Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

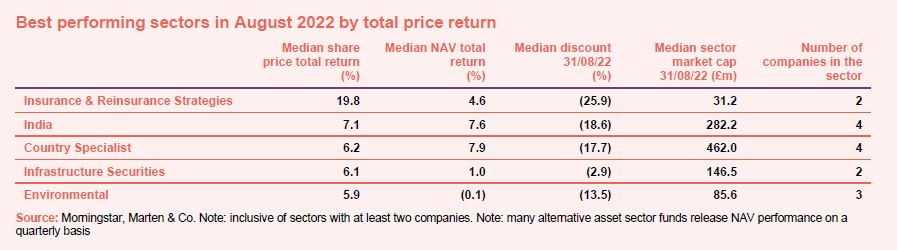

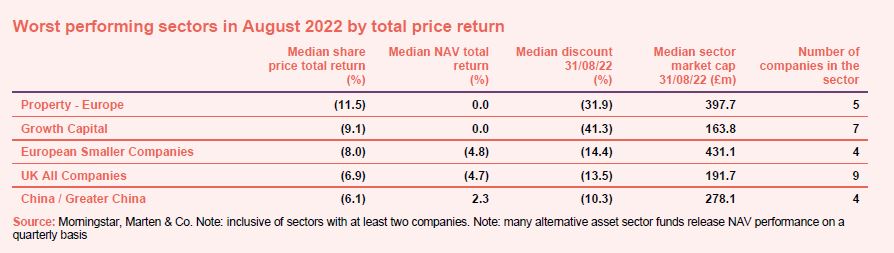

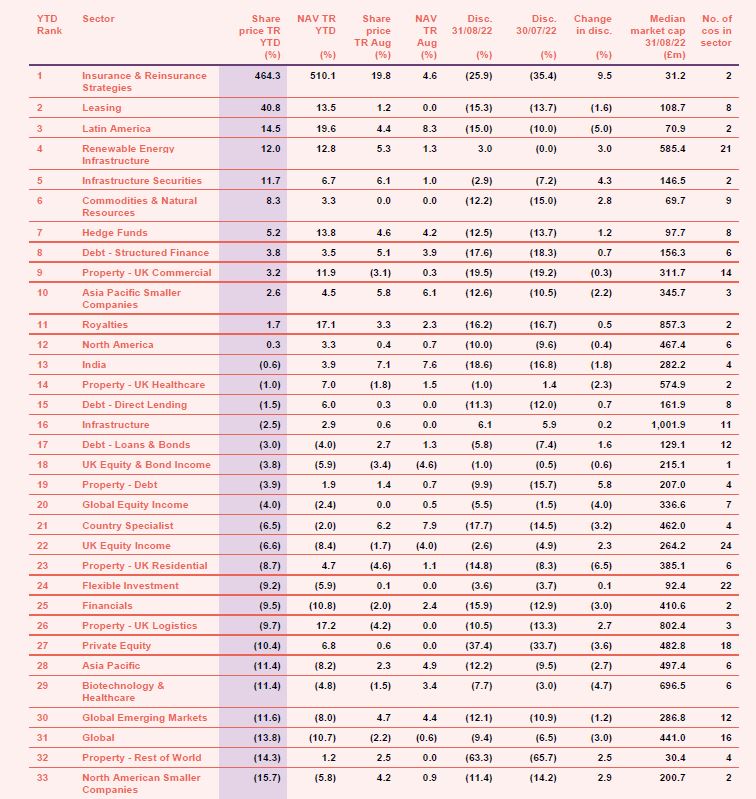

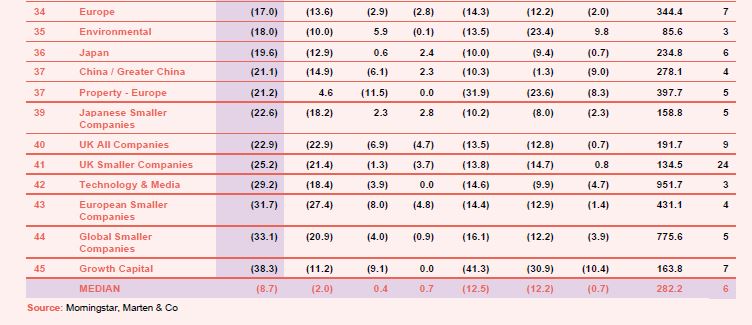

August may have been a quiet month in terms of investment company news, but markets have certainly been noisy with fears that we’re heading into a recession (or may already be in one) on top of everyone’s minds. At the start of the month investors were upbeat, believing that enough had already been done to tackle inflation in the US, but a speech by the chairman of the Federal Reserve put paid to that. India was back among the top performers in August despite geopolitical tensions and an interest rate hike. The country’s stock market had another good month, with the Nifty 50 registering gains of 3.5%. Meanwhile, the Vietnam-heavy country specialist sector also performed well, as the reopening of the country early this year brought with it the revival of the tourism sector. Infrastructure securities and environmental funds were also among the winners, but the overall top performers were insurance and reinsurance strategies funds. On the other hand, China/Greater China funds continued to suffer as COVID flare-ups, power rationing amid the worst heatwaves in decades, and the embattled property sector increased the pressure. Certain sectors in Europe were also hit, perhaps a reaction to the ECB’s decision to increase rates further. Meanwhile, growth capital trusts remain out of favour, the sector took a significant hit from underperformance by Chrysalis and Seraphim Space (see Appendix 1 for a breakdown of how all the sectors have performed so far this year).

August’s median total share price return was 0.4% (the average was 0.4%) which compares with a median of 3.6% in July. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over August

Worst performing sectors over August

On the positive side

