Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

October 2022

Monthly | Investment companies

Winners and losers in September 2022

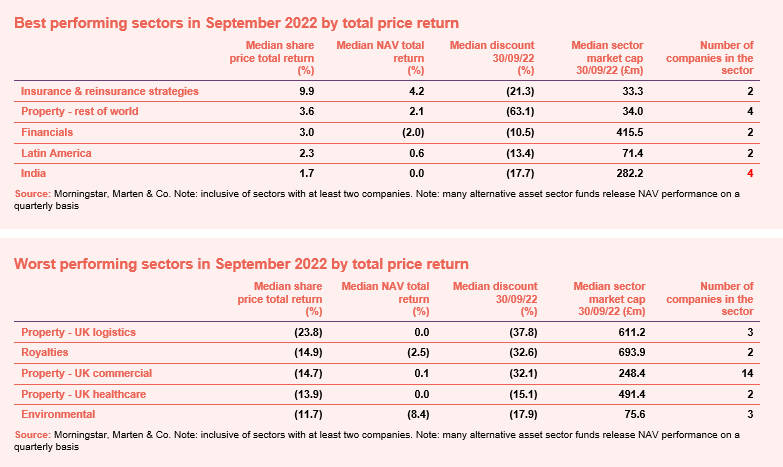

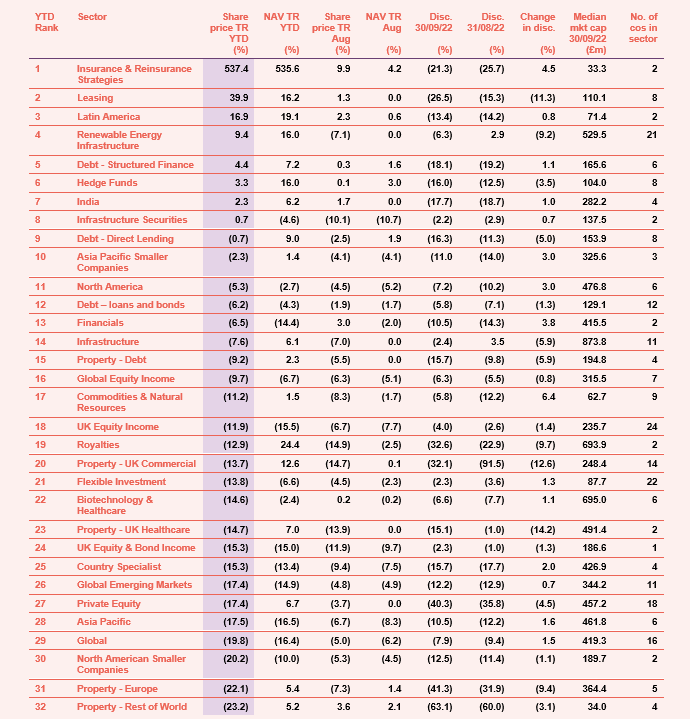

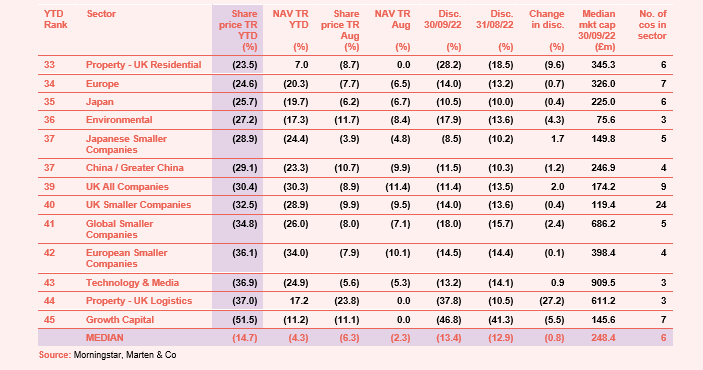

September’s median total share price return was -6.4% (+0.4% in August). The median NAV return over September was -1.2%. See Appendix 1 for a breakdown of how all the sectors have performed so far this year.

September was a turbulent month for markets. The main factor influencing the sector was the direction of interest rates, which are pushing up yields on government debt and causing investors to question valuations in the property and alternative asset sectors in particular. Our economic and political roundup for September, which includes comments from boards and managers of a wide range of investment companies, covers this in detail. Click here to access it.

The few funds with share prices that rose over September (just 45 of 346) were an eclectic bunch, usually moving either just on sterling weakness or for stock-specific reasons, and there is little that can be surmised about the best-performing sectors in price terms beyond the continuing strength of India, which is bucking the trend of most global markets.

On the negative side, the picture is much clearer. Property-related sectors have been hit hard as investors fear that interest rate rises will hit property investment companies with a lot of debt, yields that investors demand from property investments will rise – putting downward pressure on valuations, and the rising threat of recession will affect tenant’s ability to pay rents. The two funds in the royalties sector have been hit by fears of rising discount rates – see our discussion on a recent weekly news show for more details.

