Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

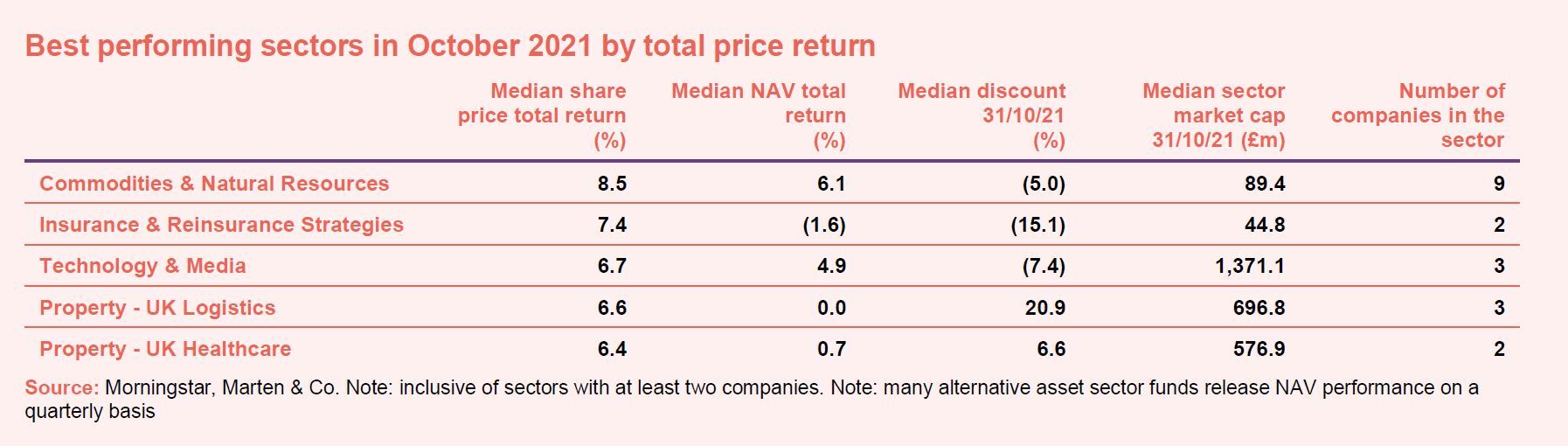

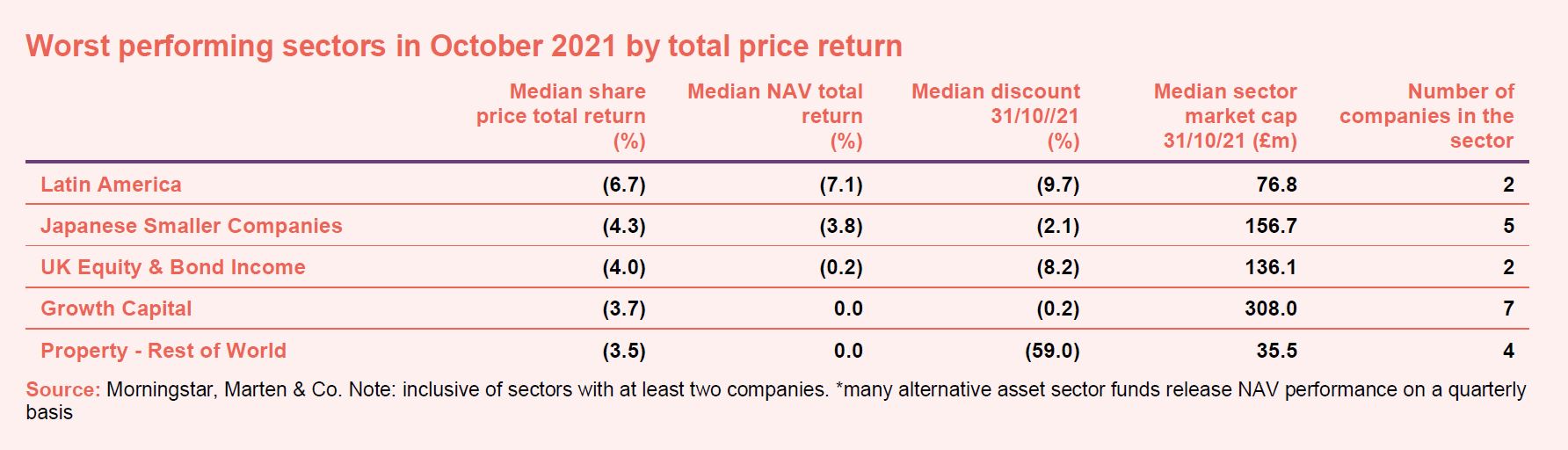

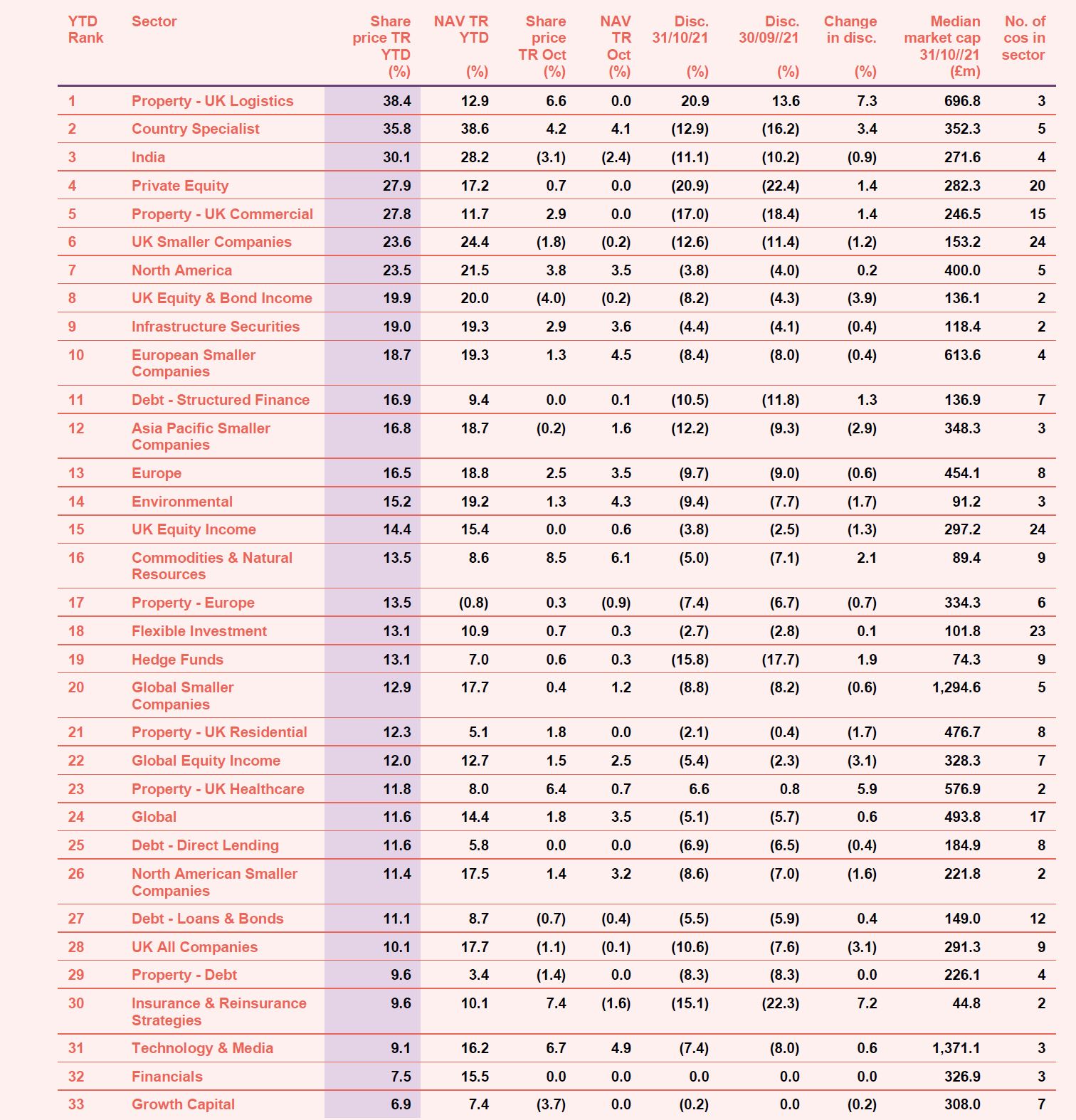

October saw somewhat of a turnaround for a number of sectors with Japan funds back among the worst performers after a brief uptick during the previous month, and the commodities & natural resources sector back at the top of the best performers list as they were at the start of the year and after a good four-month run of underperformance. This comes as energy prices have soared over Q3, which have in turn elevated inflationary pressures and started to shift economic growth to energy-exporting countries rather than energy-importing ones. This also explains the continued underperformance of the Latin America sector. Meanwhile, the insurance & reinsurance strategies sector is still reaping the rewards from CATCo Reinsurance Opportunities’ buy out plans which we discuss in more detail later, while the property – UK healthcare sector was given a boost by valuation growth seen within Target Healthcare REIT and Impact Healthcare REIT. The UK Equity & Bond Income sector was perhaps unfairly among the worst performers in October as it is home to only two members, one being Acorn Income which is in the process of winding up (see Appendix 1 for a breakdown of how all the sectors have performed this year).

