Weiss Korea Opportunity Fund (WKOF) has announced its annual results for the year ended 31 December 2023. During the year, WKOF provided an NAV total return of -5.5% while, in comparison, its reference index, the MSCI South Korea 25/50 Net Total Return Index, appreciated by 14.8% (all in sterling equivalent terms). This underperformance amounts to just over 20 percentage points and, in his statement, WKOF’s chair, Krishna Shanmuganathan, describes 2023’s relative and absolute performance as disappointing for WKOF. However, he also highlights that, since its admission in May 2023, WKOF’s NAV has increased by 112.2%, well ahead of its reference index which has returned 73.2%, a cumulative outperformance of 39% since inception (all in sterling total return terms). He also comments that WKOF’s performance last year came against a backdrop of weakening economic data in China and a ‘theme-driven stock frenzy’ in the Korean market.

While noting 2023’s difficult performance, Shanmuganathan says that there are reasons to be optimistic about the future performance. He says that, while investors will most likely remain sceptical of material change occurring in South Korea, at least in the short-term, the government appears to have introduced incentives to enact real change. Domestic retail ownership of stocks has greatly increased, and Korea has the recent success of corporate governance changes in Japan as a playbook for similar announcements and activities.

Dividend

WKOF’s policy is to pay a single dividend, which incorporates all dividends received (net of withholding tax), on an annual basis. Reflecting this, WKOF paid an interim dividend yield of 5.3517 pence per share on 2 May 2023, equating to a 3.2% net dividend yield over the past 12 months, to distribute the income received by WKOF in respect of the year ended 31 December 2022. This dividend was paid to all Shareholders on 9 June 2023.

Shanmuganathan says that there are changes afoot in Korean corporate governance. One of the initiatives aims to address Korean companies’ unique approach to the declaration of dividends, whereby a dividend is declared but its quantum is not announced at the same time. The proposal is that both the time and amount of the dividend ought to be declared together. Some of the companies in which WKOF is invested have already implemented this, such as Hyundai Motors.

Shanmuganathan comments that the impact of this change is that the dividends receivable in 2023 (that is those declared) are significantly lower than in previous years. This is because those companies that have moved to the new process have declared their dividends post year-end. He says that most of these companies have declared and (in most cases) already paid out their dividends. WKOF’s board will therefore take into account all dividends received up to 30 April 2024 when declaring the Company’s own dividend.

Realisation opportunity

WKOF offers shareholders the regular opportunity to elect to realise all, or a part, of their shareholding in WKOF once every two years, on the anniversary of WKOF’s admission date. At the last realisation opportunity in 2023, only 41,496 shares were tendered (0.06% of WKOF’s shares), which suggest strong support for WKOF’s strategy. The next Realisation Opportunity will take place in 2025.

Ongoing charges ratio of 2.1%

WKOF’s says that it is very mindful that the ongoing charges for the year were approximately 2.1%. It says that it strives to keep the cost of investing as low as possible for shareholders, with the investment management fee of 1.5% making up the bulk of the costs. The Realisation Opportunity added approximately £124,000 of expense for the year, but the Board believes that this periodic redemption facility is very much in the best interest of all shareholders.

Performance attribution

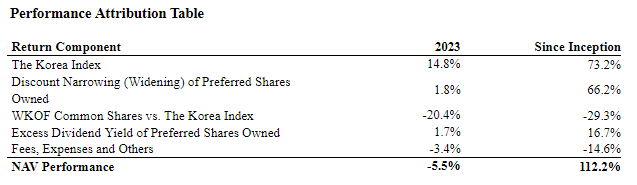

At the end of December 2023, WKOF held a portfolio of 32 South Korean preference shares. As a reminder, the economic rights of South Korean preference shares are generally the same or slightly better than the corresponding common shares, yet the preference shares often trade at substantial discounts to the common shares. WKOF’s manager says that returns, on a currency-neutral basis, are driven by five primary factors:

- The performance of the South Korean equity market generally as indicated by the Korea Index;

- The discounts of the preference shares WKOF holds narrowing or widening relative to their corresponding common shares;

- The performance of the common shares (which correspond to the preference shares held by WKOF) relative to the performance of the South Korean equity market;

- Excess dividend yields of the preference shares held by WKOF; and

- Fees, expenses and other factors.

