Economic and Political Monthly Roundup

Investment companies | Monthly | February 2023

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

“We have done a lot on rates already. The full effect of that is still to come through. But It’s too soon to declare victory just yet, inflationary pressures are still there.” -Andrew Bailey following February’s Monetary Policy Committee meeting

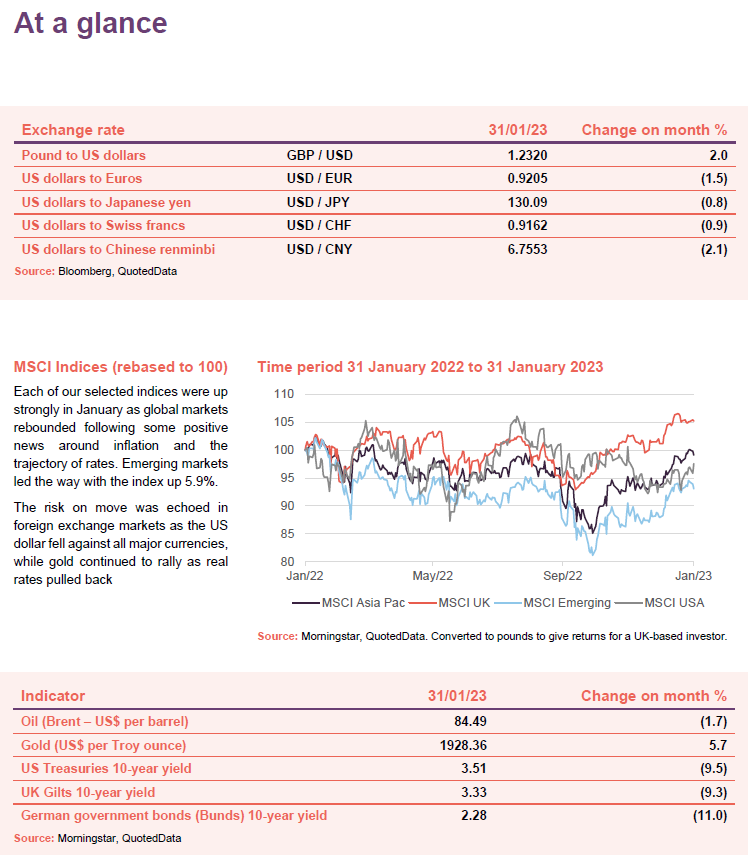

UK markets continued their recent momentum with the FTSE 100 reaching a new peak in the first week of Feb, boosted by the pound which was up a further 2% against the USD. The mood was generally ‘risk on’ as financial conditions eased following positive news around inflation, particularly in the US, and a relatively dovish response from policy makers set the scene for one of the strongest starts to the year across global risk assets in recent memory.

China’s reopening added to the positive sentiment as did Europe’s somewhat miraculous effort to avoid an energy crisis, helped by some relatively warm weather.

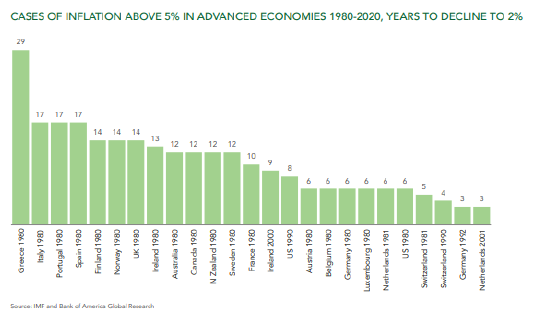

Still, despite the (arguably) improving outlook, the Bank of England (BOE) hiked interest rates for the 10th consecutive meeting at the beginning of February, and growth in the UK is still expected to contract this year. Inflation remains in the double digits and while projections see UK CPI dropping to around 4% by year end, forecasting attempts post-pandemic have been anything but accurate. Furthermore, as Ruffer Investments point out in a wonderful macro review on page 9, following periods where inflation has gone above 5% it has taken a decade on average for it to drop back below 2%.

According to the BOE, the inflation risk remains ‘skewed to the upside’ and expectations should be managed in what is predicted to a period of much greater volatility relative to the previous decade.

Global

(compare global and flexible investment funds here, here, here and here)

Russell Frith, chairman, Blue Planet Investment Trust – 30 January 2023

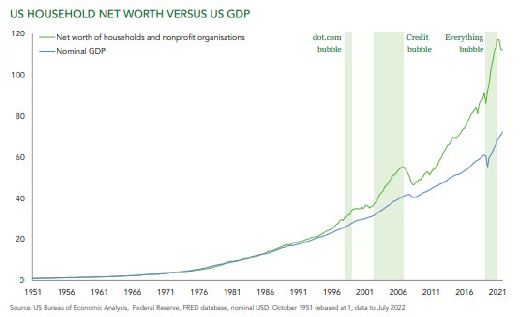

In March 2020, the US Federal Reserve reduced the Fed Funds Rate to be in the range of 0.00% to 0.25% and held it there for two years. Over this period, the cost of capital was essentially zero and the valuations of assets rose sharply. Inflation then, quite predictably, took off and in March 2022, the Fed began to hike rates to quash it. By the 2nd of November 2022, the Fed Funds Rate had increased to be in the range of 3.75% and 4.00%, an incredible 16-fold increase in the cost of capital in just over six months. Over the same period 2-year bond yields rose from 0.15% to 4.5%. and 10-year money went from 0.5% to 4.00%. This unprecedented and reckless increase in the cost of capital crushed asset prices and has led to mayhem in financial markets. Property markets, which are much slower to react to changes in the cost of capital, have yet to fully reflect the impact of these events and are likely to be the next domino to fall. During the “pandemic” the interest rate on two-year fixed rate mortgages in the UK was about 1.5%. Now it is 5.5% to 6%. As fixed rate mortgages fall due for refinancing the impact on the property market is going to be significant.

Investors have suffered enormous losses because of these wild swings in monetary policy. In fact, the largest in history. According to Bank of America over $46 trillion has been wiped off the value of shares and bonds in the last year alone. This has, quite understandably, severely damaged investor confidence and it will take some time for it to be rebuilt and for markets to recover fully.

The good news, to the extent that there is any, is that since the half-year end, the outlook has improved. Inflation peaked in June and has been falling steadily ever since. The bad news is that the same officials are still in charge at the Fed and other central banks. Instead of pausing or reducing interest rates in response to this, they have continued to aggressively increase them, and they are now far higher than is necessary to bring down inflation and risk doing serious and unnecessary economic damage. Having created the inflation in the first place by expanding the money supply at a rate that was bound to be inflationary, they have now overdone the tightening to an extent that is bound to cause a recession.

Nevertheless, a peak in central bank rates may now be in sight and as inflation falls so too does the need for high interest rates and eventually central banks will have to start reducing them. When that happens, we are likely to see a more substantial and sustained recovery in share and bond prices. In the meantime., we may have to contend with a recession brought about by their overtightening. We can only hope that it will be mild and short-lived.

. . . . . . . . . . .

David Warnock, chairman, CT Global Managed Portfolio Trust – 26 January 2023

It is quite possible that inflation in the US has peaked. It may also be the case it has in Europe and, if not, it is not far from peaking, likely in the first quarter in 2023. More importantly, interest rates, which have risen rapidly in the US, UK and Europe throughout 2022, are towards their peak. However, there does remain a danger, particularly in the US, of overshoot by the Federal Reserve which would manifest in a deeper recession with a commensurate impact on corporate profits and earnings. The key will be the depth and duration of the coming recession. With unemployment at historically low levels a relatively mild recession is possible. Should that take place prospects for equity markets will brighten as we move through the year. In terms of investment strategy, though timing is always difficult, the current intention is to build further exposure to investment companies which either specialise in, or have significant exposure to, UK mid and small cap equities. This segment of the market experienced a challenging 2022, however valuations are attractive, and in the scenario outlined above, prospects for a recovery in performance are good.

. . . . . . . . . . .

Henry CT Strutt, chairman, Edinburgh Worldwide Investment Trust – 23 January 2023

The past year has been marked by notable market volatility, arising from a number of factors, and it is unlikely that there will be an easing of the challenging economic and political backdrop in the immediate future. Business confidence and consumption are likely to remain muted against a backdrop of inflationary pressure, despite the best efforts of some Central Banks and governments to keep it in check. The effects of a slowdown in Chinese economic activity are also being felt, although ironically this is likely to be a deflationary influence for certain industries and sectors.

