Eyes on the prize

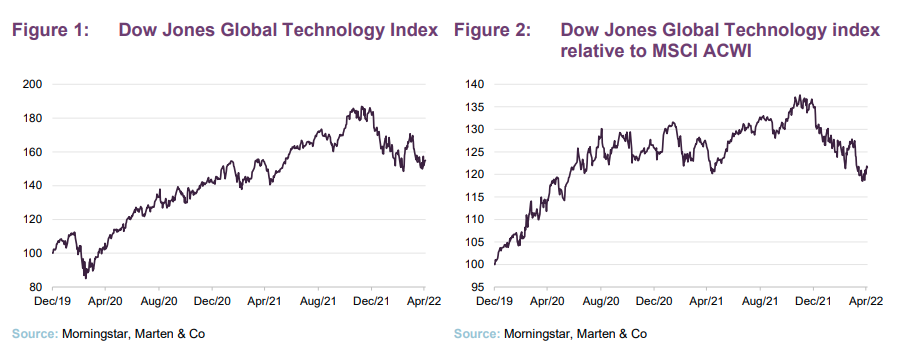

Heightened downside risk and disappointing earnings updates have seen the technology sector give back some of its considerable long-term outperformance of the wider market. As investors retreated to the sector titans (stocks such as Microsoft and Apple), Polar Capital Technology’s (PCT’s) underweight position in these companies has seen it underperform its benchmark over the 12 months to the end of April. PCT’s manager, Ben Rogoff, is undeterred by this, stating that technology stocks are in a better place than last year, and comparable performance will be more favourable.

The manager has taken advantage of valuation compression in the sector to upgrade PCT’s portfolio, rotating away from cyclicals (such as e-commerce) and into secular growth stocks. Despite depressed economic growth, the long-term fundamental growth drivers for the sector remain.

Global growth from tech portfolio

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk.

Market update

The challenges facing investors have combined to form one of biggest headwinds to returns for decades, including the highest inflation level in 30 years, Russia’s invasion of Ukraine, a hawkish Federal Reserve, and further COVID-related disruption in China. PCT manager Ben Rogoff says that the broad-based nature of inflation suggests that price increases will remain persistent. Tighter Fed monetary policy should help reduce inflation in the longer term, along with an eventual drop in energy prices and a gradual easing of supply constraints, he adds. This gave cause for the Fed to give an upbeat outlook on growth and optimism for a ‘soft landing’.

The manager compares the current post-COVID inflationary environment to that of the post-World War Two period where the US witnessed very high inflation as price controls came off, the economy reopened, and people wanted to get on with things. Despite the inflation figures in the late 1940s, the Fed’s expectations did not change, and within two- or three-years, inflation was back to normal levels. The manager believes that the Fed is hoping for a similar outcome this time. His base view is that despite higher rates the investment backdrop has not necessarily changed.

Understandably, positivity in the market has fallen in recent months, with the war in Ukraine and rising long-term rates in response to inflation heightening the risk of a full-blown recession. Economic data in the US remains mixed. The February ISM Services PMI, a leading indicator of corporate margins, fell for a third month in a row to 56.5 in February from 59.9 in January, below market forecasts of 61 (the second-largest miss since the global financial crisis). The manager says that earnings typically fall by 20% in a recession as the impact of businesses going bankrupt, SME tech spend being lost and consumers cutting spend on e-commerce bites. That recession scenario won’t be distributed evenly, the manager adds, stating that some tech sectors and companies would be fine in that scenario.

In fact, the manager believes the technology sector is in a more constructive place than a year ago, when stocks were invariably going to undershoot the recovery trajectory that other sectors were going to enjoy due to their outperformance in 2020. As it happens, 2021 revenue uplifts were in line with the S&P500, Ben states, adding that the comparatives this year are much easier on the sector.

