial Park (IMIP), operate two-line rotary kiln electric furnace (RKEF) plants producing nickel pig iron (NPI). Nickel Mines also holds an 80% economic interest in the Hengjaya Mineralindo Nickel Mine, a large tonnage, high grade saprolite deposit located in the Morowali Regency of Central Sulawesi, Indonesia.

NPI is a low-grade ferronickel invented in China as a cheaper alternative to pure nickel for the production of stainless steel, for which it is now a key ingredient. However, nickel has a range of industrial uses, including batteries, and it is one of a number of commodities that Ewan believes will be in increasingly short supply as the world develops the necessary infrastructure that is required to allow it to reduce its carbon emissions (see page 9).

Ewan says that through a buy and build strategy, Nickel Mines is emerging as a globally significant, low-cost producer of NPI. It has recently purchased six new sites, but there are plenty more available, and it is well positioned to add these assets cheaply. He believes it will benefit from increasing nickel prices, asset growth and growth in the value of its assets (its NAV will increase as nickel prices rise).

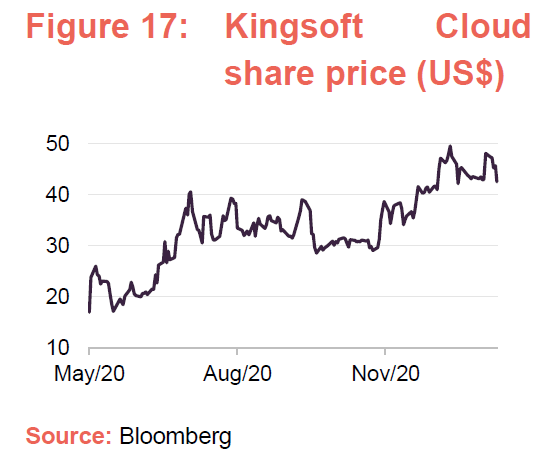

Kingsoft Cloud (2.4%) – benefitting from tailwinds from the shift to the cloud and China pushing for technological advancement

Kingsoft Cloud (en.ksyun.com) is a new entry to PHI’s portfolio. It is a Chinese cloud computing company whose platform for businesses and developers includes online cloud storage and cloud distribution services. The company owns data centres in mainland China, Hong Kong, Russia, Southeast Asia, and North America.

Kingsoft Cloud is currently loss-making but, like other cloud service providers, is growing very strongly (around 70% per annum) and Ewan can see a path to profitability. The company is a tier 3 player, and is therefore not well understood by the market, but has benefitted from the pandemic as companies have sought to shift more and more of their operations online alongside the growth in home-working. Ewan initiated the holding with a 2% position, but he expects this to grow. Like other technology companies in China, Kingsoft has a tailwind in that the Chinese state is pushing heavily for technological advancement.

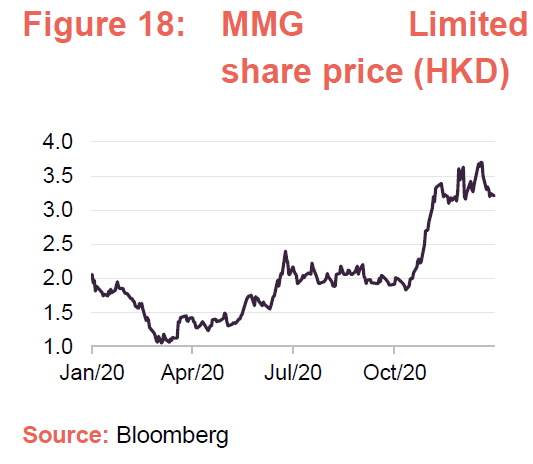

MMG Limited (2.4%) – PHI’s manager sees significant upside to the copper price

MMG Limited (www.mmg.com) is a Hong Kong listed mid-tier mining company whose assets are primarily in Peru, although it also has operations in Australia, the Republic of Congo and Canada. The bulk of MMG’s production is copper, but it also produces zinc and other base metals. In investing in MMG, PHI is investing alongside the Chinese state – MMG’s largest shareholder is China Minmetals Corporation, a Chinese state-owned enterprise that owns approximately 75% of MMG’s shares. In addition to the supply deficit in nickel discussed above (manager’s view and Nickel Mines), the manager sees significant upside to the copper price as well.

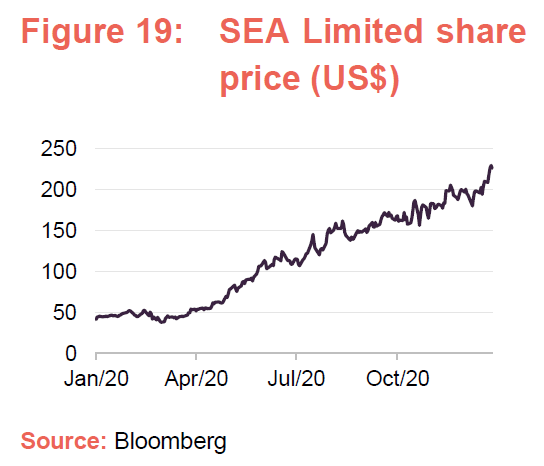

SEA Limited (7.8%) – SEA’s markets can grow exponentially over the next decade, but challenges remain

Based in Singapore, SEA Limited (SEA) (seagroup.com) is one of South-East Asia’s leading companies in gaming and online e-commerce. It remains an independent company, though it is significantly backed by Tencent. SEA has developed an integrated platform consisting of digital entertainment, electronic commerce, and digital financial services. It operates three businesses: Garena, Shopee, and SeaMoney.

- Garena is engaged in online games development and publishing.

- Shopee is an online shopping platform.

- SeaMoney provides online/digital payments and financial services.

SEA’s share price has increased 10x since it was purchased for PHI’s portfolio in October 2017. This strong performance led PHI’s manager to reduce the size of the position by 600 basis points with a view partially to take some profits, but, more importantly, to rebalance the portfolio and reduce the concentration risk (the sale brought PHI’s allocation to SEA back down to 10% of the portfolio).

Despite this stellar increase, PHI’s manager continues to believe that SEA’s markets can potentially grow exponentially over the next 10 years. Reflecting both the strength of the manager’s conviction and continued strong share price performance from SEA (see Figure 19), it remains PHI’s largest holding. Ewan believes that it will outperform the likes of Alibaba and Tencent but, he comments that, while it can more than double from here, potentially making between three and five times, there are nonetheless challenges ahead. It continues to be a far eastern, internet company rather than a global one; it has a local management team and may need a more globally-focused one for the challenges that lie ahead; and the strength of its valuation will likely remain an issue for the market, despite the strong growth prospects.

Ewan believes that SEA can overcome these hurdles and provide the strong growth he expects, but feels that SEA will likely have to provide a higher quality offering, versus its peers, to be able to differentiate itself. Ewan thinks that, reflecting the balance of these considerations, PHI’s allocation to SEA will likely fall to around 5% allocation of the portfolio over the next few years.

