Why an actively run portfolio of Japan small cap stocks could be a big winner over the coming years

Japan is the third largest economy in the world, yet its declining weight in global indices and previous false dawns have put it out of focus for investors. While enthusiasm for Japanese equities grew in 2023, as evidenced by TOPIX’s +28% return, many allocators remain underweight and sceptical. We think this time is different and the Japanese market has many good years ahead. Companies are prioritising shareholders, business practices are changing and the macroeconomic backdrop is supportive. We believe inefficiently priced Japanese small cap companies offer the greatest potential returns, and with the effectiveness of shareholder activism having never been higher, active management offers significant alpha generation.

Why Japan?

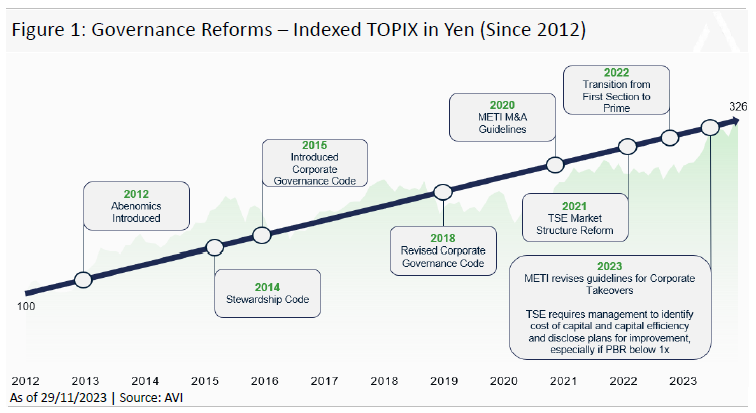

Until now valuations and earnings potential of Japanese companies had been held back for decades by practices designed to maintain stability in the wake of the 1990’s bust. In the years following the fortunes lost, management prioritised high employee retention and cash accumulation, in the absence of growth and shareholder returns. This changed with the introduction of Abenomics in 2012, which ushered in an era of structural reforms, shareholder engagement and a focus on improving corporate value. Reinforced by the subsequent Stewardship and Corporate Governance codes and various interventions since, the environment towards shareholders has transformed.

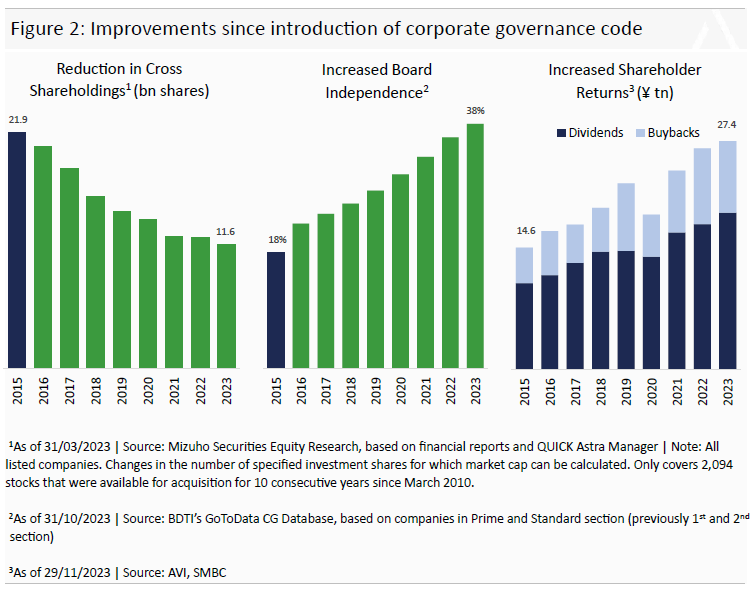

Since 2015 cross shareholdings have fallen by -44%, the proportion of outside directors on boards has increased from 18% to 38%, and shareholder returns are at an all-time high.

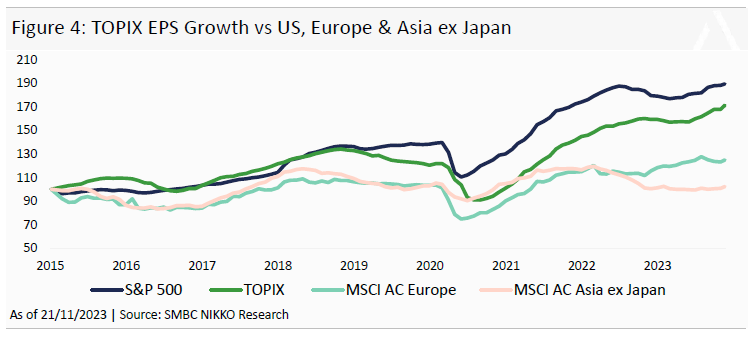

Governance reforms are leading to higher earnings. Helped by deleveraging, lower corporation tax and business restructuring, earnings growth of Japanese companies since 2015 have grown at a compound rate of 6%, only exceeded by companies in the US.

