Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

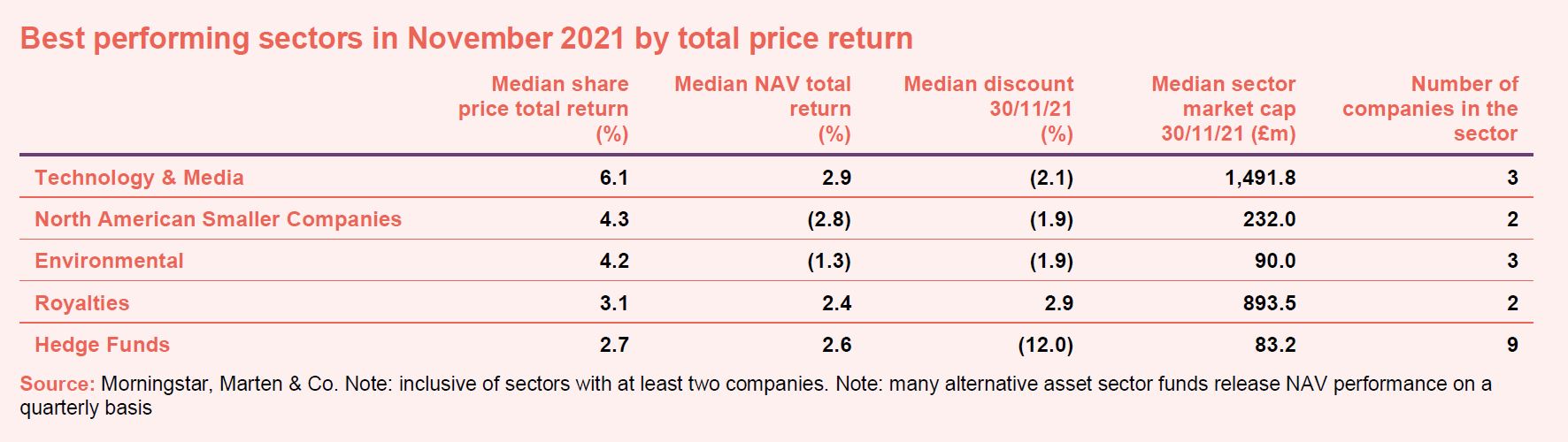

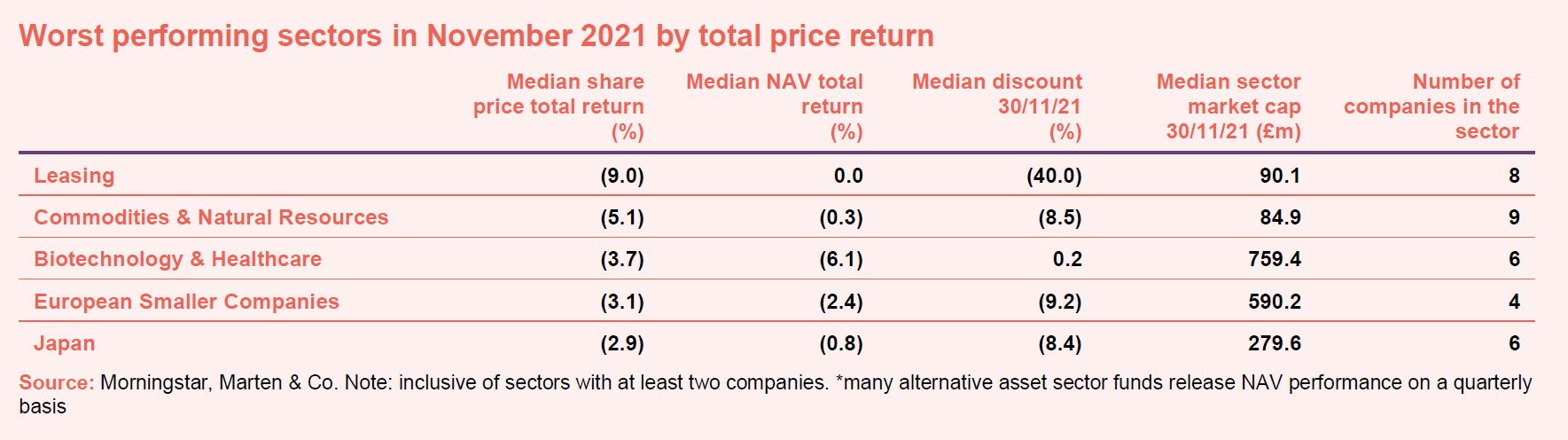

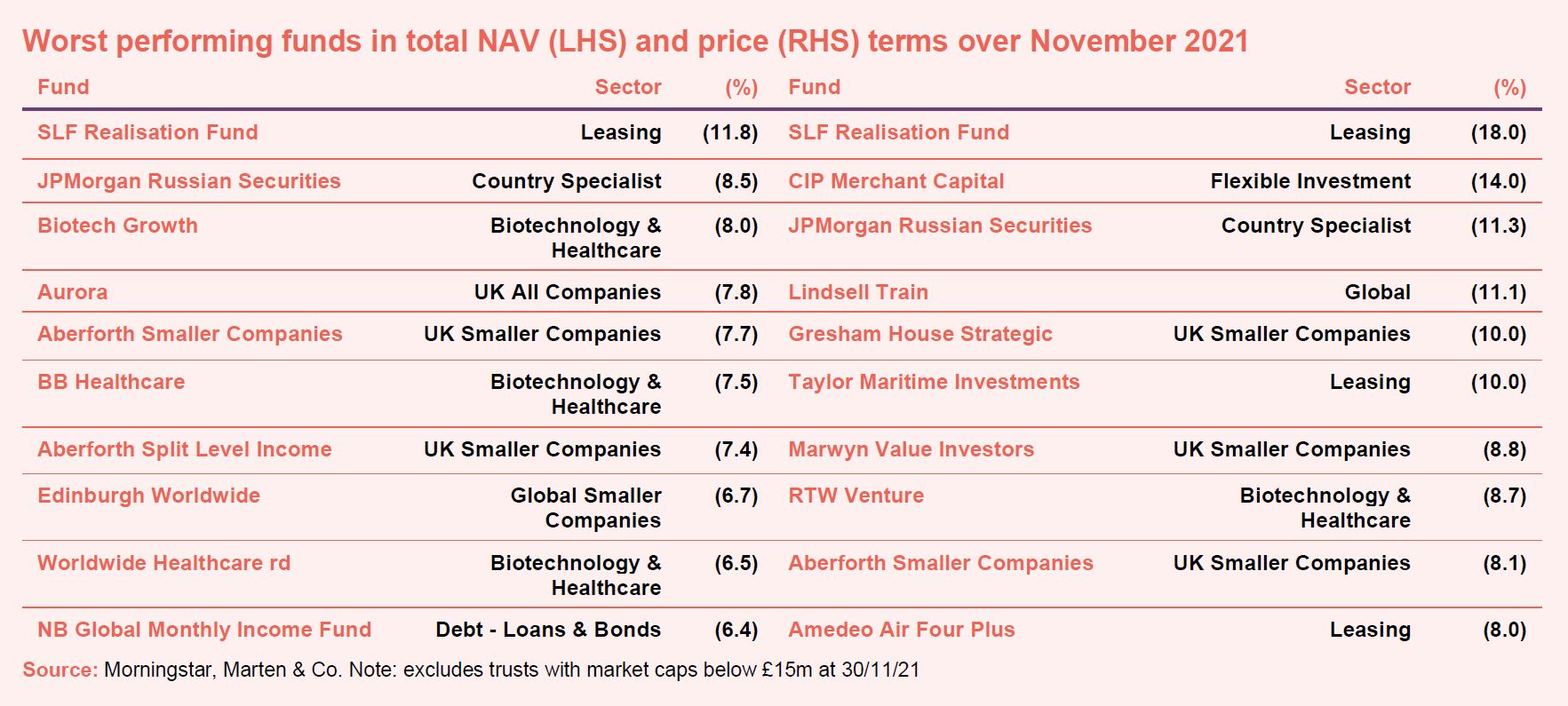

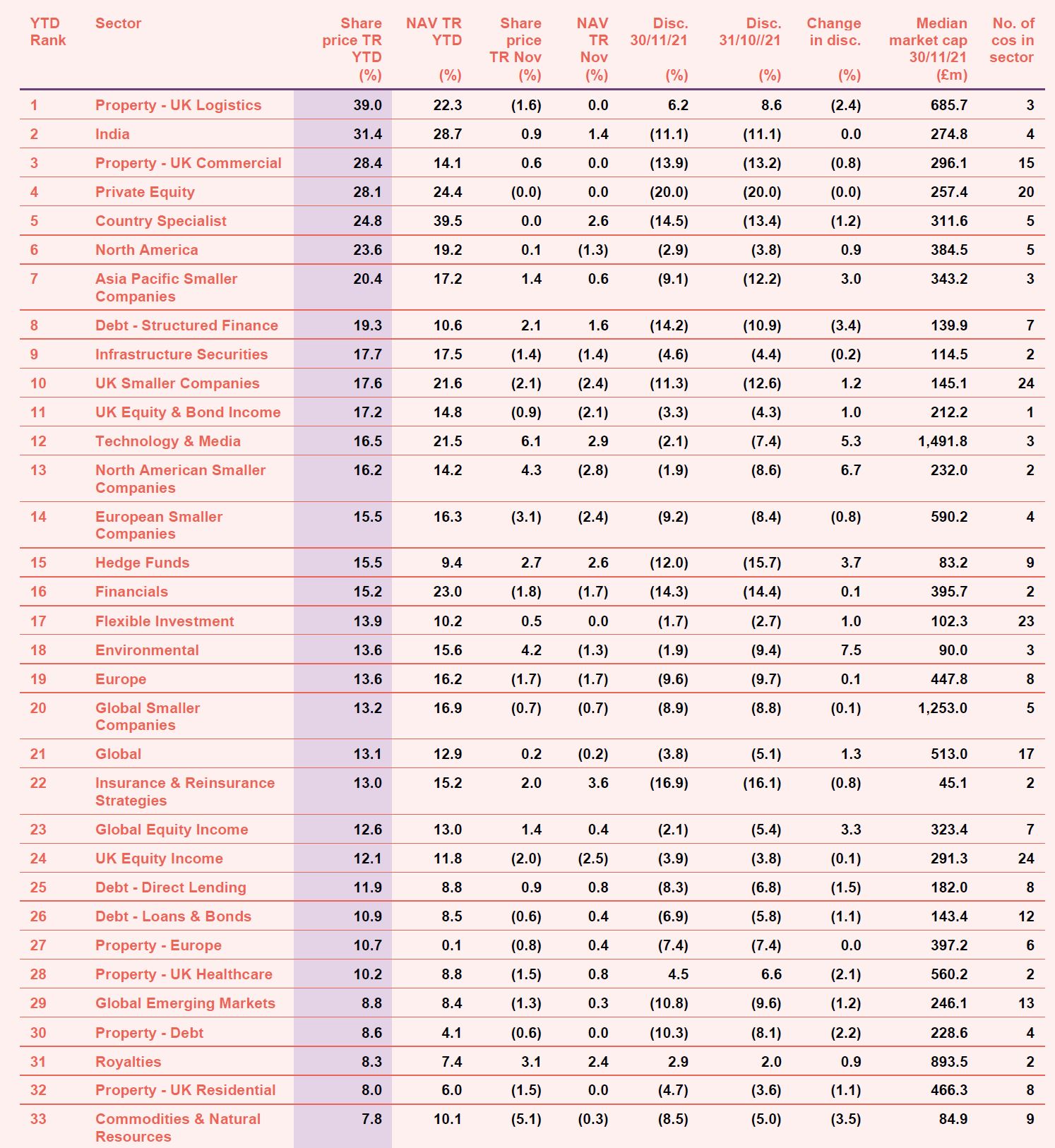

The new Omicron COVID-19 variant dominated markets in November. Technology & media funds performed best, the MSCI All Countries World Information Technology Index rose by 6.2% over the month, indicating that investors were likely returning to the perceived pandemic-resistance of growth stocks. This may well have had a knock-on effect on North American Smaller Companies trusts whose members have substantial weightings towards the tech sectors. On the negative side, leasing funds were the worst performers for the month. The aircraft leasing funds were impacted by fears of new travel restrictions, but the shine also came off Taylor Maritime, perhaps on profit-taking. With the possibility of slower economic growth, commodities and natural resources trusts slipped back, perhaps this will dampen inflationary pressures. Meanwhile, biotechnology & healthcare trusts have continued to suffer throughout 2021 after a stellar 2020 (see Appendix 1 for a breakdown of how all the sectors have performed this year).