August saw a mix of winners in the investment company world, with no obvious trends to speak of, although a weak pound did have an impact. Nonetheless, Geiger Counter was the best performer in NAV terms (and second best in share price terms). Amidst all the noise around energy, nuclear is firmly back on the agenda for many western European governments. Takeover bids in the biotech sector may be helping Biotech Growth, as businesses take advantage of relatively low valuations in the sector. As already mentioned, India and Vietnam had a good month which is reflected in the NAV performance of trusts invested in these areas including India Capital Growth, Vietnam Enterprise and VietNam Holding. Meanwhile, in share price terms, Schiehallion was the best performer, delivering an impressive 25%. Somehow, the trust has managed to power through the anti-growth sentiment unlike most of its peers. Macau Property Opportunities succeeded in selling off more of its portfolio. Gulf Investment continues to flourish as strong oil prices help those economies. Axiom European Financial Debt announced plans to wind up. Independent Investment Trust had a good month after it was announced it would be merging into Baillie Gifford’s Monks Investment Trust. The decision came after the retirement of Independent’s long-term manager, Max Ward, and we think that this is an elegant solution and one that will likely be welcomed by shareholders.

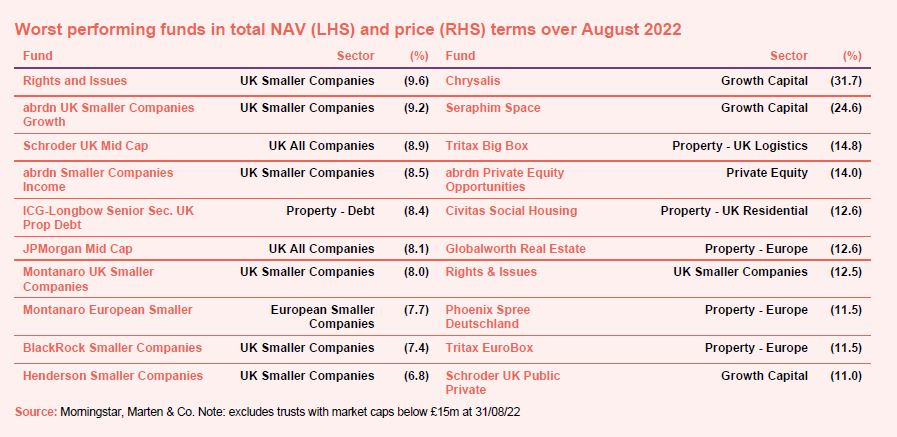

On the negative side

On the negative side, Rights and Issues saw its NAV fall by almost 10% and its share price by 12.5% over August. Its long-term manager Simon Knott announced his retirement in June and officially stepped down on 1 September. But it seems this wasn’t the only reason for the trust’s underperformance as a big chunk of the sector – including abrdn UK Smaller Companies Growth, abrdn Smaller Companies Income, Montanaro UK Smaller Companies, BlackRock Smaller Companies and Henderson Smaller Companies – also saw their NAVs suffer in August. The UK has had a lot to juggle this summer with the Conservative leadership election, record heatwaves and an increasingly worrying cost-of-living crisis heightened by the announcement of painful energy price caps. In share price terms, the growth capital sector (Chrysalis and Seraphim Space) and European property (Globalworth Real Estate, Phoenix Spree Deutschland and Tritax EuroBox) struggled in August.

