Real Estate Roundup

Kindly sponsored by abrdn

Performance data

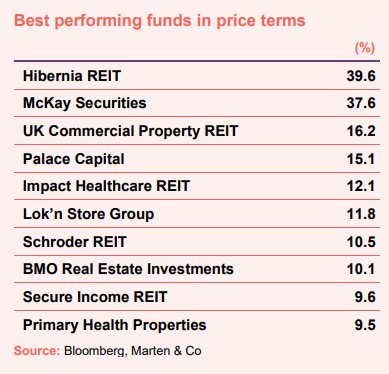

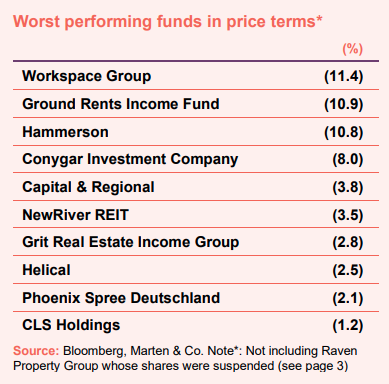

March’s biggest movers in price terms are shown in the charts below.

Property stocks generally rallied in March, perhaps due to the relative inflation hedge they can provide. There were two outliers in Dublin office specialist Hibernia REIT and small-cap South East of England landlord McKay Securities (more detail below). Both received bids for the companies at substantial premiums to their prevailing share price. It has been a common theme over the past two years of investors taking advantage of persistent and unfairly wide discounts to NAV that some property stocks trade on. Of the rest, FTSE 250 constituent UK Commercial Property REIT saw the largest share price gain in the month, jumping 16.2%. The group is still trading on a double-digit discount, however. Palace Capital’s share price rose 15.1% after exceeding its £30m disposal target, which puts the company on firm footing for growth. Diversified funds Schroder REIT and BMO Real Estate Investments both reported strong NAV growth (see below) and were rewarded with share price gains. Again, both are still trading on wide discounts, however. Secure Income REIT revealed a strong bounce back in the performance of its healthcare, leisure and hotel portfolio in positive full year results for 2021.