November’s median total share price return was 0.6% (the average was 0.4%) which compares with a median of 0.7% in October. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over November

Worst performing sectors over November

On the positive side

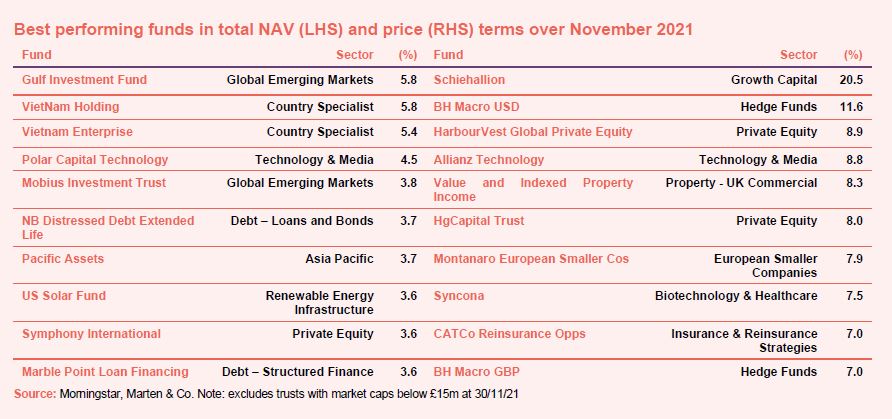

Weaker sterling was one of the most influential drivers of positive NAV returns over November. Gulf Investment, which concluded a tender offer during the month, leads the NAV risers. The UAE market shrugged off a weaker oil price to be one of strongest stock markets in November. Technology names Polar Capital Technology and Allianz Technology performed well as investors rushed to the sector for possible protection from the impact of the Omicron variant while Vietnam rebounded after its third quarter GDP contraction, which was good news for VietNam Holding and Vietnam Enterprise. In share price terms, Schiehallion was the best performer, having reported a strong year and record-breaking fundraising numbers. Syncona continued its good run from October having recently backed a number of launches as the lead investor in several funding rounds. BH Macro announced plans to issue new sterling shares and Montanaro European Smaller Companies published strong results, outperforming its benchmark by more than three times.

On the negative side

On the negative side, SLF Realisation Fund (which saw its name change on 1 December from KKV Secured Loan Fund) saw its NAV and share price plummet. As the company is in managed wind down, the business model changed from holding the assets to maturity to actively realising assets in line with the updated investment policy. The lower oil price knocked JPMorgan Russian. Biotech & healthcare funds Biotech Growth, Worldwide Healthcare and RTW Venture all suffered. The sector has been underperforming this year following record numbers in 2020. You can read further commentary as to why from some of the managers in our December 2021 Economic and Political Roundup. The Gresham House Strategic saga finally came to an end in November as the company has announced a managed wind-down. An unexpected tax charge had a knock-on effect on its share price at the end of the month.

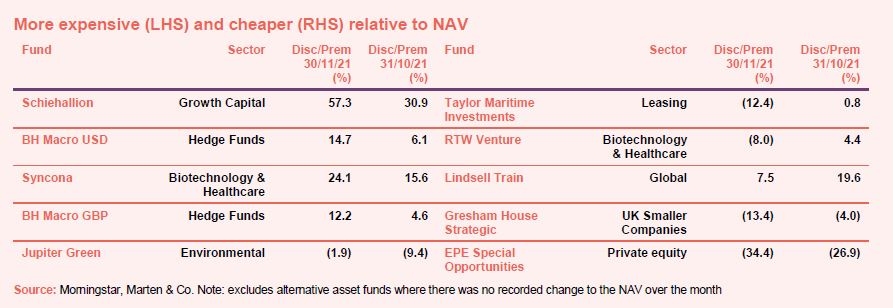

Discounts and premiums

More expensive and cheaper relative to NAV

Schiehallion became more expensive in November, with its already eye-watering premium of 30.9% rising to 57.3%. The trust has had a stellar year in which it scooped up a record $700m in a share issue. Investors have been particularly interested in its long-term exposure to new and exciting trends within the technology and healthcare spaces. Syncona also saw a significant boost in its premium for the second month in a row, as the trust has continued to lead or co-lead funding rounds in new innovative companies such as Quell Therapeutics, a cell therapies developer. It is not obvious what is driving interest in BH Macro, which has returned just 2.2% in US dollar terms over 2021 (to end October). The board is planning to issue more shares which could help bring the premium down.

