Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

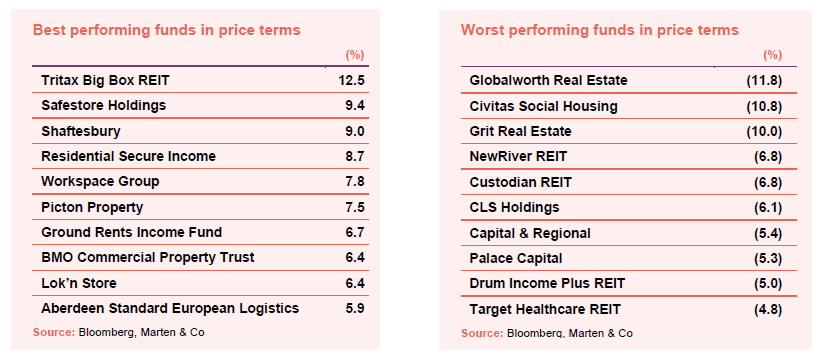

August’s biggest movers in price terms are shown in the chart below.

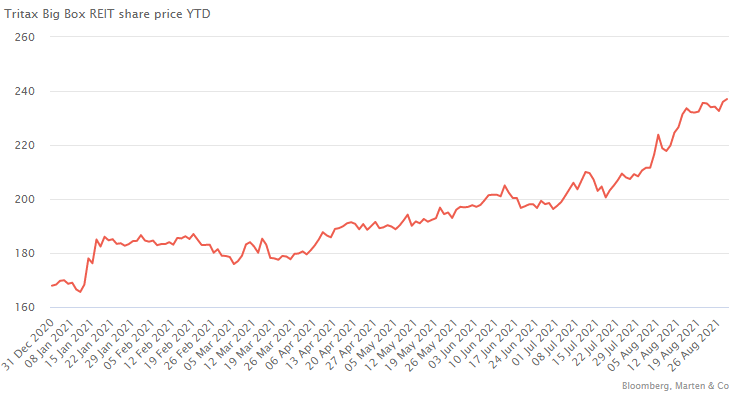

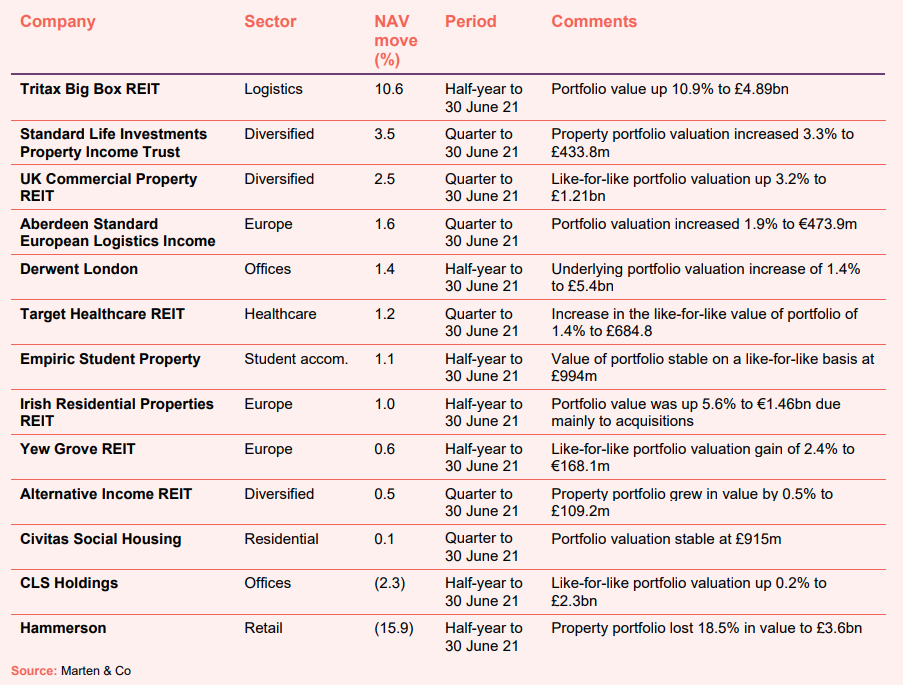

Traditionally a quiet month, August was anything but for property companies. While takeovers, IPO activity and large investment deals dominated the headlines, Tritax Big Box REIT continued its impressive performance. After reporting double-digit increases in both its portfolio valuation and NAV in interim results, its share price bounced 12.5% in the month and is now up 41.2% in the year to date.

