Real Estate Roundup

Kindly sponsored by abrdn

Performance data

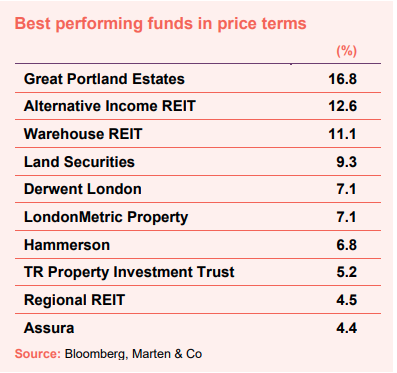

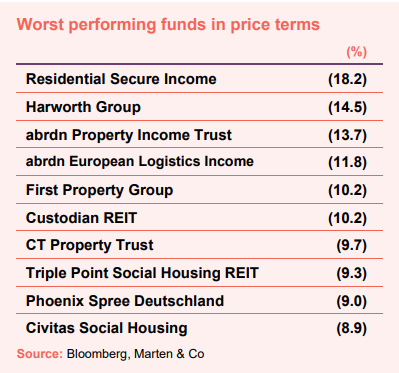

October’s biggest movers in price terms are shown in the charts below.

Having priced in a major write-down of portfolio valuations in the real estate sector, especially after interest rate expectations rocketed following the disastrous mini-budget at the end of September, the market seems to have calmed somewhat on the appointment of Rishi Sunak as Prime Minister. Having proved the resilience of the strong valuations within its portfolio with the sale of an office at a sub-4% yield (see more details on page 4) and confirmed reports that it was close to pre-letting another development, Great Portland Estates saw its share price jump 16.8%. However, it is still 29.4% down in the year-to-date. Fellow office landlords and developers Land Securities and Derwent London, as well as smaller regional office investor Regional REIT also saw their share prices recover slightly during October, but all are still down around 30% in 2022. Alternative Income REIT’s long-term, inflation-linked income and fixed rate debt may be behind its positive share price performance in a backdrop of losses amongst its peer group. Its share price is up slightly in the year-to-date, one of only a small handful in the property sector.

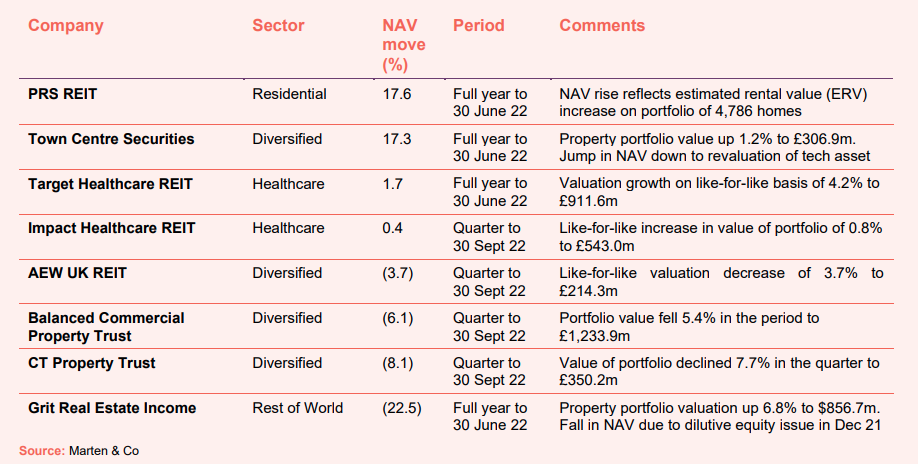

There is no consensus on where values will fall to, only that a softening of investment yields and capital values is inevitable. And so, there is no real pattern to sector winners and losers this month. Residential Secure Income’s share price has bounced around in recent months, and in October dropped 18.2%. In the year-to-date, the company’s share price is down 17.4%. Diversified trusts have had a hard time of it in recent months, with many trading at 40%-plus discounts to net asset value (NAV). The first signs of significant valuation declines have started to be reported by the diversified trusts in quarterly NAV updates (see page 2). abrdn Property Income Trust’s share price dived further in October after announcing the refinancing of its debt at inferior terms (see page 3 for more detail). Custodian REIT and CT Property Trust were the other diversified trusts to make the list of worst-performing funds in October, with the latter posting an 8.1% fall in NAV during the quarter to 30 September. Social housing REITs, Triple Point and Civitas, continue to suffer share price falls, with both down more than 30% in the year-to-date.