Taylor Maritime Investments became cheaper in November. Shipping rates have fallen some way from their peak as lower Chinese demand for commodities has been factored in. RTW Venture’s premium fell to a discount as the sector has suffered as of late while Lindsell Train‘s funds have struggled to maintain the outperformance the firm enjoyed previously since the Covid vaccines were announced last year. As already mentioned, Gresham House Strategic ended the month by revealing its plans for a managed wind-down. Before that, the trust was due to change management to Harwood Capital and more recently, it had come under fire for reportedly overstating its NAV. The saga has led to the trust becoming cheaper with its discount widening from single to double digits.

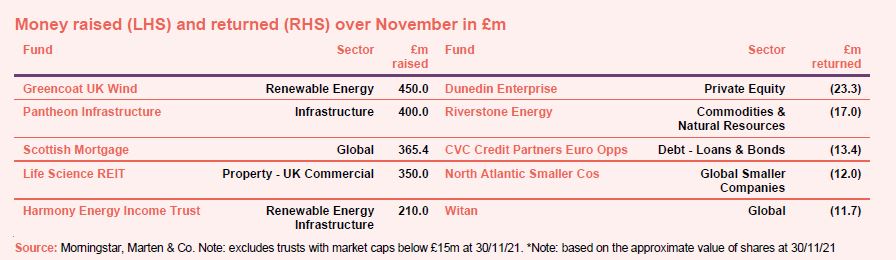

Money in and out

Money coming in and going out

£2.3bn of net new money was raised in November as investors continued to pour money into the sector, backing a number of new funds.

Greencoat UK Wind raised an incredible £450m from an oversubscribed placing, open offer intermediaries offer and offer for subscription, which it announced at the start of the month. Investor demand for the issue exceeded the maximum size of £396m and so the board used its discretion to increase the number of shares available. Pantheon Infrastructure‘s IPO was massively oversubscribed, raising £400m. However, competing fund, Alinda Capital Infrastructure failed to get across the finishing line. Life Science REIT raised £350m, adding a new investment area to the UK listed property sector. The market also welcomed two more renewable energy infrastructure funds in November in energy storage company Harmony Energy Income, which raised £210m and rooftop solar fund Atrato Onsite Energy, which raised £150m in yet another significantly oversubscribed issue. One other new launch during the month was Foresight Sustainable Forestry, which raised £130m.

Meanwhile, share buybacks were led by Dunedin Enterprise, Riverstone Energy, CVC Credit Partners European Opportunities, North Atlantic Smaller Companies and Witan.

Recently published research notes

Pacific Horizon – Blistering performance

Since we last published in January of this year, Pacific Horizon (PHI) has continued with its trend of exceptional outperformance of both its peer group (where it is comfortably the top-performing trust) and the various indices that it benchmarks itself against. PHI, with its strong focus on growth, benefitted from a high allocation to technology stocks in the aftermath of the pandemic. However, more recently, the trust has benefitted from timely decisions to reduce its high exposure to China, prior to the various regulatory clampdowns seen this year, reallocating the proceeds mostly to India, a market that has performed strongly YTD.

Polar Capital Global Financials – More to go for

Polar Capital Global Financials Trust (PCFT) has been having a great run and we are delighted to see it re-expanding. The bounce in the financials sector began with last year’s good news on vaccines. Restrictions on distributions are being lifted and, as defaults have remained low, banks are looking overcapitalised. There is also a growing expectation of higher margins as rates/long bond yields rise in response to inflation.

Civitas Social Housing – Short shrift to short seller

An unwarranted attack by an activist short seller on the fabric of Civitas Social Housing (CSH), coinciding with it falling out of the FTSE 250 index, has driven down CSH’s share price in recent months. CSH has published a strong rebuttal (details of the claims and CSH’s response are on page 5) saying these claims are baseless. The short seller may have made a quick profit, however CSH has had to put a planned capital raise to grow its portfolio on ice and it has impacted the wider sector to the detriment of thousands of people in need of specialist housing.