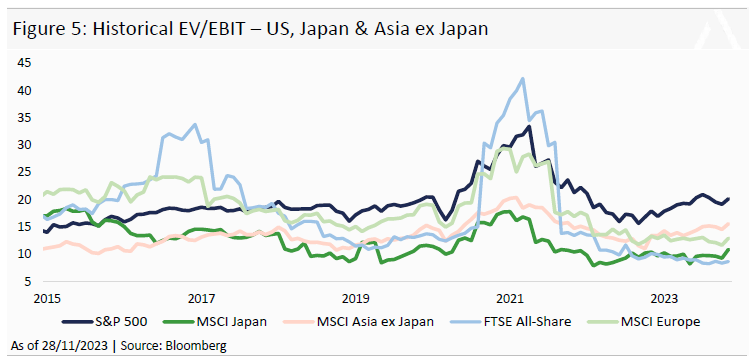

While Japan has generated market-leading earnings growth, it has suffered from a headwind of declining valuations. Now trading at a discount to the S&P 500, MSCI Europe and MSCI Asia ex Japan, the MSCI Japan Index’s EV/EBIT has declined from 17x at the start of 2015 to 11x at the end of November 2023. Japan is one of the cheapest global equity markets.

Coupled with encouraging change at the company level, we see a rosy economic environment. For decades Japan suffered from lacklustre growth, protectionist business practices and an absence of animal spirits, but that environment is changing. There is a new generation of younger management who want to facilitate growth and aren’t haunted by the collapse of the boom era are embracing more dynamic business practices. This is being helped by inflation, disrupting the status quo of stagnant prices and wages. Higher inflation also encourages spending, while penalising the hoarding of cash, adding further incentive for companies to improve balance sheet efficiency.

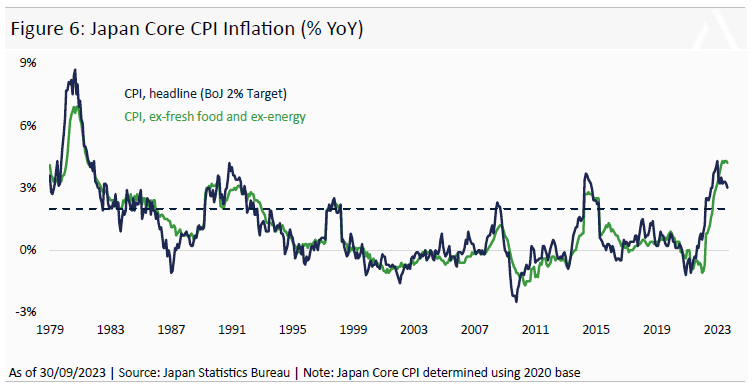

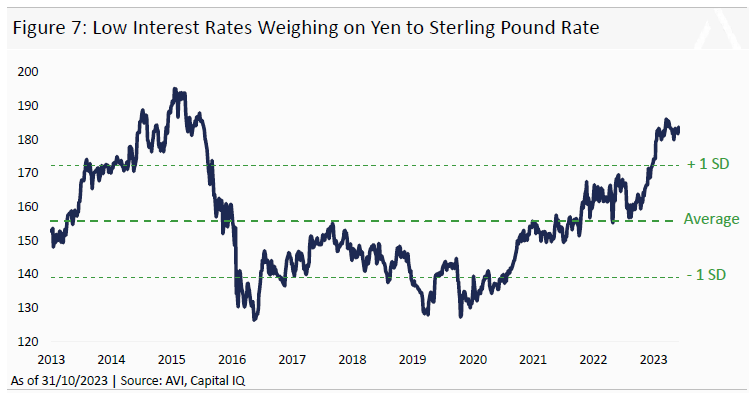

The corollary of Japan’s first inflationary environment in three decades, is that with the elusive 2% inflation target finally within reach, the Bank of Japan (BOJ) has been reluctant to tighten monetary spending. Yield Curve Control (YCC) and negative rates remains in place, which is causing a widening interest rate differential with other developed nations and a dramatic decline in the Yen.

