Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

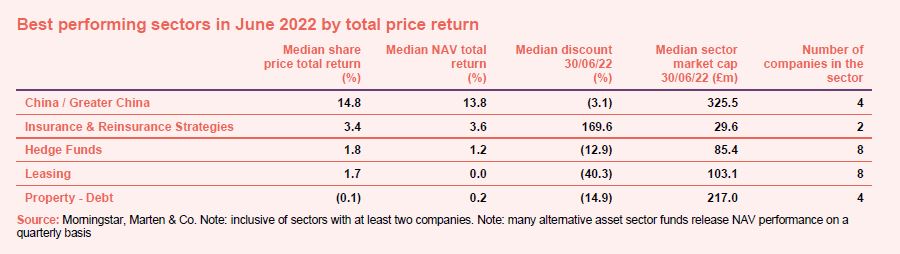

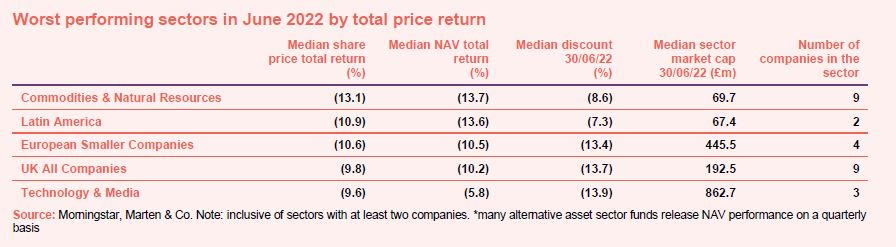

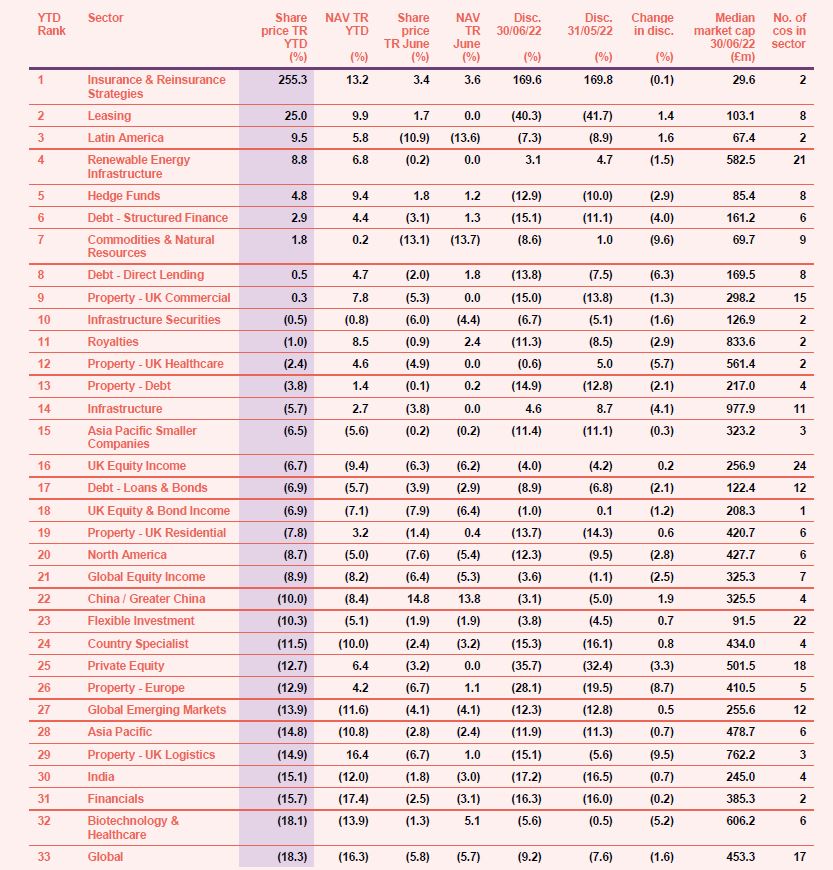

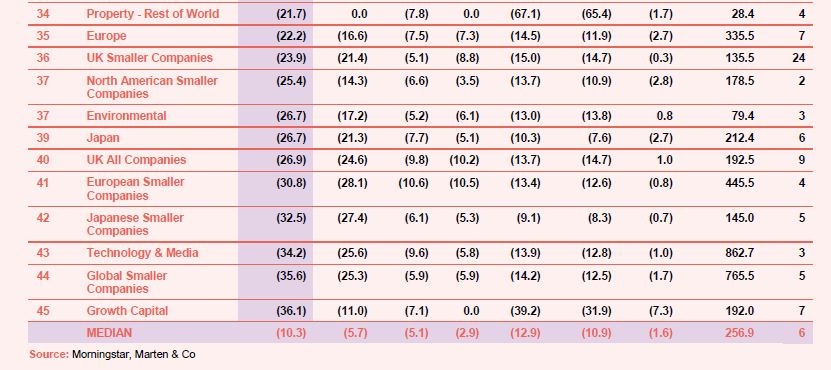

Economies around the world are still very much engulfed in rising inflation fears, supply chain woes and the ongoing conflict in Ukraine but fortunes appear to have hit a turning point halfway through the year for certain sectors. China/Greater China was the best performing sector in June after months of misery, with a strong pickup in services and construction as COVID-19 outbreaks and restrictions eased. Meanwhile, the aircraft part of the leasing sector has benefited from a surge in travel as consumers feel safe enough to fly again. The insurance & reinsurance strategies, hedge funds and property – debt sectors were also among the top performers in June. On the other hand, the commodities & natural resources sector – which has dominated performance tables almost every month so far this year – was the worst performer in June on fears of recession, with almost all its constituents among the worst performing funds (see overleaf). Unsurprisingly, Latin America followed suit due to its high correlation with commodities. European smaller companies were hit after more grim statistics of inflation on the continent reaching a record high of 8.6% in June, cementing the ECB’s commitment to a rate rise in July. Technology & media funds continued to suffer though some commentators expect this to turnaround in the second half of the year (see Appendix 1 for a breakdown of how all the sectors have performed so far this year).

June’s median total share price return was -5.1% (the average was -4.2%) which compares with a median of -2.3% in May. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over June

Worst performing sectors over June

On the positive side

The best and worst performing trust tables in June showed much clearer sector-specific trends than in recent months with China and biotechnology & healthcare as obvious winners and commodities & natural resources and UK smaller companies on the other side. Every Chinese trust (Baillie Gifford China Growth, Fidelity China Special Situations, abrdn China and JPMorgan China Growth & Income) enjoyed both NAV and share price increases as the country’s restrictions to contain COVID