Performance – exceptional outperformance

The benefit of hindsight

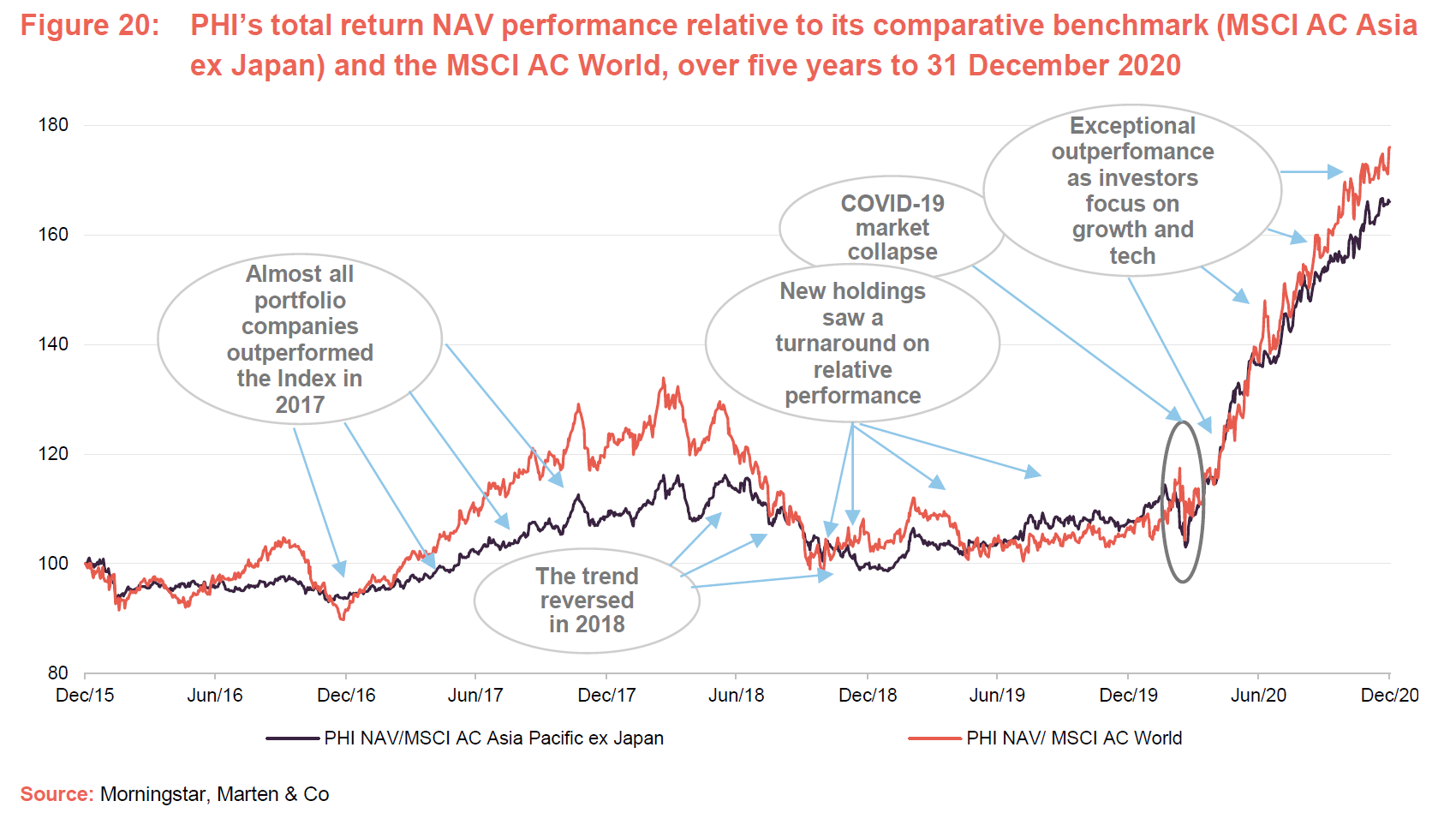

When we last published in November 2019, we commented how, between Ewan taking over the management of PHI’s portfolio on 18 March 2014 and 31 October 2019, PHI had provided an NAV total return of nearly 87%. At that time, PHI had outperformed the index since Ewan had taken over, as well as outperforming over three and five years. This strong performance meant that a potential tender offer, which was contingent on PHI’s relative performance over a three-year period, did not take place.

With the benefit of hindsight, this was clearly beneficial to PHI shareholders given the exceptional performance, both in absolute and relative terms, PHI provided during the course of 2020, which can be seen in both Figures 20 & 21 (NAV and share price total returns of 86.3% and 128.6% respectively). As markets collapsed in March, in the face of an accelerating COVID-19 infection rate, PHI’s NAV initially retrenched, but – as is illustrated in Figure 20 – this has been eclipsed by the scale of its recovery and outperformance since.

PHI found itself in a sweet spot

During the chaos of 2020, PHI has found itself in somewhat of a sweet spot. As governments across the globe rushed to limit the scale of the economic damage, injecting considerable fiscal and monetary stimulus along the way, they extended the low economic growth, low interest rate narrative for longer. In response, investors briskly turned their focus towards stocks exposed to long-term structural growth trends that should be able to progress despite the prevailing market conditions. In this regard, it should be noted that PHI is not the only fund to see its long-term growth focus vindicated in 2020. Long-term growth is Baillie Gifford’s mantra and its funds have been topping the performance tables across the investment companies sector.

Technology, to which PHI has a significant exposure, generally performed well as the world attempted to adjust to the new normal, and PHI’s biotechnology exposure also performed strongly. In addition, Asia, with its experience of similar medical emergencies such as SARS, was a relative bright spot in its handling of the pandemic. This has allowed most Asian economies to emerge from restrictions more quickly than many of their counterparts in the developed world, whose handling of the pandemic has, in comparison, been considerably more haphazard. In addition, none of PHI’s holdings suffered catastrophically and the market rout allowed the manager to add new positions to PHI’s portfolio at what the manager describes as exceptionally cheap prices. PHI has benefitted strongly as these have recovered.

Long-term record of outperformance expanded

PHI’s recent stellar performance has also lifted its long-term performance record. For example, as at 31 December 2020, PHI had provided an NAV total return of 262.1% since Ewan’s appointment in 2014. Reflecting the fact that PHI has moved from trading at a marked discount to a significant premium during this time (see the premium/(discount) section on pages 26 to 28 for more discussion), PHI’s share price total return performance has been even stronger, providing a return of 368.0%.

As illustrated in Figure 21, PHI’s NAV total return has outperformed all of the comparators, over all of the periods provided, with the exception of the month period, where it has fallen behind the MSCI AC Asia Pacific ex Japan by 10 basis points. The primary driver for this is was the discovery, towards the end of 2020, of a number of vaccines. Whilst this is clearly good news for economies and markets, it has, at least in the short-term, triggered a surge in ‘value’ style names and growth names have lagged in the very short term. However, this resurgence may be short-lived, as we discuss below, and we would also add that a long-term strategy such as PHI’s is best assessed over longer-term time frames.

There is still a considerable way to go before vaccine rollouts will be providing sufficient protection that restrictions can be lifted permanently and, irrespective of this, the pandemic has accelerated a number of structural changes that are not likely to reverse significantly, even in the short term. In reality, we expect that business fundamentals will reassert themselves over time and, with the challenges over the pandemic having driven considerable stimulus that has extended the low-growth, low-interest rate narrative for longer, it seems reasonable that companies that offer exposure to structural growth will continue to be in demand, despite the recent value-rally.

As is illustrated in Figure 21, PHI’s share price total return performance has beaten all of the periods provided, reflecting the fact that, at year-end, PHI was trading close to a five-year premium high (see Figure 26 on page 26).

