Proving its mettle

We held the view throughout 2020 that private equity funds like Standard Life Private Equity (SLPE) were being unfairly penalised by the market with wide discounts to net asset value (NAV). This was especially true once it became clearer, from the middle of 2020 onwards, that distributions were likely to be good, and relatively few underlying companies required liquidity support.

Since November, European-listed private equity has been outperforming broader global listed equities. However, until recently, this had limited impact on the discounts of funds such as SLPE, whose discount is broadly in line with the wider peer group average of 12.8%. We think this discount narrowing was justified and should continue. Over 40% of SLPE’s underlying exposure is to healthcare and technology, where rampant exit activity has been fuelling much-better-than-expected distributions. SLPE expects a busy rest of 2021, with the pipeline looking particularly good in primary investments in new funds and co-investments.

Private equity fund of funds with a European bias

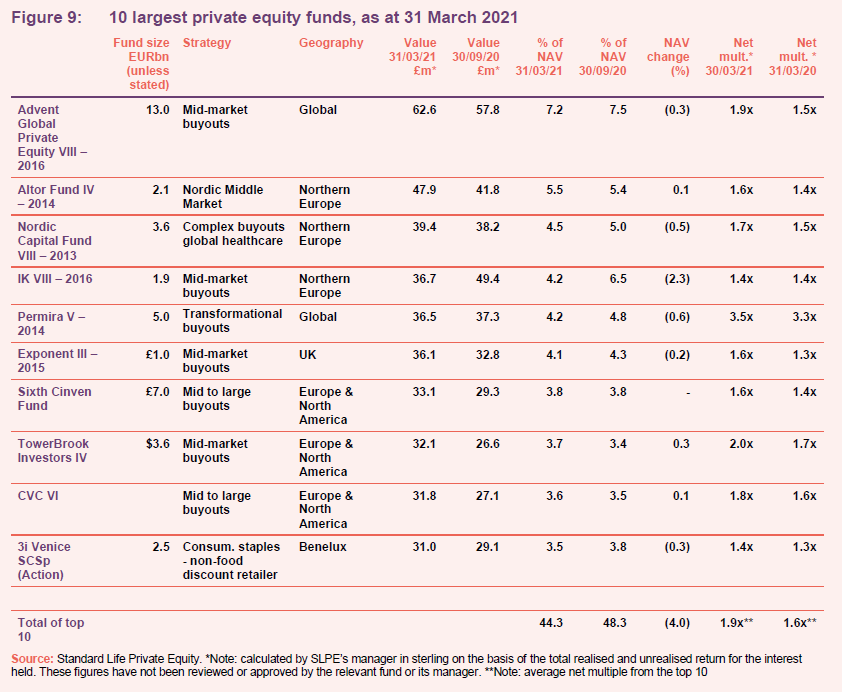

SLPE aims to achieve long-term total returns through a diversified portfolio of private equity funds, and co-investments, the majority of which will have a European focus. Its portfolio is more focused than many of its peers; the top 10 underlying private equity funds accounted for 44.3% of NAV, as at 30 June 2021. Like many private equity funds, SLPE has no formal benchmark. Historically, the portfolio has been most-closely correlated to European small-cap indices.

We think that SLPE’s recent discount narrowing was justified and should continue. We also think that SLPE’s discount is likely understated given the strong performance of equity markets since the end of March 2021 (the valuation date for most portfolios in SLPE’s end July NAV). SLPE’s discount is now broadly in line with the wider peer group average of 12.8%.

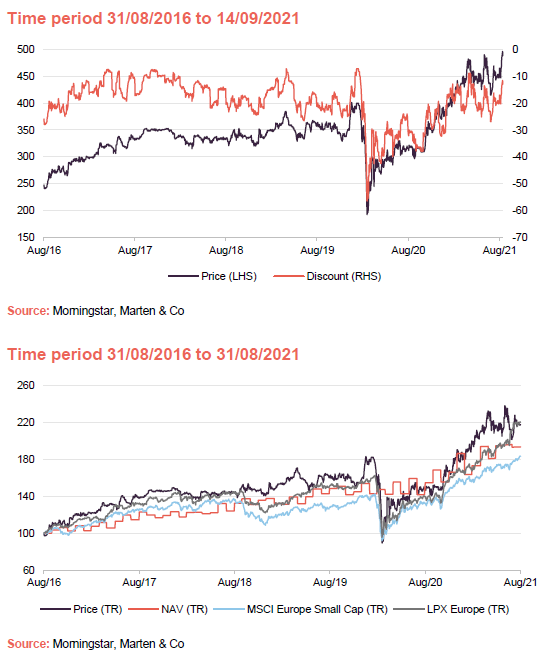

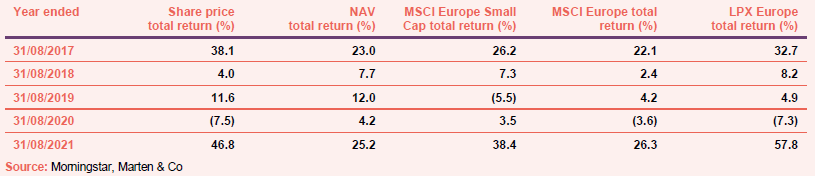

On an annualised basis, over the five years to 31 August 2021, SLPE delivered total NAV and share price returns of 14.7% and 16.9%, respectively. Over the same period, the MSCI Europe, MSCI Europe Small Cap and LPX Europe provided annualised returns of 9.5%, 12.5% and 16.4% respectively.

Fund profile – underlying focus on primary commitments and Europe

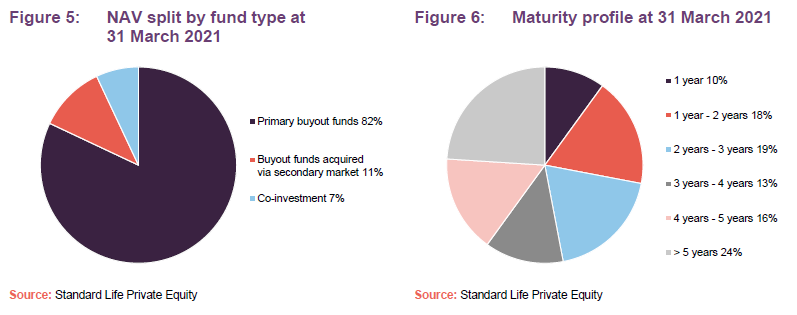

SLPE invests in what it deems ‘best-in-class private equity funds’; predominantly by making primary commitments, with a core focus on the European mid-market. The aim is to maintain a broadly diversified portfolio by country, industry sector, maturity, and the number of underlying investments.

Historically, SLPE has been a fund of funds, making both primary and secondary investments. In January 2019, shareholders approved changes to the investment objective and policy to allow for co-investments – direct investments in businesses made alongside other private equity investors (see pages 2 and 3 of our May 2019 note for more details). SLPE has since completed six co-investments, as at 31 March 2021.