In order to compare WKOF’s relative return to the South Korea Index, the manager reports the attribution of these aforementioned factors to WKOF’s performance. The table below provides this performance attribution for the year ended 31 December 2023 and for the period since the inception of WKOF in May 2013 to 31 December 2023.

Manager’s review of the South Korean macro environment

“There is increasing concern that North Korea could carry out some form of destabilising provocation against South Korea in 2024, and, as a result, WKOF has increased its exposure to Korean sovereign bond credit default swap protection. While it seems highly unlikely that an attack would occur that could trigger a large-scale military conflict, we consider that there is an increased likelihood of some form of action intended to sow political division in Korea and increase national security distractions in China and the US. In recent months, political and military tension in the Korean Peninsula have continued to escalate, as North Korea has exhibited signs of increased aggression. In January, North Korea fired artillery shells towards the border islands of South Korea, tested more ballistic missiles and followed such provocations with a declaration that “South Korea [is] its principal enemy”. In February 2024, North Korea’s parliament announced it had abolished laws that allow for economic cooperation with South Korea, further signalling an ongoing deterioration of the relationship between the Koreas. This announcement followed the discovery that North Korea demolished The Monument to the Three Charts, a 30-meter monument that had stood as a symbol of unification between the Koreas since 2001. With upcoming legislative elections and presidential elections in South Korea and in the United States, respectively, North Korea is expected to intensify their provocations throughout the year.

“South Korea’s economy, the fourth largest in Asia, expanded 1.4% in 2023. While this year’s growth was the country’s lowest since 2020, the growth during the fourth quarter suggests that the domestic economy remains on the road to recovery. In 2023, South Korea’s annual exports declined by 7.4% while annual imports decreased by 12.1%. The decline in exports has partially been attributed to decreased demand from China, to which exports fell by 2.9% year over year. After stagnating for sixteen months, chip exports began to rise in November 2023 with exports jumping by 21.8% on a year on year basis during December.

“South Korea’s 3.5% policy interest rate or bank base rate, which has been unchanged since January 2023, remains at its 15-year high. Following the Bank of Korea’s (“BOK”) November 2023 meeting, it raised its inflation target from 2.4% to 2.6% and, once again decided to leave its policy interest rate unchanged following its most recent meeting in January. In the 2023 Half-Yearly Report, we discussed the Bank of Korea’s concern about levels of household debt, which stood at 103% of GDP as of 30 June 2023. At 30 September 2023, South Korea’s household debt hit a new record, despite the restrictive interest rate policy described above, so will most likely remain an area of focus for the BOK. Governor Rhee has previously suggested that, should household debt levels continue to rise, the BOK might consider subsequent rate hikes.”

The manager also comments that South Korean equities and the portfolio holdings of WKOF continue to offer apparent valuation discounts relative to other countries’ equity markets as represented by the price-to-earnings ratios and price-to-book ratios. WKOF’s portfolio discount as at 31 December 2023 was 50% (calculated as the weighted average discount of the preference shares owned by WKOF relative to the prices of such preference shares’ corresponding common shares). In addition, the KOSPI 200 has depressed valuation multiples relative to the average of other major indices.

[QD comment: As the chairman rightly says, 2023 was a disappointing year for both WKOF’s absolute and relative performance. It is surprising that the fund has seen its NAV fall by around 5% in sterling total return terms while, at the same time, the reference index has gone up by around three times that amount. Shareholders will likely be disappointed by this.

Fundamentally, WKOF’s strategy is quite a simple but elegant one in that it largely focuses on selecting preference shares with the highest discounts, then waiting for these to rerate. Longer-term this strategy works but, clearly, some years will be an exception. Beyond sentiment, there is no obvious reason why the preference shares have, on average, underperformed the ordinary shares to such an extent, but they may now be primed for a decent rerating as sentiment improves.

However, with an ongoing charges ratio of 2.1%, we think the board is right to be mindful of this, particularly in the light of 20 percentage points of underperformance last year. The board has rightly kept a tight rein on costs but the manager’s 1.5% looks high in the context of most other funds, given that its strategy is not particularly difficult to execute. Other UK listed funds have made progress in this area and perhaps it is time that WKOF looks at this too.]