Triple whammy but standing by the dividend

Triple whammy but standing by the dividend

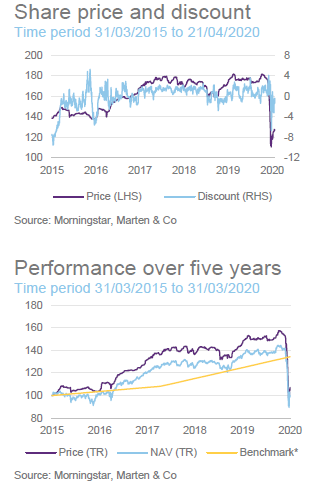

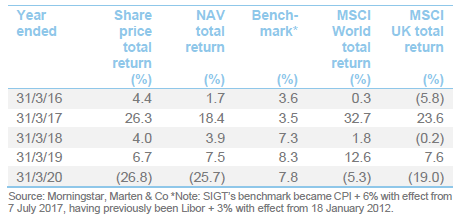

The outbreak of covid-19 has taken the wind out of global markets and Seneca Global Income & Growth Trust (SIGT) has not been immune to this; its NAV has fallen 30.4% during the first quarter of 2020 (23.6% in March – all in total return terms). It has suffered a triple whammy from its UK-biased value style, its mid cap exposure and the correlation of alternative asset fund prices to equity markets, but its board has said that it intends to maintain the quarterly dividend rate at 1.68p for the time being.

We cannot be sure how long the crisis will last, but SIGT’s manager believes that a very negative scenario is currently priced in and that under a less negative outcome, many positions will see material re-ratings. If true, the current market malaise may well be a good entry point for the longer-term investor, who can afford to be patient.

Multi-asset, low volatility, with yield focus

Multi-asset, low volatility, with yield focus

Over a typical investment cycle, SIGT seeks to achieve a total return of at least the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. To achieve this, SIGT invests in a multi-asset portfolio that includes both direct investments (mainly UK equities) and commitments to open- and closed-end funds (overseas equities, fixed income and specialist assets).

Note: SIGT’s benchmark became CPI + 6% with effect from 7 July 2017, having previously been Libor + 3% with effect from 18 January 2012

Equity reduction strategy vindicated

Equity reduction strategy vindicated

In 2017, Seneca Investment Managers (Seneca IM) began to steadily reduce its equity weighting in advance of a global recession that the manager foresaw in late 2020/early 2021. The manager thought a global equity bear market would begin in late 2019/early 2020, as investors anticipated the slowdown. SIGT’s portfolio was to be meaningfully underweight in equities by that time. Equities were 53.7% of SIGT’s portfolio at the end of January 2020, down from 63.0% in March 2017, much lower than they had been but still a significant proportion of the portfolio relative to some peers.

Covid-19 – all assets became highly correlated

Covid-19 – all assets became highly correlated

The covid-19 outbreak looks as though it could be the trigger for this recession. So, from that point of view, SIGT’s timing seems to be spot on. However, as markets rolled over, all of SIGT’s asset classes became highly correlated. UK equities, overseas equities and most of its specialist assets holdings all moved down together. SIGT’s fixed income holdings, which might have offered more protection, were tilted towards short duration high yield bonds, and these suffered as well.

Prior to the covid-19 pandemic, the manager was expecting inflation to increase, precipitating a rise in interest rates, hence the short duration exposure. Gold and government bonds held up well but SIGT’s allocation to gold, while helpful, was relatively modest (circa 7% when the crisis began), and its allocation to government bonds was nil. As we have explained in our previous notes, the manager did not consider that there was a valuation argument for holdings government bonds. They offer a negative real interest and so the manager still does not consider them to be a safe investment in the medium term or represent good value. The manager believes that the current crisis will lead to further quantitative easing and government spending, which will likely be inflationary over the longer term.

SIGT is a value-driven fund and, prior to the crisis, the manager was seeing value in the UK, particularly domestic UK, given the overhang of Brexit. The manager also saw the best value (yield, in particular) in names that are more cyclical (for example, consumer discretionary and industrial stocks), and in mid cap stocks. However, these exposures have put SIGT’s portfolio at the sharper end of the slow down (global stocks have outperformed domestic UK, large caps have outperformed mid-caps, and defensive stocks have outperformed cyclical ones). SIGT also gains a significant chunk of its exposures via holdings in closed end funds. The manager comments that many of these saw not only their underlying assets fall in value but also their discounts to NAV widen, exacerbating the impact on SIGT’s portfolio.

One of SIGT’s features that distinguishes it from most of its peers is the attractive yield that it offers. However, to provide this, SIGT’s manager cannot focus heavily on the growth stocks that the market currently favours; highly defensive assets such as gold and cash, which offer little to no yield; or a number of other defensive sectors, such as consumer staples, which do not offer sufficient income.

The consequence of this is that, at least in the short term, SIGT’s portfolio has been hit from a number of directions and has not offered the level of downside protection that the manager would have hoped for. However, in the manager’s defence, this is not a normal crisis. Consumers have been locked in their homes and consumption patterns have also shifted dramatically. While we will come out of the other side of this, the key question is, how long will the crisis prevail? If the crisis turns out to be protracted many of SIGT’s holdings may be fair value, or possibly expensive. However, with a less negative outcome, many positions will see material re-ratings.

In the meantime, the manager has been liquidating SIGT’s short duration high yield exposure and has been topping up SIGT’s exposure to UK equities, taking advantage of valuation anomalies that are now closing. The manager highlights that, for some holdings in SIGT’s portfolio, valuations have been lower in recent weeks that they were during the GFC, and so it has been making small incremental changes to the portfolio. The manager has been focusing on their UK holdings’ debt covenants and has been stress testing these for very extreme scenarios. It concluded that there is enough headroom for these to be unlikely to fail as businesses and, when the government started to provide support, the manager increased its purchases. It says that SIGT’s UK holdings’ share prices are now typically up 10-15% from the recent market lows.