Valuation moves

Corporate activity

abrdn Property Income Trust completed an extension to its debt facilities with the Royal Bank of Scotland International. It has replaced its current £110m term loan and a £55m revolving credit facility (RCF), which are both due to expire in March 2023, with a term loan of £85m and an RCF of £80m. The new three-year facility will start in March 2023 with a margin of 150bps over SONIA for both. The company has entered into a forward interest rate swap on the full amount of the term loan. The cost of the swap is 5.47% (giving an all-in rate of 6.97% on the £85m borrowed under the term loan).

Sirius Real Estate completed a refinancing of its next major debt expiry, a €170m facility with Berlin Hyp AG, a year ahead of the facility’s due date. The refinancing comprises a new seven-year, €170m facility at a fixed interest rate of 4.26%, which will replace and redeem the existing facility upon its expiry on 31 October 2023. This refinancing extends the group’s total weighted average debt expiry from 3.8 years to 5.0 years and when the new facility commences the group’s weighted average cost of debt will increase from 1.4% to 1.9%.

Grit Real Estate Income Group, the pan-African real estate investor and developer, secured new debt facilities for up to $306m. The sustainability-linked term loan and revolving credit facility consolidates seven existing loans into a single facility and has a term of 4.3 years.

Tritax EuroBox amended its investment management agreement with its manager Tritax Management, reducing the base management fee to 1.00% on NAV up to €1bn and 0.75% on NAV above €1bn. Previously, the management fee was 1.3% on NAV up to €500m, 1.15% on NAV between €500m and €2bn, and 1% above €2bn. Based on the last reported NAV at 31 March 2022, the proposed changes would result in a net €2.4m reduction in the annual costs to the company. In other changes, a new 18-month fixed term management agreement is now effective, after which the company would have a two-year rolling notice.

Major news stories

- Great Portland Estates sells City office at 3.85% yield in fillip for the market

Great Portland Estates exchanged contracts to sell 50 Finsbury Square, EC2, for £190m – in a fillip for the real estate market. The price represents a net initial yield of 3.85% – reflecting continued strength of investor demand for prime office buildings despite economic woes.

- Unite branches out into residential

Student accommodation investor Unite Students acquired a build-to-rent property in Stratford, east London, for £71m as it looks to branch out into the residential sector.

- Urban Logistics REIT lets London warehouse at 122% uplift in rent

Urban Logistics REIT signed a new 25-year lease to Delice de France for a 97,362 sq ft chilled warehouse in Southall, west London, for just under £2m a year – achieving a 122% increase on the passing rent at acquisition in August 2022.

- Sirius Real Estate buys €40m German property

Sirius Real Estate acquired a mixed-use property in Düsseldorf, Germany, for €39.8m. The property comprises mainly office and warehouse/light industrial space and is 55% occupied, offering good value add potential.

- abrdn Property Income Trust sells industrial asset at sub-3% yield

abrdn Property Income Trust completed the sale of an industrial asset in Rainham, east London, for £21.65m, reflecting a yield of 2.84%. The property was the lowest yielding asset in the portfolio, and the sale price represented a discount to the end June valuation of 2.7%.

- ASLI acquires two logistics schemes in France and the Netherlands

abrdn European Logistics Income acquired two logistics warehouses – in Dijon, France, and Horst, the Netherlands – for a total of €21.4m.

- Warehouse REIT agrees lettings at 24% premium to ERVs

Warehouse REIT completed two long-term lettings in Plymouth and Coventry, totalling 205,000 sq ft. The deals have been struck at an average 24% premium to estimated rental values (ERVs) and 30% above the previous passing rents, and will generate over £1m of annual contracted rent.

- Custodian REIT sells only mall for £9.3m

Custodian REIT sold Gosforth Shopping Centre, its only high street shopping centre, for £9.3m. It acquired the 73,367 sq ft mall as part of its acquisition of DRUM Income Plus REIT Plc, in November 2021, and the price reflects a 3.5% premium to the £8.975m apportioned value of the asset at that time.

