Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

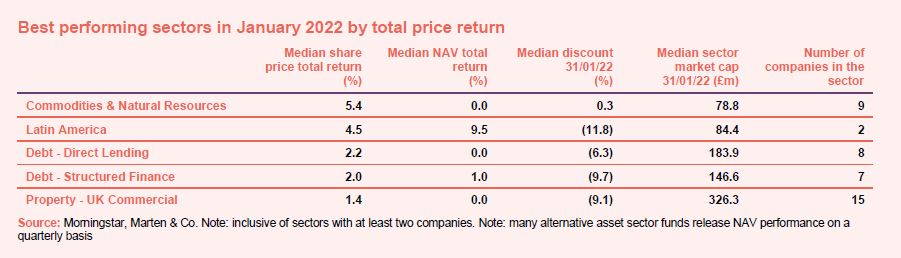

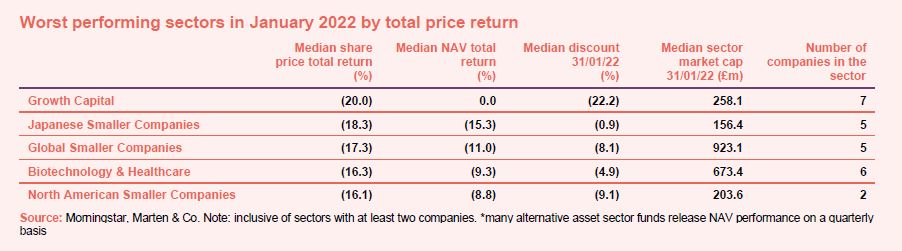

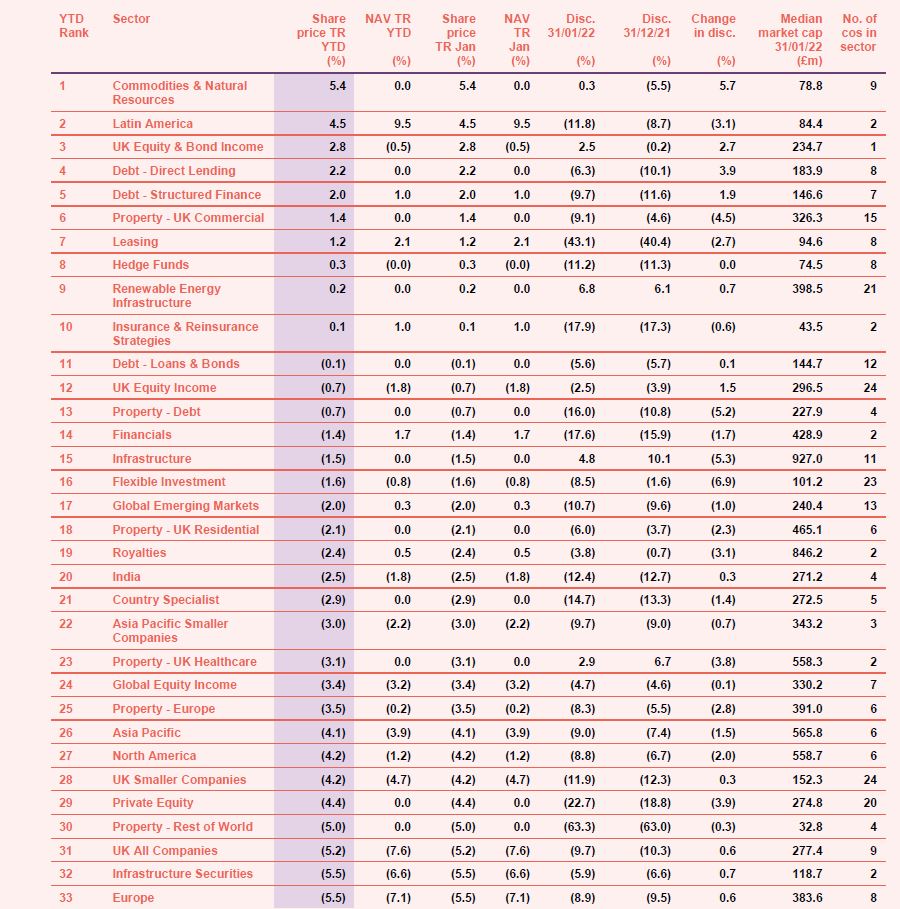

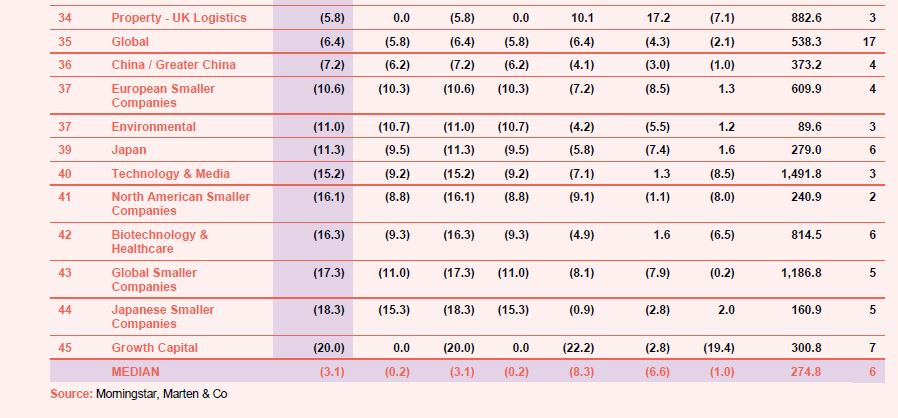

Equity markets didn’t get off to the best start in 2022, with most sectors down (see Appendix) and growth companies at the tail-end of them. This came as the direction of inflation and interest rates took a turn, with heavy hints of multiple rate rises to come in the US this year causing a sharp rotation from growth-style investing. Accordingly, the growth capital sector was the worst performing for the month, joined by biotechnology & healthcare, global smaller companies and North American smaller companies, all of which contain high proportions of growth companies. Meanwhile the threat of a Russian invasion of Ukraine has not helped sentiment on a global basis. On the positive side, the commodities & natural resources and Latin America sectors recouped some of the losses they made over 2021 while debt funds and the UK commercial property sectors also fared well. In its annual UK Real Estate Outlook, CBRE said 2022 could be a year of recovery for the commercial property market with a renewed sense of optimism and growing economy (see Appendix for a breakdown of how all the sectors have performed this year).

January’s median total share price return was -3.1% (the average was -4.5%) which compares with a median of 2.4% in December. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over January

On the positive side

As already mentioned, Latin America funds did well in January and BlackRock Latin American and abrdn Latin American Income took the two top slots out of all investment companies in NAV return terms. This may well be a simple hope that the region’s fortunes are turning around after dismal performance over 2021. It will be interesting to see where it goes to next, especially as the IMF announced last month it had reduced its growth expectations for Mexico and Brazil by 1.2 percentage points each. The positive performance may have also boosted global emerging markets trust BlackRock Frontiers. Strong power prices boosted Greencoat UK Wind’s NAV. A higher oil price contributed to Gulf Investments and Riverstone Energy‘s returns but Riverstone also saw one of its holdings – Solid Power – list at the end of December. Livermore announced a hefty dividend. UK commercial property funds BMO Commercial Property, UK Commercial Property REIT and BMO Real Estate Investment also featured in the list as the sector appears to be bouncing back. Value investing stalwart Temple Bar unsurprisingly performed well in January.