Whilst markets exhibit volatility, the investment trust structure permits the portfolio managers and discerning long-term investors to take positions in exciting, dynamic and innovative companies for the long term. Companies that can enhance productivity or deliver cost and/or productivity efficiency, should be amongst those able to navigate through the current turbulence; many of these are currently immature but with a scalable business model and ambitious management teams with a vision and desire to succeed.

. . . . . . . . . . .

Managers, Edinburgh Worldwide Investment Trust – 20 January 2023

Investing involves both respecting those things that are constants and navigating the many variables. To the mathematically orientated this might suggest it can be distilled down to a simple equation with neat outputs and defined probabilities. But the repeating pattern of investment return over any sensible time period is that such an algebraic approach is a fallacy – the path of equity markets over the past ten years is testament to this.

The global Covid pandemic and conflict in Europe are recent arrivals into the mix of variables that investors have had to navigate, and they have complicated the landscape considerably. Their unpredictable nature brings with them a host of second order variables straddling supply chain and labour force challenges through to an emerging tussle for a new world order. A decade of low interest rates was mistaken by many as a quasi-constant that has now returned as a dynamic variable as central banks wrestle with high inflation.

The temptation is often to view the individual challenges discussed above as isolated discrete events, but we think there is an underlying connection. Not in a conspiratorial sense but one which highlights that instability in a system tends to create instability elsewhere with rippling out effects.

This instability will ultimately pass but it is sculpting a new investment backdrop, one where capital is less freely available, the hurdle rate for returns is higher and the tolerance of uncertainty is lower. This adjustment phase is shortening the time horizon of many investors and lulling them into a mindset where the near-term resiliency of what they invest in is viewed with higher priority than its long-term relevance.

For an investment strategy such as that pursued by Edinburgh Worldwide, this adjustment in the backdrop has been painful. We are unashamedly long-term growth focused investors; we respect resilience in our holdings but what excites us is their relevance and long-term impact. By pointing our analytical focus lower down the market capitalisation spectrum, we seek to identify high potential growth businesses when they are early in their lifecycle and benefit from the compounding of long-term growth off a low base.

We pursue a growth focus as we believe it aligns with the overarching constant in equity investing of long-term progress being driven by innovation and adoption of technology. While the mix of technologies is always evolving and compounding, it is underwritten by another non-numerical constant, that of human ingenuity and the ability to innovate solutions to problems.

The whims of a stock market can come and go but the legacy of innovation remains and is all around us. We think the fundamental opportunity for innovation and tech-led progress are as strong as we have seen. Across numerous frontiers we see entrepreneurs and innovative companies building solutions that we think will transform what society can expect. These frontiers span a seismic shift in what we can anticipate in diverse areas such as healthcare, communications, computing and how businesses function. While many of these advances are likely to appear in a five to ten year time frame, we are equally excited about the possibilities that sit beyond this.

Although our enthusiasm for what the future offers is undiminished, the share price performance of many of the holdings in the portfolio has been sharply impacted by the changing backdrop discussed above. For many of the companies held, this feels a largely mechanical based valuation reset as interest rates have risen and consequently their future cashflows are deemed to be worth less. More recently, this has been exacerbated as stock markets have begun to price in lower economic growth assumptions.

Our bottom-up, growth-orientated investment style will always leave us at the mercy of fear-driven market sell offs. Simply put, the current areas of angst (volatility in interest rates and economic cyclicality) are not inputs that we think carry much insight when performing long term analysis on a company. Our analysis skews heavily to understanding how the operations of a business might perform over the 10+ year timeframe. For most businesses, and especially younger/smaller ones, that path will be most heavily influenced by both the decision that a company takes and how its industry evolves. We don’t seek to duck the topic of valuation, far from it. Rather, we seek to project where a business might get to and what it might be worth at that point. The real unlock in achieving that is not the immediate finessing of complex valuation spreadsheets but it’s the passage of time and the delivery of real tangible progress by the companies themselves. In a stock market that is increasingly impatient, we think the rewards to the brave and patient look increasingly attractive.

The decade long era of abundant and overly cheap capital has run its course. The premium placed on stable long-term capital will be higher. As the pendulum of power is shifting from the users of capital towards the providers of capital, we think the relevance of Edinburgh Worldwide’s structure and philosophy will, once again, come to the fore. A transition period is just that.

With the technology-led opportunity plentiful, yet the supply of capital restricted, we see greater opportunity for our analysis to actively focus on companies that are in a capital consumptive phase of growth.

. . . . . . . . . . .

Simon Miller, chairman, Bankers Investment Trust – 18 January 2023

The extraordinary economic policies enacted to protect populations and economies against Covid are still unravelling and the war in Ukraine has exacerbated the supply imbalances in the food and energy markets. It has been some considerable time since interest rates have risen as quickly as they have this year and the effects of moving from near zero to a peak, currently forecast around 4-5% in the UK, will undoubtedly cause real pain for many. Share prices have reacted to corrective actions and may be discounting a slow-down or a recession.

. . . . . . . . . . .

Alex Crooke, manager, Bankers Investment Trust – 18 January 2023

The outlook appears bleak if we only read the news headlines. A well flagged recession in Europe, the UK and possibly the US is predicted. This may be combined with increasing inflation and interest rates rising further. Central banks are undoubtedly talking tough to try to influence consumers into curtailing spending and thus reduce both inflation and the likely peak in interest rates. Underlying data is clearly pointing to inflation peaking soon and it is conceivable that interest rates, certainly in Europe, will get cut before the year end. Inflation is by no means a negative for stock prices, with good companies taking opportunities to prosper.

The US stock market has led the way relative to the rest of the world in nine of the last ten years. This relentless performance has resulted in over 70% of the FTSE World index being represented by the US market. For many decades, the Company’s philosophy of diversification, investing across the globe and focusing on both capital and income, has benefitted our investors. The growth investment style, so successful in the last decade, has now started to unwind. We are striving for an increased exposure to value stocks within the portfolio, which should help the income generated by the portfolio and reduce exposure to expensive growth stocks that may continue to come under pressure as interest rates stay elevated. There will certainly be more challenges for investors in the coming year but it will also not take much good news to lift the current downbeat mood.

Managers, Ruffer Investment Company – 15 January 2023

Globalisation is dead

“Globalisation is almost dead and free trade is almost dead. A lot of people wish they would come back, but I don’t think they will be back.”

Morris Chang, founder, Taiwan Semiconductor Manufacturing Company (TSMC) This quote from Morris Chang captures the tectonic changes in geopolitical and macroeconomic environments.

The world enjoyed 40 years of an economic order where globalisation brought us cheap goods, cheap energy, cheap labour and cheap capital.

Cheap goods from China’s mercantilist policies. Cheap energy from OPEC and Russia. Cheap labour as globalisation brought two billion people into the global workforce and held down developed world wages. Combined, these three forces kept inflation low and geopolitics stable, meaning interest rates and risk premiums could also be low, resulting in, lastly, cheap capital. To say this was a tailwind for multi-national corporations and for asset prices is an understatement.

That global order appears to have ended. The new global order is defined by great powers in geostrategic competition and the primacy of stakeholders over shareholders. The US is engaged in three wars simultaneously, a cold war against China, a hot war against Russia and an energy war against OPEC.

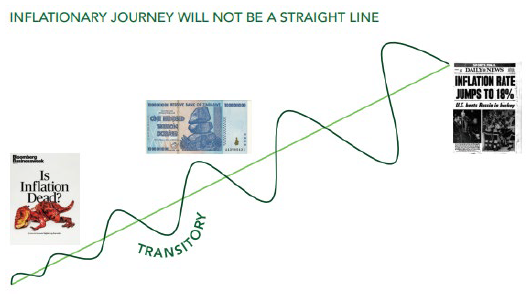

This splintering backdrop is the one which we think gives birth to the age of inflation volatility. We have discussed previously our expectation of higher economic growth volatility, inflation volatility and therefore market volatility. But we should not miss the bigger picture. The crude diagram below shows the journey we are on – we will try to navigate the oscillations of the inflationary and disinflationary impulses, but the inflationary destination remains crystal clear.

