Banks too cheap to ignore?

Banks too cheap to ignore?

US interest rate cuts and a slowing global economy have overshadowed the financials sector and banks in particular so far this year. With banks trading close to multi-year lows, Polar Capital Global Financial (PCFT)’s managers have been adding to positions in their favoured stocks.

The managers believe that banks boast far more robust balance sheets and much healthier lending exposures than they did a decade ago, when they were emerging from the global financial crisis. PCFT’s managers feel that, barring the deepest of recessions, banks are materially undervalued. Any positive shift in sentiment, could trigger a rerating in what remains the largest sector in most indices.

For a UK-based investor, PCFT offers a much more diverse exposure to the financials sector than an investment in those banks listed in the UK. Since its launch in 2013, PCFT has also delivered returns well ahead of those stocks (see page 9), while paying out an attractive dividend yield.

Growing income from financials stocks

Growing income from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

|

|

A sector out of favour

A sector out of favour

PCFT’s NAV and share price have made modest gains since we published our initiation note at the end of April 2019, but its managers say that the financials sector remains out of favour with investors.

Notwithstanding the progress that share prices have made in 2019, many banks around the world are trading close to valuation lows. The US central bank, the Federal Reserve (Fed) made a dramatic policy shift early in 2019, signalling an end to interest rate rises. So far this year, they have made two quarter point rate cuts and there is talk of more to come. Investors appear to be worried about the impact of this on bank’s margins. They may also be concerned that we are approaching the end of a decade-long period of economic growth and, by implication, we could see an uptick in defaults on loans. The managers think that the sharp moves in valuations that we saw at the end of the fourth quarter of 2018 may provide an indication of where the market sees potential problems. Credit spreads (the difference in the market rates of interest for high versus low quality borrowers) widened and high-yield (riskier debt) and structured credit were hit quite badly.

The managers say that there have been outflows from the financials sector and this has impacted on its performance relative to wider markets. The sector’s long-term underperformance has occurred despite it offering dividend yields above market averages. The managers think that so much bad news is discounted in valuations now, even a shallow recession would make the sector look cheap.

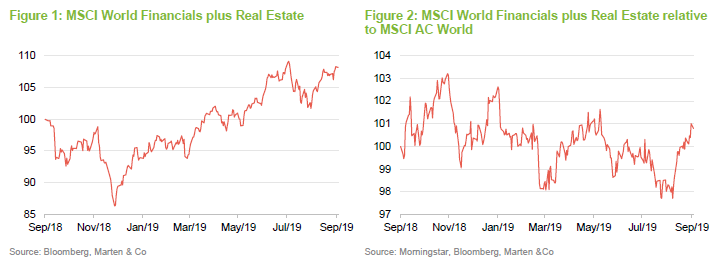

Figure 1 shows the actual performance of the MSCI World Financials plus Real Estate index (PCFT‘s benchmark) over the year to the end of September 2019, while Figure 2 shows how that index has performed relative to the MSCI All Countries World Index.

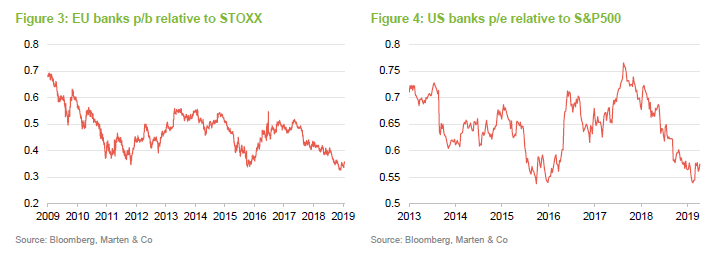

Figure 3 compares the price-to-book (p/b) ratio for European banks relative to the wider STOXX index. Figure 4 shows how the price/earnings ratio (p/e) for US banks has moved relative to the S&P500 index. It is clear, in both cases, that the banks are trading at or close to relative valuation lows.

Margins improving

Margins improving

The actions of central banks, not just the Fed and the European Central Bank (ECB) but in many other places, have depressed interest rates to new lows. Around $17trn worth of debt is said to be trading on negative yields. Last year, the Fed made an attempt to reverse quantitative easing and raise interest rates but has backtracked in 2019. In September, outgoing ECB chairman Mario Draghi cut rates again and restarted the ECB’s bond buying programme, despite some public opposition to this move from the heads of a number of European central banks (including those of Germany, France and the Netherlands). Growth fears, negative rates and concerns over Brexit mean that European banks are trading at low multiples, as is evident in Figure 3.

