Real Estate Quarterly Review

Kindly sponsored by Aberdeen Standard Investments

Rate rise fears dampens bounce back

The quarter started with much promise, as activity picked up with the full opening of the economy. This was reflected in the valuation of commercial properties and in turn investor sentiment to the listed real estate sector.

However, supply chain issues – exacerbated by a severe lack of HGV drivers – and fears that interest rate rises may rise in the near-term as inflationary pressures mount, had the effect of dampening the economic bounce back.

Merger and acquisitions (M&A) gathered pace, with St Modwen Properties being bought out in a £1.27bn deal and a £969m take private deal agreed for GCP Student Living. M&A may be a theme for the rest of the year, with many companies trading at significant discounts and the rumour mill working overtime.

Performance data

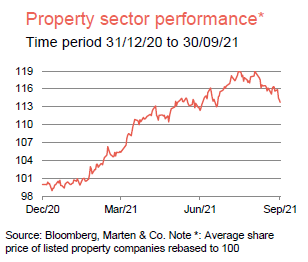

A bounce back in economic activity in the third quarter of the year was reflected in the valuation of commercial properties and in turn investor sentiment to the listed real estate sector. With supply chain issues reported and possible interest rate rises on the horizon, the bounce back was curtailed somewhat at the end of the quarter.

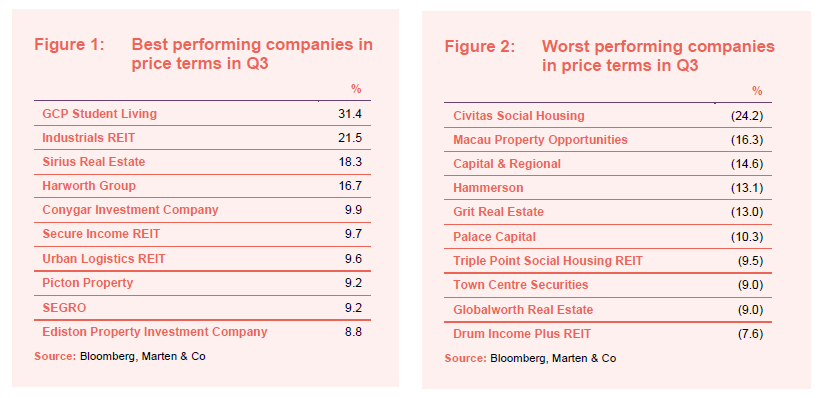

Best performing property companies

Student accommodation specialist GCP Student Living topped the table for best performing property companies in the third quarter after it received a takeover bid around 30% above its share price (more information on page 7).

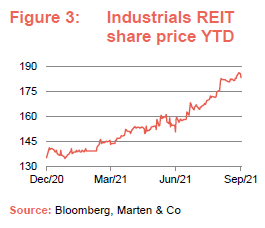

Industrials REIT, formerly Stenprop, had an impressive quarter, seeing its share price increase 21.5%. The group made significant progress in its transition to a fully focused multi-let industrial REIT (see page 9 for more detail).

German business parks owner and operator Sirius Real Estate saw its share price rise 18.3% in the three months, during which it reported a big uplift in its portfolio valuation and NAV.

Development and regeneration specialist Harworth also saw a double-digit rise in its share price after reporting a 14.5% uplift in EPRA net disposal value (NDV) for the six months to 30 June 2021. This was largely thanks to an increase in the value of its industrial and logistics developments. The group also set out plans to double the size of the business over the next five to seven years.

Secure Income REIT posted impressive half-year results that showed valuations across its long-income portfolio of healthcare, leisure and budget hotels were continuing to recover from the depths of 2020. The group was also the subject of press speculation around a possible £3bn merger with LXI REIT, but initial talks have now ended (more information on page 7).

A surge in demand for logistics space sees no signs of abating and logistics specialists are continuing to benefit. Logistics giant SEGRO’s share price jumped 9.2% after it reported impressive half-year results, while Urban Logistics REIT is operating in one of the most supply-constrained sub-sectors in property.

Worst performing property companies

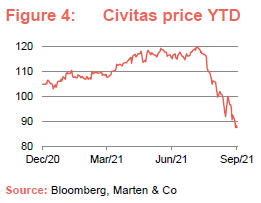

Civitas Social Housing’s share price took a dive in the three months, losing almost a quarter in value, after coming under attack from short-seller ShadowFall. A report criticising the company for not disclosing possible conflict of interest matters in a small number of property transactions as well as questioning the strength of some of its housing association tenants was published. Civitas has since published a full rebuttal.

The share price fall may have been compounded by the group dropping out of the FTSE 250 index. Fellow social housing specialist Triple Point found itself in the crossfire of the short-selling drama.

