Real Estate Roundup

Kindly sponsored by abrdn

Performance data

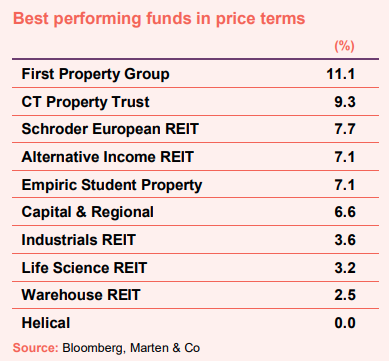

August’s biggest movers in price terms are shown in the charts below.

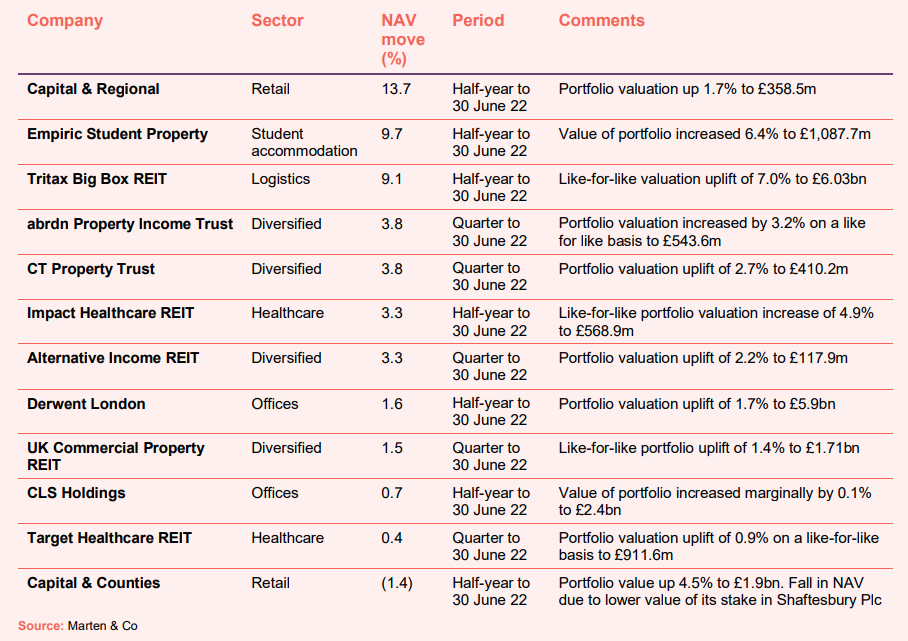

AIM-listed small cap fund manager and investor First Property Group tops the list of best performing property companies in August. It was the only company to see a double-digit rise in its share price, albeit from a two-year low. Perhaps investors are spotting some potential value, with many of the REITs in the top 10 positive price movers in August made the list of laggards in July. CT Property Trust (formerly BMO Real Estate Investments), Schroder European REIT and Alternative Income REIT all saw sizable uplifts in their share prices during the month. Both CT Property Trust and Alternative Income REIT announced NAV increases during the month for the quarter to June 2022 (see page 2 for more details). Having reported positive half-year results (see page 2 and 7 for details) in which occupancy was up on pre-COVID levels, Empiric Student Property saw its share price rise 7.1% in August. With the student accommodation sector returning to normality, the company’s share price is up 12.1% in the year-to-date, but still trades on a sizable 18.2% discount to NAV. Secondary shopping centre owner Capital & Regional saw an uptick in its share price after reporting a rise in mall valuations for the first time in years.

Central London office developers and landlords Great Portland Estates and Derwent London saw large price falls in August as investor sentiment towards that sector continues to wane as uncertainty prevails, compounded by the bleak economic outlook. Great Portland’s share price is down 31.6% in the year-to-date and at a seven-year low, while Derwent’s share price is down 28.7% in 2022. Shareholder apathy towards the merger of Capital & Counties and Shaftesbury, which is awaiting Competition and Markets Authority approval, continues to hit both share prices. Capital & Counties’ share price has fallen 20.9% since the merger was announced in June, while Shaftesbury’s has dropped 29.1%. Fears that demand for logistics space would subside persist, with many of the logistics-focused trusts suffering continued share price falls. Tritax Big Box REIT’s share price was down 15.6% in August, despite reported positive half-year results (more information on page 2 and 6), while fellow market leaders SEGRO and LondonMetric, and European specialist Tritax EuroBox also saw substantial falls during the month. All four are now down 33.1%, 34.4%, 23.4% and 29.5% respectively for the year.

