Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

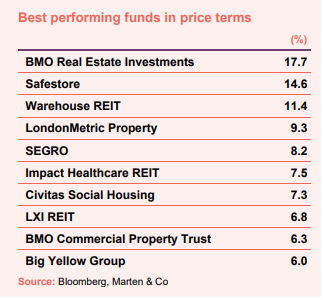

October’s biggest movers in price terms are shown in the chart below.

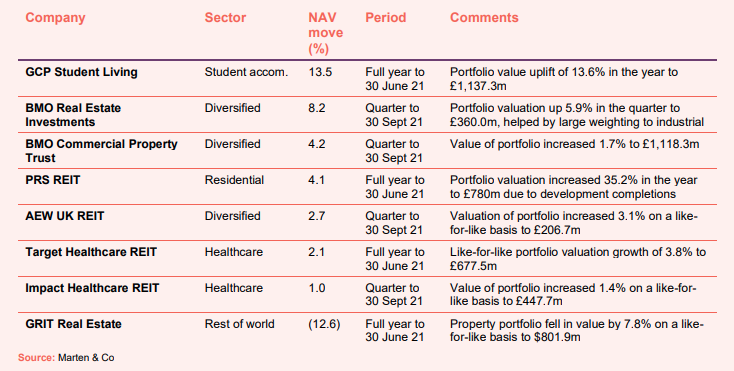

The best performing real estate funds in October were mainly sector specialists, however, the property generalists had a good month too, led by BMO Real Estate Investments. The company saw its share price jump 17.7% after reporting a substantial rise in net asset value (NAV) for the quarter to the end of September. The majority of its portfolio is in the booming industrial and logistics sector, which was behind its portfolio valuation uplift. Dedicated logistics players LondonMetric and SEGRO saw impressive gains in October, as the sector continues its run, buoyed by increased demand for space from online retailing. In the year to date, the two companies’ share price gains are 14.1% and 36.4% respectively. Industrial-focused Warehouse REIT also witnessed strong gains in October of 11.4%. The listed specialist self-storage operators continued their impressive year of growth, as the sector continues to benefit from demand-side pressures. Safestore was up 14.6% in the month (54.1% in 2021) and Big Yellow Group was up 6.0% in October (34.8% in the year to date). Civitas Social Housing’s share price rebounded slightly in the month, recovering from an attack by an activist short-seller.

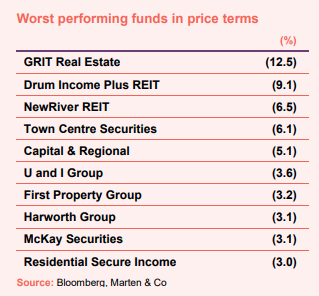

African-focused property investor GRIT Real Estate saw its share price drop 12.5% in October after reporting a similar fall in NAV in full year results. The group has had a difficult pandemic, with its exposure to retail and hospitality impacting on values. Plans are afoot to turn around its fortunes, however. Drum Income Plus REIT’s share price fell further in October despite the group’s merger with Custodian REIT being in the final throes (more information on page 3). NewRiver REIT, which has embarked on a renewed strategy focused on resilient retail, saw its share price come off 6.5% in October, after being one of the biggest risers in September. Capital & Regional’s woes continue despite agreeing a finance restructuring to stave off covenant breaches. Regeneration specialist U and I Group’s share price was down in the month, however, shot up on 1 November after it was announced Land Securities would take over the company in a £190m deal. Development specialist Harworth saw its share price cool in October having risen 13.3% in September after reporting a considerable uplift in EPRA net disposal value (NDV) in half year results. The group set out plans to double the size of the business over the next five to seven years.

Valuation moves

Corporate activity in October

A new real estate investment trust (REIT) focused on life science laboratories is looking to raise £300m in an initial public offering (IPO). Life Science REIT has announced its intention to launch on the Alternative Investment Market (AIM).

Supermarket Income REIT raised gross proceeds of £200m through a significantly oversubscribed issue of 173,913,043 shares at 115 pence. The issue had been increased from an initial target of £100m.

Drum Income Plus REIT’s shareholders overwhelmingly approved the absorption of the trust into Custodian REIT. Drum’s shares were delisted on 4 November; and the new Custodian shares issued as a result of the deal started trading on 4 November.

Urban Logistics REIT announced plans to move from the AIM market to the premium segment of the main market of the London Stock Exchange. It is also looking for shareholder support for a placing programme of up to 350m shares or C shares at a general meeting on 12 November.