This model is important because we believe we are entering one of the disinflationary lurches in 2023. Those who are wedded to the old regime, or Team Transitory, will be keen to declare victory on inflation, pulling out their 2010’s investing playbook once more. We believe that will ultimately be a mistake.

If the previous decade had 2% inflation on average with very little volatility around that, we expect the coming decade to have 3% or 4% average inflation but with much greater volatility. We won’t just have an inflation problem; we will have an inflation uncertainty problem.

History is on our side; see the chart below from the IMF. It shows that once inflation is above 5%, a level reached in every developed nation excluding Japan in 2022, it takes on average a decade to drop back to 2%. The market and central banks are planning for this to happen far sooner, in just 18-24 months.

What causes the inflation volatility and the inflationary endgame?

Structural trends underpin higher average inflation. As a result of Cold War II, covid disruption and now the Ukraine war, trends like supply chain shortening, friend-shoring and re-shoring are becoming entrenched. These are secular trends not short-term decisions. No CEO wants to run out of inventory or be at the mercy of geopolitics. No politician wants to be seen going cap in hand to leaders like Putin, MBS or Xi. As Margaret Heffernan put it, “just in case over just in time”.

But if Fortune 500 companies are going to move production back to the US – safer, popular with voters and politicians – it poses several questions. Where will the necessary workers come from and at what hourly wage? The labour market is already extraordinarily tight before we start to bring jobs back home in the pursuit of national autonomy and resilience.

The policy response creates the inflation volatility. A feature of the post-covid landscape is a sense that we lurch from one emergency or crisis to another. With each crisis comes a popular clamour for the authorities to ‘do something’, resulting in a whack-a-mole solution of targeted monetary or fiscal policy. Governments around the world have developed a taste for interventionism. Two recent examples could be the almost universal approach of developed world governments to support consumers through the winter energy crisis, a demand-side fiscal policy to solve a supply-side problem. The second would be the Bank of England’s emergency interventions in the gilt market in the autumn, a monetary policy solution to a market problem. There will always be popular support for targeted government stimulus to tackle the big societal issues of the day; inequality, climate change and now the containment of the geopolitical aspirations of China and Russia.

The problem is that, long term, most of these policies stoke the fires of inflation.

Big Society = Big Cheques

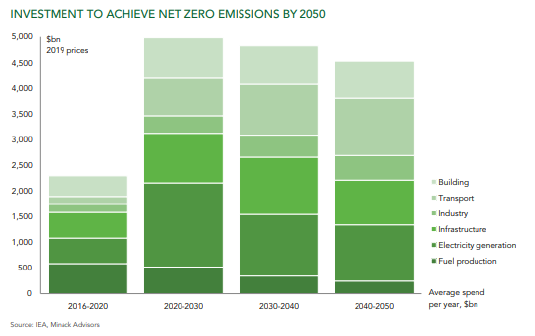

Government programs such as Levelling Up, Build Back Better, Green New Deal, or the ironically named Inflation Reduction Act, all require huge capital investment up front. For example, the IEA estimates that achieving net zero by 2050 will require investment of around $4-5 trillion per annum globally (around 5-6% of global GDP).

This would put climate change investment ahead of education and defence and behind only social security and healthcare on most developed world spending budgets. The scale and urgency of this spending puts any notion of fiscal prudence to bed for the next few decades.

It points to a long-term trend of higher government deficits, higher taxes, and higher inflation. We don’t think investors or governments are prepared for this.

The looming tension between governments and central banks

Gazing into our murky crystal ball for the 2020s we see an emerging dynamic where policymakers are constantly choosing the ‘least worst’ option between inflation pain and economic pain.

2022 was a year where inflation pain became so acute that they had to do something about it, raising rates aggressively. 2023 looks like a year where economic pain will reassert itself, perhaps pushing authorities to a point where they might have do something to fix it, even if that results in more inflationary policies.

There is a growing disconnect between the hawkish rhetoric of central banks and the actions of governments. Monetary policy is hitting the brakes, whilst fiscal policy pushes the accelerator as it tries to mitigate the grim consequences of rising prices through handouts. As economic growth deteriorates and the recession and cost of living crisis bites hard, we expect this tension to get worse. They are on a collision course.

In extremis, the tension reveals that central bank independence is a mirage. We liken their independence to the independence you might grant a teenage child. It is contingent on performance. Yes, of course, you can go out with your friends, here is some pocket money, but please be home by 10pm. If they don’t come home by 10pm, independence is over.

When governments realise that central banks are aiming at one thing (a 2% inflation target) whilst they are aiming at another (getting re-elected), and those two are not compatible, the blurring of monetary and fiscal policy lines will accelerate. Current monetary policy, engineered by central bankers in pursuit of their mandate, is a policy that will be entirely politically unacceptable.

The politicisation of interest rates

How might this tension find resolution? We have said recently that central bankers are willing to sacrifice investor portfolios to achieve their policy goals. However, governments are not going to allow central banks to sacrifice the economy on the altar of a 2% inflation target that was arrived at almost arbitrarily by a guy from the Central Bank of New Zealand in a press conference, in the 1990s.

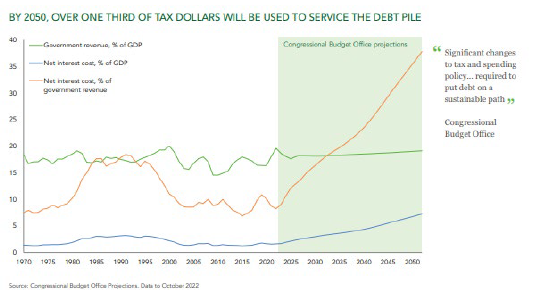

The longer we stay at rates of 4-5%, the more of the government’s debt outstanding rolls over from low rates onto these newer higher rates. Even before the covid crisis, many countries were near record high debt service ratios at a time when interest rates were at thousand-year lows. Expect this to become a hot topic in the coming year.

For example, does Elizabeth Warren know that this year the US will spend $1 trillion on just the interest on the government debt? Or that on current Congressional Budget Office forecasts over one third of all tax receipts would be going to service bond holders – that is, banks, “the 1%”, and foreign institutions? It is not hard to imagine the calls for something to be done, perhaps starting with not paying interest on, or cancelling, the debt held by the Federal Reserve?

As we move towards the 2024 US presidential election campaign the political sinews will be straining to reframe the narrative.

Revoking central bank independence seems unlikely but a growing drumbeat of academic literature explaining that the 2% inflation target should perhaps be moved to 3% or explaining the benefits of a higher target would seem a natural progression. The move to average inflation targeting is a step in this direction. After all, policymakers spent a decade trying to create inflation and now it’s here it is having some positive effects – nominal GDP growth, bringing down house prices, stimulating wage growth, helping minority unemployment etc.

Whilst the headline inflation rate will surely be lower in six months’ time, we do not believe that central banks will be able to pull off an ‘immaculate disinflation’ or the ‘soft landing’. In other words, they will not be able to bring inflation down to target without inducing a significant recession. Do they have the strength of will, or the political mandate, to do that?

A year ago, in this report we said the key question was ‘are central banks willing and/or able to tame inflation?’. That still stands, but the test of willingness gets harder as the economy deteriorates.

Zooming in – the picture for 2023

The push of high nominal GDP growth and accumulated lockdown savings are meeting the pull of higher interest rates, tighter financial conditions and a cost of living squeeze on global consumers. The probability of a global recession is rising. The US yield curve, normally upward sloping, is now the most inverted it has been in over 40 years. The path we take from here depends on two key variables

1) The policy context

2) The resilience of earnings

Policy context

‘Anybody who thinks that this is a pivot for the ECB is wrong’ Christine Lagarde, President of the European Central Bank

The lady is not for turning, yet the market cynically waits for a pause or pivot. We believe the chances of a pause (stopping) are high, the pivot (reversing course) does not happen unless markets or the economy deteriorate significantly.

The real pivot that needs to happen is in investor portfolios. Most are still over-indexed to equities and illiquid risks based on an asset allocation for a world that no longer exists. Too much risk, too US-centric and too focused on the winners of old regime. Every investment committee in the world should be debating their asset allocation in the context of a rebased risk-free rate at 4%. Why take risk when you don’t have to? Our concern is a global, synchronised de-risking of investor portfolios.