Valuation moves

Corporate activity

Grit Real Estate Income Group concluded the second phase of its acquisition of a controlling interest in Gateway Real Estate Africa (GREA) – the leading development company in Africa – increasing its stake to 35.01% from 26.29%. The acquisition provides GRIT with control of its own accretive development pipeline.

Life Science REIT completed a second drawdown from its existing £150m debt facility with HSBC totalling £37.2m. The drawdown is secured against three of the company’s assets and will be used to progress the development and repositioning of assets within the existing portfolio into flagship life science properties. In total, £48.7m remains available in the revolving credit facility. The company has also secured protection against potential future interest rate rises through capping the SONIA rate at 2.0% until 31 March 2025.

CLS Holdings set out the terms of a proposed tender offer to reduce the company’s share price discount to NAV. The company said it intends to return up to £25.5m to shareholders through the purchase of 2.5% of the company at a price of 250p per share. This represents a significant premium to its prevailing share price but a large discount to its most recently reported NAV of 352.8p at 30 June 2022.

Town Centre Securities purchased 4m shares (7.6% of the company) via a tender offer for a total cost of £7.4m (185p per share).

Palace Capital appointed former NewRiver REIT director and co-founder Mark Davies as an independent non-executive director. It follows the resignation of three members of Palace’s board last month.

Major news stories

- Urban Logistics REIT spends £90m on value-add portfolio

Urban Logistics REIT acquired five assets with significant potential for value creation through asset management, for a total of £90m and a blended net initial yield of 4.5%. Four of the properties are income-producing and one is vacant.

- Supermarket Income REIT goes on £76m shopping spree

Supermarket Income REIT acquired four supermarkets for £76.4m, reflecting a combined net initial yield of 5.1%. Acquired from different vendors, the purchase consists of two Tesco supermarkets, located in Cheltenham and Merseyside, as well as a central Glasgow site anchored by a Sainsbury’s supermarket and an M&S Foodhall.

- Home REIT continues expansion with £85m spree

Home REIT acquired 199 properties for homeless accommodation for £85.1m, as it continues to deploy the proceeds of its £263m equity raise in May. The company has now deployed a total of £170m (66%) of the proceeds with this latest tranche, which adds a further 869 beds to its portfolio bringing the portfolio total to 10,421.

- LondonMetric nets £25m in quadruple sale

LondonMetric Property sold four assets, in two separate transactions, for £25.6m, reflecting a blended net initial yield of 5.3%. It sold a portfolio of three multi-let industrial assets totalling 53 units across 235,000 sq ft, located in Halesowen and Aston, Birmingham, and a roadside asset in Stamford Hill, London.

- CLS sells trio of offices for £40m

CLS Holdings completed on the sale of two UK properties – Great West House, Brentford and 62 London Road, Staines – and one French property – 96 Rue Nationale, Lille – for a total of £39.8m. The three properties sold for an average 3.7% above the 31 December 2021 valuations. The proceeds will be used to fund a tender offer (as mentioned earlier).

- Custodian REIT sells Milton Keynes industrial unit at huge mark up

Custodian REIT sold an industrial unit in Milton Keynes for £8.5m, at a 73% premium to its 31 March 2022 valuation, to a special purchaser with vacant possession. The company acquired the 44,187 sq ft warehouse and distribution unit in January 2015 for £2.1m and subsequently invested a further £0.9m to fully refurbish the property.

- AEW UK REIT completes Glasgow sale

AEW UK REIT sold 225 Bath Street, Glasgow for £9.3m to IQ for a student accommodation conversion. Reinvestment of the sale proceeds into pipeline assets under exclusivity is expected to provide a significant boost to earnings.

- Impact Healthcare REIT acquires two care homes

Impact Healthcare REIT acquired two care homes in Kent for £14m. The properties – totalling 168 beds – are let to Belmont Healthcare on 25-year inflation-linked leases.

- abrdn Property Income Trust reduces office exposure with £8m sale

abrdn Property Income Trust sold a single-let office building in Kidlington for £8.0m, reflecting a net initial yield of 5.35%. The sale continues the trust’s strategy of reducing its portfolio weighting to the office sector.

- Circle Property continues portfolio disposal with trio of sales

Circle Property sold three office buildings for a total of £25.4m, as it continues to break up its portfolio and return capital to investors. The group sold Kents Hill Business Park in Milton Keynes for £17.2m and exchanged contracts for the disposal of Cheltenham House in Birmingham for £4.7m and Elizabeth House in Staines for £3.5m.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Offices

Paul Williams, chief executive:

Rents and yields in the London office market were stable through H1 2022 with prime buildings continuing their outperformance in both occupational and investment markets. Geopolitical events caused the macroeconomic environment to deteriorate through the period leading to rising inflation and interest rates, with upward pressure on yields emerging since the half year. Despite this, the Group is well positioned with a high quality portfolio and strong balance sheet.