SLPE’s objective is to hold around 50 ’active’ private equity fund investments. This allows for a greater diversification within the funds element, which counter-balances the additional concentration risk from the increasing allocation to co-investments (which is permitted to account for up to 20% of NAV).

Previously, SLPE previously made fund commitments in the £40m–£50m range, but this has reduced over time and £20m–£30m will be a more typical range going forward.

Aberdeen Standard Investments has £10.7bn of private equity assets under management

SLPE is managed by Aberdeen Standard Investments (ASI), which as a group managed £464.7bn of assets (as at 31 December 2020) across 80 countries. ASI is one of the top 10 largest private market asset managers globally by assets under management (AUM), with a team of more than 100 professionals focused on private markets. Within private equity specifically, ASI manages £10.7bn of assets, as at June 2021.

Momentum building after strong sell-off

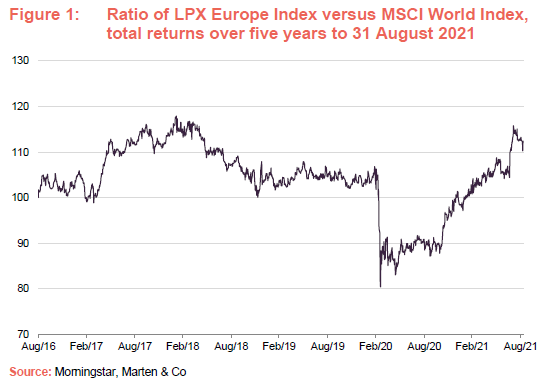

As is illustrated in Figure 1, which shows the performance of the LPX Europe Index (an index of European private equity vehicles) versus that of the MSCI World Index (a proxy for global equities more generally), listed private equity vehicles were aggressively sold-off through the early period of the pandemic.

The early sell-off may have reflected an attempt by the market to pre-empt valuation write-downs of unlisted companies, on the basis that listed fund of funds such as SLPE report NAVs periodically (this is controlled by the underlying managers the fund invests in). However, after an initial bounce, the sector has performed very strongly since the positive news came through on vaccine development in November 2020. There was a brief pause caused by a steepening yield curve in February 2021, and then again at the end of June 2021 as markets started to fret about the emergence of new COVID variants, but the trend of outperformance has resumed with the consequence that, overall, listed European private equity has outperformed broader global equities by a margin over the last five years, despite the disruption caused by the pandemic.

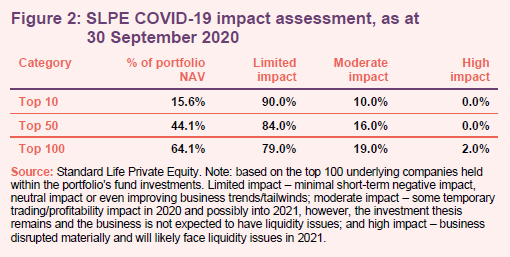

With some uncertainty still present, it is worth highlighting a few factors that can largely explain why private equity has proven resilient. Many of the listed vehicles, SLPE included, had relatively low exposure to the worst-affected industries. In the case of SLPE, exposure to technology and healthcare has been growing for a number of years (see the asset allocation sector) and both of these have performed strongly.

On a wider industry level, private equity learnt a number of lessons from the 2008 global financial crisis. It has become far less common to see covenant-heavy structures built into the debt contracts used by underlying companies. Even as borrowing costs have remained very low for several years, the proportion of equity held on the balance sheet was generally higher than it was in 2007/2008. Companies ultimately required far less liquidity support from their underlying managers than many initially expected.

Figure 2 displays the output of an updated analysis carried out by SLPE on the impact of the pandemic on the top 100 underlying companies by value held through the funds it invests in. Details behind this output are provided in the chart footnote. SLPE’s lead manager, Alan Gauld, notes that 98 of the top 100 companies were expected to see only a limited or a moderate/temporary impact. Alan says that cash flows in the form of distributions by the underlying funds have been far more resilient than initially forecast.

Valuation a double-edged sword

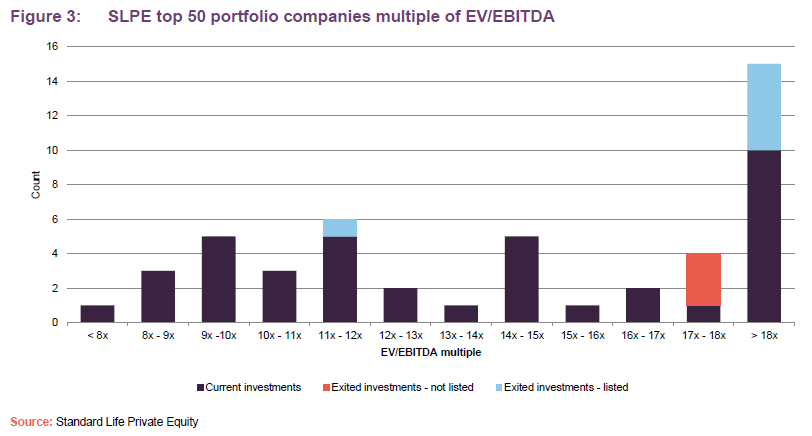

A snapshot of the distribution of SLPE’s valuation breakdown by count, split by current investments, exited unlisted investments, and exited listed investments is shown in Figure 3 below. SLPE’s underlying portfolio was valued on a median EV/EBITDA, multiple of 14.7x as at 31 March 2021 (this compares against 13.5x as at 30 September 2020 and 12x during the March 2020 trough).

SLPE’s managers say that the companies valued on multiples above 18x are generally private companies that have strategic value. These businesses are growing strongly in highly rated sub-sectors (e.g. software, medical technology).

As ever in private equity, higher valuations are a double-edged sword, as they also make it harder to deploy ‘dry powder’ and ultimately satisfy return targets. The manager also makes the point that historically, valuations within private equity have not been that much correlated with public markets.

The median net debt/EBITDA ratio has also fallen during the six months to 31 March 2021 – finishing the period at 3.7x, down from 4.3x. SLPE’s managers say that the underlying private equity managers are generally prudent in relation to the capital structures of their underlying portfolio companies. They say that, whilst leverage can be relatively high (>5x EBITDA), optically high multiples often relate to highly cash-generative businesses and that the debt metrics for SLPE’s portfolio are in line with the private equity market for similar-sized deals and vintages.

Investment process

SLPE’s board has oversight of strategy, gives guidance to the manager and challenges investment strategy annually. Day-to-day management of the fund is delegated to SL Capital, a wholly-owned subsidiary of abrdn Plc.

A mix of top-down and bottom-up

An important element in the top-down overlay process is the quarterly Portfolio Construction Committee (PCC) that considers the European macroeconomic environment. Its views inform asset allocation decisions. In practice, asset allocation evolves slowly. The PCC directs both geographic focus and the emphasis on the mix of primary versus secondary investments. The committee generates views on each country to develop convictions on where the best opportunities are in the primary and secondary markets.