Retail and leisure giant Shaftesbury published a positive trading update that showed life was returning to the West End with a recovery in footfall and trading. After also reporting it had reduced vacancy across its portfolio, its shares price rose 9%. Ground Rents Income Fund finally had some positive news to report after a prolonged period in the doldrums. It sold the Beetham Tower in Manchester, ridding it of the burden of costly remedial works. The structural tailwinds behind the logistics sector sees no signs of abating and European specialist Aberdeen Standard European Logistics Income posted a decent quarterly rise in the value of its portfolio.

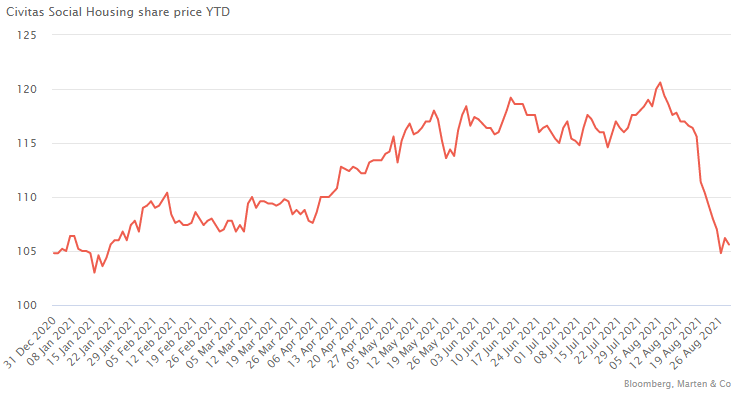

The possible takeover of Eastern European office landlord Globalworth rumbled on in August, with one of its largest shareholders declining the offer. The group’s share price has been up and down since the offer was first announced in April. Civitas Social Housing’s share price fell 10.8% in August after it said it was considering an equity raise, which would likely be at a price lower than its share price at the start of the month. This was compounded by another notice published by the regulator on one of its tenants later in the month.

Despite completing the sale of its pub business for £222m, which will be used to fix its balance sheet, NewRiver REIT saw its share price come off 6.8% in the month. Custodian REIT announced its intention to acquire small cap property company Drum Income Plus REIT in an all-share offer for around £21.6m. Peculiarly, Drum’s share price fell 5% during the month, despite the bid price being a premium to its prevailing share price. Target Healthcare REIT announced it was looking to raise £100m in a placing, at a discount to its share price, resulting in a 4.8% fall in its share price in August.

Valuation moves

Corporate activity

A new social housing REIT announced its intention to float, looking to raise £250m in an IPO. Responsible Housing REIT would be managed by BMO Real Estate Partners and is targeting a dividend yield of 5% and a NAV total return of 7.5%.

Custodian REIT announced it was in discussions over an all-share acquisition of Drum Income Plus REIT. The possible offer was at a ratio of 0.535 Custodian shares for each Drum share, valuing the company at £21.6m.

Home REIT announced it was looking to raise £262m in a placing, having fully deployed the equity and committed the debt facility raised on and since its IPO in October 2020. The company said that the net proceeds of the issue of equity would be substantially invested in an identified pipeline of assets within three to six months.

Target Healthcare REIT announced its intentions to raise £100m in a placing. The issue price of 115p is a 5.9% discount to its closing price on 25 August and a 4.2% premium to NAV. The investment manager has a pipeline of acquisition opportunities worth £230m.

Triple Point Social Housing REIT put in place £195m of sustainability-linked loan notes through a private placement with MetLife Investment Management and Barings. The loan notes have an average term of 13 years and a fixed rated coupon of 2.634%. Triple Point will refinance an existing revolving credit facility. The group has also been assigned an investment grade rating by Fitch.

Major news stories

Regional REIT acquired a portfolio of 31 multi-let offices for £236m as part of its new investment strategy solely focused on UK offices. The vendor, Squarestone Growth, will received £83.1m in shares in Regional REIT, with £76.7m being paid out of cash resources and £76.2m in new borrowings.

Derwent London announced three off-market transactions comprising the acquisitions of 250 Euston Road for £189.9m and 171-174 Tottenham Court Road for £24.7m and the formation of a 50:50 joint venture with Lazari Investments, which is expected to acquire three properties in Baker Street. All have future redevelopment opportunities.