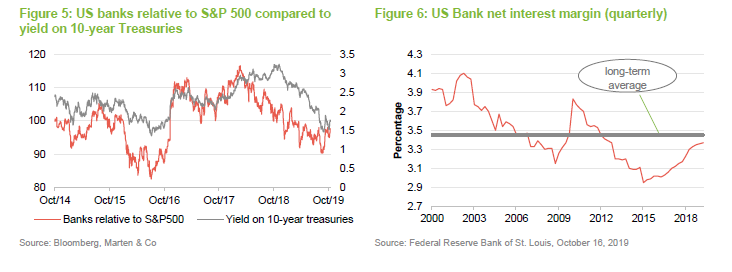

Some investors reason that ultra-low rates wipe out banks’ profit margins and, as Figure 5 shows, this manifests itself in a strong correlation between the performance of banks and government bond yields (this compares US banks’ relative performance to the S&P 500 index to the yield on US government debt. A chart of European banks against 10-year German government debt would show a similar story). However, while deposit margins have been hit, banks are still making money on lending. Large loans are more price-sensitive but, in practice, banks are reducing their balance sheet risk by either sponsoring bond issuance by mid-large corporates (and earning placing fees), syndicating loans (again earning fees) or underwriting leveraged loans that are then securitised (many ending up in CLOs).

Overall, US margins are higher than they were five years ago. We used the chart in Figure 6 in our initiation note but have updated the figures to include the first and second quarter 2019 numbers; margins appear to be climbing.

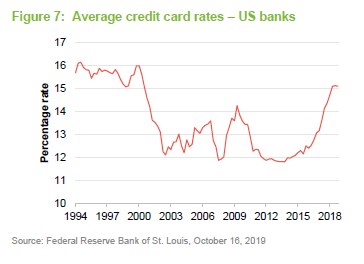

For example, one area where banks appear to have been raising margins is credit cards. This is profitable business for most banks.

Default risk overstated?

Default risk overstated?

Talking about the end of the credit cycle and the risk of borrowers defaulting on loans, the managers reiterate the points we made in our initiation note. Regulatory requirements and the need to repair balance sheets have constrained bank lending. There is an argument that regulation has become overly prescriptive, with the prospect of positive share price moves if the rules are relaxed.

In the meantime, alternative lenders have taken up the slack and it is these alternative lenders who will bear the brunt of higher defaults should they arise. The explosive growth of the leveraged loan market (loans made to companies that already have other debt), supported by securitisations, has been accompanied by a relaxation of covenants and an increase in the amount lent as a multiple of earnings. In the direct lending sector, the likes of Funding Circle and Lending Club, appear to be seeing rising default rates already.

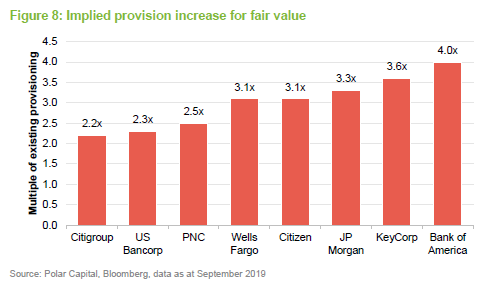

Generally, banks have been cautious on lending to the commercial property sector and have been keeping corporate bond exposure low. Banks’ balance sheets are in good shape, therefore. However, investors do not appear to be ascribing any premium for this in bank’s ratings. In fact, PCFT’s managers are convinced that the market is pricing in a material deterioration in asset quality. Figure 8 shows the increase in provisioning that would justify the managers’ estimates of fair value for a range of banks. So, for Citigroup, for example, based on a calculation that they carried out in September, PCFT’s managers think that Citigroup’s bad debt provisions could be 2.2 times what they are today without this making Citigroup’s shares look expensive.

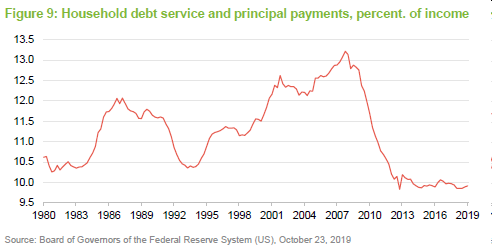

In addition, low interest rates and debt repayments have reduced the debt-servicing burden on US households. On average, US householders are having to spend less than 10% of their income on interest and paying back the debt that they owe.

Nevertheless, the managers are conscious that stock specific risk is an issue in the sector and the lack of publicly available insight into the risks that many banks’ are exposed to makes it hard to know where problems with one lender might have a knock-on effect elsewhere. This is one reason why the managers seek to maintain a diversified portfolio.

Banks are adapting in the face of fintech

Banks are adapting in the face of fintech

The fintech sector is a mixed bag. Some of these business models may be very successful but most incumbent banks recognise the threat of disruption and are attempting to adapt. High Street banks are still being rationalised, the managers believe that there is more to do on this front. Branch staff are being retrained to focus on sales but many banks do not appear to be radical enough on addressing their property overheads. Nevertheless, many of the new challenger banks are struggling to procure profitable business and are not yet impacting on established lenders.