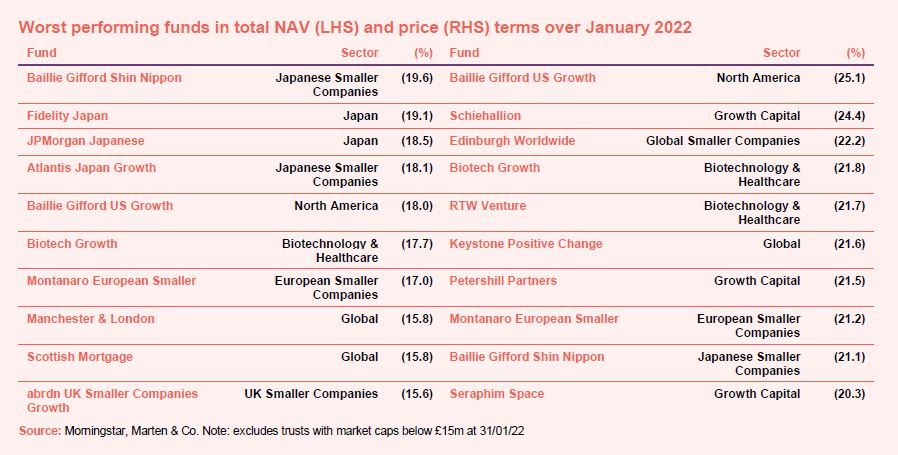

On the negative side

On the negative side, growth-focused Japanese trusts continued to suffer with the top four worst performing names in NAV terms – Baillie Gifford Shin Nippon, Fidelity Japan, JPMorgan Japanese and Atlantis Japan Growth – all from the region. Scottish Mortgage and Baillie Gifford US Growth, which are managed by famously growth-style investors Baillie Gifford, also suffered as the prospect of rising interest rates continued to dent valuations of high growth companies. The management house’s funds were also hit in share price terms as Edinburgh Worldwide and Keystone Positive Change made losses in excess of 20%. Meanwhile, growth capital names Schiehallion (another Baillie Gifford trust), Petershill Partners and Seraphim Space underperformed for the same reasons as did biotechnology & healthcare funds Biotech Growth, and RTW Venture.

