Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

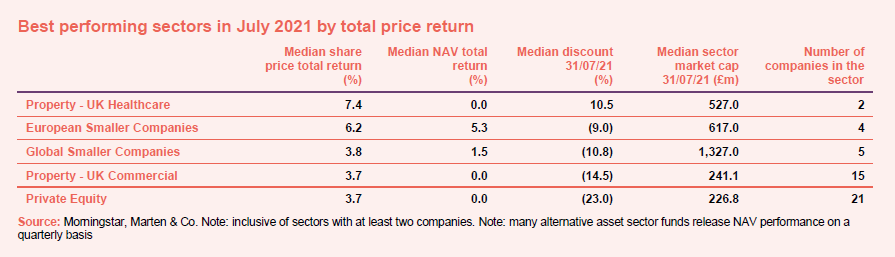

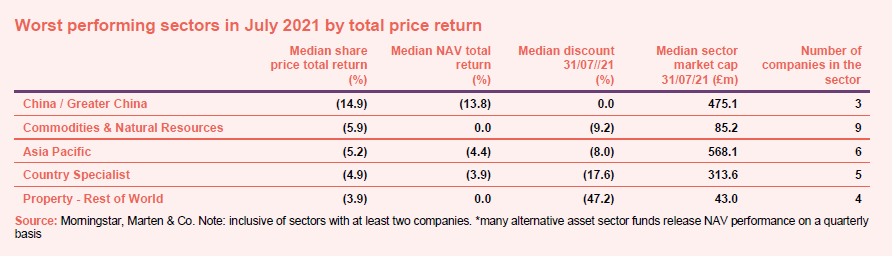

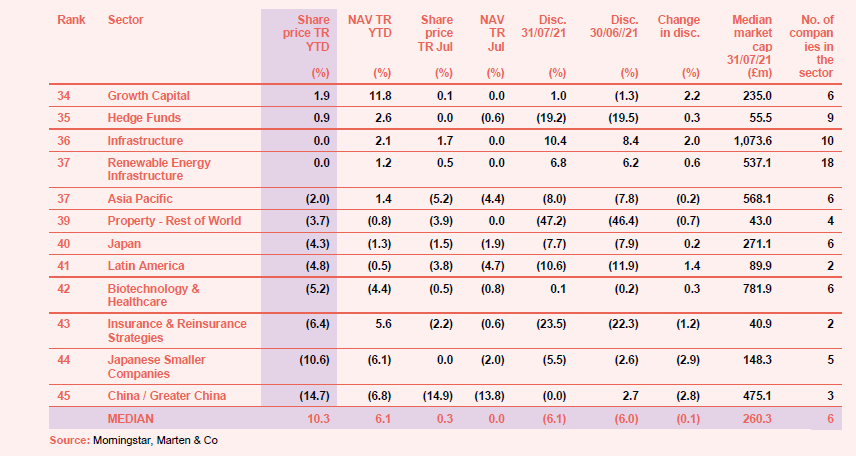

Inflation is still very much on investors’ minds at the moment, though views appear divided on whether it’s coming and what the impact might be. But even the bearish can’t help but feel a bit more optimistic after the misery of this time last year. Property performed well in July, with UK Healthcare and UK Commercial specialist trusts in the top five performing sectors, perhaps reflecting the reopening of the UK’s major cities and offices and the continuing success of its vaccination programme. Meanwhile, private equity and smaller companies mandates also delivered good returns, as consumer spending is increasing with an onus on ‘shopping small’ and with home-grown businesses as part of the recovery process. Meanwhile, the China / Greater China and country specialist (the latter of which is 50% made up of Vietnam funds) sectors saw a complete turnaround after being among the best performers in June. This comes as both China and Vietnam have seen sudden surges in Covid-19 cases while India still tries to manage theirs. Furthermore, in China, government/regulatory clampdowns on a range of businesses have knocked share prices. Commodities & natural resources funds are still down after making record gains at the start of the year (see Appendix 1 for a breakdown of how all the sectors have performed this year).