The need to invest in new technology and the costs associated with that are drivers of merger and acquisition activity, as banks try to benefit from economies of scale. The managers say that if there is overlap between two businesses, it is possible to take out as much as 80% of the cost base. Falling valuations in the sector may help encourage further consolidation.

Outside of banking, payments companies are doing well. Mastercard has been a strong performer within PCFT’s portfolio. However, the managers would still highlight the valuation gap between Mastercard and the new entrants to the sector. Square (which is not held within PCFT) has been a volatile stock and has not made headway this year. Nevertheless, it still trades on a significant premium to Mastercard.

Asset allocation

Asset allocation

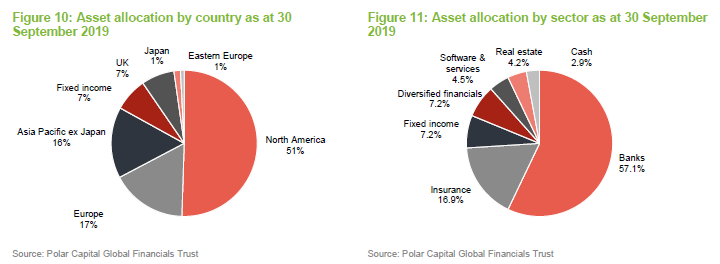

At the end of September 2019, there were 65 positions in PCFT’s portfolio, six fewer than the number at the end of March 2019 (the data we used for our initiation note).

Generally, the managers are quite cautious and for that reason are keeping gearing low. The portfolio retains its bias to the US and to banks. The managers reiterate that diversifiers such as the small/mid cap US banks can offer superior growth and the prospect of mergers and acquisitions activity. Although, for the time being, the US banks have been held back by the shift in sentiment triggered by falling US interest rates.

The managers have been adding to PCFT’s exposure to insurance. The managers cite evidence such as the Barclays Pricing Survey (which looks at pricing trends within the commercial property and casualty market) to support a belief that insurance premiums are firming. On a price-to-book basis, insurance companies are trading close to long-term averages. Recent purchases include the Bermuda-based, Arch Capital and AIA, the Asia and life assurance focused business based in Hong Kong.

Elsewhere in Asia, the exposure to Japan has been trimmed as has PCFT’s exposure to Singapore REITs.

PCFT’s Indian private banks have been beneficiaries of India’s liquidity crisis (which was manifested especially within its housing finance companies, but exacerbated by India’s failure to resolve the longstanding non-performing loan problem within its public banks). The portfolio has never had exposure to Chinese banks and overall exposure to China is relatively low. The businesses they favour are high-quality companies with strong franchises.

Top 10 holdings

Top 10 holdings

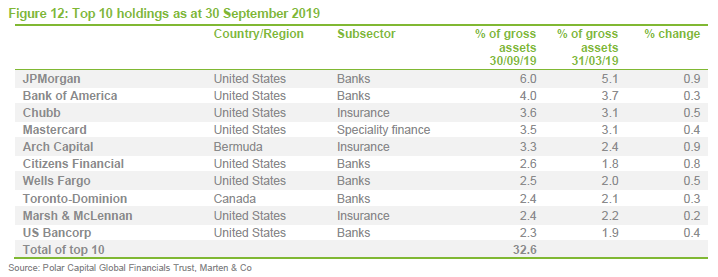

The composition of the top 10 holdings has not changed much over the past six months, as one might expect, given the managers’ investment style. While it is still reasonably diversified, the portfolio has become more concentrated in fewer names, with the top 10 accounting for 32.6% of the portfolio at the end of September 2019 against 28.4% at the end of March 2019.

The managers have taken advantage of weakness associated with US rate cuts to add to positions such as JPMorgan and Citizens Financials. Mastercard has been performing well. We mentioned the increased holding in Arch Capital above. Wells Fargo’s share price has been climbing as it recovers from the fallout of a series of scandals, including the creation of fake accounts and mis-selling. A change in CEO also helped sentiment towards the bank.

