Investment Companies Quarterly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

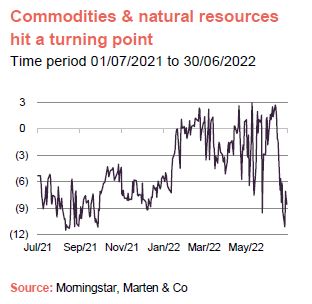

It was very much ‘more of the same’ during the second quarter of 2022 as the conflict in Ukraine continued, rising inflation and interest rates created volatility and supply chain woes didn’t seem to ease. Towards the end of the quarter, previously strong-performing sectors such as commodities & natural resources took a sudden hit, as concerns of a global slow down increased, while China/greater China funds finally seemed to get back on track. Looking ahead, the risk of stagflation across the developed world has increased, while further interest rate hikes look likely. Inflation looks set to stay high due to high commodity prices, supply chain bottlenecks, upbeat US wage growth and deglobalisation.

In this issue – Stunted growth

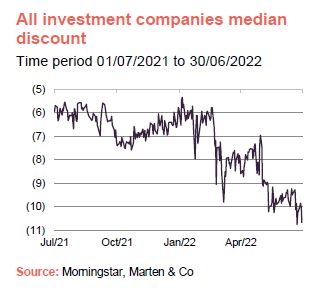

Discounts have been widened and been increasingly volatile as inflation and the risk of a global recession have increased.

Discounts on commodities & natural resources trusts have been increasingly volatile reflecting both higher energy prices and tight commodity markets versus the growing risk of a global recession. After a strong start to 2022 H1, this economically sensitive sector crashed in June.

Performance data – China/greater China funds bounced back towards the end of the quarter after a torrid start to the year, while the leasing sector was boosted by its aircraft members which have benefited from a surge in travel as consumers feel safe enough to fly again. Meanwhile, the technology & media and growth capital sectors are still suffering as growth stocks continue to be out of favour as interest rates rise.

Major news stories – CT UK High Income pleaded its case for continuation while DP Aircraft 1 decided to go ahead with its fundraising plans. Henderson International Income, Schroder Oriental Income and Greencoat UK Wind altered their fees and Urban Logistics REIT doubled in size after a ‘transformational year’.

Money in and out – Around £2.3bn of net new capital was raised over the second quarter of 2022, led by fundraises from International Public Partnerships, from Supermarket Income REIT and Home REIT.

Research published over Q2 2022

Over the quarter, we published notes on: Henderson High Income, Polar Capital Global Financials, abrdn New Dawn, Civitas Social Housing, Downing Renewables and infrastructure, AVI Global, Standard Life Investments Property Income, CQS New City High Yield, Polar Capital Technology, JPMorgan Japanese, Grit Real Estate Income and Montanaro UK Smaller Companies. You can read all of these notes by clicking on the links above or by visiting our website.