Over time, the manager plans to reduce SIGT’s allocation to gold and redeploy this into better value opportunities. After a brief dip, when investors seemed to be using their gold holdings as a source of liquidity, the gold price has increased. However, the manager is not moving to reduce SIGT’s exposure to liquid and defensive assets too quickly, as it does not know how long the current situation will last. It wants to keep some of SIGT’s powder dry for now as it anticipates that there will be lots of volatility and chaos as the crisis unfolds, which will create additional buying opportunities.

Asset allocation

Asset allocation

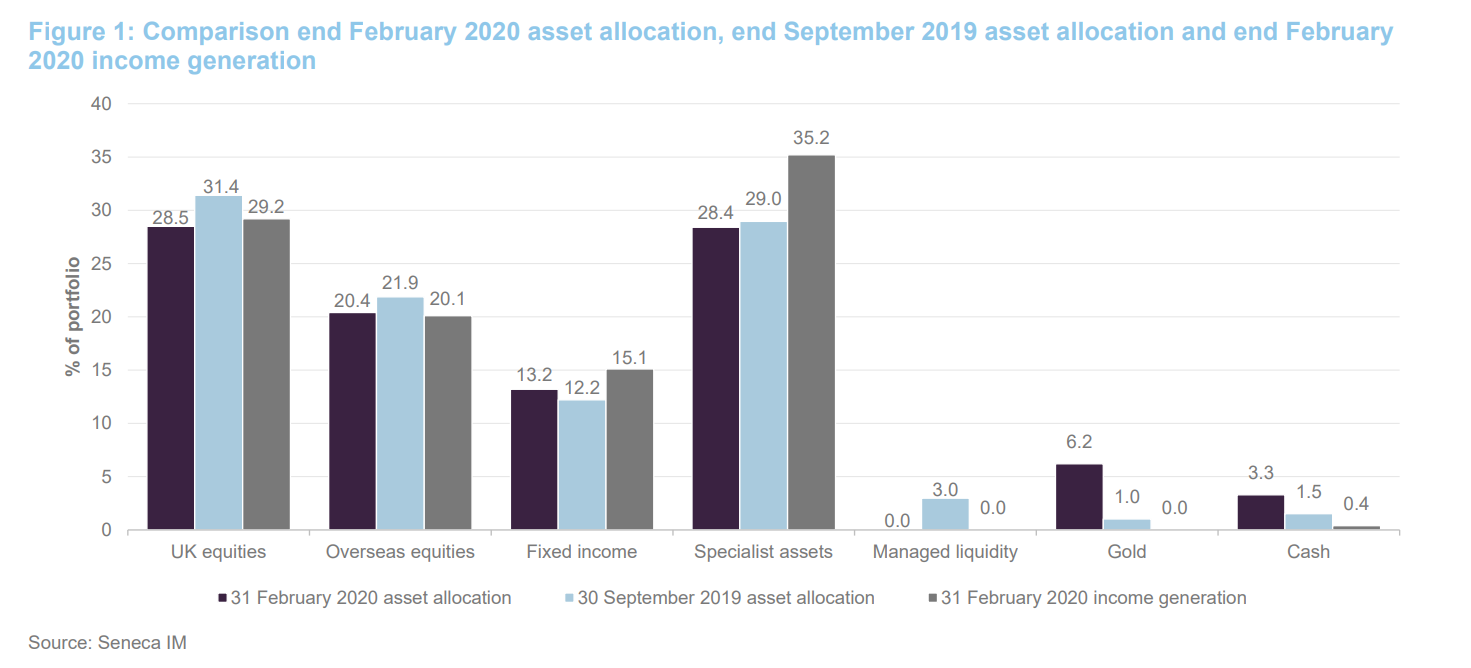

Figure 1 compares SIGT’s asset allocation as at the end of February 2020 and its asset allocation as at the end of September 2019 (the most recently available data when we last wrote on SIGT). The proportion of income generation, as at the end of February 2020, for each asset class is also included. Comparing the end of February asset allocation with the end of September asset allocation (see Figure 1), the allocation to UK equities has reduced by around three percentage points (key developments are discussed below), while the allocation to overseas equities has fallen by 1.5 percentage points. The allocation to specialist assets has been reduced by 0.6 percentage points, while the allocation to managed liquidity has been reduced from three percentage points to zero.

The biggest increase is to gold, which has moved up by 5.2 percentage points. Cash has increased by 1.8 percentage points and fixed income has increased by one percentage point. Further explanation of these changes is provided in the following pages.

UK direct equities – key developments

UK direct equities – key developments

Since we last published, Seneca IM has continued to reduce SIGT’s allocation to AJ Bell. In the short term, it has allocated some of the proceeds to the iShares Core FTSE 100 ETF (to maintain SIGT’s exposure to UK equities rather than holding cash). The manager has also sold out of SIGT’s holding in Polypipe in its entirety, which is discussed overleaf, on valuation grounds. Small additions (around 20bps each) have been made to SIGT’s holdings in BT Group and Halfords, as these have got cheaper, and the manager felt they offered good value.

Overseas equities – remains biased towards emerging markets and Asia, with zero exposure to the US

Overseas equities – remains biased towards emerging markets and Asia, with zero exposure to the US

Regular readers of our notes on SIGT, will likely be aware that the manager reduced the trust’s exposure to the US to zero as it considers that this market looks expensive, and there is limited exposure to both Europe and Japan. Instead, SIGT’s overseas equities exposure is tilted towards Asia and emerging markets (the manager likes the long-term structural growth that is available and the less efficient nature of capital markets which creates more opportunities for managers, who have the skills and resources, to take advantage of pricing inefficiencies).

SIGT’s manager has increased the size of the trust’s position in the Investec Global Gold Fund (see page 5 of July 2019 update note – Going for gold – for more details of this fund) as they wanted to increase SIGT’s allocation to gold, while diversifying away from the physical gold ETF, which is SIGT’s other allocation to gold. While the ETF is classified as a specialist asset, the Investec Global Gold Fund is classified as an overseas equities’ holding. This is because this fund invests in the equity shares of gold mining companies and so has equity risk that the physically backed gold ETF does not. Otherwise, within overseas equities, the manager has been looking to take advantage of opportunities that have been made available by the market dislocation.

