Real estate quarterly report

Kindly sponsored by abrdn

Headwinds mount up

The headwinds facing commercial real estate continued to mount up in the first quarter of 2023, reflected in an 8.9% average share price fall across the sector. Already reeling from the impact of higher interest rates on valuations, the collapse of Silicon Valley Bank in early March heightened fears of loan defaults in the commercial property sector (as shown in the figure to the right).

Most of the UK listed real estate companies have conservative debt structures, meaning they can withstand substantial valuation declines and comfortably meet loan to value covenants. The worry for some, however, is the terms of impending refinancing events. With interest rate expectations having stabilised, despite stubborn inflation in the UK, further property investment yield expansion should be minimal following one of the largest quarterly valuation declines ever recorded in the final three months of 2022. Of course, a rise in defaults and forced sellers across the wider market would put an extra strain on values.

Wide discounts across the sector persist and raise the prospect of further merger and acquisition (M&A) activity. Post-quarter end, Industrials REIT was the subject of a take-private offer at a whopping 42% premium to its share price. Meanwhile, the £3.5bn merger of Capital & Counties and Shaftesbury completed in March.

Performance data

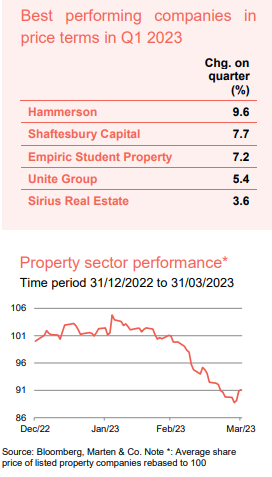

Best performing property companies

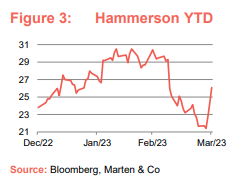

Shopping centre giant Hammerson topped the charts with the largest share price gain during the first quarter of 2023, although much of its share price bounce was lost in the month of March, where – despite a late rally – it fell 14.2%

Shaftesbury Capital was born out of the £3.5bn merger between Capital & Counties and Shaftesbury, which completed in March. Much of the shareholder positivity in the lead up to the merger was lost in the March sell-off, however, with the share price dropping 9.3% in the month.

Student accommodation operators Unite and Empiric Student Property have both reported encouraging updates on demand and rental growth across their respective portfolios, which has been reflected in their share prices over the quarter.

Retail parks landlord Ediston Property Investment Company saw a small jump in its share price during the quarter. This was before it announced in early April that it was to undergo a corporate review, which could result in the sale or merger of the company, having become frustrated with its persistently wide discount to NAV.

London office developer and landlord Great Portland Estates, which had performed strongly in 2022 with a record year for lettings activity, was also a positive mover in the quarter.

Worst performing companies

The two social housing specialists Triple Point Social Housing REIT and Civitas Social Housing saw substantial falls in their share prices in the quarter, with investor sentiment towards the sector seemingly impacted by the misconduct and misgivings over Home REIT. This was despite Triple Point demonstrating the resilience of the sector and the benefits of its inflation-linked income in reporting a valuation uplift in 2022.

The share price of Berlin residential landlord Phoenix Spree Deutschland tumbled in March after it suspended its dividend, due to the slowdown in the investment market impacted condominium sales.

Residential Secure Income, which owns a portfolio of retirement living and shared ownership homes, saw its share price drop 24.5% after announcing that its NAV fell 11.1% over the final quarter of 2022.