October’s median total share price return was 0.7% (the average was 0%) which compares with a median of -0.9% in September. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over October

Worst performing sectors over October

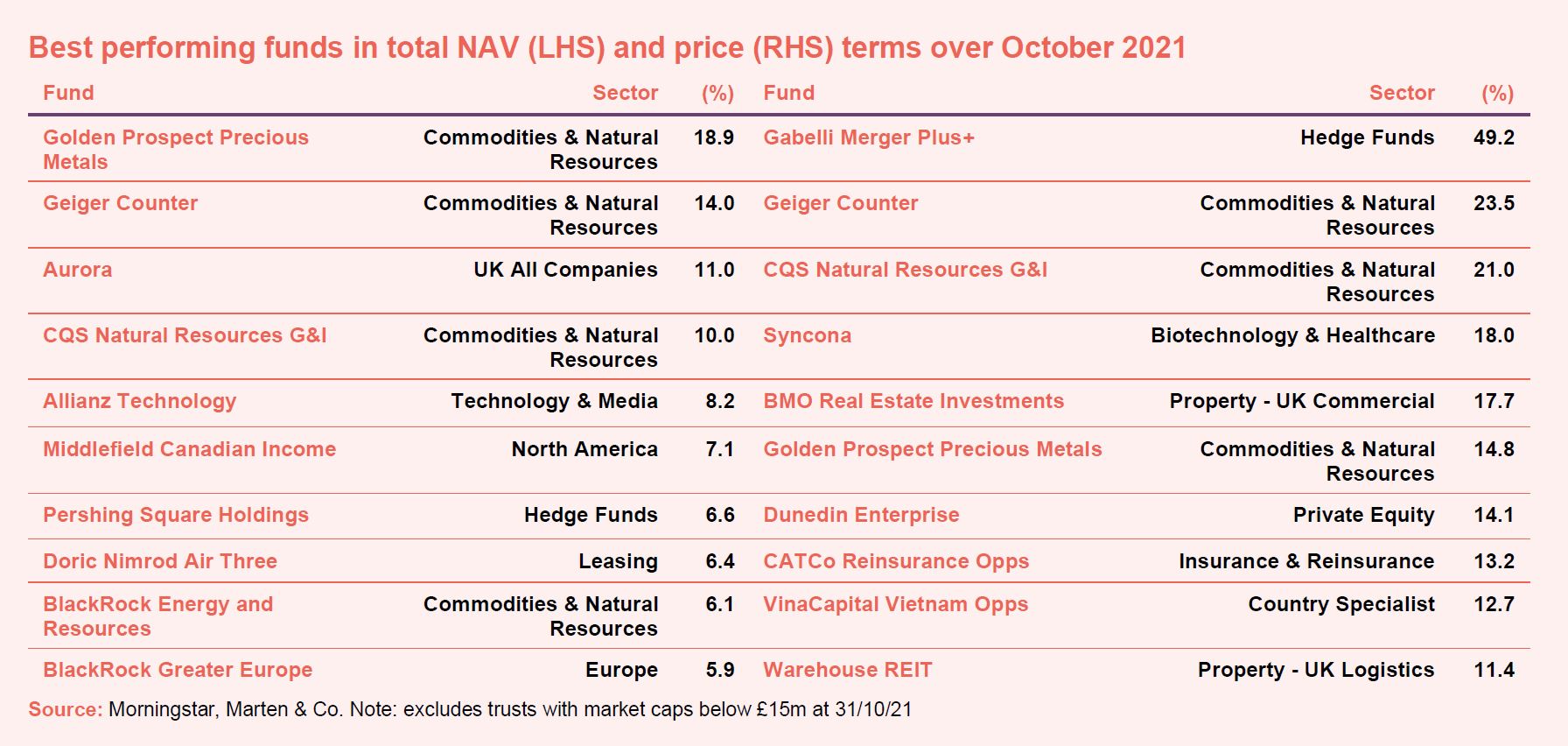

On the positive side

Commodities & natural resources trusts were the clear winners in October with Golden Prospect Precious Metals, Geiger Counter, CQS Natural Resources Growth & Income and BlackRock Energy and Resources topping the tables both in NAV and share price terms. Geiger has enjoyed its position for a while now as the uranium mining space has had an incredible year with a flurry of events that have highlighted the long-term importance of nuclear power in a decarbonising world, as well as the unsustainable demand-supply balance for a uranium market that is already in supply deficit. After being one of the worst performing funds for some time, Syncona saw a change in its fate in October. It has recently backed a number of launches as the lead investor in funding rounds including Clade Therapeutics. BMO Real Estate Investments and Warehouse REIT were both up in share price terms. The former has been a beneficiary of the booming industrial and logistics sector while the latter continues to gain from demand-side pressures.