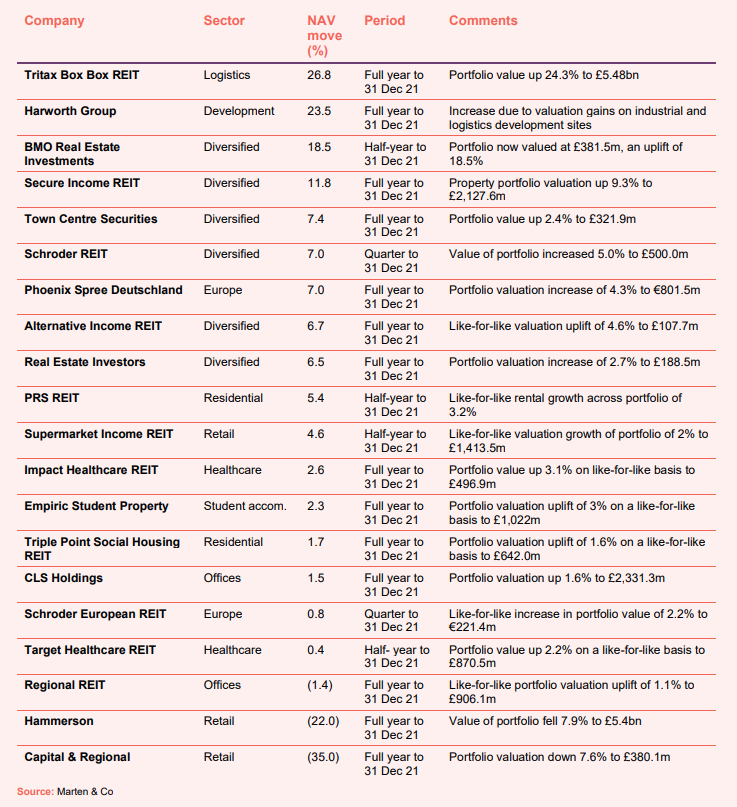

Workspace Group, the bidder for McKay Securities, saw its share price fall 11.4% following the announcement of the offer, perhaps reflecting shareholder appetite for the deal. Due to the structure of the offer, which will be part funded by the issue of new Workspace shares, the bid price for McKay has also fallen. Retail landlord Hammerson saw a double-digit fall in its share price after posting a sizable fall in NAV in annual results (see below). It was the same story for secondary shopping centre owner Capital & Regional, although its share price fell just 3.8% in the month despite reporting a 35% fall in NAV. Investor sentiment for retail-focused property companies has been hit further by the growing cost of living crisis and impact on consumer disposal income. NewRiver REIT seems to be a victim of this. Berlin residential landlord Phoenix Spree Deutschland saw a small fall in share price despite reporting a 7% uplift in NAV, as the potential for future regulation on the Berlin rental market weighs. Office specialists Helical and CLS Holdings both suffered share price losses during March as the future demand for office space continues to be questioned by working-from-home and hybrid working trends.

Valuation moves

Corporate activity

Hibernia REIT agreed a deal with Brookfield on the sale of the business for around €1.089bn. Under the terms, shareholders would receive €1.634 per share – made up of €1.60 per Hibernia REIT share and a 3.4 cent dividend. The offer price, excluding the dividend, represents a 35.6% premium to its share price and a 7.6% discount to NAV.

McKay Securities received a bid for the company by Workspace Group valuing it at around £272m. Under the terms of the acquisition, each McKay shareholder will be entitled to receive 209 pence per share in cash and 0.115 new Workspace shares. Later in the month McKay received an approach from Slate Asset Management L.P. over a possible offer. Slate has until 20 April to either announce a firm intention to make an offer or walk away.

Raven Property Group, the owner of warehouses in Russia, proposed a de-listing of its shares after the war in Ukraine and subsequent sanctions on Russia. It will sell its Russian business to Prestino Investments Ltd, which is to be owned and controlled by Raven’s Russian management team. Raven will retain an economic interest in the company via existing unsecured loans of £41m and Rub1.1bn and non-voting preference shares of £678m.

SEGRO launched a €1.15bn senior unsecured Green Bond issue. It is split into two tranches: €650m with a four-year term with an annual coupon of 1.25%; and €500m with an eight-year term with an annual coupon of 1.875%.

Life Science REIT secured its first debt facility, £150m with HSBC UK Bank, comprising a £75m three-year term loan facility and an equally sized revolving credit facility. It has an interest rate of 225 basis points over SONIA, which is currently equivalent to a total cost of 2.9%.

Picton Property increased and extended one of its long-term debt facilities. It has restructured an £80m facility, securing an extra £49m of borrowings, increasing it to £129m. The expanded facility has a fixed rate of 3.25% and matures in July 2031.

Major news stories

- Urban Logistics REIT buys first London asset in £72m acquisition spree

Urban Logistics REIT acquired four new assets for £72m, including its first central London property, at a blended net initial yield of 4.6%. It has now deployed £140m of capital since its December 2021 £250m fund raise.

- British Land sells stake in Canada Water for £290m

British Land sold 50% of its stake in the Canada Water Masterplan to AustralianSuper for £290m. Following completion of the sale, the two companies will form a 50:50 joint venture to accelerate the delivery of the 53-acre development, which is one of the largest London regeneration projects in history.

- Unite sells digs portfolio for £306m

Unite Students has sold a portfolio of 11 properties, comprising 4,488 beds, to an affiliate of Lone Star Funds for £306m (Unite share £236m). The disposals are priced in line with prevailing book value, which reflects a yield of 5.7%.

- Great Portland Estates buys Crossrail refurb opportunity

Great Portland Estates acquired 7/15 Gresse Street and 12/13 Rathbone Place for £36.5m and plans to refurbish the asset to create flexible office space. The building is located close to the Elizabeth Line station at Tottenham Court Road.

- Warehouse REIT to forward-fund industrial development

Warehouse REIT acquired, via a forward funding agreement, a 170,000 sq ft multi-let industrial development in Thame, Oxfordshire, for £35m. The scheme has secured planning permission and is scheduled to complete in December 2022.

- Tritax EuroBox to fund spec scheme in Germany

Tritax EuroBox will forward fund the development of a logistics warehouse near Düsseldorf, Germany, on a speculative basis for €76.4m. The asset, currently being constructed by the company’s development partner Dietz, will comprise three adjacent units with a total gross internal area of 36,437 sqm.