Valuations have compressed very meaningfully due to the risk to global economic growth, and this has led the manager to rotate away from cyclicals and back to secular growth stocks. For example, the company is buying back into software, which the manager believes is the best unit of economics of anything in tech due to the core function it plays in business’s efforts to digitally transform and automate processes to drive efficiency and compete.

The price for secular growth assets has halved in some cases, Ben says, making it the opportune time to upgrade the portfolio and buy stocks that are grounded in strong earnings and cashflow. Snowflake, for example, had been considered expensive by the manager, but it has now taken the opportunity to add to its position. The volatility in Mongo DB shares, which can be plus or minus 40% in a quarter, also creates a buying opportunity for the manager. The hit to valuations has seen private equity investors return to the sector.

Capturing the re-opening bounce

The manager has affirmed that PCT’s core themes haven’t changed, and the portfolio continues to be tilted towards stocks that will benefit from eight core themes:

- Software as a service (SaaS)

- Industry 4.0/automation

- Cloud infrastructure/security

- Digital entertainment

- Mobility/Connectivity/5G

- Payments/Fintech

- Data economy/artificial intelligence

- Online advertising/ecommerce.

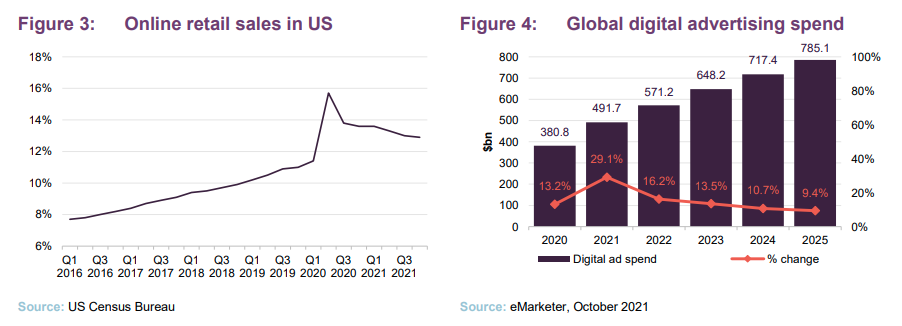

The manager has reduced exposure to sectors such as e-commerce, payments and online advertising due to the difficulty of knowing what the real growth rates are in these sectors. The stocks that benefitted from lockdowns had a tough 2021 as the economy reopened and the growth rates of 2020 proved unsustainable. The growth in demand witnessed by these companies may have been pulled forward rather than accelerated, the manager argues, and it is difficult to know how much e-commerce demand was brought forward, while the extent to which the reversing of the disproportionate amount of money spent on goods rather than services is equally difficult to gauge.

Figure 3 shows the percentage of sales that are made online in the US, the figure has fallen back since lockdowns were eased but remains much higher than pre-pandemic levels.

The manager reduced PCT’s exposure to work from home (WFH) beneficiaries last year, selling some e-commerce stocks like online fashion business Zalando (which it exited completely), Hello Fresh (which the manager says it still likes), and Etsy. He also reduced exposure to Zoom and exited Peloton.

PayPal has suffered after being forced to back away from growth forecasts as the surge in customer numbers at the start of the pandemic proved to be low-end. Ben has completely exited PayPal but says he may revisit after they reset their expectations. For most e-commerce companies, the numbers have been going down, but Ben states that the comparatives will get better within two quarters and so expects to be increasing exposure again at some point.

The manager believes that the work from home dynamic is here to stay, however. He says this is evidenced in London underground usage statistics where traffic on Mondays and Fridays are still significantly lower than Tuesday-Thursday – suggesting sustained flexible work patterns – and business travel is expected to decline by between 15% and 25% by 2025 from pre-COVID levels. Not all of the habits that were picked up during the pandemic are going to persist, but many of them will, the manager argues, and technology will continue to have a huge role to play in this new work reality. Ben likens the fall in some WFH stocks’ share price to that of the dotcom scenario. The internet wasn’t derailed by the market crash, he points out, and neither will WFH.