outbreaks gradually eased over June. June’s survey of Chinese purchasing managers showed some 19 of 21 service sectors returned to expansion last month, up from just six in the previous month while demand for services warmed up as the impact of the outbreak waned and company sentiment improved. Similarly biotechnology & healthcare names International Biotechnology, Biotech Growth and Worldwide Healthcare saw a complete reversal in their fortunes after what many suggested was a biotech bear market. The top performer in NAV terms however was Urban Logistics REIT which released exceptional results during the month detailing a ‘transformational year’ which saw it double in size. The top performer in share price terms was JZ Capital Partners which recently benefited from the sale of a holding in the JZHL Secondary Fund, in which it has an interest.

On the negative side

On the negative side, as already mentioned, commodities & natural resources funds had a torrid month. Golden Prospect Precious Metals, BlackRock World Mining, CQS Natural Resources Growth & Income, BlackRock Energy & Resources Income and Geiger Counter were all down in NAV terms and the majority also down in share price terms. Oil prices have been volatile in recent weeks as recession worries have grown. The laggards were joined by BlackRock Latin American for similar reasons. The threat of recession facing the UK may be more severe than most. UK Smaller Companies names JPMorgan UK Smaller Companies, BlackRock Smaller Companies and abrdn UK Smaller Companies Growth were also among the worst performers for the month. The biggest loser in share terms was Seraphim Space which has suffered for some time now due to a lack of investor appetite for growth stocks, which is also reflected in the fall in Chrysalis’s share price.

Discounts and premiums

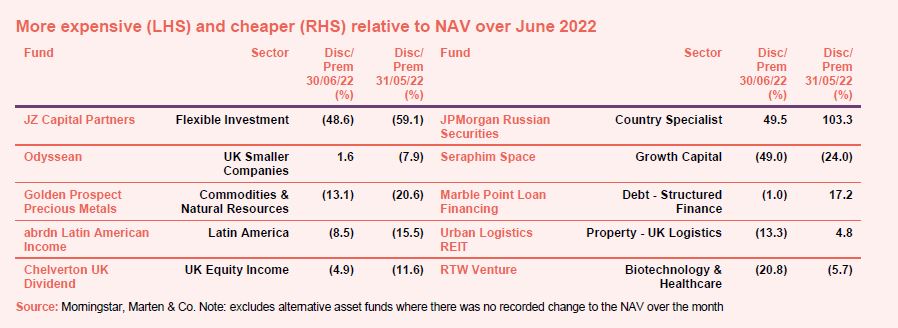

More expensive and cheaper relative to NAV

After seeing its 71% discount narrow to 55% in May, JZ Capital Partners saw a further narrowing to 48% in June after it announced it was set to benefit from the sale of a portfolio holding from the JZHL Secondary Fund, in which it has an interest. Odyssean also became more expensive with its 8% discount swinging to a 1.6% premium. Golden Prospect Precious Metals saw its 20% discount narrow slightly in June which also saw all resolutions passed at its AGM.