The path for markets is dependent on policy choices, the difference to previous tightening cycles is that central bankers are now in re-active rather than pro-active mode. They are attempting to suppress a serious inflation outbreak rather than head off an incipient one. The setup compels aggressive action and our base case that they will be slower to revert to easing than the market assumes.

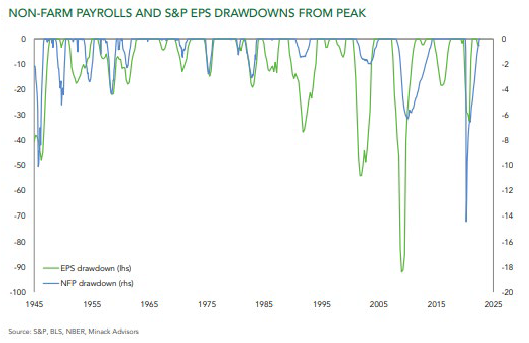

Fed policy will be guided by labour market data as much, if not more than, inflation data. The Fed cannot credibly declare victory over inflation with wage growth where it is. This is important because a decline in headline or core inflation driven by, say, falling energy or car prices may not be sufficient to change the outlook for Fed. The Fed is explicitly focused on cooling the labour market and is willing to tolerate higher unemployment to achieve their goals. This alone is anomalous; they are so far off target on their inflation goal that they are now forced to try to force job losses by tightening financial conditions. The problem is that, as the chart (below) shows, when payrolls fall (which is unemployment going up) corporate earnings always get smacked. There are no exceptions.

The resilience of earnings

Earnings estimates are coming down for 2023, but still appear optimistic pricing in +4% for the S&P 500. There are two schools of thought on the shape of the earnings recession ahead.

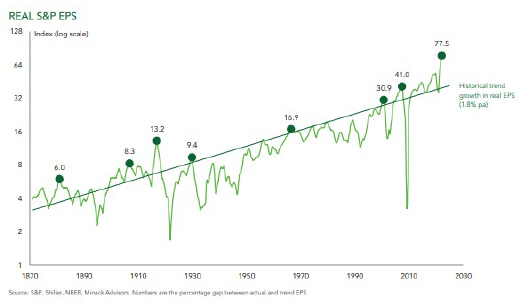

First is that we have experienced an earnings bubble with real earnings and margins well above long-term trends due to pandemic and zero interest rate distortions (see chart below). An earnings bear market, just returning to trend, would be brutal. Furthermore, these problems could be exacerbated by macro factors such as higher energy costs, supply chain re-shoring, wages, labour hoarding, energy transition etc. Perhaps earnings may be more vulnerable than many think?

The second school of thought is that nominal growth will remain high even if we have a real recession – eg the economy grows by 4% but inflation is 5% and so it has shrunk in after-inflation terms. Therefore, revenue will remain more robust than in previous recessions. Earnings will fall less in this recession than in the deflationary recessions we have become accustomed to in recent decades. Furthermore, bank loan losses are underwritten by government guarantees, which also explicitly or implicitly limit financial sector losses.

Summary

A benign outcome in 2023 depends on an almost impossible trinity – a short and shallow recession, a rapid decline in inflation and an aggressive Fed pivot. Not impossible but it is hard to see how all three can come to pass. And all three are needed if a favourable market environment is to return quickly.

Why would inflationary pressures, so broad-based as we enter 2023, suddenly dissipate? And even if they do, won’t that be because a recession has driven unemployment up meaningfully? How quickly can a Fed, so concerned about not being the Fed that let the inflation genie out of the bottle, realistically reverse course? If the real economy is deteriorating fast enough to leave the Fed confident that inflation will drop like a stone, then why wouldn’t investors also price in significant downside to corporate earnings, themselves artificially inflated by the peculiar post-pandemic rebound? We don’t have reasonable answers to these questions.

We go into the year set up for an uncomfortable ride. The first half of the year may be about an unusually durable US recovery, sticky inflation, and an even higher peak in the Fed Funds Rate. Alternatively, the market may be saved from further Fed hawkishness but only because the descent into recession happens earlier, and at greater speed, than seems probable at the end of 2022. Neither has a happy ending for investors.

The setup points to significant volatility as market participants grapple with narrative swings and shifting financial conditions. We recognise we will need to trade actively to preserve capital in these choppy waters. We stand ready to change our views as circumstances change. Rather than try to predict, it may be necessary to see events play out and respond to them.

These periods are processes, not events. Asset markets are down, investors are impatient to buy the dip and return to money-making. These things take time, there was six months between Northern Rock and Bear Stearns and then a further six months before Lehman Brothers. Today, our assessment is that this is a poor time to take risk. Patience and preparation are our watchwords and, in the meantime, for the first time in 14 years, you are paid a decent return to wait.

. . . . . . . . . . .

Simon Barnard, investment manager, Smithson Investment Trust – 30 January 2023

There was clearly one dominant factor at play throughout the year: the rising market expectation for interest rates.

As we now know, inflation started accelerating in 2021 and did not turn out to be ‘transitory’ as several of those in charge of central banks believed it to be at the time. In fact, it quickly became entrenched, and was exacerbated by the war in Ukraine, which further propelled energy and food prices.

This caused a sharp volte-face by central banks, which began raising interest rates in March 2022 by increasing increments until 75 basis point moves, a major increase by historical standards, became the norm. The effect this had on the market’s expectations for future interest rates was profound. At the beginning of 2022, bond markets were indicating that the upper bound of the Fed’s policy rate would be 1% by 2023. In December 2022, the Fed rate was already 4.5% and market expectations were for a 2023 peak of over 5%.

While not at the 19% level it took to shock the US economy into submission in 1980, it is difficult to overstate the impact this move had on asset prices. By which, of course, I am not just talking about stocks, bonds and crypto currencies, where price movements are observed most immediately, but also real estate, art, classic cars and anything else that was a recipient of the world’s recent savings glut. We always restrict ourselves to a maximum of one quote from Warren Buffett per letter and it is probably best used here, to cement the importance of the relationship in our minds: “Interest rates are to asset prices like gravity is to the apple”.

The reason for this is because the value of any asset, companies included, is the total of the future cash flows you can expect to receive, discounted back to today’s monetary value using the prevailing interest rate. As rates rise, today’s value of the future cash flows decreases, and thus the value of the asset declines.

While this increase in interest rate expectations affected the whole stock market, unfortunately the shares owned in the portfolio were affected more than most. This is because our high quality companies are growing faster than the market average and generating more cash flows in the future. In practical terms, their faster growth meant the valuations of our companies at the end of 2021 were higher than the average in the market, and therefore fell further than the market as rate expectations moved.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Managers, Aberforth Smaller Companies Trust – 27 January 2023

One of the second order effects of the pandemic has been to accelerate and accentuate several underlying challenges to the economic and financial conditions that have held sway since the global financial crisis. The conditions have been ones of modest economic growth, low interest rates and low inflation, while the underlying challenges have been broadly inflationary. These have included heightened geopolitical tension, deglobalisation, re-shoring, an upsurge in industrial action, and demographic trends that reduce the working age population. The war in Ukraine has given extra impetus to the first bout of meaningful inflation for decades. The chief executive of one of ASCoT’s investee companies has observed that what keeps him awake at night is not the price of electricity in 2023, but where his customers will be doing their business in five or ten years’ time as the tectonic plates of economics and geopolitics shift.

Year-on-year changes in the consumer prices index in the UK and further afield will likely moderate as effects of high energy prices annualise, but the structural issues listed above mean that the rate of inflation may not return reliably to the very low levels to which the world had become accustomed. It would therefore be unlikely that interest rates and bond yields can fall back to the very low levels that allowed investment with almost limitless time horizons. A reversion to financial conditions more akin to those that prevailed before the global financial crisis is not without risk. Governments and investors have adopted borrowing habits that may be exposed by the reimposition of a real cost of capital. Accidents are possible, with signs of stress already in the UK’s liability driven investment industry, in cryptocurrency failures and in the higher cost of borrowing for private equity firms.