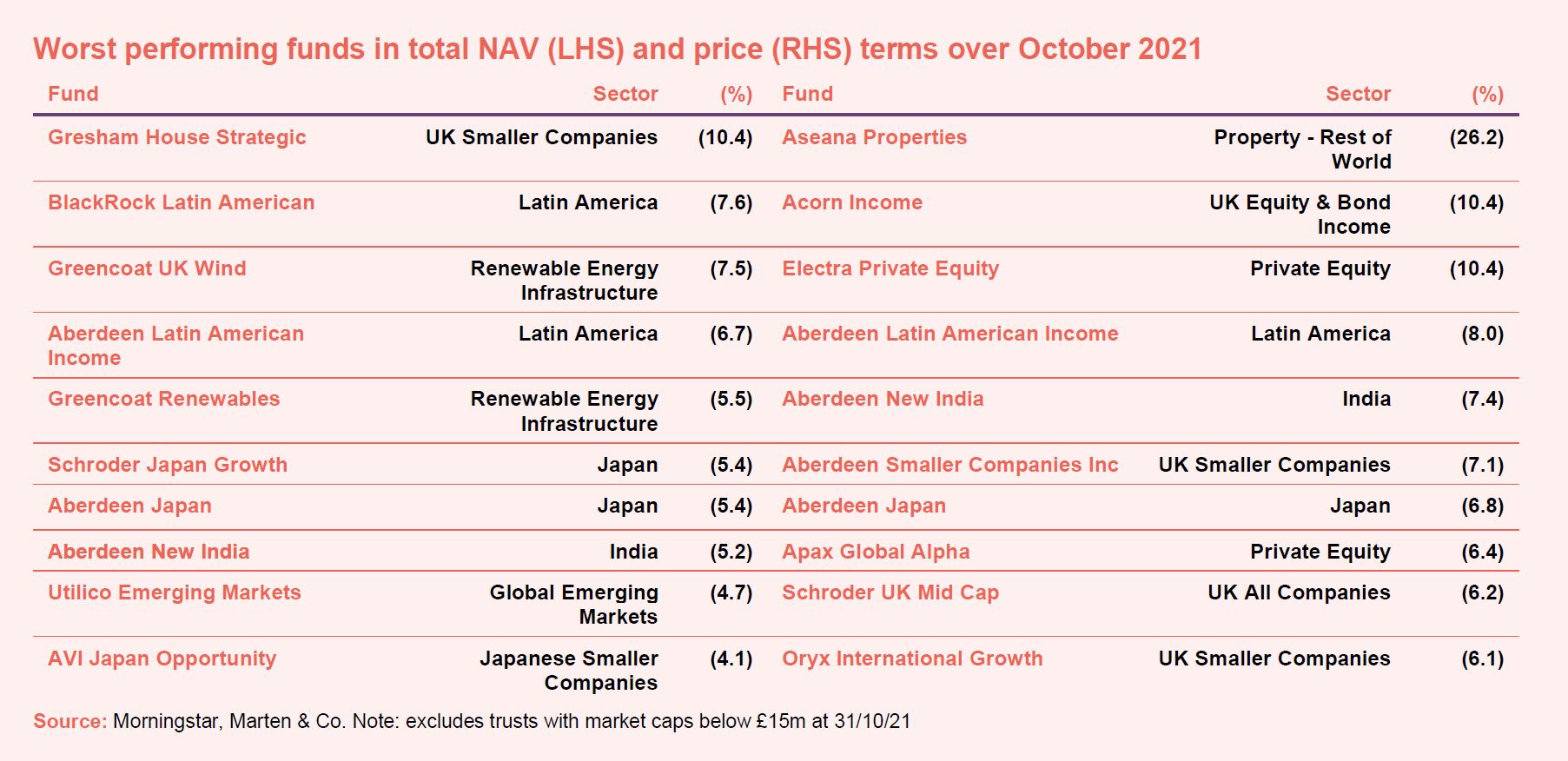

On the negative side

On the negative side, Gresham House Strategic was rocked by the fall out between its board and manager following the culmination of its strategic review and the sacking of Gresham House. Meanwhile, Japan’s September comeback was short-lived as the change in prime minister at the start of October resulted in a sell-off. Schroder Japan Growth, Aberdeen Japan and AVI Japan Opportunity were the worst-hit. As already mentioned, Latin American funds BlackRock Latin American and Aberdeen Latin American Income continue to suffer as the markets in which they invest have likely been impacted by slowing demand in China. Acorn Income is now in the throes of winding up after its shareholders approved the plan to liquidate the fund and the rollover option into an open-ended fund managed by Unicorn.