Secondary mall owner Capital & Regional‘s share price fell 14.6%, while Hammerson, which owns shopping centres and retail parks, also saw a share price fall in the quarter of 13.1%, as the challenges facing the retail sector persist, especially given the ongoing supply chain disruption.

Drum Income Plus REIT and Custodian REIT agreed terms on an all-share offer, valuing Drum at £21.4m. Peculiarly, Drum’s share price fell 7.6% following the news, despite the bid price being a premium to its prevailing share price.

Significant rating changes

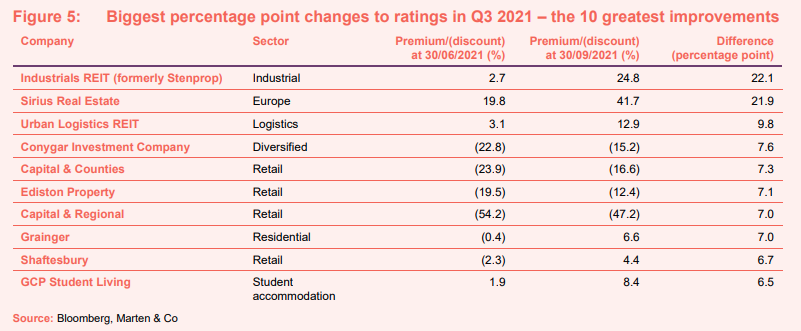

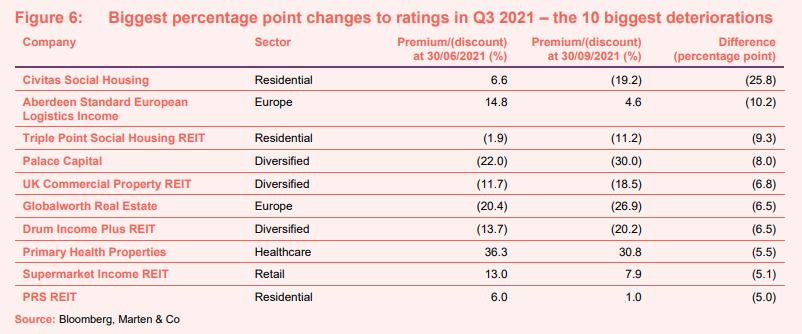

Figures 5 and 6 show how premiums and discounts have moved over the course of the quarter.

The top three positive rating changes were discussed in the previous section. Covent Garden landlord Capital & Counties saw its discount to net asset value (NAV) narrow to 16.6% in the quarter due to a combination of a slight share price rise and a 6.1% fall in NAV. Investors may be taking a long-term view of the strength of London.

That appears to also be the case for Shaftesbury, which owns a large portfolio of shops, restaurants and offices in the West End of London. It published a positive trading update that showed life was returning to the West End with a recovery in footfall and trading.

The growth in online retailing that has benefited the logistics property sector is also a structural driver for retail parks that enable omnichannel retailing. In recognition of this Ediston Property, which owns a portfolio of retail parks, saw its discount narrow during the quarter to 12.4%.

Aberdeen Standard European Logistics Income saw its premium rating narrow after it launched a rights issue, raising £125m (more information on page 7). The right-to-buy one new share for every four already held knocked ASLI’s share price in the quarter.

Major corporate activity

Fund raises

Just under £1.5bn was raised in the third quarter of 2021, as investors flocked to specialist property companies with the re-opening of the economy bringing confidence to markets. This compares to a subdued first half of the year in which around £850m was raised.

Home REIT led the way, raising £350m in a significantly oversubscribed issue, substantially exceeding its target of £262m.

Tritax Big Box REIT raised £300m in a placing of shares, while its European-focused sister fund Tritax EuroBox raised £213m (€250m), far exceeding its £170m target.

Aberdeen Standard European Logistics Income raised £125m, which will be deployed into an identified pipeline of European logistics assets.

Private rented sector (PRS) specialist Grainger will use the proceeds of its £209m raise to grow its portfolio of 10,000 homes, while PRS REIT fell short of its £75m target with a £55.6m placing.

Target Healthcare REIT raised £125m through an oversubscribed issue. The investment manager has a pipeline of acquisition opportunities worth £230m.

Urban Logistics REIT raised £108.3m, including £6.2m through PrimaryBid, as it continues to grow its portfolio.

Two proposed initial public offerings (IPOs) failed to get away during the quarter. Firstly, UK Residential REIT failed to raise its target £150m after announcing its intention to float at the beginning of June. Meanwhile, the proposed £250m float of a new social housing company, Responsible Housing REIT, has been postponed.