However, there is scope for optimism and opportunity too. A meaningful cost of capital, rather than one artificially suppressed by central banks, imposes discipline on investment decisions. This improves the chance of sustainably high returns on investment, which in turn might address the disappointingly low productivity performance of the UK and other economies in recent years. In parallel, trends such as deglobalisation and the re-shoring of production imply a period of higher capital expenditure, which would provide opportunities for business, including small UK quoted companies. A final consideration concerns the value investment style, which felt the headwinds of the low interest rate environment since the global financial crisis. A reversal would imply a better outlook for value or at least a more neutral style backdrop.

. . . . . . . . . . .

Penny Freer, chair of the board – Henderson Smaller Companies Investment Trust PLC – 26 January 2023

These are challenging times in the UK with the ongoing conflict in Ukraine and the tension between the USA and China having both immediate and longer-term implications. High inflation and the consequent fiscal tightening and rises in interest rates have sapped consumer confidence. It is noteworthy, however, that in the corporate sector conditions are intrinsically stronger than during the Global Financial Crisis of 2008/9 particularly in terms of balance sheet strength. We are seeing a strong recovery in dividend payments and evidence of companies buying back shares. Valuations are now well below long-term averages, although 2023 earnings growth is likely to be muted.

. . . . . . . . . . .

Neil Hermon, manager, Henderson Smaller Companies – 26 January 2023

Global geopolitics remain challenging, particularly with the ongoing conflict in Ukraine and heightened tensions between China and USA. The longer-term implications of this are material, with the isolation of Russia as a pariah state, a stronger and more unified Europe and NATO, materially higher defence spending and an urgent need to reduce European dependence on Russian oil and gas supplies. This has exacerbated inflation, particularly in Europe, added to the burden on government spending, dampened animal spirits and hurt economic growth.

With inflation prints continuing to remain elevated against official targets, central banks, led by the US Federal Reserve, have remained hawkish. We have seen significant rises in interest rates globally and a move from quantitative easing to tightening. The market is forecasting further global rises in interest rates although it is clear we are nearer to the end rather than the start of the monetary-policy tightening phase. Oscillating confidence levels in central bankers’ willingness and ability to strike the right balance between containing inflation and supporting economic growth is driving heightened levels of uncertainty and volatility in global bond and equity markets.

The rapid rise of inflation, particularly driven by energy prices but also by a wider number of other components, is putting pressure on consumers. Although the labour market is strong and wages are rising, real net disposable income is falling and consumer confidence is low. Sectors exposed to consumer spending are likely to face tougher trading as we move further into 2023.

In the corporate sector, conditions are intrinsically stronger than they were during the Global Financial Crisis of 2008-2009. In particular, balance sheets are more robust. Dividends have been recovering strongly and we are seeing an increasing number of companies buying back their own stock.

After an active 2021, the initial public offering (“IPO”) market has become considerably quieter as equity market confidence has diminished. There are no signs this is likely to change in the short term. Merger and acquisition (“M&A”) activity has remained robust as acquirers look to exploit opportunities thrown up by the recent equity market pullback. We expect this to continue in the coming months as UK equity market valuations remain markedly depressed versus other developed markets although recent moves in the bond market are causing a pause in activity.

In terms of valuations, the equity market is now trading below long-term averages. Corporate earnings were sharply down in 2020 although we saw a sharp recovery in 2021 and 2022. This is likely to fade in 2023 as a weakening economic environment starts to bite.

Although uncertainty remains around short-term economic conditions, we believe that the portfolio is well positioned to withstand an economic downturn and exploit any opportunities it presents. The movements in equity markets have thrown up some fantastic buying opportunities. However, it will be important to be selective as the strength of franchise, market positioning and balance sheets will likely determine the winners from the losers.

. . . . . . . . . . .

Managers, BlackRock Income and Growth Investment Trust – 17 January 2023

As we look ahead into 2023, the headwinds facing global equity markets are evident. Inflation has consistently surprised in its depth and breadth, driven by the resilient demand, supply chain constraints, and most importantly by rising wages in more recent data. Central banks across the developed world continue to unwind ten years of excess liquidity by tightening monetary policy desperate to prevent the entrenchment of higher inflation expectations. Meanwhile, the risk of policy error from central banks or politicians remains high as evidenced by the turmoil created by the ‘mini-budget’ in the UK that sent gilts spiralling. The cost and availability of credit has changed and strengthens our belief in investing in companies with robust balance sheets capable of funding their own growth. The rise in the risk-free or discount rate also challenges valuation frameworks especially for long duration, high growth or highly valued businesses. We are mindful of this and feel it is incredibly important to focus on companies with strong, competitive positions, at attractive valuations that can deliver in this environment.

The political and economic impact of the war in Ukraine has been significant in uniting Europe and its allies, whilst exacerbating the demand/supply imbalance in the oil and soft commodity markets. We are conscious of the impact this has on the cost of energy, and we continue to expect divergent regional monetary approaches with the US being somewhat more insulated from the impact of the conflict, than for example, Europe. Complicating this further, is the continued impact COVID is having on certain parts of the world, notably China, which has used lockdowns to control the spread of the virus impacting economic activity. We also see the potential for longer-term inflationary pressure from decarbonisation and deglobalisation, the latter as geopolitical tensions rise more broadly across the world.

As we enter 2023, we have seen the first signs of demand weakness, notably in areas of consumer spending impacted by rising interest rates such as demand for new housing. We would expect broader demand weakness as we enter 2023 although the ‘scars’ of supply chain disruption are likely to support parts of industrial capex demand as companies seek to enhance the resilience of their supply chains. A notable feature of our conversations with a wide range of corporates has been the ease with which they have been able to pass on cost increases and protect or even expand margins during 2022 as evidenced by US corporate margins reaching 70-year highs. We believe that as demand weakens and as the transitory inflationary pressures start to fade during 2023 (e.g. commodity prices, supply chain disruption) then pricing conversations will become more challenging despite pressure from wage inflation which may prove more persistent. While this does not bode well for margins in aggregate, we believe that 2023 will see greater differentiation as corporates’ pricing power will come under intense scrutiny.

The UK’s policy has somewhat diverged from the G7 in fiscal policy terms as the present government attempts to create stability after the severe reaction from the “mini-budget”. The early signs of stability are welcome as financial market liquidity has increased and the outlook, whilst challenged, has improved. Although the UK stock market retains a majority of internationally weighted revenues, the domestic facing companies have continued to be impacted by this backdrop, notably financials, housebuilders and property companies. The valuation of the UK market remains highly supportive as currency weakness supports international earnings, whilst domestic earners are in many cases at COVID or Brexit lows in share price or valuation terms. Although we anticipate further volatility ahead as earnings estimates moderate, we know that in the course of time, risk appetites will return and opportunities are emerging.

We continue to focus the portfolio on cash generative businesses with durable, competitive advantages boasting strong leadership as we believe these companies are best-placed to drive returns over the long-term. We anticipate economic and market volatility will persist in 2023 and we are excited by the opportunities this will likely create by identifying those companies using this cycle to strengthen their long-term prospects as well as attractive turnarounds situations.

. . . . . . . . . . .

Dan Whitestone, manager, BlackRock Throgmorton Trust – 26 January 2023

Markets continue to try and triangulate between inflation data, central bank policy and underlying economic activity levels. All three remain uncertain and the market remains very sensitive in reaction to perceived changes in each variable. We therefore expect volatility to remain elevated as a result. However, we remain of the view that inflation has peaked and will continue to fall from here across developed economies and therefore are cautiously optimistic that this will be reflected by a moderate Fed response in time. Leading indicators we track continue to fall. To take one example from the UK, wholesale gas prices are now at a level where it is estimated that the governments energy guarantee would cost £1-2bn vs the £25bn expected when the scheme was put in place. This number will be volatile but is indicative of the easing of some of the most severe pressures felt in Q3 2022. We also continue to have meetings with companies who cite easing supply chains and lower levels of input inflation in 2023 compared to 2022. Many of our spending data tools are showing us that consumption has held up well over the holiday period in both the US and UK. We are also watching the opening up of China closely for signs of its impact on the world economy as the prospects for higher demand are offset by potential for short term supply chain issues or the chance of a new COVID variant.

. . . . . . . . . . .