- CLS acquires Dortmund office for €66.25m

CLS Holdings acquired a 23,982 sqm office building in Dortmund for €66.25m. The property has a net initial yield of 5.1% and a reversionary yield of 5.6%. The acquisition is expected to complete in April 2022.

- Palace Capital exceeds disposal target

Palace Capital completed the sale of an office building in Brighton, bringing the total proceeds from its £30m disposal programme to £31.5m – 20% above the aggregate book value and 12% ahead of the original purchase prices paid plus any capital expenditure. The proceeds will be used to reduce debt and fund new acquisitions.

- Impact Healthcare REIT adds two more care homes to portfolio

Impact Healthcare REIT acquired two care homes in Mansfield, Nottinghamshire, comprising 107 beds, for £11.1m. Welford Healthcare will sign new 30-year leases at the properties.

- Grit Real Estate completes Kenyan warehouse deal

Grit Real Estate Income Group has completed the acquisition of the Orbit Africa warehouse asset in Nairobi, Kenya, in a $53.6m sale-and-leaseback transaction. It will redevelop and expand the warehousing and manufacturing facility for Orbit Products Africa Limited.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Offices

Fredrik Widlund, chief executive:

Much has been written, and continues to be written, about the future of the office and whilst a definitive conclusion has yet to be reached, trends are starting to emerge.

A 2021 Knight Frank survey showed 30% of corporates anticipated growing their total space in the next three years, 35% anticipated it staying the same, and 35% foresaw a decrease in space occupied. This balanced picture feels about right, but as work from home and other restrictions have persisted, the attractions of offices in surveys continues to increase.

Perhaps more important is the supply side of the debate. The importance of sustainability amongst investors and occupiers is increasing. Many existing offices will become obsolete, as it is uneconomic to upgrade them to meet rising environmental standards or will be converted to other uses. The pandemic has also reduced the amount of construction of new offices. This will be exacerbated if other cities follow the lead of the City of London in favouring refurbishment over redevelopment – which clearly supports CLS’ business model. And finally, Google in acquiring its office in Kings Cross highlighted the importance of de-intensifying space. This reduction in density, creates more space per worker and will further limit supply, ultimately creating additional demand.

Overall, what appears to be clear is that hybrid working is here to stay and offices need to be attractive and sustainable, and offer better amenities. For CLS and our tenant-focused strategy, this simply reinforces our belief in ensuring we have the right offices which offer Location, Quality and Flexibility.

Stephen Inglis, investment manager:

Savills research highlights that investor sentiment in the regional office market improved throughout 2021. Regional office investment totalled £7.2bn in 2021, marginally above the five-year average. Investment in office parks in 2021 reached £2.8bn, the highest level reported since 2017, and 31.6% above the five-year average. Optimism in the regional office market has been supported by strong employment growth. The most recent data from the ONS shows that the UK employment rate rose to 75.5% in the three months to November 2021, up from 74.9% for the same period in 2020. Strong employment rates and encouraging levels of recruitment are positive indicators for occupational demand.

The asset manager’s strong opinion is that the office will continue to play a vital role in working life regardless of whether hybrid or more traditional working practices are adopted. It is their opinion that many occupiers will require more office accommodation in future due to both employment growth and the improvement in the working environment by employers including de-densification.

Retail

Nick Hewson, chairman:

We are now operating in a highly inflationary environment, making our secure, upward only, inflation-linked rental reviews an ever more appealing source of inflation protected income. Given the high degree of correlation between inflation and food prices and the level of investor appetite in the sector, we believe we will see continued progressive growth in both supermarket rents and capital values.

Whilst we remain mindful of the uncertain political and macro-economic outlook and the ongoing economic risks of rising inflation and higher interest rates, we nevertheless feel well positioned for the future given the strengths of our chosen sector and the resilience of our income profile.

Through our deep sector expertise and strong relationships with both our tenants and the investment market within which we operate, we have built a leading portfolio in one of the most compelling real estate asset classes in the UK investment market. We are delighted to now be a Premium Segment listed company with an Investment Grade credit rating.

Rita-Rose Gagné, chief executive:

The major changes across the consumer and occupier landscape mean it is an exciting time to be in real estate. We are anticipating and starting to set new trends in how physical space is used in Europe’s major cities within our portfolio. Hammerson has a unique opportunity to be part of shaping future cities and transforming urban spaces.

