Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

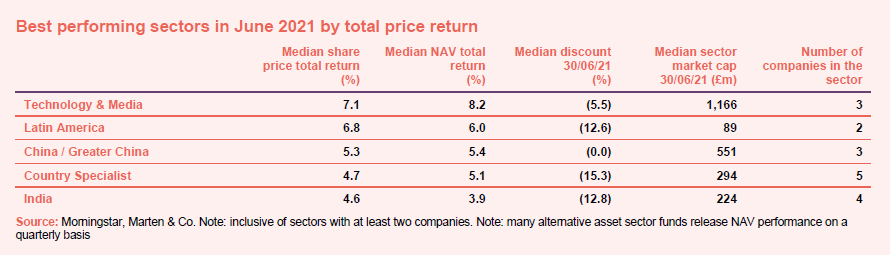

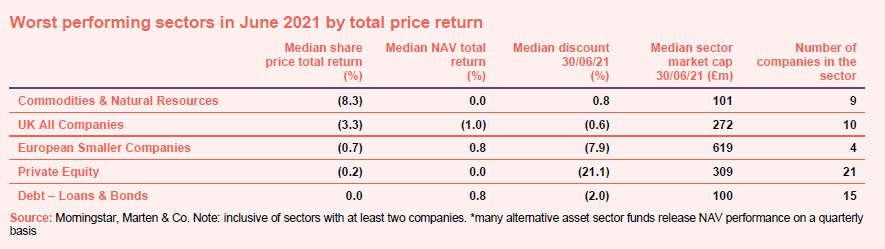

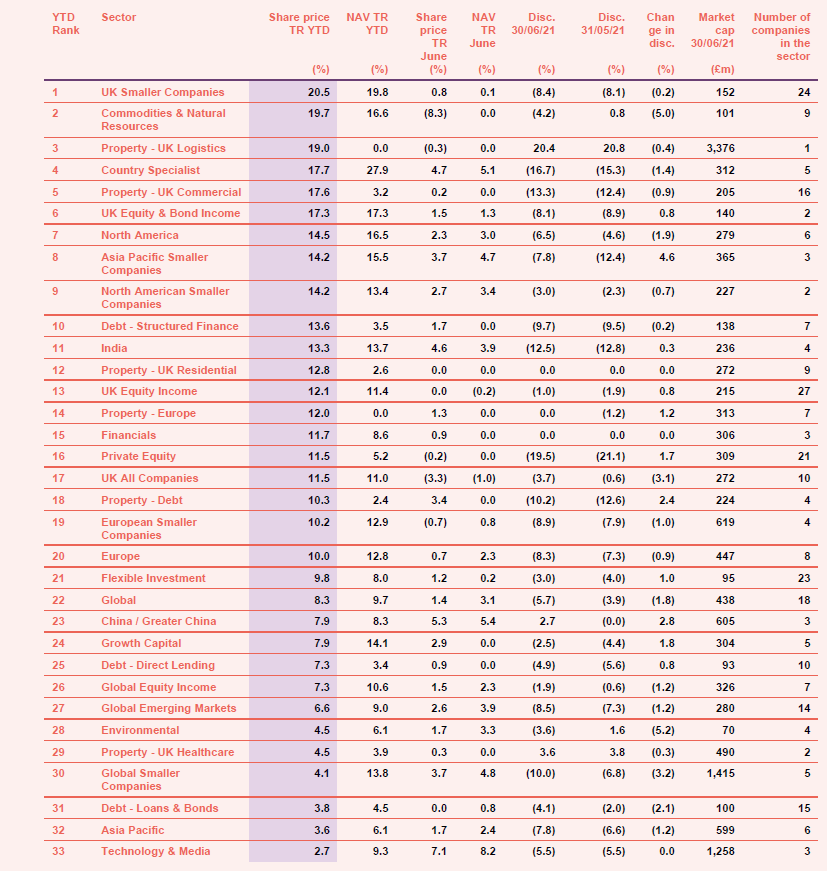

The old adage that what goes up must come down and vice versa appears to ring true this month as interestingly, the commodities & natural resources sector, which was the best performing in May, was the worst performing in June. The sector has backtracked on its 2021 rally as easing supply worries grow stronger along with monetary policy uncertainty. This has particularly affected gold and silver. The timetable for US interest rate rises appeared to move up despite the Federal Reserve saying that it thought inflation was transitory. This together with a rising dollar and China’s efforts to slow inflation meant some materials have also taken a hit. Similarly, the technology & media sector, which was the worst performing in May, was the best in June. Tech stocks led the way in June with the Nasdaq and S&P 500 hitting all-time highs towards the end of the month, as investors expect a robust earnings season while interest rates remain low. Meanwhile, emerging market names such as those in Latin America and India have performed well as central banks have been proactive in raising rates and sounding more hawkish tones which has helped lessen inflation concerns (see Appendix 1 for a breakdown of how all the sectors have performed this year).