Significant rating changes

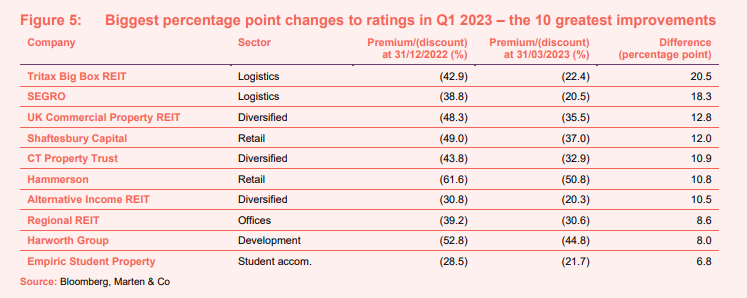

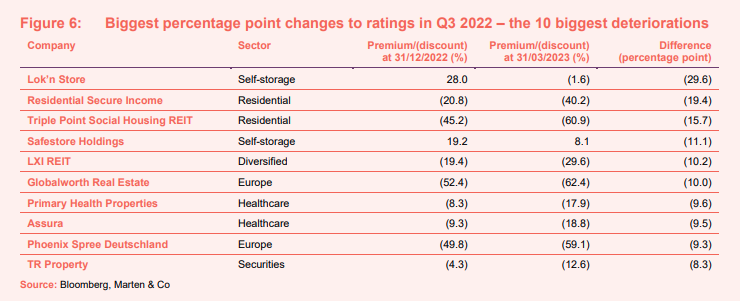

Discounts to NAV in the property sector remain some of the widest in the investment trust world. Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

Large NAV falls reported by property companies for the second half of 2022, following sharp interest rate rises, saw discounts narrow during the quarter. This was especially the case for logistics-focused companies that have posted some of the largest valuation declines, with investment yields moving out furthest from all-time low levels. The share prices of both Tritax Big Box REIT and SEGRO are still trading on 20%-plus discounts to NAV, however.

The so-called generalist REITs, which own diverse portfolios, also saw their discounts narrow considerably during the quarter as NAVs fell. Those with a greater exposure to the industrial and logistics sector, such as UK Commercial Property REIT, CT Property Trust and Alternative Income REIT, were most affected.

Some of the funds mentioned in the biggest discount deteriorations during the quarter were covered earlier. Self-storage operators Lok’n Store and Safestore Holdings suffered two of the biggest discount declines, for differing reasons. Lok’n Store saw its share price fall 23.2% over the quarter, while Safestore reported a large uplift in NAV. The listed self-storage players, which also includes Big Yellow Group, had been trading at substantial premiums for the past few years due to the favourable supply-demand fundamentals of the sector. Perhaps due to an expected drop in house moves due to the affordability of mortgages, these premiums have been eroded, with Lok’n Store falling to a discount.

The primary healthcare specialists Primary Health Properties and Assura saw their discounts widen over the quarter having suffered a 8.7% and 10.4% fall in share price respectively.

Major corporate activity

Fundraises

Unsurprisingly, there was no fundraising activity in the quarter as market conditions continue to dictate sentiment.

Mergers and acquisitions

The merger of Shaftesbury and Capital & Counties Properties completed in March after being cleared by the Competitions and Markets Authority (CMA), creating a £3.5bn company – named Shaftesbury Capital (SHC). The combined company has a substantial portfolio in the West End of London worth around £5bn across Covent Garden, Carnaby, Chinatown and Soho.

The board of Ediston Property Investment Company launched a strategic review into the future of the company having been severely impacted in its ability to grow by a persistent wide discount to NAV. The board said its preferred outcome was a merger with one or more REITs, but the strategic review could also result in the sale of the company.

Other major corporate activity

Embattled Home REIT received unsolicited interest from Bluestar Group Limited – regarding a possible offer for the company – and RM Funds which indicated an interest in taking on the management contract. The board said that it was considering all strategic options for the company including the possible sale after its rent collection rate tanked at the end of 2022. Bluestar was founded by Ben Gotlieb a former employee of Alvarium Investments, Home REIT’s former manager.

Circle Property started the process of de-listing its shares from AIM, having gained shareholder approval at an Extraordinary General Meeting in March. It is in the process of selling its last remaining asset and will return all sales proceeds to shareholders through B share issues.

Regional REIT’s manager, London and Scottish Property Investment Management, was acquired by ARA Asset Management. The board says that there will be no disruption to the services provided to Regional REIT and adds that it believes the transaction will enhance the overall strength and capabilities of the asset manager.

Dolphin Capital Investors terminated the investment management agreement with Dolphin Capital Partners (DCP) after discovering it had “entered into an undisclosed option agreement with the purchaser of the Amanzoe resort in Greece at the same time that the company sold its interest in the resort” (in August 2018). The undisclosed option agreement entitled DCP to acquire an additional 15% of the special purpose vehicle (SPV) holding the Amanzoe resort, further to a separate agreement for DCP to acquire 15% of the SPV that had been disclosed. The company said that it was seeking to recover the value arising from the undisclosed option agreement, which could be material. Miltos Kambourides, the co-founder and managing partner of DCP, was also removed from the board. The directors intend to self-manage its assets.

Land Securities launched a £400m Green Bond with a maturity of 9.5 years, paying a coupon of 4.875%. The transaction would help the company to deliver its pipeline of central London development opportunities.