The Competition and Markets Authority announced that it was looking into the proposed takeover of GCP Student Living. It says that it will make a decision by 13 December.

Big Yellow Group increased its debt facilities by £100m by securing an additional £50m seven-year debt facility with Aviva Investors (reducing the fixed cost of the total Aviva loan facility from 4.0% to 3.5%) and increasing its M&G Investments loan by £50m to a total facility of £120m.

Capital & Regional, the shopping centre REIT, reached an agreement with its lenders to restructure and reduce the debt secured over four of its mall assets, including the launch of a fully underwritten open offer to raise £30m.

Major news stories

- Home REIT adds 366 properties to portfolio with £166.4m buy

Home REIT deployed £166.4m of the proceeds raised in a £350m equity issue last month, acquiring 23 portfolios comprising 366 properties and 1,850 beds to the portfolio, bringing the total to 1,077 properties and just under 5,700 beds.

- Grainger acquires London residential scheme for £141m

Grainger exchanged conditional contracts to forward fund and acquire Merrick Place, a build-to-rent development scheme in Southall, west London, for £141m.

- Schroders and SEGRO swap property

SEGRO acquired from Schroders an urban warehouse estate in West London for £140m, while Schroders acquired from SEGRO a portfolio of UK big box and urban assets for £205m.

- Great Portland Estates sells City office for £181.5m

The Great Ropemaker Partnership, a 50:50 joint venture between Great Portland Estates and Ropemaker Properties (the property nominee of the BP Pension Fund) has sold 160 Old Street, EC1 to JP Morgan Global Alternatives for £181.5m.

- Hibernia REIT sells Dublin office complex for €152.3m

Hibernia REIT sold One and Two Dockland Central office complex in Dublin for €152.3m, reflecting a yield of 4.75%.

- Tritax EuroBox buys in Germany

Tritax EuroBox acquired a logistics development in the Rhine-Ruhr region of Germany for €32m, as it sets about deploying the proceeds of its recent equity raise. Completion of the three-unit asset is expected in early 2022.

- LondonMetric buys two London last mile logistics assets for £20.2m

LondonMetric Property bought two last mile logistics assets in Fulham and Tottenham for £20.2m. It will refurbish both properties at a cost of £1.4m which, once fully let, is expected to deliver a blended yield on cost of 4.5%.

- BMO Real Estate Investments spends £19.4m on double deal

BMO Real Estate Investments acquired an industrial asset in Colnbrook, Heathrow, for £12.1m and a net initial yield of 4.0% and a retail warehousing scheme in Banbury, Oxfordshire, for £7.3m, reflecting a net initial yield of 6.3%.

- Urban Logistics REIT splashes £15m on two more assets

Urban Logistics REIT acquired two assets for £15.1m at a 6.0% net initial yield. The assets include one income producing asset in Hertfordshire and a forward funding development project in Manchester.

- McKay Securities buys in Richmond

McKay Securities acquired Evergreen Studios, a fully refurbished office asset in central Richmond, for £14.75m, representing a net initial yield of 5.8%.

QuotedData views

- Budget baloney – 29 October 2021

- LABS launch should get lift-off – 22 October 2021

- Rental market revs up – 15 October 2021

- IPO hits the buffers – 8 October 2021

- Time to back retail recovery? – 1 October 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Peter Lowe, investment adviser:

The UK property market delivered robust returns over the third quarter, with investor sentiment continuing to improve. There was some stabilisation in fortunes for the previously unfavoured areas of the market accompanied by a continuation of the encouraging performance from the more resilient, namely the industrial, logistics, retail warehousing and supermarket subsectors. While headwinds remain in the form of inflationary pressures, staffing shortages and supply chain issues, the expectation of further yield compression and the potential for income growth from selected sectors offer a positive outlook for much of the market.

As the UK’s return to the office takes shape, occupational take-up and investment volumes continue to improve. There is however a note of caution with the recovery as yet centred on London and the core cities, with some asset types facing continued uncertainty as occupiers redefine their real estate requirements.

Healthcare

Target Fund Managers, investment manager:

As [COVID] restrictions eased later in 2020 we saw [investment] activity pick-up, with pricing continuing to respond to significant investment demand in what is a competitive market for the type of assets we acquire and hold. We did not see many acquisition opportunities reflecting distressed circumstances as the sector traded robustly, and would expect sales processes for assets whose trading has been significantly affected by COVID-19 to delay until resident occupancy recovers towards normalised levels.

