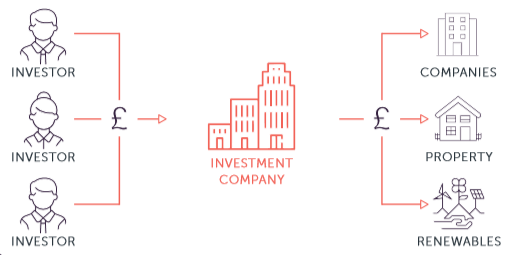

Quoted investment companies are set up to make investments on behalf of their shareholders. They are traded on a stock exchange and have a fixed share base. In other words, they are closed-ended funds. Investment trusts and real estate investment trusts (REITs) make up a majority of UK-listed investment companies.

Investing in an investment company (or any other type of pooled/collective fund such as a unit trust) is a useful way of passing the job of managing some of your investments to an expert – the investment manager.

Investment companies let you invest in a spread of different types of investment in an easier and more efficient way than buying a collection of individual investments, saving you money in dealing charges and letting you invest relatively small amounts of money. All things being equal, buying a spread of different types of investments (diversification) reduces your risk. It lessens the chance that one specific problem will have a major impact on your entire wealth.

There is a huge range of choice. There are around four hundred investment companies available to buy on a UK stock exchange. This guide aims to give you the tools to help navigate your way around them all.