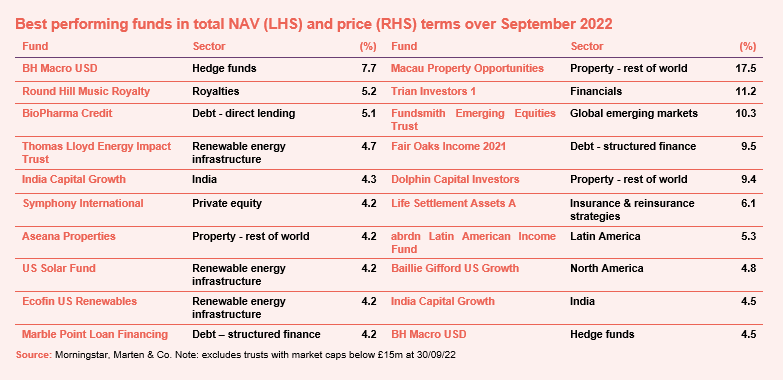

BH Macro is finding opportunities to make money in volatile markets and, like many of the best-performing funds in NAV terms, is benefiting from the strength of the US dollar. Round Hill Music announced encouraging interim figures this month, but its shares sold off on discount worries (see above). BioPharma Credit got a boost as a large borrower will repay its debt early, incurring early pre-payment penalties that add to BioPharma Credit’s income. Thomas Lloyd Energy Impact wrote up the value of its Philippines solar asset as local electricity prices rose. It says that it is close to deploying all of its IPO proceeds. India Capital Growth has been the best-performing investment company focused on India this year. The India market seems to have decoupled from other emerging markets funds. The rupee is holding up well and inflation is thought to be manageable. The other funds all have dollar denominated NAVs, though the NAVs for Symphony and Aseana, which are both focused on Asia, may be out of date.

Looking at the share price moves, Macau Property Opportunities experienced a modest narrowing of its significant discount, perhaps a continuation of the improved sentiment that followed its disposal of some property in August. Trian Investors 1, which has been in dispute with some of its shareholders, resolved to offer them their money back by this time next year. Similarly, Fundsmith Emerging Equities, which has not lived up to its initial hype, has thrown in the towel, becoming the third global emerging markets fund to liquidate this year. Fair Oaks Income Fund has decided that it will prioritise buybacks over dividends for a while, to take advantage of its wide discount. Dolphin Capital Investors has sold its one third stake in the One and Only Kea Island resort and should soon be able to pay off the last of its debt. abrdn Latin American Income has been doing well on a resurgence of South American markets. Elections are underway in Brazil which could have an impact in October.

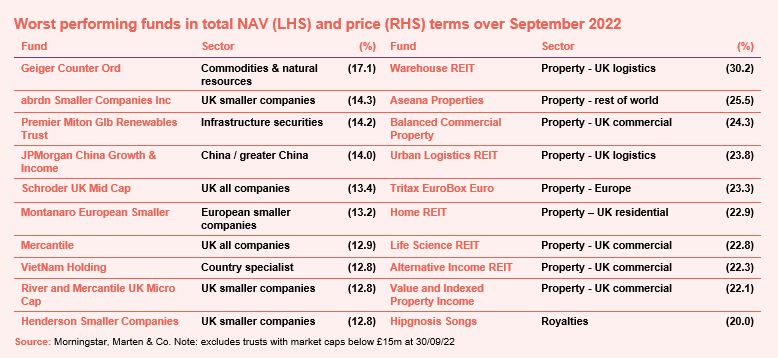

On the downside, the surprise faller is Geiger Counter. Demand for nuclear power is increasing, which should be benefiting the uranium miners that Geiger Counter invest in. The sector is quite volatile, however. It may be that the fall is reversed this month. UK assets sold off as the government found new ways to threaten the health of the economy – hitting abrdn Smaller Companies Income, Schroder UK Mid Cap, Mercantile, River & Mercantile Micro Cap and Henderson Smaller Companies. Smaller companies are perceived to be at greater risk from a recession than larger ones. The same is true in Europe, where Montanaro European Smaller Companies (which also has a growth focus) was hit. Moves in Premier Miton Global Renewables’ NAV are amplified by the gearing provided by its zero dividend preference shares. China was the weakest major market in September, hitting funds such as JPMorgan China Growth and Income. The ongoing property crisis, a weak currency and the rigid COVID policy have long been a source of concern for investors. By contrast, Vietnam had managed to avoid the general selloff in markets until September. The timing of the fall was odd though given that the country reported 13.7% GDP growth over the three months to August and the World Bank said it would be the fastest growing country in Asia this year.