As well as demand from the typical domestic investors, the main change we have noted in the year has been an uptick in activity from European investors, these are generally larger and less specialist healthcare real estate investors whose home markets are saturated and lower-yielding. Their initial forays were into poorer quality real estate, by way of portfolio acquisitions in recent years, though they are currently more active in their pursuit of the real estate we have been advocating for as fit-for-purpose.

None of this is a surprise in a market where only 28% of beds meet our quality standards, and which needs substantial modernisation overall. The non-cyclical nature of returns, which are still relatively high-yielding, make the investment desirable for the income investor. Whilst we welcome new capital to support development of real estate and operator growth, we would argue that specialist knowledge and a committed long-term holder would be characteristics of the suitable investor.

Occupancy has been depressed from normal levels in the past 18 months, not necessarily through unusually high deaths, but through lack of admissions as families sought to keep their loved ones at home. Many families found more time to care due to furlough and working from home. As lockdowns dissipate and furloughs come to an end, occupancy is on the rise again, for what is a “needs-based” service. We anticipate steady increases as homes cautiously admit new residents in small numbers, ensuring people settle into their new homes with adequate staffing and care plans effected.

Student accommodation

Gravis Capital Management, investment manager:

Applications and acceptances for higher education courses in the UK were at record levels for the 2020/21 academic year. UCAS end-of-cycle data for the 2020/21 academic year showed that 570,475 students had accepted places onto higher education courses in the UK, representing a year-on-year increase on pre-pandemic levels of 5.4%. This growth has been driven by a year‑on‑year increase in acceptances of 16.9% for non‑EU international students to 52,755 and a 4.5% increase in domestic students to 485,400. The number of EU students has also increased by 1.7% to 32,320. The increase in acceptances for domestic students has, in part, been underpinned by record entry rates of 18-year-olds into higher education.

Looking forward, UCAS clearing data published on 7 September 2021 relating to acceptances for the upcoming 2021/22 academic year shows a further increase in students placed onto higher education courses in the UK with a year-on‑year increase of 5% for non-EU international students. The effect of Brexit is impacting student numbers from the EU due to the obligation to now pay international student rates rather than domestic, with acceptances falling by 56%.

The UCAS data above supports the Investment Manager’s view that students will continue to invest in their education and enrol on courses to further their future employment prospects. The continued rise in the number of applications from non-EU international students suggests that students remain willing to travel to study abroad in order to obtain qualifications delivered in the English language and are making applications on the basis that they will do so. However, with the continued global impact on travel caused by the COVID-19 pandemic and the effect of Brexit on student movement from the EU, there remains considerable uncertainty on occupancy levels for at least one further academic year and possibly beyond.

Residential

Sigma PRS Management, investment adviser:

The delivery of new homes in the last reported period of 2019/20 fell short of the annual government target of 300,000 homes by 80,000, with 220,000 new build completions in the year. Due to the coronavirus pandemic, it is not anticipated that this shortfall will have been rectified during 2020/21. The supply of rented properties has also reduced following tighter regulation and increased tax burdens, which caused large outflows from the ‘Buy-to-let’ sector. According to Savills, in 2010, 78% of landlords in the private rented sector owned more than one property, but by 2018, this had reduced to 45%. Latest research by Savills reveals that the number of buy to let mortgage redemptions has reached 180,000 since 2017, suggesting further supply side pressure in the sector.

With the average home in the UK now a multiple of 7.7 times gross average salary (2020), the choices available to those who are too economically active to qualify for affordable housing, but without sufficient savings to pay for a minimum deposit (including to qualify for Help to Buy), are increasingly limited. The Build-to-Rent (BTR) sector can absorb some of this demand, although currently there are only 62,000 operational homes and just 39,500 under construction.

BTR currently accounts for just 2% of all private rented homes in the UK, which when compared to 45% in the US and 55% in Germany, indicates the potential growth in the market. Savills estimates that the sector could expand to nearer £550bn at full maturity.

The UK market continues to focus on high-density flatted developments in city centre locations whilst the PRS REIT has maintained its focus on regional family homes. The relevance of the PRS REIT’s housing model has been brought into sharp relief this year with COVID-19 and home-working causing tenants to rethink their space requirements and the need for private outdoor space.

Real estate research notes

Standard Life Investments Property Income Trust – Post-COVID ready

Aberdeen Standard European Logistics Income – Handbrake off in growth drive

Urban Logistics REIT – Shed load of growth to come

Tritax EuroBox – Full throttle

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.