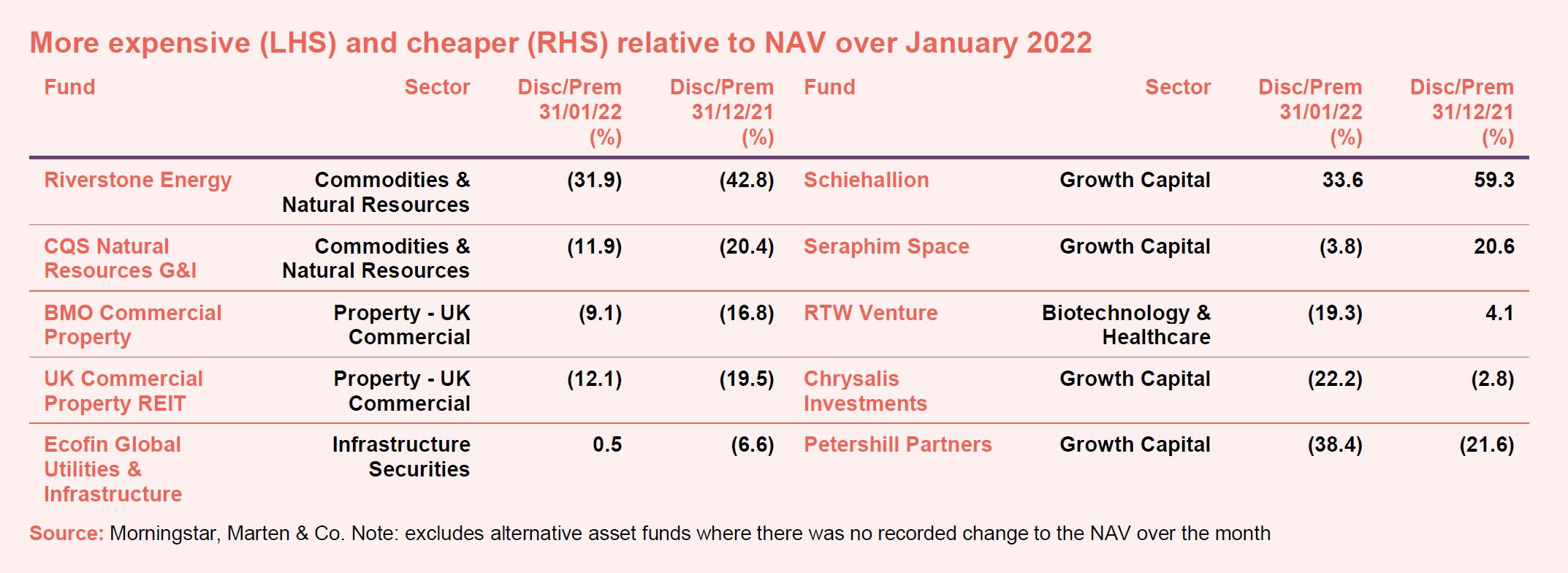

Discounts and premiums

More expensive and cheaper relative to NAV

Riverstone Energy became more expensive in January though it remains on a wide discount of 31.9%. CQS Natural Resources Growth & Income also saw its discount narrow during the month as it announced its second interim dividend of 1.26p per share payable in February. Meanwhile UK commercial property trusts BMO Commercial Property and UK Commercial Property REIT also became more expensive. The former increased its logistics exposure last month with a £66m double buy while the latter acquired a COVID-19 lab in a £94m deal at the tail-end of December.

After seeing the biggest change in its premium rating over 2021, soaring from a 11.1% premium as at the end of 2020 to a 59.3% premium by the end of last year, Schiehallion saw the biggest tumble in January. It remains on a large premium of 33.6% but the size of the fall shows just how badly growth companies have been impacted by recent market movements and sentiment. Unsurprisingly, it was joined by fellow growth capital sector peers Seraphim Space, Chrysalis and Petershill Partners. All three trusts are now trading on a discount, with Seraphim Space taking the biggest hit as it said goodbye to its double-digit premium. Biotech name RTW Venture also saw its premium rerate to a discount in January.

Money in and out

Money coming in and going out

January was quiet for fundraising compared to recent months which have seen billions of pounds come in. Just £330m of net new money was raised, with Cordiant Digital Infrastructure topping the list thanks to an oversubscribed fundraise. Having only launched in 2021 and already conducted further fundraises, this latest placing brought in £200m while fellow digital infrastructure trust, Digital 9 Infrastructure which also launched last year, raised just under £96m. Smithson, BH Macro and Ruffer issued new shares over the month.

India Capital Growth returned almost £20m to investors following its December 2021 redemption facility. The redemption price was confirmed (after a 6% exit discount) at 126.26p per redemption share. Share buybacks were also led by F&C, Scottish Mortgage, Monks and SME Credit Realisation, the latter of which remains in the process of winding up.

Major news stories over January

Portfolio developments

- Hg backed ProcessMAP Corporation

- NextEnergy Solar invested in a Cadiz solar plant

- JLEN Environmental Assets made its first divestment

- Digital 9 Infrastructure bought an Irish wireless network

- Round Hill Music Royalty acquired the David Coverdale Catalogue

- Ruffer got a boost from its index-linked bonds

- BB Biotech remained resilient during a challenging period

- Bluefield bought a Good Energy portfolio

- Downing Renewables & Infrastructure acquired additional Swedish hydropower assets

- Foresight Sustainable Forestry made good progress

- Chrysalis reported another strong year as it doubled in size

- Record results were achieved by Standard Life Private Equity

- RTW Venture Fund backed Kyverna

- Stellar results from Henderson Opportunities as it announced plans to amend its investment objective and policy

- Jupiter Emerging & Frontier Income enjoyed turnaround performance

Corporate news

- Cordiant Digital Infrastructure invested the last of its C share proceeds and announced a new placing

- Staude Capital sent an open letter to Third Point Investors…

- …while AVI called for a review at Third Point Investors

- Jupiter Emerging & Frontier Income planned to amend its redemption facility

- Electra Private Equity rebranded as Unbound Group and relisted on AIM

- JLEN Environmental Assets launched a placing…

- …and raised more than £60m in the oversubscribed issue

- Infrastructure India got two more months

- HydrogenOne was looking for more money

- CIP Merchant Capital got a new bid approach

- Polar Capital Global Financials considered an equity raise

- JPMorgan Russian narrowly avoided the need for a tender

- Another £300m raised for 2021’s IPO stars Digital 9 Infrastructure and Cordiant Digital Infrastructure

- Aquila Energy Efficiency announced a review of its strategy

Managers and fees

- There was a management shake-up at JPMorgan Japan Small Cap Growth & Income as lead manager Saito departed

