Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

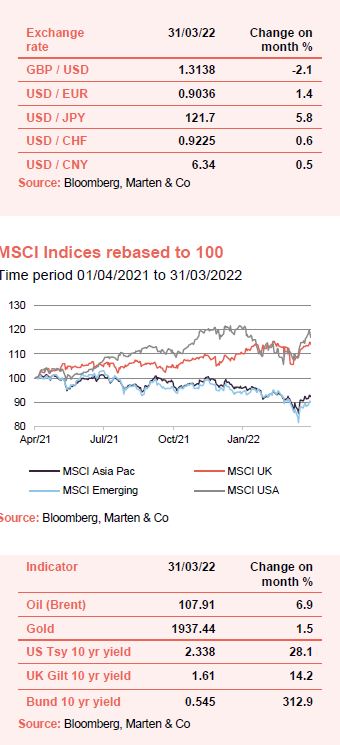

The Russo-Ukrainian conflict, which began at the end of February, worsened over March and more sanctions were imposed. We have seen further volatility in global markets and a significant impact on energy, metals, and wheat prices. That has been good news for commodity exporting regions such as Latin America. Higher inflation and increasing interest rates now seem likely to persist. Government bond yields are rising. Investors have sought out alternative safe havens in asset classes such as gold. Coronavirus cases appear to be on the rise again but the easing of restrictions in most places (with the notable exception of parts of China) have gone ahead as planned as vaccination levels are still climbing.

March’s highlights

Global

Witan’s Andrew Bell believes central banks will stop short of aggressive interest rate rises as, given the debt burden in major economies, high rates would rapidly impact growth.

Simon Barnard, manager of Smithson explains why he does not fear moderate inflation.

EP Global Opportunities’ manager believes it is becoming increasingly clear that inflationary pressures will continue to persist for some time.

Mid Wynd International’s Napier says inflation is now a chosen policy option and not a ‘transitory’ accident resulting from supply side disruptions associated with the pandemic.

F&C chair, Nicola Ralston, says for an investor with a long-term horizon, it is generally preferable to remain invested even in times of heightened uncertainty.

The investment directors at Murray International highlight rising global protectionism, regulation and redistribution of wealth to labour from capital as new challenges for financial markets.

JPMorgan Global Growth & Income’s managers believe we are now firmly in the ‘mid-cycle’ phase of the economic recovery, which tends to support stock markets, and they expect further market gains over the coming year as the cycle progresses.

UK

JPMorgan UK Smaller Companies’ managers discuss how their confidence wavered at the start of 2022 as stock markets declined and the situation in Russia and Ukraine took a dramatic turn.

Richard Hills, chair of Strategic Equity Capital, says we are finally witnessing a strong global economic rebound from the pandemic.

Temple Bar’s managers say commodity prices have increased very dramatically and this will squeeze corporate profit margins whilst acting as a tax on consumers, thereby reducing their spending power.

The manager of abrdn Smaller Companies Income notes that it has been encouraging to see that the number of new issues coming to the market continues to grow, bringing further diversity and investment opportunities to the small and mid-capital company arena.

JPMorgan Claverhouse’s Meadon and Abbot explain how UK stocks have held up better than most in the recent turmoil.

John Evans, chair of JPMorgan Mid Cap, highlights that the UK mid-cap space has seen in the first half of the financial year a high level of bid activity for its constituents as corporate investors see value.

Henderson High Income manager, David Smith, believes inflation is likely to remain elevated, at least in the first half of the year, caused by surging oil, gas and wheat prices.

Global emerging markets

Fundsmith Emerging Equities manager, Michael O’Brien, says political risk will continue to be a greater issue for developing markets against developed ones.

The managers of ScotGems are concerned about India. They say India has a long list of high quality small and mid-cap companies but valuations are often excessive.

Austin Forey and John Citron, managers of JPMorgan Emerging Markets, highlight that it is important, especially in times of uncertainty and market stress, to remember that in the long run, good businesses are always likely to create value for their shareholders.

Renewable energy infrastructure

US Solar’s chair says though we are yet to see the full repercussions of the conflict across the globe and across industries, the trajectory seems set for higher energy prices and stronger demand for renewables.

The chair of VH Global Sustainable Energy Opportunities notes that COP26 demonstrated that while governments focused on the wider debate, it was clear the burden of providing financial support for the transition to net zero would fall on the private capital world.

Foresight Solar’s managers share their views on market developments in the solar space across the UK, Australia and Spain.

Downing Renewables and Infrastructure chair, Hugh W M Little, reflects on the findings from COP 26 and what they mean for the future of renewables.

The chair of Octopus Renewables Infrastructure highlights that the desire to avoid purchases of Russian oil and gas has led governments across Europe and beyond to seek ways to accelerate the deployment of new renewable capacity.

Other

We have also included comments on Asia Pacific from Pacific Horizon; Europe from Henderson EuroTrust, European Assets and The European Smaller Companies Trust; North America from JPMorgan US Smaller Companies; Japan from Baillie Gifford Shin Nippon; India from India Capital Growth and Ashoka India Equity; Vietnam from VinaCapital Vietnam Opportunity and VietNam Holding; flexible investment from Tetragon Financial, RIT Capital Partners and Schroder BSC Social Impact; infrastructure from Digital 9 Infrastructure, Premier Miton Global Renewables and BBGI Global Infrastructure; commodities & natural resources from Golden Prospect Precious Metals, CQS Natural Resources Growth and Income and BlackRock World Mining; biotechnology & healthcare from RTW Venture; technology & media from Allianz Technology; growth capital from Schroder British Opportunities; private equity from BMO Private Equity and Apax Global Alpha; hedge funds from BH Macro and Pershing Square; debt from M&G Credit Income, Axiom European Financial Debt, Honeycomb and Invesco Bond Income Plus; and property from Hammerson, Secure Income REIT, Alternative Income REIT, Tritax Big Box, Supermarket Income REIT, Target Healthcare REIT, Empiric Student Property, PRS REIT, Harworth Group, Regional REIT, BMO Real Estate Investments, Impact Healthcare REIT, CLS Holdings.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.