There were winners and losers in the re-opening of the economy, however. Uber should have been a name that did well in the re-opening, the manager says, but the company has struggled to get both sides of the network (drivers and customers) to work when it rebooted. They are struggling to recruit drivers that were lost to other companies/pursuits during the pandemic, while experiencing real wage inflation.

Netflix was a clear winner during the pandemic, as people sought entertainment during lockdowns, but has seen a downturn as the economy re-opened. It has reported the loss of 200,000 subscribers in the first quarter of the year – its first decline in paid users for more than 10 years – and forecasts it will lose around 2m more in the second quarter. The group is now exploring introducing advertising and increasing security to stop password-sharing in a bid to boost revenue. The poor quarterly performance caught the manager by surprise, and Ben says that the management team appears to have much less of a handle on the troubles of the business than previously and PCT has exited its position completely.

Airbnb, on the other hand, did well both during the pandemic, as ‘staycations’ peaked last year, and on the re-opening of the economy. A quarter of all bookings are for stays over 28 days as people go away for months at a time to work. The manager believes that this is “the WFH play that is here to stay”. PCT has held Airbnb since IPO and it now makes up around 0.5% of the portfolio.

The manager says that it remains positive on cybersecurity and has been meaningfully adding to the sector during recent market weakness. It expects the war in Ukraine to further reinforce demand for cybersecurity due to the elevated risk of a Russian cyber response to sanctions. Cloudflare and Crowdstrike could be big beneficiaries. Ukraine recently saw an attack described as the largest in the country’s history, targeting government websites and several financial institutions, which the manager says highlights the importance of strong cybersecurity defences to NATO member states as the conflict and sanctions imposed on Russia escalate.

Ben is also excited by AI and the metaverse and believes the best way to reflect that in the portfolio is in things like travel assets and semi-conductor assets. PCT bought into companies like Seagate and Micron, which the manager believes trade more like commodities, and adds that if AI was to take off, a huge increase in data storage and infrastructure spend will be required. The manager says that a lot of the $10bn of infrastructure spend announced by Meta last year should end up with Seagate and Micron. The group also bought Arista Networks as a way to play growth in data centre spending.

Asset allocation

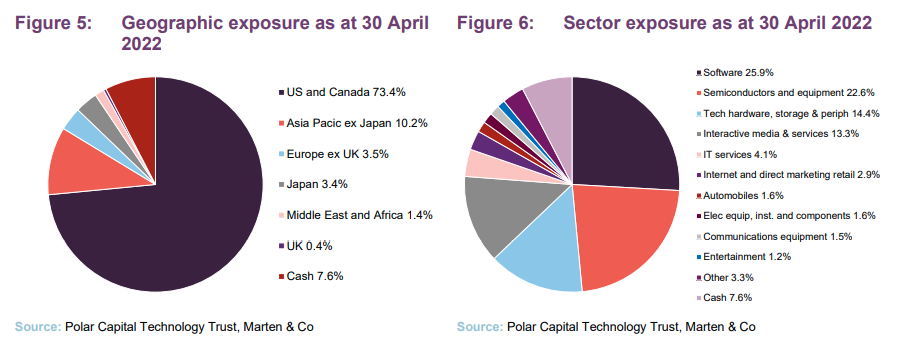

At the end of March 2022, there were 104 stocks in PCT’s portfolio. The portfolio remains benchmark-aware – at the end of March 2022 the active share was in the 40s. The outperformance of Microsoft and Apple has seen PCT’s exposure to them grow. These two stocks were still PCT’s largest underweights, however, with around a 7% underweight position in Apple compared to the benchmark and around 3% in Microsoft. The portfolio may be managed in a benchmark-aware style, but the manager is happy to have zero weightings in large stocks when he feels that their growth prospects do not merit their inclusion within the portfolio.

Cash and equivalents amounted to 7.6% of the portfolio at the end of April 2022. The manager has taken profits in some higher growth companies and added NASDAQ put protection to reflect the more challenging macroeconomic backdrop.

