Real Estate Roundup

Kindly sponsored by abrdn

Performance data

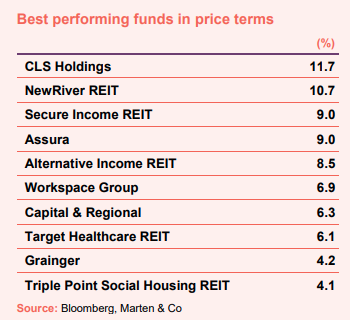

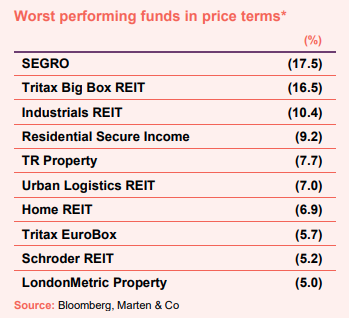

May’s biggest movers in price terms are shown in the charts below.

A perpetual theme in the listed property sector over the last few years has been the persistent discount to net asset value that many companies’ share prices have traded on. Some have succumbed to private buyouts, but office landlord CLS Holdings has taken matters into its own hands and announced a proposed tender offer of its shares if its discount persists (see corporate activity section). Unsurprisingly, its share price reacted with an 11.7% uplift in May, however, its discount still languishes at around 35%. Retail specialist NewRiver REIT continued its share price recovery after it said it had returned to positive capital value growth, suggesting valuations in that sector were stabilising after years of decline. Secure Income REIT’s share price jumped 9.0% on the back of news it had agreed a merger with fellow long-income specialist LXI REIT (see corporate activity section). GP and primary health owner and developer Assura also saw a 9.0% uplift in its share price in May after reporting positive full year results (see valuation moves section). Following the completion of its takeover of McKay Securities (see last month’s property roundup), London flexible office provider Workspace saw its share price bounce 6.9%. Its share price is still down 11.8% in the year to date, however.

May’s share price fallers list is dominated by industrial and logistics specialists. Amazon’s bleak earnings update and admission that its warehouse expansion was over hit the share price of many of the logistics focused property companies. The online retail behemoth had accounted for a quarter of all lettings in the sector in the UK over the past two years. This coupled with an expected squeeze on retail spend and the tight margins involved in online retailing saw investors convey caution towards the sector that has for the past several years seen exponential growth. SEGRO, the largest listed property company, saw 17.5% wiped off its value during the month, while Tritax Big Box REIT was close behind with 16.5%. Both companies are still slightly up over 12 months, however. Tritax’s sister European fund, Tritax EuroBox, also saw its share price fall despite reporting half-year results in which NAV increased by 10.4% (see valuation moves section). Urban Logistics REIT and LondonMetric, which also has a large portfolio focused on the urban located logistics facilities, were also swept up in the logistics property sell-off. Home REIT’s share price suffered despite its substantially oversubscribed equity raised (see corporate activity section), which was executed at a slight discount to its prevailing share price.