We have developed a robust strategy to take advantage of future opportunities. We will further strengthen the balance sheet by continuing to simplify the portfolio, as well as generating capital for reinvestment. We are focused on: reducing vacancy and void costs; repurposing space; delivering a mix that occupiers and customers demand; and unlocking value from the development opportunities in the portfolio. By continuing to execute our strategy, we will continue to build a better business, and that will deliver value for shareholders.

Logistics

Aubrey Adams, chairman:

Our market has powerful, long-term structural growth drivers which have been accelerated by the global pandemic and other factors, such as Brexit. These include the continued growth in e-commerce, the consolidation of logistics networks into fewer, larger, more modern and efficient buildings, the need to build resilience into supply chains and the increasing focus on ESG. This includes the socio-economic benefits of our schemes, as well as environmental considerations, including our proactive work towards net zero carbon.

Record occupational demand and severely constrained supply is leading to very strong rental growth, which we are capturing through proactive asset management, lease re-negotiations, rent reviews and bringing forward activity within our extensive development portfolio. Attractive rental growth is also underpinning confidence in the investment market, with sharpening yields producing improved capital values.

Diversified

M7 Real Estate, investment adviser:

Although the UK isn’t in the clear with regards to the COVID-19 pandemic, progress has been made and people are moving forward with a renewed sense of optimism. An improving economy and the labour market holding stable following the removal of the furlough scheme provide a generally positive backdrop for real estate in 2022.

Whilst there is a general positivity around real estate in 2022, following the easing of COVID-19 related lockdown measures, sectors such as industrial are assumed to continue to thrive, which will benefit the group’s industrial exposure. It is expected that the rental growth experienced in recent years will continue into 2022, with speculative development at an all-time high, but insufficient to meet the current demand, causing vacancy rates to remain low and created upward pressure on rents. Additionally, retail is expected to recover during 2022, driven by a pick-up in spend in 2022 leading to increased occupier demand. Retail warehousing and parks are expected to continue to be the strongest performers during 2022.

Hotel revenues are expected to recover during 2022, driven by increases in international travel and the removal of national lockdown restrictions. Increased investor appetite will support recovery in asset values and liquidity. Healthcare was another sector that struggled during 2022, however, CBRE expect the market to recover to pre-pandemic levels, boosting investor confidence and leading to prime yields of 4.5%. Furthermore, they are anticipating record M&A activity in the leisure industry during 2022, because of investors looking to capitalise on operational risk with the market.

Student housing is another sector in which the group has a large exposure. At the end of 2021, it was reported that 2021 saw significant confidence return to the UK’s purpose build student accommodation sector with over £2.5bn invested and companies, such as Unite, reporting occupancy figures of 94%.

2021 saw an emphasis placed on the importance of ESG related credentials. Normally associated with sustainability, and gaining in prominence, ESG is a growing and has quickly become an ethical priority for businesses, both large and small. It is becoming a central aspect of how businesses define themselves. This is having significant impacts on the occupational market with perspective tenants taking ESG values into account when considering their next office, making ESG related credentials a key selling point.

Martin Moore, chairman:

The trading outlook for our tenants has brightened as the Omicron wave fades and the government has signalled its clear intent for the country to learn to live with the residual impact of the pandemic without restrictions. This has been welcomed by the leisure and hospitality sector and bodes well for a resumption of the strong bounce back in trading we saw in the late summer and autumn of 2021.

The rise in inflation is a genuine concern for many, but our index-linked leases should provide both an element of protection and a stronger rental trajectory than in recent years. Across the real estate sector, the majority of inflation-linked leases contain caps and our portfolio is no exception, albeit 27% of our reviews are uncapped. Whether inflation proves to be transitionary or embedded we do anticipate that inflation rates are likely to average out below our caps over the medium term. After a generation of falling rates the interest rate cycle has finally turned. Interest rates and property yields have historically shown limited correlation and if the current gilt curve is any guide the implied future interest rate rises are modest by historic standards and in our view unlikely to have much, if any, impact on property yields. Availability of debt, in our experience, usually has a bigger impact than its absolute pricing and we take comfort in the current balance sheet strength of the banking system and widening availability of debt from other sources. The government’s proposed reform of Solvency II could unleash billions of pounds of life assurance money, some of which is likely to be funnelled either into providing debt or direct demand for long lease index-linked property.