Performance

Performance

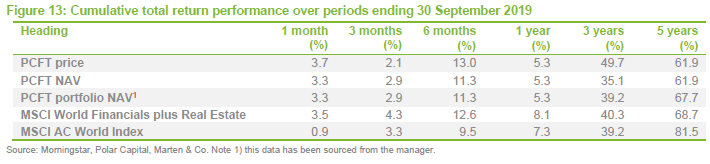

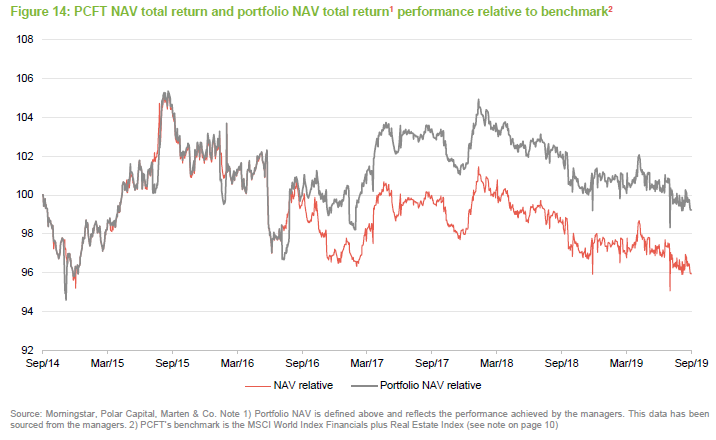

PCFT lagged its benchmark by a small margin over the six months ended 30 September 2019 (the period since we last published). In part, this reflects the poor performance of banks relative to other constituents of the financials and real estate index. The extent of the benchmark’s underperformance relative to the MSCI AC World Index over the past five years is clear from Figure 13, illustrating how out of favour the sector has been with investors.

When PCFT was launched, investors were given subscription shares alongside their ordinary shares. Holders of subscription shares had the right to buy one ordinary share at a price of 115p on 31 July 2017 for each subscription share that they held. The effect was that, as PCFT’s NAV rose above 115p, returns to ordinary shareholders were diluted. The portfolio NAV (or undiluted NAV) shows the returns that the managers actually generated and represents the return that an investor who held onto their subscription shares and exercised them would have received. For periods beginning after 31 July 2017 the NAV and portfolio NAV returns are identical.

PCFT’s share price returns are ahead of those of the benchmark over the past six months, reflecting a welcome narrowing of its discount.

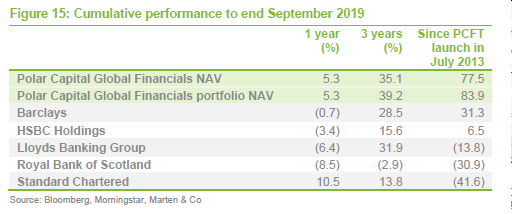

PCFT has outperformed UK banks by some margin

PCFT has outperformed UK banks by some margin

A key argument behind the launch of PCFT in 2013 was that it would provide UK-based investors a lower risk exposure to the financial sector. The UK banks have lagged PCFT’s NAV returns by some margin since then as is evident in Figure 15. The UK economy has influenced this to some extent, but many of these banks operate globally.

Discount

Discount

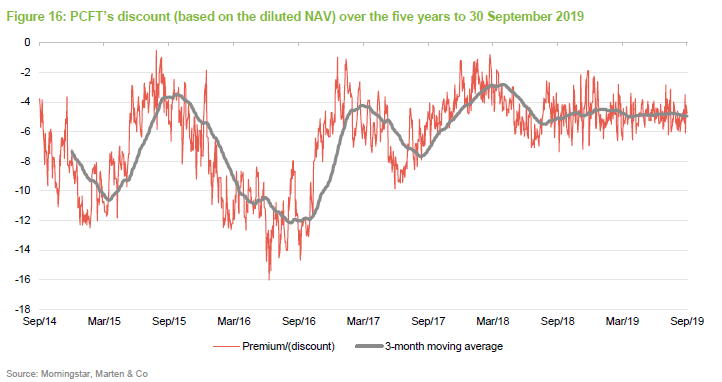

Over the year to the end of September 2019, PCFT’s discount has moved within a range of 7.4% to 1.8% and has traded at an average of 4.8%. At 25 October 2019, the discount was 6.0%. Reflecting the small narrowing of the discount achieved over the past six months and the relatively low volatility of the discount, no shares have been bought back since we last published on the company but the board does have the ability to do this should the need arise.

Fund profile

Fund profile

Polar Capital Global Financials Trust (PCFT) launched on 1 July 2013 and has a fixed life that expires in May 2020. Its twin objectives focus on growing investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

The trust was benchmarked against the MSCI World Financials Index from launch until 31 August 2016. Then, when MSCI spun the Real Estate sector out of the Financials index, the benchmark became the MSCI World Financials plus Real Estate Net Total Return Index (in Sterling) – effectively a continuation of the pre-September 2016 benchmark.

PCFT’s AIFM is Polar Capital LLP and the lead managers are Nick Brind and John Yakas.

Previous publications

Previous publications

QuotedData published its initiation note on PCFT, Don’t fear a slowing economy, on 30 April 2019. You can read this by clicking the link or by visiting the quoteddata.com website.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.