July’s median total share price return was 1.3% (the average was 1.4%) which compares with 0.4% in June. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over July

Worst performing sectors over June

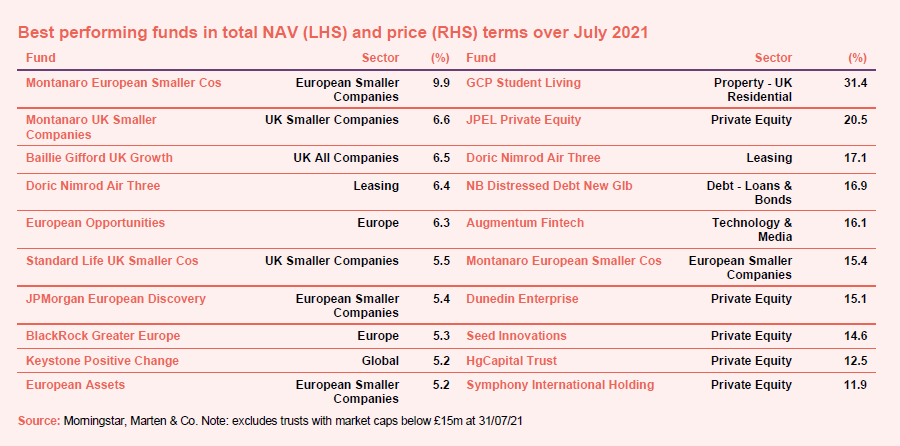

On the positive side

Smaller companies trusts dominated the best performers in NAV terms last month, with Montanaro European Smaller Companies, Montanaro UK Smaller Companies, Standard Life UK Smaller Companies, JPMorgan European Discovery and European Assets all up by 5% or more. European trusts in general have started to pick up as vaccination programmes have grown in momentum, having initially fallen behind the UK. In share price return terms, private equity trusts were the favourites for the month, led by JPEL Private Equity which was up by more than 20% after announcing the sale of its largest investment and a return of cash to shareholders. It was no surprise that GCP Student Living topped the table after it received a takeover bid of a staggering £969m – 30% above its share price during the month.

On the negative side

China funds were the biggest losers in both NAV and share price terms in July, with Fidelity China Special Situations, JPMorgan China Growth & Income and Baillie Gifford China Growth all down. In addition to the government/regulatory clampdowns mentioned above, the country ‘s economic recovery appears to have lost steam as production has fallen and a fresh bout of Covid-19 outbreaks has taken hold. Some feel that policymakers may need to do more to aid the recovery. This may have also had an impact on global emerging markets names Templeton Emerging Markets and Genesis Emerging Markets. It was revealed early in July that Fidelity would be Genesis Emerging’s new manager from September.