Specialist assets – property exposure recycled, exposure to JLEN and Greencoat UK Wind reduced

Specialist assets – property exposure recycled, exposure to JLEN and Greencoat UK Wind reduced

Since we last published, SIGT’s manager has sold the trust’s holding in Primary Health Properties, significantly reduced Assura and trimmed London Metric Property; all on valuation grounds. The proceeds were, prior to the recent downturn, rotated into holdings in LXI REIT (this is a small 40bp position) and Ediston Property, which the manager considered to offer better value. In addition, SIGT’s holdings in JLEN Environmental Assets and Greencoat UK Wind were both reduced on valuation grounds (SIGT’s manager says that, prior to concerns over the falling power price coming to the fore this year, they felt that the sector was looking very hot and they decided to take some money off of the table). The manager has also added to UK Mortgages (UKML). The more significant changes are discussed in greater detail in the following pages.

Polypipe – sold in its entirety, on valuation grounds

Polypipe – sold in its entirety, on valuation grounds

As illustrated in Figure 3, between the middle of August last year and the turning of markets with the outbreak of covid-19, Polypipe (www.polypipe.com) had a very strong run of performance (it was up 33.1% in Q4 2019 alone). SIGT’s manager says that, while it still likes the company, its valuation expanded significantly during the second half of 2019 and this triggered the position to be sold. By way of illustration, Polypipe, which has been a SIGT holding for a number of years, was trading at 8x EV/EBITDA towards the middle of 2019 but, following a significant re-rating, had moved up to 12x EV/EBITDA by the end of the year. This is way above its 10-year average of around 9.5x. SIGT’s manager felt that, while the outlook had improved post the general election, this was more than priced in. Having reviewed Polypipe on the back of this strong performance, the manager exited the position quickly.

Primary Health Properties – exited on valuation grounds

Primary Health Properties – exited on valuation grounds

Primary Health Properties (www.phpgroup.co.uk) has performed strongly during the last year (see Figure 4), buoyed by its merger with rival MedicX, which completed in March 2019. SIGT’s manager likes the healthcare property space (inflation linked, government backed revenues and very high tenancy ratios) but felt that this sector was becoming over-bought. Like the market as a whole, it welcomed the merger with MedicX as it felt that the two companies were a good strategic fit and that the combined companies greater scale increased liquidity, interest and opportunities. However, with PHP trading at a premium in the region of 44%, after the merger had completed, the manager found the valuation hard to justify.

On their estimates, PHP’s premium suggests that its net initial yield of 4.9% was actually being priced at 3.3% by the market. PHP’s rental growth is heavily indexed and delivering under 2% and, while this was increasing as new assets came on stream, gearing this by a 50% loan-to-value suggests room for dividend growth of around 3%. In the manager’s view there were better opportunities available elsewhere. A similar argument applies to the investor and developer of primary care property, Assura, which reached a premium of around 36% and has also been reduced significantly on valuation grounds.

UK Mortgages – added to position despite dividend cut

UK Mortgages – added to position despite dividend cut

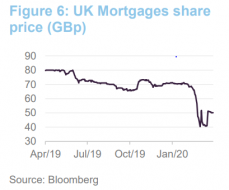

As noted on page 11, UK Mortgages (UKML) has cut its dividend significantly (from 1.25p to 0.375p per quarter). Arguably reflecting strong underwriting standards, UKML was slow in deploying its capital but, until the announcement of the dividend cut following the outbreak of covid-19, it had met its dividend commitments, albeit at the expense of paying an uncovered dividend. However, UKML now has two forward flow agreements in place, which has seen a marked uplift in capital deployment. The manager has also secured agreement from the board to increase the fund’s leverage and, with UKML’s Malt Hill securitisation due to be refinanced in May (SIGT’s manager says that this was expected to save around 200bp), it was expected that in tandem this would provide the solution to the dividend coverage problem.

Going into the crisis, UKML’s dividend was 70-80% covered but borrowers can now ask for payment holidays. It is hard to know how large the uptake will be, but SIGT’s manager believes that 15% is a reasonable assumption. However, while this represents a temporary cash flow issue, it should not lead to a permanent loss of capital.

Credit markets are currently locked, and so the Malt Hill refinancing cannot be done efficiently at the moment, but the securitisation doesn’t have a drop-dead date and it can continue with the existing lender. It just means that UKML will not be able to generate the cost savings as soon as it had hoped and the costs will go up marginally, but the interest rate is not punitive (this was expected to generate savings of £30-£50m of capital, which could be used for buy backs or further lending).

SIGT’s manager thinks that while UKML has cut its dividend aggressively, its income should spike back up again. However, the market did not welcome this development and UKML was pushed to a circa 40% discount. SIGT’s manager felt that UKML was being punished heavily for short term issues that should not be meaningful in the long term. It therefore decided to add to SIGT’s position (the stock is up around 12% since the dividend announcement).

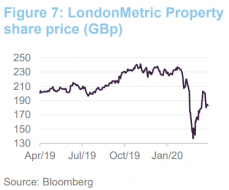

LondonMetric Property – long-time holding reduced on valuation grounds

LondonMetric Property – long-time holding reduced on valuation grounds

LondonMetric Property (www.londonmetric.com) is a FTSE 250 REIT and a long-time constituent of SIGT’s portfolio. It describes itself as being focused on retailer-led distribution, out of town and convenience retail. It takes an occupier-led approach to property investments. It seeks opportunistic acquisitions, active asset management and short cycle developments and SIGT’s manager says that it has been successful in this regard. So much so that, on the back of its strong asset management credentials, SIGT’s manager says it was trading on a 30% premium to NAV, prior to the recent market dislocation. Seneca IM says that, prior to the market rout, it was expecting further NAV appreciation as LondonMetric integrates A&J Mucklow, which it acquired in June 2019. However, even allowing for this LondonMetric was looking more fully valued and, with a prospective dividend yield of 3.7%, it decided to reduce the position.