SLPE’s European remit includes the UK. The manager estimates there are about 1,500 funds in its European universe. It believes about 800 of these are ‘institutional grade’ and theoretically a fit for its strategy. Through both its origination efforts and its regional experts, ASI aims to track and maintain a deep understanding of all of these funds. Private equity firms in Europe raise capital, on average, every three to five years, so it considers about 150 funds a year. In practice, the filter is tight and few managers make it through to the final investment list.

The trust goes on to identify its preferred funds in each market (between five and 10) and typically the best of these will form a pipeline. It has a predisposition towards funds specialising in Northern Europe, which has the most developed private equity markets. Each week, SLPE will review a list of about 20 funds, which are discussed at a committee meeting. If a fund is deemed worthy of more detailed due diligence, the team will spend three to six months on due diligence for a potential primary fund investment, and from one to two/three months for secondaries (investments in existing funds) and co-investments.

The most important differentiator that ASI is looking for is ‘operational alpha’ from a fund – the added value generated by the limited partner (LP) managers in their underlying portfolio companies. It partners with firms that are very active in improving the businesses they invest in, rather than simply being passive financial investors. Most of their favoured managers have considerable in-house industrial expertise that they can make available to portfolio companies.

Beyond that, SLPE’s manager assesses factors such as whether a fund has a unique strategy or unique resources for originating deals, as well as the strength and depth of their investment team. Managers that focus on sectors where they have proven expertise are preferred, and any sign of drift in strategy will trigger a review of the investment. SLPE’s manager does not like concentration of risk within a fund portfolio.

ASI wants to invest in funds run by motivated, stable teams so it looks at issues such as team growth, development and succession planning. This means that SLPE’s manager will typically avoid firms with an ‘investment bank’ model, where there is usually a higher turnover of personnel.

ASI looks at a broad range of fund managers and fund sizes, but is focused on funds investing in companies with enterprise values between €100m and €1bn.

Looking at past performance, a fund with a high ratio of loss-making investments is not a good sign. ASI comments that it is unrealistic to expect zero losses – like all investment strategies, private equity investing is a trade-off between risk and reward. It prefers managers who have learned from their mistakes.

Fees on the underlying funds

ASI spends significant time analysing fund structures and ensuring that they are acceptable. Part of this includes establishing that the fees it is being asked to pay are in-line with European market norms, incentivising the underlying managers appropriately and confirming that the underlying managers’ interests are aligned with investors’ interests. However, when it is weighing up one potential investment against another, it will opt for the one that offers the best risk-adjusted net return (after fees). This might not necessarily be the one with the lowest headline fees.

As we note in the peer group section, beginning on page 21, unlike many of its peers, SLPE does not levy a performance fee at the fund level, on top of fees paid out to the underlying managers.

Managing commitment levels

ASI manages SLPE’s portfolio intending to ensure that it has a spread of maturities. It uses a detailed cash flow model to forecast the timing of potential drawdowns and distributions.

We discuss the fund’s borrowing facilities on page 25. In practice, it will rarely use these. The manager does not hedge currency in the portfolio. It considers that the cost of doing this would likely outweigh any potential benefit. Uninvested cash is held in euros, sterling or US dollars, in line with the trust’s underlying exposure.

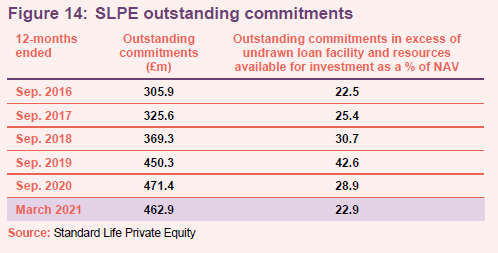

SLPE has followed an over-commitment strategy since inception 2001. As at 31 March 2021, its total outstanding commitments amounted to £462.9m. We note that the majority of capital calls from underlying private equity are spread over three-to-five years.

Portfolio construction

All of this activity boils down to six to eight new primary fund commitments of around €30-35m each year. The target net return on these investments is a minimum of 1.7x cost over the life of the investment and a 15% internal rate of return (IRR), although most fund investments in recent times have materially outperformed this.

The second element of the investment focus is on secondary transactions, an area that ASI has been placing increasing emphasis on in recent years as it seeks to minimise cash drag. This is particularly pertinent at present as SLPE has been benefitting from a high level of distributions. This is because private equity funds have been focused more on realising investments and are aggressively distributing capital as they exit companies. Funds are purchased in the secondary market, often at discounts, where they can generate an instant uplift to SLPE’s NAV as these are revalued at full asset value. If SLPE’s manager is expecting attractive growth in a fund’s NAV, as the underlying investments deliver, this may justify purchasing it at a premium to the prevailing NAV. Where secondary fund positions have been purchased at par value or even premiums, the manager says that it generally sees good uplifts coming through quickly.

The manager monitors the portfolio closely. Members of ASI’s team often sit on advisory boards of funds (not interfering in day-to-day decision-making but providing strategic oversight and other ad-hoc advice) and they have quarterly meetings with the underlying managers.

SLPE’s manager says that it is given a high level of transparency on the underlying portfolio. Unfortunately, it cannot share all of this information with shareholders, but it can publish useful aggregate information such as earnings growth and debt levels within the portfolio. ASI usually holds funds to maturity, but will occasionally sell funds in the secondary market if it believes the returns on these funds will not meet its minimum target future returns, or if it believes maximum value has been achieved.

Asset allocation

SLPE invests in funds run by managers with whom ASI has established relationships over many years. We note that as at 31 March 2021, over 70% of the fund’s NAV was attributable to 17 core managers. The portfolio provided exposure to over 450 underlying private companies, through around 55 funds. Out of these funds, the top 10 funds account for 44.3% of NAV. The concertation levels are seen by the manager as a sweet spot, providing sufficient diversification, without overly diversifying away potential returns.

As is illustrated in Figure 6, 40% of the underlying portfolio is over four years old, with around a quarter in excess of five years old, this being the sweet spot for realisations. We noted that there are ongoing concerns regarding the potential emergence of new COVID variants, but observe that distributions have held up more robustly across the industry, during the pandemic, than all but the most optimistic of voices would have envisaged in the early months of the crisis. This suggests that having a sizeable chunk of the portfolio nearing maturity will not be a disadvantage to SLPE. The less-mature vintages typically drive value accretion. Alan notes that the average value uplift upon exit has been more than 20% above the carrying value two quarters prior, and this level of uplift has persisted since 2010.

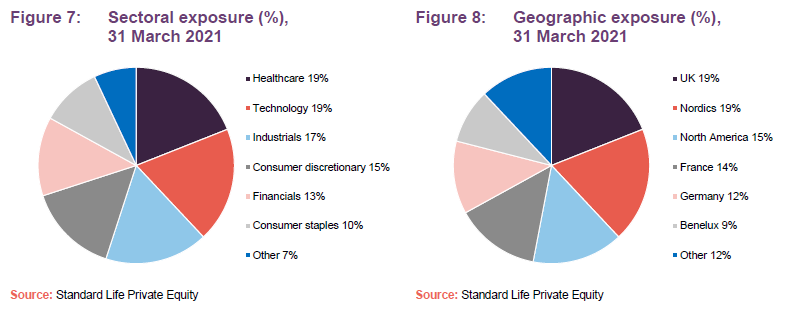

Reflecting the core focus on the European mid-market, Northern and Western Europe accounted for 73% as at 31 March 2021. As Figure 8 illustrates, no single geography dominates, which has helped to spread out SLPE’s country-specific risk.

