Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

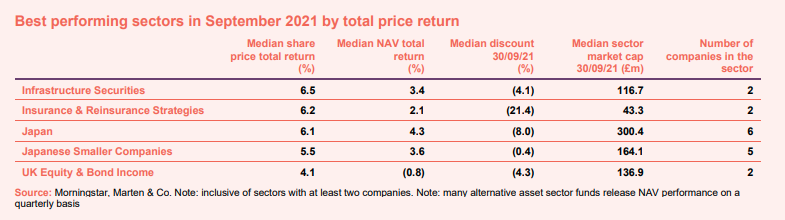

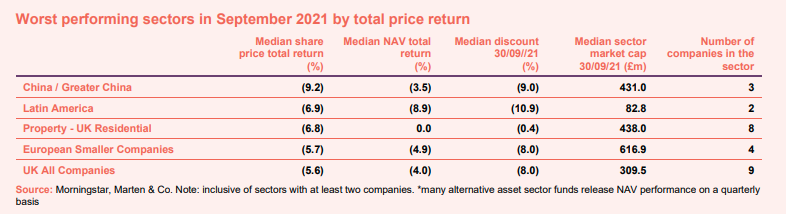

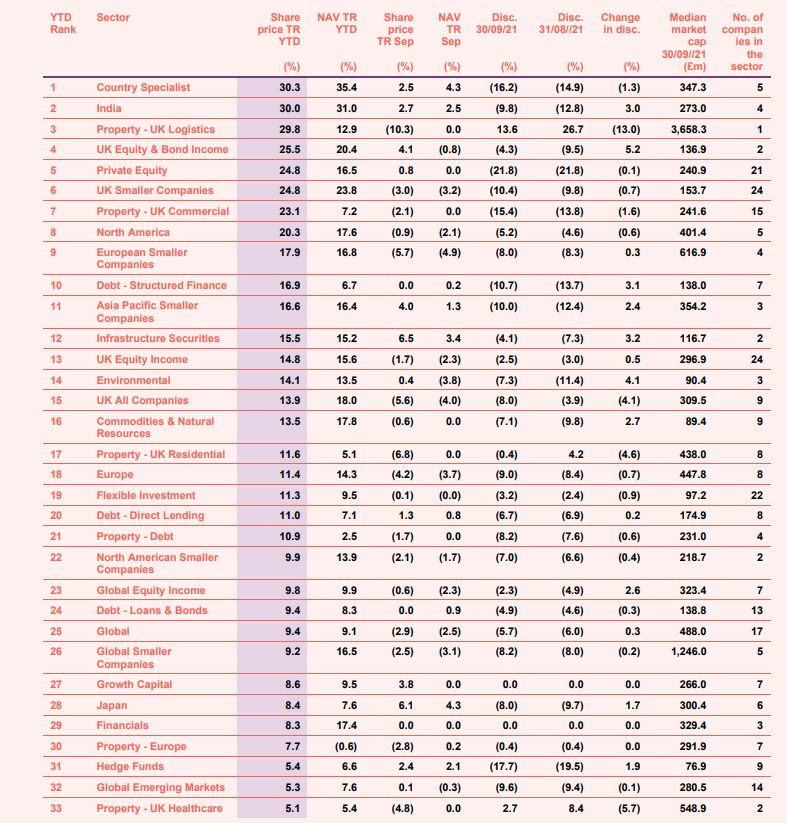

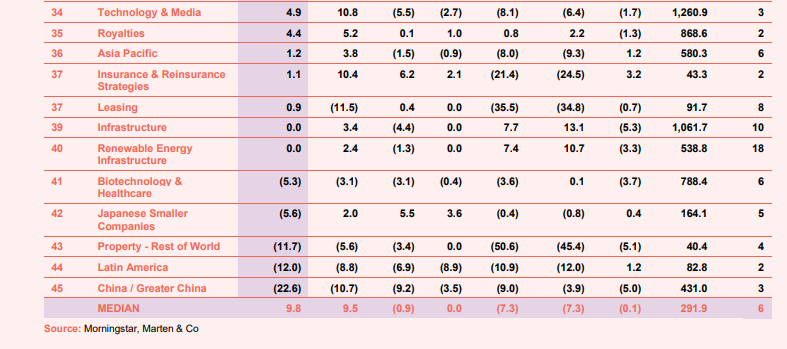

The pandemic recovery continued in September with certain countries catching up on their vaccination programmes, such as Japan, which after a few rough months made gains and took two of the top spots for the best performing sectors. Meanwhile, the UK Equity & Bond Income sector, which only has two members, soared on the back of the news that Acorn Income is to undergo a ‘scheme of reconstruction’ which involves winding up, with assets rolling into the open-ended Unicorn UK Income fund. Meanwhile, Infrastructure Securities took the top spot from Premier Miton Global Renewables performing well likely from rising energy prices, with gains amplified by being around 40% geared by its split capital structure. Insurance and Reinsurance Strategies also benefited from CatCo Reinsurance’s plans to hand back money to ordinary shareholders and C shareholders. China’s rebound lost momentum in September and was the worst performing sector following lacklustre sales, a weaker stock market and worsening business confidence. As the state takes greater control of key sectors, questions are being raised over the country’s regulatory environment. European Smaller Companies and UK All Companies also fell as both regions are suffering from rising energy costs and the impact of Brexit (see Appendix 1 for a breakdown of how all the sectors have performed this year).