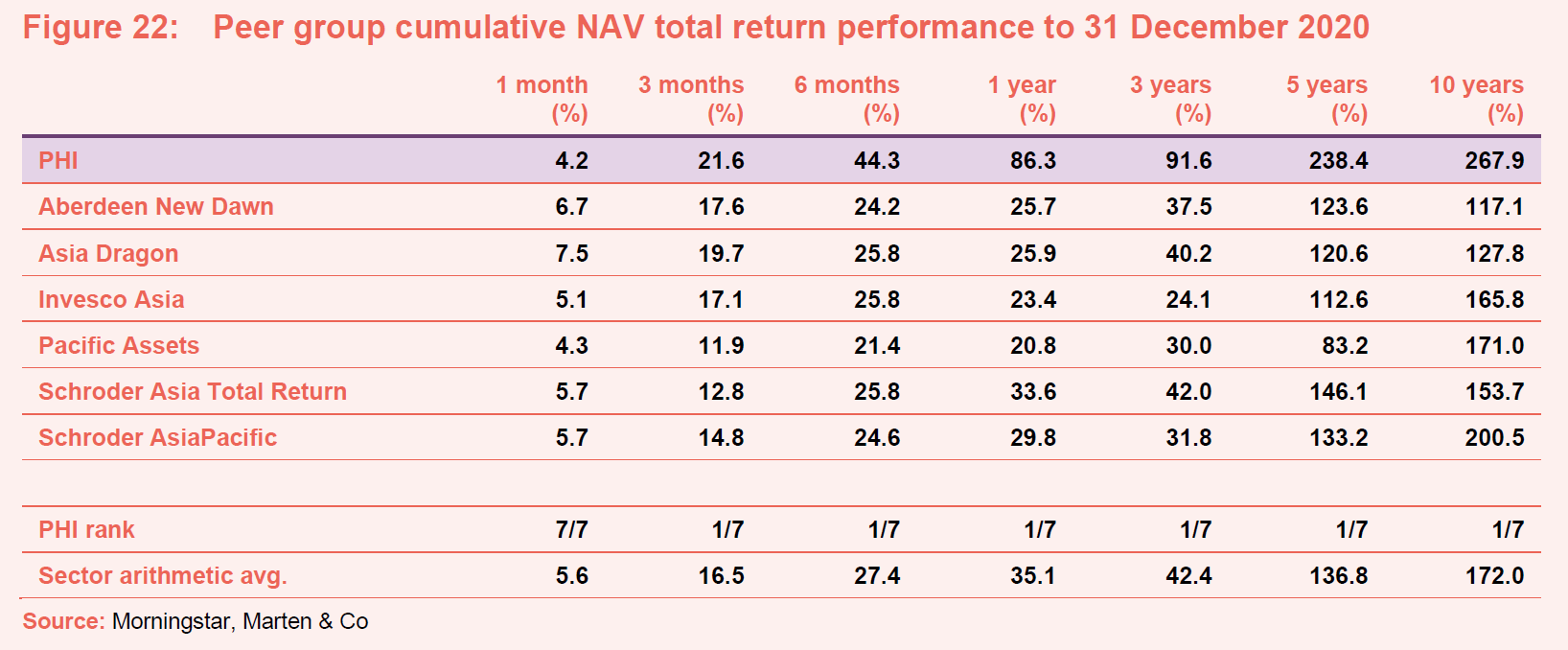

Peer-group comparison – Asia Pacific sector

Since we last published on PHI, the AIC has recast its sectors. PHI, which was formerly in the Asia Pacific ex Japan sector, is now in the Asia Pacific sector, which has a broadly similar focus. The Asia Pacific sector is comprised of seven members, which are detailed in Figures 22 to 24. All of these were members of the old peer group which, when we last wrote about PHI, had nine members. The two trusts that were previously included in the peer group are Witan Pacific and Fidelity Asian Values. Witan Pacific has been reformed as Baillie Gifford China Growth and has moved to the country specialists – Asia Pacific ex Japan sector, while Fidelity Asian Values, with its small-cap bias, has migrated to the Asia Pacific Smaller Companies sector.

Members of Asia Pacific sector will typically have:

- over 80% invested in quoted Asia Pacific shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in Asia Pacific shares;

- a majority of investments in medium to giant cap companies; and

- an Asia Pacific benchmark

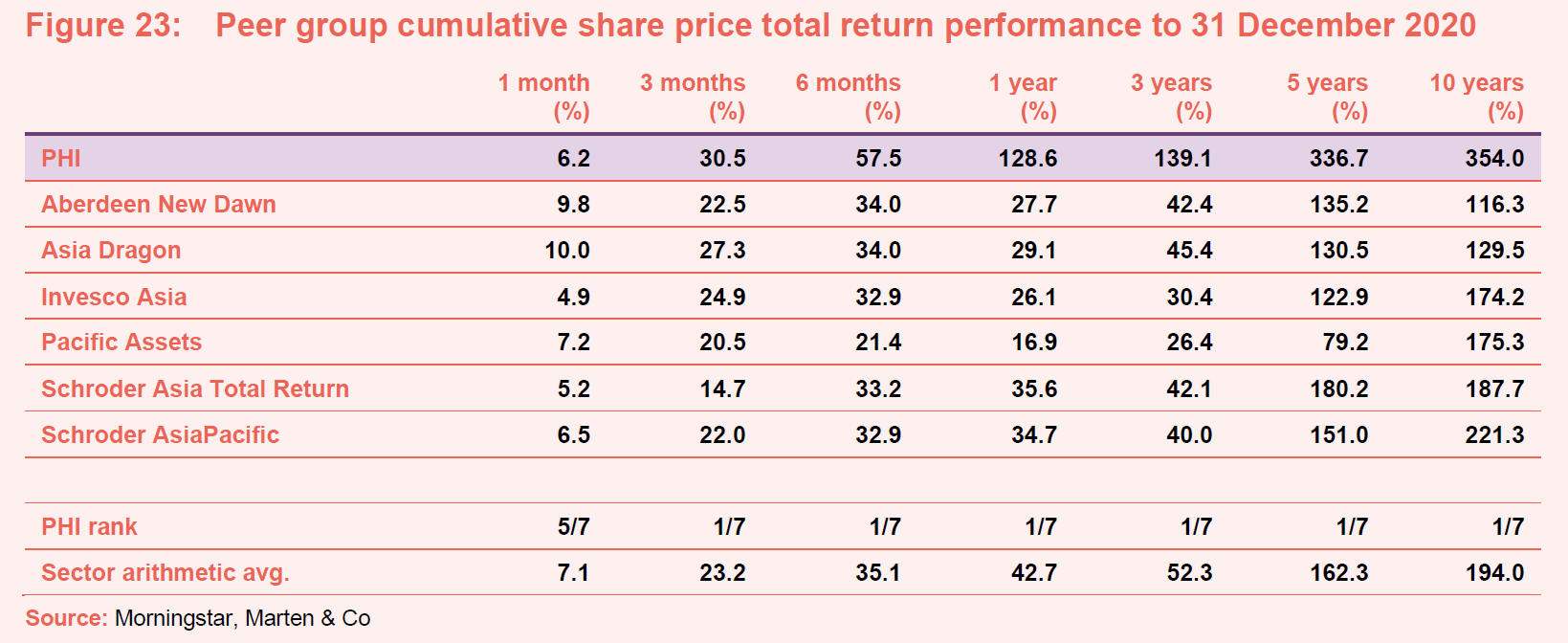

As illustrated in Figure 22, PHI’s cumulative NAV total return performance ranks first out of the entire peer group for every time-period provided except the one-month period. As discussed above, the one-month underperformance reflects the recent discovery of a number of vaccines for COVID-19, which has caused markets, and in particular value stocks, to rally. However, we think that this relief for structurally-challenged companies will likely prove temporary. Otherwise, PHI’s exceptionally strong performance during the last 12 months has lifted its performance over all of the periods. Not surprisingly, PHI’s NAV performance is markedly ahead of the peer group average, particularly over the longer measurement periods.

