This week’s QD view looks at four investment companies that offer attractive dividend yields

Inflation has become a painful reality for many, impacting everything from rent and mortgages to groceries. This ongoing cost-of-living crisis underscores the importance of making your money work harder for you, particularly for those who rely on their investments for income. Arguably, the most obvious strategy to counteract rising expenses is to invest in trusts that generate high total returns. However, achieving this is often easier said than done – markets and economies change, so past performance is not always a guide to future performance, and the investments that offer the best return prospects will likely reflect a higher level of risk and some balance needs to be achieved.

A more reliable approach to mitigating the impact of inflation is to invest in dependable dividend-paying trusts. By definition, these will be invested in assets that are underpinned by strong cash flow generation – be it corporates or governments – so, while the top dividend payers might not exhibit the explosive growth of technology funds, they can provide steady income. If chosen wisely, these investments can offer capital growth and dividend yields that comfortably outpace inflation, over the long term.

Our top picks for reliable dividend investments

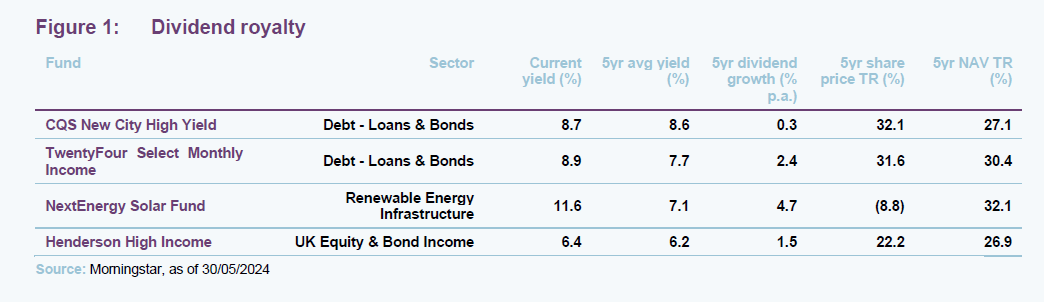

We have analysed the numbers and applied some of our own judgment to identify four investment companies that stand out for their attractive dividend profiles and reliability. Here’s our selection criteria:

- Dividend yields exceeding closest benchmarks and UK inflation – if you reinvest the income from a trust where the yield is higher than inflation then, all else being equal, you’ve maintained your capital in real terms.

- Consistent dividend growth – trusts with at least five years of steady nominal dividend growth were prioritised.

- Positive growth – trusts showing positive net asset value (NAV) growth over five years.

- Avoid trusts with high yields driven by excessive discounts – we haven’t included trusts that are only on big yields because they’re on big discounts.

Our chosen investment trusts not only represent an optimal blend of these factors but also hopefully offer a range of strategies to fit diverse portfolio needs. By considering these trusts, investors can find options that best align with their financial goals and help offset the pressures of inflation.

CQS New City High Yield (NCYF) aims to combine high dividend yields with capital growth and preservation. Managed by Ian Francis, NCYF takes a conservative approach to capital growth. The portfolio predominantly consists of high-yielding fixed-income securities from corporate and government issuers, with a small stake in high-yielding equities. NCYF consistently ranks among the highest-yielding funds in its debt and loans peer group and is one of the peer group’s best-performing over the long term.

These characteristics don’t come cheap, however, as it has traded on a premium for much of the last five years. Thankfully, NCYF’s managers are keen to see the fund grow in a measured way and considerable care is taken not to dilute its revenue reserves, so that existing shareholders are protected and it can continue to cover its dividend.

Part of NCYF’s recent success has come as a result of Ian taking advantage of interest rate rises to lock in high yielding bonds, getting in early before any potential interest rate falls. NCYF’s portfolio has traditionally had a strong exposure to the UK. This has been reduced previously where Ian has felt the outlook has been uncertain but has increased recently as he feels the economy is looking a lot healthier and the political outlook is improving. NCYF has also maintained a high exposure to financials – typically in the region of 50% of the portfolio – but has a broader spread than some other comparable funds.

NCYF pays quarterly dividends, having paid at least a 1p dividend each quarter for the last five years, with a larger (and growing) dividend paid in the fourth quarter. NCYF also has revenue reserves of £16m, enough to cover its dividend 0.6 times.

TwentyFour Select Monthly Income

The presence of two bond funds in this list shouldn’t be too big a surprise, given the income advantages the asset class has. TwentyFour Select Monthly Income (SMIF) also illustrates the income potential of bond funds. Unlike NCYF, SMIF focuses on debt issued by financial companies and asset-backed debt, primarily in Europe. With a generally defensive investment approach, SMIF’s portfolio features conservative risk characteristics, such as a sub-three-year duration.

Other than the differences in its portfolio, and thus the possible tailwinds supporting it, SMIF is set apart by its dividend schedule, targeting an annual dividend of at least 6.0p per year, paid monthly, with its final dividend also including any excess revenues. SMIF has arguably the most aggressive dividend schedule of the list. While SMIF doesn’t guarantee its dividend, it has exceeded this target each financial year. While a regular and frequent dividend payment may be an advantage for SMIF, it has unfortunately no revenue reserves to support its target, though it has the ability to fund its dividend from capital when needed. Like NCYF, SMIF has also traded on a premium, and has been issuing shares.

As the name implies, NextEnergy Solar Fund (NESF) holds a portfolio of primarily UK-based solar energy infrastructure and complementary energy storage assets. Since launch nearly a decade ago, NESF has built a £1.2bn, 933MW portfolio of 100 operating solar assets, powering the equivalent of over 330,000 homes, declared dividends totalling £333m, and avoided the emission of about 2.2 Mt CO2e.

NESF’s portfolio generates strong cash flows, with the 2024 financial year target dividend of 8.35p expected to be covered 1.3 times. Although NESF lacks revenue reserves, its cash flows can be estimated with a good degree of accuracy – solar irradiation can be predicted with a decent degree of confidence (it tends to fall within a band of +/-7% 95% of the time) and using PPAs to sell some power generated forward at known prices also helps. This allows the board to announce a target for a fully covered dividend for each forthcoming financial year, which it has gone on to achieve in every year so far.

NESF has the highest yield of any trust in this group, a result of both its strong cash flow and wide discount, but the yield would still be attractive if it was trading at asset value (8.9% yield, which is well above inflation). There is potential for the discount to narrow as NESF has decided to put five of its assets up for sale to reduce borrowings and fund a potential share buyback, which could act as a powerful catalyst for a positive rating of its shares.

Henderson High Income (HHI) favours well-known UK dividend payers. However, HHI goes beyond the standard UK dividend strategy as it has a small (c. 10%) allocation to fixed income that is funded by debt that is at a lower cost than the yield the manager is able to achieve on this debt. Manager David Smith has steered the portfolio toward UK mid-cap stocks, seeking to capitalise on their more attractive valuations, and has a small allocation to non-UK assets.

David’s flexible approach and proven management skills (having outperformed the wider UK market over 1, 3, and 5 years) make HHI an attractive UK income strategy. HHI recently expanded through a merger with Henderson Diversified Income. The fresh capital that this added to the fund will help lower the ongoing charges ratio and make the shares more liquid. HHI pays four equal dividends each year and is expected to pay a total dividend of 10.54p for its current financial year.

Despite its strengths, HHI’s discount has widened over the last six months due to the general aversion to UK equities. HHI has historically traded closer to its NAV, with 2020 being the last time it traded on a comparable discount, due to the effects of the pandemic. However, its current discount presents a potentially attractive entry point, as future interest rate cuts by the Bank of England and the forthcoming election could boost investor confidence in UK equities.