Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

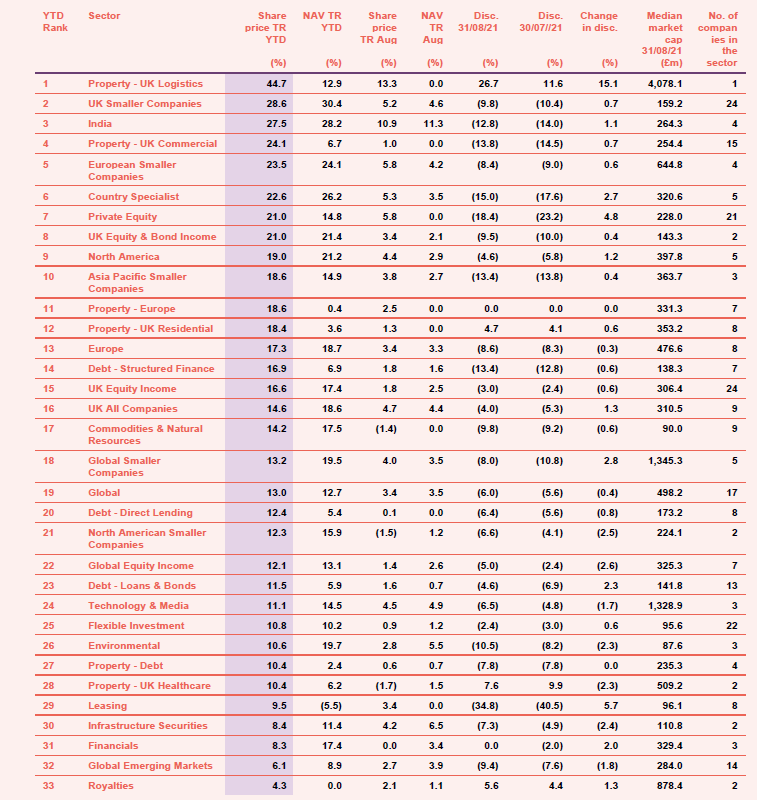

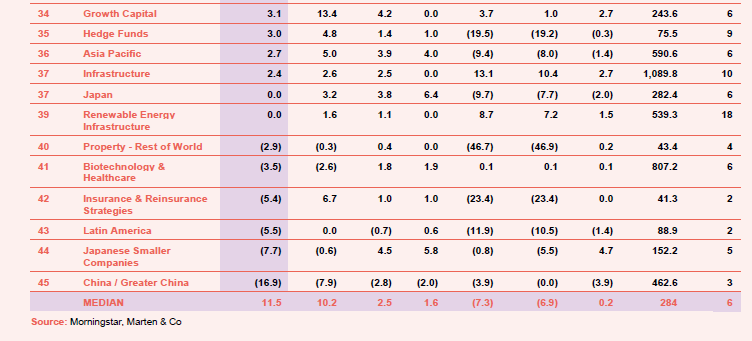

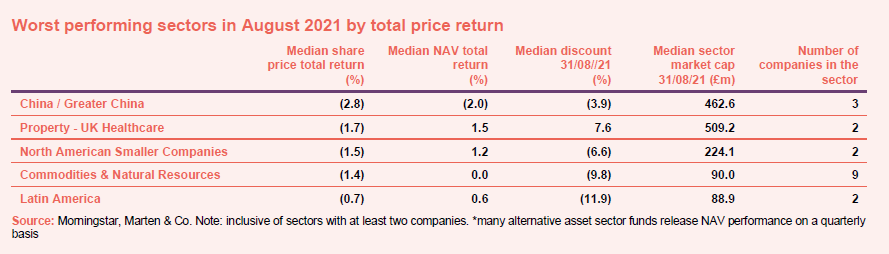

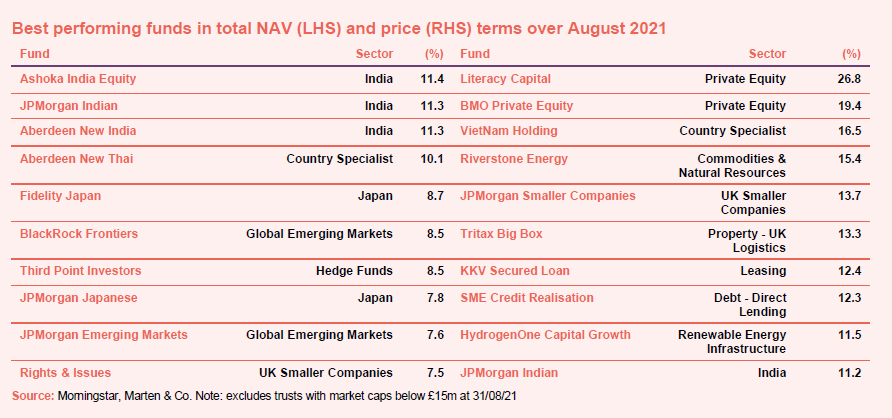

While inflation concerns remain, they are accompanied by the idea that the global recovery is well underway, with the return of company dividend payouts and an uptick in deal activity. It is therefore perhaps no surprise to see private equity and smaller companies trusts among the top performers last month, with confidence rising among consumers and businesses alike. The best performing sector was India, which had a difficult Q2 this year, as it suffered at the hands of its deadliest coronavirus waves to date, but which seems to have gone from strength to strength since.

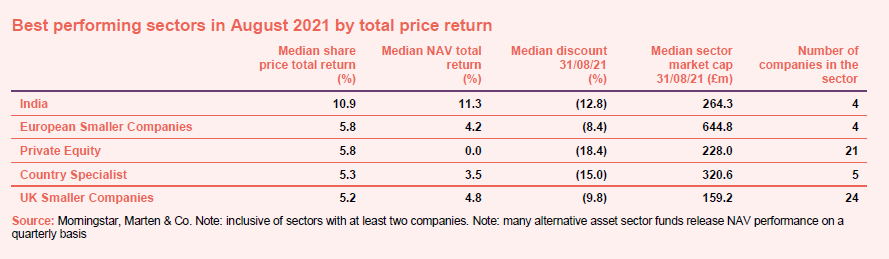

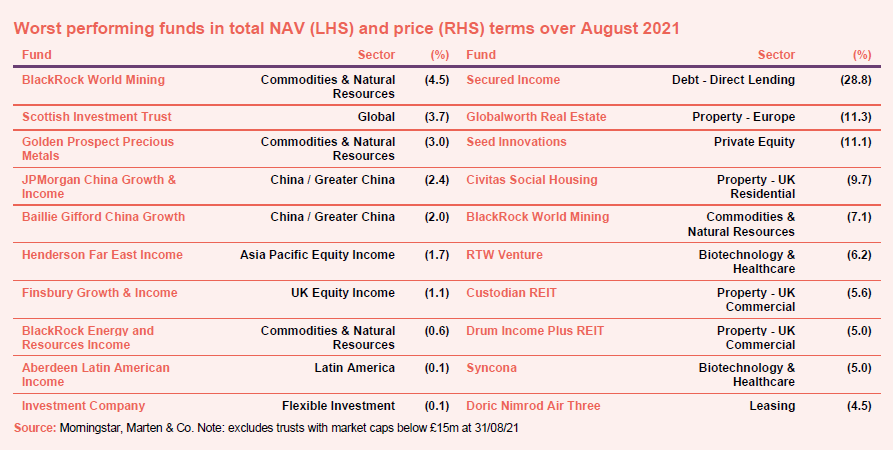

Country specialist trusts also performed well. More than half of that sector is made up of Vietnam-focused trusts, which performed poorly in July as its own coronavirus wave took hold. However, even though much of the country remains under a strict lockdown, there is light at the end of the tunnel as its vaccination programme is due to start next month. China funds were among August’s laggards, as regulatory activity led to a broad sell-off amid concerns over the country’s policy direction. Commodities & Natural Resources trusts continue to suffer. An anticipated oil price rise has taken a backseat after Delta variant woes triggered the biggest falls in nine months (see Appendix 1 for a breakdown of how all the sectors have performed this year).

August’s median total share price return was 2.5% (the average was 2.7%) which compares with a median of 0.3% in July. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over July

Worst performing sectors over June

On the positive side

Indian funds Ashoka India Equity, JPMorgan Indian and Aberdeen New India topped tables in NAV terms in August, as the economy started to get back on track after suffering one of the world’s worst coronavirus outbreaks earlier this year. The country’s headline indices, Sensex and Nifty, closed at new record highs during the month with IT companies among the top gainers. Japan also seems to be making a comeback after months of uncertainty over its own handlings of the covid-19 pandemic, which was good news for Fidelity Japan and JPMorgan Japanese. In share price terms, Literacy Capital was the biggest winner, just two months after its IPO (see below for the reason). Another recent launch HydrogenOne also seems to have caught investors’ attention. BMO Private Equity announced good results. VietNam Holding announced a tender offer.