September’s median total share price return was -0.9% (the average was 1%) which compares with a median of 2.5% in August. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over September

Worst performing sectors over September

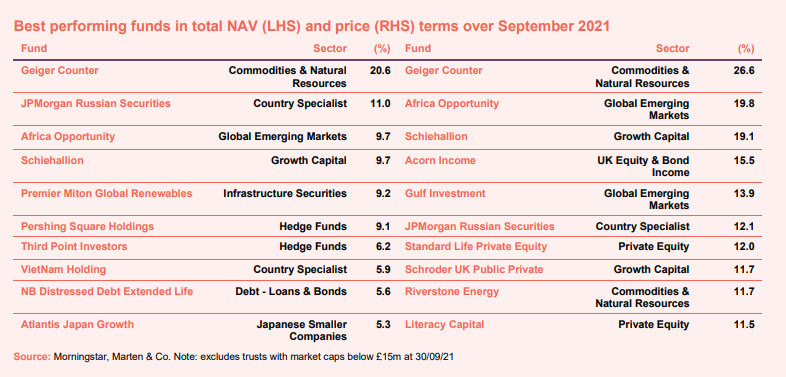

On the positive side

September saw a whole range of trusts from different sectors performing well, which points to more focused individual events rather than the usual broader market events impacting performance. Geiger Counter was the best performing trust in both NAV and share price terms in September. The Uranium mining sector continues to shoot the lights out and the trust’s small-cap focus also helped. Strong gas prices benefitted JPMorgan Russian. As mentioned earlier, Premier Miton Global Renewables’ NAV performed well from being heavily invested in renewables during the current energy crisis and from being heavily geared. Growth Capital and Private Equity funds including Schiehallion, Standard Life Private Equity, Schroder UK Public Private and Literacy Capital also performed well in both NAV and share price terms. The private equity industry has substantial liquidity to deploy which has led to high levels of investment and takeover activity.

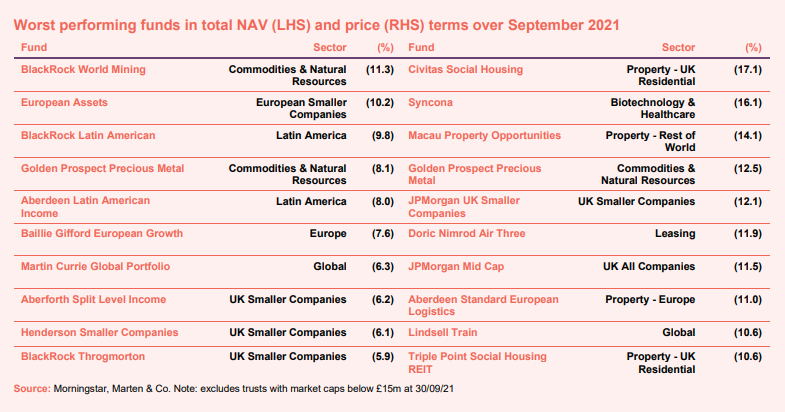

On the negative side

Commodities & Natural Resources trusts including BlackRock World Mining and Golden Prospect Precious Metals were among the worst performers once again in September, likely on fears of slowing Chinese demand, and were joined by BlackRock Latin American and Aberdeen Latin American Income, whose markets are heavily reliant on basic materials such as commodities and natural resources. European and UK funds also featured heavily in the worst performing trusts in NAV terms, as the regions have suffered from the impact of Brexit. In share price terms, Civitas Social Housing was the worst performer after being targeted by ShadowFall, a short seller, who made a variety of accusations (after it shorted the stock) which the company intends to address.