Figure 23 illustrates a similar story for share price total return, with PHI ranking first for all of the periods provided for three months and above. PHI’s share price total returns are well ahead of the peer group average for all of the time-periods provided.

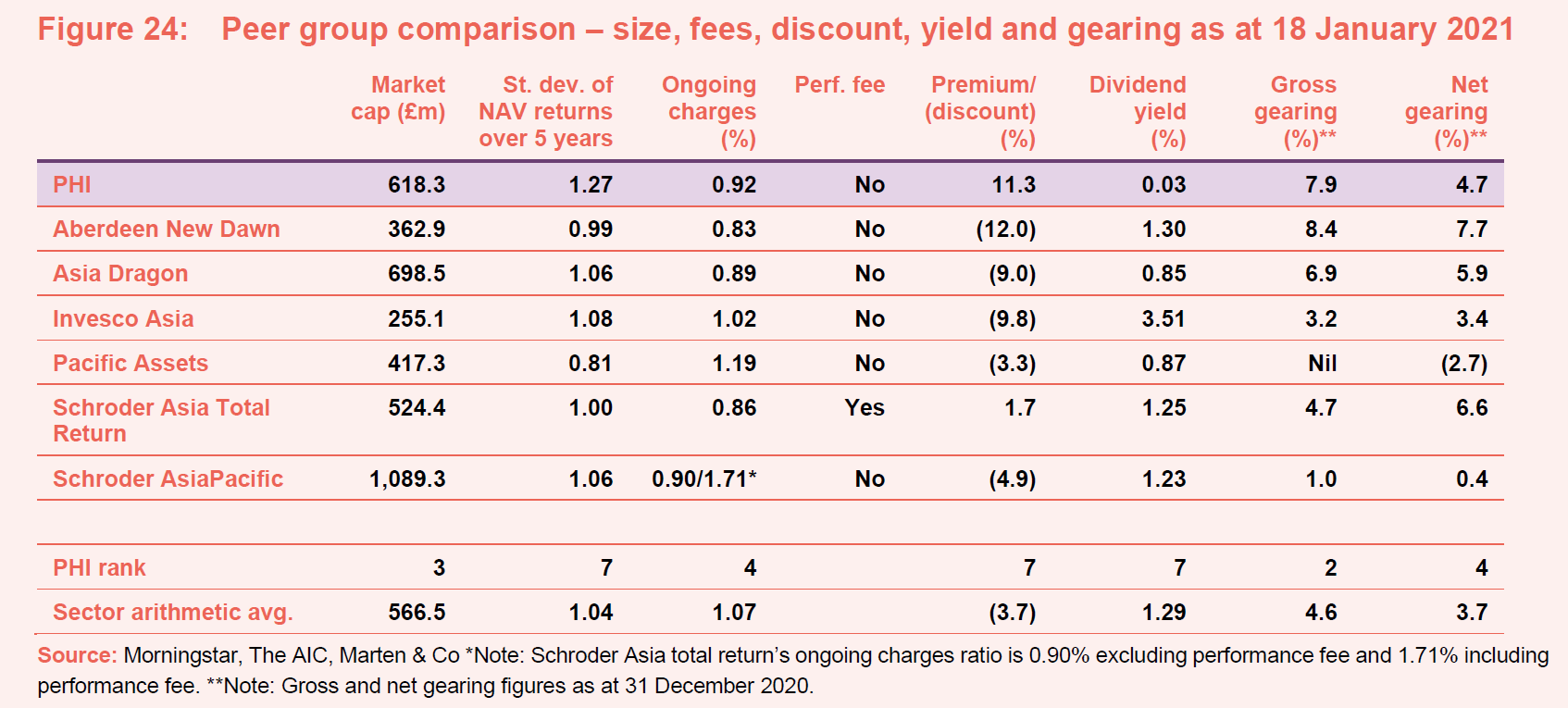

When we last wrote on PHI in October 2019, we commented how PHI was one of the smallest funds in the sector, but that this was not reflected in its ongoing charges ratio, which was equal to the sector average at that time. Fast-forward to today and PHI’s growth, both from its very strong performance and the significant share issuance that the subsequent premium rating has allowed, has moved PHI up the market cap scale so that it now ranks third – behind Asia Dragon and the titan of the sector, Schroder AsiaPacific.

Reflecting this, PHI’s ongoing charges ratio has been on a declining trend (see

page 29 for more discussion). We expect this to fall further as the full benefit of the recent asset growth feeds through (both allowing PHI to spread its fixed costs over a wider asset base and its shareholders to benefit from the tiered fee structure that sees additional assets from here charged at the lowest fee in its tiered structure of 0.55% of net assets).

As illustrated in Figure 24, PHI is one of only two trusts trading at a premium, and PHI’s is the highest. The other is Schroder Asian Total Return, which has also been another strong-performing trust, although its returns are significantly behind that of PHI’s.

Not surprisingly, given its focus on capital growth (PHI only pays dividends to the extent required to maintain its investment trust status – see page 24), PHI’s dividend yield is the lowest in the sector (it should be noted that PHI frequently pays no dividend, but was required to for its most recent financial year).

In terms of net gearing levels, PHI is middle of the pack. Its NAV returns have shown the greatest volatility, but these are by no means high.