Sadly, geopolitics is back in centre stage with the tragic events unfolding in Ukraine. This may amplify some of the short-term inflationary dynamics but also encourage central banks to behave less precipitously in their interest rate moves. It may also lead to greater risk aversion by investors and an increase in demand for safe haven assets. When the outlook is far from clear we find it helpful to focus on those elements upon which we hold the highest conviction. Our rents have not only resumed their pre-pandemic path but the trajectory is now higher than it was due to rising inflation. At 30 years our average lease length is the longest it has ever been. These elements combine to form a strong platform for the year ahead.

Vikram Lall, chairman:

Economic performance in 2022 will be more muted with two key markers to watch; one is the speed of further interest rate rises as the Bank of England looks to curb inflationary pressures, having recently raised the rate to 0.75%, the third rate rise in a row. The second is the rate of inflation which is more than 6% for the last 12 months and expected to stay above the Bank of England’s 2% target for some time.

The above is likely to be exacerbated by the tragic events in Ukraine, following the Russian invasion. The situation is fast moving and unpredictable; however, the introduction of sanctions on Russia is leading to an increase in energy and food prices. This will push up inflation and is expected to be followed by a period of sustained high price rises and weakening growth prospects.

This economic uncertainty will impact the UK real estate market although the extent of this is not yet clear. In the short term, the industrial sector looks set to continue to benefit from the shift of traditional retail to e-commerce, which has seen vacancy rates in the sector fall to an all-time low. With the supply pipeline still constrained, we are likely to see continued income growth from this segment through 2022 and beyond. Opportunistic investors are seeing value in a stabilisation of the retail sector, development funding in the hospitality sector is showing green shoots of recovery, while a reversal of the work from home guidance is seeing the reoccupation of office buildings and providing a much-needed boost to city centres.

Student accommodation

Mark Pain, chairman:

In 2021, the PBSA sector rebounded from the COVID-19 pandemic in a buoyant fashion, driven by the underlying growth in the UK’s full-time student population. Confidence is returning to the market following reduced low occupancy rates in 2020/21 as learning shifted online and restrictions on travel were implemented due to COVID-19. International mobility has been impacted by the pandemic, but the PBSA sector has remained much more resilient than analysts had initially projected. Domestic students partially filled the void left by international students, while in some markets, certain groups of international students rose to boost overall occupancy rates.

Remote study has worked for many students, although it is a weak substitute for on-campus tuition and the holistic student experience. As a result, PBSA occupancy rates recovered considerably in 2021 as restrictions gradually lifted. At the end of Q3 2021, JLL reported that 90% of beds were leased for the 2021/22 academic year, compared with 83% for the comparative period in 2020/21.

In the year to September 2021, the CBRE PBSA Index reported total returns of 7.7% for the 250 assets in the index, 2.8% higher than in 2020. Capital value growth for PBSA assets recovered from -0.4% in the year to September 2020 to 2.2% in 2021. Notably, capital growth in Super Prime Regional markets grew from 0.3% in the year to September 2020 to 4.7% in the same period to September 2021. The performance gap between the regional markets (Super Prime and Prime) and Central London narrowed. Assets in the capital achieved total returns that were 0.3% higher than those in the regions, a fall from the 2-4% outperformance seen over the previous four years, mainly due to falling net income return for London assets. Assets in Secondary locations saw capital values fall again in 2021, but not as dramatically as in 2020. The Empiric portfolio is well aligned to the best-performing locations with 92% by value classified as either London, Super Prime Regional or Prime Regional in the December 2021 portfolio valuation, compared with 86% in December 2020.

Healthcare

Target Fund Managers, investment manager:

The [care home] sector is in a period of cautious optimism. Residents have remained generally protected and, while we owe a debt to the science of vaccinations in this regard, we should not underestimate how adept care homes have become at testing, safe visiting, and infection control procedures.

After suffering some unwarranted reputational damage in the early stages of the pandemic, public scrutiny of the sector mellowed and helped focus government attention on sector change and funding. The resulting White Paper, while heralded by Government Ministers as ground-breaking, was generally met with disappointment by the sector, with concern that the public funding of those with means is not as generous as first impressions suggest. In fact, the national insurance fuelled tax raise does little for the social care sector, with the lions’ share ending up in the NHS for the first few years.