Mergers and acquisitions

St Modwen Properties, which has a large landbank for industrial and logistics development, was taken private by private equity giant Blackstone, which acquired the company for £1.272bn. The price represented a 21.1% premium to its EPRA net tangible asset (NTA) value.

GCP Student Living received a takeover bid from Scape Living (funded by APG – a current shareholder) and iQ (funded by Blackstone) valuing the company at £969m. The bid price was a 30.7% premium to its 1 July share price and a 19.1% premium to its 31 March 2021 EPRA net tangible asset value.

Custodian REIT and Drum Income Plus REIT agreed terms on an all-share acquisition of Drum by Custodian. The offer was at a ratio of 0.530 Custodian shares for each Drum share, valuing the company at £21.4m.

LXI REIT held what it called “very preliminary discussions” with Secure Income REIT over a possible £3bn merger of the two funds, but said it was “no longer reviewing this opportunity”.

Other major corporate activity

Stenprop changed its name to Industrials REIT, with a new ticker of MLI. Multi-let industrial (MLI) assets now comprise 92% of its total portfolio, and the group is on course to be a 100% MLI business by March 2022.

SEGRO launched a ten-year, €500m senior unsecured green bond issue. The bonds were priced at 55 basis points above euro mid-swaps and have an annual coupon of 0.5%. The proceeds will be used to finance and/or refinance eligible green projects.

Unite signed a £450m sustainability-linked unsecured revolving credit facility (RCF) with HSBC, NatWest and Royal Bank of Canada. The facility has an initial term of three and a half years, which may be extended by a maximum of a further two years. The RCF is fully available for general corporate purposes and is an amendment and extension of the group’s existing bank debt facilities, which were due to mature in November 2022. The refinancing extends the group’s earliest debt maturity to 2025 and increases its weighted average debt maturity to 5.0 years.

Triple Point Social Housing REIT put in place £195m of sustainability-linked loan notes through a private placement with MetLife Investment Management and Barings. The loan notes have an average term of 13 years and a fixed rated coupon of 2.634%. Triple Point will use some of the proceeds to refinance an existing revolving credit facility. The group has also been assigned an investment grade rating by Fitch.

Assura cut the size of its revolving credit facility from £225m to £125m. Its A-credit rating allows it to borrow at more attractive rates.

Major news stories

- Civitas Social Housing was targeted by short-seller ShadowFall, which criticised the company for conflict-of-interest issues in a small number of transactions. Civitas’s board said the criticism was based on “factual inaccuracies”.

- Standard Life Investments Property Income Trust acquired 1,447 hectares of upland rough grazing and open moorland in the Cairngorm national park for £7.5m, where around 1.5 million trees will be planted to offset carbon emissions from its portfolio, in a first for the property sector.

- Urban Logistics REIT deployed £88m of the £109m it raised in July in six off-market transactions. At a blended net initial yield of 5.4%, the assets are made up of a combination of income producing assets and forward funding commitments.

- BMO Commercial Property Trust sold its second largest holding – Cassini House, in St. James’, London – for £145.5m, 11% more than the last external valuation of 30 June 2021.

- Tritax EuroBox entered into the forward funding of a 13,181 sqm logistics facility near Stockholm, Sweden, for €27.9m. The deal marks the company’s second acquisition in Sweden.

- Regional REIT acquired a portfolio of 31 multi-let offices for £236m as part of its new investment strategy solely focused on UK offices. The vendor, Squarestone Growth, will received £83.1m in shares in Regional REIT, with £76.7m being paid out of cash resources and £76.2m in new borrowings.

- Derwent London announced three off-market transactions comprising the acquisitions of 250 Euston Road for £189.9m and 171-174 Tottenham Court Road for £24.7m and the formation of a 50:50 joint venture with Lazari Investments, which is expected to acquire three properties in Baker Street. All have future redevelopment opportunities.

- Industrials REIT made significant progress in its strategy to become a 100% UK multi-let industrial (MLI) business with the sale of Trafalgar Court, a Guernsey office building. MLI now makes up 92% of the portfolio by value.

- NewRiver REIT sold its pub business, Hawthorn Leisure REIT, to Admiral Taverns for £222.3m. It used the proceeds to strengthen its balance sheet and reduce its loan to value (LTV) to below 40%.

- British Land acquired a retail park in Thurrock for £82m and plans to redevelop it into an urban logistics scheme. The company has turned its hand to logistics development to take advantage of the favourable demand-supply characteristics.

Selected QuotedData views

- Harworth-y plan

- Carbon kings

- Contrarian view worth backing?

- More property companies in crosshairs of private equity

Real estate research notes

Aberdeen Standard European Logistics Income – Handbrake off in growth drive

Urban Logistics REIT – Shed load of growth to come

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.