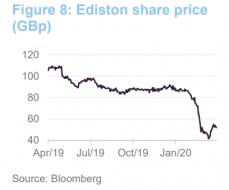

Ediston Property – position increased on weakness; market price does not reflect evolving retail

Ediston Property – position increased on weakness; market price does not reflect evolving retail

When we last discussed Ediston Property Investment Company (www.epic-reit.com), in our January 2018 note (see page 6 of that note), it had recently re-joined SIGT’s portfolio following a successful fundraising that alleviated liquidity concerns. Seneca IM had been impressed by EPIC’s manager’s ability to ‘work the assets’ in its portfolio, which SIGT’s manager felt would be very important in the late part of the property cycle. More recently, EPIC has been suffering because of its retail property exposure (see Figure 8), which accelerated as the market digested the covid-19 outbreak.

SIGT’s manager says that EPIC’s portfolio is a combination of retail property and warehouses and that, given the current economic backdrop, the market was pricing it for bankruptcy of many of its tenants (it was trading at around a 60% discount to the most recent NAV, which spurred SIGT’s manager to take a closer look). The manager acknowledges that around 63% of EPIC’s portfolio is retail but this includes the likes of B&Q, Tesco, Aldi, Iceland and B&M. The manager analysed EPIC’s portfolio, establishing which of its tenants are open and those that are closed, and concluded that over half of EPIC’s retail exposure is in fact defensive and secure. To illustrate the point, Hammerson collected around 29% of the Q1 2020 rent it was expecting, Intu collected 34% and EPIC collected 69% (it expects to get to 75% shortly).

20-30% of EPIC’s portfolio is in the office space. SIGT’s manager has also run its slide rule over the tenants and has concluded that the income is reasonably secure revenue (EPIC can count the likes of AXA, Ernst and Young and Capita amongst its tenants).

A further consideration is that EPIC’s properties tend to be in less expensive rental locations (typically £14-£15 per square foot per annum). SIGT’s manager thinks that, in the current downturn, retailers are more likely to cut expensive locations first, giving the portfolio additional resilience. The manager acknowledges that there are challenges ahead, in terms of some tenants ultimately going bust, and properties having to be re-let, but it believes that the market reaction has been overdone and has therefore added to the position in the 40-43p range. The manager recognises that the NAV will have fallen, but it does not believe that it has fallen by around 50%, which is what the price movement would imply. It believes that 60-70% of EPIC’s revenue can be classified as secure, or highly secure, and it expects to see a material re-rating over the longer term.

LXI REIT – new specialist assets holding

LXI REIT – new specialist assets holding

Launched in February 2017, with a premium main market listing on the London Stock Exchange, LXI REIT is just over three years old. It invests in a portfolio of UK commercial property assets let, or pre-let, on very long (typically 20 to 30 years to first break), inflation-linked leases. It has a wide range of institutional grade tenants across a range of property sectors – hotels, discount retail, industrial, care homes, student accommodation, car parks, leisure facilities, automotive and office). It targets an NAV return of a minimum of 8% per annum over the medium term. At the time of investment, LXI was trading at a small premium to NAV, which was somewhat out of line with its peers and offered a decent yield. Prior to the outbreak of covid-19, SIGT’s manager felt that the portfolio was well managed, was well positioned to weather a downturn and offered room for yield compression and so it decided to establish a small 40bp position.

Clearly the outbreak of covid-19 has disrupted any near-term expectations the manager and the market had for LXI, but the manager believes it is well positioned to benefit from a material re-rating over the longer term. It likes the diversification offered by LXI’s portfolio (it is fairly broadly split by sector with a heavy emphasis on index linking) and the track record of good asset management. SIGT’s manager points to the half year ended 30 September 2019, which saw 42 index-linked or fixed rental uplifts agreed with tenants giving a weighted average uplift of 2.21% on those reviewed, and the potential asset growth from forward funded assets (as at 30 September 2019, there were £95m of forward funding assets post balance sheet which should deliver a degree of NAV growth going forward).