On the negative side

Commodities & Natural Resources trusts including BlackRock World Mining, Golden Prospect Precious Metals and BlackRock Energy and Resources Income saw their NAVs hit in August, as energy prices finally retreated after rising for the past nine months. Metals and minerals dropped 4.4% and precious metals fell by 2.3% during the month, according to The World Bank.

Discounts and premiums

More expensive and cheaper relative to NAV

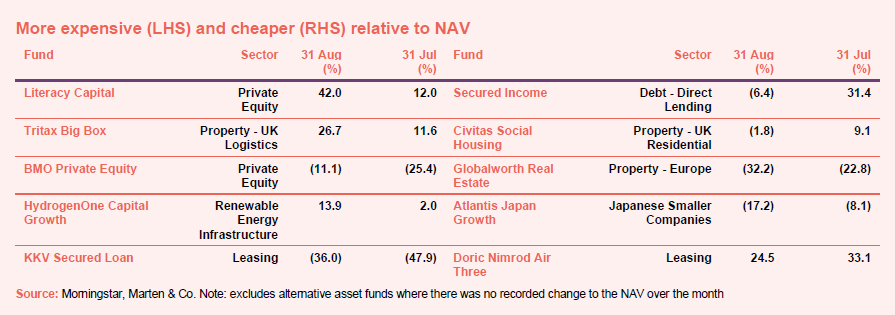

Literacy Capital saw its premium shoot up in August as one of its holdings, Butternut Box, a fresh dog food subscription service, finalised a funding round to raise further equity. It also posted impressive results, as did Tritax Big Box which saw its premium more than double, and BMO Private Equity, which saw its 25% discount narrow to 11%. Despite missing its IPO target in July, HydrogenOne Capital Growth seems to have done everything right since as its premium rose to double digits in August. It may soon be able to expand towards its original target size. Finally, KKV Secured Loan said a package of loans secured against shipping vessels to a single borrower had been refinanced with another provider for $35m, meaning more money available for distribution to shareholders.

Secured Income became significantly cheaper in August as its 31% premium plummeted to a 6% discount following last month’s return of capital. The company agreed to amend its investment management agreement with KKV Investment Management, confirming a monthly management fee of £20,500 until the end of the year. Meanwhile, Civitas Social Housing considered an equity raise to fund its acquisition pipeline and enhance returns, as uncommitted capital reserves are limited. Its premium fell to a small discount last month.

Money in and out

Money coming in and going out

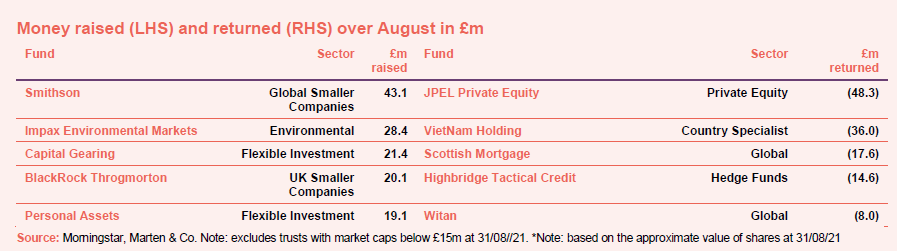

After several bumper months of fundraises and IPOs, August appeared relatively quiet with just £580m of net new money raised. Smithson led the way with just over £43m raised, followed by Impax Environmental Markets and Capital Gearing.

Share buybacks were led by JPEL Private Equity, VietNam Holding, Scottish Mortgage, Highbridge Tactical Credit and Witan. JPEL made a mandatory redemption of shares after its sale of its largest holding. Highbridge also made a compulsory redemption. VietNam Holding held a tender offer. The take up for this was far higher than we would have expected given the fund’s excellent recent performance record.

Recently published research notes

Henderson High Income – A taste of more to come

The UK market has been making somewhat of a comeback since the start of 2021, after years of uncertainty, volatility and being outright unloved. Henderson High Income (HHI) has been a beneficiary of the recovery in the UK’s fortunes, outperforming its performance benchmark and putting its NAV ahead of comparable indices over all time periods.