Whilst the manager does not try to add value through geographic asset allocation, Ben has reduced PCT’s exposure to Europe following the invasion of Ukraine. European consumers are particularly exposed to higher energy prices while the longer-term implications of replacing Russian energy with more expensive alternatives are unlikely to be positive for consumption. In Figure 6, the most significant change is a reduction in exposure to interactive media and services.

10 largest quoted holdings

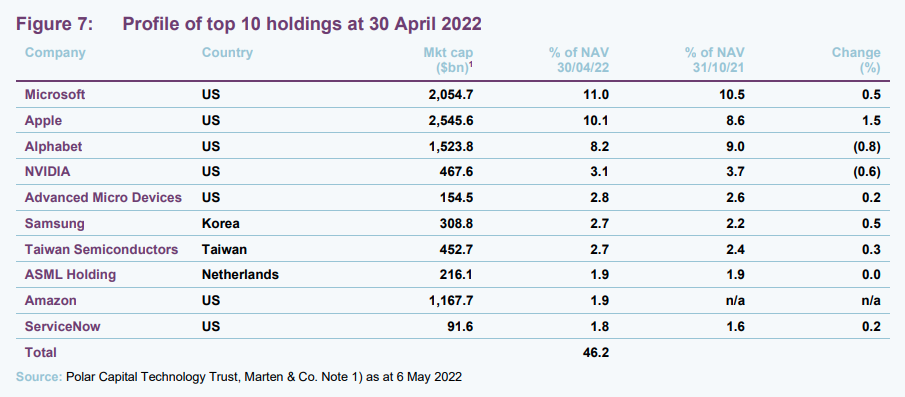

There has been very little change to the constituents of the top 10 list over the past six months, with Amazon and ServiceNow moving up into the list to replace Meta (Facebook) and Adobe Systems.

Amazon

The manager has rebuilt PCT’s position in Amazon to 1.9% having been to as low as around 1% last year. He says that guidance from the company suggests that its capital spending cycle is now behind them, while it believes that the company is ahead of risks such as wage inflation (paying well ahead of minimum wage). Struggles in the e-commerce side of the business contributed to the company’s first quarterly loss in seven years for the three months to March 2022. Ben says he is hopeful for a better second half of the year for margins and believes the long-term prospects of its e-commerce business despite the near-term headwinds. Its AWS business has performed strongly with 36.5% year-on-year revenue growth. The manager says that while tough year-on-year comparisons remain for the retail side of the business, the combination of AWS margin improvement, an Amazon Prime price increase (of $20 to $139 for annual membership in the US) and strong advertising growth are all supportive for operating margin expansion.

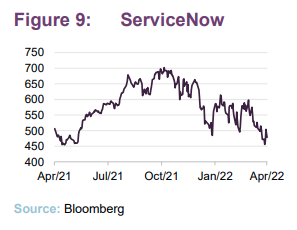

ServiceNow

The manager admires ServiceNow’s business model and believes in its future growth potential. ServiceNow is a software automation platform that helps companies manage digital workflows and automate work. Its background is in healthcare IT, but it is moving into various areas where demand for automation of menial tasks across business sectors is high.

Snap

PCT has been rebuilding its position in social media company Snap in recent months, and at the end of March 2022 it made up 1.2% of NAV. The manager had stayed away from the company for a long time on governance concerns, but as it has become more comfortable with it, PCT has grown its holding. Ben says that it is the only social media platform that is still growing fast (daily active users was up 18% in first quarter 2022 to 332m and revenues rose by 38% year-on-year), and he believes there is further scope for monetarisation, unlike its peers. The Gen Z audience and innovative use of augmented reality make it a unique platform, according to the manager. The challenge for Snap has been with Apple’s decision to change IDFA (identifier for advertisers) rules that mean apps are limited in their ability to track users of Apple’s iOS 14 outside of their own apps, through an ‘opt-in’ function.