Offices have an important role for companies in attracting and retaining talent. An increasing number of businesses have actively re-engaged with their long-term occupational requirements as Covid restrictions have lifted which translated into high market take-up in the first half of 2022. However, leasing transactions are taking longer to complete as decision making timescales are being extended. The supply of top quality buildings remains relatively constrained and established businesses with large requirements continue to enter into early pre-let discussions. In addition, we may see some development deferrals as market conditions lead to a re-appraisal of schemes.

Despite some of the large Tech companies pulling back on their space expansion plans, there remains a broad range of businesses with active requirements. A variety of international companies continue to choose London for their UK or European HQ.

CBRE reported a net withdrawal of tenant-controlled space in H1 across central London. Combined with strong take-up, market vacancy has reduced to 8.2% (December 2021: 8.8%) although this masks the ongoing divergence between the West End at 4.3% (now back in line with the long-term average since 2000 of 4.2%) and the City at 12.3% (long-term average 6.6%). Space under offer is close to record levels at 4.3m sq ft, 1.7m sq ft of which is in the West End.

We expect the flight to quality to continue. We maintain guidance for 2022 of average ERV growth in our portfolio of 0% to 3%, following 0.9% growth in H1. Following a strong start to the year, the macroeconomic environment has weakened. The substantial increase in financing costs and inflation, among other factors, is bringing upward yield pressure across the real estate sector. London continues to have global appeal and we believe our portfolio will prove more resilient given the location and scarcity of our high-quality portfolio.

Fredrik Widlund, chief executive:

The economic, geopolitical and market situation and outlook have deteriorated markedly since the end of the first quarter with the impact of the Russian invasion of Ukraine contributing to existing inflationary and supply chain pressures. CLS though retains significant protection through its well-placed portfolio with over half of its leases being index-linked and the majority of its financing at fixed rates.

Our focus remains on minimising vacancy in our existing portfolio with the potential to capture significant uplifts from the portfolio’s net reversion and the increased rents that will be commanded from our higher quality refurbished space with great tenant amenities and facilities.

We believe that our strategy and business model remain well-placed for the long-term success of the company with significant benefits from our focus on, and the diversity benefits of exposure to, the three largest economies in Europe (Germany, France and the UK). Our portfolio has significant opportunities to grow rental income over the next couple of years.

Logistics

Aubrey Adams, chairman:

Year to date, the occupational market has been very strong with record demand from a wide range of occupiers leading to historically low vacancy rates and driving attractive levels of rental growth. Occupational demand is supported by long term structural drivers, some of which have been accelerated by the pandemic, such as the transformation of retail due to demographic and technological change, the drive to enhance sustainable performance, and the need to increase supply chain efficiency. Looking forward, the extent of this demand gives us confidence in both the ongoing strength of the occupational market and our ability to support our customers by producing solutions which enhance efficiency and supply chain resilience.

Investment demand remained high in the first quarter of the year, with pricing for high-quality investments supported by the significant weight of money looking to be deployed into the sector. Sentiment shifted through the second quarter as the deteriorating economic environment caused reduced investment activity. Our high-quality investment portfolio is focused on prime assets, let on long leases to resilient customers and with strong ESG credentials; we therefore expect our relative performance to remain attractive in the face of a potentially more uncertain investment market.

Retail

Ian Hawksworth, chief executive:

There has been strong operational momentum at Covent Garden over the first half of the year, with encouraging leasing demand across all uses, high occupancy levels and rent collection patterns continuing to normalise. Footfall continues to trend towards pre-pandemic levels and customer sales in aggregate are ahead of 2019 levels, reflecting the appeal of Covent Garden and London’s West End.

Footfall patterns and consumer behaviour continue to evolve, with activity levels typically being higher at and around weekends. There has been a growing number of international tourists since Easter and through the summer contributing to strong trading performance of retail and hospitality customers.

The Elizabeth Line opened on 24 May 2022 which will further improve the West End’s connectivity and accessibility, adding around 10% to central London’s rail network capacity. The changing travel and footfall patterns it will bring over time are expected to benefit Covent Garden and create valuable medium-term asset management opportunities.

Looking ahead, there is strong operational momentum at Covent Garden with demand across all uses. Customer sales in aggregate are ahead of 2019 levels and footfall continues to improve providing us confidence in our leasing strategy for further rental growth. There remain macroeconomic and political headwinds and the West End is not completely insulated. However the West End has demonstrated remarkable resilience and our unique portfolio of prime investments provides a greater degree of resilience.