Discounts and premiums

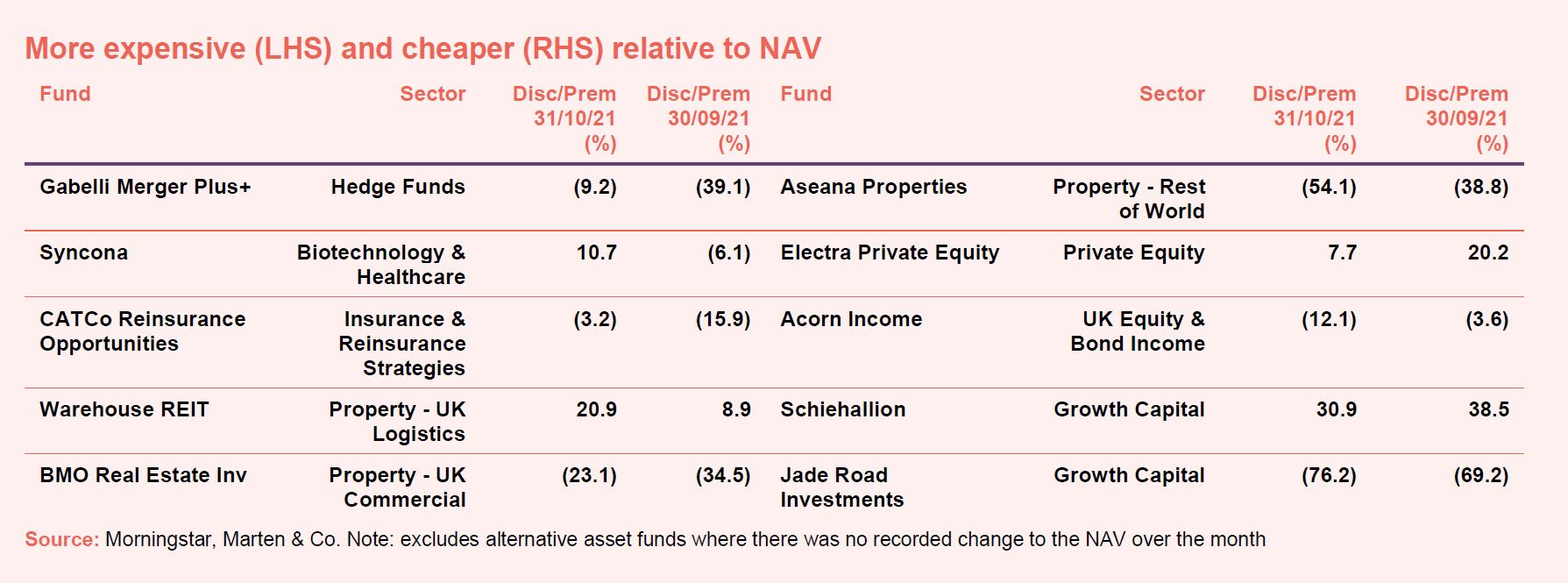

More expensive and cheaper relative to NAV

Gabelli Merger Plus+ became more expensive over October, with its 39.1% discount narrowing to just under double-digits at 9.2%, simply down to trading thinly. After seeing its discount widen over the previous two months, Syncona bounced back to a premium of 10.7% in October. CATCo Reinsurance Opportunities sweetened the terms of its offer to shareholders. Holders of ordinary shares will receive an accelerated return of approximately $0.30 per share (approximately $44.1m in total) while C shareholders will receive an accelerated return of approximately $0.46 per share (approximately $38.5m in total).