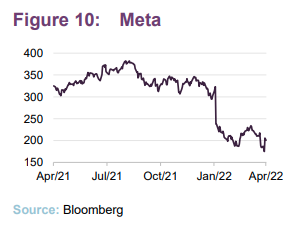

Meta

Snap’s relatively positive outlook compares favourably with Meta (Facebook), which posted its slowest revenue growth in years in an earnings update for the first quarter of 2022. Total quarterly revenue was up 7% year-on-year to $27.9bn (the first time it has reported single digit revenue growth since listing), impacted by an 8% fall in average price per ad versus the same period in the prior year and its platforms being pulled in Russia. The manager says the results were a reminder of the relevance of the two platforms, but adds Meta now looks cheap especially given its commitment to defending margins. PCT’s position in Meta has fallen from 3.3% in October 2021 to 1.8% at the end of April 2022.

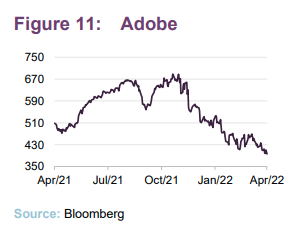

Adobe

PCT has gone from an overweight or neutral holding in Adobe to an underweight position relative to the benchmark. Salesforce.com is now one of PCT’s biggest underweights. Both positions follow recent M&A activity by the two companies, which the manager believes highlights concerns over slowing organic growth or a changing competitive landscape. The manager adds that the weight of M&A as a percentage of free cash flow at the two companies will continue to go up, which could be of concern.