Largest investments

Largest investments

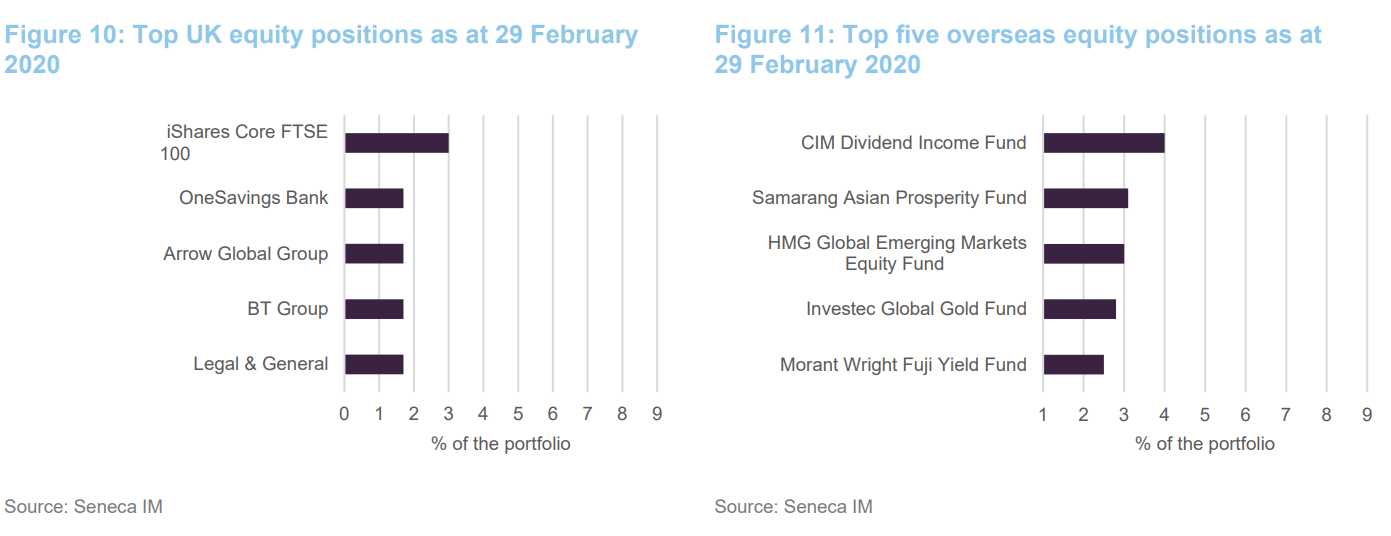

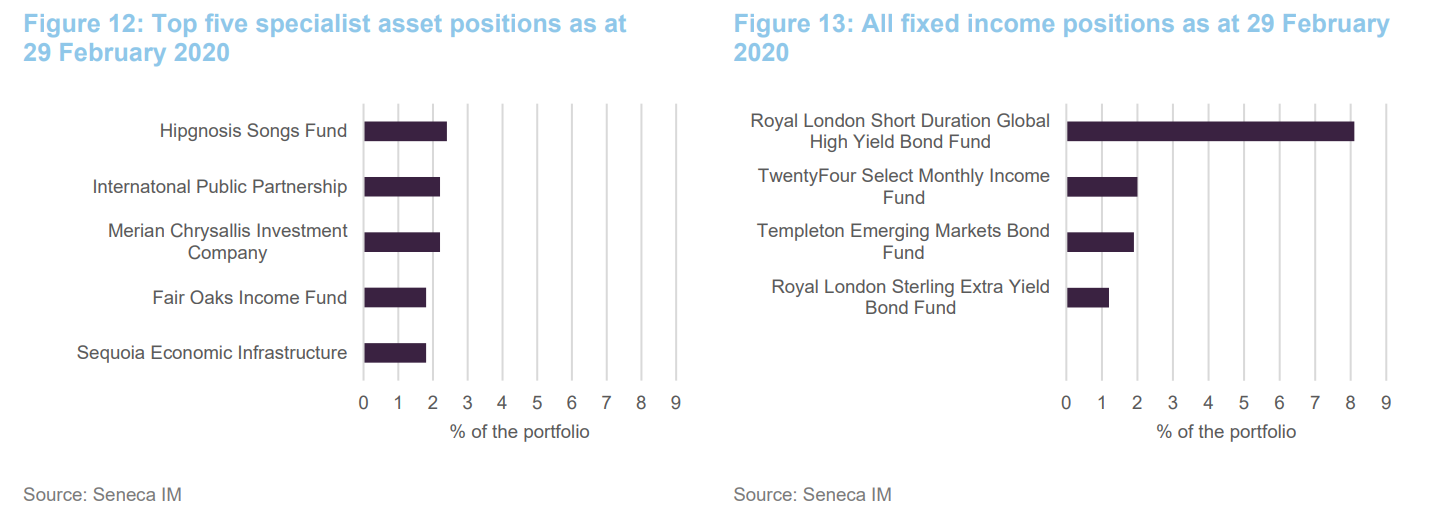

Figures 10-to-13 show the largest positions in each part of the portfolio as at 29 February 2020. Details of the rationale underlying some of these and other positions can be found in our previous notes (see page 14 of this note). For example, readers who would like more detail on the CIM Dividend Income Fund, Samarang Asian Prosperity Fund, Hipgnosis Songs Fund, Diploma, Victrex or Custodian REIT should see pages 6–9 of our September 2018 update note. Our November 2019 note has more detail on Hipgnosis Songs Fund, Purplebricks, the Morant Wright Fuji fund as well as updates on Schroder UK Public Private Trust (formerly Woodford Patient Capital) and AJ Bell. Some of the more recent changes are also discussed in detail above. The holdings in Figures 10-to-13 accounted for 49.7% of SIGT’s portfolio as at 29 February 2020.

Many of the names in Figures 10-to-13 will be familiar to readers of our previous notes on SIGT, particularly for the overseas equities, specialist asset and fixed income positions. Within SIGT’s top five UK direct equities, Further reductions in the AJ Bell position has moved this out of the top five altogether, while Babcock International has also moved out. Legal and General and OneSavings Bank have moved up the rankings to take their places. The top spot at the end of February was held by the iShares Core FTSE 100 ETF, which was acquired as a temporary store for the proceeds of the partial AJ Bell sale.

Looking at overseas equities, the manager has been adding to SIGT’s holdings in the Investec Global Gold Fund, which has pushed this up the rankings, and Liontrust European Enhanced Income has moved out of the top five.

Looking at specialist assets, the merger of Hipgnosis Sings Fund C-share (SIGT participated in this fund raising) with its ordinary share, has moved this fund up into the top five (for more discussion on SIGT’s holding in Hipgnosis, see page 10 of our November 2019 annual overview note). Reflecting its recent share price performance, in common with the other aircraft leasing funds, Doric Nimrod Air 2 (DNA 2) has moved out of the top five.

For SIGT’s fixed income holdings, the same funds continue to hold the top four positions, although the manager has been reducing exposure to the Royal London Short Duration High yield Bond Fund.

Performance

Performance

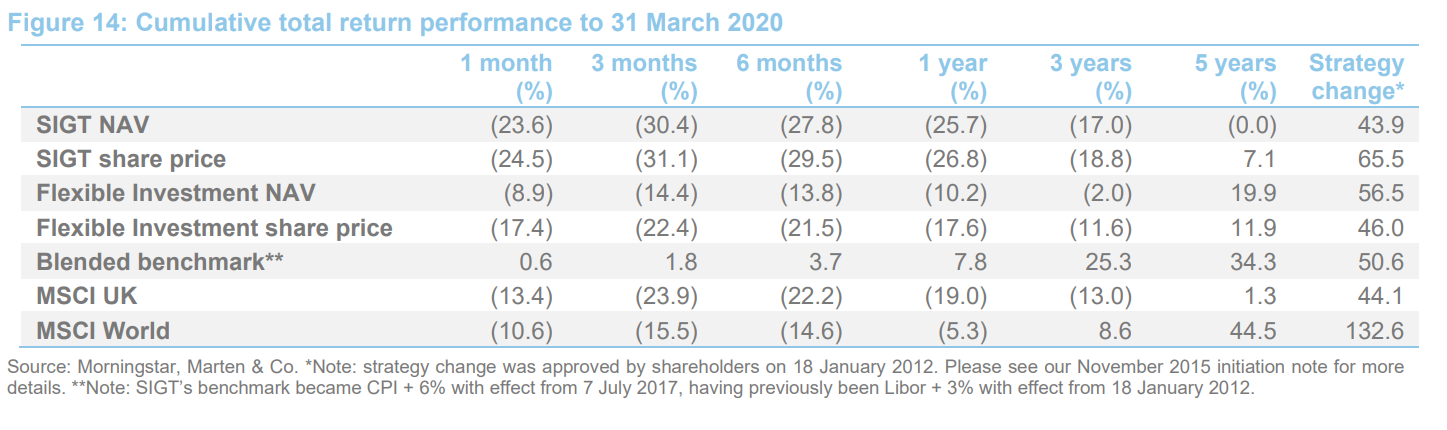

Figure 14 illustrates SIGT’s share price and NAV total return performances in comparison with those of its peer group, its blended benchmark, the MSCI UK and MSCI World indices. SIGT has had a very difficult start to 2020. The outbreak of