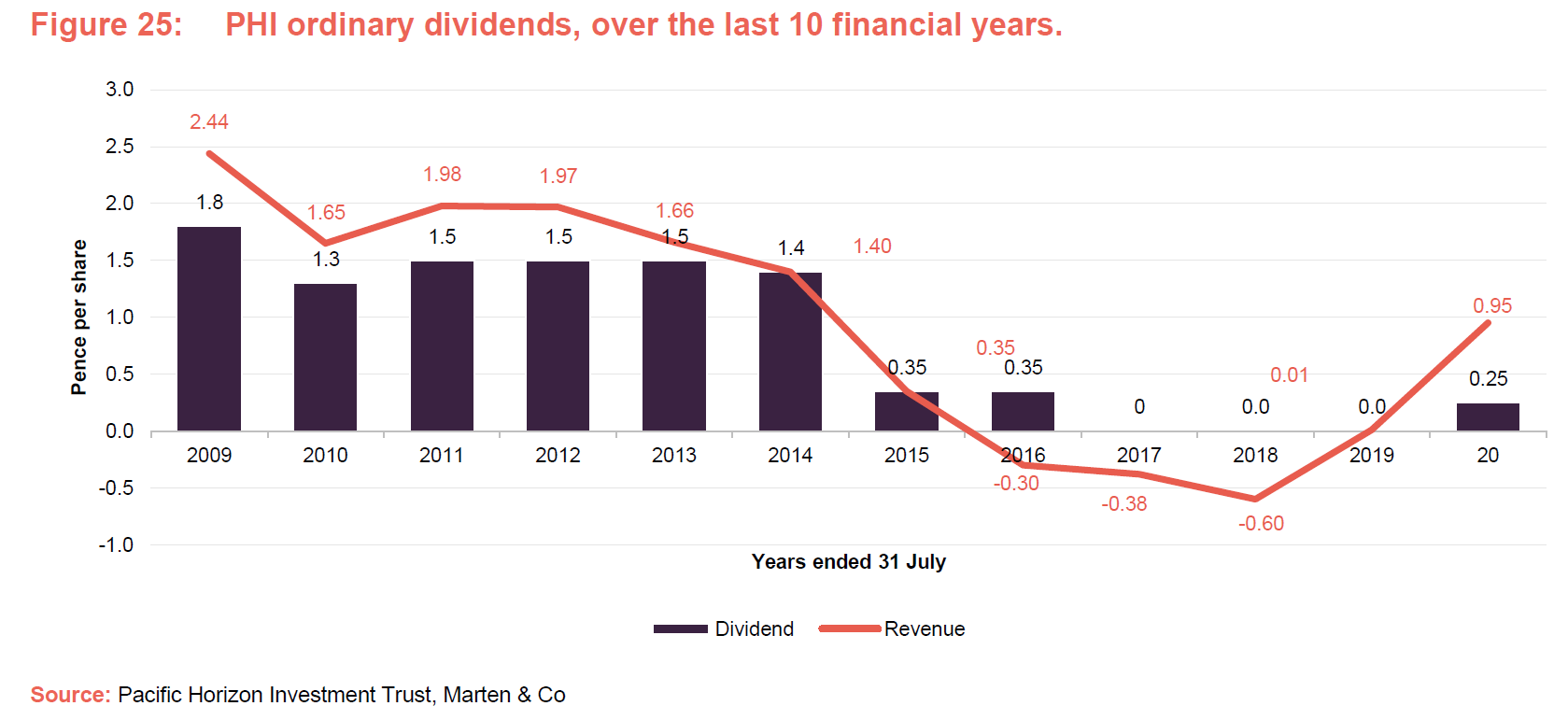

Dividend

PHI’s primary objective is to generate capital growth and the board’s policy is that any dividend payable in the future will be determined as being the minimum permissible in order to maintain PHI’s investment trust status. Where necessary, this is paid by way of one final payment per year, following approval at the annual general meeting (AGM). For the avoidance of doubt, PHI’s board have made it clear that investors should not consider investing in the company if they require income from their investment.

For the year ended 31 July 2020, PHI generated a small revenue surplus of £564k, equivalent to 0.95p per share (2019: a small surplus of 0.01p per share). This was sufficient to require PHI to pay a dividend and, as illustrated in Figure 25 above, PHI has, for the first time in four financial years, declared a dividend. This dividend, for the year ended 31 July 2020, was declared at 0.25p per share and, following approval by shareholders at PHI’s AGM on 12 November 2020, was paid the following day.

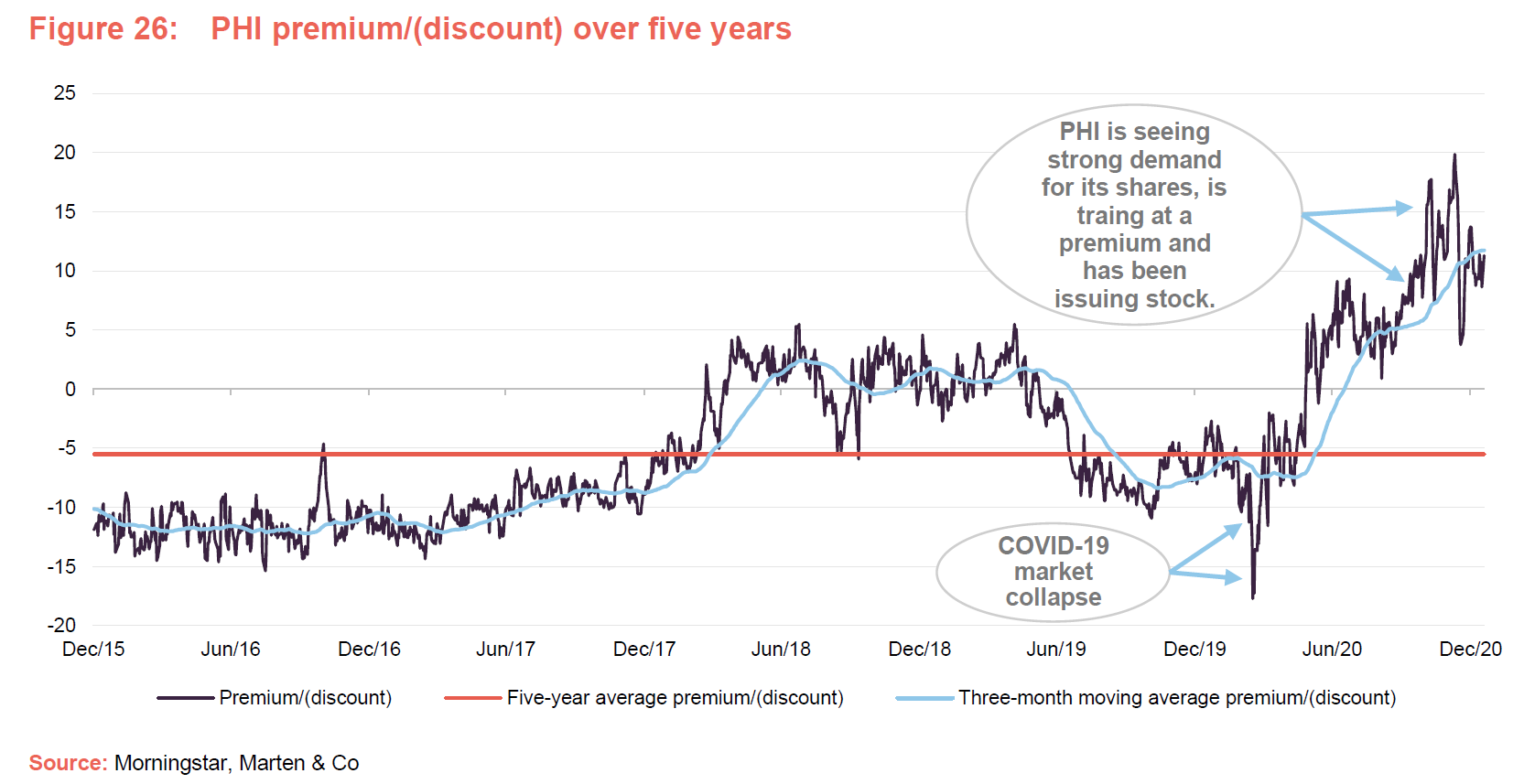

Premium/(discount)

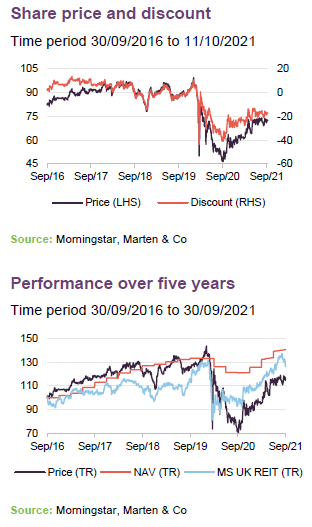

As illustrated in Figure 26, PHI’s shares have, for much of the last three years, traded at a premium to NAV. As discussed in our previous notes, this initially occurred as PHI successfully rejigged its portfolio in 2018, which led to a marked improvement in performance (it should be remembered that PHI made shareholders a performance-based tender offer in 2019 that was ultimately not required due to a strong improvement in performance coming through – see page 13 of our November 2019 note).