Performance

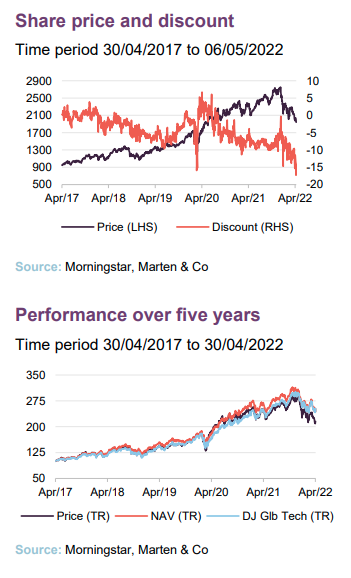

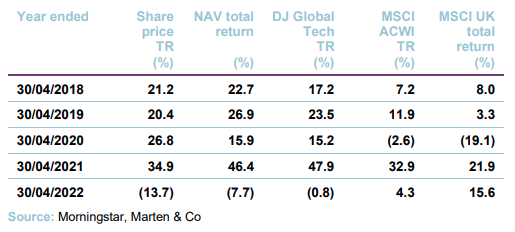

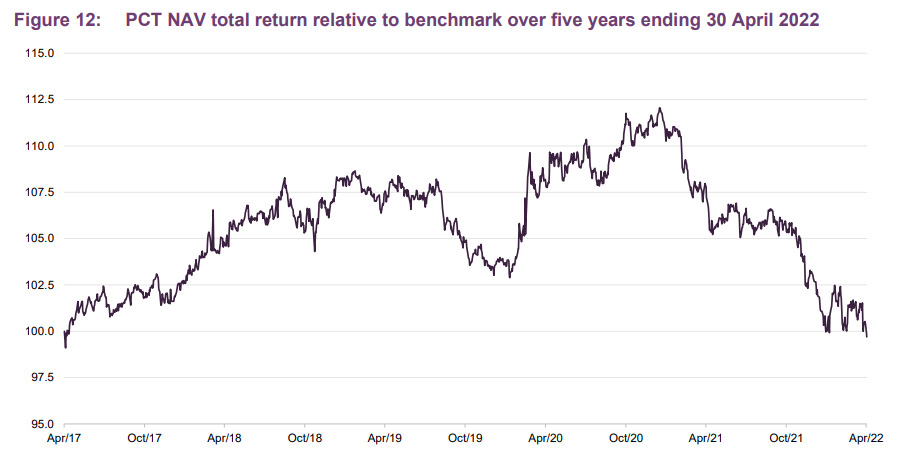

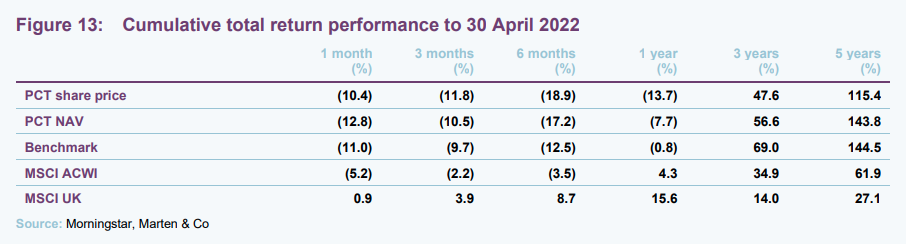

PCT’s underperformance of its Dow Jones Global Technology benchmark over the past year has largely been due to the effect of its two largest underweight exposures – Apple and Microsoft – performing reasonably well against a falling technology sector. In the year to the end of April 2022, PCT’s NAV returns are 6.9 percentage points lower. Prior to this, the trust has had a strong run of outperformance relative to the benchmark, but the underperformance from January 2021 has seen its five-year NAV return fall just below that of the benchmark.

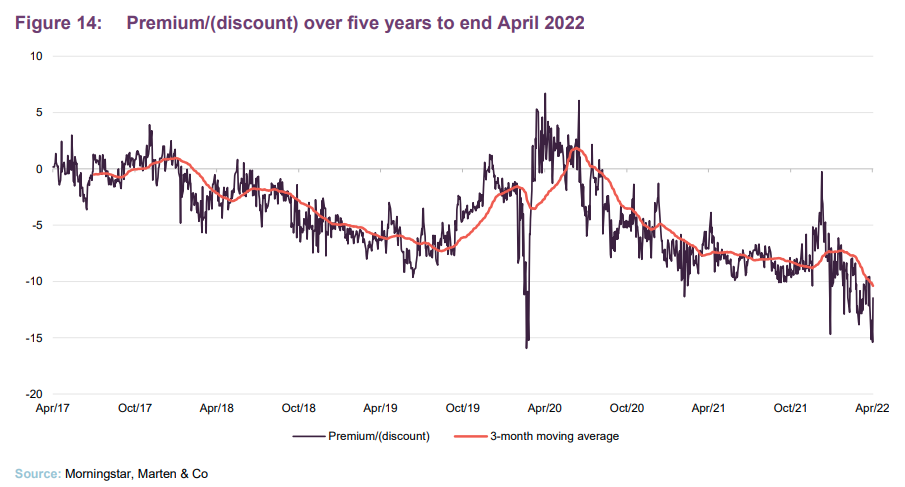

Premium/discount

Over the 12 months to 30 April 2022, PCT traded between a discount of 0.3% and 15.4%. The average discount over this period was 8.5%. At 6 May 2022, PCT’s shares were trading at a discount of 15.3%. This feels excessive to us, given that the technology sector’s long-term fundamental growth drivers remain intact.

Fund profile

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in April 2001.

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of nine technology specialists, including another partner, Nick Evans. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Automation & Artificial Intelligence Fund.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. The events surrounding the collapse of the tech bubble have influenced the way in which he manages money. One important lesson is that there is no permanence in the technology sector; it is forever engaged in a process of creative disruption. Change in the sector is a non-linear process. Once-great companies can disappear and minnows can become giants.

Nick joined the team from Framlington in 2007. He complements Ben in that he has a more bottom-up approach to selecting stocks, whereas Ben has a bias to a top-down stance.

Previous publications

Readers interested in further information about PCT may wish to read our earlier notes (details are provided in Figure 15 below). You can read the notes by clicking on the links below.

Figure 15: QuotedData’s previously published notes on PCT

Source: Marten & Co |

The legal bit

This marketing communication has been prepared for Polar Capital Technology Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.