Lar España Real Estate – Ducks in a row

Lar España Real Estate has lined up its ducks ready for a growth push, having trod water successfully through the COVID-19 pandemic. The group has made significant headway in improving the ESG-credentials of its more than €1.4bn shopping centre and retail park portfolio, so much so that it was able to refinance its debt through the issue of two ‘green’ bonds worth €700m, substantially lowering its cost of debt while increasing its maturity. It has also sold a non-core portfolio at a premium and is now looking to recycle further assets into NAV and earnings accretive investments.

Aberdeen New Dawn – Caution wins out in the end

After another challenging six months since our last note, with initially unscathed Asia finally being hit hard by COVID-19, Aberdeen New Dawn (ABD) has maintained its strong performance, showing it can still be resilient in down markets. But the manager says the numbers also reflect ABD’s long-standing caution over China, which experienced one of its worst market sell-offs for some time this year. A greater state interference in key sectors has raised questions about the country’s regulatory environment and even spooked some investors. However, ABD continues to focus only on Chinese companies that its manager believes can adapt to the changing environment, and exposure to the country remains lower than its MSCI AC Asia Pacific ex Japan benchmark.

Major news stories over November

Portfolio developments

- AVI Japan got a boost from portfolio holding Daibiru Bird

- Syncona co-led a fundraise for a cell therapies developer

- Triple Point Energy Efficiency Infrastructure made a new buy

- Keystone Positive Change reported on its transition year

- JLEN Environmental Assets’ NAV surged by 6.7%

- BMO Capital and Income posted strong results

- Montanaro UK Smaller Companies outperformed

- Cordiant Digital Infrastructure enjoyed a strong start

- 3i Infrastructure bought a subsea fibre optic network

- Schroder UK Public Private backed tech platform Attest

- A low exposure to China helped Schroder Oriental

- Aberdeen Latin American dipped into its revenue reserves

- Double returns against the benchmark for AVI Global

- Scottish Mortgage was helped by its health and tech exposure

Corporate news

- There was a shake-up for Aberdeen Standard Asia Focus

- Gresham House Strategic announced a managed wind-down

- Greencoat UK Wind raised £450m

- Atrato Onsite Energy’s IPO was oversubscribed

- Octopus Renewables Infrastructure announced a placing

- Nippon Active Value launched a share issuance programme

- Pantheon Infrastructure enjoyed an oversubscribed IPO

- VH Global Sustainable Energy Opportunities sought to raise £258m

- Over 70% of Aberdeen New Thai shares opted for cash

- £210m raise for new Harmony Energy Income

- BlackRock Greater Europe’s performance drove a share reissuance

- ThomasLloyd Energy Impact Trust hoped to raise $340m

- Schroder BSC Social Impact planned to raise £26m

Managers and fees

- Ruffer announced plans to launch a new issue to benefit new and existing shareholders

- Fidelity Emerging Markets posted its first results under new management

Property news

- Shaftesbury resumed its final dividend after a bounceback

- Tritax EuroBox bought a new holding in Italy…

- ….and a green lease in Belgium

- Schroder REIT bought a £20m industrial portfolio

- Grit Real Estate announced plans to raise $216m

- Great Portland Estates launched a social impact strategy

- LondonMetric planned to raise £175m in a placing

- Workspace acquired a £45m Islington office

- Life Science REIT raised £350m at IPO

- Yew Grove REIT was the subject of a takeover offer

- Urban Logistics REIT announced another placing

- Home REIT posted a 7.2% NAV uplift in its first results

- Civitas Social Housing saw its NAV nudge up

- Sirius Real Estate proposed a £135m capital raise

QuotedData views

- Showing some grit – 26 November

- Turn and face the change – 19 November

- Feel-good investing – 12 November

- Grabbing the bull by the horns – 5 November

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Henderson International Income AGM 2021, 7 December