LXI REIT secured a new £150m 16-year, interest-only term loan signed with a leading insurance company. The new facility carries a margin of 1.75% per annum plus the prevailing UK Treasury 2039 Gilt rate and is secured against a ring-fenced pool of assets. The company has also agreed a short-term extension of its existing £60m loan with HSBC, which now matures in December 2024, with a further six-month extension option. The facility now carries a margin of 2.05% per annum above SONIA.

Workspace Group’s chairman Stephen Hubbard will step down on 6 July 2023 after serving nine years on the board. Duncan Owen will succeed him as chairman and chair of the company’s nominations committee from that date. Owen, formerly global head of real estate at Schroders plc, joined the board as a non-executive director on 22 July 2021, with his appointment forming part of the company’s long term succession planning.

Land Securities appointed Sir Ian Cheshire as an independent non-executive director and chair designate. Sir Ian will join the board on 23 March 2023 and will succeed Cressida Hogg as chair on 16 May 2023, when she retires after almost five years as chair and over nine years on the board. Sir Ian is currently chair of Channel 4, Spire Healthcare Group Plc, UK investment trust Menhaden Resource Efficiency Plc and serves as non-executive director at BT Group Plc. He will step down as chair (but remain as non-executive director) at Menhaden Resource Efficiency Plc on 16 May 2023 and retire from BT Group Plc at their AGM in July 2023 to ensure he has sufficient capacity to act as chair of Land Securities.

Major news stories

- Supermarket Income REIT completed the sale of its interest in a portfolio of Sainsbury’s-let supermarkets for £430.9m. Sainsbury’s acquired 21 of the 26 stores and entered into new 15-year leases on four of the five remaining stores (which SUPR has an option to acquire for £28.3m). The one remaining store is to be sold at vacant possession value.

- Helical was selected as the preferred investment partner by Transport for London for the development of its commercial office portfolio above three central London tube stations – Bank, Paddington and Southwark.

- Tritax Big Box REIT exchanged contracts for the sale of three investment assets for a total of £125m, in line with the 31 December 2022 valuations and reflecting a blended net initial yield of 4.6%.

- Land Securities secured 100% ownership of St David’s shopping centre, Cardiff, with the purchase of the debt secured against the 50% share of the asset previously owned by intu plc. Comprising separate transactions with two debt holders, the overall purchase price represented a “meaningful discount” to the £113m September 2022 book value of Landsec’s existing 50% share of the centre, and a net initial yield of 9.7%.

- Great Portland Estates completed the sale of 50 Finsbury Square, EC2 (its first net zero carbon development) for £190m, reflecting a net initial yield of 3.85%. The company recently completed development of the building and fully let it to Inmarsat Global Limited.

- Derwent London pre-let 106,100 sq ft of office space at 25 Baker Street to PIMCO worth £11.0m a year on a 15-year lease with no breaks. It also let 31,100 sq ft at The Featherstone Building to Buro Happold at a rent of £2.3m a year, also on a 15-year lease with a break a year 10.

- Triple Point Social Housing REIT will voluntarily implement a 7% cap on its inflation-linked rental uplifts this year. The temporary one-year cap will allow for material rental growth whilst ensuring that the group’s rent increases remain sustainable and in line with wider social housing sector policy, it said.

- Grit Real Estate Income Group has sold a 17.32% stake in BHI, a hospitality company that owns three hotels in Mauritius, for €14.5m. It also announced the potential further exit by Grit of its remaining 27.1% interest in the company.

- UK Commercial Property REIT secured new leases on 116,200 sq ft of space at Ventura Park industrial estate in Radlett, Hertfordshire. Location Collective, the UK’s third largest film studio operator, took 86,000 sq ft on a 15-year lease and Aerospace Reliance, a global supplier of aircraft maintenance materials, took 32,000 sq ft of space on a 10-year lease.

- Urban Logistics REIT acquired five new assets for a total of £48m at a net initial yield of 6.0%. It bought a portfolio of four assets for £39.5m and a separate asset for £8.7m. All of the assets are income producing but with short- or medium-term asset management opportunities.

Selected QuotedData views

Real estate research notes

Lar España Real Estate – Dominant assets make a resilient business

Civitas Social Housing – Time to buy?

abrdn European Logistics Income – Negotiating choppy waters

Grit Real Estate Income Group – Going for growth

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.