Winners and losers

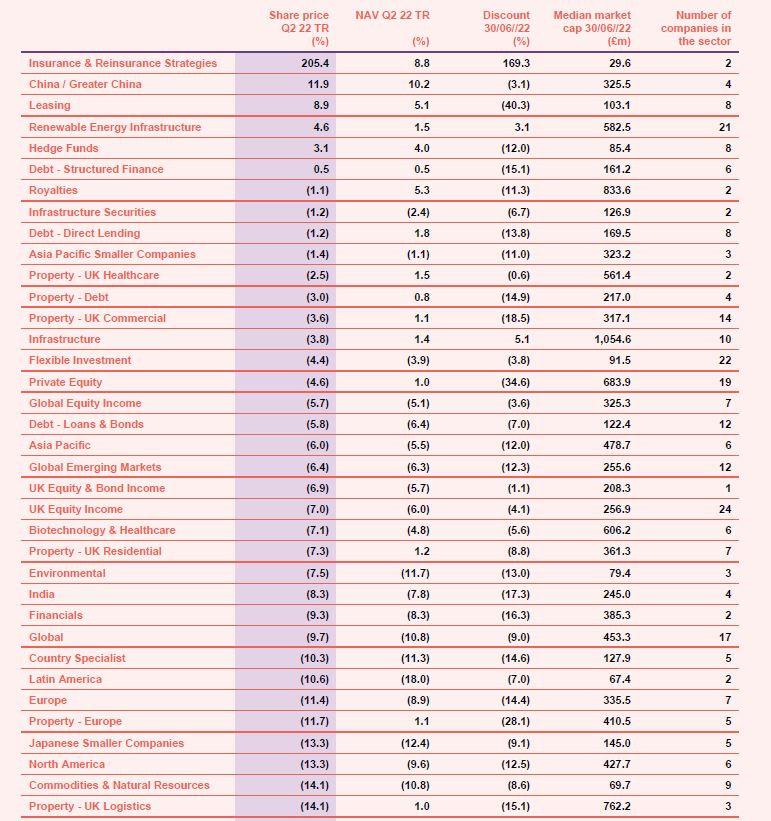

Out of a total of 353 investment companies that we follow, the median total NAV return over the second quarter of 2022 was -3.9% (the median total share price return was -6.9%). This compares with a median total NAV return of -0.4% in Q1.

By sector

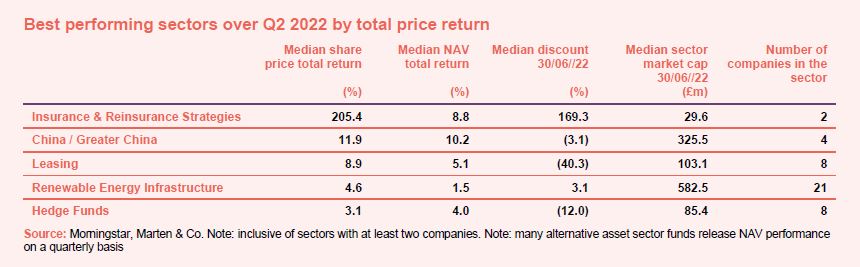

The best performing sector for the second quarter of 2022 was insurance & reinsurance strategies as one of its two members, CatCo Reinsurance, made progress with its wind up. China/greater China funds bounced back towards the end of the quarter after a torrid start to the year, with a strong pickup in services and construction as COVID-19 outbreaks and restrictions eased. Meanwhile, the aircraft funds in the leasing sector benefited from a surge in travel as consumers feel safe enough to fly again.

Renewable energy infrastructure trusts also performed well as many of its members have benefited from rising power prices (in the UK, the marginal price for power tends to be set by the cost of electricity provided by gas-fired peaking plants, which has been driven up by higher gas prices) and a stronger awareness and need for renewable energy solutions, while hedge funds placed fifth in the table.

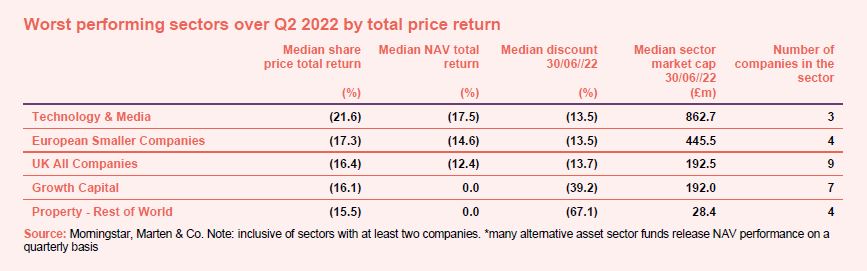

On the other hand, the technology & media and growth capital sectors are still suffering as growth stocks continue to be out of favour as the direction of inflation and interest rates have caused a sharp rotation from growth-style investing. European smaller companies were hit towards the end of the quarter after more grim statistics showing inflation on the continent reaching a record high of 8.6% in June, cementing the ECB’s commitment to a rate rise in July. The UK all companies and property – rest of world sectors were also among the bottom performers in Q2.