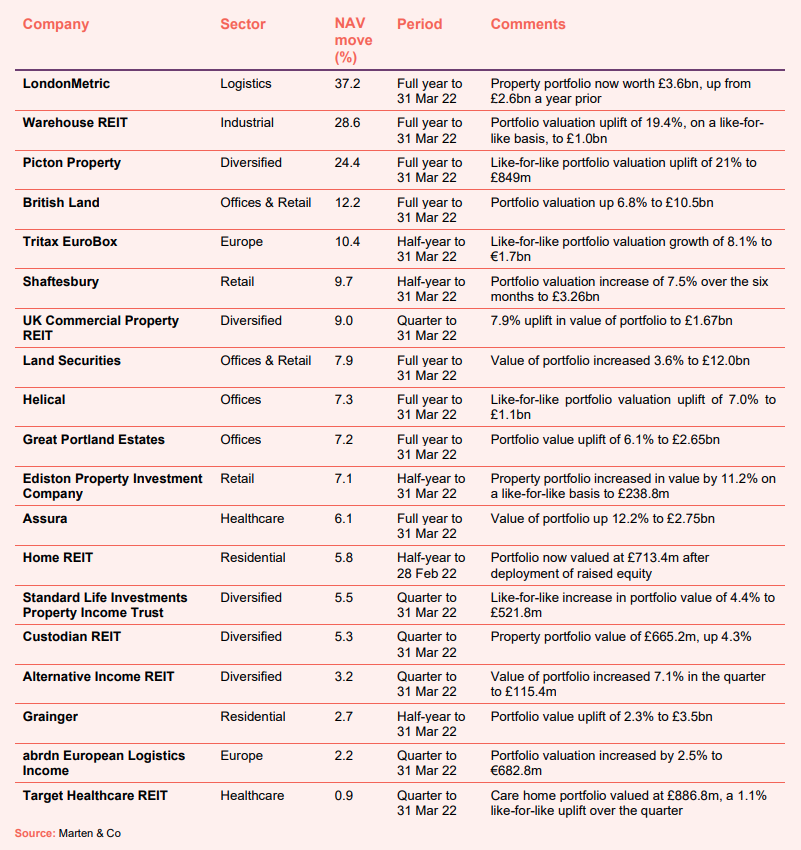

Valuation moves

Corporate activity

Shaftesbury and Capital & Counties Properties confirmed that they are in advanced discussions regarding a possible £3.6bn all-share merger of the two companies. The merger would create a REIT focused on the West End of London with a portfolio of 2.9m sq ft of lettable space across Covent Garden, Carnaby, Chinatown and Soho. Discussions are ongoing and the full terms of a possible merger have not been finalised.

LXI REIT and Secure Income REIT agreed terms on a merger that would see LXI acquire the entire share capital of Secure Income. Under the terms of the merger, each Secure Income shareholder will receive 3.32 new LXI shares per one Secure Income share. The deal would see the combined company have a portfolio worth £3.9bn and net assets of £2.8bn and comes eight months after initial merger talks between the two long income property companies broke down.

Home REIT raised £263m in a significantly oversubscribed placing, smashing its initial target of £150m. The proceeds of the raise will be used to tackle the ongoing critical need for homeless accommodation in the UK, with the company having a £300m acquisition pipeline.

CLS Holdings proposed a tender offer of its shares due to its persistent and unjustified share price discount to net tangible assets. The size of the tender will be scaled to ensure the group’s loan-to-value is within an acceptable level. The terms of tender offer will be announced following the group’s half year results on 10 August 2022.

AEW UK REIT secured a new £60m, five-year term loan facility with AgFe, an independent asset manager specialising in debt-based investments. The loan is fixed with a total interest cost of 2.959%. The group’s existing £54m RBS International loan facility, which is due to mature in October 2023, will be repaid in full by the new loan facility.

Warehouse REIT announced its proposed admission to the premium segment of the main market and cancellation of trading on AIM, which should happen in July. The move should open up its shares to a wider pool of investors and improve their liquidity.

Major news stories

- Life Science REIT fully deployed with £120m Oxford buy

Life Science REIT completed the acquisition of Oxford Technology Park, a 20-acre science and technology park, for £120.3m, meaning it has now fully deployed the proceeds from its IPO in November 2021.

- Derwent buys Moorfields eye hospital for £239m

Derwent London exchanged contracts to acquire the Moorfields Eye Hospital and the UCL Institute of Ophthalmology, for £239m. The site is being sold by Moorfields Eye Hospital NHS Foundation Trust and UCL and is subject to final Treasury approval, which is expected by the end of 2022. Derwent plans to redevelop the 2.5-acre site into a 750,000 sq ft campus.

- Landsec sells Strand office for £195m

Land Securities agreed a deal to sell 32-50 Strand, in London, for £195m, representing a net initial yield of 4.2%, to Sinarmas Land Limited, a real estate company listed on the Singapore Exchange. The disposal is in line with Landsec’s strategy to recycle capital into higher return opportunities.