In share price terms, the list is dominated by various funds investing in property. As mentioned above, the big jump in UK interest rates and gilt yields is worrying investors. It remains to be seen, however, whether NAVs will be hit as hard. Our analyst Richard Williams has published a note on Urban Logistics REIT, which looks at the underlying dynamics of the logistics sector. Home REIT, whose income is largely linked to inflation, was one of the more surprising casualties. An attempt to launch a new competitor, Independent Living REIT, foundered during the month. Life Sciences REIT is being interviewed on this week’s news show. Hipgnosis Songs Fund sold off on concerns that the discount rate used to value its assets might be increased. The concern was that an NAV fall might cause the fund to breach its borrowing covenants. Since the end of the month, Hipgnosis has refinanced its debt.

Moves in discounts and premiums

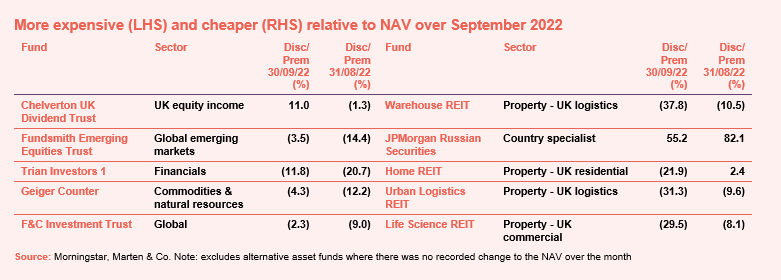

Chelverton UK Dividend Trust’s premium looks a bit strange to us. The NAV has been falling faster than the share price, and the trust is the worst-performing in its peer group over the past 12 months, but it might be that the high yield is persuading investors to hang on. As discussed above, Fundsmith and Trian rose as investors were promised their money back. While it has lost money, F&C is the best-performing of the global funds this year. It may be that investors see some safety in a large liquid and diversified fund such as this.

While all logistics funds sold off, Warehouse REIT was hit hardest. The sharp fall in its shares since the middle of September came as a large block of shares changed hands. However, the fall looks to have been arrested in recent days. Perhaps, with a yield of about 5.7% and a 35% discount to NAV today, the shares are starting to look more attractive. JPMorgan Russian’s shares are a bet on an end to the war and/or the demise of Putin.

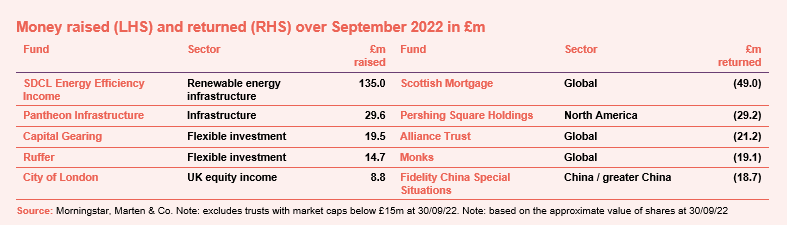

Money raised and returned

While three IPOs launched in September, one has already been scrapped – Independent Living REIT, which would have been a competitor to Home REIT, Civitas Social Housing and Triple Point Social Housing, said “given current market conditions, the Board of Directors has decided not to proceed with the Initial Issue at the current time”. Welkin China Private equity pushed back the close of its IPO by a month. A result on Sustainable Farmland is due imminently.

SDCL Energy Efficiency managed to raise £135m, having targeted £100m but been offered much more than that. It has a deep pipeline of potential new investments available. However, it was surprising that its share price fell away so soon afterwards. Pantheon Infrastructure managed to expand as the last of its subscription shares were exercised. However, a planned £250m fundraise was abandoned on 30 September “as a result of the extreme volatility of recent days in UK markets, notably within Government bonds and yield-based asset classes” – another casualty of the fallout from the mini budget.

Absolute return funds such as Capital Gearing and Ruffer are understandably in demand. So too are solid income funds like City of London.

The trusts buying back shares were the usual suspects. We do wonder though whether Scottish Mortgage could be even more aggressive given its past share issuance and current 14% discount – a single figure discount ought to be a reasonable target.