While Europe dominates, the process of gradually broadening SLPE’s exposure to the US continues – this grew by 2% over the six months to 31 March 2021 to 15% of the portfolio – it could expand to around 20% over time.

Over recent years, the sector exposure has shifted more towards higher growth areas, such as information technology (IT) and healthcare. This has proved especially useful over the pandemic. We note that 10 years ago, healthcare and IT accounted for a combined 14% of the portfolio. Five of the six primary fund commitments made over the most recent financial year to 30 September 2020 (see page 17) have a technology focus, which should see the technology exposure continue to grow over the next few years.

Top 10 fund exposures

Short-term changes to fund allocations tend to be driven by realisations, the pace of reinvestment, and the frequency of revaluation by the underlying managers. Reflecting the managers’ long-term fund of funds approach, the names of the underlying managers and their funds will be familiar to followers of the trust and regular readers of our notes on SLPE. Names that have moved up to the top 10 funds over the course of the first half of the financial year are TowerBrook Investors IV and CVC VI. Names that have moved out of the top 10 are Bridgepoint Europe V and PAI Europe VI (as at 31 March 2021, these held the 14th and 15th positions respectively).

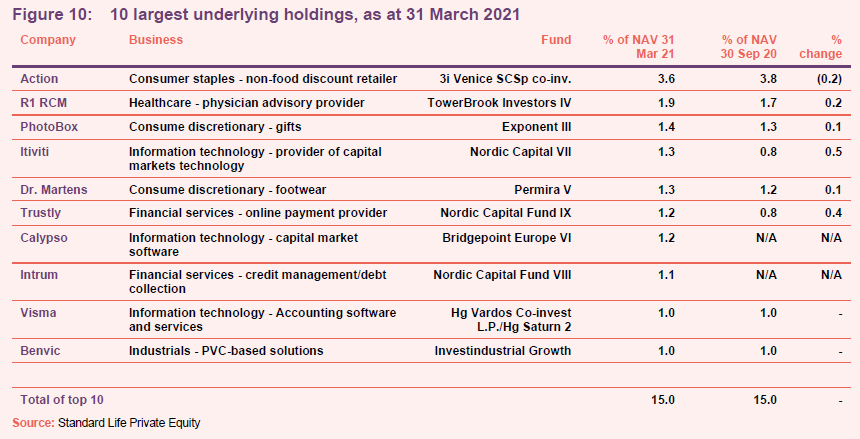

Top 10 underlying company exposures

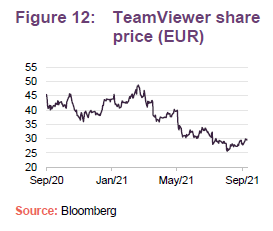

Readers familiar with SLPE will note that changes to the top 10 underlying company exposures are common. Movement is often a function of holdings within the underlying funds moving closer to realisation. Names that have moved up into the top 10 are Itiviti, Trustly, Calypso, Intrum, Visma and Benvic. Names that have moved out of the top 10 are TeamViewer, Coliseé, Allegro, Culligan, Handicare and ELITechGroup.

Action remains the largest underlying company exposure. This has long featured in SLPE’s largest underlying holdings, having occupied the number one position for a number of years, and is a position we have discussed in previous notes. To recap, Action is a highly successful non-food discount retail business in the Benelux, French and Germanic markets. SLPE re-deployed £22.6m into a co-investment in Action from the £51.1m proceeds (over 5x its initial investment) it realised when Eurofund V sold its investment in Action to the 3i Group (at over 30x its initial investment).

Shares in physician advisory provider R1 RCM – held via the TowerBrook Investors IV fund, performed very strongly following the COVID-related market collapse of March 2020 – nearly doubling over the six months to 30 September 2020. This strong trajectory continued until February 2021 when a steepening yield curve took the wind out of growth equities more generally. The shares have lost around a third of their value since their February peak.

PhotoBox (Exponent III) was acquired by Exponent, alongside Electra, for around £400m in 2015. The company is a market leader in Europe’s personalised gifts space. It has grown considerably over recent years and has not been impeded by the pandemic.

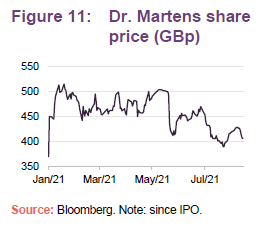

Dr. Martens (Permira V) – Permira has looked to unlock value in Europe’s footwear and apparel industry, with companies such as the UK’s Dr. Martens and Italy’s Golden Goose part of its portfolio – the latter was acquired for EUR1.3bn in early 2020. Dr. Martens has been a very successful investment for Permira’s since the initial outlay in 2017. Dr. Martens’s products have a strong following amongst celebrities, and a doubling in operating margins to more than 25%, since 2019, significantly increased the value ascribed to Dr. Martens. It was listed in January 2021, with a market capitalisation on admission of £3.7bn.

Names that have moved up into SLPE’s top-10 look-through holdings

Itiviti Group (www.itiviti.com) is a software company that describes itself as offering world class electronic trading platforms and connectivity solutions, that enable sell-sides and buy-sides to seize opportunities faster. The company, which is owned by Nordic Capital VII, is a growth financial that looks well positioned to benefit from the trend towards self-investment (a function of ageing populations and the move away from defined-benefit pensions schemes).

Trustly (www.trustly.net) is a Swedish fintech company, founded in 2008 and owned by Nordic Capital Fund IX, that operates an open banking payment method that allows customers to shop and pay from their online bank account, in a secure way, without using a card or an app. In addition to allowing for quick and easy payments, no sign-up or software installation is required. Easy activation and multi-currency functionality allows Trustly’s customers to expand their businesses across borders with access to customers in Europe, Australia, Canada and the US. The company has just announced that it has extended its partnership with West Ham United Football Club and is now the Official West Ham United Women’s team sleeve sponsor.

Calypso Technology (www.calypso.com) describes itself as is a leading provider of cloud-enabled, cross-asset, front-to-back solutions for financial markets, with over 40,000 users in over 60 countries. Its product suite is a full-service offering that is designed to improve reliability, adaptability, and scalability for its clients. It offers services to investment management, central banking, clearing, treasury, liquidity, and collateral operations. Like Itiviti, Calypso is well positioned to benefit from the trend towards self-investment.

