Real estate is a cyclical market where timing is everything, and signals are starting to flash that the sector is primed to stage a recovery.

Market data, company activity and macroeconomic events appear to be aligning to suggest that now is the time to invest in real estate.

After months in the doldrums as values plummeted following rapid interest rate rises from near zero to 5.25%, optimism that the eagerly anticipated rate cutting cycle will begin this summer has grown.

Inflation in the UK fell to 2.3% in April (from 3.2% in March), while rhetoric from the Bank of England has been encouraging. Even if that first cut is only a quarter point, it will send a message to lenders and borrowers that the trajectory is down and the forward yield curve should follow suit.

Confidence that the bottom of the market has been hit would facilitate more investment activity and a return to positive valuation growth. History shows, and logic dictates, that real estate returns are greatest in times of uncertainty – with MSCI data showing that UK property bought in 2008 and 2009 generated seven-year annualised returns of more than 10%.

With REITs languishing on discounts to NAV last seen in the aftermath of the global financial crisis (GFC), the timing appears perfect.

Opportunities

If the market has not reached the bottom, it cannot be far off. London office developer Great Portland Estates certainly believes the market is at an inflexion point. It launched a rights issue to raise £350m this week to take advantage of rock-bottom prices in London.

It says that it has not seen a better investment opportunity since in the aftermath of the GFC – and it didn’t do too badly that time around. It completed a rights issue in 2009 and over the next couple of years picked up assets across London, redeveloped them and sold them in rising markets achieving profit on cost of 30%-plus.

Across the wider UK commercial property market, values have fallen around 20% since June 2022, with industrial and logistics assets bearing the brunt – coming off tighter yields.

Loan covenants are under stress, while imminent refinancing events will inevitably result in an uptick in distressed sales – however, these so far appear to have been more of an issue in Europe than the UK where loan to value ratios are generally lower.

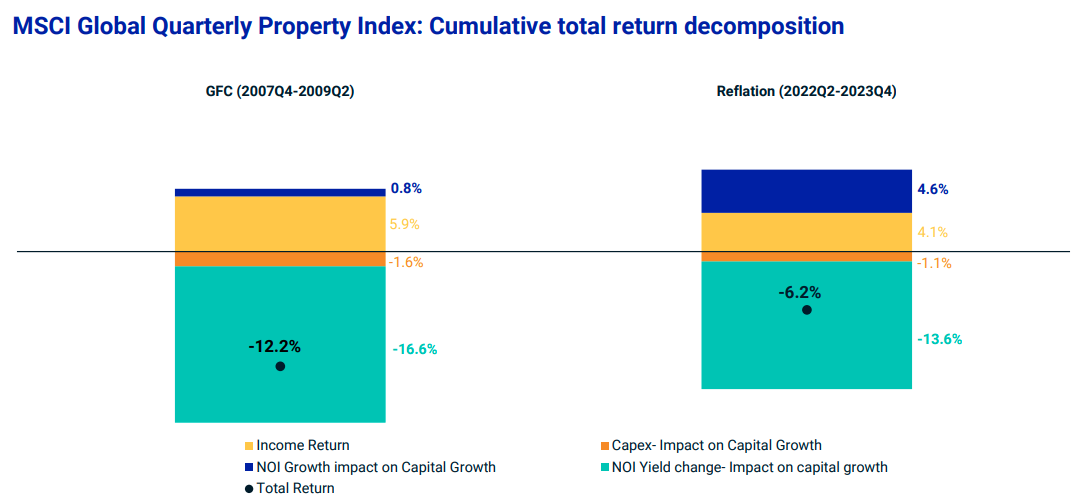

Occupier markets have remained resilient across global real estate markets, with the UK holding up well. Net operating income growth has done a good job of offsetting the impact of the outward yield shift, as shown in the graph below, a key differentiator to the GFC.

It is these fundamentals that has led the former LXi REIT management team to explore the launch of the Special Opportunities REIT. It wants to raise £500m to take advantage of price dislocation in the market to bag assets with strong real estate characteristics and ride the recovery.

Timing on the real estate side feels spot on, but capital market timing may put a spanner in the works, which would be a shame. The premise, however, should give investors confidence that now is the time for a real estate recovery.

Given this, the current rush for the exit with managed wind downs and selling out to bids, may be a mistake.

Another signal comes from the real estate lending market, where a host of names have entered the market to plug the gap left by retreating banks. Reuters has reported that US funds PGIM, LaSalle and Nuveen, Canada’s Brookfield and QuadReal, the UK’s M&G, Schroders and Aviva, and France’s AXA all plan to increase their credit exposure to property.

All cited a belief that the worst may have passed, meaning their loans should have low delinquency rates but high spreads.

Back to the future

Even if we have reached the bottom of the market, the period of super low interest rates and historically high real estate values is over, and investors are going to need to go back to the good old fashioned real estate fundamentals to turn a profit.

From about 2011 on, making money in real estate was easy at 1% cost of debt. Landlords will have to roll up their sleeves and get their hands dirty to achieve returns as interest rates are expected to settle around 3% to 4%.

That means intensive asset management – pushing rents on through refurbed space and recycling the portfolio into value-add opportunities.

Many of the listed property companies pride themselves on their hands-on asset management approach, and these skills should now come to the fore. With the sector primed to stage a recovery and the pivot in sentiment towards real estate that should follow, now is the time to buy high-quality REITs.