Roland Arnold, representing the investment manager, BlackRock Throgmorton Trust – 26 January 2023

We believe 2023 will see continuation of recent themes of uncertainty; Russia/Ukraine war, China, supply chains and inflation. However, we expect to see an end to interest rate rises and we think inflation is peaking. Generally speaking, financial conditions are not too stretched; corporates and consumers are reasonably well capitalised, and banks have plenty of capital. As such the path of employment will dictate the consumer outlook but we continue to expect the trough to be shallower than in previous recessions.

Industrial activity is likely to decline as inventory works through the system but given major markets such as automotive and aerospace were seeing choked demand through supply chain issues, again we expect a shallower trough. Housebuilding and RMI (repair, maintenance and improvement) will have a tough H1, but given the rapid re-pricing of mortgages post Prime Minister Truss, the outlook isn’t as bad as it was in September. Valuations have corrected quickly and looking back it appears all consumer orientated stocks overshot to the downside during the chaotic period around the Truss budget.

We expect to see M&A (Mergers & Acquisitions) picking up through the course of the year as management teams shift the focus away from returning excess cash flow to deploying it.

We are not out of the woods yet. In the face of a likely tough reporting season, we could very easily see another sell off. Therefore, gearing within the portfolio remains low and we are keeping our powder dry for the time being. However, with oil and gas prices lower year-on-year, China re-opening, US$ weakening, shipping / logistics / factory gate prices dropping, much of the inflation pressure of last year could become deflationary during the course of this year.

Against this difficult backdrop, we remind ourselves that many equity markets (Europe, UK) are structurally under owned and could benefit as sentiment turns and investors begin to reduce these underweights. We remain focused on bottom-up company specific analysis to identify high quality, nimble businesses, operated by entrepreneurial management teams, with strong market positions and resilient cash-flows. These are the types of businesses that we believe will be best placed to manage and thrive in the current environment. Historically these periods have been followed by strong returns for the strategy and presented excellent investment opportunities.

. . . . . . . . . . .

Asia Pacific

(compare Asia Pacific funds here, here and here)

Neil Rogan, chairman, Invesco Asia Trust – 26 January 2023

While the relative performance numbers for the last six months are good, the absolute falls are clearly not. Writing six months ago, I noted surprise that Asia had held up so well in the face of China tensions, the Russian invasion of Ukraine and global economic turmoil. With no respite from any of these and new concerns arising, some stock market weakness was perhaps inevitable.

Looking forward, I have to start by being honest that the short term outlook remains highly uncertain. It will not be easy for anyone to perform well over the next twelve months. However, if you are free from worrying about monthly or quarterly performance and are able to take a long term view, then the decision-making seems to become a lot easier. The fact that Asian stock market valuations are cheap compared to their long-term averages is perhaps the most compelling factor. Yet by the end of 2023, many of the current headwinds should have calmed or could even become tailwinds: global inflation is likely to peak early in 2023. One way or the other, Covid should become less of a problem for China. The economic strength (and lack of inflation) in many Asian countries should allow them to grow their economies faster than those in the West. Remember, stock markets are usually lead indicators.

. . . . . . . . . . .

Ian Hargreaves & Fiona Yang, portfolio managers, Invesco Asia Trust – 26 January 2023

Asian equity markets are not immune to global macro headwinds, but conditions in Asia should continue to remain largely stable in 2023. Many countries in the region are at an earlier stage in their economic cycle, with rising incomes and consumer penetration a tailwind to structural demand.

The improved visibility on China’s reopening is a significant positive and combined with the property market support and signs that regulatory headwinds are abating, provides us grounds to believe that the outlook for corporate earnings and broader economic growth should be supportive after downgrades in 2022.

Although equity market valuations for Asia, as measured by traditional metrics such as price to book ratios, have recovered in recent months from deeply discounted to more reasonable levels, they continue to trade at a significant discount to US and world equity market averages. Asia’s underperformance has lasted more than a decade. Although this was justifiably driven by lower earnings growth compared to US equities when denominated in US-dollars, this may change. US-dollar strength is being challenged by an imminent recession in the US to root out inflation. While inflation in the US may be stickier than expected it is declining, which may lead to an easing of financial conditions at a time when Asia is recovering. Inflation is less of an issue in Asia which provides some policy flexibility. We believe there is great potential for a narrowing of Asia’s valuation discount.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Stefan Gries, manager, BlackRock Greater Europe Investment Trust – 16 January 2023

After a challenging 2022, we expect equity markets to remain volatile in the near term as macro uncertainty remains elevated. Going into 2023, it will be important to see whether inflation comes down to levels the market can deal with. With energy prices having come down in recent weeks, there is reason to be hopeful this can be achieved. Clarity on the terminal rate of this hiking cycle – and a potential peak – would likely be enough to bring attention back to company fundamentals – the ultimate driver of long-term equity returns.

The market is forward looking and at some point will start to consider what a recovery could look like. For now, European equities remain under-owned and valuations are low. Some areas of the market, particularly within the cyclical sectors, have suffered a significant derating and signs of economic optimism such as easing inflation or a potential China re-opening, could help close some of these valuation gaps. Whilst there are a number of unknowns from a macroeconomic perspective, we see opportunities for attractive returns in select areas.

Corporate balance sheets are in decent shape and in much better positions than in previous downturns. Many companies in Europe have spent the last decade deleveraging balance sheets and interest coverage is significantly higher than during the Global Financial Crisis or other prior periods associated with deep recessions or prolonged bear markets. Corporate spending intentions also remain healthy and this spend is often linked to transformational capex.

Lastly, long-term structural trends and large amounts of fiscal spending via the Recovery Fund, Green Deal and the REPowerEU plan in Europe can drive demand for years to come, for example in areas such as infrastructure, automation, innovation in medicines, the shift to electric vehicles, digitisation or decarbonisation. We believe the portfolio is well aligned to many of these structural spending streams.

. . . . . . . . . . .

Japan

(compare Japanese funds here and here)

Harry Wells, chairman CC Japan Income & Growth – 23 January 2023

The long period of disinflation and free money is over. Collective Central Bank policy led by the US Federal Reserve is firmly aimed at reducing inflation at a time when the pricing power of labour in the USA and Europe is in the ascendant. As interest rates rise on the back of a collapse in monetary aggregates in the USA, it looks as if the risks of global recession are rising. With the high levels of debt embedded in the world economy, tightening policy beyond a certain point could also potentially expose credit problems. Global market sentiment will, as ever, be driven by the perception of policy direction emanating from the US Federal Reserve.

Japan too, is facing similar inflationary pressures, although these are largely due to the war and hence exogenous. As elsewhere, the labour market is tight, reflecting an ageing demographic and shrinking workforce. Both the BOJ and Government are keen to encourage wage growth which has been static for so long. Indeed, Prime Minister Kishida has urged employers to increase wages by more than 3% as part of his “new economic capitalism” plans with Consumer Price Inflation (CPI) running at its highest for 30 years. After a long period of deflation, some inflation will be good for Japan. Any increase in wages should benefit domestic consumption.

Just before Christmas, the BOJ announced a relaxation of the bands for controlling the yield on the 10-year bond. This is seen as a first step to normalising monetary policy and has sparked a sharp rally in the yen. However, the BOJ has had to absorb massive liquidation of Japanese Government Bonds (JGBs) by stepping in to buy bonds to defend the new yield level. Hence, rather than tightening monetary policy, the BOJ are now forced to expand their balance sheet and appear chained to loose monetary policy. We can expect interest rates and the Yield Curve Control Band to rise further in the months ahead and the market will be looking closely for pointers as to further policy direction, particularly with the appointment of a new BOJ Governor in April 2023.

A weak yen has deterred foreign buying of Japanese securities, and a rebound in its value could help stimulate foreign interest which has always provided a catalyst for buying the stock market. Equally, it should be noted that TOPIX index companies now produce an income dividend yield higher than inflation, which could tempt domestic savers earning no interest on deposits. Moreover, the Government has announced measures to try and mobilise savings by offering incentives for people to invest.

Although Japan’s domestic economy is steadily reopening for business, it is frustrating to see that yet another Covid-19 wave in China may further delay a recovery in tourist visitor arrivals. Nevertheless, the overall economic outlook appears favourable. The wild card remains geopolitics and the stability of the region. GDP forecasts show higher expectations for Japanese growth compared to other developed economies while there is growing confidence in better corporate earnings guidance. Continuing commitment to corporate governance reforms should also underpin rising dividend distributions.