- CLS Holdings sells £7.0m London office

CLS Holdings sold Sentinel House in Coulsdon, Greater London, for £7.0m. The sale of Sentinel House, which was acquired by CLS in 2012 and comprises 36,711 sq ft of office space, was at a price 4.5% above the 30 June 2022 valuation.

- Impact Healthcare REIT disposes of non-core care home

Impact Healthcare REIT sold a care home for £2.65m at a 4% premium to the latest book value. Attlee, a 68-bed care home in Wakefield, was not considered a long-term strategic asset for IHR.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Vikram Lall, chairman:

Double digit inflation is expected to last for a year as households face an acute cost of living crisis driven by increasing energy prices. 2023 should see inflation begin to edge down with the unveiling of the government’s energy price guarantee package designed to shield households and businesses from soaring energy prices over the next 6 months, followed by a review. The Bank of England has raised interest rates to 2.25 per cent, with further increases anticipated as they battle to tame inflation. Increases in the costs of financing will undoubtedly slow real estate activity, while the ability of occupiers to withstand inflationary pressures will be a key differentiator. There have been falls in property valuations across all sectors since 30 June, with industrial valuations seeing the largest declines and the Company’s portfolio will not be immune. Discounts in the UK REIT sector have widened substantially in recent months and the current discount in our shares reflects that.

In uncertain markets, the quality of the underlying portfolio comes to the fore. Our portfolio is characterised by assets in core locations, with long term value in the residual and a quality tenant base, which has delivered consistent long-term capital and income performance. As we move to the next stage in the property market cycle, income will drive returns, while asset resilience should protect long-term capital values. Consequently, the portfolio’s income advantage, sector exposures, geographical focus and low vacancy rate stand us in good stead as we enter a period of economic uncertainty.

Edward Ziff, chairman:

The Russia‐Ukraine conflict and the unpredictability resulting from the situation has led to inflationary and other economic pressures on our business and those of our tenants including changes to consumer spending, increased property and other expenses, interest rate rises, a weakening sterling exchange rate, increased construction costs and rent affordability for tenants.

We remain focused on enhancing value for our shareholders and continue to look at further opportunistic disposals, the proceeds of which will be used to reduce debt. Unless there are acquisitions offering significant opportunities to increase value we are not envisaging any further property investments until there is stability in the real estate sector and wider economy.

Healthcare

Malcolm Naish, chairman:

Other headwinds [following COVID] have emerged in 2022 which are potentially more long-lasting and impactful, though we feel our business model and strategy provides insulation. Matters of concern include: energy and food source supplies; inflation; monetary policy tightening by Central Banks and fast-rising interest rates; the cost of living crisis, and general fears of a significant economic downturn/recession. The repricing of financial assets is likely to arise with commercial real estate tipped by many to bear the brunt, as reflected in the sector’s recent share price movements.

However, our investment class benefits from tailwinds. Underlying demand for residential care places is supported by demographic change, evidenced by projected growth in the number of over 85s, and investment demand for modern, ESG-compliant care home real estate remains strong.

The group has some protection from higher interest rates, having fixed rates on £180m of its borrowings prior to recent market increases. On inflation, our portfolio bias towards private pay provides comfort that our tenants are more likely to be able to reflect their cost increases in resident fees, supporting sustainable trading.

Residential

Steve Smith, chairman:

The macro-economic environment has become more uncertain with the war in Ukraine, inflation and rising interest rates driving a more negative outlook in the UK and globally. In terms of the UK housing market, the impact of rising interest rates is expected to reduce mortgage affordability and drive demand in the rental sector as prospective homeowners turn to rental alternatives. We expect these factors, together with the existing structural shortage of quality family rental homes, to provide a strong underpinning to demand in the private rented sector.

Against this backdrop, our high-quality, well-located homes remain highly attractive to prospective renters. Our emphasis on customer service and strong promotion of a sense of community in our developments is also an important aspect of what our homes offer. In addition, the proven energy efficiency of our homes is particularly relevant with high and rising energy prices. The board remains confident that its cashflow will be stable and sustainable.

The company’s exposure to interest rate increases is limited with approximately 60% of investment debt fixed. In addition, our fixed-price construction contracts will limit the company’s exposure to price inflation on existing contracts.

Real estate research notes

Urban Logistics REIT – Long-term dynamics remain strong

Grit Real Estate Income Group – Transition underway

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.