June’s median total share price return was 1.3% (the average was 1.4%) which compares with 0.4% in May. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over June

Worst performing sectors over June

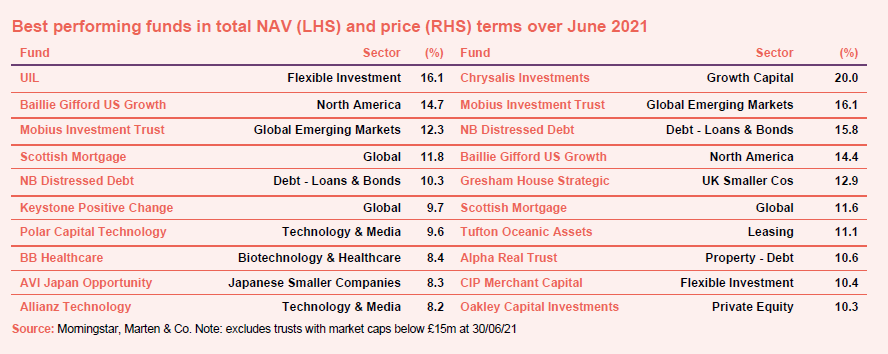

On the positive side

After a short blip, the flavours of the month for June were once again tech and growth, and relevant trusts such as Baillie Gifford US Growth, Scottish Mortgage, Polar Capital Technology and Allianz Technology delivered some of the best returns in both NAV and share price terms. Investors are piling back into tech-oriented growth stocks on diminishing worries about runaway inflation – though inflation is certainly still a concern on people’s minds. UIL’s NAV increase is largely down to a change in the way it values its investment in Somers. Meanwhile, Gresham House Strategic made gains after it committed to a strategic review and Mobius Investment Trust‘s focus on high quality and sustainable stocks meant it outperformed in COVID-hit emerging markets. AVI Japan Opportunities has been busy engaging with a number of investee companies. Sentiment towards Tufton Oceanic may have been benefiting from rising charter rates for ships.

On the negative side

On the other hand, as highlighted previously, the rally in commodities appears to have come to a halt and many of the top performing funds in May, which sit in the commodities & natural resources sector, made losses in June. Golden Prospect Precious Metal, CQS Natural Resources and Geiger Counter were among the worst performers in both share price and NAV terms for June. Crude oil prices are holding onto gains but gold and palladium slumped while copper on the London metal Exchange saw its biggest weekly loss since March 2020. Other laggards in June included Miton UK MicroCap while Secure Income saw its share price fall in June by 20% after taking a knife to the valuations of its film financing portfolio. Augmentum Fintech fell after it announced a significant fundraise (see below).

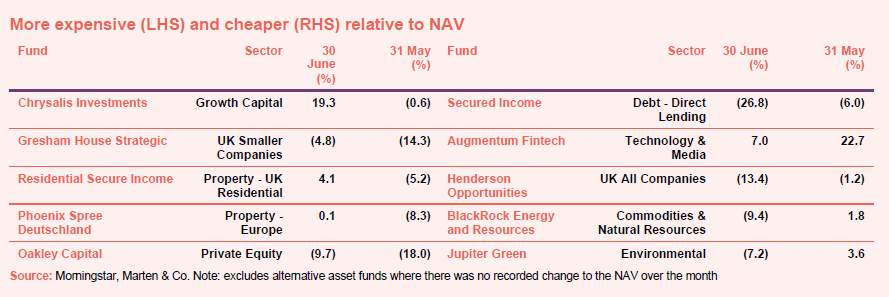

Discounts and premiums

More expensive and cheaper relative to NAV

Chrysalis Investments enjoyed a huge turnaround from a small discount at the end of May to a premium just shy of 20% by the end of June. It announced a £75m investment in leading retirement platform Smart Pension, but the price move reflects hopes of an uplift in its end June NAV (the last published is as at 31 March). It is a similar story for Oakley Capital, which has had a run of good news recently. Gresham House Strategic also became more expensive last month as it saw its discount narrow – after seeing it swing out in May – likely on the back of the commitment to a strategic review, as mentioned earlier.