. . . . . . . . . . .

Richard Aston, manager, CC Japan Income & Growth – 23 January 2023

The global economic backdrop appears increasingly challenging with the recent debate over the sustainability of inflationary trends and prospect of a new era of rising interest rates shifting notably to rapidly falling expectations for economic growth and the risk of global recession. Japan, on a relative basis, is set to offer many interesting opportunities given that its economic cycle is no longer in sync with other major economies, primarily as a consequence of its delayed domestic recovery following the Covid-19 pandemic. There are reasons to be optimistic about the expected economic rebound in Japan in 2023 given the experience of other economies as consumer behaviour returned to normal. The recent Yen weakness that has accompanied these developments only adds to the attraction of Japanese equities over the medium term.

The investment strategy employed by the Company is not dependent on any economic outcome nor correlated with a particular investment style – it is one that seeks to capture a total and compounding shareholder return over time regardless of short-term economic variations. This seems a particularly relevant consideration for investors in these more uncertain times and we believe that Japanese equites now offer a differentiated and compelling opportunity in this regard. A combination of strong balance sheets, healthy dividend cover and, most importantly, changing attitudes have created a new investment landscape. The benefit has been demonstrated clearly over the past three years with companies in Japan offering robust levels of distribution to shareholders despite the sluggish trends in the domestic and global economies.

As a result, dividends and share buybacks are set to establish new records during the current fiscal year, with minimal strain on balance sheets and dividend cover ratios. A further revision to the Japanese Corporate Governance Code in June 2022 and the restructuring of the main Tokyo Stock Exchange indices in April 2022 were consistent with the previously established objectives of improving capital efficiency and corporate governance which have underpinned the favourable progression of shareholder returns. We believe that the benefits of Prime Minister Kishida’s goal of doubling asset-based income places further pressures on companies to continue the trajectory of improvement and that shareholders in Japanese companies will consequently continue to reap the rewards.

. . . . . . . . . . .

North America

(compare North American funds here, here and here)

Alice Ryder, chair, BlackRock Sustainable American Income Trust– 26 January 2023

High inflation and tighter monetary policy are two important reasons why the world economy is slowing down. Since recognising the urgent need for policy tightening to combat inflationary pressures, the Fed has raised interest rates at the fastest pace in more than three decades. Most other major developed market central banks have followed suit and the scale and speed of subsequent rate rises have surprised markets.

A resilient labour market in the U.S. and excess savings have so far protected the economy from a more severe slowdown, but have given rise to more persistent inflationary trends and sustained pressure on the Fed to continue to tighten fiscal policy. In turn, higher financing costs and declining real disposable income (driven by fiscal normalisation and high inflation) will be a headwind for the economy. The odds have now shifted towards a recession in 2023, driven by a Fed that is laser focused on bringing down inflation. While inflation has peaked, it is coming down slowly and is still well above the Fed’s 2% inflation target.

It has been a difficult decade for the ‘value’ approach to investing but one of the defining characteristics of financial markets in 2022, aside from the volatility, has been the rotation from high growth stocks to ‘value’ areas of the market. Historically, value has tended to do best in periods of higher and rising rates and higher and rising inflation, so this is likely to continue to be supportive of our Portfolio Managers’ value investing approach in the near term.

. . . . . . . . . . .

Investors and policymakers alike are finding themselves in quite an unusual and uncertain market environment. Over the past twelve months we have seen geopolitical tensions rise, rapid inflation, increased market volatility and the fastest pace of central bank tightening in decades. We believe elevated core inflation will linger for a while longer and a recession is to be expected across developed markets. In this vein, central banks are in a difficult position as they must address inflation but remain cognisant of growth at risk. While inflation seems to have finally stopped rising, it remains stubbornly elevated, but we believe inflation will inevitably drop in 2023 as commodity prices decline and energy and food inflation falls. Core goods inflation will decline as supply shortages decrease and shipping costs continue to fall. However, risks remain around price pressures in the service sector and central banks must stay ahead to curb long-term, high inflation.

Now, more than ever, is a time to be very cautious and strategic in portfolios. As a shallow recession is more likely than not, we can expect U.S. GDP to contract and unemployment to rise slightly. Further rate hikes are to be expected as the year progresses and as policymakers struggle with inflation running well above central bank targets. All told, we see potential downside risk for equity markets as companies will have to navigate a tumultuous market environment with slowing demand and cost pressures, ultimately leading to margin reduction. While we are conscious of the risks, we continue to favour high quality companies with strong balance sheets at reasonable valuations.

. . . . . . . . . . .

Managers, Baillie Gifford US Growth Trust PLC – 26 January 2023

We are in a period of heightened geopolitical and economic uncertainty and the short-term outlook is unclear. We do not believe there is value in us making macro predictions. This is not where our core skill set lies. We do not know what inflation or GDP growth will be next year. And even if we did, we’re not convinced it would help us make better long-term decisions. What we remain focused on is trying to identify and own the exceptional growth companies in America. Exceptional growth companies address large market opportunities, and it is their ability to capture these opportunities, rather than economic cycles, which will be the primary determinant of long-term outcomes.

The last few years have been tough, but we remain optimistic about the future. We are facing short-term headwinds, but we believe we will come through these as we always have done. The structural forces of change – from Moore’s Law in semiconductors, to Wright’s Law in clean energy and Flatley’s Law in healthcare – continue unabated. We are on a path towards abundance. The path may not be smooth, but we are convinced that the future holds promise and that the innovative companies that have the potential to drive us there will be the outliers that drive stock markets for the next decade.

. . . . . . . . . . .

Global emerging markets

Eric Sanderson, chairman, JPMorgan Emerging EMEA Securities – 26 January 2023

The outlook for relations between the West and Russia continue to appear to be grave. Western governments are seeking to reduce their reliance on Russian energy supplies. This, together with the continuing sanctions and exclusion of Russia from Western financial systems may destabilise and isolate Russia to such an extent that holding investments in the country becomes prohibited and/or unviable. There can be no certainty as to if, or when the Russian markets will reopen, and the circumstances of the opening.

. . . . . . . . . . .

Latin America

(compare Latin American funds here)

Sam Vecht and Emily Fletcher, managers, BlackRock Latin American Investment Trust – 27 January 2023

It has been a tough period for Latin America, with many countries hit hard by the COVID-19 crisis. However, we believe there are arguments to be made for better times ahead for the region as the world rebuilds after the pandemic and Latin America could be considered as a beneficiary of recovery in the global economy. As the region rebuilds, the Latin countries will have some important tailwinds. Perhaps the most significant are high commodity prices. Vast stimulus in the US and economic recovery across the world has pushed up demand for commodities after a period of tight supply. Global governments have ambitious, commodity-heavy infrastructure plans, particularly for green energy development. Latin America is one of the most abundant regions in the world for lithium, iron ore and copper with some of the longest-life reserves at a low cost in Brazil, Chile, and Peru. Despite this positive external backdrop, there are also broader risk factors that could weigh on regional economic growth. Across Latin America, a growing middle class is seeing domestic consumption pressured from rising inflation and increasing domestic interest rates. Latin American economies were boosted throughout the pandemic for the most part by expansionary monetary and fiscal policies. This has led to a rapid near-term rebound in demand given the reopening of economies at a time where rising energy costs, low inventories and supply chain issues have led to inflation exceeding expectations across the region. Central banks have aggressively reacted by hiking domestic interest rates to tame rising inflation. The impact of rising domestic rates will weigh on growth prospects, at the margin, but could be offset by continued loose fiscal policy. Over the next 12 months we will see presidential elections in Colombia and Brazil and one of the biggest debates is the amount of government spending to continue to support development. The outcome of these debates will have profound impact on growth going forward. Against this challenging backdrop, we see Latin American equities as already pricing in a great deal of risk factors as a number of stocks and country indices are already trading at discounted valuations in both absolute and relative terms.

. . . . . . . . . . .

Debt

(compare debt funds here, here, here and here)

Manager, TwentyFour Select Monthly Income – 13 January 2023

Looking ahead, the team believe the outlook for returns has significantly improved given much higher starting yields and an expectation that government bond volatility will decline as the Central Banks move closer to peak base rates and inflation pressures start to subside.