On the other hand, two of the funds that became cheaper in October are in the process of winding up. We have already discussed Acorn Income but it is joined by Electra Private Equity, which has since completed the demerger of its Hostmore business. Aseana Properties mulled demerger plans last year and has spent this year selling many of its holdings. The trust saw its already wide discount of 38.8% widen further to an eye-watering 54.1%.

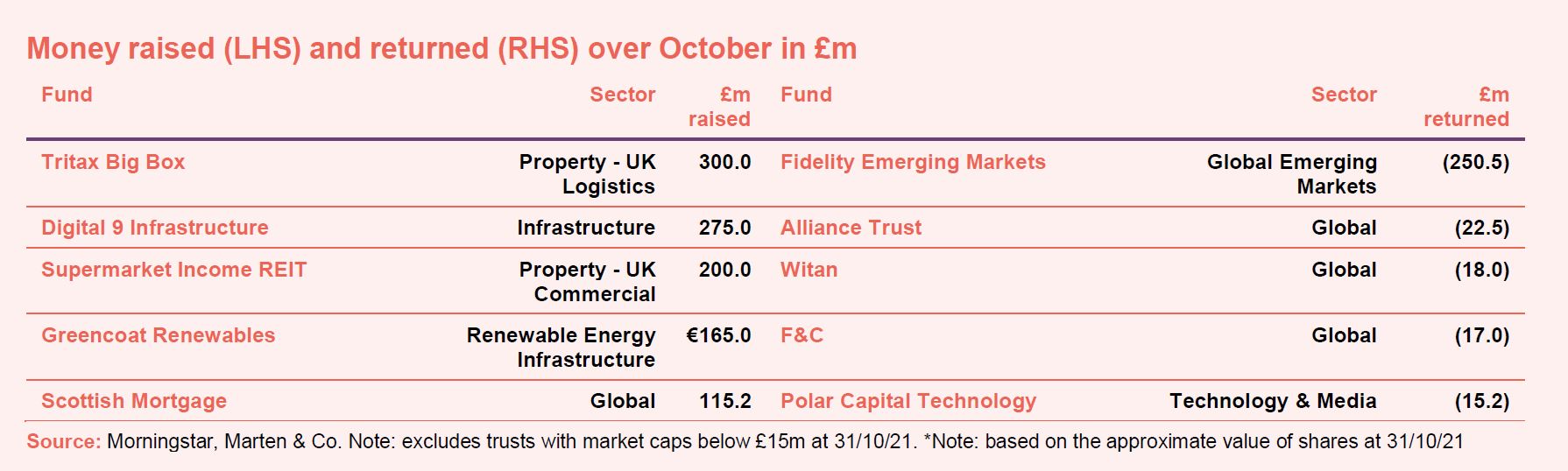

Money in and out

Money coming in and going out

£5.7bn of net new money was raised in October. Tritax Big Box raised £300m and Digital 9 Infrastructure raised £275m at the turn of the month. Supermarket Income REIT raised £200m following a significantly oversubscribed issue (the initial target was £100m) while Greencoat Renewables raised €165m in what was also an oversubscribed placing. Just outside of the list, uranium investor Yellowcake raised £109m.

In terms of new launches, Castlenau Group raised gross proceeds of £53.1m from its initial issue of shares, so together with the money raised, the market capitalisation at admission will be £177.6m.

Fidelity Emerging Markets saw a huge take-up of its tender offer of 25% in conjunction with the move of the manager from Genesis to Fidelity. 103,326,957 shares were validly tendered – that is 85% of all shares in issue. Given that there is always some inertia in share registers, that is a massive vote of no confidence in the trust.

Meanwhile, Alliance Trust, Witan, F&C and Polar Capital Technology also led share buybacks.

Recently published research notes

Ecofin Global Utilities and Infrastructure – Happy birthday to ya!

Ecofin Global Utilities and Infrastructure Trust (EGL) has just had its fifth birthday and has much to celebrate. As at end September 2021, since its launch, EGL had provided NAV and share price total returns of 71.3% and 120.2% respectively, in just over five years. The icing on the cake is the trust’s outperformance of global utilities over 2021 to date, during what has been a very challenging period. Reflecting the strength of its NAV performance, EGL has benefitted from a sustained narrowing of the discount over the last three years.

Weiss Korea Opportunity – On the front foot

Weiss Korea Opportunities (WKOF)’s share price and net asset value (NAV) returns continue to be well-ahead of those of comparable indices. From its launch in May 2013 to the end of September 2021, shareholders saw returns of almost 190%, more than double those of the MSCI Korea 25/50 Index (the trust’s chosen performance benchmark). Nevertheless, the board and the manager feel that the discount opportunity that WKOF was designed to exploit remains highly attractive.