Intrum (www.intrum.com/www.intrum.co.uk) describes itself as Europe’s undisputed market leading credit management services company. It claims to offer a complete range of credit management and financial services with a strong base in collection operations. The company, which has more than 10,000 employees across 24 countries in Europe plus Latin America (Brazil), says that it aims to be the UK’s most ethical debt purchase and collection company. Headquartered in Stockholm, Sweden, Intrum is listed on the Stockholm Stock Exchange. Intrum says that, through its wide range of credit management services, it supports 80,000 companies, in a variety of industries, to improve their cash flow and increase liquidity. It says that every day, it is in contact with 250,000 people in debt, helping them to solve their financial problems.

Visma’s (www.visma.com) primary focus is the provision of mission-critical business software to small and midsize businesses (SMBs) in Northern Europe. Due to their size, SMBs tend to have different IT requirements, and often face different IT challenges, than larger companies do. SMBs IT resources are often highly constrained and software solutions need to reflect this. Visma is well entrenched in this sweet spot, providing accounting – resource planning and payroll software, as well as transaction process outsourcing, such as debt collection and procurement services – to a customer base of over 600,000 enterprises. It benefits from trends of increased digitalisation and growing regulation across all sectors.

Benvic (www.benvic.com) is a European leader in the production of highly innovative PVC based thermoplastic solutions and biopolymers. On 5 August 2021, Benvic announced the acquisition of Chemres, a leading provider of polymers, custom compounds and solutions for a variety of industries including medical, packaging, wire & cable in the US (for example, Chemres has a strong position in the US contact lens market). The purchase is designed to allow Benvic to enter the US market and strengthen its exposure to the medical sector, allowing it to become a key global supplier in this market.

Names that have moved out of SLPE’s top 10 look through holdings

TeamViewer (www.teamviewer.com), with its remote working enabling technology, was a major beneficiary of the pandemic as employees shifted to working from home. The company, which was one of the largest European software initial public offerings (IPOs) in history when it listed in 2019, recently agreed a €275m deal with Manchester United that will see it replace Chevrolet as the club’s shirt sponsor. The shares have retrenched as signs of a broader re-opening have emerged.

Coliseé (www.groupecolisee.com) is a 2017 vintage investment for IK Fund VIII. The company’s activities are centred around delivering essential services for elderly people in need of care, and so it is exposed to the long-term structural growth trend of an ageing population. The company, which is a leading European provider, has a network of medical facilities and residences in countries globally. This includes 270 nursing homes as well as assisted-living facilities and home care service agencies across France, Belgium, Spain and Italy.

Allegro (allegro.pl) is a company that Alan describes as the ‘Amazon of Poland,’ with the company holding around half of Poland’s e-commerce market. In October, Allegro’s IPO was Poland’s largest since 2007. Amazon recently launched a retail website in Poland (amazon.pl), having previously serviced the market mainly through its German infrastructure. Allegro is expected to be one of Amazon’s most formidable incumbent competitors, although this has arguably weighed on the company’s share price.

Culligan (www.culligan.com) is an American water treatment company, owned by Advent GPE VIII, that is amongst the leading water treatment brands globally. It specialises in water softeners, water filtration systems and bottled water, offering a complete line of water treatment products across homes, offices, restaurants, and hospitals. The company sells its equipment through a direct sales force and over 800 exclusive dealers and franchisees in more than 90 countries.

Handicare (www.handicaregroup.com) is owned by Nordic Capital VII and has been a significant SLPE look through holding for some time (the investment is of 2010 vintage for Nordic Capital VII). The company offers solutions and support to increase the independence of physically challenged or elderly people. Its products include homecare products (such as stairlifts), patient handling and bathroom safety products, as well as personal transfer and automobile adaptation solutions.

ELITechGroup (www.elitechgroup.com) describes itself as a leading provider bringing high-value diagnostic solutions to laboratories that are closer to the patients. The company is a collection of global manufacturers and distributors of in vitro diagnostic equipment (IVD) and reagents, owned by PAI Europe VI. The company is a leader in a number of niche markets (for example, it says that it has the second-largest installed base in benchtop Clinical Chemistry in the US, and is a world leader in Cystic Fibrosis and Mycoplasma). The company says that its markets are underserved by the largest diagnostic Industry players and, with the global trend towards greater emphasis on service quality and patient experience in Primary Care, that serving labs that provide service closer to the patient positions it for growth.

Commitment levels – room for more commitment

Reflecting a further strong period of realisations, SLPE’s over-commitment ratio is below its long-term target range of 30% to 75%. As at 31 March 2021, SLPE had total outstanding commitments of £462.9m (30 September 2020: £471.4m). As at 31 March 2021, the value of SLPE’s outstanding commitments that were in excess of its liquid assets, as a percentage of net assets was 22.9% (30 September 2020: 28.9%). In its interim results, SLPE said that this is expected to be a short-term phenomenon, with new investment activity likely to drive an increase in the second half of the financial year.

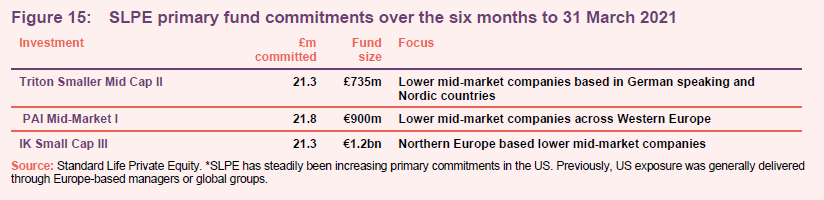

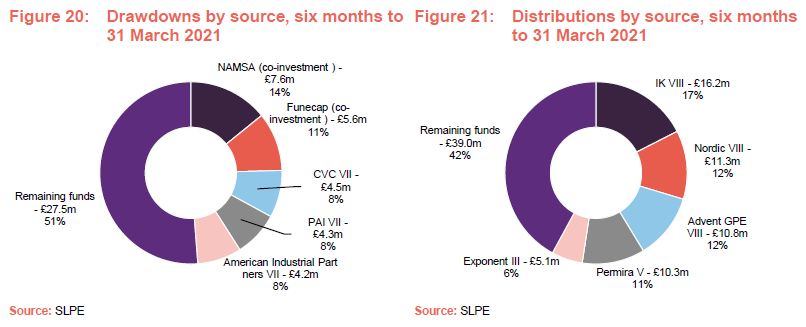

SLPE committed £88.4m to three primary fund commitments and three co-investments during the six months to 31 March 2021 (2020: £83.9m), taking the number of co-investments to six and increasing the proportion of co-investments in the portfolio to 6.7%, up from 5.3% at 30 September 2020. The primary fund commitments are detailed in Figure 15 below.

Secondary market activity, where the opportunity set is opportunistic by nature, saw a recovery during the six months to 31 March 2021, although activity was still somewhat muted. SLPE did not close any new secondary transactions during the period, but an agreement was signed, in relation to a new secondary deal, that completed after the period end.