- Workspace to sell McKay’s industrial portfolio

Workspace will look to sell a light industrial portfolio that was acquired as part of its takeover of McKay Securities earlier in May. It said that it received several unsolicited approaches for the acquisition of the entire portfolio, last valued at £137m at 30 September 2021.

- UK Commercial Property REIT to fund £62.7m Leeds hotel development

UK Commercial Property REIT acquired a hotel development site in Leeds for £62.7m. The group will fund the development of the 305-room hotel, which is scheduled to complete in 2024 and will have a 25-year franchise agreement in place with Hyatt Hotels. The hotel will be operated under a lease by Interstate Hotels & Resorts, with UKCM’s rental income based on the income generated from the operation of the hotel.

- Regional REIT bags trio of offices

Regional REIT acquired three offices in Derby, Milton Keynes and Crawley for a total of £48.2m, reflecting a blended net initial yield of 8.7%, and sold £35.1m of non-core assets as part of its ongoing programme of capital recycling.

- Capital & Regional sells mall

Capital & Regional exchanged contracts to sell The Mall, Blackburn to the retail arm of the Adhan Group of Companies for £40m. This represents a premium to the December 2021 valuation of £38.2m. The proceeds will be used to repay debt secured on the property and will reduce the group’s net loan to value (LTV) ratio by 600 basis points (6%).

- Big Yellow Group sells industrial land

Big Yellow Group sold its industrial warehouse scheme at Harrow, London for £61m. The company expects to deploy £31.5m on developing the industrial scheme (a condition of the sale), including the cost of the land, and will be left with an acre of land on which it is building a new 82,000 sq ft self-storage store which is scheduled to open later this summer.

- Helical sells Manchester office

Helical sold the Trinity office in Manchester to Mayfair Capital for £34.55m, reflecting a net initial yield of 5% and representing a premium to book value.

- Schroder REIT buys Manchester office

Schroder REIT bought St. Ann’s House in Manchester, for £14.7m, reflecting a net initial yield of 7.8% and a reversionary yield of 9.1%. The 51,885 sq ft building is 96% occupied and generates £1.22m of annual rent.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Andrew Jones, chief executive:

We are operating in an ever-changing macro environment. The conflict in Ukraine is adding to the geopolitical uncertainty which, together with the economic impact from a re-opening of the global economy and the lingering effects of Covid-19 lockdowns, has increased the cost of goods and resulted in elevated inflation and a cost-of-living squeeze.

These macro factors are having a profound impact on a real estate market that has already seen a significant acceleration of evolving consumer habits as a result of Covid-19, a number of which were already in the system: increased online shopping, greater convenience, better experiences and increased flexibility from working from home. This has led to a shift in demand and supply dynamics highlighting material polarisation in performances across various real estate subsectors; the gap between the winners and losers remains wide.

Many landlords have emerged from the pandemic realising that their assets are not fit for purpose. They will blame the pandemic for poor performances, dividend cuts, share price collapses and falling rental income, although the truth is that many failed to embrace a rapidly changing world and shift their portfolios to support these emerging trends. A quick look back shows that, as we emerged from the Global Financial Crisis, new structural trends in how we work, shop and interact with our friends and family began to surface, largely driven by the introduction of new technological innovations.

This is evidenced by the enormous rise in online sales penetration, from 9% a decade ago to 19% pre-pandemic and 26% today. This represents an extraordinary acceleration and has meant that growth that was forecast to take five years has taken just two. However, it is unlikely to stop there with some of the strongest retailers seeing significantly higher online sales, including both John Lewis and Next who have reported online sales at around 70% and 65% respectively. Online grocery has also seen a significant rise, from 8% pre-pandemic to 13% today. Again, what was expected to take years has happened in a matter of months.

In all likelihood, this upward trend will be maintained as consumers’ appreciation of online convenience, price transparency and quicker delivery times continues to grow. Demand for warehousing remains both broad and deep with online operations competing with businesses who are reacting to global trade disruptions by onshoring more of their operations and also holding higher inventory levels within the UK. We do believe that peak globalisation may have passed and localisation is emerging. It’s no longer a case of just in time, but now just in case.