LondonMetric sold its Primark-let distribution warehouse in Thrapston, Northamptonshire, for £102m, reflecting a net initial yield of 4.1%. The group acquired the property in 2013 for £60.5m.

LXI REIT bought three long-let properties for £80m, reflecting a net initial yield of 5.25%. The three assets – a biotech campus in York, TV studios in Glasgow and a recycling facility in Aberdeen – have a WAULT to first break of 23 years.

Great Portland Estates pre-let 121,800 sq ft of office space at its 50 Finsbury Square development to Inmarsat Global.

Primary Health Properties acquired the Townside Primary Care Centre and adjacent office building in Bury, Lancashire for £40m.

Sirius Real Estate acquired four assets and development land for €84.8m. Located in Oberhausen, Frankfurt, Heiligenhaus and Öhringen, the assets provide over 150,000 sqm and income of €3.4m.

Ediston Property acquired Springskerse Retail Park in Sterling for £21.85m, reflecting a net initial yield of 9.54%.

Tritax EuroBox entered into a forward-funding of a new 28,249 sqm logistics asset in Turin, Italy, for €24.4m.

AEW UK REIT sold two industrial assets – in South Kirkby and Basingstoke – for £16.7m, ahead of their most recent valuations.

QuotedData views

- Urban vibes – 20 August 2021

- More property companies in crosshairs of private equity – 13 August 2021

- Who’s looking good for property bounceback? – 6 August 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Offices

Paul Williams, chief executive:

Business activity has been improving as London follows the roadmap out of lockdown and with the increased level of vaccinations. We believe it is the strength of the London economy and its adaptability in attracting new sectors that will ultimately determine demand and Derwent London’s long-term growth. London’s large, relatively young and well-educated labour pool continues to attract growing businesses. All of this further endorses our confidence in London.

Office demand has focused on much more than just location and price for some time. A building’s adaptability, amenities, ability to promote wellbeing, sustainability and ‘digital intelligence’ are increasingly important to occupiers. The pandemic has further highlighted these broader issues. High quality office space is an important weapon in promoting a business’s culture and the ‘war for talent’.

Many businesses are still considering how changing working practices will affect them in the future. However, we expect space requirements to continue to focus on peak occupational demand, which often requires a significant proportion of the workforce to be present at one time. Less individual desk space may be replaced by additional video conferencing facilities. In addition, as more businesses return to their offices the need to be ‘at the centre of things’ will be reinforced.

Fredrik Widlund, chief executive:

With the easing of the majority of lockdown measures in our three country markets (Germany, France and the UK), we expect activity to see a pronounced pick-up in the rest of the year. Our balance sheet remains resilient which supports our transactional activity. These transactions will remain opportunistic with some selective disposals likely in the second half.

Whilst we expect the return to offices will support increased activity, we also recognise that the market has become more discerning in terms of the space that is sought after. CLS is continuing to focus on its tenants by providing modern, quality space with great amenities and facilities and, as announced today, sustainability improvements continue to be made. We also recognise that space and leases need to remain flexible all while providing well-located buildings at affordable rents.

Logistics

Aubrey Adams, chairman:

We are still in the early stages of a long-term growth cycle in the UK logistics real estate sector. The structural tailwinds driving occupier demand, notably the accelerating growth in e-commerce, remain firmly in place, contributing to the ongoing occupational demand-supply imbalance. As more of the sites within our development portfolio mature through the planning process, we increase our ability to capture these unprecedented levels of demand, particularly in a sub-sector which exhibits significant barriers to entry. Aligned to this, we expect to see further letting activity in the second half of this year. In conjunction with increasing development activity, we also expect to capture further rental growth in our investment portfolio, from the attractive combination of open market and inflation-linked rent reviews falling due over the remainder of this year and the next. To support our development and investment activity and maintain our portfolio strength, we will look to take advantage of the strong market conditions and continue to selectively dispose of assets that no longer meet our investment criteria.

Diversified

Will Fulton, investment manager:

Most remaining COVID-related restrictions were relaxed in England on 19 July, despite a growing third wave of infections driven by the Delta variant. Encouragingly, the successful vaccination programme in the UK appears to have significantly weakened the link between infections and hospitalisations. However, the risk to less well-vaccinated countries of the more infectious Delta variant, where two vaccine doses are required to afford high levels of protection, is likely to continue to restrict international travel both into and out of the UK, with negative implications for some key real estate sectors and markets. Hotels, leisure and luxury retail in central London are the most susceptible to protracted travel restrictions.