Investment manager David Smith is positive about UK equity markets going forward and believes there is plenty more upside to come in the form of economic recovery following the COVID-19 pandemic, merger and acquisition (M&A) activity and improving dividends. The trust currently offers an attractive dividend yield of 5.60%.

Baillie Gifford UK Growth – Looking way beyond the now

It is now just over three years since Baillie Gifford, an investment management house famed for its growth-focused investment strategies, took over the management of Baillie Gifford UK Growth Trust (BGUK). This move has paid off, with absolute and relative performance versus its peers (in the AIC’s UK All Companies sector) improving dramatically, while a marked share price discount to NAV was, until recently, eliminated.

BGUK offers investors the best ideas from Baillie Gifford’s UK equities team. Its managers are stock pickers, with a long-term (five-to-10-year) view, whose portfolios are managed with a consistent philosophy, allowing them to look through short-term market noise. While markets fret about the risk of new COVID variants, BGUK’s managers are excited about the innovation and prospects they see for their portfolio companies. Today’s discount opportunity could prove to be short-lived.

Henderson Diversified Income Trust – Sticking to its guns

Henderson Diversified Income Trust (HDIV) focuses on high-quality companies with sustainable business models. It was resilient in the face of COVID-19-related market falls, but, unlike some of its peers, has not benefitted from the bounce in the prices of debt issued by low-quality borrowers and those whose business models are sensitive to shifts in the economic cycle that has occurred since last November’s vaccine news. Nevertheless, its three-year figures are well-ahead of those of competing funds.

Over 2021 to date, HDIV’s shares have moved to trade at a discount to NAV. We think that this is unjustified, given HDIV’s longer-term track record. As we discuss later, the managers highlight the disruptive changes underway in many industries that have accelerated recently. They are convinced that the inflation we have been experiencing this year is transitory, that fundamentals will soon reassert themselves, and that HDIV’s portfolio positioning will be rewarded.

Urban Logistics REIT – Shed load of growth to come

Urban Logistics REIT (SHED) is pressing ahead with its ambitious growth strategy, having raised £108.3m in a placing of shares in July 2021. This is the third successful capital raise it has made during the pandemic (totalling £336.7m), highlighting the strength and resilience of its investment proposition. SHED is the only listed company focused solely on the urban logistics sub-sector, which is benefitting from a surge in demand for space from e-commerce operators, as online retailing rates accelerate and are faced with a chronic lack of supply of property.

SHED’s manager, led by Richard Moffitt, has an active asset management approach whereby it can impact the portfolio’s value through lease re-gears (beneficial renegotiations of leases for existing tenants) and new lettings, meaning it is less reliant on market conditions. The majority of SHED’s assets are acquired off-market (sourced through contacts rather than through formal bidding processes), which is testament to the manager’s reputation and skillset – especially with the logistics investment market being so hot right now.

The company has reached a size that justifies a move from the AIM market to a premium listing on the main market of the London Stock Exchange, which should happen in the near future and increase liquidity in its shares.

Major news stories over August

Portfolio developments

- Unlisted name was Fidelity Japan’s ‘standout contributor to performance’

- RIT Capital Partners enjoyed new all-time high NAV numbers

- Allianz Technology was hit by the market rotation from growth to cyclical stocks

- Another year of outperformance for Henderson Smaller Companies

- Another legendary acquisition for Hipgnosis boosted its Fleetwood Mac exposure

- Stellar Moderna share drives BB Biotech back to near all-time high

- Chrysalis backed Tactus Holdings

- It’s been a good start for RWC at Temple Bar

Corporate news

- Custodian REIT was in talks to buy Drum Income Plus REIT

- Civitas considered an equity raise

- Aberdeen Asian Income looked to migrate its tax residence to the UK

- Electra’s demerger plans progressed

- A lawsuit was filed against Pershing Square Tontine Holdings

- Blue Planet appeared to be in dispute with a big shareholder

- AVI requisitioned Third Point Investors to address its ‘entrenched trading discount’