Meanwhile, Secured Income has become a lot cheaper on the bad news about its film finance portfolio. In addition, its chief investment officer, Dawn Kendall took a temporary leave of absence, which was announced in May. She was due to return in mid-July but this has been extended to September. The bounce in UK stocks that began following November’s good news on vaccines may have paused, as is reflected in Henderson Opportunities’ widening discount. Augmentum Fintech’s high premium of 22% became cheaper in June, though is still trading higher than its NAV at 7%. The company revealed excellent results for the year to 31 March 2021 while also sharing details of an amendment to its investment policy and plans to raise £40m at 135.5p, then a 3.9% premium to NAV. Jupiter Green is back trading on a meaningful discount for the first time since last October. The board is supposed to keep this under control.

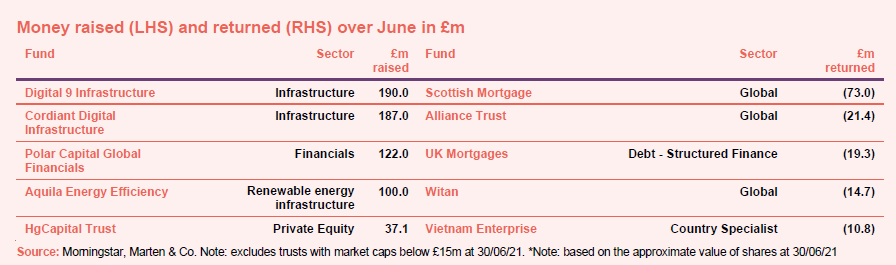

Money in and out

Money coming in and going out

June was a bumper month for fundraising with one new listing and a number of existing funds raising substantial additional capital. Many more funds announced fundraising plans including a couple of new issues. Approximately £757m of net new money was raised in June in total. New trusts on the block, Digital 9 Infrastructure and Cordiant Digital Infrastructure raised £375m between them – making £1bn in total raised for these trusts this year. Both companies have substantial pipelines of new assets and we could easily see them come back again for more money later in the year. Polar Capital Global Financials capped a remarkable turnaround in its fortunes since last year’s cash exit opportunity. Investors are backing banks once again and the sector is outperforming. Aquila Energy Efficiency was this month’s new issue. It is the third of these funds to launch but is differentiated by its European focus. Hg Capital heads a long list of funds tapping stock out in response to demand.

Not on the list is Literacy Capital, another new entrant to the sector but it didn’t raise any fresh capital at launch – although some existing investors sold shares. It currently has a market cap of about £116m. One fund that didn’t make it was Liontrust ESG Trust. Private investors were supportive but professional investors seem to have been put off by its size – saying it was too small.

Share buybacks were led by Scottish Mortgage, Alliance Trust, UK Mortgages, Witan and Vietnam Enterprise.

Research published over June

Jupiter Emerging & Frontier Income – Out in front

“In both total net asset value (NAV) and share price return terms, Jupiter Emerging & Frontier Income (JEFI) has been the pacesetter within its peer group since the November 2020 vaccine announcements. Manager Ross Teverson and the team’s long-held view that stocks were priced more attractively outside of China has been paying off, led by its Taiwan-based holdings in particular.”

India Capital Growth – Lessons learnt

“Though India’s second coronavirus wave – which started in March 2021 and saw as many as 414,000 recorded daily cases as recently as 6 May – has been described as one of the worst in the world, Gaurav Narain, India Capital Growth’s (IGC’s) investment adviser, believes the peak in infections has now passed. The number of new daily cases appears to be falling and the country’s vaccine rollout is ramping up after a temporary slowdown following production constraints.”

Bluefield Solar Income Fund – Transformational deal

“Bluefield Solar Income Fund (BSIF)’s ambition to expand beyond its narrow focus on solar power generation looks close to fruition, with the announcement of a deal to buy a portfolio of 109 wind turbines, located across the UK. This is the first in a series of transactions aimed at diversifying BSIF’s asset base. The target is to have 25% of its portfolio in assets other than solar within 18 months.”