Conversely, physical retail assets face significant challenges with reduced demand and over supply as the consumer pivots towards a more omni-channel model, meaning that there are few hiding places for those without an online platform, with too many shops and behind the curve strategies. Department stores and over built shopping centres look particularly vulnerable with prime shopping centres not being the ‘safe haven’ that many management teams thought they would be. The effect has been witnessed in rising vacancies, falling rents, increasing obsolescence and almost universal value destruction.

Commentary from retailers, as well as evidence from property investment transactions, continues to highlight that the pricing power has firmly shifted away from traditional retail owners to the retailers, with rents continuing to fall and valuations continuing to drift downwards. However, there are some bright spots within the retail space with convenience, grocery and discount retailers outperforming as consumer shopping patterns continue to evolve.

In offices, it is hard to ignore that demand is facing structural disruption and continued uncertainty. Working from home during the pandemic has transformed employees’ views on traditional working practices. Despite a strong re-opening and a ‘buzz’ returning to many city centres, there is increased demand from employees for greater flexibility leading to reduced office presence and occupancy settling well below pre-pandemic levels. This is making future office demand and rental growth harder to predict, and at a time when owners are having to retrofit their offices to meet new sustainability requirements.

Whilst the post-pandemic economic recovery is well underway, inflationary pressures arising from current macro events and the reopening of the global economy risk derailing this. We are now faced with constrained supply chains, surging commodity, energy and food prices which are leading to higher interest rates.

Consumers are having to adjust to higher household bills which will likely suppress non-essential expenditure. Experiential shopping increasingly feels like a luxury that few will be able to afford. We believe that all these factors will continue to drive the polarisation in performances across various real estate subsectors with legacy retail assets likely to experience further headwinds. After all, the macro trends accelerated by the pandemic will almost certainly outpace micro decisions.

Retail

Brian Bickell, chief executive:

The continuing strong rebound in the West End economy since the lifting of pandemic restrictions last summer has continued throughout the period. The patient, long-term stewardship of our high profile, centrally located ownerships, and the actions we took to support our occupiers and stakeholders through the long period of pandemic challenges, have underpinned the welcome recovery we are now seeing in key operating metrics, EPRA earnings and net tangible assets.

Although Covid concerns are receding, new challenges are now coming to the fore, both in the UK and in many other economies, exacerbated by macroeconomic and political issues. Whilst London and the West End cannot be completely sheltered from these headwinds, their global status, appeal and broad-based, dynamic economies should provide a considerable degree of protection, which few other locations can match.

With the prospect of an extended period of uninterrupted trading as we enter the important summer season, further enhanced by the improving outlook for international leisure and business travel, the revival in confidence and growth we are now seeing is already providing a firm foundation for the return to long-term prosperity for the West End and our exceptional portfolio.

Ediston Property Investment Company

Calum Bruce, investment manager:

Global supply chain issues, rising inflation and the squeeze on household incomes all pose a risk to the economy and the forecast recovery since the health crisis. Inflation may prove to be less transitory than previously forecast, interest rates could increase further by the end of 2022 and consumers might have less money in their pockets to spend – all of which could impact on retail, particularly discretionary purchasing. However, our tenant line-up is underpinned by convenience led retailers, a strength during the pandemic when retail was under pressure.

Whilst these issues must be borne in mind, there are still plenty of reasons to be optimistic. There is no doubt that the Company is in a much stronger position than it was 12 months ago. There are no signs that investment demand for retail warehousing will wane in the near term, which should lead to further NAV improvement. There is good occupational demand from tenants looking to extend leases and acquire new space. In a sector with low supply levels, this could lead to rental growth. Rent collection remains strong, the EPRA vacancy rate has fallen, and we continue to identify and complete asset management projects across multiple properties.