As also discussed in our November 2019 note, the discount widened over the summer of 2019 as risk aversion increased, but narrowed again as markets settled before briefly spiking out to a five-year high of 17.7% on the 17 March 2020 as markets collapsed in the face of an accelerating COVID-19 infection rate. However, as illustrated in Figure 26, this widening has been brief because, as discussed in the performance section above, PHI has found itself in a performance sweet spot.

As governments have scrambled to stabilise the global economy in the face of the pandemic, pumping considerable fiscal and monetary stimulus into the financial system, investors’ attention has rotated strongly to a focus on growth stocks as the low interest rate for longer narrative was extended even further, with technology and biotechnology/healthcare being massive beneficiaries.

Furthermore, Asia, having previous experience of handling pandemics such as SARS and MERS have also been demonstrably effective in controlling the spread of the virus, allowing their economies to normalise more quickly. All of this has been reflected in PHI’s own exceptionally strong performance, which has led to strong demand for its strategy from investors. This not only pushed the trust back to a premium relatively quickly, but as illustrated in Figure 26, saw the premium continue to widen over time finally peaking at 19.9% on 10 December 2020 (a five-year high). During the last five years, PHI has traded at an average discount of 4.5% and during the last 12 months the average premium has been 2.6%.

Premium/(discount) management

PHI has authority to repurchase up to 14.99% of its issued share capital, as well as to issue up to 10% at a premium to NAV. These authorities give the board mechanisms through which it can manage PHI’s discount or moderate any premium that should arise. Shares repurchased can be held in treasury and reissued by the company to meet demand. Any reissue of treasury shares would only be undertaken at a premium to NAV.

Strong demand has led to proposals to allow PHI to issue up to 100% of its issued share capital over the next year

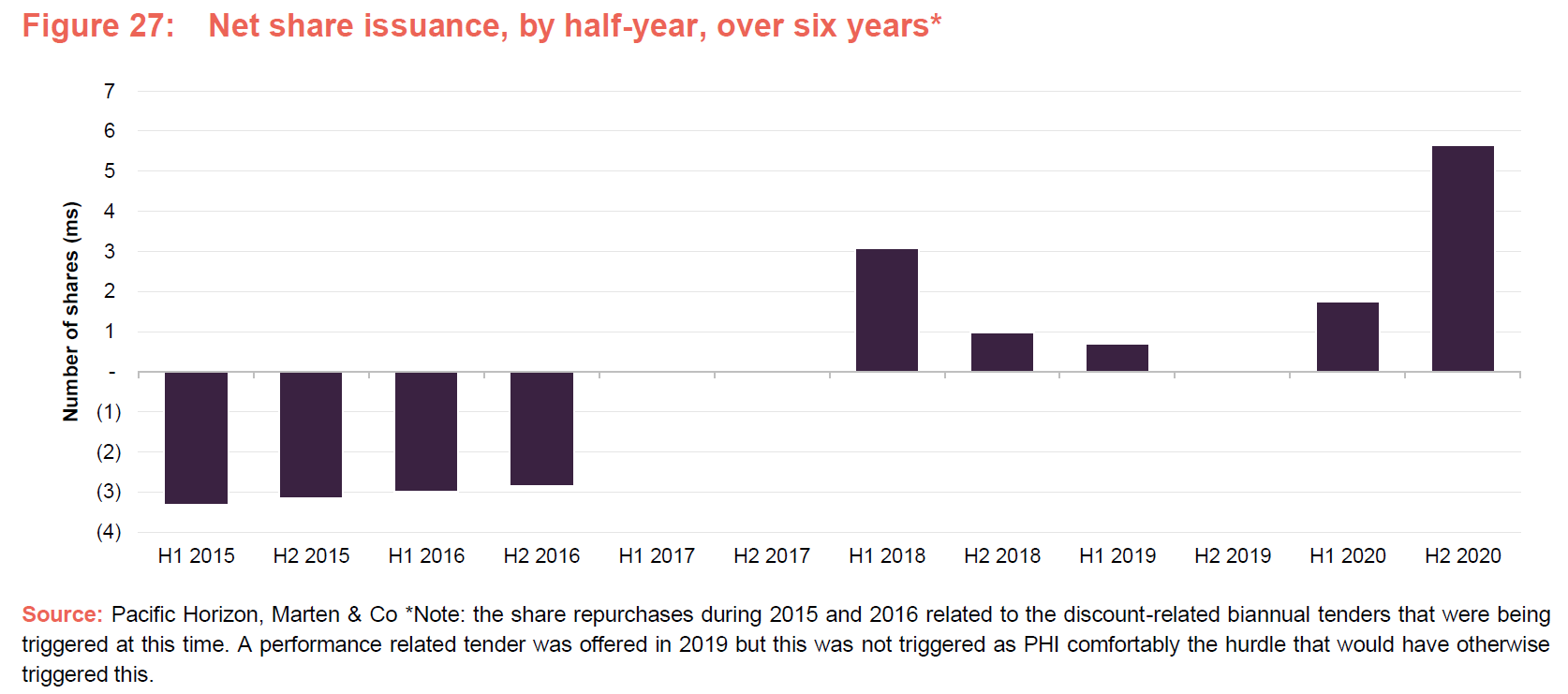

As illustrated in Figure 27, PHI’s premium has allowed PHI to issue stock during the last three years, although it has struggled to keep up with the strength of demand this year, particularly in the second half, which is why the premium has continued to expand. However, on 11 December 2020, PHI published a prospectus detailing proposals to allow it to issue up to 73,608,338 new shares (100% of PHI’s issued share capital at the time the prospectus was published), over a 12-month period, to satisfy investor demand. The shares will only be issued:

- at a premium to NAV;

- to meet demand from investors; and

- when the board believes it is in the best interests of PHI and its shareholders.

In addition to this, PHI is also asking shareholders for permission to renew the board’s authority to allot shares and to disapply the pre-emptive rights on the issue of such shares. A general meeting is being convened on 19 January 2021 at which shareholders will be asked to vote on the following proposals:

- An ordinary resolution to give the board authority to allot up to 20% of the aggregate nominal value of PHI’s issued share capital as at 8 December 2020.

- A special resolution to give the board authority to disapply rights of pre-emption in respect of the issue of up to 10% of the aggregate nominal value of PHI’s issued share capital of the company as at 8 December 2020.

- A second special resolution that will also give the board authority to disapply rights of pre-emption in respect of the issue of up to 10% of the aggregate nominal value of PHI’s issued share capital of the company as at 8 December 2020.

If approved, the authorities conferred by these resolutions are set to expire at the conclusion of PHI’s next AGM, which is expected to take place in November 2021. In the meantime, the proposed measures appear to have settled investors nerves regarding the scarcity of PHI stock, which has in turn moderated its premium (see Figure 26).