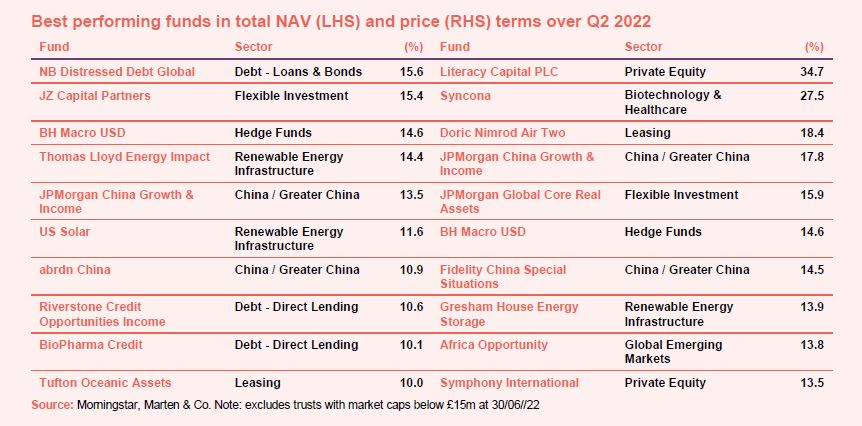

By fund

NB Distressed Debt Global took the top spot for NAV performance over Q2 with the trust still in realisation mode. In April, the board agreed to waive all future fees. Fellow debt funds Riverstone Credit Opportunities Income and BioPharma Credit returned around 10% each in NAV terms while JZ Capital Partners was up more than 15%. The latter benefited from a sale in its JZHL Secondary Fund in May. Thomas Lloyd Energy Impact and US Solar did well after announcing new investments, while Chinese names JPMorgan China Growth & Income, abrdn China and Fidelity China Special Situations saw a pick-up in performance as signs suggest the country’s economy is starting to recover.

In share price terms, Literacy Capital delivered an impressive 34.7% as the trust continues to outperform despite being just over a year old. Syncona shared good results in June while Doric Nimrod Air Two performed well for reasons already explained. Gresham House Energy Storage raked in £150m in a placing in May proving investors are confident in its pipeline, which in turn was reflected in strong share price performance for the quarter.

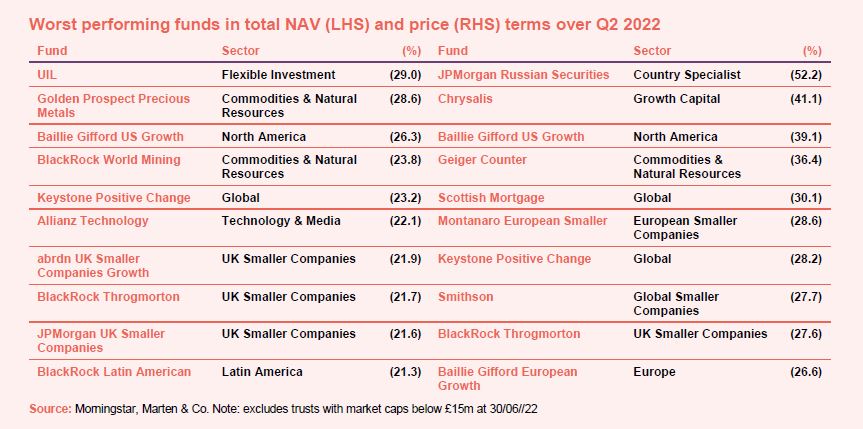

On the negative side, some commodities & natural resources names struggled towards the end of Q2 despite a stellar start to the year, with Golden Prospect Precious Metals and BlackRock World Mining down by almost 30% in NAV terms. Unsurprisingly, BlackRock Latin American followed suit due to its high correlation with commodities. They were joined by growth-focused names such as Baillie Gifford US Growth, Keystone Positive Change and Allianz Technology which have suffered from negative sentiment towards growth-style investing. UK smaller companies names JPMorgan UK Smaller Companies, BlackRock Throgmorton and abrdn UK Smaller Companies Growth were also among the worst performers for the quarter in NAV terms.

JPMorgan Russian Securities saw a significant unwinding of its ridiculous premium, which continues to look elevated, making it the worst performing trust in share price terms over Q2, by some margin (we have long bemoaned the trust’s non-sensical premium, which appears to be driven by speculation in the hope of making a quick buck, when the trust’s portfolio continues to be seriously impaired). The anti-growth sentiment leaked into share price performance too with the Baillie Gifford names already mentioned in addition to Chrysalis and Scottish Mortgage each featuring and down by 28% or more. Meanwhile, Geiger Counter fell by almost 37% in share price terms after being one of the best-performing trusts in 2021. However, investors should note that this is a result of the actioning of its unique embedded right feature rather than the quality and performance of its underlying holdings.