- Schroder Japan Growth AGM 2021, 7 December

- Scottish Oriental Smaller Companies AGM 2021, 7 December

- Fidelity Emerging Markets AGM 2021, 8 December

- Alternative Liquidity Fund AGM 2021, 8 December

- Ashoka India Equity AGM 2021, 8 December

- International Biotechnology AGM 2021, 8 December

- BlackRock Greater Europe AGM 2021, 9 December

- Scottish Investment Trust ESM, 9 December

- Round Hill Music Royalty AGM 2021, 9 December

- CQS Natural Resources Growth & Income AGM 2021, 14 December

- Asia Dragon AGM 2021, 15 December

- Schroder Oriental Income AGM 2021, 15 December

- Baillie Gifford Japan AGM 2021, 16 December

- AVI Global AGM 2021, 16 December

- Troy Income & Growth AGM 2022, 19 January

- Aberdeen Standard Asia Focus presentation, 19 January

- Henderson Far East Income AGM 2022, 20 January

- Aberdeen Standard Asia Focus AGM 2022, 27 January

- JPMorgan China Growth & Income AGM 2022, 28 January

- Bailie Gifford European Growth AGM 2022, 3 February

- BMO Capital and Income AGM 2022, 10 March

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

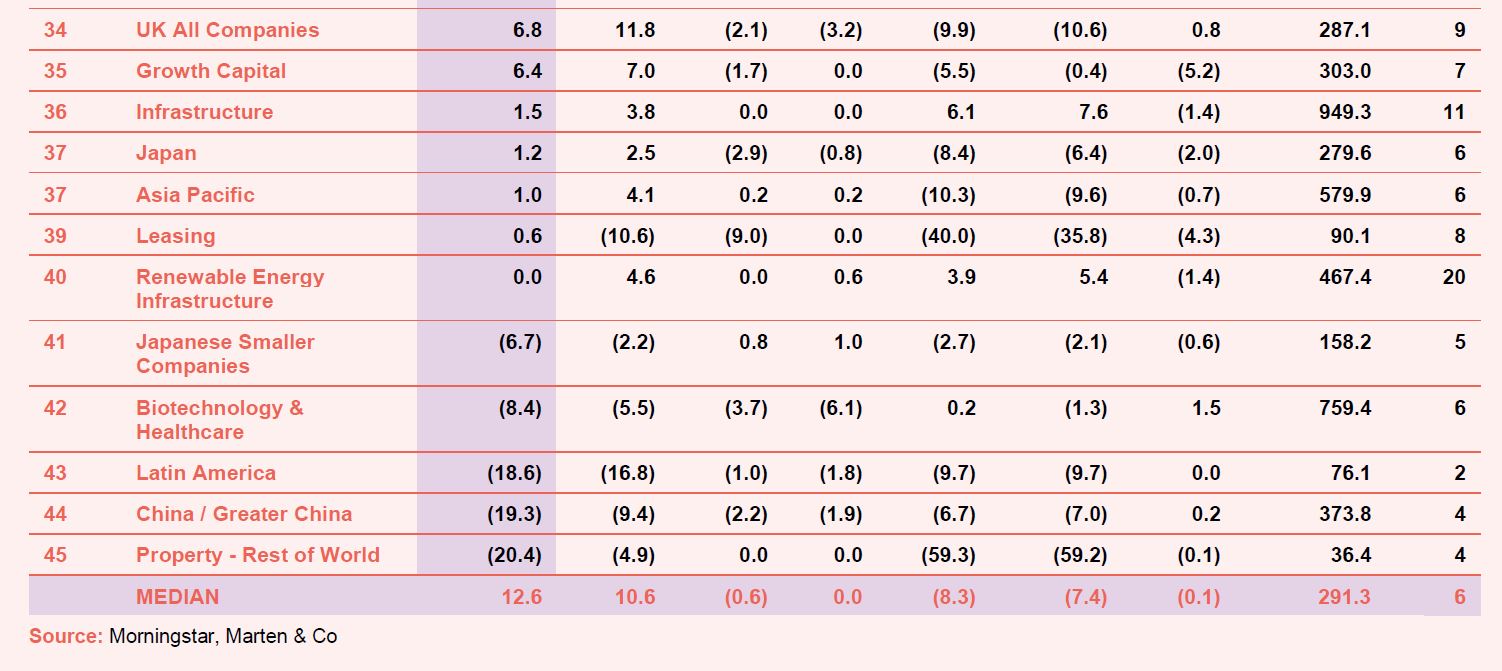

Appendix – November median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.