In summary, we welcome the proposals, as this will allow PHI to continue to expand to the benefit of all shareholders. First of all, as stock will be issued at a premium to NAV, all issuance will be NAV accretive to existing shareholders. Second, expanding the trust should allow for greater operational efficiencies and, all things being equal, should lower PHI’s ongoing charges ratio by spreading its fixed costs over a wider asset base. Third, further share issuance should lead to greater liquidity in PHI’s shares.

Fees and costs

Baillie Gifford & Co Limited acts as PHI’s alternative investment fund manager and has delegated portfolio management services to Baillie Gifford & Co. PHI’s management fee is calculated on a tiered basis. With effect from 1 January 2019, the annual management fee is 0.75% on the first £50m of net assets, 0.65% on the next £200m of net assets and 0.55% on the remaining net assets. In the periods before 1 January 2019, the fee was 0.95% on the first £50m of net assets, 0.65% on the next £200m of net assets and 0.55% on the remaining net assets.

Management fees are calculated and paid quarterly in arrears and there is no performance fee. The managers may terminate the management agreement on six months’ notice and the company may terminate it on three months’ notice.

The ongoing charges ratio for the accounting year ended 31 July 2020 was 0.92%, down from 0.99% in the prior accounting year, and 1.02% the year before that. Baillie Gifford & Co Limited also provides company secretarial services. These services are included as part of the management agreement. PHI’s ongoing charges ratio has been on a declining trend in recent years. This reflects both the reduction in the base management fee that is noted above, as well as the recent strong share issuance which means that PHI’s fixed costs are spread over a larger asset base.

Capital structure and trust life

PHI has a simple capital structure with just one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 18 January 2021, there were 76,618,338 in issue with none held in treasury.

Each year, the company takes powers to buy back up to 14.99% of its shares at a discount to NAV. It also asks for permission to issue up to 10% of its issued share capital at a premium to NAV. These authorities give the board a means by which they can manager PHI’s premium/discount.

Over the course of the 2020, PHI was able to issue 16.1m shares (representing 27.2% of the shares in issue on 31 December 2019) at a premium to NAV, when demand could not be satisfied from existing shareholders. By issuing shares at a premium, PHI was able to improve liquidity in the trust’s shares and while also providing a boost to the NAV. Increasing the trust’s size also has the effect of reducing ongoing charges, as fixed costs are spread over a wider base. PHI has got off to a strong start this year, having issued 1.56m shares as at 18 January 2021.

Gearing

PHI has a one-year £30m multi-currency revolving credit facility with The Royal Bank of Scotland Plc. Gearing parameters are set by the board and the manager operates within these. As of 31 July 2020, the range was set at -15% (i.e. a net cash position) to +15%. PHI’s gross and net gearing were 7.9% and 4.7% as at the end of December 2020, compared to 8.1% and 3.8% at the financial year-end, respectively.

Five-yearly continuation votes

Shareholders are given the opportunity to vote on the continuation of the company every five years. The next vote will be at the annual general meeting of the company, to be held in November 2021.

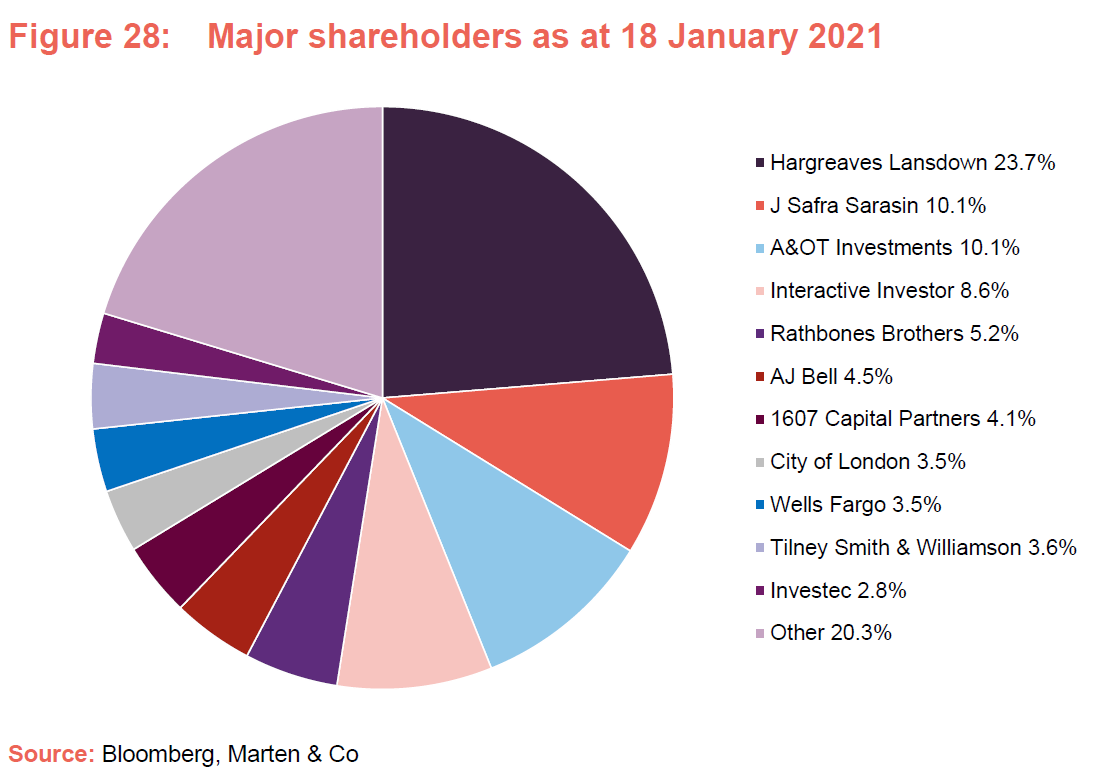

Major shareholders

Financial calendar

PHI’s financial year-end is 31 July. It usually publishes its annual results in September (interims in March) and holds its AGMs in October or November. Where applicable, it pays its annual dividend shortly after its AGM.