Significant rating changes by fund

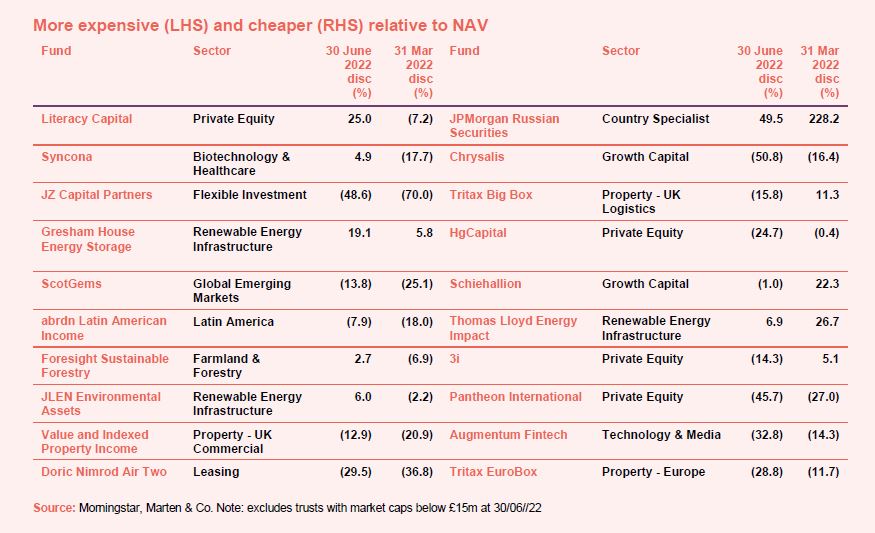

Getting more expensive

Literacy Capital became more expensive over Q2 with its rating moving from a single digit discount swinging to a double-digit premium (it is very tightly held and so its share price moves can be quite sharp, with similar changes in its rating). The trust announced in June that it had received approval as an investment trust, with effect from its accounting period commencing on 1 April 2022. It was joined by Syncona which posted good results while renewable energy infrastructure names Gresham House Energy Storage and JLEN Environmental Assets have seen strong demand and performance while rising inflation has driven up their NAVs. Foresight Sustainable Forestry also saw its discount swing to a premium after announcing a fundraise in early June (which went on to raise £45m).

Getting cheaper

After soaring to a ridiculous 228% by the end of March as, rather distastefully, some investors tried to profit from the war in Ukraine, JPMorgan Russian Securities narrowed back down to a 49.5% premium. Schiehallion’s premium continued to come back down to reality after trading on a 59.3% premium by the end of 2021, and finally swung to a discount by the end of June of 1%. Fellow growth capital peer, Chrysalis, which also enjoyed trading on a premium for some time, is now trading on a 50% discount, as growth-focused funds continue to be out of favour. With a high proportion of tech-focused names sitting in certain private equity funds, it is no surprise that HgCapital, 3i and Pantheon International also feature on this list alongside pure play technology name Augmentum Fintech.

Money raised and returned

Out of the 353 investment companies we follow, around £2.3bn of net new capital was raised over the second quarter of 2022, with the bulk of that being in May (£1.6bn).

2022 has still not seen any new trusts come to market, though there has been a good amount of fundraising from a number of existing trusts via placings, with many of these fundraisings oversubscribed. A significant number took place in Q2.

Money coming in

April saw an oversubscribed £307m fundraise from Supermarket Income REIT while Greencoat Renewables also saw its placing oversubscribed and raised a commendable €281m (£250m). Gore Street Energy Storage raised £150m (up from the £75m target) with net proceeds planned to be deployed towards the company’s significant pipeline.

The biggest fundraise of the quarter came in May via a £325m fundraise from International Public Partnerships, with Home REIT not far behind having completed a £263m fundraise which will be used to acquire and create homeless accommodation across the UK. Meanwhile, Gresham House Energy Storage raised £160m in a placing, which will allow it to fund the majority of its pipeline. The company said that the placing was significantly oversubscribed, and a scaling back exercise was undertaken.

June saw the smallest amount of fundraising at just £230m of net new money, led by a £150m fundraise from Bluefield Solar Income. Proceeds will be used to pay down the trust’s revolving credit facility, which will in turn provide capacity to fund its pipeline.

Money going out

BlackRock Latin American completed a tender offer in May which saw it purchase of 9,810,979 tendered shares at 417.0889p per share (a 2% discount to the trust’s NAV on 20 May 2022), returning £40.9m to shareholders. Meanwhile, share buybacks over Q2 were led by Monks, Alliance Trust, Pershing Square, Scottish Mortgage and Witan.