Having increased to ludicrous levels at the start of the year, JPMorgan Russian Securities’ premium fell sharply in April and May and continued into June, finally swinging from three digits though to a still bizarre 50%. Seraphim Space also stayed in the ‘getting cheaper’ list with its 24% discount widening to 50%. Meanwhile Urban Logistics REIT moved to a discount in June while RTW Venture saw its 6% discount almost quadruple to 21%.

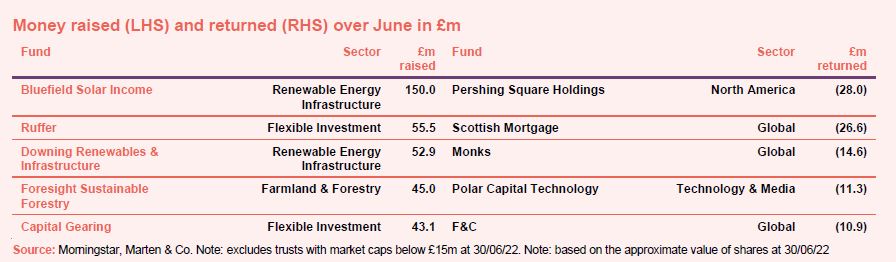

Money in and out

Money coming in and going out

Only £230m of net new money was raised in June, led by a £150m fundraise from Bluefield Solar Income. Proceeds will be used to pay down the trust’s revolving credit facility. Ruffer and Downing Renewables & Infrastructure raised just over £50m each, with the latter also planning to use net proceeds to repay amounts drawn down under its RCF and to pursue the manager’s pipeline of investment opportunities. Towards the end of the month, Foresight Sustainable Forestry raised £45m after only launching in November last year. The chair said this represented ‘a significant milestone for the fund’.

Share buybacks were led by Pershing Square, Scottish Mortgage, Polar Capital Technology and F&C.

Major news stories over June

Portfolio developments

- Odyssean outperforms during tough year while board highlights a ‘missed opportunity’ following failed merger talks

- Edinburgh Worldwide portfolio in ‘the eye of the storm’ says board

- HgCapital boosts holding in The Access Group

- Personal Assets plans 100 for one share split

- Reorganised JPMorgan European off to good start

- 3i Infrastructure to increase stake in equipment maker TCR

- Montanaro UK Smaller Companies suffers from volatility

- Templeton Emerging Markets takes double beating from pressure on tech and Russian conflict

- Syncona well-placed to back its portfolio through adverse market

- An outstanding year for JLEN Environmental Assets

- Schroder British Opportunities takes stake in Pirum

- Momentum Multi-Asset Value falling behind benchmark

- Rockwood Strategic well ahead of benchmark in turbulent year

- Montanaro European Smaller Companies’ “unremarkable results disguise significant volatility”

- Triple Point Energy Efficiency Infrastructure to focus on energy transition

- Digital 9 buying Arqiva stake

- Taylor Maritime sells one vessel and cancels sale of another

- Baillie Gifford UK Growth – patience will be rewarded

Corporate news

- Bluefield Solar Income raises £150m following strong demand

- Chrysalis establishes new independent valuation committee

- Downing Renewables launches £50m fundraise

- VH Global looking for £150m…and raises £122m

- Foresight Sustainable Forestry ready to grow…and raises £45m

- Shaftesbury and Capital & Counties merger agreed

- Trian shareholders call for EGM to replace three directors for not meeting ‘required standards of corporate governance’

- Impact Healthcare REIT announces capital raise

- Asset Value Investors raises concerns over Fujitec board’s actions

- Africa Opportunity announces mandatory redemption of shares

- DP Aircraft 1 to go ahead with $750,000 fundraising plan

- Chrysalis conserving cash to fund existing portfolio

Managers and fees

- Jupiter lined up for Rights and Issues as manager retires

- Greencoat UK Wind renews investment management agreement with new fee structure