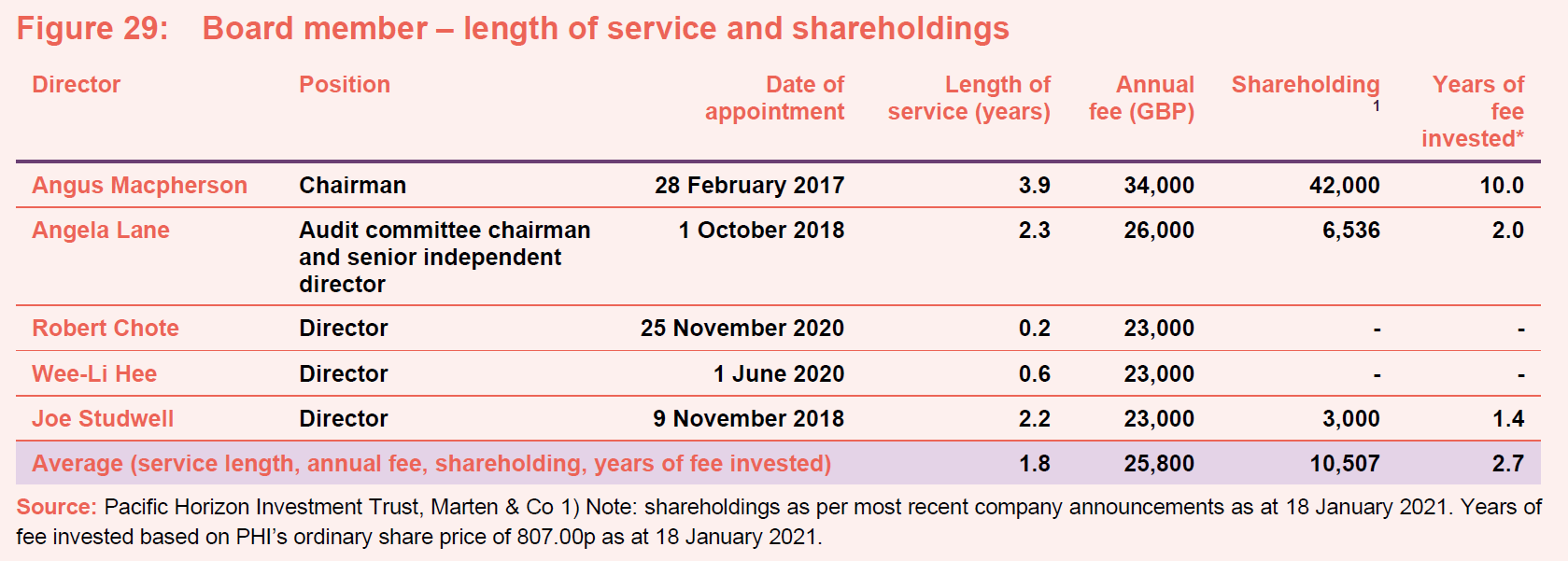

Board

PHI’s board comprises five directors, all of which are non-executive, considered to be independent of the investment manager and do not sit together on other boards. The directors put themselves forward for re-election at the first AGM following their appointment. Thereafter, directors submit themselves for re-election every three years. Having seen some longer-standing directors retire during the last couple of years, PHI has a relatively young board with an average length of service of 1.8 years.

Figure 29 includes Robert Chote, who was appointed with effect from on 25 November 2020. In line with trust policy, Robert’s appointment will be put to shareholders for ratification at the company’s next AGM, which is scheduled for November 2021.

There is a limit of £200,000 for the aggregate of fees paid to directors, which forms part of the company’s articles of association. Shareholders approved the raising of this limit from its previous level of £150,000 at the November 2020 AGM. They would have to vote to approve any further change to this limit.

With the exception of Wee-Li Hee and Robert Chote, who have only recently joined the board (in June and November respectively), each of the directors has a significant personal investment in the trust. This is favourable in our view, as it shows significant commitment and helps to align directors’ interests with those of shareholders.

Angus Macpherson (chairman)

Angus Macpherson was appointed to the board of directors in 2017 and became chairman of the trust on 12 November 2019, following the retirement of Jean Matterson from the board, at the company’s AGM the same day.

Angus was based in Asia between 1995 and 2004 in Singapore and Hong Kong, most recently as head of capital markets and financing for Merrill Lynch for Asia. Currently, Angus is chief executive of Noble and Company (UK) Limited, an independent Scottish corporate finance business. He is also currently chairman of Henderson Diversified Income Trust Plc and is the former chairman of JP Morgan Elect Plc.

Angela Lane (audit committee chair and senior independent director)

Angela Lane was appointed as a director on 1 October 2018, and became both the audit committee chair and senior independent director on 10 November 2020, following the retirement of Edward Creasy at the conclusion of PHI’s AGM that same day.

Angela is a qualified accountant and has held several non-executive and advisory roles for small and medium capitalised companies across a range of industries. She also holds the role of non-executive chairman of Huntswood CTC, and non-executive directorships at Sherborne Schools Worldwide and Dunedin Enterprise Investment Trust Plc, where she is also chairman of its audit committee.

Robert Chote (director)

Robert Chote is an economist, journalist and academic. He was chairman of the Office for Budget Responsibility, the nation’s top fiscal watchdog, from 2010 to 2020. He chaired the OECD’s network of parliamentary budget officials and independent fiscal institutions, and currently chairs the external advisory group of the Irish parliamentary budget office. Robert served as director of the Institute for Fiscal Studies from 2002 to 2010, as an advisor to senior management at the International Monetary Fund from 1999 to 2002, as economics editor of the Financial Times from 1995 to 1999, and as an economics and business writer on the Independent and Independent on Sunday from 1990 to 1994.

Robert is chair of the Royal Statistical Society’s advisory group on public data literacy. He is also a member of the Policy Committee of the Centre for Economic Performance at the London School of Economics, the advisory committee of the ESRC Centre for Macroeconomics, and the Council of Westcott House Theological College in Cambridge. He is a governor of the National Institute of Economic and Social Research (NIESR) and a visiting professor at the Department of Political Economy, Kings College London.

Wee-Li Hee (director)

Wee-Li Hee is an experienced Asian analyst, fund manager and CFA Charterholder. Brought up in Singapore, she speaks fluent Mandarin and studied in the UK at the University of Leeds and the London School of Economics and Political Science. After graduation, in 2002 she joined First State Investments in Singapore as an analyst, subsequently moving to the firm’s Edinburgh office in 2005. Having co-managed Scottish Oriental Smaller Companies Trust, she became lead manager in 2014, stepping back as a result of family commitments to return to a co-manager role in 2017 and retiring at the end of 2019.

Joe Studwell (director)

Richard Frank (‘Joe’) Studwell is the most recent appointee to the board (November 2018). He has spent 25 years working in East Asia as a journalist, independent researcher at Dragonomics and author under the name of Joe Studwell. His published works include Asian Godfathers: Money and Power in Hong Kong and South East Asia and How Asia Works: Success and Failure in the World’s Most Dynamic Region.

Previous publications

Readers interested in further information about PHI, may wish to read our previous notes on the trust, details of which are provided below.

- 2018 re-calibration paying off (our annual overview note published on 8 November 2019) discussed how the manager’s decision to re-position PHI’s portfolio, by lowering its allocation to technology stocks, as well as excellent returns from stock picks made in 2018, were paying off. At that time, PHI was the best-performing Asia Pacific fund in net asset value (NAV) terms over the year-to-date.

- Pause for breath? (our annual overview note published on 8 November 2018) discussed how, after two years of strong performance, PHI had suffered a reversal of fortune over three months as sentiment swung against both China and the technology sector. The note discussed how this could prove to be short-lived, if China and the US could agree a trade deal.

- Top of the pops! (our annual overview note published on 30 October 2017) discussed how PHI benefitted strongly as both the Asia ex Japan region and technology stockshad rallied. This pushed PHI up its peer-group rankings so that it was first and second, in terms of NAV total return, over one and three years respectively.

- Brave new world (our update note published on 10 October 2016) discussed how PHI’s performance had started to improve, but that the manager thought there is still considerable potential for the portfolio. He believed that some of the themes that PHI’s portfolio was focusing on could radically alter all our lives and that many Asian companies will be at the forefront of this change.

- Invest in Asian growth (our Initiation note published on 21 March 2016) discussed how PHI was suffering as investors were shying away from Asia (weak Chinese growth) and were also focused on defensive stocks for the same reason(technology and biotechnology were not in favour). The note explained that PHI could perform well in an environment where investors were less risk averse.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Pacific Horizon Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.