Co-investments – anticipating a busy 2021

In addition to the £22.6m co-investment into Action alongside the 3i Group, SLPE made a £5.3m investment in Visma along with the Hg Saturn 2 fund. Visma is described as a leading provider of business-critical software to private and public enterprises in the Nordic, Benelux, and Baltic regions. SLPE completed three co-investments in the six months to 31 March 2021 that are illustrated in Figure 16, while the manager notes that the pipeline remains strong.

Co-investing carries advantages, such as greater control over the deployment of capital and lower costs compared to the fee levels and carried interest associated with the primary fund allocation model.

Co-investments (and this is also true for secondaries) do not usually share the ‘J’ curve longer-dated return profile that is associated with primary fund investments. The investor typically enters later in the process. Whilst returns from secondary investments can appear lower when a multiple of cost is used, we note that from an IRR perspective, typically shorter holding periods compared to primary investments can lead to relatively higher returns.

Readers familiar with SLPE will note that Mademoiselle Dessert, SLPE’s first

co-investment, had slipped out of the top 10 underlying company exposures at the end of September 2020, having been the third-largest exposure at 1.3%, as at 31 March 2020. Alan says the business was hit by the closure of hotels and restaurants in particular, which it supplies to along with food retailers. He believes that the investment case remains compelling, with the business not expected to face structural challenges once hospitality re-opens. The business has ample liquidity and could move back up SLPE’s rankings as it recovers.

Performance

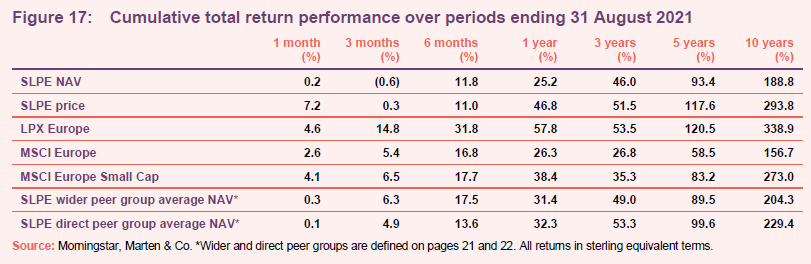

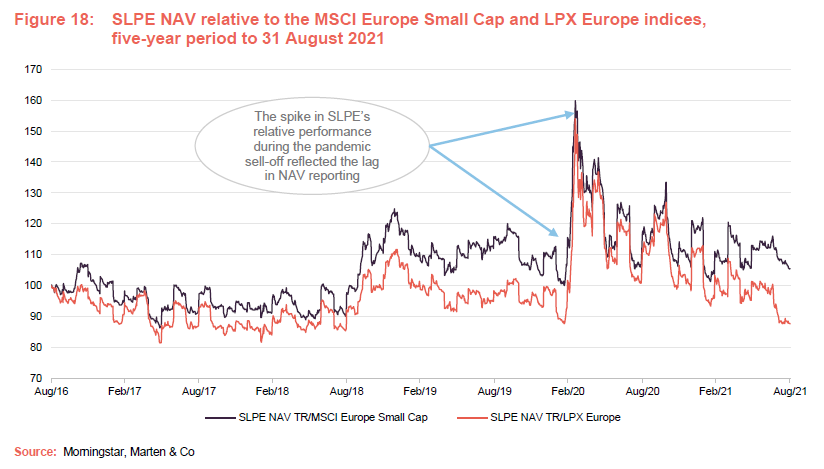

The narrowing of SLPE’s discount that occurred during August 2021 is reflected in Figure 17. SLPE’s last published NAV is as at 31 July 2021 and 99.6% of the underlying portfolio valuations in that NAV were as at 31 March 2021. Therefore, its NAV returns do not reflect positive market moves over the past five months. This reinforces our belief that, for a long-term strategy such as SLPE’s, longer-term periods are more relevant in assessing its performance and it is noteworthy that SLPE’s NAV and share price both outperform the MSCI Europe, the MSCI Europe Small Cap and its wider peer group over the three and five-year periods.

LPX Europe is an index of listed private equity companies in Europe and its returns reflect the share price returns of those companies rather than NAV.

On an annualised basis, over the five years to 31 August 2021, SLPE delivered total NAV and share price returns of 14.7% and 16.9%, respectively. Over the same period, the MSCI Europe, MSCI Europe Small Cap and LPX Europe provided annualised returns of 9.5%, 12.5% and 16.4% respectively.

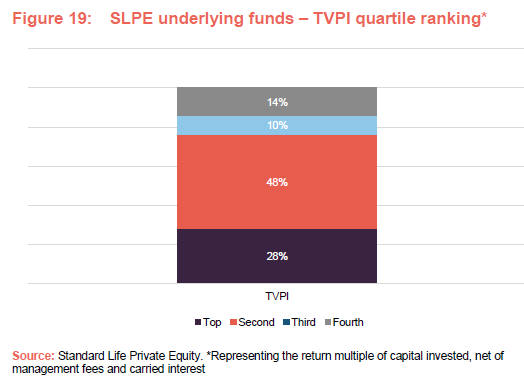

76% of SLPE’s investments lie within the top or second quartile from a total value to paid-in multiple (TVPI) perspective (see Figure 19).

Interim results – six months to 31 March 2021

Over the six months to 31 March 2021, SLPE delivered a NAV total return of 14.9% (2020: -6.3%). Realisations amounted to £92.7m, continuing the trend of strong realisation from the previous financial year (the year to 30 September 2020 saw £140.7m of realisations – the second-highest since SLPE’s inception in 2001 – which include £51.1m from the 3i Fund V, which held Action).

Despite the global pandemic, the managers continued to selectively deploy capital into new investments, committing £88.4m in the six months to 31 March 2021 (up from £83.9m for the equivalent period for the prior year). As a result of the ongoing strong distribution activity, SLPE’s balance sheet remains strong, with £62.5m of cash and cash equivalents at the half-year end, along with an undrawn £200m revolving credit facility. This gives SLPE considerable fire power to continue to make new investments and to help weather any COVID-related difficulties that may present themselves in the medium term.

Peer group

SLPE is a member of the AIC’s private equity sector, which comprises some 23 members. For the purpose of this analysis, we have narrowed down the wider peer group to 11 funds. 3i Group is among those excluded, as it considers itself to be an asset manager. It also has investment interests extending beyond private equity. We have also excluded JPEL Private Equity this time, on the basis that it is winding down and now has a market capitalisation well-below £100m.