We are delighted that shareholders have recognised the benefits of the merger with Shaftesbury Plc by voting in favour of the transaction and we are looking forward to bringing the two companies together once the CMA process completes. We believe the merger of Capco and Shaftesbury represents a compelling strategic fit creating an almost irreplaceable portfolio.

The combination will generate both short- and long-term benefits including greater efficiencies and synergies, a more diverse portfolio with a stronger operational platform of scale and efficiency and enhanced access to capital. There is significant revenue growth potential to be captured over time through the difference between annualised gross income and ERV. Shaftesbury Capital will combine the best of both companies, to create a leading central London REIT and seek to deliver long-term value for shareholders.

Lawrence Hutchings, chief executive:

The current macroeconomic environment, heightened by inflationary pressures on the consumer and exacerbated by the impact of the tragic war in Ukraine, presents a challenging market backdrop. Whilst this has inevitably tempered some of the optimism that was building in the recovery from COVID, we remain well-positioned to navigate such challenges given the hard work undertaken in the period.

The actions taken over the last 12 months to restructure the balance sheet and refocus the portfolio have stabilised the business. This, aligned to the naturally more defensive nature of our well-located, affordable and needs-based community shopping centres, leave us well positioned to withstand any cyclical pressures and to take advantage of opportunities to grow the business and further utilise our proven skills and management expertise.

Healthcare

Andrew Cowley, investment manager:

Now, as the pandemic recedes, all businesses face a new challenge: a spike in inflation which has taken it to levels which we have not seen in G7 economies for four decades. Since founding the business five years ago, we have always applied two principles. First, the group’s leases must be inflation-linked and today 100% of its leases are inflation-linked. Second, rent needs to be sustainable over the long fixed term of the group’s leases. This requires careful tenant selection, setting the initial rent at a prudent level and putting in place floors and caps on rent increases in most of our leases to give our tenants some level of protection against a spike in inflation such as we are now experiencing, while in periods of low inflation providing the group with progressive rental uplifts.

Our tenants provide an essential service and the sector in which they operate has demonstrated over long time periods the ability to pass on inflationary cost increases. The group continues to have no voids and to receive 100% of rent due with no alterations to leases. Tenants’ rent cover remains healthy, at an average of 1.85x times for the 12 months ended 30 June 2022, making it higher than it was pre-pandemic. Three factors underpin this solid level of rent cover. Firstly, the care we take in setting initial rents when agreeing new leases with tenants to ensure the building is not structurally over-rented and the inflation-linked rent is likely to be received through the life of a long-term lease; secondly; the support from government through to March 2022, which was focused on improving infection control measures, during the pandemic; and, thirdly, strong increases in the fees our tenants charge for the care they provide.

Student accommodation

Duncan Garrood, chief executive:

We are encouraged that occupancy for the next academic year 2022/23 is currently at 92%, which is ahead by 10% compared to the same time pre-pandemic. With greater confidence that market conditions are normalising and progress on further improving our business and portfolio, we are increasing our guidance for revenue occupancy to 90% to 95% for 2022/23 academic year, and we expect to be toward the top of this range, assuming no further disruption.

2021 saw investment volumes in the UK student accommodation sector total just over £4.1bn despite the lingering effects of the COVID-19 pandemic. In 2022 so far, investment volumes have been considerable, highlighting demand from a growing list of private equity, sovereign wealth funds, property companies and private individuals looking to increase exposure in the sector. Investors have been prepared to look beyond wider economic market sentiment to focus on the UK student accommodation sector’s strong long-term growth prospects.

Student demand figures for the upcoming year are looking positive. In the UCAS June Deadline results the key points were:

- Total undergraduate applicants up slightly by 0.2%

- Non-EU international applicants up 9% with growth in applicants from China and India

- Chinese applicants up 10%

- Indian applicants up 20%

- EU applicants down by 27%

- Total applicants up 6% from 2019/20 applications.

We are encouraged to see the year-on-year trend of growth in students, fuelled by the desire of international students to study in the UK, and in top quality UK universities in particular. UCAS is predicting that by 2026 there will be over a million applicants for UK universities, and that at least a fifth of those will be international students. This means overall applications are projected to grow nearly 50% over the next five years.

There is also a long-term trend of growing numbers of postgraduate students. The data for this is not as recent as UCAS, which only records undergraduate applications, but the latest figures from the Higher Education Statistics Agency reported 743,000 UK post graduate students in 2020/21 which was up 16% on the previous year. This gives us confidence that our Postgrad product, which we are piloting in Edinburgh, will have significant attraction.

Real estate research notes

Grit Real Estate Income Group – Transition underway

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.