covid-19 has had a starkly negative effect on financial markets and SIGT’s NAV lost 30.4%, in total return terms, during the first quarter of 2020. Most of this has occurred in March where the NAV was down 23.6% during that month alone. As illustrated in Figure 14, this has eaten into its long-term performance record. This is both in absolute terms, and relative to its Flexible Investment sector peer group.

In the case of its peers, we believe that SIGT’s higher weighting to equities (one of the highest in the peer group) is the primary cause of its underperformance, particularly given its emphasis on mid-caps, and its bias towards the UK. A second issue is SIGT’s income requirement. SIGT’s peers are overwhelmingly capital growth focused and they have been able to make higher allocations to more defensive assets, such as gold and cash, that are not suitable for SIGT’s portfolio as they would not allow it to meet its income requirement. Similarly, growth assets, which have been highly prized for some time, have performed strongly in the current market environment. However, these are inherently low yielding and so SIGT’s portfolio is biased away from them.

Returning to SIGT’s UK equities exposure, the mid-caps have tended to offer better value but can suffer more than large caps during periods where the market is selling off. The overhang of Brexit has also caused UK equities to be cheap relative to global equities, and while UK equities benefitted from the “Boris bounce”, following the strong conservative majority in the UK’s general election in December 2019, this move pales into insignificance when compared against the market’s movements in the face of covid-19. In fact, UK equities appear to have suffered more heavily than global equities in general as markets have retreated. As illustrated in Figure 14 below, UK equities (as measured by the MSCI UK index) were down 23.9% during the first quarter of 2020, while global equities were down by 15.5% (as measured by the MSCI World index).

Another detractor has been SIGT’s nil allocation to US equities. SIGT has not held any US equity exposure for some time on valuation grounds, but US equities have performed relatively well. As noted on page 2, SIGT’s allocation to gold has been helpful but the allocation was relatively modest.

In summary, it would appear that SIGT has entered the crisis exposed to a number of areas that have been particularly hard hit.

Global economic growth will be dented by the covid-19 outbreak, and corporate earnings overall will likely fall in the near term. However, SIGT’s strategy is a long term one and the current market malaise may well be a good entry point for the longer-term investor who can afford to be patient.

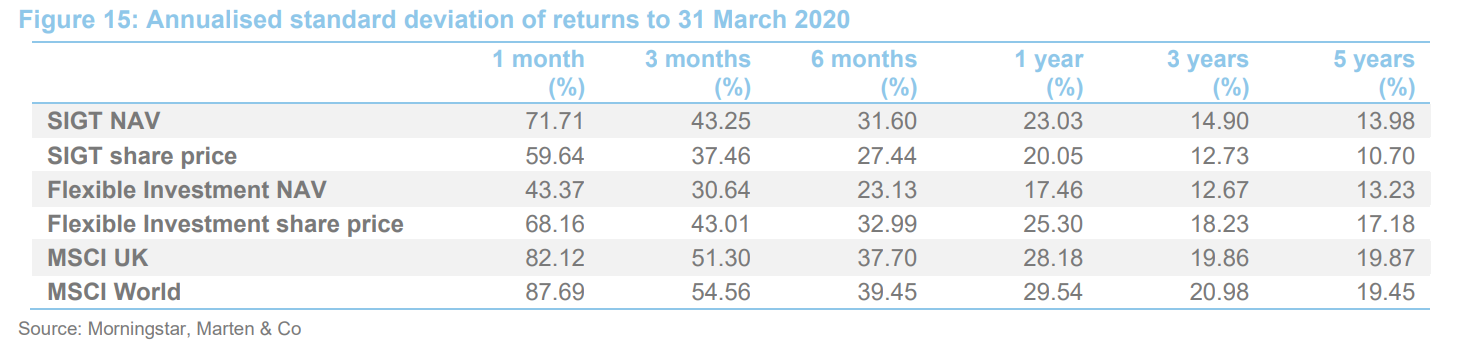

As illustrated in Figure 15, recent events have also seen a marked uplift in the volatility of SIGT’s NAV and share price returns, although these are still below that of UK and global equities (as represented by the MSCI UK and MSCI World). By way of illustration, when we last published in October annualised standard deviation of NAV returns to 30 September 2019, were 6.48, 6.83 and 6.78 over one, three and six months respectively, which were markedly below the peer group averages of 15.09, 2.77 and 11.32. Once again, we attribute this to SIGT being more exposed to areas that have suffered heavily in response to the outbreak of covid-19. However, we think this should reverse when markets regain their composure.