Offices

Gerald Kaye, chief executive:

The Central London commercial property market continues to demonstrate its inherent resilience. The end of the UK Government’s Covid-19 restrictions has enabled employees to return to the office and confidence to grow throughout the sector. Data collected by The Freespace Index, which provides office use statistics, shows that daily London office occupancy has steadily increased, demonstrating the importance of the office in effective working practices, albeit employees are adopting a range of working practices depending on the nature of their industry. Any uncertainty over the future of the office has much reduced as the value of the office to workplace culture, efficiency and knowledge sharing is rediscovered and reinforced.

These trends are evidenced in the letting market where velocity has continued to increase in Central London as greater stability has enabled occupiers to develop longer-term plans. According to CBRE, since July 2021 the amount of space under offer has exceeded the 10-year average of 3.3m sq ft. While availability remains high at 26.0m sq ft, 18.1m sq ft of this relates to second hand stock, further demonstrating that best-in-class space is desired as the flight to quality intensifies. A combination of these factors, coupled with limited newly built office space, has led to increases in headline rents across most Central London sub-markets in 2021 for these best-in-class buildings.

From an investment perspective, a significant amount of capital continues to be allocated to the Central London office market with CBRE identifying more than £40bn of capital targeting the sector at the end of 2021. While London saw consecutive years of declining investment volumes in 2019 and 2020 due to the destabilising impacts of Brexit and Covid-19, this trend reversed in 2021, with investment into London offices of £12.3bn, an increase of £3bn on 2020. 2022 has continued this trend with CBRE reporting a record first quarter of £5.5bn of inbound investment, with a further £5bn under offer.

London continues to be a highly desirable market and the renewed sense of confidence is manifesting in growing development activity, with the amount of new development starting on site at 1.0m sq ft above the long-term average. While this is positive, significant headwinds remain, with the impact of increasing cost price inflation, rising interest rates and disrupted global supply chains adversely impacting development activity. As general inflation hits its highest levels in 40 years, Arcadis notes that manufacturing inflation is outpacing all other sectors, with raw material prices increasing by 13.6% during the year. These disruptive trends will need to be monitored over the coming year and are likely to partially moderate some of the renewed sectoral confidence.

Toby Courtauld, chief executive:

As the London economy continues its recovery from the pandemic, we are seeing some encouraging positive prospects. London remains a dominant global city and is the world’s top ranked city for innovation. Whilst inflationary pressures and the unknown full impact of the Ukraine conflict persist, healthy office employment growth is driving demand for prime and flex office space, with buoyant investment market activity demonstrating London’s enduring appeal for investors. We have seen this positive momentum feed into our occupational markets, where we expect the future supply of new office space in central London to decline further, leading to a potential shortage of some 55% over the next three years. As a result, we expect rents for the best office space to rise over the next 12 months by 0.0%-6.0%.

Offices & Retail

Simon Carter, chief executive:

We are mindful that the year ahead will be impacted by heightened macroeconomic and geo-political uncertainty. In the context of higher inflation, we are seeing investors rotate out of bonds and increase their allocations to real estate, particularly in subsectors with strong pricing power and affordable rents. We are well positioned in this respect across both Campuses and in Retail & Fulfilment. In addition, we are pleased with our financial position and that our strong momentum has continued into the new financial year.

Our Campus offering provides customers in London with best-in-class space where we expect demand to remain strong, particularly from the growing, innovative businesses we are targeting. Rents typically represent a small proportion of salary costs, meaning demand is less sensitive to price and for prime London office space, vacancy remains low and new supply is constrained. Reflecting these dynamics, and continued gravitation to the best space, our central case is for rental growth on our Campuses of 1-3% with the potential for some further yield compression.

We expect the strong occupational demand for our Campus developments to continue, reflecting their market leading sustainability credentials. We target BREEAM Outstanding ratings on developments and just 1% of available London office buildings are BREEAM Outstanding. This year construction cost inflation is likely to be between 8-10% and we are pleased to have fixed 91% of the cost on our committed development programme of 1.7m sq ft. Forecasting is difficult with elevated uncertainty, but our base case is for construction cost inflation to moderate to 4-5% over the next 18 months as commodity, transportation and energy prices continue to increase but at a lower rate and capacity in the construction industry slowly increases. The attractive IRRs we are forecasting on our development pipeline of 10-15% incorporate these levels of construction cost inflation and additional contingencies. Higher land values mean that returns from London development are more insulated to cost inflation than development in other parts of the country and we anticipate being able to achieve the modest increase in rents needed to offset any further cost inflation above our base case.