Major news stories over Q2 2022

Portfolio developments:

- Triple Point Energy Efficiency Infrastructure buys BESS assets

- TRIG acquires 49% interest in Spanish solar park, Project Valdesolar

- International Public Partnerships buys Gold Coast Light Rail Stage 3

- Schroder Asian Total Return outperforms over tough year

- BB Biotech remains resilient in another difficult quarter

- Bluefield Solar Income buys UK-based solar and wind portfolio and announces proposed issue

- NextEnergy Solar reports positive performance for Q1 ‘22

- Aquila European Renewables Income acquires solar asset

- BBGI Global Infrastructure buys German motorway

- Schroder British Opportunities backs Mintec

- Digital 9 buying Arqiva stake

- Taylor Maritime sells one vessel and cancels sale of another

- Baillie Gifford UK Growth – patience will be rewarded

Corporate news:

- Final update on offer for CIP Merchant Capital

- Greencoat Renewables raises €281m in oversubscribed placing

- HydrogenOne Capital Growth announces placing to fund immediate £45m pipeline

- Downing Renewables & Infrastructure’s hydro debt facility classified as a green loan

- Home REIT raises £263m to tackle homeless crisis

- abrdn Japan underperforms in challenging year but avoids continuation vote

- BMO UK High Income pleads case for continuation

- Asset Value Investors raises concerns over Fujitec board’s actions

- Africa Opportunity announces mandatory redemption of shares

- DP Aircraft 1 to go ahead with $750,000 fundraising plan

- Chrysalis conserving cash to fund existing portfolio

- Trian shareholders call for EGM to replace three directors for not meeting ‘required standards of corporate governance’

- Impact Healthcare REIT announces capital raise

Managers and fees:

- Henderson International Income reduces management fee and changes benchmark for better alignment

- Schroder Oriental Income cuts performance fee

- Capital Gearing reveals ‘satisfactory’ results as trust celebrates 40 years under Peter Spiller’s management

- Jupiter lined up for Rights and Issues as manager retires

- Greencoat UK Wind renews investment management agreement with new fee structure

Property news:

- Palace Capital to boost dividend following strong year

- UK Commercial Property hit by wider discount

- Regional REIT splashes £48.2m on trio of offices

- Warehouse REIT posts 33.2% NAV total return as it gears up for main market move

- AEW UK REIT posts 29.7% total return

- Urban Logistics REIT doubles in size in transformational year

QuotedData views:

- Circling the Pershing Square – 1 April

- To B or not to B – 8 April

- Are you still watching? – 22 April

- What’s going on? – 29 April

- Is logistics a house of cards? – 6 May 2022

- Delhi’s dilemma – navigating geopolitics – 13 May

- What’s the craic, Scottish Mortgage? – 20 May

- Unloved quality – 27 May

- Fishing for an Asian fund?, China or Vietnam? – 10 June

- Riding out stagflation – 17 June

- Discounted opportunity – Not all private equity is exuberant growth plays – 24 June

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- JPMorgan European Discovery AGM 2022, 18 July

- Biotech Growth AGM 2022, 19 July

- Woodford – The Cavalry is Coming, 19 July

- BMO UK High Income AGM 2022, 20 July

- Fidelity China Special Situations AGM 2022, 20 July

- Montanaro UK Smaller Companies AGM 2022, 27 July

- JPMorgan Japan Small Cap Growth and Income AGM 2022, 27 July

- The Global Smaller Companies Trust AGM 2022, 28 July

- JPMorgan Global Core Real Assets AGM 2022, 5 August

- JLEN Environmental Assets AGM 2022, 1 September

- Monks AGM 2022, 6 September

- Lindsell Train AGM 2022, 8 September

- Augmentum Fintech AGM 2022, 14 September

- Odyssean Investment Trust AGM 2022, 21 September

- Aberdeen New India AGM 2022, 28 September

- QuotedData’s Property Conference 2022, 19 October

- The London Investor Show 2022, 28 October

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

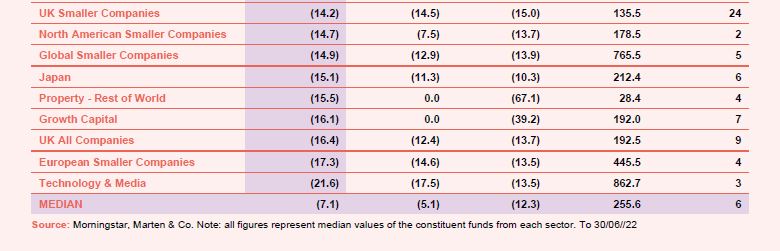

Appendix – Q2 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in any of the securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.