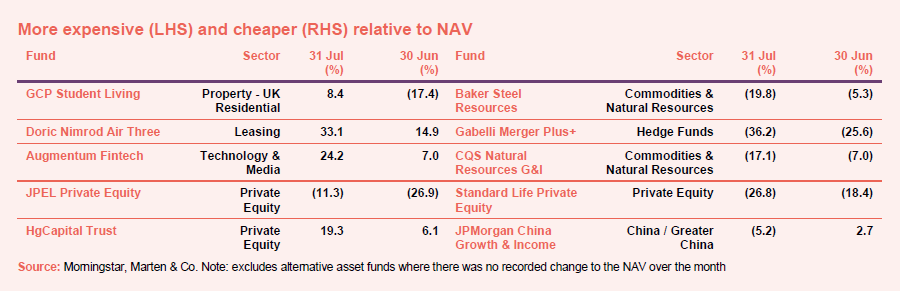

Discounts and premiums

More expensive and cheaper relative to NAV

As already discussed, GCP Student Living received a knock-out takeover bid in July, from Scape Living (funded by APG – a current shareholder) and iQ (funded by Blackstone) valuing the company at £969m. The bid price of 213p per share was a 30.7% premium to its 1 July share price and a 19.1% premium to its 31 March 2021 EPRA net tangible asset value of 179p. Unsurprisingly this has seen its 17.4% June discount swing significantly to an attractive 8.4% premium. Doric Nimrod Air Three rose after it published a factsheet updating on demand for its A380s. Augmentum Fintech’s premium has reverted back to its usual levels having narrowed in June, after announcing plans to amend its investment policy and to raise £40m. Private equity names JPEL Private Equity and HgCapital Trust also saw their premiums increase in July. The end of June saw the latter to agree to sell its position in Allocate, a leading workforce and people management software-as-a-service provider, at an uplift of £9.4m.

Meanwhile, commodities & natural resources trusts Baker Steel Resources and CQS Natural Resources Growth & Income became cheaper during the month, with their discounts widening into double digits. Gabelli Merger Plus+ also saw its discount widen but we note that this has reversed early in August. There is no good reason why Standard Life Private Equity’s discount widened over July. JPMorgan China Growth & Income was impacted by the negative sentiment generated by the government/regulator triggered share price falls in the country.

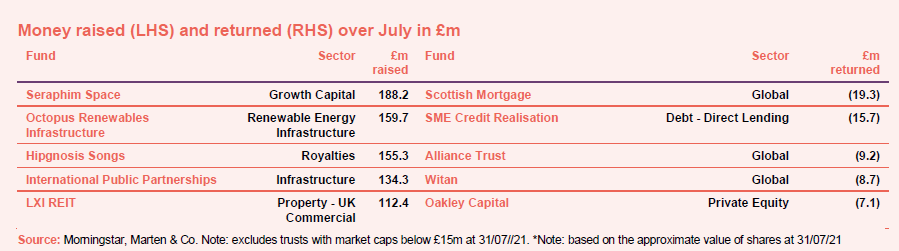

Money in and out

Money coming in and going out

A whopping £1,318.4m of net new money was raised in July with two IPOs and several fundraises. Seraphim Space launched in the middle of the month, having been oversubscribed and exceeding its target of £150m. HydrogenOne Capital Growth also launched but failed to hit its £250m target, raising just £108m – not even making the top biggest fundraisers for the month. While this figure is slightly disappointing, if it can get the money invested quickly and values rise, it has a good chance of growing. However, if there is any initial disappointment within the portfolio and the trust goes to a discount, it could face a real challenge.

Octopus Renewables Infrastructure raised gross proceeds of around £150m through a placing, having only targeted £100m. Meanwhile Hipgnosis Songs’ placing, which was only announced in June, was also oversubscribed. The trust had a target of £150m but raised £156m during the month.

Share buybacks were led by Scottish Mortgage, SME Credit Realisation, Alliance Trust, Witan and Oakley Capital.

Recently published research notes

JLEN Environmental Assets – On the front foot

Even before its recent acquisitions, JLEN Environmental Assets (JLEN) could already boast the most diversified portfolio of its peers. A change in investment policy, approved by shareholders in March 2021, allowed it to invest in a wider universe of environmental infrastructure assets that supports the transition to a low-carbon economy. Since then, we have seen JLEN’s first investment in a biomass-fuelled combined heat and power plant, a co-investment in a battery storage asset, and the purchase of a stake in an Italian energy-from-waste plant. Each of these investments is discussed in this note.

AVI Global Trust – Focused high conviction portfolio

AVI Global Trust (AGT) has had a strong run of performance since last November. Its manager, Asset Value Investors (AVI) has been realising substantial profits from a number of positions where the discounts that these companies have traded at in the market, relative to their underlying net asset values, have narrowed significantly or have been eliminated altogether. As we describe on page 9 onwards, the proceeds of these sales are being recycled into a more focused, high conviction portfolio of good quality companies trading at meaningful discounts to AVI’s estimate of their true asset value.