Property news

- Schroder REIT reports sharp rise in NAV

- NewRiver REIT returns to capital value growth

- LXI REIT reports 18.2% NAV total return in annual results

- Flexible office space need back to pre-COVID levels – Workspace

- Valuation gains help Industrials REIT post 25% NAV total return

- Sirius Real Estate posts good results for year it entered UK

- Palace Capital posts double-digit uplift in NAV

- AEW UK REIT posts 29.7% total return

- Urban Logistics REIT doubles in size in transformational year

QuotedData views

- Fishing for an Asian fund?, China or Vietnam? – 10 June

- Riding out stagflation – 17 June

- Discounted opportunity – Not all private equity is exuberant growth plays – 24 June

Recently published research notes

It has been another tough six months for abrdn New Dawn (ABD) as the Asia Pacific region has had to face new challenges from the Russo-Ukrainian conflict to China’s deadliest COVID-19 wave yet (the economic impacts of which have been made worse by Xi Jinping’s zero-COVID policy). This has only exacerbated headwinds already in place such as rising inflation. Manager James Thom believes the worst is behind us, but uncertainty and volatility remain. The trust itself has underperformed in the short-term but still boasts strong long-term numbers and, if a new dawn is indeed rising over the region, with India finally enjoying its reformation and the vaccine rollout (mostly) underway, now could be an attractive entry point. The trust is also trading on a 12.4% discount.

Montanaro UK Smaller Companies

Shares in the good-quality growing businesses favoured by Montanaro UK Smaller Companies (MTU) have experienced a sharp selloff since the beginning of 2022, when interest rates began to rise in response to rampant inflation. Manager Charles Montanaro is focused on picking stocks for the long term rather than trying to second-guess macroeconomic trends. He and his extensive team have a strong dialogue with the management of these companies. He observes that high-quality, well-managed small businesses with strong market positions and pricing power have been able to pass on additional costs and are better able to cope with supply chain disruptions. Charles believes that following the selloff, valuations are now the most attractive that they have been in many years. This could be a great opportunity for long-term investors.

African property company Grit Real Estate Income Group (Grit) has cleared a path for increased dividend distributions and net asset value (NAV) growth following a decisive piece of corporate action in the form of a heavily NAV dilutive capital raise. It has used the proceeds to bring its loan to value (LTV – borrowings plus cash as a percentage of portfolio valuation) under control and to expand its core business with the acquisition of a developer and asset manager.

The developer – Gateway Real Estate Africa (GREA) – has an attractive pipeline of NAV accretive development projects, most notably diplomatic residences across the continent let to the US government and data centres (see page 5 for an in-depth look at the development pipeline). Meanwhile, within its current portfolio, its hospitality assets are rebounding with the return of international travel, and retail valuations seem to have bottomed out – suggesting valuation growth in these sectors. Grit also has plans to ramp up exposure to the industrial sector, which is chronically undersupplied across Africa.

A sharp selloff in the share prices of the types of high-quality, growing companies favoured by JPMorgan Japanese Investment Trust (JFJ) has meant that the trust has given back much of its recent outperformance. The selloff mimics those of other countries such as the US and UK, but Japan is not afflicted by the high inflation or the threat of rising interest rates that triggered the stock market falls in other countries.

JFJ’s managers are seeing opportunities to buy stocks that they favour on attractive valuations. They are also encouraged by the increasingly shareholder-friendly environment in the country; share buy backs and dividends are at record levels.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Shires Income AGM, 6 July

- JPMorgan Multi Asset Growth & Income AGM 2022, 8 July

- Downing Strategic Micro-Cap AGM 2022, 11 July

- ShareSoc & Yellowstone Webinar with Halma plc, 12 July

- Templeton Emerging Markets AGM 2022, 14 July

- Vietnam Enterprise AGM 2022, 14 July

- JPMorgan European Discovery AGM 2022, 18 July

- Biotech Growth AGM 2022, 19 July

- Woodford – The Cavalry is Coming, 19 July

- BMO UK High Income AGM 2022, 20 July

- Fidelity China Special Situations AGM 2022, 20 July

- Montanaro UK Smaller Companies AGM 2022, 27 July

- JPMorgan Japan Small Cap Growth and Income AGM 2022, 27 July

- The Global Smaller Companies Trust AGM 2022, 28 July

- JPMorgan Global Core Real Assets AGM 2022, 5 August

- JLEN Environmental Assets AGM 2022, 1 September

- Monks AGM 2022, 6 September

- Lindsell Train AGM 2022, 8 September

- Augmentum Fintech AGM 2022, 14 September

- Odyssean Investment Trust AGM 2022, 21 September

- Aberdeen New India AGM 2022, 28 September

- QuotedData’s Property Conference 2022, 19 October

- The London Investor Show 2022, 28 October

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – June 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.