The tapering down of relief from business rates will put further pressure on those sectors later in the year, although vulnerable occupiers will benefit from the government’s controversial decision to extend the moratorium on tenant evictions until March 2022. The re-basing of retail and leisure rents is ongoing but the process has much further to run in fashion-oriented shopping locations, particularly in shopping centres and traditional High Street locations.

For offices, removal of the guidance to work from home where possible should spur greater re-occupation over Q3 and into Q4. But remote and hybrid working policies will outlive the pandemic and most occupiers are acting cautiously and consultatively with their workforces in respect of future requirements. Availability rates have risen in all major office markets but most steeply in London with smaller, more secondary buildings hardest hit. Vacancy may be plateauing but at a high level that is consistent with falling rents, especially in secondary stock that is out of favour with tenants.

In contrast take-up in the industrial sector shows little sign of slowing, driven as it is by ongoing structural changes to the distribution of goods and the increased importance of effective supply chains amongst businesses in general. The larger logistics size brackets have been especially active. There is, however, a sense that affordability is increasingly an issue for smaller and lower margin businesses, especially in low supply/high demand urban industrial locations.

Investment transaction volumes for Q2 2021 are set to total around £11.5bn, according to Property Data, which is almost identical to quarter one. Industrials continue to represent a huge proportion of activity and over the last 12 months represented 30% of investment volumes against a long-term average of just 12%. Those volumes continue to apply downward pressure to yields, enhancing returns already supported by rental value growth of 3.7% over the year to May, according to MSCI. The “beds, meds and sheds” sectors are likely to continue to drive investment volumes as we move into Q3.

Europe

Irish Residential Properties REIT

Margaret Sweeney, chief executive:

Market conditions remain highly sensitive as differences in recovery paths are emerging across the globe. Closer to home, we are seeing economic reopening, increased mobility, and improving consumer sentiment. Economic indicators for the Irish economy are positive, and we are hopeful that we are now finally emerging from the most difficult periods of the pandemic.

There remains a clear and significant supply and demand imbalance across all aspects of the housing market in Ireland, and this has been further exacerbated by the pandemic. As a result, demand for rental accommodation in Dublin has remained strong, further supported by continued population growth. I-RES will continue to play a key role in delivering housing solutions to the Irish market on a sustainable basis for the long term.

Jonathan Laredo, chief executive:

The short-term outlook for our market (Ireland) is positive. Despite uncertainty triggered by the rise of new COVID variants, the success to date of the vaccine rollout in Europe and the consequent reduction in hospitalisations and death rates means that most European economies can look forward to a return to some version of normality. In Ireland, despite the relative stringency of the lockdown, the economy has been buoyed by the strength of the multinational sector. When combined with a rapid increase in the domestic savings rate this augurs well for the economy in late 2021 and 2022. Given the strength of the sectors that make up most of Ireland’s inward investment, we would expect continued growth in demand for properties and despite the changing requirements for offices, demand for quality office space will, except in Dublin, outstrip supply creating a more segmented market across the country and driving rental growth.

In the industrial market, the effect of reopening on retail demand and the continued need for domestic logistic and cold storage space, as the impact of Brexit continues to reverberate, will increase pressures on well situated properties especially with larger footplates as tenants continue to vie for space. The life science sector, Ireland, unlike the UK or US, relies on larger, developed businesses who site in-country as part of the inward investment drive led by IDA Ireland. These businesses look to site close to existing clusters of similar life science businesses and require purpose built advanced technology buildings. Initial demand is usually met through IDA Ireland development and subsequent growth is largely left to the private sector. We expect inward FDI demand to continue to increase as international business travel eases and businesses again focus on global expansion.

In the medium term, the success of the economy depends largely on the success of Ireland’s inward investment policy and how it navigates the changing geo-political landscape as governments try to tackle the digital age and progress globally coordinated policies on tax and climate change. Despite the political difficulties Brexit has and will continue to cause, it should provide an opportunity for Ireland over the next few years and provided the value of multinational businesses to Ireland continues to be recognised by the electorate and politicians, the future looks positive.

Real estate research notes

Urban Logistics REIT – Shed load of growth to come

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.