In Retail Parks, we attract a broad tenant base and space is more affordable than alternative formats, thereby making them attractive for retailers facing increased margin pressures due to rising input prices and labour costs; supply is relatively tight, with retail parks accounting for around 10% of the total retail market and vacancy falling. We expect the value play opportunity in retail parks to continue and our ability to unlock value through asset management means we are well placed to make further acquisitions whilst retaining a strong focus on returns. Overall, we expect rents to be stable with some growth for smaller, well-located parks with further yield compression likely. For shopping centres, we have seen ERV decline moderating, and yields were flat in the second half of the year. We expect that yields could compress for the best centres, given increasing investor interest delivering attractive medium-term returns.

In Urban Logistics, the market in London is chronically undersupplied and demand remains strong, underpinned by the continued growth of same day delivery. We expect strong rental growth of over 5% p.a. with stable yields – a good backdrop for delivering new space via our repurposing and intensification strategy.

Mark Allan, chief executive:

The recent surge in geopolitical risk has the potential to upend decades of relative international stability and increasing globalisation, which is adding further disruption to global supply chains already affected by the pandemic. It also is putting significant upward pressure on energy costs in the short term, and potentially in the long term through an accelerated energy transition. This clearly creates uncertainty around the economic outlook, with gilt yields having risen to the highest level in six years and UK inflation at its highest level in 30 years – something which will be felt by many in the months ahead. Whilst we are alive to the risks this creates, we look forward to the future with confidence.

Diversified

Michael Morris, chief executive:

The speed and strength of the property market’s recovery from the pandemic was better than expected. Although the average returns are positive, there is still polarisation between sectors and within subsectors, particularly retail.

According to the MSCI UK Quarterly Property Index, commercial property delivered a total return of 19.6% for the year ended March 2022, which compares to 1.1% for the year ending March 2021. The stellar performance was largely attributable to the continued growth in the industrial sector and a recovery in values in the retail warehouse subsector. All Property capital growth was 14.9% in the year to March 2022, significantly better than the -3.2% recorded for the previous year. The income return was 4.2%, slightly lower than the 4.5% recorded for the preceding year.

The industrial sector had an extraordinarily strong year. The industrial total return for the year ending March 2022 was 40.7%, with annual capital growth reaching an all-time high of 35.9% and an income return of 3.6%. Industrial ERV growth for the period was 11.2%, with a subsector range of 15.8% to 8.2%. Capital growth ranged from 47.7% to 28.2% within subsectors. Equivalent yields for industrial property now stand at 4.1% (March 2021: 5.0%).

The office sector continued to face a degree of uncertainty over future demand levels and suffered an additional setback in December 2021 as people were once again advised to work from home in the face of the Omicron wave. The office sector produced a total return of 6.9% for the year to March 2022, comprising 3.2% capital growth and 3.7% income return. All Office annual rental growth was 1.4% ranging from 2.4% to 0.9% within subsectors. Office capital growth ranged from 6.5% to -0.6%. Equivalent yields for office property now stand at 5.5% (March 2021: 5.8%).

The elevated rate of online sales over bricks and mortar retail and oversupply of retail units continues to hamper the retail sector as a whole, albeit some segments have recently seen a return to positive capital growth. The retail sector produced a total return of 14.9% for the year to March 2022. This comprised capital growth of 8.9% and income return of 5.6%. Rental values fell -2.0% over the period, ranging from 0.6% to -7.0%. Retail subsector capital growth ranged from 22.9% to -5.8%. The retail warehouse subsector was the driver of growth, with increased demand from investors pushing down yields. Equivalent yields for all retail property now stand at 5.9% (March 2021: 6.7%).