- Greencoat Renewables called for an EGM to consider a new investment policy

- Blackfinch Renewable European Income announced it was targeting a £300m IPO

Managers and fees

- Industry veteran and former F&C chair Simon Fraser passed away

- BBGI Global Infrastructure announced a new dividend target

Property news

- Standard Life Property Income posted a 3.5% jump in NAV

- Tritax EuroBox funded a Turin warehouse

- Derwent London added to its West End portfolio

- LondonMetric made a big profit on its sale of a £102m big box

- Sirius Real Estate splashed €85m on four business parks

- LXi REIT announced £80m of acquisitions

- Shaftesbury was optimistic over London’s recovery

- Social Housing REIT announced its intention to float

- Home REIT eyed a £262m fund raise

- Regional REIT acquired a £236m portfolio

QuotedData views

- UK glass half-full? – 27 August

- Growth works, value works, cash not so good – 20 August

- Urban vibes – 20 August

- Reading is fundamental – 13 August

- More property companies in crosshairs of private equity – 13 August

- Do we love tech or not? – 6 August

- Who’s looking good for property bounceback? – 6 August

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- SVM UK Emerging AGM 2021, 10 September

- CIP Merchant Capital AGM 2021, 10 September

- Baker Steel Resources AGM 2021, 14 September

- Hipgnosis Songs AGM 2021, 15 September

- Henderson Diversified Income AGM 2021, 16 September

- Baillie Gifford US Growth AGM 2021, 17 September

- Civitas Social Housing AGM 2021, 22 September

- Miton UK Microcap AGM 2021, 22 September

- SEED Innovations AGM 2021, 22 September

- BMO Managed Portfolio AGM 2021, 30 September

- Henderson Smaller Companies AGM 2021, 1 October

- Miton Global Opportunities AGM 2021, 6 October

- Aberforth Split Level Income AGM 2021, 28 October

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 9 April | Review of March, CBA, SEC, SEIT, SUPP | Neil Hermon | Henderson Smaller Companies |

| 16 April | BLND, PSDL, SBO | Hugo Ure | Troy Income & Growth |

| 23 April | AEWU, AIF, GSF, MNTN | James Harries | Securities Trust of Scotland |

| 30 April | AGT, DIG, HOME, GWIini | Nick Montgomery | Schroder Real Estate Investment Trust |

| 7 May | JLG, JLIF, SIGB, SMP | Helen Steers | Pantheon International |

| 14 May | NPSN, RMDL | Stuart Widdowson | Odyssean |

| 21 May | AIF, CORD, SBO | Georgina Brittan | JPMorgan Smaller Companies |

| 28 May | GHE, SEC | Matthew Potter | Honeycomb |

| 4 Jun | ARR, BHGG, BHGU, BHME, BHMG, BHMU, LTI, SCIN, WWH | Ben Ritchie | Dunedin Income Growth |

| 11 Jun | CORD, DGI9, PHI | Stephanie Sirota | RTW Ventures |

| 18 Jun | AUGM, LTI, MTE | Stephen Inglis | Regional REIT |

| 25 June | AEMC, CRS, BOOK | Michael O’Brien | Fundsmith Emerging Equities |

| 2 July | GSS, PCFT, SHED, BSIF | David Conlon | GCP Asset Backed Income |

| 9 July | AGT, DIGS | Matthias Siller | Baring Emerging EMEA Opportunities |

| 16 July | AGT, ABD, SONG, PRSR, RHM | Nick Wood | Quilter Cheviot |

| 23 July | RNEW, PSH | Gareth Powell | Polar Capital Global Healthcare |

| 6 August | AEMC, ANW, CREI, DRIP | Matthew Howard | BMO Commercial Property |

| 13 August | AIF, SSON | Andrew Bell | Witan |

| 20 August | APAX, ELTA, PSH | Abbie Glennie | Aberdeen Smaller Companies Income |

| 27 August | GRP, SHB | David Smith | Henderson High Income |

| 3 September | AIF, BRET | Ian Lance | Temple Bar |

| Coming up | |||

| 10 September | ATST | Craig Baker | Alliance Trust |

| 17 September | ATR | Robin Parbrook | Schroder Asia Total Return |

| 24 September | BMPG/BMPI | Peter Hewitt | BMO Managed Portfolio |

| 1 October | SUPP | Tim Creed | Schroder UK Public Private |

| 8 October | OCI | Steven Tredget | Oakley Capital |

| 15 October | AEMC/ANW | Nicholas Yeo | Aberdeen China |

| 22 October | SMT | Catharine Flood | Scottish Mortgage |

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – August median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.