Alliance Trust – The fruits of diversification

More than four years after it refocused its global equity portfolio, Alliance Trust (ATST) has proven the merits of blending different expertise across different investment styles. Since the overhaul in April 2017, it has matched its peers and beaten its benchmark. In particular, over the past 14 months, which have been clouded by the uncertainty created by the coronavirus pandemic, its strategy has outperformed.

Downing Renewables and Infrastructure Trust – Ahead of expectations

It is still early in the life of Downing Renewables and Infrastructure Trust (DORE), yet, with an early focus on Swedish hydropower – 51% of the portfolio at the end of March 2021 – complemented by a diverse portfolio of UK solar assets, it can already boast a portfolio that is clearly differentiated from its peers.

AVI Japan Opportunity Trust – Progress on a number of fronts

AVI Japan Opportunity Trust (AJOT) is not yet three years old, but it is making great strides in its various campaigns to improve shareholder value across a select group of Japanese companies. The value opportunity presented by the Japanese market is considerable, and this is true for smaller companies and value-style stocks in particular. Many of AJOT’s holdings trade close to the value of cash and listed investments on their balance sheets. Attitudes to corporate governance and shareholder rights are changing in Japan, helped by supportive legislation. After a COVID-related lull in corporate activity last year, things are heating up and this is flowing through into AJOT’s NAV.

Polar Capital Technology – Exciting times

In the short term, the technology sector has given back some of its considerable long-term outperformance of the wider market. Ben Rogoff, manager of Polar Capital Technology Trust (PCT), is unfazed by this. The COVID-19 pandemic has accelerated many societal shifts that Ben believes will be permanent. Areas such as e-commerce, cloud computing, video conferencing, digital entertainment and telemedicine have benefitted. At the same time, advances in sectors such as electric vehicles (EVs) and artificial intelligence (AI) will revolutionise a swathe of industries.

Major news stories over July

Portfolio developments

- BB Biotech ended a volatile Q2 on an (almost) all-time high

- Gresham House Energy Storage acquired new projects

- International Public Partnerships acquired a police headquarters

- Hipgnosis shared strong results reflecting success of songs

- Artemis Alpha narrows discount by more than half

- Miton UK Micro Cap reported stellar results

- Atlantis Japan Growth significantly outperformed the TOPIX

- Hg Capital invested in insight software

- Aberdeen New Dawn turned its performance around

- SDCL Energy Efficiency Income invested in a green gas project

- Pershing Square rejigged its deal with Universal Music

- Ruffer’s controversial bitcoin exposure drove returns

- Polar Capital Technology was held back by its widening discount

- Ecofin US bought 12 new solar projects

- RTW Venture backed Artios Pharma in a series C funding round

- EPE Special Opps backed British homeware brands

Corporate news

- Henderson Diversified Income outlined a new investment objective and policy

- Octopus Renewables Infrastructure raised £150m

- BBGI Global Infrastructure agreed three social infrastructure investments and initiated a £50m placing

- Augmentum Fintech fundraise hit its £55m target

- Seraphim Space launched with £178.4m

- Gabelli Value Plus officially wound up

- Round Hill Music Royalty’s C share placing raised US$86.5m

- HydrogenOne Capital Growth launched but failed to hit its £250m target

Managers and fees

- Genesis Emerging Markets announced its appointment of Fidelity as its new manager

- The Association of Investment Companies appointed ex Share Centre boss Richard Stone to replace Ian Sayers as CEO

- Aberdeen Emerging Markets and Aberdeen New Thai announced plans to combine and focus on China as one trust