Quarterly dividend payments

Quarterly dividend payments

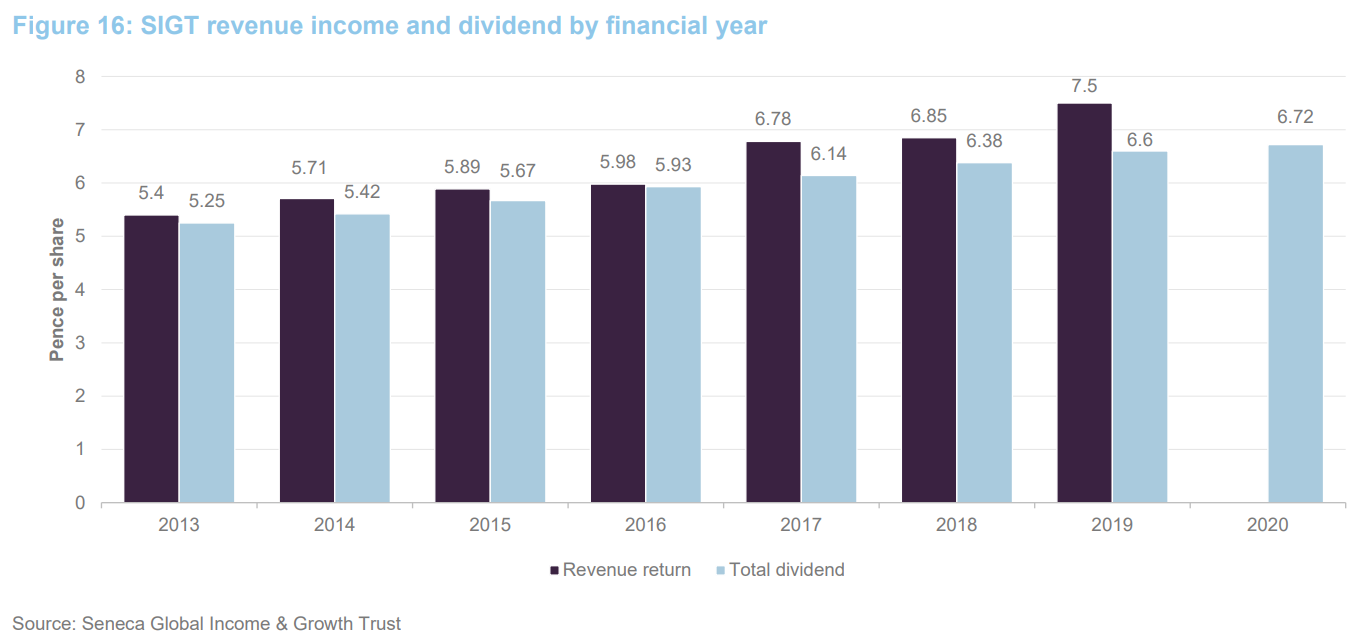

On 7 April 2020, SIGT declared its fourth interim dividend, for the year ending 30 April 2020, at 1.68p per share (in line with the first three quarterly dividends), bringing the total for the year to 6.72p per share. This is a 1.8% increase over the 2019 dividend of 6.60p per share. The 6.72p per share total dividend for the year is a yield of 5.3% on SIGT’s share price of 127.25p as at 21 April 2020. The board has also said that, barring further unforeseen circumstances, it intends to maintain the quarterly dividend rate at 1.68p for the time being.

In recent years, the declaration of the fourth quarterly dividend has typically seen a small increase in the quarterly dividend rate. This has established the base level for the first three interims of the following financial year (ex-dividend dates and record dates being the month prior to payment). Against a backdrop of the marked dislocation in markets caused by the outbreak of covid-19, with many companies cutting or ceasing dividend payments, including companies that SIGT owns, it seems wholly prudent that SIGT’s board has decide not to increase the quarterly dividend rate at this time.

“Well endowed with distributable reserves”

“Well endowed with distributable reserves”

SIGT’s board believes that it should do what it can to help shareholders through the current difficult period. It says that SIGT is “well endowed with distributable reserves” and that the trust is comfortably able to sustain the current dividend rate of 1.68p per share, although this almost certainly means drawing on its revenue reserves and paying an uncovered dividend. As illustrated in Figure 16, this would be a departure from its practice in recent years; SIGT has paid a covered dividend following its reorganisation in 2012 and has rebuilt its revenue reserves. As at 31 October 2019, SIGT’s revenue reserve stood at £2.187m or 4.44p per share. Prior to the strategy change in 2012, it stood at 0.3p per share.

SIGT has benefitted from low exposure to banks and energy

SIGT has benefitted from low exposure to banks and energy

SIGT’s board says that it is unclear how long the dividend reductions of its underlying holdings will last and when full dividends might be reinstated. The board says that once this position is clearer, it will evaluate an appropriate level for SIGT’s dividend. However, for now, the cuts have been significant and are ongoing. These include Essentra, Halfords, Marks & Spencer, Arrow Global, OneSavings Bank, Marston’s, Morgan Advanced Materials and National Express. Within specialist assets, Fair Oaks and DP Aircraft 1 have cancelled, PRS REIT has deferred and UKML has cut is dividend significantly (from 1.25p to 0.375p).

Value, as a style, tends to be overweight banks and energy, but SIGT was not highly exposed to either. Its financials exposure is mostly to insurance companies (for example Phoenix and Legal and General), which have been more robust. Nonetheless, the manager remains watchful and is maintaining a list of companies that have announced dividend cuts, as well as companies that are expected to cut, thereby allowing it to maintain a live estimate of the revenue it expects SIGT to receive. In this regard, SIGT’s closed end structure is very useful as it gives the manager freedom to position the portfolio to capture potential recovery without the need to worry about maintaining cash for redemptions that can occur in an open-ended structure. The manager says that it is expecting to see recoveries in both capital value and dividend income.

For more information on SIGT’s dividends, including coverage and revenue reserves, see page 17 and 18 of our October 2019 annual overview note (see page 14 of this note).