The opportunity set in fixed income has rarely been this attractive, with many investment grade bonds now yielding significantly more than the CCC rated index yielded in September of 2022, so the team are focusing on continuing to rotate assets and increase purchase yields whilst maintaining the solid BB- rating.

. . . . . . . . . . .

Angus Macpherson, chairman, Henderson Diversified Income – 6 January 2023

For the moment at least markets have stablised and interest rate expectations are falling. Since the period end, we have seen some encouraging signs that performance has started to pick up, and we hope that markets may be beginning to reward the cautious approach taken by the Managers.

Looking forward to the full year, critical questions are whether inflation has peaked and whether Central Banks have achieved this without triggering a hard landing for global economies. The managers remain cautious on this point and the focus on investment grade bonds reflects this.

. . . . . . . . . . .

We feel that the market now understands and prices monetary policy risks increasingly well, but fundamental risks are not in the price. We remain cautious on gearing and credit in the short term given current valuations and possible hard landing outlook. We feel a hard economic landing outlook is much more likely than a soft landing. Consequently, we are taking a more defensive stance against default risk:- by favouring investment grade bonds over high yield bonds (and secured loans). We feel the Company would be better positioned, in a relative sense, with this asset class bias. However, if a softer economic landing were to occur, the Company would be expected to perform reasonably well but with a lower beta to the upside. Further, if we were to experience increased risk aversion, which we do expect, we would be well positioned to add more high yield bonds at more attractive yields going forwards.

. . . . . . . . . . .

Bronwyn Curtis, chair, NB Global Monthly Income Fund – 19 January 2022

December was a mixed month for non-investment grade credit markets while the fourth quarter was generally positive. The global high yield bond market gave back some of the rally from the first two months of the quarter as returns ended the month in negative territory. The risk-off sentiment for high yield in the latter part of December was driven by hawkish comments from the Federal Reserve (“Fed”) and the European Central Bank, weaker global economic data and Bank of Japan’s surprise monetary policy normalization. However, the overall loan market strung together a third consecutive month of positive returns closing out the fourth quarter solidly up in what was a volatile year. The risk-on sentiment for loans late in 2022 was driven by solid fundamentals, attractive valuations, easing investor concerns over inflation but with the expectation that interest rates are likely still headed higher. Importantly, issuer fundamentals of free cash flow, interest coverage and leverage have remained in relatively favourable ranges with the default outlook for 2023 still below the long-term average.

Notwithstanding the macro volatility, the loan market has been relatively resilient compared to other asset classes over the month, quarter and year to date periods.

Although default rates have moved up modestly from earlier in the year, they remain low across non-investment grade credit which is consistent with healthy balance sheets and positive free cash flow growth. Our outlook for defaults also remains relatively benign with well-below average default rates expected in 2023. Non-investment grade credit, especially given its lower duration profile and attractive yields, could likely see a re-emergence of investor demand as valuations have become very attractive on an absolute and relative basis.

In our view, non-investment grade yields are compensating investors for the below average default outlook, will continue to provide durable income and are attractive compared to other fixed income alternatives. The tightening of financial conditions has caused real GDP growth to slow and slowing demand has helped inflation come off the boil, but it is still higher than the Fed’s target range. Normalizing supply chains and changes in consumer behaviour, among other factors, are likely to continue to mitigate upward inflationary pressures, which could eventually lead to a less aggressive path for Fed policy. That said, our analysts remained focused on the specific credit fundamentals of individual issuers in their coverage, assessing the base and downside cases in the event of a soft-landing or recession. Relatively healthy consumer and business balance sheets and growing nominal GDP should remain supportive for issuer fundamentals. While inventories are building as a result of slowing demand, we remain focused on sector-specific dynamics and idiosyncratic risks to individual issuers. Despite short-term volatility resulting from heightened uncertainty on economic growth and central bank tightening, we believe our bottom-up, fundamental credit research that focuses on security selection, avoiding credit deterioration, and putting only our “best ideas” into portfolios, will position us well to take advantage of the increased volatility.

. . . . . . . . . . .

Commodities

(compare funds here)

Tom Holl and Mark Hume, managers, BlackRock Energy and Resources Income Trust – 11 January 2023

Equity markets came under pressure during the last month of the year, with the MSCI All Country World Index falling by 4.0%. For reference, the index returned -19.8% during the full year of 2022. The sharp losses were driven by aggressive interest rate hikes in an effort to curb inflation, fear surrounding a potential imminent recession, combined with rising geopolitical risk following the Russia-Ukraine conflict and rising concerns over China’s Covid-19 lockdowns. During the month of December, the US Treasury yield curve also inverted its most since the early 1980s. Elsewhere, China abandoned its strict zero-Covid regime, however China’s official PMI data showed a steep decline in economic activity, with its manufacturing and services readings coming in at 47 and 41.6, respectively (a reading below 50 indicates a contraction). Both readings have fallen to their lowest levels since early 2020.

The reaction from mining equities, following the removal of COVID-related restrictions in China was muted, having moved higher in October and November on expectations that China was about to re-open. Mined commodity prices generally performed well, aided by a weakening US dollar. For reference, iron ore (62% fe.) and copper prices were up by 15.7% and 1.7% respectively over the month. Meanwhile, warmer-than-expected weather during the month led to falling gas prices which reduced cost pressures for the miners.

Within the traditional energy space, oil prices were modestly lower reflecting deteriorating economic data and an expectation that relaxing of China’s Covid restrictions would be positive for oil demand. Additional sanctions in the form of an EU and UK ban on Russian crude oil came into force on 5 December 2022, which included a ban on ancillary services, such as insurance, related to the transport of oil. Natural gas prices moved lower in the US and in Europe as warmer weather contributed to Europe’s natural gas storage levels being maintained at >90%, above seasonal norms. US Henry Hub fell by 36% during the month to end the year at $4.4/mmbtu. The Brent and WTI (West Texas Intermediate) oil prices fell by 3.3% and -0.3%, ending the month at $83/bbl and $80/bbl respectively.

Within the energy transition theme, the IEA raised expectation for solar installations and forecast that installed solar capacity may be greater than that of coal within 5 years (although this ignored the difference in load factors). European power prices tracked lower from their elevated levels as warmer weather contributed to Europe’s natural gas storage levels being maintained at >90%, which is above seasonal norms. Should Europe exit winter with higher storage, this would reduce the pressure to secure enough LNG ahead of next winter. Lower European gas prices continued to support European equities, relative to global equity markets.

. . . . . . . . . . .

We do not expect the mining sector to be immune to deteriorating global economic growth. However, whilst recession looms for developed markets, the most important economy for mining, China, is moving in the opposite direction, re-opening following a year of lockdowns and a strict zero-Covid policy.

Meanwhile, mined commodity markets are generally tight, with inventories for many commodities at historic lows. At the same time, mined supply is being constrained by the underinvestment of recent years and continued capital discipline. Mining companies are in an excellent financial position, in our view, with high levels of free cash flow, rock-solid balance sheets and a continued focus on returning capital to shareholders.

Last year, we saw greater appreciation of the role mining companies will need to play in supplying the materials required for lower carbon technologies like wind turbines, solar panels and electric vehicles. In 2023, we expect Brown to Green to emerge as a key theme, where mining companies focus on reducing the greenhouse gas emissions intensity associated with their production. We expect to see a re-rating for the mining companies able to best navigate this and are playing this in the portfolio.

. . . . . . . . . . .

Growth capital

(compare growth capital funds here)

Manager, Chrysalis Investments Limited – 31 January 2023

With most of 2022 having been dominated by difficult market conditions, it is easy to become pessimistic over the future: investor sentiment typically reflects the recent past. In the Investment Adviser’s opinion, it is important to look forward and consider what might change.

Although one swallow might not make a summer, the indications from other leading growth investors suggest pricing has begun to stabilise in the market.

Anecdotally, and post period end, the Investment Adviser has also seen bids for certain of the Company’s assets at levels above recent funding rounds, which supports the above assertion. The Investment Adviser would expect market sentiment to be sensitive to this second derivative.

So the backdrop to valuations may be slightly more optimistic than it has been. Time will tell.

If market sentiment does improve, one area this is likely to be felt is in the IPO market. Currently, the IPO market has endured four consecutive quarters of low issuance.