Property news

- Great Portland Estates reported momentum in London offices

- Urban Logistics REIT raised £108.3m

- ASLI bought in Barcelona

- UK Resident REIT failed to hit its IPO target

- Lar España issued a €400m green bond

- GCP Student Living received a knockout £969m takeover bid

- Regional REIT sold more of its industrial property

- NewRiver REIT sold its pub business for £222.3m

QuotedData views

- China poses a puzzle – 30 July

- Eyes on Tokyo – 23 July

- Levelling up – 23 July

- Is India back on track? – 16 July

- Define future fit offices – 16 July

- Is football coming home? – 9 July

- Another property takeover? – 9 July

- Volatility remains hallmark of biotech in first half – 5 July

- Told you so! – 2 July

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- NextEnergy Solar Fund AGM 2021, 9 August

- SDCL Energy Efficiency Income AGM 2021, 10 August

- Montanaro UK Smaller Companies AGM 2021, 12 August

- Aberdeen New Dawn AGM 2021, 1 September

- Polar Capital Technology AGM 2021, 1 September

- JLEN Environmental Assets Group AGM 2021, 2 September

- Monks AGM 2021, 2 September

- Gore Street Energy Storage AGM 2021, 6 September

- Schroder Real Estate AGM 2021, 9 September

- SVM UK Emerging AGM 2021, 10 September

- Hipgnosis Songs AGM 2021, 15 September

- Henderson Diversified Income AGM 2021, 16 September

- Civitas Social Housing AGM 2021, 22 September

- BMO Managed Portfolio AGM 2021, 30 September

- Henderson Smaller Companies AGM 2021, 1 October

- Miton Global Opportunities AGM 2021, 6 October

- Aberforth Split Level Income AGM 2021, 28 October

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 9 April | Review of March, CBA, SEC, SEIT, SUPP | Neil Hermon | Henderson Smaller Companies |

| 16 April | BLND, PSDL, SBO | Hugo Ure | Troy Income & Growth |

| 23 April | AEWU, AIF, GSF, MNTN | James Harries | Securities Trust of Scotland |

| 30 April | AGT, DIG, HOME, GWIini | Nick Montgomery | Schroder Real Estate Investment Trust |

| 7 May | JLG, JLIF, SIGB, SMP | Helen Steers | Pantheon International |

| 14 May | NPSN, RMDL | Stuart Widdowson | Odyssean |

| 21 May | AIF, CORD, SBO | Georgina Brittan | JPMorgan Smaller Companies |

| 28 May | GHE, SEC | Matthew Potter | Honeycomb |

| 4 Jun | ARR, BHGG, BHGU, BHME, BHMG, BHMU, LTI, SCIN, WWH | Ben Ritchie | Dunedin Income Growth |

| 11 Jun | CORD, DGI9, PHI | Stephanie Sirota | RTW Ventures |

| 18 Jun | AUGM, LTI, MTE | Stephen Inglis | Regional REIT |

| 25 June | AEMC, CRS, BOOK | Michael O’Brien | Fundsmith Emerging Equities |

| 2 July | GSS, PCFT, SHED, BSIF | David Conlon | GCP Asset Backed Income |

| 9 July | AGT, DIGS | Matthias Siller | Baring Emerging EMEA Opportunities |

| 16 July | AGT, ABD, SONG, PRSR, RHM | Nick Wood | Quilter Cheviot |

| 23 July | RNEW, PSH | Gareth Powell | Polar Capital Global Healthcare |

Coming up |

|||

| 6 August | BCPT | Matthew Howard | BMO Commercial Property |

| 13 August | WTAN | Andrew Bell | Witan |

| 20 August | AEWU | Alex Short | AEW UK REIT |

| 27 August | HHI | Henderson High Income | David Smith |

| 3 September | TMPL | Temple Bar | Ian Lance |

| 10 September | ATST | Craig Baker | Alliance Trust |

| 17 September | ATR | Schroder Asia Total Return | Robin Parbrook |

| 24 September | BMPG/BMPI | BMO Managed Portfolio | Peter Hewitt |

| 1 October | SUPP | Schroder UK Public Private | Tim Creed |

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – July median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.