Eyebrows were raised in the sector by the mention of ‘levelling’ fees, a reference buried in the white paper in relation to the common practice of operators subsidising publicly funded residents by charging private residents higher fees. While the sector rightly feels some consternation regarding this point, the intention to require Local Authorities to address fees paid to private operators in line with the ‘true cost of care’ is a welcome directive. This, coupled with strong demand by clientele for quality accommodation and the fact that residents will still be able to ‘top-up’ to the quality of their choice, means we envisage operators will not be unduly troubled by the potential changes. Other white paper proposals are welcome, such as increased integration between authorities and joined up health pathways for the public.

2022 will remain a challenging year for operators. Even if COVID-19 should fade, or more likely become endemic, the spectre of inflation is firmly on the horizon; wages, energy and food costs, coupled with a continued difficult recruitment environment will keep the pressure on. While the pandemic has been tough on smaller operators, particularly those with older real estate, which will likely speed their demise, a new public focus on the quality of accommodation will support operators such as our own tenants.

Rupert Barclay, chairman:

As we emerge from the pandemic, the long-term investment case for care homes is unchanged. Occupancy is expected to recover while the support from government grant funding falls away. Demographic trends and the rising incidence of specialist needs, such as dementia, will continue to drive demand for care, which will require many new beds, in suitable homes, to be added to the market. The government’s reforms will provide additional funding for the sector and contribute to its resilience.

We have a good level of protection against the current inflationary environment, through the upward-only index-linked rent reviews in our leases. The caps on these rent reviews help to protect our tenants and ensure that rents remain affordable for them in the long term. This is important when tenants are also managing the effect of wage and cost inflation.

Development

Lynda Shillaw, chief executive:

The early months of 2022 have been extraordinary. Against the backdrop of continued strong demand for our products we are seeing rising inflation and interest rates in the UK, and a war in Europe, which has potentially wide-reaching implications in the near term for Western European economies, particular in our energy and some core commodity markets. Our core markets are currently performing well, but are not immune to global supply issues, or any downturn in the economy driven by a combination of global and UK economic factors. Government policy remains focused on driving up regional investment and growth and delivering a more equal balance of economic outcomes and opportunities for UK citizens.

Looking forward, overall commercial property returns are expected to be lower in 2022. The industrial sector is still expected to continue to perform well, driven by a huge weight of capital seeking access to occupiers chasing finite available stock, causing record low void rates. The shortage in supply of new homes seen in 2021 pushed prices higher and this has continued into 2022. Order books and demand for developable land from housebuilders, and rental product from investors, are robust, with prices rising ahead of inflation and cost increases, and the end of the stamp duty holiday having remarkably little impact on buyer demand. The sector does however face some headwinds as interest rates rise, the cladding repair crisis remains unresolved and the sector digests the changes to Building Regulations and the Future Homes Standards pathway.

Residential

Steve Smith, chairman:

The need for high-quality rental homes for families in the UK remains acute while the supply of new homes continues to fall short of both government aspirations and aggregate and increasing demand. The buy-to-let sector, which traditionally provided the bulk of the rental stock in the UK is continuing to see private landlords leave the market, and there have been 180,000 buy-to-let redemptions since 2017. These factors are continuing to create upward pressure on rental demand.

While we are mindful of the current inflationary environment, which is creating a rise in the cost of living for the population, demand for the company’s high-quality family rental homes remains strong and we expect our assets continue to perform well. This is in part a reflection of the affordable nature of our properties and the fact that rising interest rates typically drive an expansion in renting versus home ownership. It also reflects the rental management model, created by Sigma PRS, which aims both to set a higher standard of customer care in the private rented sector than hitherto and to create communities that are attractive to renters generally and families in particular.

These factors are driving performance, and the combination of growing income, rental appreciation and asset value growth are beginning to enhance returns to shareholders. As the Built-to-Rent sector becomes more established and institutionally attractive, we expect to make significant progress.

Real estate research notes

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Tritax EuroBox – Fast-tracked

Urban Logistics REIT – In the sweet spot

Grit Real Estate Income Group – Showing some grit

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.