SIGT’s DCM keeps it trading close to asset value

SIGT’s DCM keeps it trading close to asset value

Effectiveness of DCM is proven for volatile markets

Effectiveness of DCM is proven for volatile markets

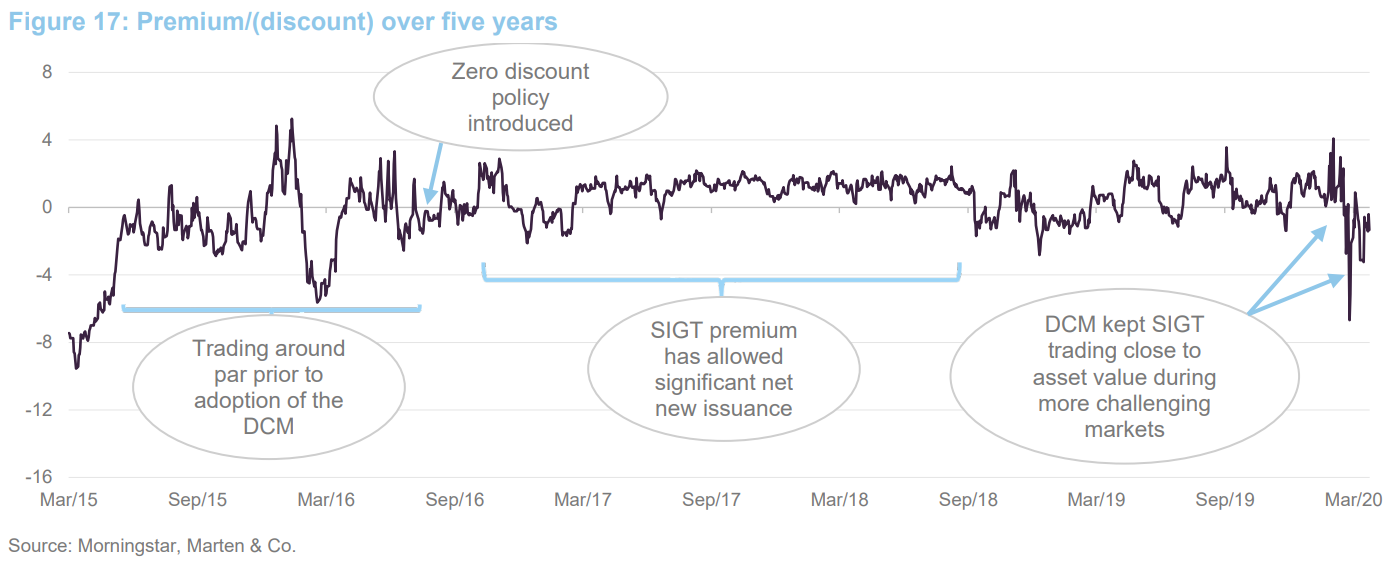

As illustrated in Figure 17, SIGT’s discount control mechanism (DCM), which went live on 1 August 2016, continues to keep the trust trading close to asset value (SIGT has traded at an average premium of 0.4% during the last 12 months). It is noteworthy that during more challenging market conditions, the certainty offered by the DCM kept SIGT trading close to asset value. For example, both towards the end of 2018, and so far this year (the widest discount during the recent market capitulation has been 6.7% on 25 March 2020). Furthermore, the DCM has been shown to keep SIGT trading around asset value during periods where the market has been rallying.

By giving investors confidence that they can enter and exit SIGT at close to NAV, the DCM is designed to allow SIGT to attract new shareholders and grow its asset base over time. This will be helped if it continues to provide low-volatility returns that are attractive to investors.

The DCM has now been in place for just over three and a half years. As highlighted in our previous notes, the overwhelming trend has been one of share issuance since the DCM was introduced, although readers should note that the DCM is proven for both stock issuance and repurchases.

The significant net issuance that has taken place since the DCM was introduced illustrates that there is demand for SIGT’s strategy. We like the certainty that the DCM offers investors, and believe that the asset growth that it has facilitated is positive as, all things being equal, it serves to lower SIGT’s ongoing charges ratio and should support liquidity in SIGT’s shares. These should benefit all of SIGT’s shareholders.

Fund profile

Fund profile

Multi-asset portfolio with low-volatility returns and an income focus

Multi-asset portfolio with low-volatility returns and an income focus

SIGT’s aim is to grow both income and capital through investment in a multi-asset portfolio and to have low volatility of returns. Its portfolio includes allocations to UK equities, global equities, fixed income and specialist assets.

SIGT is designed for investors who are looking for income, want that income to grow, want the capital of the investment to grow, and are seeking consistency, or lower volatility, in returns. A pure bond fund could meet the first of those needs; a pure equity fund could meet the first three. SIGT invests across a number of different asset classes with the aim of achieving all four.

Seneca Investment Managers – a multi-asset value investor

Seneca Investment Managers – a multi-asset value investor

SIGT’s portfolio has been managed by Seneca Investment Managers (Seneca IM), and its forerunners, since 2005. Seneca IM describes itself as a multi-asset value investor. We think the combination of multi-asset investing with an explicit value-oriented approach may be unique to Seneca IM. The idea is that Seneca IM can allocate between different asset classes and investments, emphasising those that offer the most attractive opportunities and yields, making asset allocation, direct UK equity and fund selection (for access to other overseas equities and other asset classes) follow a value-based approach.

Seneca IM says that it saw significant inflows into its products from retail investors during 2019 (some £123m), and that 2020 has also started well. Flows of these size are very healthy for a management house of Seneca IM’s size.

A new director

A new director

The board has announced the appointment of Anne Gilding as a new non-executive director. Anne’s appointment will commence from 15 June 2020, coinciding with the expected date of publication of the company’s annual results for the year ended 30 April 2020.

Over the last 25 years Anne has led the development of global communications, branding and marketing solutions for a broad range of companies including Impax Asset Management Group Plc, BMO (formerly F&C), GAM, Vernalis Group Plc and UBS. She is currently a senior advisor to Peregrine Communications and a non-executive director of Aberdeen New Thai Investment Trust Plc.

Previous publications

Previous publications

Readers interested in further information about SIGT, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Pausing on equity reductions, published on 4 November 2019, as well as our previous update notes and our initiation note. You can read the notes by clicking on the links below.

- Low volatility and growing income – 02-Nov-15

- On track for zero discount policy – 11-May-16

- In demand and no discount – 16-Sep-16

- Celebrating five years since strategy change – 10-Mar-17

- Changing tack – 13-Jun-17

- Steady reduction in equity exposure – 13-Sep-17

- Walking the walk – 16-Jan-18

- Cutting back on equities – 21-Jun-18

- Mind the (inflation) gap! – 18-Sep-18

- Holding steady as cycle turns – 24-Apr-19

- Pausing on equity reductions – 04-Nov-19

The legal bit

The legal bit

This marketing communication has been prepared for Seneca Global Income & Growth Trust Plc by by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.