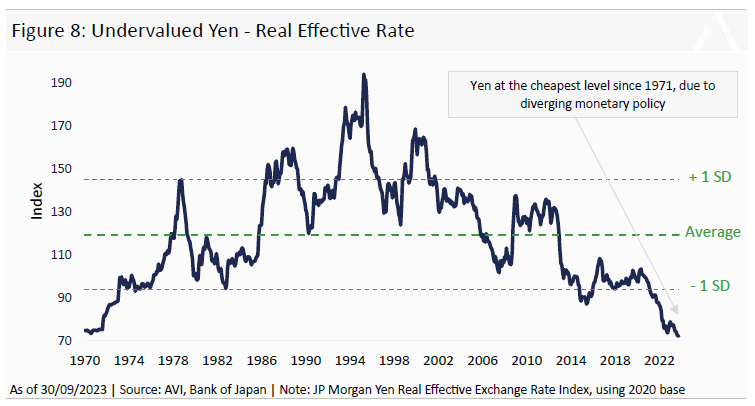

The real effective rate of the Yen is at the cheapest level since 1971, and with global rates showing signs of falling while Japanese rates are ticking higher, the situation is ripe for the Yen to outperform. Having been a drag for foreign investors, a reverse of the Yen’s weakness would be a huge tailwind.

Company reform, growing earnings, cheap valuations, manageable inflation and an undervalued Yen positions the Japanese stock market for stellar returns.

Why active allocation to small-cap, cash-rich companies?

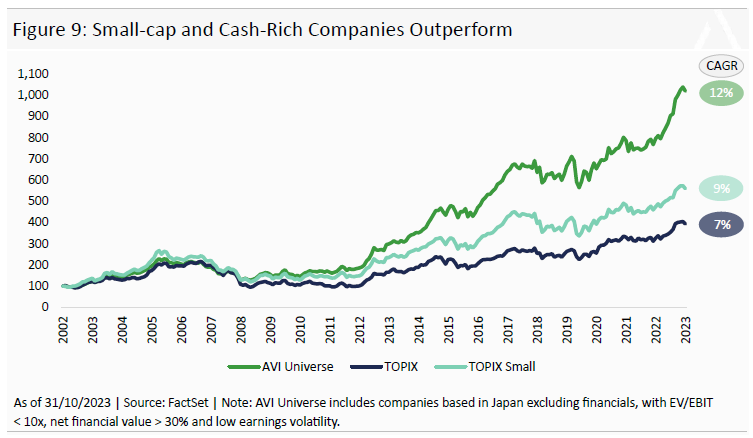

The purest way to gain exposure to the Japanese economy and the upside of corporate reform is through small-cap companies. While large-cap companies are dominated by global giants, with heavy dependency on exports and overseas demand, small-cap companies have domestically biased sales. There are a plethora of wonderful small companies operating in niche markets with enormous barriers to entry. Being smaller, they have greater growth opportunities, both overseas and domestically as industries consolidate. The returns speak for themselves, over the past two decades small-cap companies in Japan have generated an annualised 2% outperformance relative to their large-cap counterparts.

A feature of Japanese small caps is an abundance of excess balance sheet capital, typically in the form of investment securities, real estate and cash. Balance sheet assets are structurally discounted, some studies suggesting by up to 50%, and while these assets generate low returns, they provide investors with downside protection and when the cash is put to better use, or returned to shareholders, a narrowing of the discount. Overlaying a high cash screen on top of small-cap allocation yields an annualised 12% return over the past two decades, significantly higher than both the large cap and small cap index.

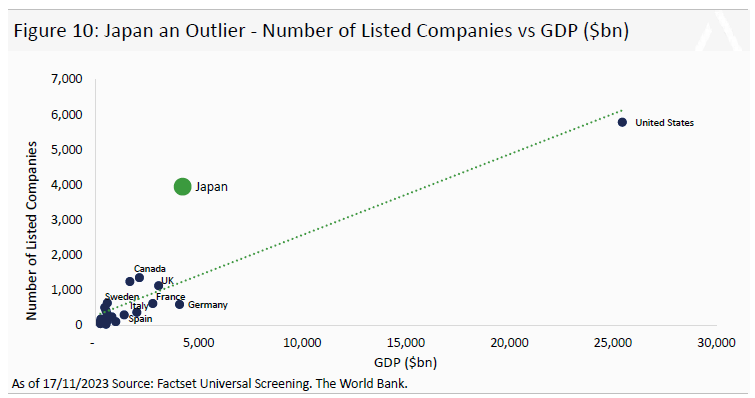

Active managers in Japan are spoilt for choice with the number of small cap companies. Excluding Hong Kong, whose stock exchange is home to mainland Chinese companies, only Sweden and Singapore have more companies proportionally to their respective GDP than Japan. If Japan were to have the same ratio of listed companies to GDP as other developed nations, then almost 3,000 of the 4,000 listed companies would need to be taken over/privatised.