According to Property Data, the total investment volume for the year to March 2022 was £70.5 billion, a 66.5% increase on the year to March 2021. The volume of investment by overseas investors in the year to March 2022 was £33.0 billion, accounting for 46.8% of all transactions.

As the disruptive threat of the pandemic recedes, new challenges for the property market are emerging from the macroeconomic and geopolitical environment. In times of uncertainty, UK property is often seen as a safe haven for investment. During periods of increased inflationary pressure property can provide a hedge in the form of an opportunity to grow income through rental growth and in turn generate capital growth. Certain property types are more akin to acting as an inflation hedge. At the current time, assets where demand is strong and supply limited are likely to offer protection through rising rental values, equally leases with fixed or inflation linked leases will also provide support.

Healthcare

Jonathan Murphy, chief executive:

The critical need for investment in the infrastructure that supports the services delivered by the NHS is as pronounced as it has ever been. Waiting lists are longer than they have been for decades because hospitals are overburdened, and appropriate space doesn’t exist in a community setting to deliver care where it is needed.

The existing NHS estate is not fit for purpose and requires significant investment to meet this demand. Healthcare professionals openly admit that the premises they work in are constraining the services they can provide, hindering recruitment of additional staff and holding back progress on tackling the care backlog. So it is not surprising that 98% of Primary Care Network clinical directors feel more investment is needed for primary care premises.

The restructuring of the NHS into Integrated Care Partnerships in the coming months provides an opportunity for greater collaboration across health professionals, services and estate – with scope to improve individual patient experiences and reduce health inequalities.

The NHS has ambitious targets to become the world’s first net zero carbon health system, but this is not yet filtering down to plans on how this will be implemented and paid for across the existing estate. Our role is to be an expert partner to bridge those gaps and share our learnings with the NHS, always pushing the bar higher at our buildings and through our impact – using our unique expertise and financial capacity to deliver.

Europe

Nick Preston, fund manager:

The European logistics market continues to see strong and growing occupier demand generated from a wide range of different business types, all driven by powerful structural trends. At the same time, supply of suitable logistics assets in the right locations is highly constrained and there are significant barriers to developing new stock to meet this demand, both in the short and long term.

The primary structural trends driving long-term occupier demand are: the continued growth of e-commerce, requiring companies to have large and often highly automated logistics facilities, close to major population centres and strong transport links; the need to optimise, reinforce and de-risk supply chains, by adopting the latest supply chain planning tools, reviewing manufacturing locations and transportation networks, and by holding more critical stock closer to customers and end users, hence making the supply chain more resilient; and the growing necessity for businesses to operate from sustainable properties that will remain fit for purpose for years to come.

The global events of recent years have accelerated and intensified these trends. The COVID-19 pandemic continues to disrupt supply chains, with countries globally following different approaches to COVID-19 and local lockdowns, disrupting the production and flow of goods. Geopolitical risk has been elevated in recent years and Russia’s invasion of Ukraine has increased uncertainty for businesses. The Suez Canal blockage in 2021 also highlighted the vulnerability of global supply chains to unexpected events.

Occupiers are therefore looking to minimise the risk of future disruption by increasing inventories, diversifying and/or reshoring, and adding back-up storage space. They are also accelerating long-term plans to ensure facilities can cope with increased online business. Automation is an important part of this process, which also improves resilience against COVID-19 and potential future pandemics, in part by reducing the reliance on close human interaction. Occupiers are also focused on digital connectivity, reflecting the need for advanced tools and data to give them end-to-end visibility of their supply chains and also allowing these advanced building management systems to provide efficient goods handling and energy reduction processes.

At the same time there are ever fewer suitable vacant buildings, and little land on which to build new ones. There are even fewer sites available that can accommodate the very largest logistics facilities, and municipalities are often reluctant to zone land for the construction of assets of this scale. As a consequence, companies looking for large new logistics facilities have few choices.

Real estate research notes

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Tritax EuroBox – Fast-tracked

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.