- Invesco Asia hired Fiona Yang as a new co-manager

Property news

- Supermarket Income REIT continued its acquisition push

- Irish Residential REIT acquired 152 Dublin apartments

- LondonMetric bought a cold storage logistics scheme for £53m

- Abrdn European Logistics Income announced a placing

- Tritax EuroBox acquired a third Swedish asset

- BMO Commercial Property increased its logistics exposure

- LXI REIT said it was targeting a £125m fund raise

- Home REIT completed a £350m acquisition spree

QuotedData views

- Feeling the pinch? – 7 January

- Ecofin Global Utilities and Infrastructure – better value than you might think – 14 January

- Private companies dominate in 2021 – 21 January

- Every cloud – 28 January

Recently published research notes

Tritax EuroBox (EBOX) is continuing on its rapid growth path, having raised €250m of fresh equity in September 2021 and secured a private placement for €200m more in December. It has already acquired four assets with the proceeds and has a further pipeline worth €300m. Once the proceeds of the September capital raise has been fully deployed, the group’s assets will be worth around €1.9bn – remarkable growth from a portfolio value of just over €800m a year ago.

Edinburgh Worldwide – Tomorrow’s winners

Edinburgh Worldwide (EWI) invests in some of the world’s most exciting companies, many of which would otherwise be hard for investors to access. It seeks to identify tomorrow’s winners when they are still relatively small, and hang onto them as they become successful. The manager acknowledges that not every company will make it, but expects that the profits accruing to EWI from those that succeed more than make up for those that fall by the wayside. After a phenomenal 2020, sentiment switched against high-growth companies (for reasons that we explain on page 16) and EWI gave back some of its considerable outperformance. The manager is a long-term investor, however. EWI’s five-year numbers remain well ahead of benchmark indices and peers. The small discount that has opened up in recent weeks may provide a buying opportunity.

GCP Infrastructure – The future is brighter and greener

GCP Infrastructure (GCP) has seen a marked improvement in its net asset value (NAV) performance in recent months. The surge in UK power and carbon prices (see page 8) is working to the benefit of the entities behind many of GCP’s renewable energy infrastructure loans. The push to reduce carbon dioxide and other greenhouse gas emissions from the UK economy is likely to provide substantial new opportunities for the company. A £260m pipeline of potential investments identified by the investment adviser is likely to swell over time.

Urban Logistics REIT – In the sweet spot

It has been a whirlwind few months for Urban Logistics REIT (SHED) as it continues to grow rapidly in one of the best-performing real estate sectors in the UK. The group deployed the proceeds of a July capital raise in short order and earlier this month raised a further £250m to plough into a net asset value (NAV) accretive pipeline. The logistics sector is currently in the sweet spot, with high demand for space and a chronic lack of supply resulting in strong and sustained rental growth.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Schroder AsiaPacific AGM 2022, 1 February

- Edinburgh Worldwide AGM 2022, 2 February

- JPMorgan Indian AGM 2022, 3 February

- Bailie Gifford European Growth AGM 2022, 3 February

- Aberdeen Standard Equity Income AGM 2022, 4 February

- Schroder UK Mid Cap Fund AGM 2022, 9 February

- JPMorgan Asia Growth & Income AGM 2022, 9 February

- Finsbury Growth & Income AGM 2022, 9 February

- Polar Capital Global Healthcare AGM 2022, 11 February

- Chrysalis Investments AGM 2022, 17 February 2022

- Aberdeen Diversified Income & Growth AGM 2022, 22 February

- Shares Investor webinar, 23 February

- QuotedData’s Round the World investment trust webinar series 2022, 24 February – 17 March

- Aberforth Smaller Companies AGM 2022, 3 March

- JPMorgan Russian AGM 2022, 4 March

- BlackRock Income & Growth AGM 2022, 8 March

- Henderson Opportunities AGM 2022, 10 March

- BMO Capital and Income AGM 2022, 10 March

- Master Investor Show 2022, 19 March

- Standard Life Private Equity AGM 2022, 22 March

- Jupiter Emerging & Frontier Income AGM 2022, 28 March

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – January 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.