Discounts and premiums

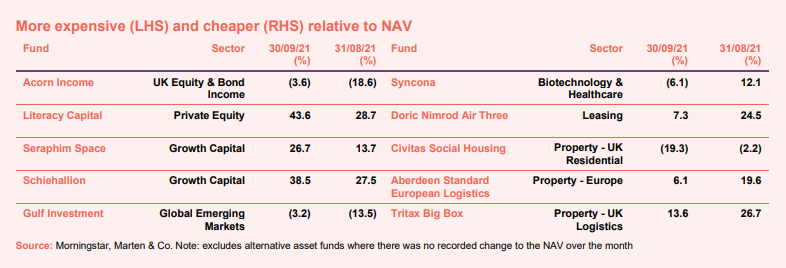

More expensive and cheaper relative to NAV

As highlighted earlier, Acorn Income performed well following the announcement of its ‘scheme of reconstruction’ which will see shareholders’ money either returned or rolled into the open-ended Unicorn UK Income fund (which is managed by Simon Moon and Fraser Mackerise, who currently manage the trust’s smaller companies portfolio) and the trust officially wind up. The news helped narrow its double-digit discount to just 3.6% in September. Meanwhile, Literacy Capital saw its premium shoot up last month in anticipation of a higher NAV as one of its holdings, Hometree, completed a funding round with a new lead investor to raise further equity to support the continued growth of the business. Seraphim Space completed its purchase of Spire Global, one of the leading pioneers of the nanosatellite market while Schiehallion published strong interim results.

On the other hand, Syncona became cheaper in September. Investors may have become disillusioned as its NAV slides on weak prices for its listed portfolio. Civitas Social Housing came under attack from ShadowFall, as already mentioned, but also suffered as it fell out of the 250 Index. Aberdeen Standard European Logistics and Tritax Big Box both launched fundraising issues at discounts to prevailing market prices but premiums to NAV.

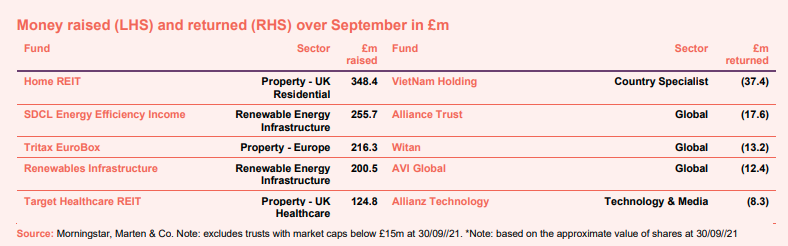

Money in and out

Money coming in and going out

After a quiet August, fundraising soared again in September, with £2.8bn of net new money raised, with much of it going into Property and Renewable Energy Infrastructure trusts. Home REIT raised £350m in a hugely oversubscribed issue, far exceeding its original target of £262m. The money will be used to provide accommodation for homeless people in the UK. Tritax EuroBox decided to increase the size of its placing to £213m after demand flew past its £170m target. Target Healthcare REIT also raised £125m, having initially targeted £100m. It will invest in more care homes.

Meanwhile SDCL Energy Efficiency Income also enjoyed an oversubscribed issue, raising £250m against a target of £175m, while Renewables Infrastructure raised gross proceeds of £200m to repay debt it had run up, in part as it made its first investments in Spain, buying four solar plants.

Share buybacks were led by VietNam Holding (by way of a tender offer for 30% of the company), Alliance Trust, Witan, AVI Global and Allianz Technology.

Recently published research notes

Strategic Equity Capital – Headed in the right direction

At the end of September 2020, Ken Wotton became the lead manager of Strategic Equity Capital (SEC) and, during the ten months since, SEC has provided NAV and share price returns that are significantly ahead of the MSCI UK Smaller Companies and even the broader MSCI UK Index. Despite this, and a comprehensive plan to reduce the discount, which now includes potential tender offers in both 2022 and 2024 (subject to certain triggers), the discount to net asset value has reduced but is still material.

We do not think that this will persist and, with the decision to shift the focus of SEC’s portfolio towards smaller companies now bearing fruit, combined with a UK market that is becoming increasingly investable for overseas institutions and attracting the interests of private equity buyers, now could prove to be a very good entry point.

Standard Life Private Equity Trust – Proving its mettle

We held the view throughout 2020 that private equity funds like Standard Life Private Equity (SLPE) were being unfairly penalised by the market with wide discounts to net asset value (NAV). This was especially true once it became clearer, from the middle of 2020 onwards, that distributions were likely to be good, and relatively few underlying companies required liquidity support.

Since November, European-listed private equity has been outperforming broader global listed equities. However, until recently, this had limited impact on the discounts of funds such as SLPE, whose discount is broadly in line with the wider peer group average of 12.8%. We think this discount narrowing was justified and should continue. Over 40% of SLPE’s underlying exposure is to healthcare and technology, where rampant exit activity has been fuelling much-better-than-expected distributions. SLPE expects a busy rest of 2021, with the pipeline looking particularly good in primary investments in new funds and co-investments.

Aberdeen Standard European Logistics Income – Handbrake off in growth drive

Aberdeen Standard European Logistics Income’s (ASLI’s) manager has taken a prudent approach to growing the fund thus far, taking a little-and-often capital raise strategy to improve the quality of the portfolio. However, it now proposes a £75m placing to acquire assets from an identified investment pipeline worth €165m and take advantage of the structural tailwinds behind the logistics sector.