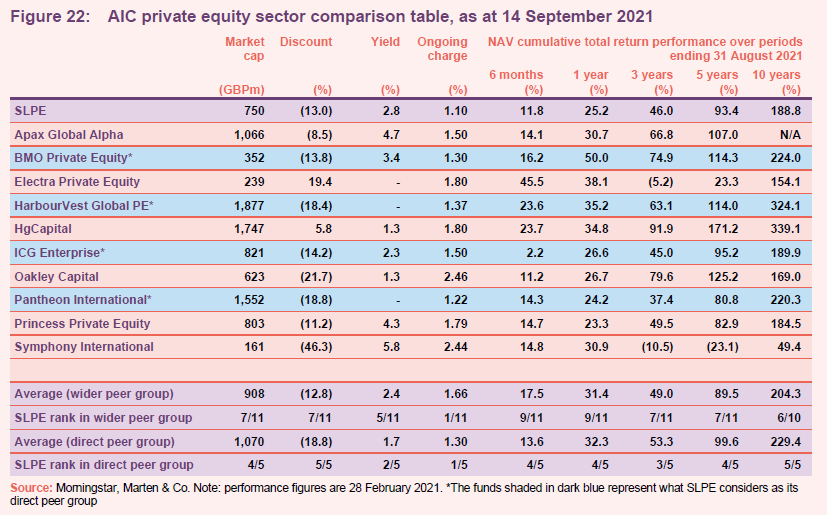

As shown in Figure 22, we have also included rankings against a subset of fund of funds that SLPE considers to be its direct peer group: HarbourVest Global Private Equity, Pantheon International, ICG Enterprise, and BMO Private Equity.

SLPE ranks fourth within its direct peer group over the six-month and one-year period to 31 August 2021. However, given that SLPE’s – and indeed the wider sector’s – strategies are inherently longer-term, and SLPE’s indefinite life structure, the five- and 10-year figures provide the best basis for comparison. Here, SLPE was the fourth- and fifth-best performer (out of five) on a total NAV return basis. Longer time periods provide a more accurate representation of the realised returns generated, although, as noted above, its NAV returns do not reflect positive market moves over the past five months.

SLPE’s discount is now 13.0%, which is markedly narrower than its five-year average of 19.4% and that of the direct peer group of 18.8%, although broadly in line with the average discount for the wider peer group. We note that at 2.8%, SLPE’s trailing dividend yield remains at the top-end of the peer group’s.

SLPE’s ongoing charges ratio of 1.1% is the lowest of its direct peer group and competitive versus the wider peer group. We note that SLPE, unlike most of its direct peer group, does not charge a performance fee at the fund level, on top of fees paid out to third-party managers. SLPE’s ongoing charges are lower than funds that are more than twice its size, in market cap terms.

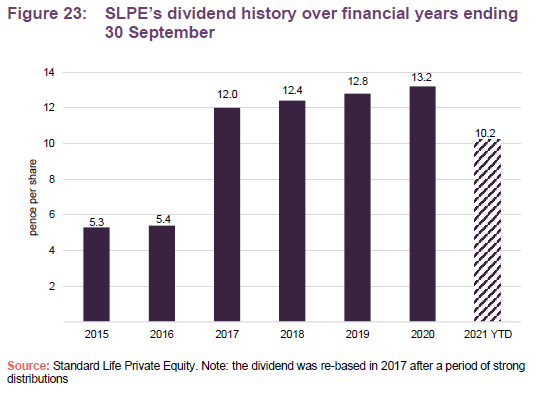

Dividend – a 3.1% increase over FY20

SLPE paid a total dividend of 13.2p per share for the year to 30 September 2020, which represented a 3.1% increase on the previous financial year (2019: 12.8p per share). The first three dividends for the current financial year have been declared at 3.4p per share (versus 3.3p per share for the prior financial year). Assuming that SLPE maintains its quarterly dividend at 3.4p per share for the fourth quarter of the current financial year, this suggests a total dividend of 13.6p per share, which is a yield of 2.8% on SLPE’s share price of 488p per share as at 10 September 2021.

As discussed in the peer group section above, many of SLPE’s peers do not pay a dividend. SLPE’s dividends are paid every quarter, typically in January, April, July, and October of each year. The fund has historically aimed to retain the real, inflation-adjusted, value of the total annual distribution.

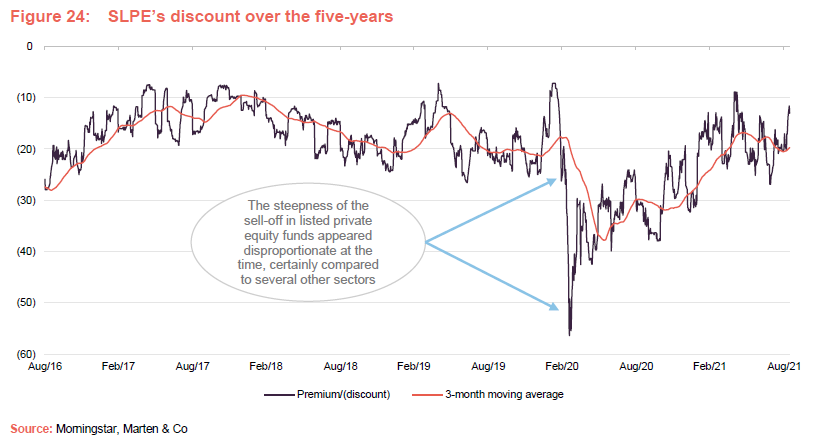

Premium/(discount)

Over the last 12 months, SLPE’s discount has moved within a range of 8.9% discount to a 37.9% discount. The one-year average discount was 22.8%. As at 14 September 2021, the discount stood at 13.0%, placing it broadly in line with the average for the wider private equity peer group (see page 21).

The sell-off in listed private equity fund of funds appears disproportionately steep in the period from the middle of 2020 onwards, when it became increasingly apparent that the underlying companies were going to be a lot more resilient than initially expected. Factoring this in, along with some of the lessons learnt from the 2008 financial crisis (including underlying companies building in significantly more covenant-lite debt facilities and a greater proportion of equity into balance sheets, as well as the diversification benefit embedded into the private equity asset class) means that mid-2020 was a historically attractive entry point.

SLPE retains the authority to repurchase up to 14.99% of its issued share capital, which is renewed annually. The trust has not repurchased any shares since

August 2016. The board’s policy is generally to preserve cash for investment purposes. SLPE did not conduct any share buy-backs during the financial year to

30 September 2020 and has not repurchased any shares so far during the current financial year.

As stated on page 18, SLPE’s discount is likely understated given the strong performance of equity markets since the end of March 2021 (the valuation date for most portfolios in SLPE’s end July NAV).

Fees and costs

Under the terms of its investment management agreement, with ASI, SLPE pays a base management fee of 0.95% per annum of its total net assets. The investment management agreement does not include a performance-fee element and is terminable on 12 months’ notice by either side. The total investment management fee for the year ended 30 September 2020 was £6.82m (2019: £6.46m), and the ongoing charges ratio was 1.08% (compared to 1.09% a year earlier). The investment management fee is allocated based on a 90:10 capital/revenue split.

abrdn Plc provides company secretarial services to SLPE, while IQ EQ Administration Services (UK) Ltd provides administrative services. The fees for both are adjusted annually in line with the retail price index. The secretarial agreement and administrative agreement can be terminated by either side on six months’ and three months’ notice respectively. The combined cost of the secretarial and administration fees for the year ended 30 September 2020 was £222,000 (2019: £202,000).