Discounts and premiums

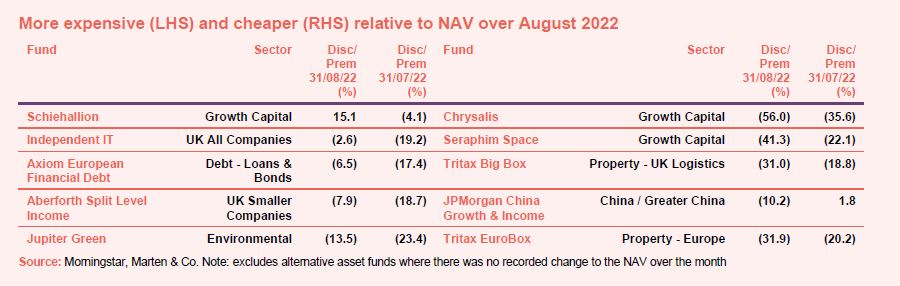

More expensive and cheaper relative to NAV

Schiehallion has been all over the place this year, with its absurdly high premium (60%) coming back down to reality before finally swinging to a discount of 1% by the end of June. It looks as though the pendulum has gone back the other way, however, as the trust ended August trading on a premium of 15%. Independent Investment Trust, Axiom European Financial and the small cap sell-off that hit funds such as Aberforth Split Level Income were discussed above. After seeing its discount widen during the previous month, Jupiter Green saw a slight narrowing over August though it remains on a double-digit discount.

Seraphim Space, which has suffered from a widening discount in recent months, bounced back in July but that appears now to have been only temporary as it ended August on a 41% discount. Fellow growth capital peer Chrysalis announced a sharp fall in its NAV, which seemed to unnerve investors. Tritax Big Box suffered a double whammy for not only becoming cheaper in August but also for being downgraded by several brokers. Logistics-focused funds have struggled since Amazon said it was abandoning plans for new warehouses. Big Box’s European counterpart Tritax EuroBox also saw its discount widen over the month.

Money in and out

Money coming in and going out

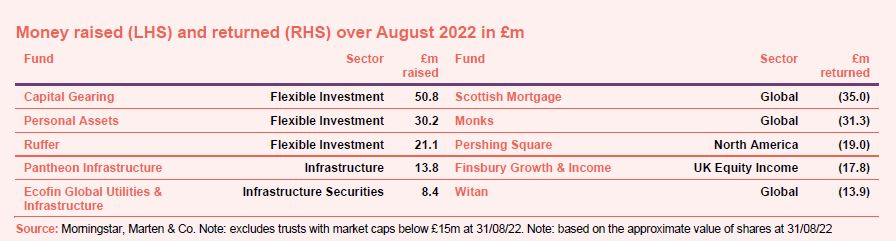

Only £144m of net new money was raised over the month, reinforcing the idea of August traditionally being a quiet month.

Capital Gering, Personal Assets and Ruffer grew while Pantheon Infrastructure expanded as another tranche of its subscription shares was exercised. Ecofin Global Utilities expanded as its NAV continued to climb.

Share buybacks were led by Scottish Mortgage, Monks, Pershing Square, Finsbury Growth & Income and Witan.

Major news stories over August

Portfolio developments

- JLEN Environmental Assets bolsters battery storage exposure

- Foresight Sustainable Forestry acquires trio of afforestation projects and signs new RCF

- Invesco Asia holds up well in falling market

- NextEnergy Solar secures subsidised UK solar contracts

- Henderson Smaller Companies suffers in growth selloff

- Pantheon will battle discount with buybacks

- Schroder British Opportunities tops up Cera investment

- Invesco Select results a mixed bag

- SEED Innovations boosts investment in South West Brands

- Baillie Gifford US back to square one

- Small cap bias drags down Diverse Income

- HydrogenOne backs Strohm pipeline business

- Octopus Renewables buys stake in Crossdykes windfarm

- Bluefield Solar confirms subsidies secured for new projects

- SDCL Energy Efficiency backs US energy storage provider

- HICL Infrastructure adds to train set

- Oakley Capital invests in Affinitas Education

- Taylor Maritime announces all cash offer for Grindrod Shipping

Corporate news

- Independent and Monks combine forces

- Time’s up for Axiom European Financial Debt

Managers and fees

- JPMorgan American’s Parton announces retirement while trust reports tough start to 2022