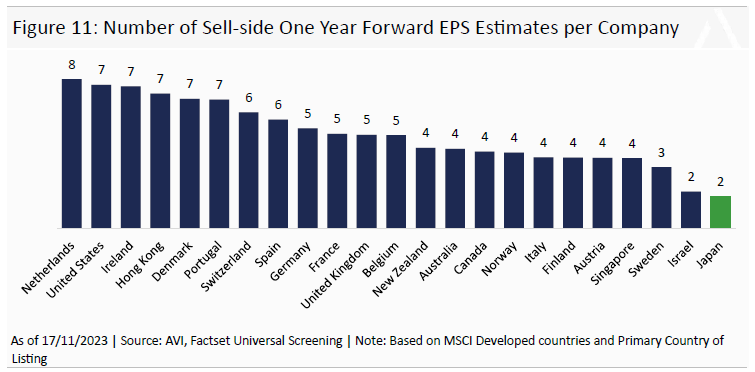

The high number of listed companies in Japan leads to poor analyst coverage and in turn more opportunities for active managers to exploit. On average listed companies in Japan have two sell-side earnings forecasts, compared to 7 in the US and 4 in China. Of 23 developed countries defined by MSCI, Japanese companies have the least coverage.

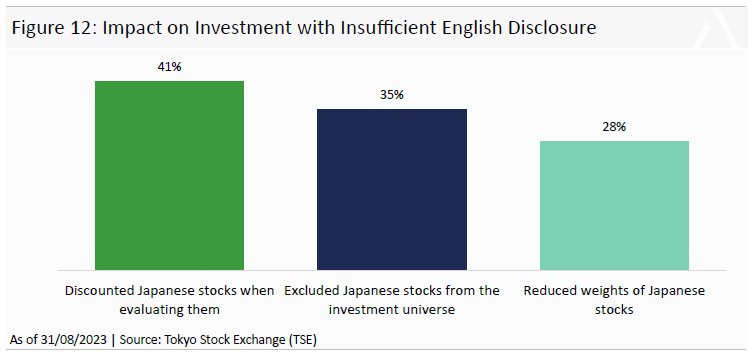

The poor sell-side coverage is compounded by poor IR disclosure, with information not always translated into English and access to senior management difficult. A study by the Tokyo Stock Exchange (TSE) found that 41% of investors discounted Japanese companies that had insufficient English disclosure and 35% excluded them entirely. Non-fundamental factors like poor disclosure create mispricing opportunities for firms that have the resources to undertake detailed research and Japanese speakers to overcome the language barrier.

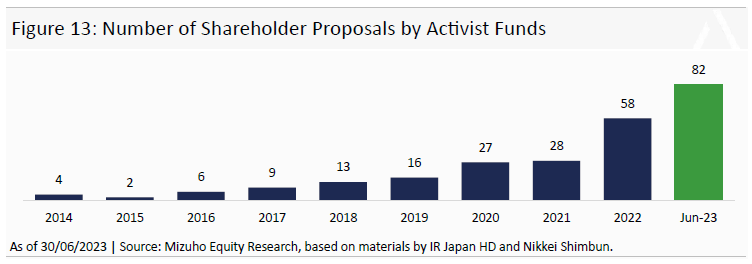

While the Government and Regulators are doing all they can to drive reform, responsibility lies with shareholders to help management drive change. At no time before has activism in Japan been more prevalent and effective. Activism not only helps to rectify low valuations through improved shareholder communication and balance sheet restructuring, but also through strategic initiatives designed to boost margins and growth. Sitting on the sidelines passively waiting for reform leaves money on the table, and with Japan being the second largest market for activist events, it’s a prime target for engagement.

The purest exposure to Japan reform and the economy is through small companies. They have historically outperformed larger companies and those with excess cash have generated further outperformance. The market is primed for consolidation with too many small companies. For active managers, with a broad universe, pricing inefficiencies and engagement, Japanese small companies offer a huge potential to generate significant alpha.

This document is issued by Asset Value Investors Limited (“AVI”) which is authorised and regulated by the Financial Conduct Authority. The distribution of this document may be restricted by law and persons into whose possession it comes are required to inform themselves of and comply with any such restrictions. The information in this document is selective and subject to verification, completion and amendments. As such, all information and research material provided herein is subject to change and this document does not purport to provide a complete description of the investments or markets referred to or the performance thereof. No undertaking, representation, warranty or other assurance, express or implied, is or will be made and no responsibility or liability is or will be accepted by or on behalf of the Fund or Company or AVI or by any of their respective officers, servants or agents (as applicable) or by any other person as to or in relation to the accuracy or completeness of this document or the information or opinions contained herein and no responsibility or liability is accepted by any of them for the accuracy or sufficiency of any such information. All opinions expressed in this document are subject to change without notice and do not constitute advice and should not be relied upon.