Geiger Counter Limited – Explosive performance

The uranium mining space has had an incredible year with a flurry of events that have highlighted the long-term importance of nuclear power in a decarbonising world, as well as the unsustainable demand-supply balance for a uranium market that is already in supply deficit. Geiger Counter (GCL), with its small cap focus, has handsomely beaten its closest peers and captured the explosive performance of the sector during the last six months. The managers do not expect any new greenfield supply entering the market within the next few years and comment that GCL with its small cap bias, will continue to benefit disproportionately.

Standard Life Investments Property Income – Post-COVID ready

Standard Life Investments Property Income Trust’s (SLI’s) manager has tweaked its investment criteria, putting a greater emphasis on holding assets with strong environmental, social and governance (ESG) credentials (see page 10). These follow structural trends that have emerged during the COVID-19 pandemic. In the pursuit of durable income with growth potential, investments in higher-yielding, secondary assets have made way for newer, quality assets that the manager believes will meet future occupier and investor demand in a post-COVID world.

JPMorgan Multi-Asset Growth & Income – New policy bearing fruit

There are many investors looking for high and growing income and a modest level of capital growth. JPMorgan Multi-Asset Growth & Income (MATE), with a portfolio diversified across a range of different asset classes, was designed with this in mind. MATE’s manager can focus on the overall total return, including income, without having the restriction of needing to target investments that provide a particular income level, which means that it is no longer be fighting with one hand tied behind its back. Equally importantly, MATE was able to commit to growing its dividend at least in-line with inflation (as measured by UK CPI).

Major news stories over October

Portfolio developments

- Vietnam Holding approached 15 years with robust performance

- Bluefield Solar pushed ahead with a subsidy-free development

- Civitas published a rebuttal to its short-seller allegations

- JPMorgan UK Smaller Companies dipped into revenue reserves despite exceptional performance

- Fidelity Asian Values posted strong results in its 25th year

- Baillie Gifford Japan celebrated its 40th birthday in style

- Dramatic recovery for TR European Growth

- HydrogenOne backed Sunfire

- BBGI bought a stake in a Canadian hospital

- Ecofin US Renewables Infrastructure announced plans to acquire Whirlwind

- CQS Natural Resources Growth & Income shot the lights out with a turnaround year

Corporate news

- Greencoat Renewables revealed expansion plans

- Henderson Eurotrust announced plans to split its shares

- Downing Renewables launched its PrimaryBid offer

- Harmony Energy Income planned to float

- Pantheon Infrastructure targeted a £300m IPO

- Castlenau’s launch went to plan

- Artemis Alpha proposed cancelling its 2021 tender offer

- Alinda Capital Infrastructure Investments intended to float

- A huge take-up for Fidelity Emerging’s tender spelt trouble

- EP Global Opportunities responded to shareholder unrest

- …before announcing plans to become a self-managed trust

- JPMorgan European completed its company review

- Asia Dragon planned conditional tender offers

- Nippon Active Value proposed a capital raise

- Third Point Investors responded to AVI’s EGM request

- Atrato Onsite Energy eyed a £150m IPO

Managers and fees

- JPEL Private Equity revealed its manager would receive a $1.7m performance fee

- Gresham House Strategic sacked Gresham House following its strategic review

- Scottish Investment Trust was to be taken over by JPMorgan Global Growth and Income

Property news

- Schroders and SEGRO swapped property

- PRS REIT reported strong progress

- Grainger acquired a London residential scheme for £141m

- Capital & Regional restructured its debt

- Home REIT added 366 properties to its portfolio

- Life Sciences REIT looked to raise £300m in a new IPO

- Target Healthcare REIT delivered an 8.8% NAV total return

- Urban Logistics REIT splashed £15m on two more assets

- Tritax EuroBox bought in Germany

- Urban Logistics REIT planned a main market move

QuotedData views

- Energy crisis, opportunity in uncertainty – 1 October

- Time to back retail recovery? – 1 October

- IPO hits the buffers – 8 October

- 7% yield opportunity, but read the small print – 8 October

- And now a look at what’s coming up – 15 October

- Rental market revs up – 15 October

- Busy boards – 22 October

- LABS launch should get lift-off – 22 October

- Budget Baloney – 29 October

- Wake up and smell the COP26 – 29 October

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Schroder BSC Social Impact manager presentation, 9 November