Capital structure and life

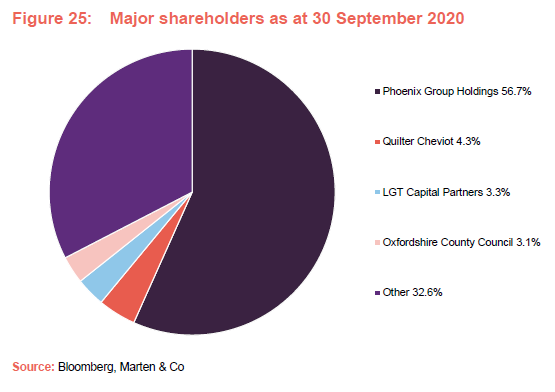

SLPE has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 14 September 2021, there were 153,746,294 shares in issue with none held in treasury. ASI has voting rights over 56.7% of the shares, by virtue of the initial transaction that launched SLPE (see Phoenix Group Holdings in Figure 25).

Credit facility increased to £200m with no change to expiry

SLPE announced in September 2020 that its existing multicurrency syndicated revolving credit facility (effectively a bank overdraft) had been expanded from £100m to £200m. The facility’s financial covenants and expiry date (December 2024) were unchanged. The interest rate on this facility is LIBOR plus 1.625%, rising to 2.0% depending on utilisation and the commitment fee payable on non-utilisation is 0.7% per annum.

The facility is provided by Citi, Société Générale and State Street Bank International. SLPE’s articles of association permit it to borrow up to 100% of net assets, although the board has said that it does not expect bank borrowings to exceed 30% of net assets. As at 31 August 2021, the facility was unused.

SLPE’s board has agreed that the over-commitment ratio (outstanding commitments less resources available for investment and available debt facility/ NAV) should sit within the range of 30% to 75% over the long term. The increased facility reduced SLPE’s over-commitment ratio from 47% to 33%, which is well within the target range of 30% to 75%. With more firepower in hand, SLPE will be able to increase commitment levels to match any improvements in the opportunities available going forward.

Unlimited life

Arguably reflecting the longer-term nature of its underlying investments, SLPE has been established with an indefinite life and there is no specific mechanism, such as a regular continuation vote, to wind up the company.

Major shareholders

Financial calendar

SLPE’s financial year-end is 30 September. The most recent annual results were released in January, while interim results are typically released in June. The most recent annual general meeting (AGM) was held on 23 March 2021. As discussed on page 23, SLPE usually pays dividends in January, April, July, and October of each year.

Management

The lead manager, Alan Gauld, is an investment director in the private equity team at ASI. Alan is supported by Patrick Knechtli (head of secondary investments), Mark Nicolson (head of primary investments), and Simon Tyszko (investment manager). Backup is provided by the rest of ASI’s private equity team (which has 41 investment professionals – as at 30 June 2021).

Alan has a strong network and extensive experience with leading private equity funds, particularly pan-European and French, Nordic, and Iberian GPs. He is involved in sourcing, appraising, and executing investments as well as portfolio monitoring. Alan is a qualified chartered accountant and holds a BSc (Hons) in Genetics from the University of Edinburgh. He joined Aberdeen Standard Investments in 2014 as part of the Scottish Widows Investment Partnership (SWIP) transaction.

Board

Following the appointment of Dugald Agble and Yvonne Stillhart, with effect from 1 September 2021, SLPE’s board comprises of six directors, all of which are non-executive and considered to be independent of the investment manager (details of their individual experience are provided below).

Christina McComb has chaired the board since 1 January 2019. She also chairs the management engagement and nomination committee, while Alan Devine has served as senior independent director. At the time of writing, Christina is the longest-serving director, having provided 8.6 years of service. The average length of service is 4.0 years and all directors stand for re-election annually.

- Christina McComb OBE (chair)

Christina assumed the role of chairman on 1 January 2019. She has a background in private equity and venture capital investment, having spent 14 years at 3i Group. She is currently chairman of OneFamily Mutual Assurance and is a non-executive director of Baronsmead Venture Trust Plc and Nexeon Ltd. Christina is currently chair of financial mutual OneFamily and is the senior independent director of Big Society Capital Limited.

- Alan Devine (senior independent director)

Alan has over 40 years of experience in both commercial and investment banking having spent his entire career working for The Royal Bank of Scotland Group. He was appointed as senior independent director on 1 January 2019. Alan held a variety of senior roles and was chief executive officer (CEO) of RBS Shipping Group. He holds an MBA, is a Fellow of the Institute of Bankers in Scotland and is a non-executive director of Capital Flow Holdings DAC. He is also chair of the private equity-owned Irish-based cash logistics company known as GSLS.

- Calum Thomson (independent director and chair of the audit committee)

Calum is a qualified accountant with over 25 years of experience in the financial services industry. He has been with Deloitte LLP since October 1988, and for 21 of those years, he was a partner in the firm. Calum is a non-executive director and the audit committee chair of the Diverse Income Trust, the AVI Global Trust and Baring Emerging EMEA Opportunities. He is also a non-executive director and audit committee chair of BLME Holdings and Bank of London and The Middle East Plc.

- Dugald Agble (independent director)

Dugald Agble was appointed on 1 September 2021. Dugald holds a PhD in Chemical Engineering from Imperial College London and has over 20 years direct investment experience in private equity. He started his career at Nomura Principal Finance Group, which later evolved into Terra Firma Capital Partners. More recently, Dugald has been involved in investing in emerging and frontier markets at Helios Investment Partners and 8 Miles. Dugald is a supervisory board member at FMO, the Dutch finance institution.

- Diane Seymour-Williams (independent director)

Diane worked for Deutsche Asset Management Group (previously Morgan Grenfell) for 23 years from 1981 until 2005, during which time she held various senior positions. These included chief investment officer of Asian Equities, CEO of the Asian asset management business, head of European client relationships and head of global equity product. Diane then spent nine years from 2007–16 at LGM Investments, a specialist global emerging markets manager, where she was global head of relationship management. She is a non-executive director of Baillie Gifford China Growth Trust and Brooks Macdonald Group, where she has also chaired the remuneration committee since 2012. Diane is also a pro-bono member of the investment committees of Newnham College, Cambridge and the Canal & River Trust.

- Yvonne Stillhart (independent director)

Yvonne was appointed on 1 September 2021. Yvonne was a co-founding senior partner and member of the Investment Committee of Akina AG, a Swiss based specialised private equity manager which merged in 2017 with Unigestion S.A. She has over 30 years senior executive experience in business building, transformational leadership, private equity and infrastructure investment, finance, banking as well as risk- and investment management across broad industries and geographical regions.

Yvonne serves currently as a non-executive director and member of the Audit and Risk committee at UBS Asset Management Switzerland Ltd., and is the chairperson and member of the Social and Ethics committee of the South African EPE Capital Ltd.

Yvonne holds a Director Certificate from Harvard Business School and the ESG Competent Boards Certificate. She is fluent in German, English, Spanish and French.

Previous publications

QuotedData has published eight notes on SLPE. You can read these by clicking the links in the table below or by visiting our website.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Standard Life Private Equity Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication.

Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.