GCP Infrastructure – Penalised for being conservative?

“In recent months, despite its attractive dividend yield (6.9% at the time of publication), GCP Infrastructure (GCP)’s shares moved to trade on a small discount to its net asset value, which is unusual both for funds in the infrastructure sector (where GCP sits) and the renewable energy sector, which is a better match for the majority of GCP’s portfolio. As the figures on page 18 show, even today, when GCP’s shares have recovered to trade at a small premium to asset value, it remains one of the cheapest funds in both sectors.”

Major news stories over June

Portfolio developments

- Bluefield Solar bought a new UK based wind portfolio

- HgCapital’s manager agreed the sale of its Allocate holding

- Chrysalis bought a leading retirement tech platform provider

- NextEnergy Solar invested in its sister fund NextPower III

- Taylor Maritime completed deployment of its IPO proceeds

- Hipgnosis announced plans to raise £150m and acquired producer Joel Little’s catalogue

- Apax X invested in CyberGrants

- JLEN made its first investment into large-scale biomass combined heat and power plant

- Oakley Capital acquired controlling stakes in e-commerce names Afterbuy and DreamRobot

- Octopus Renewables bought a Scottish wind farm

- Triple Point Energy Infrastructure bought CHP+ company Spark Steam

- Caledonia sold long-term holding Deep Sea Electronics

Corporate news

- BlackRock North American Income revealed a revised objective and name change to BlackRock Sustainable American Income

- Activist Investor publicised plans to block the continuation of Crystal Amber

- Round Hill Music Royalty announced a new C share placing

- Literacy Capital announced its intention to float

- FastForward Innovations proposed a name change

- New space fund Seraphim Space issued an intention to float and published its prospectus

- JPMorgan European Smaller Companies officially relaunched as JPMorgan European Discovery

- Augmentum Fintech revealed plans to amend its investment policy

- Requisition notice withdrawn for Gresham House Strategic

- BH Macro and BH Global agreed heads of terms for its proposed combination

- BBGI Global Infrastructure secured a £230m revolving credit facility

Managers and fees

- Montanaro European Smaller Companies confirmed its split share plans

- Third Point Investors proposed an exchange facility

- Ewan Markson-Brown, co-manager of top-performing Pacific Horizon trust left Baillie Gifford

- Lindsell Train updated its benchmark and performance fee

Property news

- Urban Logistics announced a fundraising

- LXI REIT revealed plans to raise £75m through new shares

- Tritax EuroBox acquired its first asset in the Nordics

- UK Residential REIT published its prospectus

- Sigma Capital Group reached an agreement on its takeover

- Lar Espana Real Estate extended its IMA with Grupo Lar by five years on a reduced fee

- Home REIT invested the remainder of its IPO proceeds

QuotedData views

- Chinese private equity – 25 June

- Office needs to Flex muscles – 25 June

- Is property still a good hedge against inflation? – 18 June

- Step off the train? – 18 June

- Space! – the not so final frontier – 11 June

- Not all industrial is equal – 11 June

- REIT IPO to get excited about – 4 June

- On drugs – 4 June

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- JPMorgan Multi-Asset Growth & Income AGM 2021, 6 July

- JZ Capital Partners AGM 2021, 6 July

- Downing Strategic Micro-Cap AGM 2021, 7 July

- JPMorgan European AGM 2021, 8 July

- Third Point Investors AGM 2021, 8 July

- TwentyFour Select Monthly Income AGM 2021, 8 July

- Worldwide Healthcare AGM 2021, 8 July

- 3i Infrastructure AGM 2021, 8 July

- Gabelli Value Plus+ AGM 2021, 12 July

- India Capital Growth AGM 2021, 14 July

- Jupiter Emerging & Frontier Income webinar, 15 July

- Axiom European Financial Debt AGM 2021, 19 July

- HarbourVest Global Private Equity AGM 2021, 21 July

- Blackstone Loan Financing AGM 2021, 23 July

- Gresham House Strategic AGM 2021, 26 July

- BlackRock North American EGM 2021, 29 July

- Montanaro UK Smaller Cos AGM 2021, 12 August

- Civitas Social Housing AGM 2021, 22 September

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – June median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.