Property news

- Home REIT expands with £85m acquisitions

- Supermarket Income REIT goes on £76m shopping spree

- Circle Property sells Milton Keynes business park and progresses on sales in Birmingham and Staines

- Impact Healthcare REIT buys two new care homes

- Urban Logistics acquires five assets with significant value creation potential

- Picton Property Income acquires mixed-use property in Cheltenham

QuotedData views

- The logistics paradox – 5 August

- Meaningful mergers – 12 August

- Small is beautiful – 19 August

Recently published research notes

It is coming up to two years since Redwheel (formerly RWC Partners) took over management responsibility for Temple Bar (TMPL), and performance figures show that the change has proven to be a good decision for the trust. Of course, the change in investor appetite from growth to value-style investing has helped it along its way, but the willingness of the managers – Ian Lance and Nick Purves – to go against the trend (by buying cyclical businesses at the lows, for example) shows the importance of stock-picking too. The managers say that valuations are a measure of appetite for risk, and that on that score we are back down to the lowest levels we have seen for about the past 25 years. In times like this (as seen during the global financial crisis, for example), they say, it pays to take on more risk.

JPMorgan Multi-Asset Growth & Income – Navigating a changed landscape

Measures being taken to tackle inflation are weighing on markets. Reflecting this, JPMorgan Multi-Asset Growth & Income (MATE) has also been affected, with falls in its net asset value (NAV) and share price. However, living up to its objective (see below), these falls have not been as severe as those of global equity markets. In the current environment, MATE’s policy of growing its dividend at least in line with inflation should be attractive to investors. The managers have repositioned the portfolio to reflect the changed circumstances. They are looking for signs that the worst is priced in and markets are braced to recover, and will look to take advantage of this when the time is right.

Gulf Investment Fund – Much more than just oil & gas

Gulf Investment Fund (GIF) has built up an attractive track record of both absolute performance and outperformance of its index benchmark. For example, as we show on page 18, GIF outperforms competing open-ended funds over most time periods. Recent higher energy prices have bolstered sentiment toward the countries that comprise the Gulf Cooperation Council (GCC) – see below. Their governments are using the revenue windfall to fund vast infrastructure projects aimed at diversifying their economies. We think that this helps underpin the long-term case for an investment in the region and the fund. GIF is unique within the investment company universe and offers exposure to an increasingly important region. Notwithstanding its impressive track record, institutional investors have taken advantage of stringent discount control mechanisms and have shrunk the company. The board would like to see it re-expand and we agree.

North American Income Trust – Next generation dividend hero

After a few difficult years, the North American Income Trust (NAIT) has plenty to feel good about in 2022. It has enjoyed a turnaround in performance as its value style of investing has come back in favour. As we discuss on page 4, investors have been rotating away from growth stocks on the back of inflation fears. Acknowledging these fears, NAIT’s manager, Fran Radano, is confident that the trust can provide an income stream that should outpace US inflation. Meanwhile, the trust, which has been run in its current form since 2012, achieved ‘next generation dividend hero’ status this year (a commendation awarded by the Association of Investment Companies), as it has managed to increase its dividend every year for 10 consecutive years. It has also built up sufficient revenue reserves to cover more than a full year’s dividend at current rates.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Monks AGM 2022, 6 September

- abrdn new Dawn AGM 2022, 6 September

- SEED Innovations AGM 2022, 7 September

- Lindsell Train AGM 2022, 8 September

- Polar Capital Technology AGM 2022, 8 September

- Baillie Gifford UK Growth AGM 2022, 9 September

- Rockwood Strategic AGM 2022, 13 September

- Augmentum Fintech AGM 2022, 14 September

- Baillie Gifford US Growth AGM 2022, 16 September

- Odyssean Investment Trust AGM 2022, 21 September

- India Capital Growth AGM 2022, 21 September

- Miton UK Microcap AGM 2022, 27 September

- Aberdeen New India AGM 2022, 28 September

- MIGO Opportunities AGM 2022, 29 September

- Henderson Diversified Income AGM 2022, 4 October

- Invesco Select AGM 2022, 4 October

- Artemis Alpha AGM 2022, 13 October

- Diverse Income AGM 2022, 18 October

- QuotedData’s Property Conference 2022, 19 October

- The London Investor Show 2022, 28 October

- QuotedData’s Investment Strategies Conference 2022, 9 November

- QuotedData’s Responsible Investing Conference 2022, 10 November

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – August 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.