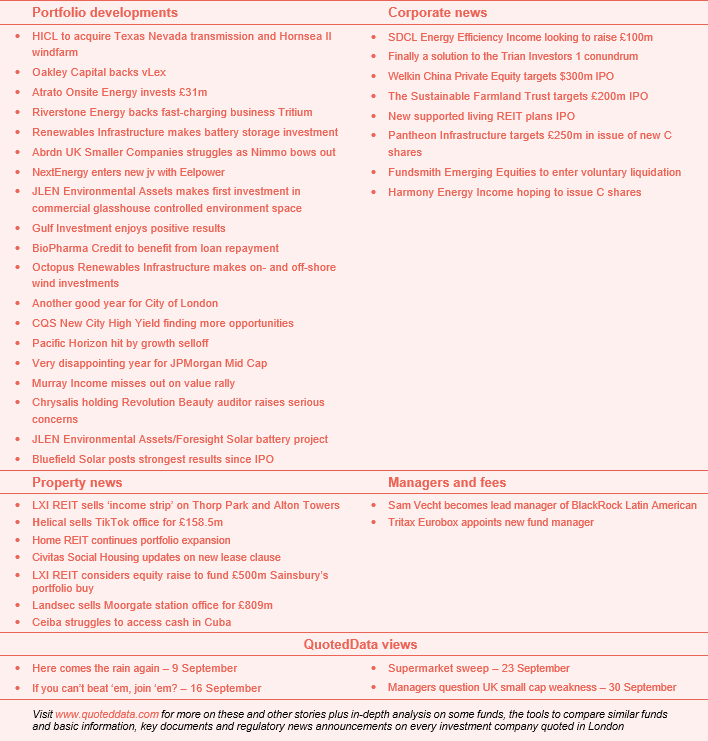

Major news stories and QuotedData views over September 2022

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Henderson Diversified Income AGM 2022, 4 October

- Invesco Select AGM 2022, 4 October

- Rockwood Strategic investor presentation, 4 October

- ShareSoc Webinar with European Opportunities, 5 October

- Artemis Alpha AGM 2022, 13 October

- Greencoat Renewables EGM, 13 October

- Seraphim Space presentation, 17 October

- Diverse Income AGM 2022, 18 October

- QuotedData’s Property Conference 2022, 19 October

- abrdn UK Smaller Companies Growth AGM, 20 October

- Mid Wynd AGM, 26 October

- The London Investor Show 2022, 28 October

- QuotedData’s Investment Strategies Conference 2022, 9 November

- QuotedData’s Responsible Investing Conference 2022, 10 November

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Research

Recently, Urban Logistics REIT’s (SHED’s) share price has fallen to a wide discount rating to its net asset value (NAV), as the rising cost of debt and concerns over a protracted recession have hit sentiment towards the logistics property sector. However, the long-term trends that have characterised growth in the sector remain and are even more acute in the ‘last mile’ sub-sector that SHED operates. Supply of logistics space is at record lows, while tenant demand is robust, with lettings for the first half of the year at record highs.

In recent weeks, JLEN Environmental Assets Group (JLEN) has further diversified its portfolio with three new investments, a battery storage project and two investments in the low carbon and sustainable solutions portion of its portfolio; a controlled environment aquaculture facility in Norway; and a UK glasshouse construction project drawing low-carbon heat and power from an existing anaerobic digestion plant owned by JLEN.

In an environment of volatile energy prices and uncertainty over the shape of future electricity market reforms, investors may be reassured by the breadth of JLEN’s portfolio and the managers’ ability to find new ways of adding value.

Baillie Gifford UK Growth Trust (BGUK) has seen a marked fall in its net asset value (NAV) during the last 12 months as inflation expectations have risen, bringing with them interest rate rises and, in all likelihood, a recession. The selling-off of many ‘growth’ stocks has been severe and, BGUK’s managers say, indiscriminate, with good companies being hit as well as the bad. However, this provides an opportunity for long-term investors. The managers have been reappraising their investment cases in light of the changing market conditions and have been adding to holdings that they think are fundamentally attractive.

The managers believe strongly that their patience will be rewarded over the longer term. An NAV recovery would also likely be accompanied by a narrowing of BGUK’s discount, which is currently close to its five-year high.

In its first three years, Chrysalis Investments (CHRY) generated significant net asset value (NAV) and share price returns for investors by building an exciting portfolio of fast-growing, disruptive and potentially market-leading companies. An abrupt change in sentiment towards these types of businesses has since impacted on CHRY’s NAV, with falls in the values of listed investments and a notable write down in the valuation of Klarna. However, this is set against good news coming from portfolio companies such as Starling Bank and wefox.

In a market where financing for growth companies has become harder to obtain, CHRY is fortunate to have cash on hand from its first full exit to support portfolio companies, if needed. However, increasingly, these businesses are becoming profitable and cash-generative.

abrdn Private Equity Opportunities (APEO) has recently been trading at discounts to net asset value (NAV) in excess of 40%, way above its long-term average of around 16-17%, suggesting that the market is pricing in an NAV fall comparable to that seen during the global financial crisis.

Alan Gauld, APEO’s lead portfolio manager, thinks that the discount is nonsensical, and we agree. The listed private equity sector has changed immeasurably since the crisis and APEO’s portfolio is focused on managers of funds invested in cash generative businesses that are able to finance their growth. Add in APEO expanding its direct co-investment side (17% of NAV as at 31 March 2022), an increased focused on sector specialist managers that are better able to add value, conservative valuations for private equity positions and a focus on the mid-market where there is less competition, and the current discount adds to an already compelling opportunity.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.