ASLI is poised to capture significant rental growth in the short and medium term. The European logistics market is characterised by growing demand for space – driven by a continued boom in online retailing – and historic low levels of supply of logistics property. The fund’s market-leading environmental, social and governance (ESG) credentials, with further initiatives to come, emphasise the quality nature of the portfolio and ensures that it is fit for the future.

BlackRock Throgmorton Trust – Confidence rewarded

In mid-December 2020, when we last published a note on BlackRock Throgmorton Trust (THRG), its manager Dan Whitestone said he was genuinely excited about the prospects for the stocks in its portfolio. That enthusiasm has been vindicated and the many investors that have embraced the trust over the past year have been well-rewarded.

Dan highlights the breadth of opportunity afforded by the stocks in THRG’s portfolio. His confidence in the outlook for these companies is undimmed and, reflecting this, THRG’s net market exposure is at the high end of its range.

Major news stories over September

Portfolio developments

- Downing Renewables & Infrastructure posted strong numbers for its first set of results

- Ecofin US Renewables Infrastructure revealed its pipeline

- Apax invested in T-Mobile

- Seraphim Space completed a nanosatellite deal

- VH Global backed new UK CHP plants

- Round Hill Music bought Dennis Elliott’s catalogue…

- …and another from Tim Palmer of Pearl Jam fame…

- ….and one more from the O’Jays

- Schroder UK Public Private got excited about Oxford Nanopore’s IPO plans

- CQS New City High Yield made a good recovery

- JPMorgan Mid Cap reported a bumper year of outperformance

- NextEnergy Solar announced a battery storage joint venture

- India Capital Growth posted strong results ahead of its redemption vote

- JPMorgan Emerging Markets achieved record outperformance

- Ashoka India did well from India’s resurgence

Corporate news

- Third Point Investors announced plans to borrow $150m as it declined a second EGM requisition

- Acorn Income revealed its ‘scheme of reconstruction’

- Digital 9 Infrastructure announced another equity raise

- Foresight Sustainable Forestry shared IPO plans

- Petershill Partners announced its intention to float

- Henderson Diversified Income shareholders approved its investment objective and policy changes

- SDCL Energy Efficiency raised £250m

- Gresham House Energy Storage agreed a five-year debt facility

- Gore Street Energy Storage planned a placing and retail offer

- Castelnau Group announced its IPO on the SFM

- Downing Renewables & Infrastructure announced a £25m placing

- Strategic Equity Capital focused on discount narrowing

Managers and fees

- Gresham House agreed terms to purchase VCT business Mobeus Equity Partners

- Genesis spoke out on the future of Genesis Emerging Markets as the board prepares for the EGM to change manager

- Schroder UK Public Private’s Ben Wicks stepped down

- City of London appointed David Smith as deputy manager

Property news

- LondonMetric bought a trio of urban warehouses

- SLI Property Income shared carbon offsetting plans

- Aberdeen Standard European Logistics raised £125m in an oversubscribed issue

- Tritax EuroBox announced a £170m equity raise

- Civitas Social Housing was targeted by a short-seller

- Supermarket Income REIT bought six stores for £113.1m

QuotedData views

- Ranking UK equity income trusts – 24 September

- HOME run and a strike-out? – 24 September

- Private equity – silly cheap – 17 September

- Harworth-y plan – 17 September

- Carbon kings – 10 September

- Tree time – 10 September

- Something in the water – 3 September

- Contrarian view worth backing? – 3 September

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Henderson Smaller Companies AGM, 1 October

- Genesis Emerging Markets EGM, 1 October

- Mello Trusts & Funds presentation, 5 October

- Miton Global Opportunities AGM, 6 October

- Bluefield Solar presentation, 7 October

- Schroder British Opportunities presentation, 8 October

- Acorn Income AGM/EGM, 12 October

- Murray Income presentation, 13 October

- Tufton Oceanic Assets AGM, 20 October

- Master Investor – Small Cap Chat, 21 October

- Standard Life UK Smaller Companies AGM, 21 October

- The Investment Company AGM, 27 October

- Aberforth Split Level Income AGM, 28 October

- Greencoat Renewables EGM, 28 October

- City of London AGM, 28 October

- ICUK – London Investor Show, 29 October

- Murray Income AGM, 2 November

- JPMorgan Mid Cap AGM, 2 November

- JPMorgan Emerging Markets AGM, 4 November

- Mid Wynd International AGM, 9 November

- European Opportunities AGM, 10 November

- QuotedData’s annual ESG webinar, 16-18 November

- Master Investor – Investing in the Age of Longevity, 17 November

- Schroder British Opportunities AGM, 30 November

- CQS New City High Yield AGM, 2 December

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – September median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.