- European Opportunities AGM 2021, 10 November

- QuotedData’s Annual ESG Webinar 2021, 16-18 November

- Henderson EuroTrust AGM 2021, 17 November

- Master Investor – Investing in the Age of Longevity, 17 November

- Crystal Amber AGM 2021, 22 November

- JPMorgan UK Smaller Companies AGM 2021, 23 November

- Supermarket Income REIT AGM 2021, 24 November

- Brown Advisory US Smaller Companies AGM 2021, 29 November

- TR European Growth AGM 2021, 29 November

- Schroder British Opportunities AGM, 30 November

- CQS New City High Yield AGM, 2 December

- VinaCapital Vietnam Opportunity AGM 2021, 2 December

- Fidelity Asian Values AGM 2021, 3 December

- Schroder BSC Social Impact AGM 2021, 3 December

- Henderson International Income AGM 2021, 7 December

- Schroder Japan Growth AGM 2021, 7 December

- Scottish Oriental Smaller Companies AGM 2021, 7 December

- Fidelity Emerging Markets AGM 2021, 8 December

- Alternative Liquidity Fund AGM 2021, 8 December

- Ashoka India Equity AGM 2021, 8 December

- International Biotechnology AGM 2021, 8 December

- CQS Natural Resources Growth & Income AGM 2021, 14 December

- Asia Dragon AGM 2021, 15 December

- Baillie Gifford Japan AGM 2021, 16 December

- Henderson Far East Income AGM 2021, 20 December

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

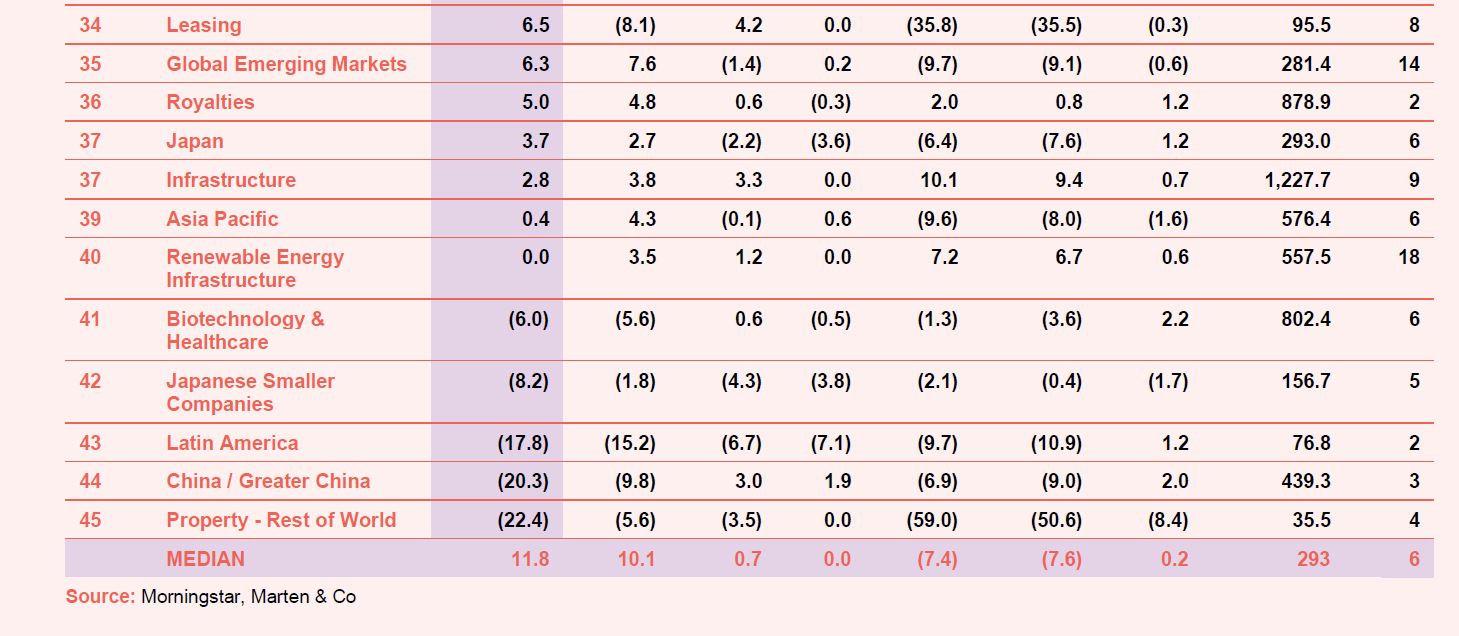

Appendix – October median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.